Laboratory Proficiency Testing Market by Industry (Clinical Diagnostics, Microbiology, Pharmaceutical, Food & Animal Feed, Water, Opioid), Technology (PCR, Cell Culture), and Region; Unmet Needs, Stakeholder & Buying Criteria - Global Forecast to 2028

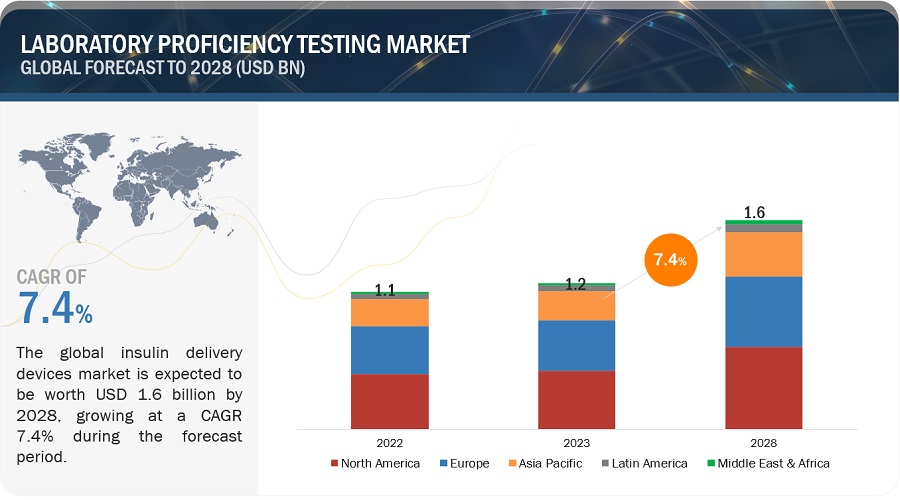

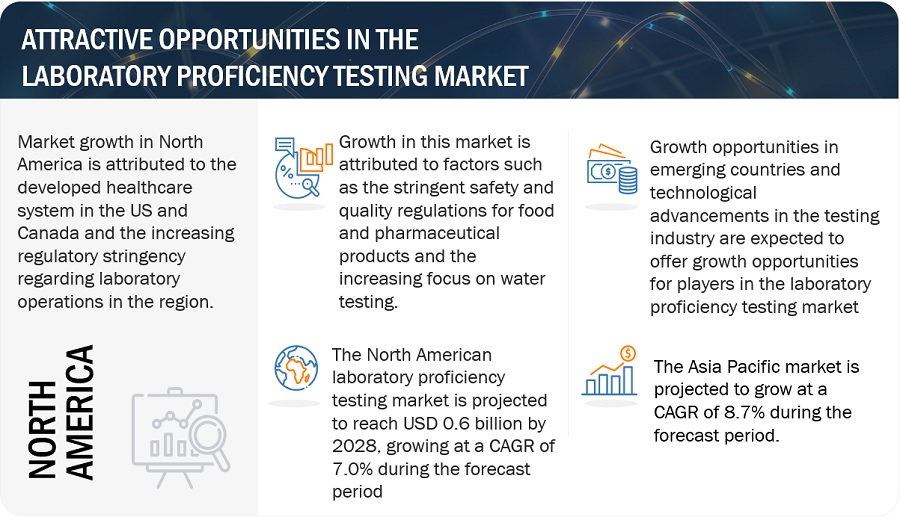

The global laboratory proficiency testing market in terms of revenue was estimated to be worth $1.2 billion in 2023 and is poised to reach $1.6 billion by 2028, growing at a CAGR of 7.4% from 2023 to 2028.The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The proficiency testing market is projected to experience substantial expansion in the forecasted period due to its mandatory requirement for laboratories operating in various regulated industries like APIAC, CLIA, and CLSI. The market's growth is further bolstered by stringent safety and quality regulations governing food and pharmaceutical products, alongside a growing emphasis on water testing. However, the requirement of high capital investments for accurate and sensitive testing is expected to restrain the growth of this market during the forecast period.

