PVDF Membrane Market by Technology, Type (Hydrophobic, Hydrophilic), Application (General Filtration, Sample Preparation, Bead – Based Assays), End-Use Industry (Biopharmaceutical, Industrial, Food & Beverage), and Region - Global Forecast to 2027

Updated on : August 08, 2024

PVDF Membrane Market

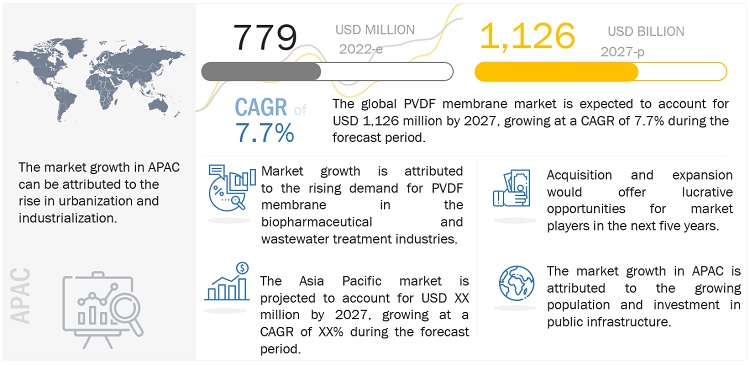

The global PVDF membrane market was valued at USD 779 million in 2022 and is projected to reach USD 1,126 million by 2027, at 7.7% cagr from 2022 to 2027. The key factors driving the market growth are the increased demand for PVDF membranes from biopharmaceutical companies and stringent regulations pertaining to the release and treatment of industrial waste.

Attractive Opportunities in the PVDF Membrane Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

PVDF Membrane Market Dynamics

Driver: Advancement in membrane filtration technologies

Consistent technological advancements in the membrane filtration industry have fuelled the global membrane market. Emerging membrane filtration technologies, such as membrane distillation (MD) and forward osmosis (FO), have proven to be beneficial in terms of low energy consumption.

Membrane distillation is a separation technique that uses a porous, liquid-unwettable lyophobic membrane. Due to the polymer's lipophobicity, only vapors may pass through membrane pores. On the other side of the membrane, in an air gap, a cooling liquid, or an inert carrier gas, condensation occurs. MD is typically used to treat water solutions; therefore, hydrophobic membranes made of polymers, such as polypropylene (PP), polytetrafluoroethylene (PTFE), or poly (vinylidene fluoride) (PVDF), are utilized in the process. In direct contact membrane distillation (DMCD), PVDF is preferred by researchers for fabricating membranes due to its solubility in common solvents. The PTFE are also more brittle and has higher degree of crystallinity. This can act as a constraint at elevated temperatures.

Restraint: High production cost of PVDF membranes

Membranes play a vital role in controlling the permeation of specific components. Membrane materials can affect the properties and characteristics of a membrane, such as hydrophobicity and surface charge, thus altering the separation characteristic of a membrane. PVDF membranes with adequate characteristics are not available at a reasonable cost, as the membrane industry is capital-intensive. These membranes are costlier than PTFE and other nitrocellulose membranes. The cost of production and maintenance of these membranes is high, thus giving rise to alternatives that are more cost-effective. The fluctuations in raw material costs and equipment costs required for membrane manufacturing restrict new players from entering the membrane manufacturing market. Updating the technology of membranes and the cost associated with R&D also add to capital investments.

The initial investment cost for setting up membrane modules in end applications is very high for small players. The existing players are dominant in the market, which makes it difficult for new entrants to establish high-cost manufacturing units and market their products. This is restraining the growth of the PVDF membrane market, especially in emerging economies.

Opportunity: Increasing use of PVDF membranes in venting and medical accessories

PVDF membranes are used for gas filtration, vapor filtration, medicine filtration, and filtration in the food industry. The different characteristics of PVDF hydrophobic membranes include high flow rate and long service life at low operating pressures, which make the membranes ideal for sterile filtration and venting of air/gases. These membranes are used in a wide variety of applications, such as IV filters, drug filtration, acid analysis, protein concentration, antibiotics production, blood plasma processing, drainage bags, medical device enclosures, vent caps, IV administration sets, surgical smoke filters, and suction filters.

