Industrial drone Market by Solution (Hardware, Software, Infrastructure), by Platform (Micro, Small, Medium, Large), by Type (Fixed Wing, Fixed Wing VTOL, Rotary Wing), by Mode of operation (Remotely Piloted, Optionally Piloted, Fully Autonomous), by Application (Construction & Infrastructure, Oil & Gas, Utilities, Mining, Oil & Gas, Others) and Region - Global Forecast to 2029

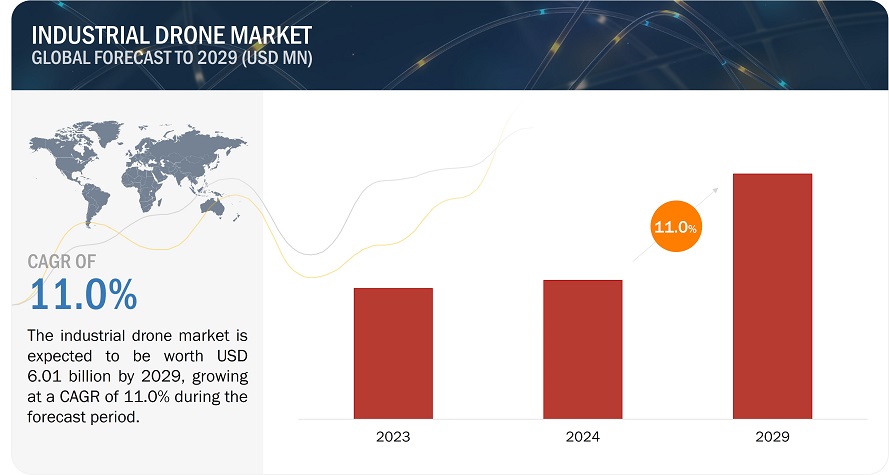

The industrial drone market is projected to reach USD 6.01 billion by 2029, from USD 3.56 billion in 2024, at a CAGR of 11.0%. Industrial drones are equipped with advanced technologies such as high-resolution cameras, sensors, GPS, and thermal imaging to perform tasks like aerial surveying, inspection, monitoring, mapping, and data collection. Unlike consumer drones, industrial drones are built for durability, longer flight times, and the ability to carry heavy payloads, making them suitable for complex industrial operations across various sectors such as construction, energy, mining, logistics, and infrastructure. As drone technology continues to evolve, industrial drones are expected to play an increasingly vital role in enhancing productivity, reducing costs, and improving safety across industries. However, challenges such as low battery life remain significant barriers to their widespread adoption. Despite various challenges, the industrial drone market is expected to grow rapidly as businesses seek innovative solutions to streamline operations.

Industrial drone Markett Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Drone Market Market Dynamics:

Driver: Increased efficiency and productivity

The improved efficiency and productivity brought by drones are significant factors driving their adoption in various industries. Unlike traditional methods that often require extensive manpower, heavy machinery, and long timelines, drones provide a faster, more precise, and cost-effective alternative. For instance, in sectors like construction, drones are used for aerial surveys and progress tracking, significantly reducing the time needed for site inspections. These drones, equipped with technologies like high-resolution cameras, LiDAR, and AI-powered analytics, collect and process vast amounts of data in real time, enabling informed decision-making and minimizing delays. Furthermore, drones enhance productivity by reducing repetitive manual tasks, allowing workers to focus on more strategic activities. Their ability to operate in remote or hazardous areas ensures efficiency even in the most challenging conditions, such as disaster recovery or offshore asset inspections. By delivering superior operational speed, accuracy, and resource optimization, drones are becoming an important tool for industries seeking to boost productivity and streamline workflows, driving their widespread adoption across diverse applications.

Restraint: Sensitivity of drones to severe weather conditions

The sensitivity of drones to severe weather conditions presents a significant restraint to the industrial drone market, limiting their reliability and effectiveness in certain environments. Drones are highly dependent on favorable weather for optimal performance, and harsh conditions such as high winds, heavy rain, snow, or low temperatures can severely impact their stability, flight time, and operational safety. For instance, strong winds can cause drones to lose control or make it difficult for them to maintain stable flight, while rain or snow can damage sensitive components like cameras, sensors, and electronics. Additionally, low temperatures can cause battery performance to degrade, shortening flight times and reducing the overall efficiency of operations. These weather-related challenges pose a particular risk for industries such as construction, oil, and gas, where drones are used for tasks like surveying, monitoring, and inspecting infrastructure. In such conditions, the inability of drones to perform consistently and safely may lead to delays, increased operational costs, and safety concerns. As a result, severe weather conditions limit the full potential of drones in critical industrial applications, making weather resilience an area for ongoing improvement and innovation in the drone market.

