Infectious Disease Diagnostics Market by Product & Service (Reagents, Kits), Test Type (Lab, PoC), Sample (Blood, Urine), Technology (Immunodiagnostics, NGS, PCR, ISH, INAAT), Disease (Hepatitis, HIV, HAI, HPV, Syphilis, TB, Flu) & Region - Global Forecast to 2028

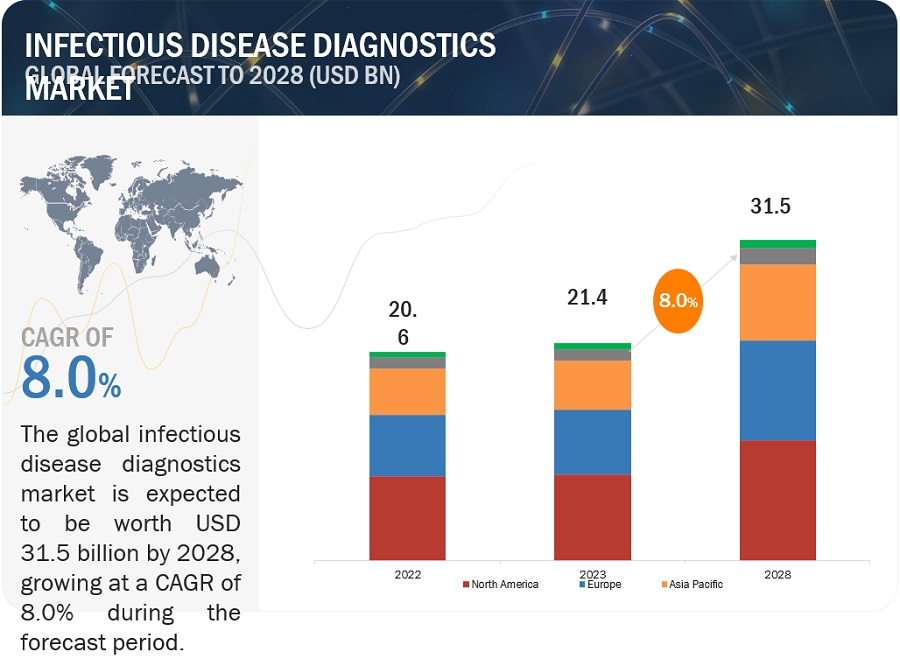

The global infectious disease diagnostics market in terms of revenue was estimated to be worth $21.4 billion in 2023 and is poised to reach $31.5 billion by 2028, growing at a CAGR of 8.0% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Government initiatives, schemes, or funding that support and promote the innovation and development of the diagnostics market provide growth opportunities in the market. These financial incentives and support systems enable companies/institutes to invest in R&D, infrastructure, and the production of advanced diagnostic technologies. By facilitating access to funds, the manufacturers can push the boundaries of diagnostics, leading to breakthrough innovations in disease detection, monitoring, and personalized medicine.