Challenge: Shortage of key raw materials

The use of PVDF is increasing in various applications. The growth in the demand of PVDF has been stretched by lithium battery manufacturing, photovoltaic backplane, and energy storage, among other applications. R-142B being the main raw material in the production of PVDF has also seen increase in price due to the rising demand. The latest price of the raw material has risen to USD 29.2 per kg, a monthly increase of 10% and a cumulative increase of 12 times in the past year. R-142B, is largely exported from China, may hamper the production of PVDF. The current increase in the number of COVID-19 cases in China will pose a challenge to the export of raw materials. This scenario has affected the price of PVDF as well. Most of the cell factories regard PVDF as the scarcest material in the future. In the application of PVDF membranes, due to the price barrier, materials like PTFE and nitrocellulose are posing an increasing threat to the market growth of PVDF membrane. Nitrocellulose are cheaper when compared to PVDF and are being preferred due to the pricing barrier for immunoblotting application. Similarly, PTFE membranes can act as a substitute for applications such as membrane distillation and tensile structures.

PVDF Membrane Market Ecosystem

|

COMPANY |

ROLE IN ECOSYSTEM |

|

Bio-Rad Laboratories |

Product Manufacturer |

|

Thermo Fisher Scientific Inc. |

Product Manufacturer |

|

Pall Corporation |

Product Manufacturer |

|

Cytiva Life Sciences |

Product Manufacturer |

|

Merck Millipore |

Product Manufacturer |

|

Arkema |

Raw Material Provider |

|

Vizag Chemicals |

Raw Material Provider |

|

Kureha |

Raw Material Provider |

|

ClearChem Corporation |

Distributor |

|

Total Plastics, Inc. |

Distributor |

|

Sterlitech Corporation |

Distributor |

Source: Company Websites and MarketsandMarkets Analysis

In terms of value, the ultrafiltration segment is projected to account for the largest share of the PVDF Membrane market, by technology, during the forecast period.

The construction segment accounted for a share of 49.6% in terms of value, of the overall PVDF membrane market in 2021. Ultrafiltration involves finely porous membranes to separate water and micro solutes from macromolecules and colloids. In ultrafiltration, the mechanism for the separation of the solvent from the solute/colloidal particle is similar to that of reverse osmosis and nanofiltration, with distinction in pore sizes. UF also finds applications in wine and other beverage industries. It is used to filter water to remove organic contaminants. It is also used to improve wine concentrations, remove the color from heavy press juice fractions, remove bitter tannins from red varietals, and many other applications

Biopharmaceutical segment is projected to account for one of the fastest growth of the PVDF Membrane market, by end-use industry, during the forecast period

Biopharmaceutical is the largest and fastest-growing end-use industry in the PVDF membrane market due to its extensive use in filtration applications, such as drug filtration, venting, and acid analysis. Its unique properties, such as chemical inertness, ability to sustain high temperatures, good mechanical properties, and high filtration efficiency, make PVDF membranes suitable for applications involving exposure to corrosive environments and contact with gases, acids, solvents, and alkaline solutions.

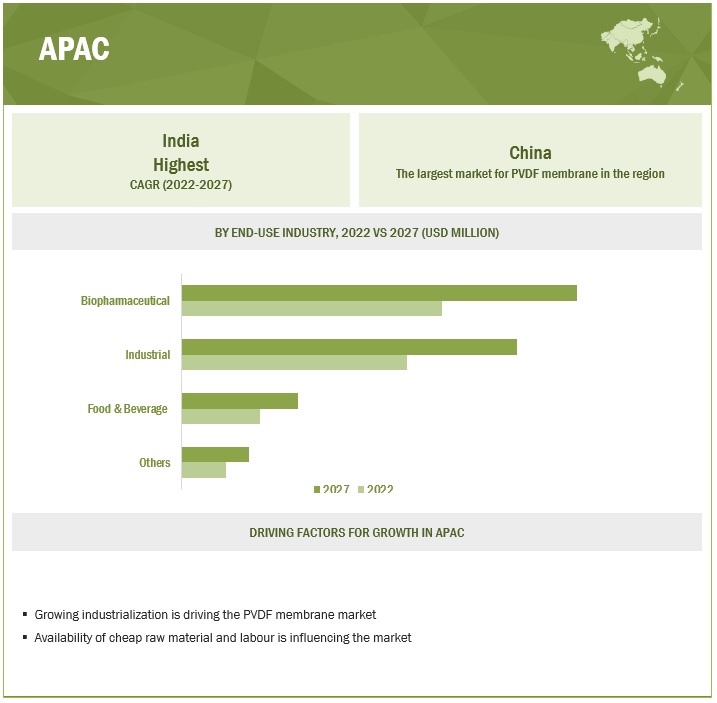

APAC is expected to be the fastest-growing market during the forecast period.