Opportunity: Rise of Drone-as-a-Service (DaaS)

The rise of Drone-as-a-Service (DaaS) presents a significant opportunity in the industrial drone market by offering businesses a flexible and cost-effective way to integrate drone technology into their operations without the need for substantial upfront investment in hardware, maintenance, and training. DaaS allows companies across various sectors, including construction, energy, and logistics, to access drone services on a pay-per-use basis, making drone technology more accessible to smaller businesses or those with limited budgets. By adopting DaaS, companies can leverage the latest drone technologies and expertise without the complexities of owning and managing a fleet of drones. This model is especially attractive for industries that require drone services intermittently or for specific tasks, such as aerial surveys, inspections, and data collection. As drone service providers continue to develop specialized offerings tailored to different industries—such as infrastructure inspection, and environmental monitoring—there is an opportunity for the market to expand rapidly. Additionally, DaaS providers often handle the regulatory compliance, insurance, and operational safety concerns, further reducing the burden on businesses.

Challenge: Limited battery life

Limited battery life is a significant challenge in the industrial drone market, as it directly impacts the operational efficiency and scope of drone applications. Drones typically have short flight durations, ranging from 20 to 60 minutes on a single charge, depending on factors like payload, weather conditions, and the type of drone. This limitation can be problematic for industries that require drones for extended tasks, such as infrastructure inspections, large-scale surveys, or agricultural monitoring, where long-range operations are common. Frequent recharging or battery swaps can lead to delays, reduce productivity, and increase operational costs. While advancements in battery technology are being made, achieving longer flight times remains a key hurdle to realizing the full potential of drones in industrial applications. Until this challenge is addressed, industries will need to find ways to manage or mitigate the impact of limited battery life, such as through the use of multiple drones or advanced charging solutions.

Based on solution, the hardware segment will lead the industrial drone market in 2024

The hardware segment of the industrial drone market is expected to lead the market due to the continuous advancements in drone technology and the growing demand for high-performance systems across various industries. Key components such as advanced sensors, cameras, GPS, and communication systems are critical for the effective operation of drones in applications like surveying, inspection, and monitoring. As industries seek more accurate, efficient, and reliable drones, the demand for cutting-edge hardware solutions will drive growth in this segment. Furthermore, innovations in battery technology, propulsion systems, and structural materials are enhancing drone capabilities, making the hardware segment a dominant force in the market's expansion.

Based on applications, the construction & infrastructure segment will lead the industrial drone market in 2024.

The construction and infrastructure segment is poised to lead the industrial drone market due to the increasing adoption of drones for tasks like surveying, mapping, and site inspection. Drones provide significant advantages in these sectors by offering faster, more accurate data collection, reducing labor costs, and improving safety by minimizing the need for workers to perform hazardous tasks. In construction, drones are used for real-time monitoring of project progress, measuring stockpiles, and conducting aerial inspections, all of which enhance efficiency and decision-making. With the demand for smarter, more efficient construction processes and the need for accurate infrastructure maintenance, drones are becoming indispensable tools in these industries, driving substantial growth in this segment.

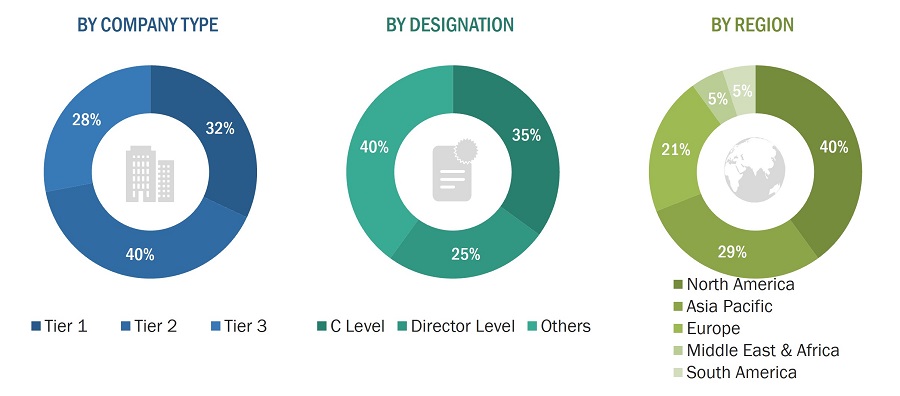

The North American region is to have the largest share in 2024.

