Isobutyl Stearate Market by Application (Metalworking, Personal Care, Industrial), and Region (Asia-Pacific, Europe, North America, Latin America, Middle East & Africa) - Global Forecast to 2026

The Isobutyl Stearate market is projected to reach USD 182.3 million by 2026, at a CAGR of 4.8%. Isobutyl stearate (IBS) is an ester which is primarily used in metalworking, personal care and other industrial activities. It is a stearate ester which is available in both liquid and solid forms. Isobutyl stearate due to its less toxicity is widely preferred as an ingredient in personal care products. Similarly, the use of esters in metal lubricating application has increased over the years due to its excellent lubricating properties. It improves the lubricity of different metals like copper, steel and aluminum. In this study, 2015 has been considered the base year and 2016-2026 as the forecast period to estimate the Isobutyl stearate market size.

Isobutyl Stearate Market Dynamics

Drivers

- Strong demand for bio-lubricants

- Market price and technology costs driven by few giant players in market

Barriers

- Slow growth of metalworking fluid market which is one of the key applications of IBS

- Production of IBS confined to limited countries in Europe

The increasing consumption in metalworking fluids and personal care industry drives the global Isobutyl stearate market

Isobutyl stearate (IBS) is an ester which is primarily used in metalworking, personal care and other industrial activities. It is a stearate ester which is available in both oily liquid and waxy solid forms. Isobutyl stearate due to its less toxicity is widely preferred as an ingredient in personal care products. Similarly, the use of esters in metal lubricating application has increased over the years due to its excellent lubricating properties. It improves the lubricity of different metals like copper, steel and aluminum. The demand for isobutyl stearate is expected to grow in the coming years, due to its increasing consumption in metalworking fluids and personal care industry. Stearate esters have excellent lubricating properties and therefore preferred as metalworking lubricants. These esters have a low viscosity and are also used in personal care products.

The Following are the Major Objectives of the Isobutyl Stearate Market Study:

- To define, describe, and analyze the isobutyl stearate market on the basis of application and region

- To determine and forecast the global market with respect to applications in different regions

- To analyze the short-term and long-term impact of the factors that influence the growth of the market

- To identify opportunities in the market for isobutyl stearate manufacturers and suppliers

- To study the industry supply chain, pricing analysis and manufacturing cost analysis

- To study company profiles, developments, upcoming trends & technologies, growth strategies, and industry activities

- To identify current and future trends, drivers and constraints for isobutyl stearate market and end-use applications

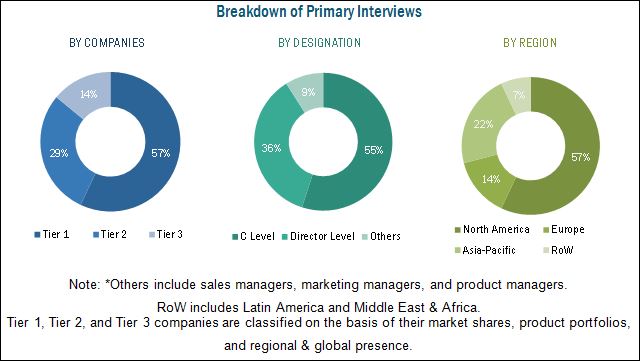

Different secondary sources, such as company websites, encyclopedias, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource have been used to identify and collect information useful for this extensive, commercial study of the global isobutyl stearate market. Primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. With data triangulation procedures and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

This study answers several questions for stakeholders, primarily, which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. These stakeholders include Isobutyl stearate manufacturers such as Emery Oleochemicals (Malaysia), Oleon NV (Belgium), Faci S.p.A. (Italy), A&A Fratelli Parodi Spa (Italy), Industrial Química Lasem SA (Spain), Hangzhou Dayanchem Company Limited (China), and Mosselman S.A. (Belgium).

Major Isobutyl Stearate Market Developments

- In May 2016, The company announces the launch of dicarboxylic acid corrosion inhibitors under the brand EMEROX 1199. The product is aimed to improve processing efficiency and simultaneously improve performance in water based lubricants.

- In March 2016, A&A Fratelli Parodi Spa acquired an industrial building at in Ceranesi (GE), with 2000 m2 surface used as warehouse and plants, and 500 m2 as office. This acquisition help the company to do new business activities in the food sector and a cosmetic markets.

- In November 2014, Oleon NV along with its partner United Plantations Bhd opened a new food emulsifier factory in Malaysia. This is operative under a 50:50 joint venture UniOleon Sdn Bhd. The factory will produce food oleo-derivative products and is expected to strengthen the company’s presence in bakery and confectionery.