Based on region, Asia Pacific is a key market to produce PVDF Membrane and is projected to grow at a CAGR of 8.5% in terms of value during the forecasted period. The availability of low-cost raw materials and labour, coupled with growing industrialization, makes the region an attractive investment destination for PVDF Membrane manufacturers. The rising population, urbanization, and industrialization are some of the factors that will drive the PVDF Membrane market in this region.

To know about the assumptions considered for the study, download the pdf brochure

PVDF Membrane Market Players

Major players operating in the global PVDF Membrane market include Arkema S.A. (France), Merck Millipore (US), KOCH Separation Solutions (US), Pall Corporation (US), Cytiva Life Science (US), CITIC Envirotech Pte Ltd (Singapore), Bio-Rad laboratories (US), Thermo Fisher Scientific Inc. (US), Membrane Solutions, LLC. (US), GVS Filter Technology (Italy), and Toray Industries, Inc. (Japan)

PVDF Membrane Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion), Volume (Ton) |

|

Segments |

Type, Technology, Application, End-Use Industry, and Region |

|

Regions |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies |

Arkema S.A. (France), Merck Millipore (US), KOCH Separation Solutions (US), Pall Corporation (US), Cytiva Life Science (US), CITIC Envirotech Pte Ltd (Singapore), Bio-Rad laboratories (US), Thermo Fisher Scientific Inc. (US), Membrane Solutions, LLC. (US), GVS Filter Technology (Italy), and Toray Industries, Inc. (Japan). |

This research report categorizes the PVDF Membrane market based on type, technology, application, end-use industry, and region.

PVDF Membrane Market based on Type:

- Hydrophobic

- Hydrophilic

PVDF Membrane Market based on Technology:

- Microfiltration

- Ultrafiltration

- Nanofiltration

PVDF Membrane Market based on Application:

- General Filtration

- Sample Preparation

- Bead-based Assays

- Others

PVDF Membrane Market based on End-use Industry:

- Biopharmaceutical

- Industrial

- Food & Beverage

- Others

PVDF Membrane Market based on Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In April 2021, Koch Separation Solutions launched Indu-Cor HD; an enhanced technology designed to treat various industrial waste streams more effectively. It provides a higher packing density of up to 300%, which makes crossflow filtration more economical while taking up less space.

- In May 2022, GVS Filter Technology acquired 100% stake of the Italian Group Haemotronic, a leading supplier of advanced filtration solutions for highly critical applications and a specialized producer of components and bags for the medical sector with plants in Italy and Mexico. This acquisition helps in the growth of GVS's product portfolio, which can thus integrate and expand the range of products offered and strengthen its presence in the European and North American markets within the healthcare sector.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the PVDF Membrane market?

The key factors driving the market growth are the increased demand for PVDF membranes from biopharmaceutical companies and stringent regulations pertaining to the release and treatment of industrial waste.

Which are the key applications driving the PVDF Membrane market?

Applications such as general filtration, sample preparation, and bead-based assays are driving the demand for PVDF Membrane market.

Who are the major manufacturers?

Major manufacturers include Arkema S.A. (France), Merck Millipore (US), KOCH Separation Solutions (US), Pall Corporation (US), Cytiva Life Science (US), CITIC Envirotech Pte Ltd (Singapore), Bio-Rad laboratories (US), Thermo Fisher Scientific Inc. (US), Membrane Solutions, LLC. (US), GVS Filter Technology (Italy), and Toray Industries, Inc. (Japan), among others.

What is the biggest restraint for PVDF Membrane?

The biggest restraint can be high production cost of PVDF membranes.

How is COVID-19 affecting the overall PVDF Membrane?

The PVDF Membrane market saw a disruption in supply chain for supply of raw materials.

What will be the growth prospects of the PVDF Membrane?

High demand for PVDF Membranes in the biopharmaceutical industry and industrial application are driving the market.

How is the PVDF membrane market in the United States being impacted by environmental regulations?

In the United States, environmental regulations such as the Clean Water Act and increasingly stringent discharge standards are driving demand for PVDF membranes. These membranes play a crucial role in wastewater treatment and environmental protection.