In this report, the laboratory proficiency testing market is segmented based on industry, technology, and region.

Global Laboratory Proficiency Testing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Proficiency Testing Market Dynamics

Driver: Stringent safety and quality regulations for food and pharmaceutical products

Growing complexities in the supply chain of food and pharmaceutical products, rising use of economic lack of adoption of proper hygiene, growing instances of adulteration, and sanitation practices during production, transportation, and storage, lack of awareness about allergens, growing instances of cross-contamination, and non-compliance with labeling laws have increased the incidence of contamination of final products, which in turn are responsible for large-scale outbreaks of foodborne illnesses in consumers. This has raised severe concerns among producers, regulatory authorities, end consumers, and other industry stakeholders.

To curb such violations, regulatory authorities across countries are focusing on framing and implementing strict safety and quality regulations. This has fueled the growth of the inspection, testing, and certification markets, with regulatory bodies such as the United States Department of Agriculture (USDA) and EFSA introducing guidelines for testing, inspection, and sampling services for the food industry to ensure the safety and quality of products. Thus, the increasing focus of regulatory organizations on product safety is driving the growth of the laboratory proficiency market.

Restraint: Requirement of high-capital investments for accurate and sensitive testing

The growing utilization of proficiency testing as a means for accreditation bodies to verify the credibility of laboratories engaged in accreditation initiatives is placing increased financial strain on the laboratories involved. The expenses tied to proficiency testing typically encompass the operational overhead costs of running a laboratory. These investments are necessary at different stages of proficiency testing programs, including program preparation, sample processing, sample handling, and shipment, as well as the interpretation and reporting phases. The need for thorough sample preparation necessitates laboratory analysts to employ sophisticated testing methodologies and advanced technologies. Advanced technologies, such as liquid chromatography (LC), high-performance liquid chromatography (HPLC), and spectrometry, are accurate, sensitive, and efficient. However, these technologies come with drawbacks, including prolonged sample preparation times and calibration challenges, contributing to the substantial investments needed for proficiency testing. Furthermore, many analytical methods are tailored to specific sample types, necessitating the adoption of more advanced techniques for substances like pharmaceuticals and opioids. This incorporation of advanced methods, however, escalates the overall testing expenses, thereby leading to increased capital outlays for laboratories.

Opportunity: Growth opportunities in emerging countries

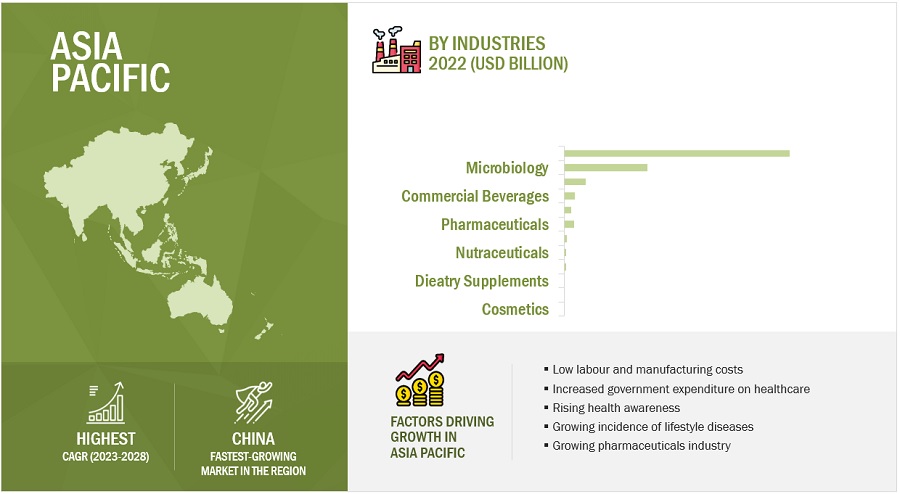

Emerging economies such as China, India, and South Korea are expected to offer significant growth opportunities for players operating in the laboratory proficiency testing market. This can primarily be attributed to the presence of less stringent regulatory policies, low labor costs, and high growth in their respective pharmaceutical and food sectors.