Key Target Audience in Isobutyl Stearate Market

- Manufacturers of Isobutyl Stearate

- Traders, Distributors, and Suppliers of Isobutyl Stearate

- End-Use Industries Operating in Isobutyl Stearate Supply Chain

- Government and Consulting Organizations

- Cosmetic Regulators and Other Regulatory Institutions

- Investment Banks and Private Equity Firms

Isobutyl Stearate Market Report Scope

This research report categorizes the Isobutyl Stearate market on the basis of application and region. The report forecasts revenues as well as analyzes the trends in each of these submarkets.

On the Basis of Applications:

- Metalworking

- Personal Care

- Industrial

On the Basis of Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- Latin America

Isobutyl Stearate Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Isobutyl Stearate Market Application Analysis

- Further breakdown of the applications and end-use industry into sub segments

The isobutyl stearate (IBS) market is projected to reach USD 182.3 million by 2026, at a CAGR of 4.8% from 2016 to 2026. The key factor driving the growth of the isobutyl stearate market is the rising demand for personal care, metalworking, and industrial application.

Major applications of isobutyl stearate are personal care, metalworking, and industrial and others. Isobutyl stearate is one of the most preferred easter due to its inherent properties. These stearate ester, due to its less toxicity is widely preferred as an ingredient in personal care products. Also due to its excellent lubricating properties it is widely used in metal lubricating application over the years.

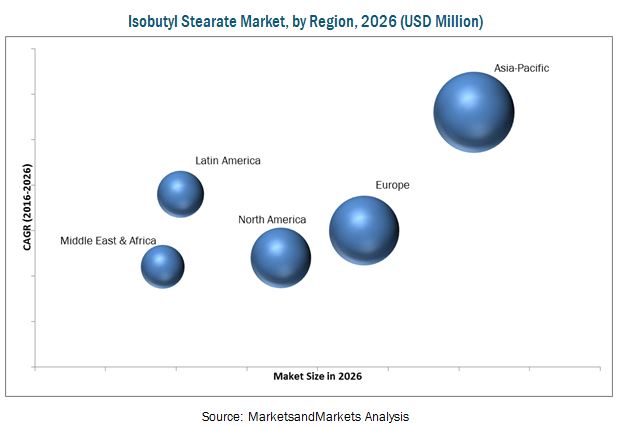

The isobutyl stearate market in the Asia-Pacific region is anticipated to grow at the highest CAGR between 2016 and 2026. China and Japan have witnessed a stable economic growth, and the growth of IBS is expected to be higher in these two countries. Moreover the rising demand from metalworking based industry will drive the demand for IBS in the Asia-Pacific region.

Isobutyl stearate’ application in metalworking, and personal care segment drives the growth of isobutyl stearate market

Metalworking

Metalworking application was the largest segment of the global isobutyl stearate market in 2015. Growing usage of bio-lubricants especially in metalworking fluid, is fueling the demand for isobutyl stearate.

Personal care

Personal Care application was the second largest segment of the global isobutyl stearate market in 2015. Growing usage of bio-based esters in personal care products will drive the demand for isobutyl stearate.

Critical Questions the Isobutyl Stearate Market Report Answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for isobutyl stearate?

The future demand for isobutyl stearate is expected to be hampered due to certain regulatory challenges, concerned with the use of isobutyl stearate is in some countries, for example limitation of isobutyl stearate in some countries of Europe.

Key Players in Isobutyl Stearate Market Industry

Key companies operating in the isobutyl stearate market include Emery Oleochemicals (Malaysia), Oleon NV (Belgium), Faci S.p.A. (Italy), A&A Fratelli Parodi Spa (Italy), Industrial Química Lasem SA (Spain), Hangzhou Dayanchem Company Limited (China), and Mosselman S.A. (Belgium). These players are engaged in supply of isobutyl stearate and have a strong regional presence. Companies in North America and Europe region are focussing on additional capacities and new product developments to meet the surging demand from end user industries.

Frequently Asked Questions (FAQ):

What is the Isobutyl Stearate Market growth?

Growth of Isobutyl Stearate Market - At a CAGR of 4.8% from 2016 to 2026.

Who leading market players in Isobutyl Stearate industry?

The major Isobutyl Stearate Market players covered in this report are, Emery Oleochemicals (Malaysia), Oleon NV (Belgium), Faci S.p.A. (Italy), A&A Fratelli Parodi Spa (Italy), Industrial Química Lasem SA (Spain), Hangzhou DayangChem Co., Limited (China), and Mosselman S.a. (Belgium).

How big is the Isobutyl Stearate Market?

The global isobutyl stearate market is projected to reach USD 182.3 Million by 2026.

Which segments are covered in Isobutyl Stearate Market report?

