Industrial Hemp Market by Type (Hemp Seed, Hemp Seed Oil, CBD Hemp Oil, Hemp Bast, Hemp Hurd), Source (Conventional, Organic), Application (Food & Beverages Pharmaceuticals, Textiles, Personal Care Products) and Region - Global Forecast to 2027

The industrial hemp market size is expected to grow rapidly in the next years, rising from $6.8 billion in 2022 to $18.1 billion in 2027, at a CAGR of 21.6% from 2022 to 2027. The industrial hemp market is a rapidly growing industry. It is used for a variety of products including textiles, building materials, and food products. The market is driven by the increasing demand for sustainable and eco-friendly products, as well as the legalization of hemp cultivation in many countries. Additionally, the market is also driven by the growing use of hemp-derived CBD in the healthcare industry.

Key features of the Industrial hemp market

- Increasing legalization and deregulation of hemp cultivation in many countries, leading to more availability of raw materials.

- High demand for hemp-based products such as textiles, paper, and building materials.

- Advancements in cultivation and processing technology, which are driving down costs and improving efficiency.

- Rising interest in hemp as a sustainable alternative to traditional crops, as it requires less water and pesticides to grow.

- Growing use of hemp in the food and beverage industry, particularly for hemp seeds and hemp oil.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Hemp Market Dynamics

Drivers:Increase in the legalization of industrial hemp

Hemp has been grown all over the world as a source of fiber and oilseed to make a variety of consumer and industrial products. Cannabis sativa L, which is not marijuana but a different variety of the same species, is the source of industrial hemp. Because of its name, consumers believe hemp has psychoactive properties. This factor has a negative impact on the hemp industry's growth. The United States took several steps in the 2018 farm bill (a federal government agricultural and food policy tool) to legalize the production of hemp as an agricultural commodity and to remove it from the list of controlled substances; however, it cannot be grown as freely as other crops. The bill outlined actions that would be considered violations of the law, such as producing a plant with more than 0.3% THC (tetrahydrocannabinol) content or cultivating hemp without a license.

Due to the legalization of industrial hemp cultivation in the United States, the North American region has become preoccupied with the production of oilseeds and cannabidiol (CBD), a non-intoxicant cannabinoid that can be used in the food and pharmaceutical industries. Hemp seed and hemp seed oil are high in vitamin and mineral nutrients. Hemp seed oil is high in fatty acids, has a balanced protein content, and is easily digestible. CBD is becoming more popular as a food supplement and as an ingredient in pharmaceutical and cosmetic products. As a result, the use of CBD hemp oil is gradually gaining prominence in the food and pharmaceutical industries, which is expected to drive the growth of industrial hemp in the coming years.

Restraints: The complex regulatory structure for the usage of industrial hemp

Companies that sell hemp and hemp-derived products must follow various regulatory guidelines around the world. While different countries around the world have different levels of legalization for different types of hemp, manufacturers and stakeholders may find it difficult to comply with strict regulatory norms regarding the production and sale of industrial hemp across different states within the same country. Furthermore, the regulations governing hemp containing cannabidiol (CBD) and tetrahydrocannabinol (THC) vary greatly from state to state, adding to the complications associated with the commodity's trading.

Many countries restrict the use of CBD hemp oil for personal care and cosmetics. China only allows the use of hemp seed and hemp seed oil, while CBD is only permitted in cosmetic products. It has not yet received FDA approval for use in food or pharmaceutical applications. Furthermore, hemp-derived CBD is not yet legal for industrial use in Australia, Spain, or the Middle East. These regulations related to the trading, manufacturing, and prescription of industrial hemp continue to be highly complex and varied across various states and countries, making the industry one of the most heavily regulated.

Opportunities:Innovative product development from industrial hemp

As hemp cultivation becomes more legal, manufacturers and research institutions are developing new products from industrial hemp. One such application is biofuel, which is expected to have significant growth potential in the coming years. With the rise in oil prices (diesel and gasoline), as well as growing concerns about global warming, biofuels have gained popularity. Hemp seed extracts are used to make hemp biodiesel, which is suitable for use in any diesel-powered vehicle. Additionally, hemp can be used to produce ethanol, which is currently produced from food crops such as wheat and corn. This would result in increased food production efficiency.

Another product that allows for the growth of industrial hemp is bioplastic. Hemp bioplastics are made from used hemp seeds and CBD oil. Growing consumer demand for sustainable goods, as well as corporate and government initiatives and support, are expected to fuel the growth of hemp-based biofuel and bioplastics. Furthermore, hemp contains approximately 70% cellulose fibers, which can be converted into bioplastics.

Challenges: Lack of top-of-the-line hemp processing facilities

Following the legalization of industrial hemp in the United States, the country's industrial hemp industry has grown rapidly, as it is one of the largest consumers of hemp-derived products. However, proper planting and harvesting equipment has been lacking. Due to the fragility of air seeders used for crop planting, they must be used with a low air volume in the case of hemp speed. In September 2021, the National Hemp Association proposed a USD 1 billion amendment to the upcoming infrastructure bill through its Standing Committee of Hemp Organizations (SCOHO) to expedite hemp fiber and grain production facilities. Grants of up to USD 3 million would be made to businesses to help them buy equipment that allows a farmer to harvest or cultivate a hemp plant, a manufacturer to extract decorate, degum, layout, can, pack, mold, press, and/or any other machinery that uses the hemp plant or any derivatives of the hemp plant to create a product.