What role are PVDF membranes playing in the United Kingdom’s push for sustainable water management?

In the United Kingdom, PVDF membranes are at the forefront of sustainable water management initiatives. They enhance water reuse and minimize waste, helping businesses meet strict environmental standards and sustainability goals.

What are the key applications driving the demand for PVDF membranes?

PVDF membranes are primarily utilized in water and wastewater treatment, biopharmaceuticals, and food and beverage processing. Their chemical resistance and durability make them ideal for these applications.

How do PVDF membranes contribute to environmental sustainability?

PVDF membranes support recycling efforts due to their durability and chemical resistance. This aligns with sustainability practices aimed at improving water quality and reducing environmental impact.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Thriving biopharmaceutical industry- Stringent regulations pertaining to release and treatment of municipal and industrial wastewater- Advancements in membrane filtration technologies- Shift from chemical to physical water treatmentsRESTRAINTS- High production cost of PVDF membranesOPPORTUNITIES- Rising need for water treatment services by emerging economies- Increase in scarcity of fresh water- Rising adoption of PVDF membranes in microfiltration, venting, and medical applicationsCHALLENGES- Issues related to lifespan and efficiency of PVDF membranes- Shortage of key raw materials

-

5.3 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 ECOSYSTEM MAPPING

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

- 5.6 ECONOMIC RECESSION: RISK ASSESSMENT

-

5.7 CASE STUDY ANALYSISKOCH SEPARATION SOLUTIONS ADOPTED MBR TECHNOLOGY WITH TMBR SYSTEM TO IMPROVE SAO PAULO’S NEED FOR WATER FOR INDUSTRIAL USEKOCH SEPARATION SOLUTIONS SUPPLIED PURON MBR SYSTEM TO MCGM TO ENABLE REUSE OF WASTEWATERHASGAK WATER PVT. LTD. HELPED MEET INCREASING DEMAND FOR CLEAN WATER IN SEZ BY OFFERING ZLD SYSTEM

-

5.8 MACROECONOMIC DATATRENDS IN HEALTHCARE SECTORCHEMICAL SALES

-

5.9 REGULATORY FRAMEWORK, BY REGIONASIA PACIFICEUROPENORTH AMERICA- US- CanadaMEDICAL DEVICES

-

5.10 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE BASED ON APPLICATION

- 6.1 INTRODUCTION

-

6.2 HYDROPHOBICHYDROPHOBIC PVDF MEMBRANES KNOWN FOR HIGH FLOW RATE, EXCELLENT OXIDATION RESISTANCE, AND HIGH HEAT RESISTANCE

-

6.3 HYDROPHILICHYDROPHILIC PVDF MEMBRANES FEATURE HIGH POROSITY, FLOW RATE, THROUGHPUT, AND STRENGTH

- 7.1 INTRODUCTION

-

7.2 ULTRAFILTRATIONADOPTION OF ULTRAFILTRATION TECHNOLOGY TO PRODUCE POTABLE WATER

-

7.3 MICROFILTRATIONIMPLEMENTATION OF MICROFILTRATION TECHNOLOGY TO STERILIZE COLD BEVERAGES; CLEAR FRUIT JUICES, WINES, AND BEERS; AND PRODUCE WHEY PROTEIN ISOLATES

-

7.4 NANOFILTRATIONUTILIZATION OF NANOFILTRATION TECHNOLOGY IN DAIRY APPLICATIONS SUCH AS ICE CREAMS AND YOGURTS

- 8.1 INTRODUCTION

-

8.2 GENERAL FILTRATIONSOLVENT FILTRATION- Good heat resistance and chemical stability to facilitate use of PVDF membranes in filtration applicationsCHEMICAL INTERMEDIATE FILTRATION- Requirement to decolorize, clarify, and demineralize acid to boost demand for PVDF membranesBIOPRODUCTS FILTRATION- Use of PVDF membranes to filter protein solutions, tissue culture media, additives, antibiotics, and alcohol to stimulate market growth

-

8.3 SAMPLE PREPARATIONULTRA-LOW BINDING AND RESISTANCE TO BROAD CHEMICALS AND TEMPERATURES TO DRIVE DEMAND IN SAMPLE PREPARATIONHPLC SAMPLE PREPARATION- Durability and excellent housing strength to boost usage in HPLC sample preparation