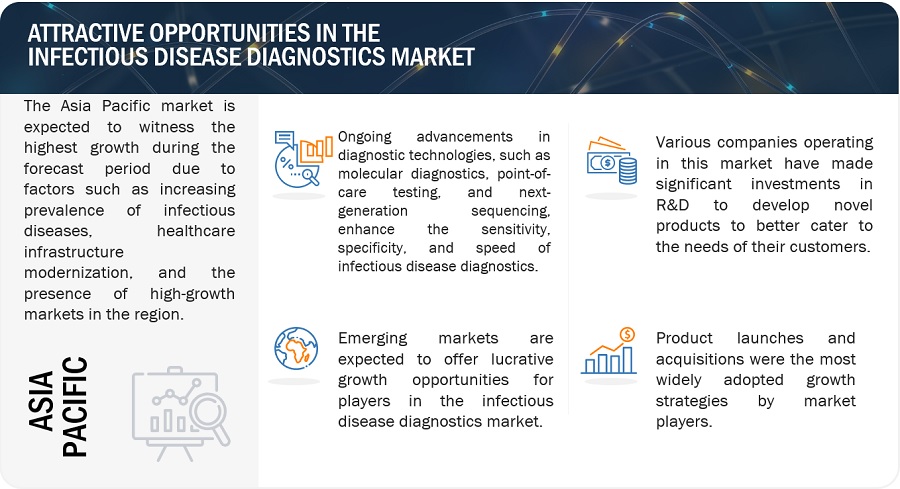

Attractive Opportunities in the Infectious Disease Diagnostics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Infectious Disease Diagnostics Market Dynamics

DRIVER: Rising prevalence of infectious diseases

Diseases such as tuberculosis, HIV/AIDS, hepatitis, sexually transmitted infections, and respiratory infections require an accurate and timely diagnosis for effective treatment and control. Early diagnosis of these diseases plays a crucial role in the monitoring of these infectious diseases, driving the growth of the market in this area.

RESTRAINT: Unfavorable reimbursement scenario

Inadequate reimbursements are a major factor restraining the growth of the market. According to MedPAC (Medicare Payment Advisory Commission), medical testing has seen a 40% decline in reimbursement over the last 40 years. This decline and additional budgetary concerns among healthcare systems are major obstacles to implementing novel diagnostic techniques in clinical laboratories.

OPPORTUNITY: Increased growth opportunities in emerging economies

Emerging economies such as India, Brazil, Turkey, Russia, and South Africa are expected to offer potential growth opportunities for major players operating in the market. This can be attributed to the high disease prevalence, large patient population, improved healthcare infrastructure, increased disposable income, and growing medical tourism. In addition to the factors mentioned above, the Asia Pacific region has emerged as an adaptive and business-friendly hub due to relatively less stringent regulations and data requirements.

CHALLENGE: Operational barriers and shortage of skilled laboratory technicians

Clinical laboratories in key markets are undergoing continuous evolution, and technicians encounter operational challenges in guaranteeing the efficient procurement, storage, and transportation of samples. This is particularly true when incorporating innovative technologies like Next-Generation Sequencing (NGS) and lab-on-a-chip PCR devices. Additionally, laboratory spaces must be reconfigured to align with the demands of conducting specific diagnostic tests for infectious diseases, ensuring pathogen detection while preventing cross-contamination and optimizing time efficiency. Therefore, there is a significant increase in costs associated with maintaining and operating advanced infectious disease diagnostic instruments, especially those designed to handle a single sample type.

Infectious Disease Diagnostics Ecosystem/Market Map

Reagents, kits, and consumables segment accounted for the largest share of the infectious disease diagnostics industry in 2022, by product & service.

The infectious disease diagnostics market is categorized into reagents, kits, and consumables; instruments; and software & services, based on product & service. The reagents, kits, and consumables segment emerged as the dominant force in the market in 2022. The versatility of reagents and kits in accommodating diverse testing needs contributes to their extensive usage and market demand. Moreover, with the growing prevalence of diseases and the need for accurate and timely diagnoses, the volume of infectious disease diagnostics tests is consistently increasing. Reagents and kits play a critical role in accommodating this rise in test volumes, ensuring an ongoing demand for these consumables. The availability of advanced reagents and kits that offer enhanced performance and reliability fosters their widespread adoption and contributes to the growth of the segment.

Hepatitis segment accounted for the largest share in the infectious disease diagnostics industry in 2022, by disease type.

The global infectious disease diagnostics market is categorized into hepatitis, HIV, hospital-acquired infections, Chlamydia trachomatis, Neisseria gonorrhea, HPV, tuberculosis, influenza, syphilis, mosquito-borne diseases, and other infectious diseases based on disease type. The hepatitis segment accounted for the largest share of the market in 2022. The global impact of hepatitis in terms of morbidity, mortality, and economic burden has contributed to a greater emphasis on developing diagnostic tools for these infections. Many countries have implemented hepatitis B vaccination programs to prevent new infections. As a result, there is a focus on early screening and diagnostics to identify and manage existing cases.