By industrial hemp type, the hemp seed segment is projected to account for the largest market share in the industrial hemp market during the forecast period

Hemp seeds are derived from the Cannabis sativa plant and contain only a trace amount of tetrahydrocannabinol (THC) These are high in two essential fatty acids, linoleic (omega-6) and linolenic (omega-3), as well as vitamins E, 81, 82, 86, and D, calcium, magnesium, and potassium. Hemp seed contains easily digestible protein (20-25%), polyunsaturated fatty acids (PUFA), a lot of lipids (25-35%), and a lot of carbohydrates (20-30%) with a lot of insoluble fiber. The rich source of PUFA linoleic and (LA omega 6) and alpha-linolenic acid (ALA omega 3) is considered favorable and balanced for human nutrition at a ratio of 3:1.

"Hemp seeds come from the Cannabis sativa plant and contain minimal THC. They are high in essential fatty acids, vitamins, minerals, and easily digestible protein, making them a suitable food ingredient for human and animal consumption, especially among vegan consumers. The rich source of PUFA and balanced fatty acid composition is beneficial for human nutrition, and the high-quality proteins in hemp seeds are expected to drive their demand as food ingredients in the future."

Linoleic acid accounts for 64 to 72% of the total fatty acid composition. Gamma Linolenic acid (GLA) has been shown to help prevent and treat diseases such as diabetes, high blood pressure, obesity, premenstrual syndrome, skin allergies, and rheumatoid arthritis. Hemp seed protein is suitable for human and animal consumption because it is primarily composed of high-quality, easily digestible proteins edestin and albumin, both of which are high in essential amino acids. Furthermore, they have more digestible proteins than meat, eggs, cheese, and milk, which is expected to drive their demand as food ingredients, particularly among vegan consumers, in the coming years.

By application, food & beverage lead the application segment due to its versatility

Hemp is increasingly being used in food products because it contains essential fatty acids (linoleic and linolenic acid), vitamin E, and minerals such as phosphorus, potassium, sodium, magnesium, calcium, zinc, iron, and protein. Hemp is most consumed as hemp seed, either raw or roasted. Salads, smoothies, yogurt, and cereals all contain it. The increased consumption of plant-based protein due to the global popularity of veganism is expected to drive demand for hemp-based processed food products such as bars, flour, snacks, and cheese. Furthermore, due to the presence of highly digestible fiber, its role in improving digestion is expected to fuel its demand for food products. Hemp tortilla chips, hemp corn chips, and hemp hearts are some of the hemp-based snacks that are popular. Hemp is used as a breakfast cereal because of its nutrient-rich profile of essential fatty acids, which are required for proper body functioning. Furthermore, the growing demand for hemp snacks as post-exercise food is expected to increase in the coming years due to their high protein content.

By source, organic has the highest growth rate during the forecast period

Hemp grown conventionally is a non-GMO crop grown without the use of pesticides. Conventional hemp does not necessitate the same stringent inspections and guidelines that certified organic hemp does. As a result, they are less expensive than organic Hamp products. Hemp grown conventionally is increasingly being used in the textile and pulp and paper industries. Furthermore, their use in biofuel, construction and material, furniture, and bioplastics has increased their demand. Hemp Factory (Germany) provides a variety of traditional hemp-based products. Unpeeled whole hemp seeds/hemp nuts, peeled hemp seeds/hemp nuts, cold-pressed homo seed oil, refined hemp seed oil, and hemp flour are among the products available.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Hemp Market Key Players

Marijuana Company of America Inc. (US), Cronos Group Inc. (Canada), Ecofibre Limited (Australia), Green Thumb Industries (US), Curaleaf Holdings Inc. (US), GenCanna (US), HempFlax BV (Netherlands), Konoplex Group (Russia), Hemp Oil Canada (Canada), BAFA (Germany), Dun Agro Hemp Group (Netherlands), Colorado Hemp Works (US), Canah International (Romania), South Hemp Tecno (Italy), and MH Medical Hemp GmbH (Germany).

Industrial Hemp Market Report Scope

|

Report Metrics |

Details |

| Market size estimation | 2022–2027 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD) |

| Segments Covered | type, source, region, and mode of application. |

| Regions covered | North America, Europe, Asia Pacific, and RoW |

| Companies studied |

|

Industrial Hemp Market Segments

This research report categorizes the industrial hemp market, based on product type, application, source, and region.

By Type

- Hemp seed

- Hemp seed oil

- CBD hemp oil

- Hemp bast

- Hemp hurd

By Source

- Conventional

- Organic

By Application

- Food & Beverages

- Textiles

- Pharmaceuticals

- Personal Care Products

- Animal Nutrition

- Paper

- Construction Materials

- Other applications

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World (RoW)

Target Audience

- Supply side: industrial hemp producers, suppliers, distributors, importers, and exporters

- Demand side: food & beverage, personal care, textile, construction material, animal nutrition manufacturers

- Regulatory bodies Government agencies and non-governmental organizations (NGO) Commercial R&D institutions and financial institutions

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- Food and Drug Administration (FDA)

- European Industrial Hemp Association (EIHA)

- National Hemp Association (NHA)

- United States Department of Agriculture (USDA)

- American Farm Bureau Federation (AFBF)

- European Food Safety Authority (EFSA)

- Canadian Hemp Trade Alliance (CHTA)

- British Hemp Association (BHA)

- Indian Industrial Hemp Association (IIHA)

- Hemp Industries Association (HIA)

- Vote Hemp

- Hokkaido Industrial Hemp Association (HIHA)

Recent Developments

- In December 2021, Green Thumb Industries Inc. purchased Leafline Industries. As one of only two approved cultivators in the Minnesota medical cannabis industry, Leafline is licensed to grow, process, and distribute cannabis directly to patients. With this acquisition, the corporation expands its market footprint into Minnesota.