-

8.4 BEAD-BASED ASSAYSLOW BINDING, INERT SUPPORT OFFERED BY PVDF MEMBRANES TO BOOST THEIR DEMAND IN BEAD-BASED SEPARATION APPLICATIONS

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 BIOPHARMACEUTICALRISING DEMAND FROM MEDICAL SECTOR TO SUPPORT MARKET GROWTHDIALYSIS AND FILTRATION- Use of PVDF membranes in dialysis and filtration to separate small molecules from macromoleculesSAMPLE PREPARATION- Implementation of PVDF membranes to reduce sample processing time

-

9.3 INDUSTRIALSTRINGENT GOVERNMENT POLICIES REGARDING TREATMENT OF INDUSTRIAL WASTE TO DRIVE MARKETWATER & WASTEWATER TREATMENT- Need to discharge contaminated water generated during industrial processes to propel growthINDUSTRIAL GAS PROCESSING- Low maintenance cost, simple design, and environmental friendliness of PVDF membranes to lead to increased use for processing natural gasMEMBRANE DISTILLATION- Adoption of hydrophobic polymer-fabricated PVDF membranes to drive market

-

9.4 FOOD & BEVERAGEUSE OF PVDF MEMBRANES IN FOOD & BEVERAGE INDUSTRY TO CONCENTRATE OR REMOVE SPECIFIC SUBSTANCES FROM LIQUID STREAMS TO DRIVE MARKETDAIRY APPLICATION- Need to retain lactose and organic molecules in milk and whey products to increase demand for PVDF membranesJUICE & WINE PRODUCTION- Adoption of PVDF membranes to enhance color and flavor of juices and drinks to stimulate market growth

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICCHINA- Increased healthcare expenditure to drive marketJAPAN- Thriving food and filtration industries to boost demand for PVDF membranesINDIA- Government initiatives toward infrastructure development and industrial growth to drive marketSOUTH KOREA- Rising demand for PVDF membranes by food & beverage industry to drive marketAUSTRALIA- Presence of key water treatment organizations to propel marketMALAYSIA- Need to recycle and reuse wastewater for industrial use to boost demand for PVDF membranesINDONESIA- Water & wastewater treatment projects to drive marketTHAILAND- Investments in desalination plants to support market growthREST OF ASIA PACIFIC

-

10.3 EUROPEGERMANY- Technological advancements in biopharmaceutical industry to support market growthUK- Growing food industry to stimulate market growthFRANCE- Investments in wastewater treatment to drive marketITALY- Booming food processing industry to drive marketNETHERLANDS- Water scarcity to result in high demand for PVDF membranesSPAIN- Construction of desalination plants to propel demand for PVDF membranesREST OF EUROPE

-

10.4 NORTH AMERICAUS- Large chemical and oil & gas companies to boost demand for PVDF membranes in filtration applicationsCANADA- Flourishing chemical industry due to abundance of natural resources to stimulate demandMEXICO- Rising demand for healthy food products to fuel market growth

-

10.5 SOUTH AMERICABRAZIL- Production and export of agricultural products to support market growthARGENTINA- Increasing export of food products and beverages to boost demandREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICASAUDI ARABIA- Significant demand from chemical and petrochemical industries to support market growthUAE- Changing energy-mix to drive marketQATAR- Increased health-conscious customers to boost demand for PVDF membranesSOUTH AFRICA- Food industry to contribute to market growthTURKEY- Increasing investments in pharmaceutical industry to drive marketREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

- 11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS, 2019–2021

- 11.5 MARKET EVALUATION MATRIX

-

11.6 COMPANY EVALUATION MATRIX (TIER 1), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 11.8 STRENGTH OF PRODUCT PORTFOLIO

- 11.9 BUSINESS STRATEGY EXCELLENCE

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSARKEMA S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK MILLIPORE- Business overview- Products/Solutions/Services offered- MnM viewKOCH SEPARATION SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPALL CORPORATION- Business overview- Products/Solutions offered- Recent developments- MnM viewCYTIVA LIFE SCIENCES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIO-RAD LABORATORIES- Business overview- Products/Solutions/Services offered- MnM viewCITIC ENVIROTECH PTE LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGVS FILTER TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMEMBRANE SOLUTIONS, LLC.- Business overview- Products/Solutions/Services offered- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Solutions/Services offered- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- Recent developments- MnM view