By Application (Metalworking, Personal Care, Industrial).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Research Design

2.3 Market Size Estimation

2.3.1 Top- Down Approach

2.3.2 Bottom Up Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary

3.1 Introduction

3.2 Market Insight

3.3 Regional Growth Rates

3.4 Conclusion

4 Market Overview

4.1 Introduction

4.2 Market Dynamics

4.2.1 Market Dynamics - Drivers

4.2.2 Market Dynamics - Barriers

4.2.3 Market Dynamics - Factors Affecting Prices

4.3 Supply Chain Analysis

4.4 Historical Price Analysis

4.5 Manufacturing Cost Analysis

5 Isobutyl Stearate Market, By Application

5.1 Introduction

5.2 Metalworking Application, By Region

5.3 Personal Care Application, By Region

5.4 Industrial & Other Application, By Region

6 Isobutyl Stearate Market, By Region

6.1 Introduction

6.2 Global Market, By Region

6.3 Asia-Pacific Isobutyl Stearate Market

6.3.1 Asia-Pacific Market, By Country

6.3.2 Asia-Pacific Market, By Application

6.4 Europe Isobutyl Stearate Market

6.4.1 Europe Market, By Country

6.4.2 Europe Market, By Application

6.5 North America Isobutyl Stearate Market

6.5.1 North America Market, By Country

6.5.2 North America Market, By Application

6.6 Latin America Isobutyl Stearate Market

6.6.1 Latin America Market, By Country

6.6.2 Latin America Market, By Application

6.7 Middle East & Africa Isobutyl Stearate Market

6.7.1 Middle East & Africa Market, By Country

6.7.2 Middle East & Africa Market, By Application

7 Supplier Analysis

7.1 Key Suppliers

7.1.1 Asia-Pacific - Key Suppliers

7.1.2 Europe - Key Suppliers

7.1.3 North America - Key Suppliers

7.1.4 Latin America - Key Suppliers

7.1.5 Middle East & Africa - Key Suppliers

8 Company Profiles

8.1 Emery Oleochemicals

8.2 Oleon NV

8.3 FACI SPA

8.4 A&A Fratelli Parodi Spa

8.5 Industrial Quimica Lasem S.A.

8.6 Hangzhou Dayangchem Co. Ltd.

8.7 Mosselman S.A.

9 Appendix

9.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

9.2 Marketsandmarkets Knowledge Store: Snapshot

9.3 Introducing RT: Real Time Market Intelligence

List of Tables (40 Tables)

Table 1 Isobutyl Stearate Product Properties and Identifiers

Table 2 General Assumptions

Table 3 Year wise Forecast and Assumptions

Table 4 Europe : Manufacturing Cost Analysis

Table 5 Asia-Pacific : Manufacturing Cost Analysis

Table 6 Global Isobutyl Stearate Market, By Application, 2014-2026 (USD Million)

Table 7 Global Market, By Application, 2014-2026 (Metric Ton)

Table 8 Metalworking Application, By Region, 2014-2026 (USD Million)

Table 9 Metalworking Application, By Region, 2014-2026 (Metric Ton)

Table 10 Personal Care Application, By Region, 2014-2026 (USD Million)

Table 11 Personal Care Application, By Region, 2014-2026 (Metric Ton)

Table 12 Industrial and Other Application, By Region, 2014-2026 (USD Million)

Table 13 Industrial and Other Application, By Region, 2014-2026 (Metric Ton)

Table 14 Global Isobutyl Stearate Market, By Region, 2014-2026 (USD Million)

Table 15 Global Market, By Region, 2014-2026 (Metric Ton)

Table 16 Asia-Pacific Market, By Country, 2014-2026 (USD Million)

Table 17 Asia-Pacific Market, By Country, 2014-2026 (Metric Ton)

Table 18 Asia- Pacific Market, By Application, 2014-2026 (USD Million)

Table 19 Asia- Pacific Market, By Application, 2014-2026 (Metric Ton)

Table 20 Europe Isobutyl Stearate Market, By Country, 2014-2026 (USD Million)

Table 21 Europe Market, By Country, 2014-2026 (Metric Ton)

Table 22 Europe Market, By Application, 2014-2026 (USD Million)

Table 23 Europe Market, By Application, 2014-2026 (Metric Ton)

Table 24 North America Isobutyl Stearate Market, By Country, 2014-2026 (USD Million)

Table 25 North America Market, By Country, 2014-2026 (Metric Ton)

Table 26 North America Market, By Application, 2014-2026 (USD Million)

Table 27 North America Market, By Application, 2014-2026 (Metric Ton)

Table 28 Latin America Market, By Country, 2014-2026 (USD Million)