- In September 2021, CBD Capital Ltd, the leading provider of CBD distillate, isolate, and water-soluble bulk ingredients, as well as white and private label services to the United Kingdom, European Union, and global markets has been acquired by GenCanna. CBD Capital also brings with it several sub-brands, which will now benefit from accelerated product development and market expansion as more resources are devoted to them. CBD Capital's acquisition broadens and solidifies GenCanna's leadership position in high-growth CBD markets in the United Kingdom, Europe, and the rest of the world.

- In March 2021, Curaleaf Holdings Inc. acquired Emmac Life Sciences, a European marijuana startup, for $286 million. Curaleaf's geographic reach would expand to eight countries, including Portugal, Spain, Germany, Italy, and the United Kingdom.

- In May 2020, HempFlax BV, based in the Netherlands acquired Thermo-Natur, a German company that makes insulation from natural fibers, and launched a building supplies division. The acquisition includes Thermo-Natur's existing operations, as well as licensing, brand, and product certifications. The acquisition of certifications, which can take up to 18 months to obtain independently, enables HempFlax to immediately operate a "seed to shell" business model to capitalize on Europe's rising consumer demand for sustainable building materials.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Industrial Hemp Market?

The global industrial hemp market size is projected to reach USD 18.1 billion by 2027.

What is the estimated growth rate (CAGR) of the global Industrial Hemp Market for the next five years?

The global industrial hemp market is expected to grow at a compound annual growth rate (CAGR) of 21.6% from 2022 to 2027

What are the major revenue pockets in the Industrial Hemp Market currently?

The European market is expected to account for the fastest growth in the industrial hemp market. The growth can be attributed to the increased usage of hemp seed and hemp seed oil in food, beverages, dietary supplements, and personal care products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL HEMP MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

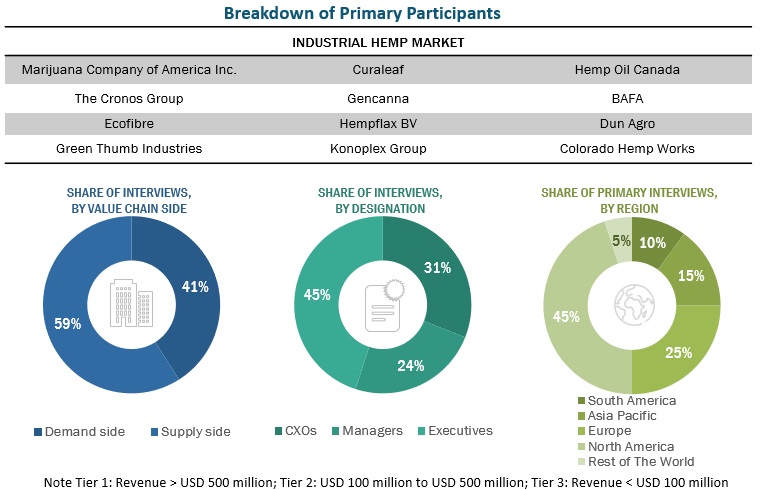

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 INDUSTRIAL HEMP MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

FIGURE 5 MARKET FOR INDUSTRIAL HEMP SIZE ESTIMATION (DEMAND SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET FOR INDUSTRIAL HEMP SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET FOR INDUSTRIAL HEMP SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 2 INDUSTRIAL HEMP MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET FOR INDUSTRIAL HEMP SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET FOR INDUSTRIAL HEMP

FIGURE 13 LEGALIZATION OF HEMP CULTIVATION AND PROJECTED BOOST IN CONSUMPTION TO DRIVE MARKET

4.2 INDUSTRIAL HEMP MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 14 CANADA PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

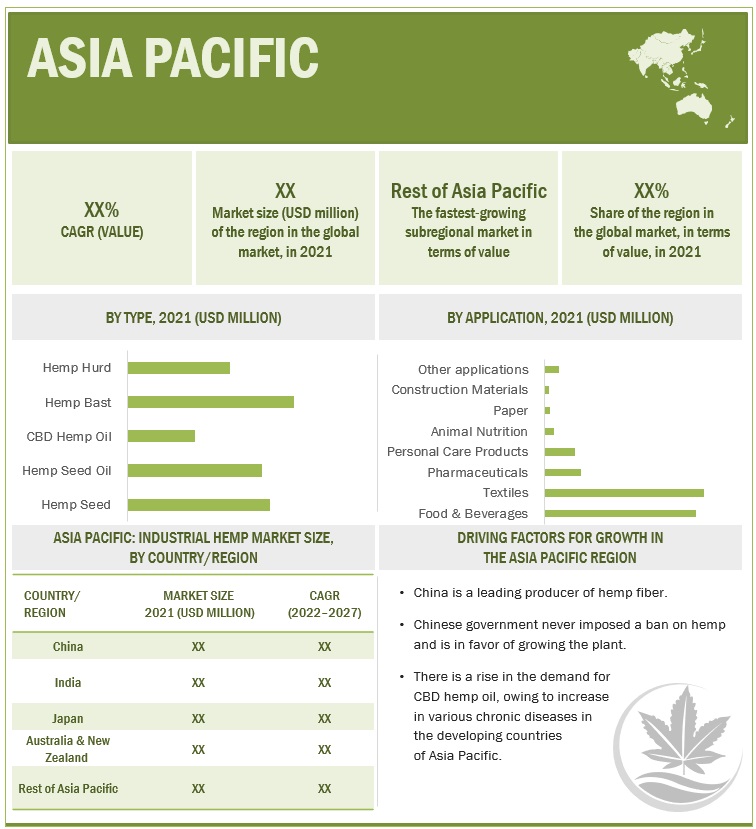

4.3 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP, BY KEY TYPE & COUNTRY