-

12.2 OTHER PLAYERSADVANCED MICRODEVICES PVT. LTD.ASAHI KASEI CORPORATIONCOBETTER FILTRATION GROUPELABSCIENCEHIMEDIA LABORATORIES PVT. LTD.HYUNDAI MICRO CO., LTD.KAMPS GMBHLG CHEMMITSUBISHI CHEMICAL CORPORATIONPENTAIR PLCSTARLAB GROUPSTERLITECH CORPORATIONSYNDER FILTRATIONTHEWAY MEMBRANES

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 APPLICATIONS OF PVDF MEMBRANES IN MEDICAL INDUSTRY

- TABLE 2 PVDF MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 KEY COMPANIES AND THEIR ROLE IN PVDF MEMBRANE ECOSYSTEM

- TABLE 4 HEALTHCARE EXPENDITURE BY KEY COUNTRIES (% OF GDP, 2019)

- TABLE 5 CHEMICAL SALES IN KEY COUNTRIES, 2020 (USD BILLION)

- TABLE 6 COUNTRY-WISE REGULATIONS

- TABLE 7 AVERAGE SELLING PRICE BASED ON APPLICATION (USD/KG), 2020–2027

- TABLE 8 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 9 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 10 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (TON)

- TABLE 11 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (TON)

- TABLE 12 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 13 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 14 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (TON)

- TABLE 15 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (TON)

- TABLE 16 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 17 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 18 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2021 (TON)

- TABLE 19 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

- TABLE 20 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 21 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 22 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 23 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 24 PVDF MEMBRANE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

- TABLE 25 PVDF MEMBRANE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 PVDF MEMBRANE MARKET SIZE, BY REGION, 2018–2021 (TON)

- TABLE 27 PVDF MEMBRANE MARKET SIZE, BY REGION, 2022–2027 (TON)

- TABLE 28 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

- TABLE 31 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

- TABLE 32 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (TON)

- TABLE 35 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (TON)

- TABLE 36 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (TON)

- TABLE 39 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (TON)

- TABLE 40 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 41 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 42 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 43 ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 44 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 45 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 46 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 47 CHINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 48 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 49 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 50 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 51 JAPAN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 52 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 53 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 54 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 55 INDIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 56 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 57 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 58 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 59 SOUTH KOREA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 60 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 61 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 62 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 63 AUSTRALIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 64 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 65 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 66 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 67 MALAYSIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 68 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 69 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 70 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 71 INDONESIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 72 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 73 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 74 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 75 THAILAND: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 76 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 79 REST OF ASIA PACIFIC: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 80 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 81 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 82 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

- TABLE 83 EUROPE: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

- TABLE 84 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 85 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 86 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (TON)

- TABLE 87 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (TON)

- TABLE 88 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 89 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 90 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (TON)

- TABLE 91 EUROPE: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (TON)

- TABLE 92 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 93 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 94 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 95 EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 96 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 97 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 98 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 99 GERMANY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 100 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 101 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 102 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 103 UK: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 104 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 105 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 106 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 107 FRANCE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 108 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 109 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 110 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 111 ITALY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 112 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 113 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 114 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 115 NETHERLANDS: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 116 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 117 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 118 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 119 SPAIN: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 120 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 121 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 123 REST OF EUROPE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 124 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 126 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

- TABLE 127 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

- TABLE 128 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 129 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 130 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (TON)

- TABLE 131 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (TON)

- TABLE 132 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 134 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (TON)

- TABLE 135 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (TON)

- TABLE 136 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 137 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 138 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 139 NORTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 140 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 141 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 142 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 143 US: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 144 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 145 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 146 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 147 CANADA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 148 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 149 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 150 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 151 MEXICO: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 152 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 154 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

- TABLE 155 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

- TABLE 156 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 157 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (TON)

- TABLE 159 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (TON)

- TABLE 160 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (TON)

- TABLE 163 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (TON)

- TABLE 164 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 165 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 166 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 167 SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 168 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 169 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 170 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 171 BRAZIL: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 172 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 173 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 174 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 175 ARGENTINA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 176 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 177 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 179 REST OF SOUTH AMERICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 180 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2021 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

- TABLE 184 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2018–2021 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TYPE, 2022–2027 (TON)

- TABLE 188 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2018–2021 (TON)

- TABLE 191 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2022–2027 (TON)