Laboratory testing segment accounted for the largest share in the infectious disease diagnostics industry in 2022, by type of testing.

The infectious disease diagnostics market has been segmented into laboratory testing and PoC testing, based on the type of testing. In 2022, the laboratory testing segment accounted for the largest share of the market. Laboratory tests generally have higher sensitivity and specificity compared to PoC tests. The controlled laboratory environment allows for more accurate and precise measurements, reducing the chances of false-negative or false-positive results. This is particularly crucial in infectious disease diagnostics, where accuracy is paramount for appropriate treatment and containment measures. Another advantage of lab tests is the ability to process a large volume of samples simultaneously. Automated platforms and high-throughput systems in laboratories can handle a high sample throughput, enabling efficient testing for infectious diseases. Such factors are expected to fuel the growth of this segment.

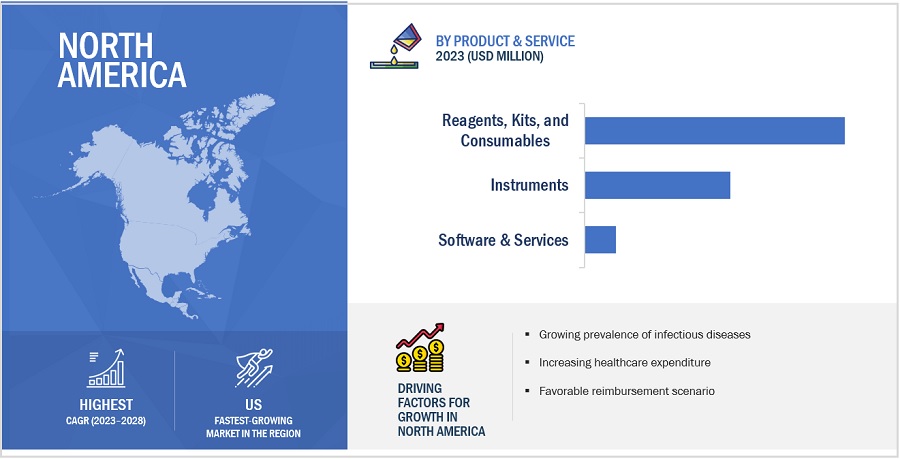

North America accounted for the largest share of the infectious disease diagnostics industry in 2022.

The infectious disease diagnostics market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the leading contributor, claiming the largest portion of the market share in the infectious disease diagnostics industry. The region has a robust infrastructure for R&D. Also, North America houses several major companies operating in the infectious disease diagnostics sector. These companies have significant expertise, resources, and established distribution networks, which contribute to the region's market dominance. Also, the high burden of infectious diseases on regional healthcare systems is another major driver for market growth.

To know about the assumptions considered for the study, download the pdf brochure

The major players in infectious disease diagnostics market are F. Hoffmann-La Roche Ltd. (Switzerland), Abbott (US), bioMérieux (France), Siemens Healthineers AG (Germany), and Danaher (US). These players lead the market because of their extensive product portfolios and wide geographic presence.

Scope of the Infectious Disease Diagnostics Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$21.4 billion |