FIGURE 15 CHINA AND HEMP BAST ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC MARKET IN 2021

4.4 INDUSTRIAL HEMP MARKET, BY TYPE & REGION

FIGURE 16 NORTH AMERICA PROJECTED TO DOMINATE MARKET FOR INDUSTRIAL HEMP ACROSS HEMP SEED, HEMP SEED OIL, AND CBD HEMP OIL SEGMENTS

4.5 EUROPE: MARKET FOR INDUSTRIAL HEMP, BY APPLICATION

FIGURE 17 FOOD & BEVERAGES SEGMENT PROJECTED TO LEAD EUROPEAN MARKET DURING FORECAST PERIOD

4.6 INDUSTRIAL HEMP MARKET, BY SOURCE & REGION

FIGURE 18 ASIA PACIFIC DOMINATED CONVENTIONAL SEGMENT IN 2021

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 PRODUCTION SCENARIO: INCREASING PRODUCTION OF HEMP

FIGURE 19 EUROPEAN UNION LAND AREA USED FOR HEMP CULTIVATION, 2015-2019 (1,000 HECTARES)

5.2.2 INCREASE IN AGING POPULATION

FIGURE 20 INCREASING POPULATION OF INDIVIDUALS AGED 60 AND ABOVE (2021–2021)

5.3 MARKET DYNAMICS

FIGURE 21 INDUSTRIAL HEMP MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increasing legalization of industrial hemp cultivation

TABLE 3 US STATUTES AND PUBLIC ACTS ON INDUSTRIAL HEMP RESEARCH AND CULTIVATION

5.3.1.2 Growing use of hemp seed and hemp seed oil in food applications

5.3.1.3 Rising incidence of chronic diseases

5.3.2 RESTRAINTS

5.3.2.1 Complex regulatory structure for use of industrial hemp

5.3.2.2 Stigmatization of hemp market

5.3.3 OPPORTUNITIES

5.3.3.1 Development of new industrial hemp-based products

5.3.3.2 Increasing preference for edibles across generations

5.3.4 CHALLENGES

5.3.4.1 Unavailability of suitable seeds for cultivation of industrial hemp

5.3.4.2 Lack of processing facilities and planting & harvesting equipment

6 INDUSTRY TRENDS (Page No. - 65)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION

6.2.4 PACKAGING, STORAGE, AND DISTRIBUTION

6.2.5 END USERS AND RETAIL

FIGURE 22 INDUSTRIAL HEMP MARKET: VALUE CHAIN

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 INDUSTRIAL HEMP MARKET: SUPPLY CHAIN

6.4 MARKET MAPPING AND ECOSYSTEM

6.4.1 DEMAND-SIDE COMPANIES

6.4.2 SUPPLY-SIDE COMPANIES

FIGURE 24 MARKET FOR INDUSTRIAL HEMP: ECOSYSTEM MAP

6.4.3 ECOSYSTEM MAP

TABLE 4 MARKET FOR INDUSTRIAL HEMP: ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN INDUSTRIAL HEMP MARKET

FIGURE 25 REVENUE SHIFT IMPACTING INDUSTRIAL HEMP MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 NANOENCAPSULATION

6.6.2 CROP STEERING

6.6.3 DRONE FARMING

6.6.4 IOT AUTOMATION

6.7 PRICING ANALYSIS

6.7.1 AVERAGE SELLING PRICE, BY PRODUCT TYPE (KEY PLAYERS)

FIGURE 26 SELLING PRICES OF KEY PLAYERS, BY HEMP PRODUCT TYPE

TABLE 5 SELLING PRICES OF KEY PLAYERS, BY PRODUCT TYPE

FIGURE 27 AVERAGE SELLING PRICE IN KEY REGIONS, BY PRODUCT TYPE, 2018–2021 (USD/KG)

TABLE 6 HEMP SEED: AVERAGE SELLING PRICE, BY REGION, 2018–2021 (USD/KG)

TABLE 7 HEMP SEED OIL: AVERAGE SELLING PRICE, BY REGION, 2018–2021 (USD/KG)

TABLE 8 CBD HEMP OIL: AVERAGE SELLING PRICE, BY REGION, 2018–2021 (USD/KG)

TABLE 9 HEMP BAST: AVERAGE SELLING PRICE, BY REGION, 2018–2021 (USD/KG)

TABLE 10 HEMP HURD: AVERAGE SELLING PRICE, BY REGION, 2018–2021 (USD/KG)

6.8 INDUSTRIAL HEMP MARKET: PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED FOR MARKET FOR INDUSTRIAL HEMP, 2011–2021

FIGURE 29 TOP PATENT APPLICANTS FOR MARKET FOR INDUSTRIAL HEMP, 2019–2022

FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR INDUSTRIAL HEMP MARKET, 2019–2022

