Infrastructure Adhesives & Sealants Market by Product Type (Adhesives, Sealants), Job Type (New Construction, Rehabilitation), Application (Bonding, Sealing), End-Use Industry (Railways, Highways & Motorways) and Region - Global Forecast to 2027

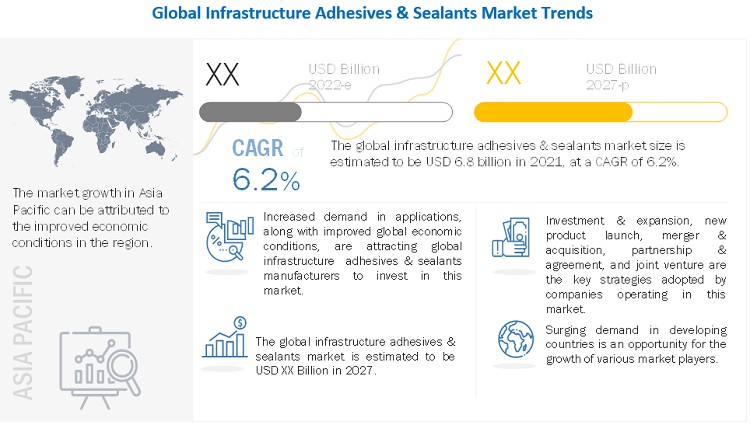

The market size for infrastructure adhesives & sealants was USD 6.8 billion in 2021 and is projected to grow at a CAGR of 6.2%. The major drivers for the market are increased demand for adhesives & sealants from the building & construction industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Infrastructure Adhesives & Sealants Market Dynamics

Driver: High demand for adhesives & sealants from building & construction industry

The growing population and urbanization are driving the construction segment in developing countries such as China, India, Indonesia, Vietnam, Brazil, and Mexico. There is an increasing demand for permanent infrastructure in these countries, which, in turn, is driving the demand for adhesives & sealants. The demand for adhesives for construction sector is increasing in the emerging countries owing to the new infrastructure development. The increasing focus of governments on infrastructure development in Brazil and Argentina and growing demand from India, China, and Vietnam owing to massive infrastructural projects, such as high-speed rail, road works, water transportation, airport development, and nuclear projects, are propelling the demand of infrastructure adhesives.

Restraint: Environmental regulations in North America and Europe

Europe and North America are strictly regulated by environmental laws regarding the production of chemical and Petro-based products. Agencies such as the Epoxy Resin Committee (ERC) and the European Commission (EC) govern the manufacturing of solvent-based products in these regions. This is affecting the production capacities of manufacturers in Europe and North America. The stringent environmental regulations are compelling manufacturers to focus on producing eco-friendly adhesives.

Opportunity: Rising requirement for non-hazardous and sustainable adhesives

The stringent regulations by the USEPA (the United States Environmental Protection Association), Europe’s Registration, Evaluation, Authorisation and Restrictions of Chemicals (REACH), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have compelled adhesive & sealant manufacturers to make eco-friendly products with no- or low-VOC levels. The shift toward more sustainable products has provided significant growth opportunities for manufacturers. Leading adhesives & sealants company, Henkel, offers products such as H4500, H4710, H4720, and H3151, which are solvent-free and comply with environmental regulations. There is a growing demand for environmentally friendly or green buildings, which gives an opportunity for the development of green and sustainable adhesive solutions made from renewable, recycled, remanufactured, or biodegradable materials.

Challenge: Shifting rules and changing standards

The adhesives market undergoes frequent changes in terms of standards and rules. The Construction Products Regulation (CPR) implemented new regulations such as regulation (EU) No 305/2011 for the marketing of construction products in the EU. With the new regulations, manufacturers must bear the additional burden, in terms of labeling and paperwork, and additional external test costs to demonstrate compliance. Additional substance alerts focusing on biocides and waste packaging occur on a regular basis, leading to changes in regulatory standards. The adhesives manufacturers must abide by the rules and changing standards to commercialize their products. This poses a challenge for manufacturers.

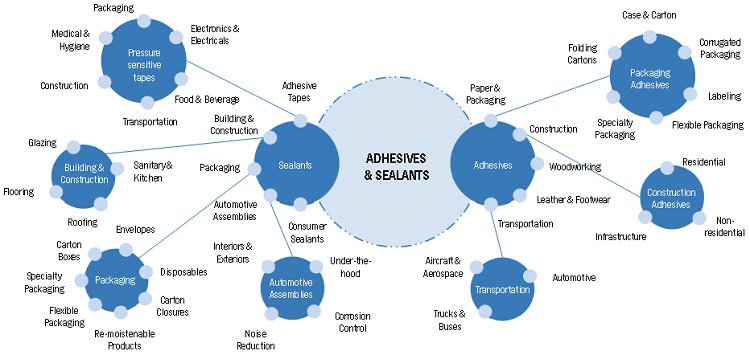

Adhesives & Sealants Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in the market are Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), and 3M (US).

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Product Type |

|

Regions covered |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), 3M Company (US), and Dow Inc. (US). (Total of 25 companies) |

This research report categorizes the infrastructure adhesives & sealants market based on product type, job type, application, end-use industry, and region.

By Product Type:

- Adhesives

- Sealants

- Mortars

By Job Type:

- New Construction

- Rehabilitation

By Application:

- Bonding

- Sealing

- Waterproofing

By End-Use Industry:

- Railways

- Highways & Motorways

- Power Generation & Transmission

- Telecommunication

- Muncipal

- Others

By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In February 2020, Henkel has officially inaugurated its new production facility in Kurkumbh, India, near Pune. With a total investment of about USD 57 million, the business unit aims to serve the growing demand of Indian industries for high-performance solutions in adhesives, sealants, and surface treatment products. Designed as a smart factory, the new plant enables a wide range of Industry 4.0 operations and meets the highest standards for sustainability.