|

Projected Revenue by 2028 |

$31.5 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.0% |

|

Market Driver |

Rising prevalence of infectious diseases |

|

Market Opportunity |

Increased growth opportunities in emerging economies |

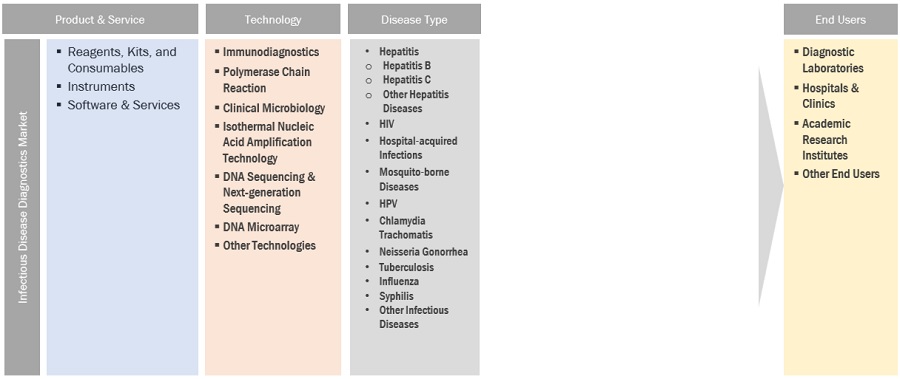

This report categorizes the infectious disease diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Reagents, Kits, and Consumables

- Instruments

- Software & Services

By Type of Testing

- Laboratory Testing

- PoC Testing

By Technology

- Immunodiagnostics

- Polymerase Chain Reaction

- Clinical Microbiology

- Isothermal Nucleic Acid Amplification Technology

- DNA Sequencing & Next-generation Sequencing

- DNA Microarray

- Other Technologies

By Disease Type

-

Hepatitis

- Hepatitis B

- Hepatitis C

- Other Hepatitis Diseases

- HIV

- Hospital-acquired Infections

- Mosquito-borne Diseases

- HPV

- Chlamydia trachomatis

- Neisseria gonorrhea

- Tuberculosis

- Influenza

- Syphilis

- Other Infectious Diseases

By Sample Type

- Blood, Serum, and Plasma

- Urine

- Other Sample Types

By End User

- Diagnostic Laboratories

- Hospitals & Clinics

- Academic Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

-

Middle East & Africa

- GCC Countries

- Rest of Middle East & Africa

Recent Developments of Infectious Disease Diagnostics Industry

- In January 2023, Thermo Fisher Scientific Inc. (US) launched its CE-IVD marked Applied Biosystems TaqPath Seq HIV-1 Genotyping Kit.

- In July 2022, Roche launched Elecsys HCV Duo, an immunoassay that allows the simultaneous and independent determination of the hepatitis C virus (HCV) antigen and antibody status from a single human plasma or serum sample.

- In September 2022, Siemens Healthineers released its CE-marked FTD SARS-CoV-2/FluA/FluB/HRSV Assay, a PCR test, and the CLINITEST Rapid COVID-19 + Influenza Test.

- In December 2021, Roche completed a purchase agreement with TIB Molbiol (Germany) to expand the PCR-test portfolio in the fight against new infectious diseases.

- In February 2020, Cepheid collaborated with Sherlock Biosciences (US). This collaboration between the two companies aimed to explore the development of new cutting-edge molecular diagnostic tests for infectious diseases leveraging CRISPR technology.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global infectious disease diagnostics market?

The global infectious disease diagnostics market boasts a total revenue value of $31.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global infectious disease diagnostics market?

The global infectious disease diagnostics market has an estimated compound annual growth rate (CAGR) of 8.0% and a revenue size in the region of $21.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