Table 29 Latin America Market, By Country, 2014-2026 (Metric Ton)

Table 30 Latin America Market, By Application, 2014-2026 (USD Million)

Table 31 Latin America Market, By Application, 2014-2026 (Metric Ton)

Table 32 Middle East & Africa Isobutyl Stearate Market, By Country, 2014-2026 (USD Million)

Table 33 Middle East & Africa Market, By Country, 2014-2026 (Metric Ton)

Table 34 Middle East & Africa Market, By Application, 2014-2026 (USD Million)

Table 35 Middle East & Africa Market, By Application, 2014-2026 (Metric Ton)

Table 36 Asia-Pacific – Supplier Analysis

Table 37 Europe – Supplier Analysis

Table 38 North America – Supplier Analysis

Table 39 Latin America – Supplier Analysis

Table 40 MEA – Supplier Analysis

List of Figures (48 Figures)

Figure 1 Isobutyl Stearate Market Scope

Figure 2 Market : Research Methodology

Figure 3 Market : Top Down Approach

Figure 4 Market : Bottom Up Approach

Figure 5 Market : Data Triangulation

Figure 6 Asia-Pacific to Register Highest CAGR Between 2016-2021

Figure 7 Isobutyl Stearate Market : Segmentation

Figure 8 Isobutyl Stearate : Drivers and Barriers

Figure 9 Europe Supply Chain Analysis

Figure 10 Asia-Pacific Supply Chain Analysis

Figure 11 Middle East & Africa Supply Chain Analysis

Figure 12 Latin America Supply Chain Analysis

Figure 13 India Pricing Trend 2010-2014

Figure 14 Germany Pricing Trend 2010-2014

Figure 15 Brazil Pricing Trend 2010-2014

Figure 16 UAE Pricing Trend 2010-2014

Figure 17 Europe – Cogs Breakdown

Figure 18 Asia-Pacific – Cogs Breakdown

Figure 19 Global Isobutyl Stearate Market, By Application, 2014-2021 (USD Million)

Figure 20 Global Market, By Application, 2014-2021 (Metric Ton)

Figure 21 Metalworking Application, By Region, 2014-2021 (USD Million)

Figure 22 Metalworking Application, By Region, 2014-2021 (Metric Ton)

Figure 23 Personal Care Application, By Region, 2014-2021 (USD Million)

Figure 24 Personal Care Application, By Region, 2014-2021 (Metric Ton)

Figure 25 Industrial and Other Application, By Region, 2014-2021 (USD Million)

Figure 26 Industrial and Other Application, By Region, 2014-2021 (Metric Ton)

Figure 27 Global Isobutyl Stearate Market, By Region, 2014-2021 (USD Million)

Figure 28 Global Market, By Region, 2014-2021 (Metric Ton)

Figure 29 Asia-Pacific Isobutyl Stearate Market, By Country, 2014-2021 (USD Million)

Figure 30 Asia-Pacific Market, By Country, 2014-2021 (Metric Ton)

Figure 31 Asia-Pacific Market, By Application, 2014-2021 (USD Million)

Figure 32 Asia-Pacific Market, By Application, 2014-2021 (Metric Ton)

Figure 33 Europe Isobutyl Stearate Market, By Country, 2014-2021 (USD Million)

Figure 34 Europe Market, By Country, 2014-2021 (Metric Ton)

Figure 35 Europe Market, By Application, 2014-2021 (USD Million)

Figure 36 Europe Market, By Application, 2014-2021 (Metric Ton)

Figure 37 North America Isobutyl Stearate Market, By Country, 2014-2021 (USD Million)

Figure 38 North America Market, By Country, 2014-2021 (Metric Ton)

Figure 39 North America Market, By Application, 2014-2021 (USD Million)

Figure 40 North America Market, By Application, 2014-2021 (Metric Ton)

Figure 41 Latin America Isobutyl Stearate Market, By Country, 2014-2021 (USD Million)

Figure 42 Latin America Market, By Country, 2014-2021 (Metric Ton)

Figure 43 Latin America Market, By Application, 2014-2021 (USD Million)

Figure 44 Latin America Market, By Application, 2014-2021 (Metric Ton)

Figure 45 Middle East & Africa Isobutyl Stearate Market, By Country, 2014-2021 (USD Million)

Figure 46 Middle East & Africa Market, By Country, 2014-2021 (Metric Ton)

Figure 47 Middle East & Africa Market, By Application, 2014-2021 (USD Million)

Figure 48 Middle East & Africa Market, By Application, 2014-2021 (Metric Ton)

Growth opportunities and latent adjacency in Isobutyl Stearate Market