These countries are attracting pharmaceutical companies not only because of the low-cost manufacturing advantage but also due to the high and growing incidence of chronic and infectious diseases, rising disposable income levels, improving access to healthcare services, and implementation of favorable government policies. The growing presence of global as well as local pharmaceutical and biopharmaceutical companies in these countries is, in turn, driving the demand for proficiency testing services.

Challenge: Logistical and data interpretation challenges

Participation in external PT programs, internal PT programs, and benchmarking or comparison studies (between laboratories using proficiency testing or reference materials) is needed for the validation and evaluation of test methods. However, certain logistical activities, such as shipping and handling of samples (availability of carriers or spills in traffic), need careful planning as they may potentially influence the end results. Also, the number of laboratories necessary to conduct a valid inter-laboratory comparison and the availability of a commercial PT program for a specific analyte of interest may also influence the overall results. These are some of the major challenges faced by laboratories while assessing their standards and gaining accreditation.

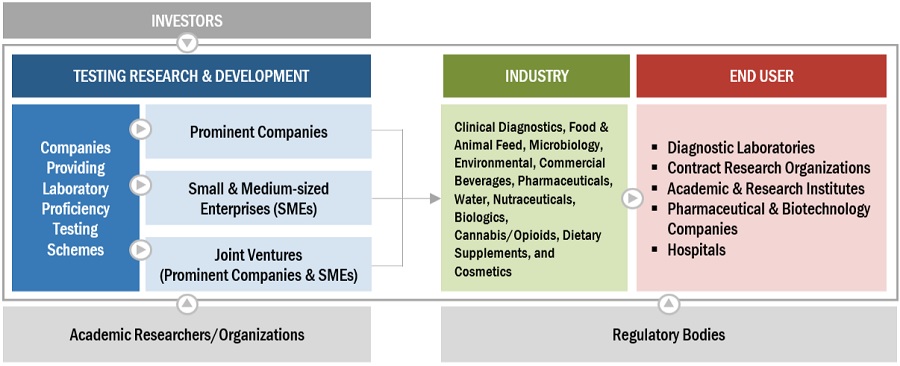

Laboratory Proficiency Testing Market Ecosystem Map

Based on industry, Clinical Diagnostics to account for the largest share of the laboratory proficiency testing industry during the forecast period.

Based on industry, the laboratory proficiency testing market is categorized into various segments, including clinical diagnostics, pharmaceuticals, microbiology, water analysis, environmental testing, food & animal feed, biologics, commercial beverages, cannabis/opioids, cosmetics, dietary supplements, and nutraceuticals. In the year 2022, the clinical diagnostics segment held the largest share of the market. This can be attributed to advancements in clinical diagnostic techniques, a rising demand for early and precise disease detection, increased government initiatives aimed at enhancing the quality and affordability of clinical diagnostic tests, and growing investments from both public and private sectors, including research funding and grants, aimed at developing innovative laboratory testing procedures.

Based on technology, the global laboratory proficiency testing market has been segmented into PCR, immunoassays, cell culture, spectrophotometry, chromatography , and other technologies. In 2022, the cell culture segment accounted for the largest share of the market. Growing awareness about the application of cell cultures in the production and testing of microbiology samples, biopharmaceuticals, and clinical diagnostic samples is supporting the growth of this market.

The APAC laboratory proficiency testing industry is projected to grow at the highest rate during the forecast period.