6.8.1 MAJOR PATENTS

TABLE 11 PATENTS IN MARKET FOR INDUSTRIAL HEMP, 2019–2022

6.9 TRADE ANALYSIS

6.9.1 EXPORT SCENARIO

FIGURE 31 HEMP EXPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 12 EXPORT DATA FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.2 IMPORT SCENARIO

FIGURE 32 HEMP IMPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 13 IMPORT DATA FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.10 CASE STUDIES: INDUSTRIAL HEMP MARKET

6.10.1 CANVALOOP FIBRE: PROVISION OF ECO-FRIENDLY HEMP

6.10.2 ONYX AGRONOMICS: USE OF PRECISION CANNABIS FACILITY

6.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 14 KEY CONFERENCES AND EVENTS

6.12 TARIFF AND REGULATORY LANDSCAPE

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.2 REGULATORY FRAMEWORK

6.12.2.1 North America

6.12.2.1.1 US

6.12.2.1.2 Canada

6.12.2.2 Europe

6.12.2.2.1 Germany

6.12.2.2.2 Italy

6.12.2.2.3 Denmark

6.12.2.2.4 Malta

6.12.2.2.5 Netherlands

6.12.2.2.6 France

6.12.2.2.7 Switzerland

6.12.2.2.8 UK

6.12.2.2.9 Belgium

6.12.2.2.10 Poland

6.12.2.2.11 Czech Republic

6.12.2.2.12 Spain

6.12.2.2.13 Austria

6.12.2.2.14 Norway

6.12.2.2.15 Finland

6.12.2.2.16 Croatia

6.12.2.3 Asia Pacific

6.12.2.3.1 China

6.12.2.3.2 India

6.12.2.3.3 Japan

6.12.2.3.4 New Zealand

6.12.2.3.5 Australia

6.12.2.3.6 Thailand

6.12.2.3.7 South Korea

6.12.2.3.8 Malaysia

6.12.2.4 Rest of the World

6.12.2.4.1 Chile

6.12.2.4.2 Colombia

6.12.2.4.3 Uruguay

6.12.2.4.4 South Africa

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 19 INDUSTRIAL HEMP MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

6.14.2 BUYING CRITERIA

FIGURE 34 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 INDUSTRIAL HEMP MARKET, BY TYPE (Page No. - 98)

7.1 INTRODUCTION

FIGURE 35 INDUSTRIAL HEMP MARKET SHARE, BY TYPE, 2022 VS. 2027 (BY VALUE)

TABLE 22 MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 24 MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (KT)

TABLE 25 MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (KT)

7.2 HEMP SEED

7.2.1 HIGH NUTRIENT PROFILE EXPECTED TO DRIVE DEMAND IN FOOD INDUSTRY

TABLE 26 HEMP SEED MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 HEMP SEED MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 28 HEMP SEED MARKET SIZE, BY REGION, 2018–2021 (KT)

TABLE 29 HEMP SEED MARKET SIZE, BY REGION, 2022–2027 (KT)

7.3 HEMP SEED OIL

7.3.1 SUITABLE FOR USE IN PHARMACEUTICALS AND OTHER INDUSTRIES

TABLE 30 HEMP SEED OIL MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 HEMP SEED OIL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 HEMP SEED OIL MARKET SIZE, BY REGION, 2018–2021 (KT)

TABLE 33 HEMP SEED OIL MARKET SIZE, BY REGION, 2022–2027 (KT)

7.4 CBD HEMP OIL

7.4.1 GROWING APPLICATION IN PERSONAL CARE AND FOOD & BEVERAGE PRODUCTS TO DRIVE MARKET

TABLE 34 CBD HEMP OIL MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 CBD HEMP OIL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 CBD HEMP OIL MARKET SIZE, BY REGION, 2018–2021 (KT)

TABLE 37 CBD HEMP OIL MARKET SIZE, BY REGION, 2022–2027 (KT)

7.5 HEMP BAST

7.5.1 IDEAL FOR PRODUCTION OF BIOPLASTICS AND CONSTRUCTION MATERIAL DUE TO EXCEPTIONAL STRENGTH-TO-WEIGHT RATIO

TABLE 38 HEMP BAST MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 HEMP BAST MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 HEMP BAST MARKET SIZE, BY REGION, 2018–2021 (KT)

TABLE 41 HEMP BAST MARKET SIZE, BY REGION, 2022–2027 (KT)

7.6 HEMP HURD

7.6.1 VERSATILITY ACROSS APPLICATIONS TO DRIVE DEMAND

TABLE 42 HEMP HURD MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 HEMP HURD MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 HEMP HURD MARKET SIZE, BY REGION, 2018–2021 (KT)

TABLE 45 HEMP HURD MARKET SIZE, BY REGION, 2022–2027 (KT)

8 INDUSTRIAL HEMP MARKET, BY SOURCE (Page No. - 110)

8.1 INTRODUCTION

FIGURE 36 INDUSTRIAL HEMP MARKET SHARE, BY SOURCE, 2022 VS. 2027(BY VALUE)

TABLE 46 MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2022–2027 (USD MILLION)

8.2 CONVENTIONAL

8.2.1 LOW PRICE OF CONVENTIONAL HEMP SEEDS TO DRIVE MARKET

TABLE 48 CONVENTIONAL INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 CONVENTIONAL MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 ORGANIC