The North American segment is expected to have the largest share in the industrial drone market due to strong technological advancements, favorable regulatory environments, and high adoption rates across various industries. The United States, in particular, has been at the forefront of drone innovation, with significant investments in research and development, as well as the implementation of drone-friendly regulations by the Federal Aviation Administration (FAA). Industries such as construction, energy, and logistics are increasingly turning to drones for tasks like surveying, monitoring, and delivery, driving demand for drone solutions. Additionally, the presence of key drone manufacturers and service providers in North America further supports the region's dominant position in the market, positioning it for continued leadership in the global industrial drone industry.

Scope of the Report

| Report Metric |

Details |

|

Estimated Market Size (2024) |

USD 3.56 billion |

|

Projected Market Size (2029) |

USD 6.01 billion |

|

Market Growth Rate (CAGR) |

11.0% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Solution, Platform, Application, Type, Mode of Operation, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Latin America, and Africa |

|

Companies covered |

DJI (China), Skydio (US), XAG (China), Parrot (France), Teledyne FLIR (US), a total of 25 companies |

Industrial Drone Market Highlights

The study categorizes the industrial drone market based on solution, platform, application, type, mode of operation, and region.

|

Segment |

Subsegment |

|

Solution |

|

|

Platform |

|

|

Application |

|

|

Type |

|

|

Mode of Operation |

|

|

Region |

|

Recent Developments

- In January 2025, Arcsky (US) announced the launch of the X55 V2, an upgraded version of its X55 industrial drone. The company developed the new model based on two years of operational feedback and technological advances, aiming to meet the complex needs of industrial applications.

- In February 2024, Oil and Natural Gas Corporation (India) and TotalEnergies (India) have signed a cooperation agreement to enhance methane emissions detection and reduction in India, employing TotalEnergies’ advanced AUSEA (Airborne Ultralight Spectrometer for Environmental Applications) technology.

- In December 2023, Pacific Gas and Electric Company (US) orchestrated a comprehensive conference, uniting certified drone pilots, industry collaborators, community partners, and federal stakeholders to delve into the myriad applications of unmanned aerial systems for utility operations.

Frequently Asked Questions (FAQs):

What is the current size of the Industrial Drone Market?

The Industrial Drone Market is estimated to reach USD 3.56 billion in 2024

What is the projected growth of the Industrial Drone Market?

The Industrial Drone Market is projected to grow at a CAGR of 11.0% from 2024 to 2029.

What solution for UAV navigation will lead the market in 2024?

The hardware UAV solutions will lead the market in 2024.

Which region is expected to hold the highest market share in the Industrial Drone Market?

The Industrial Drone Market in the North American region is estimated to hold the largest market share in 2024.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Exhaustive secondary research was done to collect information on the Industrial drone market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and UAV parts and component research papers.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Industrial drone market scenario through secondary research. The market for Industrial drones is being driven by a range of stakeholders, including drone manufacturers, Industrial drone developers, UAV Software/Hardware/Service and Solution Providers, Regulatory Bodies, UAV Consultants, and governments of Various Countries. The demand-side of this market is characterized by various end users, such as component manufacturers as well as facility providers and service providers. The supply-side is characterized by technology advancements in Advanced Imaging and Sensors, Connectivity and Communication, Higher Payload Capacities. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the Industrial drone market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Industrial drone market based on solution, platform, type, application, mode of operation, and region

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, Middle East and RoW, along with their key countries

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify technology trends currently prevailing in the Industrial drone market

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the key market trends

- To profile the leading market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying the key growth strategies, such as acquisitions, new product launches, contracts, and partnerships, adopted by the leading market players

- To identify detailed financial positions, key products, and unique selling points of the leading companies in the market

- To provide a detailed competitive landscape of the market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Company Information

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Industrial drone Market

Growth opportunities and latent adjacency in Industrial drone Market