The laboratory proficiency testing market is anticipated to witness its highest growth rate in the Asia-Pacific (APAC) region during the forecast period. This can be attributed to the presence of emerging economies like China and India and the substantial expansion in outsourcing services in recent years. Additionally, Singapore is emerging as another promising market within the APAC region. Other than these APAC countries, Latin American countries also exhibit significant growth potential in the market. Most of this growth is driven by the significant growth in the healthcare industry. Technological advancements in clinical diagnostics, low-cost manufacturing advantage, microbiology, and pharmaceutical industries are contributing to the growth opportunities of the laboratory proficiency market in these regions.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are LGC Limited (UK), American Proficiency Institute (US), College of American Pathologists (US), Bio-Rad Laboratories (US), Randox Laboratories (UK), Merck (Germany), Fapas (UK), Waters Corporation (US), Weqas (UK), AOAC INTERNATIONAL (US).

Scope of the Laboratory Proficiency Testing Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.2 billion |

|

Estimated Value by 2028 |

$1.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.4% |

|

Market Driver |

Stringent safety and quality regulations for food and pharmaceutical products |

|

Market Opportunity |

Growth opportunities in emerging countries |

This report categorizes the global laboratory proficiency testing market to forecast revenue and analyze trends in each of the following submarkets:

By Industry

-

Clinical Diagnostics

- Clinical Chemistry

- Immunoassay/immunochemistry

- Hematology

- Molecular diagnostic

- Cytology

- Other Clinical Diagnostics

-

Microbiology

- Pathogen Testing

- Sterility Testing

- Endotoxin & Pyrogen Testing

- Growth Promotion Testing

- Other Microbial Testing

-

Food & Animal Feed

- Meat & Meat Products

- Vegetables & Fruits

- Dairy Products

- Fish

- Egss

- Fat/oil

- Other Food & Animal Feed

-

Commercial Beverages

- Non-Alcoholic Beverages

- Alcoholic Beverages

- Environmental

-

Pharmaceuticals

- Branded/Innovator Drugs

- Generic Drugs

- Over-THE -Counter Drugs

- Biosimilars

- Water

- Nutraceuticals

-

Biologics

- Monoclonal Antibodies

- Vaccines

- Blood

- Tissue

-

Cannabis/Opioids

- Potency Testing

- Terpene Profiling

- Residual Solvents

- Pesticide Screening

- Heavy Metal Testing

- Other Cannabis/Opioids Testing

- Dietary Supplements

-

Cosmetics

- Trace Elements

- Other Cosmetic Testing

By Technology

- Cell Culture

- PCR

- Immunoassays

- Chromatography

- Spectrophotometry

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- ROE

-

Asia Pacific

- China

- Japan

- India

- South Korea

- RoPAC

- Latin America

- Middle East & Africa

Recent Developments of Laboratory Proficiency Testing Industry

- In July 2023, LGC Limited (US) acquired Kavo International (US) to strengthen its portfolio of quality measurement tools.

- In March 2023, the College of American Pathologists (US)launched a new proficiency testing program focused on the monkeypox (mpox) virus. By introducing the new mpox PT program, laboratories can enhance the quality assurance of their molecular testing process and contribute to the assurance of precise and dependent test outcomes, aiding in the detection of the mpox virus.

- In April 2022, Spex CertiPrep (US) acquired NSI Lab Solutions (US) to strengthen its product portfolio in the proficiency testing segment.

- In January 2022, Fera Science Ltd. - FAPAS (UK) formed a partnership with BioFront Technologies, which will act as the agent representing FAPAS proficiency testing services in the United States.

- In October 2021, Waters Corporation (US) entered into a partnership with Sartorius AG (Germany). The objective of this collaboration was to offer bioprocess experts direct access to top-notch mass spectrometry (MS) data, thereby enhancing the efficiency and precision of biopharmaceutical process development.

- Also in October 2021, Waters Corporation (US) partnered with the University of Delaware (US) to develop new analytical solutions for bioprocessing and biomanufacturing.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory proficiency testing market?

The global laboratory proficiency testing market boasts a total revenue value of $1.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global laboratory proficiency testing market?