8.3.1 INCREASING DEMAND FOR ORGANIC HEMP PRODUCTS IN FOOD AND PHARMACEUTICALS INDUSTRIES

TABLE 50 ORGANIC MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 ORGANIC MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9 INDUSTRIAL HEMP MARKET, BY APPLICATION (Page No. - 114)

9.1 INTRODUCTION

FIGURE 37 INDUSTRIAL HEMP MARKET SHARE, BY APPLICATION, 2022 VS. 2027 (BY VALUE)

TABLE 52 MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 FOOD & BEVERAGES

9.2.1 WIDE-RANGING APPLICATIONS OF HEMP SEED AND HEMP SEED DERIVATIVES TO DRIVE MARKET

TABLE 54 FOOD & BEVERAGES: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 FOOD & BEVERAGES: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 TEXTILES

9.3.1 DIVERSE BENEFITS OF HEMP FIBER TO DRIVE DEMAND

TABLE 56 TEXTILES: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 TEXTILES: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 PHARMACEUTICALS

9.4.1 GROWING RESEARCH ON EFFICACY OF HEMP TO TREAT VARIOUS DISEASES TO DRIVE DEMAND

TABLE 58 PHARMACEUTICALS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 PHARMACEUTICALS: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 PERSONAL CARE PRODUCTS

9.5.1 MOISTURIZING AND ANTI-AGING PROPERTIES OF HEMP TO DRIVE DEMAND

TABLE 60 PERSONAL CARE PRODUCTS: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 PERSONAL CARE PRODUCTS: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9.6 ANIMAL NUTRITION

9.6.1 REGULATORY HURDLES FOR INCLUSION OF HEMP IN ANIMAL FEED TO RESTRICT DEMAND

TABLE 62 ANIMAL NUTRITION: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 ANIMAL NUTRITION: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.7 PAPER

9.7.1 PREFERENCE FOR ECO-FRIENDLY HEMP IN PAPER PRODUCTION TO DRIVE DEMAND

TABLE 64 PAPER: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 PAPER: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9.8 CONSTRUCTION MATERIALS

9.8.1 GROWING DEMAND FOR HEMP DUE TO ITS STRENGTH AND THERMAL INSULATION PROPERTIES TO BOOST DEMAND

TABLE 66 CONSTRUCTION MATERIALS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 CONSTRUCTION MATERIALS: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHERS

TABLE 68 OTHERS: INDUSTRIAL HEMP MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 OTHERS: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

10 INDUSTRIAL HEMP MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

FIGURE 38 INDUSTRIAL HEMP MARKET SHARE (BY VALUE), BY KEY COUNTRY, 2021

TABLE 70 MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (KT)

TABLE 73 MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (KT)

10.2 NORTH AMERICA

TABLE 74 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (KT)

TABLE 79 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (KT)

TABLE 80 NORTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Positive market growth due to legalization of industrial hemp cultivation and production in several states

TABLE 84 US: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 US: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing demand for hemp-derived products such as CBD concentrates to drive market

TABLE 86 CANADA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 87 CANADA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 High market potential due to conducive conditions for hemp production

TABLE 88 MEXICO: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 89 MEXICO: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 39 EUROPE: INDUSTRIAL HEMP MARKET SNAPSHOT

TABLE 90 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (KT)

TABLE 95 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (KT)

TABLE 96 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Growing application in pharmaceuticals to drive market growth

TABLE 100 GERMANY: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 101 GERMANY: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Rising demand for hemp-based food products to boost market

TABLE 102 UK: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 UK: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing R&D related to novel applications of hemp fiber to positively influence market

TABLE 104 FRANCE: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 105 FRANCE: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Investments and acquisitions by major global hemp corporations to drive market

TABLE 106 SPAIN: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 107 SPAIN: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Increased processing of hemp seeds for human consumption to bolster market

TABLE 108 ITALY: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 109 ITALY: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.6 NETHERLANDS

10.3.6.1 Growing applications of hemp in automobile and construction industries to drive market growth

TABLE 110 NETHERLANDS: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 111 NETHERLANDS: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.7 REST OF EUROPE

10.3.7.1 Rising use of hemp in food and pharmaceutical products to drive market

TABLE 112 REST OF EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SNAPSHOT

TABLE 114 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (KT)

TABLE 119 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (KT)

TABLE 120 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Leading producer of hemp fiber and hemp seed due to relaxed regulations

TABLE 124 CHINA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 125 CHINA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 AUSTRALIA & NEW ZEALAND

10.4.2.1 Increased R&D by food companies to introduce hemp-based products to propel market

TABLE 126 AUSTRALIA & NEW ZEALAND: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 127 AUSTRALIA & NEW ZEALAND: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Revised drug laws to create opportunities for hemp-based pharmaceuticals

TABLE 128 JAPAN: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 129 JAPAN: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Increasing introduction of hemp-based products in food and pharmaceuticals industries to boost market

TABLE 130 INDIA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 131 INDIA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

10.4.5.1 Growing inclination for hemp-derived CBD products to positively influence market

TABLE 132 REST OF ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 134 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 135 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 136 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 137 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 138 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (KT)

TABLE 139 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (KT)

TABLE 140 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 141 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 142 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 143 ROW: MARKET FOR INDUSTRIAL HEMP SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Government regulations in favor of hemp to contribute to market growth

TABLE 144 SOUTH AMERICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 145 SOUTH AMERICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Rising application of hemp seed oil in personal care products to drive market