- TABLE 192 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 195 MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 196 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 197 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 198 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 199 SAUDI ARABIA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 200 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 201 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 202 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 203 UAE: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 204 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 205 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 206 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 207 QATAR: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 208 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 209 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 210 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 211 SOUTH AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 212 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 213 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 214 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 215 TURKEY: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2018–2021 (TON)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2022–2027 (TON)

- TABLE 220 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- TABLE 221 PVDF MEMBRANE MARKET: REVENUE ANALYSIS, 2019–2021 (USD)

- TABLE 222 MARKET EVALUATION MATRIX

- TABLE 223 PRODUCT LAUNCHES, 2021

- TABLE 224 DEALS, 2018—2022

- TABLE 225 OTHER DEVELOPMENTS, 2018–2022

- TABLE 226 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 227 ARKEMA S.A.: PRODUCT OFFERINGS

- TABLE 228 ARKEMA S.A.: DEALS

- TABLE 229 ARKEMA S.A.: OTHERS

- TABLE 230 MERCK MILLIPORE: COMPANY OVERVIEW

- TABLE 231 MERCK MILLIPORE: PRODUCT OFFERINGS

- TABLE 232 MERCK MILLIPORE: OTHERS

- TABLE 233 KOCH SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 234 KOCH SEPARATION SOLUTIONS: PRODUCT OFFERINGS

- TABLE 235 KOCH SEPARATION SOLUTIONS: PRODUCT LAUNCHES

- TABLE 236 KOCH SEPARATION SOLUTIONS: DEALS

- TABLE 237 KOCH SEPARATION SOLUTIONS: OTHERS

- TABLE 238 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 239 PALL CORPORATION: PRODUCT OFFERINGS

- TABLE 240 PALL CORPORATION: OTHERS

- TABLE 241 CYTIVA LIFE SCIENCES: COMPANY OVERVIEW

- TABLE 242 CYTIVA LIFE SCIENCES: PRODUCT OFFERINGS

- TABLE 243 CYTIVA LIFE SCIENCES: DEALS

- TABLE 244 CYTIVA LIFE SCIENCES: OTHERS

- TABLE 245 BIO-RAD LABORATORIES: COMPANY OVERVIEW

- TABLE 246 BIO-RAD LABORATORIES: PRODUCT OFFERINGS

- TABLE 247 CITIC ENVIROTECH PTE LTD: COMPANY OVERVIEW

- TABLE 248 CITIC ENVIROTECH PTE LTD: PRODUCT OFFERINGS

- TABLE 249 CITIC ENVIROTECH PTE LTD: DEALS

- TABLE 250 GVS FILTER TECHNOLOGY: COMPANY OVERVIEW

- TABLE 251 GVS FILTER TECHNOLOGY: PRODUCT OFFERINGS

- TABLE 252 GVS FILTER TECHNOLOGY: DEALS

- TABLE 253 MEMBRANE SOLUTIONS, LLC.: COMPANY OVERVIEW

- TABLE 254 MEMBRANE SOLUTIONS, LLC.: PRODUCT OFFERINGS

- TABLE 255 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 256 THERMO FISHER SCIENTIFIC INC.: PRODUCT OFFERINGS

- TABLE 257 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 258 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 259 TORAY INDUSTRIES, INC.: DEALS

- TABLE 260 TORAY INDUSTRIES, INC.: OTHERS

- FIGURE 1 PVDF MEMBRANE MARKET: RESEARCH DESIGN

- FIGURE 2 PVDF MEMBRANE MARKET: BOTTOM-UP APPROACH

- FIGURE 3 PVDF MEMBRANE MARKET: TOP-DOWN APPROACH

- FIGURE 4 PVDF MEMBRANE MARKET: DATA TRIANGULATION

- FIGURE 5 HYDROPHOBIC SEGMENT TO LEAD PVDF MEMBRANE MARKET FROM 2022 TO 2027

- FIGURE 6 ULTRAFILTRATION TO BE LARGEST SEGMENT IN PVDF MEMBRANE MARKET, BY TECHNOLOGY, THROUGHOUT FORECAST PERIOD

- FIGURE 7 GENERAL FILTRATION SEGMENT ACCOUNTED FOR LARGEST SHARE OF PVDF MEMBRANE MARKET, BY APPLICATION, IN 2021

- FIGURE 8 BIOPHARMACEUTICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF PVDF MARKET, BY END-USE INDUSTRY, BETWEEN 2022 AND 2027