Asia Pacific is the largest infrastructure adhesives & sealants market in the forecast period

Asia Pacific has emerged as one of the leading producers as well as consumers of infrastructure adhesives & sealants due strong growth in infrastructure activities, coupled with domestic demand, drives the market in Asia Pacific. The economic growth in the Asia Pacific region, particularly in the emerging markets such as India, Taiwan, Indonesia, Malaysia, Thailand, and Vietnam, is contributing to the increase in the number of infrastructure projects, which is expected to drive the demand for infrastructure adhesives & sealants.

Frequently Asked Questions (FAQ):

What is the current size of the global infrastructure adhesives & sealants market?

The global infrastructure adhesives & sealants market is estimated to be USD 6.8 billion in 2021

Who are the major players of the infrastructure adhesives & sealants market?

Companies such as Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (Bostik SA) (France), and 3M (US) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, partnership & agreement, investments & expansions, and joint ventures are expected to help the market grow. Several mergers & acquisitions and investments are made on increasing the production capacity of adhesives manufacturers for different applications.

Which segment has the potential to register the highest market share for infrastructure adhesives & sealants?

Adhesives and sealants guarantee durability on roads, in harbours as well as airports and on similar areas. They bond and seal making the structures last longer.

Which is the fastest-growing region in the market?

Asia Pacific is expected to be the largest and fastest-growing market for infrastructure adhesives & sealants. China and India have been the driving forces behind the rapid development of the market in Asia Pacific, as well as globally .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSION

1.2.2 MARKET EXCLUSION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.3.1 ASSUMPTIONS

2.3.2 LIMITATIONS

2.4 RISK ANALYSIS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACRO ECONOMIC INDICATOR ANALYSIS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

5.5 VALUE CHAIN ANALYSIS

5.6 TRADE ANALYSIS

5.7 REGULATIONS

5.8 PATENT ANALYSIS

6 INFRASTRUCTURE ADHESIVES & SEALANTS MARKET, BY PRODUCT TYPE

6.1 ADHESIVES

6.2 SEALANTS

6.3 MORTARS

7 INFRASTRUCTURE ADHESIVES & SEALANTS MARKET, BY JOB TYPE

7.1 NEW CONSTRUCTION

7.2 REHABILITATION

8 INFRASTRUCTURE ADHESIVES & SEALANTS MARKET, BY APPLICATION

8.1 BONDING

8.2 SEALING

8.3 WATERPROOFING

8 INFRASTRUCTURE ADHESIVES & SEALANTS MARKET, BY END-USE INDUSTRY

8.1 RAILWAYS

8.2 HIGHWAYS & MOTORWAYS

8.3 POWER GENERATION & TRANSMISSION

8.4 TELECOMMUNICATION

8.5 MUNCIPAL

8.6 OTHERS

9 INFRASTRUCTURE ADHESIVES & SEALANTS MARKET, BY REGION

9.1 INTRODUCTION

9.2 ASIA PACIFIC

9.2.1 CHINA

9.2.2 JAPAN

9.2.3 SOUTH KOREA

9.2.4 INDIA

9.2.5 OCEANIA

9.2.6 TAIWAN

9.2.6 REST OF ASIA PACIFIC

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 ITALY

9.3.4 UK

9.3.5 RUSSIA

9.3.6 TURKEY

9.3.7 REST OF EUROPE

9.4 NORTH AMERICA

9.4.1 US

9.4.2 MEXICO

9.4.3 CANADA

9.5 MIDDLE EAST & AFRICA

9.5.1 SAUDI ARABIA

9.5.2 IRAN

9.5.3 UAE

9.5.4 REST OF THE MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE PLAYERS

10.2.4 PARTICIPANTS

10.3 STRENGTH OF PRODUCT PORTFOLIO

10.4 BUSINESS STRATEGY EXCELLENCE

10.5 REVENUE ANALYSIS

10.6 COMPETITIVE BENCHMARKING

10.6.1 MARKET EVALUATION MATRIX

10.7 MARKET RANKING ANALYSIS

10.8 STRATEGIC DEVELOPMENTS

10.8.1 NEW PRODUCT LAUNCHES

10.8.2 DEALS

10.8.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

11.1 KEY PLAYERS

11.1.1 HENKEL AG

11.1.2 SIKA AG

11.1.3 ARKEMA

11.1.4 WACKER CHEMIE

11.1.5 THE DOW CHEMICAL COMPANY

11.1.6 3M COMPANY

11.1.7 KONISHI CO., LTD.

11.1.8 DAP PRODUCTS

11.1.9 BASF SE

11.1.10 FRANKLIN INTERNATIONAL

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

12 APPENDIX

The study involves four major activities in estimating the current market size of infrastructure adhesives & sealants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The infrastructure adhesives & sealants market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as railways, highways & motorways, power generation & transmission, telecommunication, muncipal, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply & demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the infrastructure adhesives & sealants market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the infrastructure adhesives & sealants market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, describe, and forecast the market by product type, job type, application, and end-use industry

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as investments & expansions, new product developments, partnerships & agreements, mergers & acquisitions, and joint ventures

- To strategically profile the key players and comprehensively analyze their market shares and core competencies1

Note: Core competencies1 of companies are determined in terms of their key developments and key strategies adopted by them to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the infrastructure adhesives & sealants market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Infrastructure Adhesives & Sealants Market