TABLE 146 MIDDLE EAST: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 147 MIDDLE EAST: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 South African government support for cultivation of hemp crops to drive market growth

TABLE 148 AFRICA: MARKET FOR INDUSTRIAL HEMP SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 149 AFRICA: INDUSTRIAL HEMP MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 172)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

TABLE 150 INDUSTRIAL HEMP MARKET SHARE (COMPETITIVE)

11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 41 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2021 (USD MILLION)

11.4 STRATEGIES ADOPTED BY KEY PLAYERS

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 42 INDUSTRIAL HEMP MARKET, COMPANY EVALUATION QUADRANT, 2022 (OVERALL MARKET)

11.5.5 PRODUCT FOOTPRINT

TABLE 151 COMPANY PRODUCT SOURCE FOOTPRINT

TABLE 152 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 153 COMPANY REGIONAL FOOTPRINT

TABLE 154 OVERALL COMPANY FOOTPRINT

11.6 INDUSTRIAL HEMP MARKET, STARTUP/SME EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 43 MARKET FOR INDUSTRIAL HEMP, COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

11.6.5 COMPETITIVE BENCHMARKING

TABLE 155 MARKET FOR INDUSTRIAL HEMP: KEY STARTUPS/SMES

TABLE 156 MARKET FOR INDUSTRIAL HEMP: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES

TABLE 157 MARKET FOR INDUSTRIAL HEMP: PRODUCT LAUNCHES, JULY 2019–MARCH 2020

11.7.2 DEALS

TABLE 158 INDUSTRIAL HEMP MARKET: DEALS, MARCH 2018–SEPTEMBER 2022

TABLE 159 INDUSTRIAL HEMP MARKET: OTHERS, NOVEMBER 2018-JUNE 2022

12 COMPANY PROFILES (Page No. - 199)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 MARIJUANA COMPANY OF AMERICA, INC.