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF GLOBAL PVDF MEMBRANE MARKET IN 2021

- FIGURE 10 ASIA PACIFIC TO BE MOST POTENTIAL MARKET FOR PROVIDERS OF PVDF MEMBRANES IN COMING YEARS

- FIGURE 11 INDUSTRIAL SEGMENT AND CHINA LED MARKET IN ASIA PACIFIC IN 2021

- FIGURE 12 HYDROPHOBIC SEGMENT TO DOMINATE MARKET, IN TERMS OF VOLUME, THROUGHOUT FORECAST PERIOD

- FIGURE 13 ULTRAFILTRATION TECHNOLOGY TO HOLD LARGEST MARKET SHARE, IN TERMS OF VOLUME, IN 2027

- FIGURE 14 GENERAL FILTRATION SEGMENT TO LEAD MARKET, IN TERMS OF VOLUME, THROUGHOUT FORECAST PERIOD

- FIGURE 15 BIOPHARMACEUTICAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE, IN TERMS OF VOLUME, IN 2027

- FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET GLOBALLY DURING FORECAST PERIOD

- FIGURE 17 PVDF MEMBRANE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 PROJECTED R&D EXPENDITURE BY TOP PHARMACEUTICAL COMPANIES, 2026

- FIGURE 19 PVDF MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 ECOSYSTEM MAP

- FIGURE 21 PVDF MEMBRANE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

- FIGURE 23 HYDROPHOBIC PVDF MEMBRANES TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 24 ULTRAFILTRATION TECHNOLOGY TO CAPTURE LARGEST SHARE OF PVDF MEMBRANE MARKET DURING FORECAST PERIOD

- FIGURE 25 GENERAL FILTRATION SEGMENT TO LEAD PVDF MARKET DURING FORECAST PERIOD

- FIGURE 26 BIOPHARMACEUTICAL SEGMENT TO DOMINATE PVDF MEMBRANE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 27 INDIA TO BE FASTEST-GROWING MARKET FOR PVDF MEMBRANES GLOBALLY DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC: PVDF MEMBRANE MARKET SNAPSHOT

- FIGURE 29 EUROPE: PVDF MEMBRANE MARKET SNAPSHOT

- FIGURE 30 NORTH AMERICA: PVDF MEMBRANE MARKET SNAPSHOT

- FIGURE 31 RANKING OF TOP FIVE PLAYERS IN PVDF MEMBRANE MARKET, 2022

- FIGURE 32 PVDF MEMBRANE MARKET SHARE, BY COMPANY (2022)

- FIGURE 33 PVDF MEMBRANE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 PVDF MEMBRANE MARKET: START-UPS AND SMES MATRIX, 2022

- FIGURE 35 ARKEMA S.A.: COMPANY SNAPSHOT

- FIGURE 36 MERCK: COMPANY SNAPSHOT

- FIGURE 37 BIO-RAD LABORATORIES: COMPANY SNAPSHOT

- FIGURE 38 GVS FILTER TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 40 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

The study involves four major activities in estimating the current market size of PVDF membranes. Extensive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Factiva, Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; and databases.

Primary Research

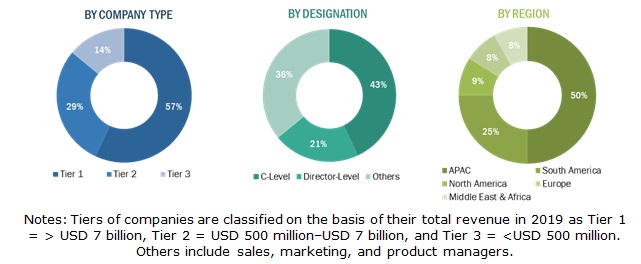

The PVDF membrane market comprises several stakeholders, such as raw material suppliers, manufacturers, and distributors of PVDF membrane, industry associations, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of major construction companies, whereas the supply side consists of PVDF system manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the PVDF membrane market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define and analyze the PVDF membrane market size, in terms of value.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, technology, application, end-use industry, and region

- To forecast the size of the market with respect to five regions; Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, investment & expansion, merger & acquisition and partnership & agreement.

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies, along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC PVDF membrane market

Company Information:

- Detailed analysis and profiles of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in PVDF Membrane Market