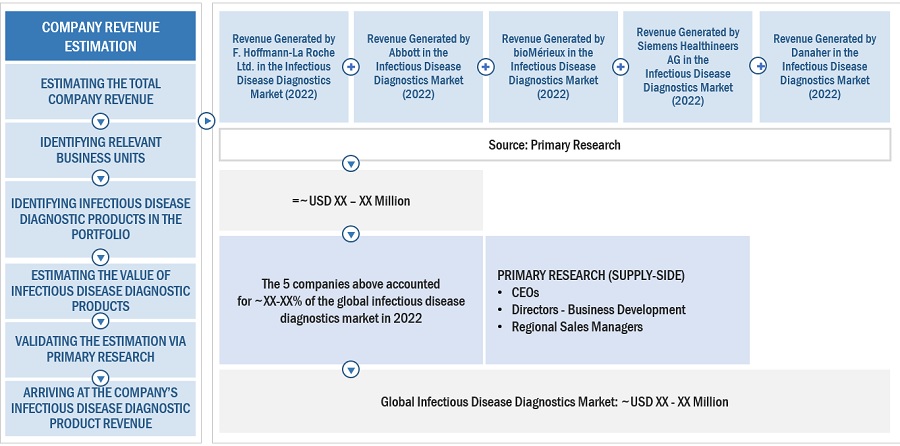

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, restraints, challenges, and key player strategies. To track company developments such as acquisitions, product launches, expansions, agreements, and partnerships of the leading players, the competitive landscape of the infectious disease diagnostics market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

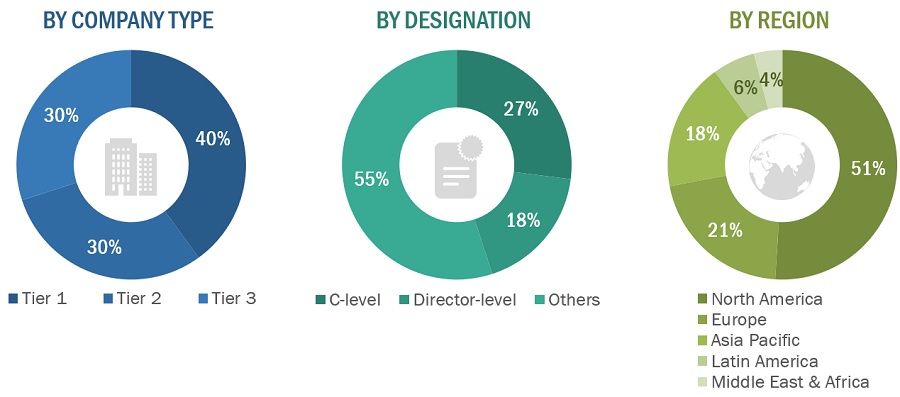

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Abbott |

Sales Manager |

|

Becton, Dickinson and Company |

Product Manager |

Market Size Estimation

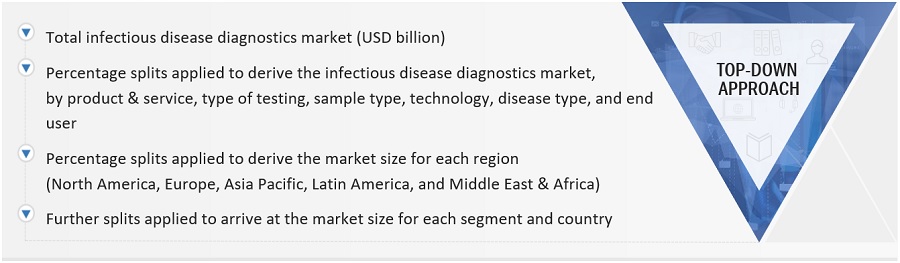

Both top-down and bottom-up approaches were used to estimate and validate the infectious disease diagnostics market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the market have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Infectious Disease Diagnostics Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Infectious Disease Diagnostics Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Infectious disease diagnostics can be defined as various techniques and products (including kits, assays, tests, reagents, and analyzers) used by healthcare professionals to detect and diagnose disease-causing pathogens in human samples such as serum, blood, urine, throat swab, and stool, among others.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global infectious disease diagnostics market by product & service, type of testing, sample type, technology, disease type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

MarketsandMarkets offers the following customizations for this market report.

Country Information

- Additional country-level analysis

Company profiles

- Additional five company profiles of players operating in the market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infectious Disease Diagnostics Market

What are the challenges faced by the key players of the Infectious Disease Diagnostics Market?

Which of the segments of Infectious Disease Diagnostics Market is expected to hold the major share?

How the technological innovations are boosting the global growth of Infectious Disease Diagnostics Market?