TABLE 160 MARIJUANA COMPANY OF AMERICA, INC.: BUSINESS OVERVIEW

FIGURE 44 MARIJUANA COMPANY OF AMERICA, INC.: COMPANY SNAPSHOT

TABLE 161 MARIJUANA COMPANY OF AMERICA, INC.: PRODUCTS OFFERED

TABLE 162 MARIJUANA COMPANY OF AMERICA, INC.: PRODUCT LAUNCHES

TABLE 163 MARIJUANA COMPANY OF AMERICA, INC.: DEALS

TABLE 164 MARIJUANA COMPANY OF AMERICA, INC.: OTHERS

12.1.2 CRONOS GROUP INC.

TABLE 165 CRONOS GROUP INC.: BUSINESS OVERVIEW

FIGURE 45 CRONOS GROUP INC.: COMPANY SNAPSHOT

TABLE 166 CRONOS GROUP INC.: PRODUCTS OFFERED

TABLE 167 CRONOS GROUP INC.: DEALS

TABLE 168 CRONOS GROUP INC.: OTHERS

12.1.3 ECOFIBRE LIMITED

TABLE 169 ECOFIBRE LIMITED: BUSINESS OVERVIEW

FIGURE 46 ECOFIBRE LIMITED: COMPANY SNAPSHOT

TABLE 170 ECOFIBRE LIMITED: PRODUCTS OFFERED

TABLE 171 ECOFIBRE LIMITED: OTHERS

12.1.4 GREEN THUMB INDUSTRIES

TABLE 172 GREEN THUMB INDUSTRIES: BUSINESS OVERVIEW

FIGURE 47 GREEN THUMB INDUSTRIES: COMPANY SNAPSHOT

TABLE 173 GREEN THUMB INDUSTRIES: PRODUCTS OFFERED

TABLE 174 GREEN THUMB INDUSTRIES: DEALS

12.1.5 CURALEAF HOLDINGS INC.

TABLE 175 CURALEAF HOLDINGS INC.: BUSINESS OVERVIEW

FIGURE 48 CURALEAF HOLDINGS INC.: COMPANY SNAPSHOT

TABLE 176 CURALEAF HOLDINGS INC.: PRODUCTS OFFERED

TABLE 177 CURALEAF HOLDINGS INC.: DEALS

TABLE 178 CURALEAF HOLDINGS INC.: OTHERS

12.1.6 GENCANNA

TABLE 179 GENCANNA: BUSINESS OVERVIEW

TABLE 180 GENCANNA: PRODUCTS OFFERED

TABLE 181 GENCANNA: DEALS

12.1.7 HEMPFLAX BV

TABLE 182 HEMPFLAX BV: BUSINESS OVERVIEW

TABLE 183 HEMPFLAX BV: PRODUCTS OFFERED

TABLE 184 HEMPFLAX BV: DEALS

TABLE 185 HEMPFLAX BV: OTHERS

12.1.8 KONOPLEX GROUP

TABLE 186 KONOPLEX GROUP: BUSINESS OVERVIEW

TABLE 187 KONOPLEX GROUP: PRODUCTS OFFERED

12.1.9 HEMP OIL CANADA

TABLE 188 HEMP OIL CANADA: BUSINESS OVERVIEW

TABLE 189 HEMP OIL CANADA: PRODUCTS OFFERED

TABLE 190 HEMP OIL CANADA: DEALS

12.1.10 BAFA

TABLE 191 BAFA: BUSINESS OVERVIEW

TABLE 192 BAFA: PRODUCTS OFFERED

12.1.11 DUN AGRO HEMP GROUP

TABLE 193 DUN AGRO HEMP GROUP: BUSINESS OVERVIEW

TABLE 194 DUN AGRO HEMP GROUP: PRODUCTS OFFERED

TABLE 195 DUN AGRO: OTHERS

12.1.12 COLORADO HEMP WORKS

TABLE 196 COLORADO HEMP WORKS: BUSINESS OVERVIEW

TABLE 197 COLORADO HEMP WORKS: PRODUCTS OFFERED

12.1.13 CANAH INTERNATIONAL

TABLE 198 CANAH INTERNATIONAL: BUSINESS OVERVIEW, 2021

TABLE 199 CANAH INTERNATIONAL: PRODUCTS OFFERED

12.1.14 SOUTH HEMP TECNO

TABLE 200 SOUTH HEMP TECNO: BUSINESS OVERVIEW

TABLE 201 SOUTH HEMP TECNO: PRODUCTS OFFERED

12.1.15 MH MEDICAL HEMP GMBH

TABLE 202 MH MEDICAL HEMP GMBH: BUSINESS OVERVIEW

TABLE 203 MH MEDICAL HEMP GMBH: PRODUCTS OFFERED

12.2 STARTUPS/SMES

12.2.1 HEMPOLAND

TABLE 204 HEMPOLAND: BUSINESS OVERVIEW

TABLE 205 HEMPOLAND: PRODUCTS OFFERED

TABLE 206 HEMPOLAND: DEALS

12.2.2 BOMBAY HEMP COMPANY PRIVATE LIMITED

TABLE 207 BOMBAY HEMP COMPANY PRIVATE LIMITED: BUSINESS OVERVIEW

TABLE 208 BOMBAY HEMP COMPANY PRIVATE LIMITED: PRODUCTS OFFERED

12.2.3 PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.

TABLE 209 PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.: BUSINESS OVERVIEW

TABLE 210 PARKLAND INDUSTRIAL HEMP GROWERS CO-OP. LTD.: PRODUCTS OFFERED

12.2.4 HEMPMEDS BRASIL

TABLE 211 HEMPMEDS BRASIL: BUSINESS OVERVIEW

TABLE 212 HEMPMEDS BRASIL: PRODUCTS OFFERED

TABLE 213 HEMPMEDS BRASIL.: PRODUCT LAUNCHES

TABLE 214 HEMPMEDS BRASIL: DEALS

TABLE 215 HEMPMEDS BRASIL: OTHERS

12.2.5 IND HEMP

TABLE 216 IND HEMP: BUSINESS OVERVIEW

TABLE 217 IND HEMP: PRODUCTS OFFERED

TABLE 218 IND HEMP: DEALS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2.6 BLUE SKY HEMP VENTURES LIMITED

12.2.7 MINNESOTA HEMP FARMS

12.2.8 EAST MESA INC.

12.2.9 AMERICAN HEMP

12.2.10 VALLEY BIO LTD.

13 ADJACENT & RELATED MARKETS (Page No. - 261)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 CANNABIS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 CANNABIS MARKET, BY TYPE

TABLE 219 CANNABIS MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 220 CANNABIS MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 221 CANNABIS MARKET, BY PRODUCT TYPE, 2018–2021 (TONS)

TABLE 222 CANNABIS MARKET, BY PRODUCT TYPE, 2022–2027 (TONS)

13.3.4 CANNABIS MARKET, BY APPLICATION

TABLE 223 CANNABIS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 224 CANNABIS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4 CANNABIS TESTING MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 CANNABIS TESTING MARKET, BY PRODUCT & SOFTWARE

TABLE 225 CANNABIS TESTING MARKET, BY PRODUCT & SOFTWARE, 2018–2025 (USD MILLION)

13.4.4 CANNABIS TESTING MARKET, BY SERVICES

TABLE 226 CANNABIS TESTING MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 267)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the industrial hemp market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the industrial hemp market.

Secondary Research

In the secondary research process, various sources such as the Food and Agriculture Organization (FAO), Food and Drug Administration (FDA), European Industrial Hemp Association (EIHA), National Hemp Association (NHA), United States Department of Agriculture (USDA), American Farm Bureau Federation (AFBF), European Food Safety Authority (EFSA), Canadian Hemp Trade Alliance (CHTA), British Hemp Association (BHA), Indian Industrial Hemp Association (IIHA), Hemp Industries Association (HIA), Vote Hemp, and Hokkaido Industrial Hemp Association (HIHA) were referred to, to identify and collect information for this study. The secondary sources also include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers and manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include food & beverages manufacturers, personal care product manufacturers, pharmaceutical manufacturers, researchers, and other paper, automobiles, construction & materials, furniture, and pet food manufacturers. The primary sources from the supply side include producers, distributors, importers, and exporters of industrial hemp.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the industrial hemp market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer market—the cannabis market—was considered to validate further the market details of industrial hemp.

-

Bottom-up approach:

- The market size was analyzed based on the share of each type of industrial hemp and its application at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include the penetration rate of industrial hemp in distinguished application sectors, such as food & beverages, paper, construction material, personal care products, pharmaceuticals, animal nutrition; consumer awareness; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the industrial hemp market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- 1The following sections (bottom-up and top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall industrial hemp market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for industrial hemp market based on type, mode of application, source, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the industrial hemp market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe’s industrial hemp market, by key country

- Further breakdown of the industrial hemp market for food application by region

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Hemp Market