The global laboratory proficiency testing market has an estimated compound annual growth rate (CAGR) of 7.4% and a revenue size in the region of $1.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful to the study on the laboratory proficiency testing market. Primary sources were largely several industry experts from core and related industries and preferred suppliers, laboratory proficiency testing service providers, hospitals and clinical diagnostic laboratories, specialty laboratories, distributors, contract research organizations, academic & research institutes, and technology developers. Primary sources also included standard and certification organizations from companies and organizations related to all segments of this industry’s value chain.

Secondary Research

In the secondary research process, various sources such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents were referred to, to identify and collect information useful for a technical, market-oriented, and commercial study of the laboratory proficiency testing market. These secondary sources include Clinical and Laboratory Standards Institute (CLSI), Clinical Laboratory Improvement Amendments (CLIA), National Accreditation Board for Testing and Calibration Laboratories (NABL), National Association for Proficiency Testing (NAPT), International Organization for Standardization (ISO), World Health Organization (WHO), Quality Council of India (QCI), and College of American Pathologists (CAP). Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

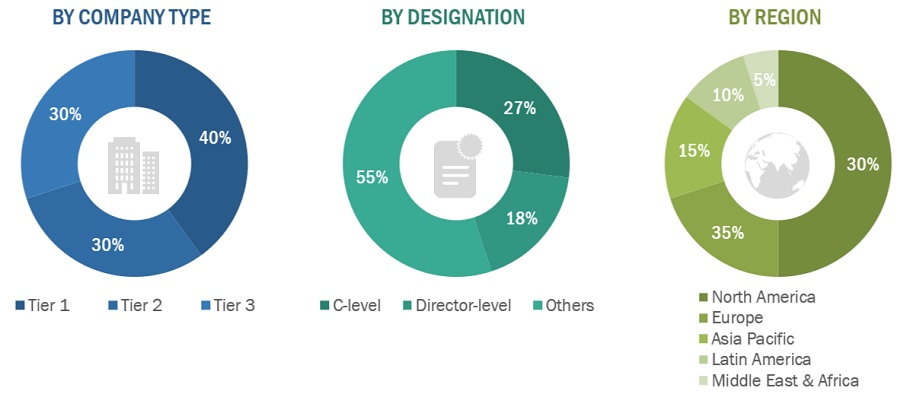

The laboratory proficiency testing market comprises several stakeholders such as laboratory proficiency testing service providers, end-users such as hospitals and clinical diagnostic laboratories and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the hospitals and clinical laboratories, food testing laboratories, analytical laboratories, water, environmental testing laboratories, and cannabis testing laboratories, among others. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the laboratory proficiency testing market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Merck |

Head of Field Sales Advanced Analytical |

|

Cardinal Foods, LLC |

QA Manager |

|

Global Proficiency Testing Ltd. |

Project Manager |

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the laboratory proficiency testing market and to estimate the size of various other dependent submarkets in the overall laboratory proficiency testing market.

The research methodology used to estimate the market size includes the following details:

- The market value of laboratory proficiency testing for clinical diagnostics, food and animal feed, microbiology, environmental, commercial beverages, pharmaceuticals, water, nutraceuticals, biologics, cannabis, dietary supplements, and cosmetics have been extracted from the repository and validated through secondary and primary research.

- The market shares of the polymerase chain reaction (PCR), cell culture, immunoassay, chromatography, spectroscopy, and other technologies have been extracted from the repository and validated through secondary and primary research.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- The bottom-up approach has been applied to different regions and other segments of the laboratory proficiency testing market. All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Approach to calculating the revenue of different players in the Laboratory Proficiency Testing market.

In this report, the global laboratory proficiency testing market size was arrived at by using the revenue share analysis of leading players. For this purpose, major players in the market were identified, and their revenues from the laboratory proficiency testing business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key market players’ marketing executives.

Approach to derive the market size and estimate market growth.

The total size of the laboratory proficiency testing market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Proficiency testing (PT) is the testing of unknown samples sent to a laboratory from an approved provider to evaluate the ability of the laboratory to produce an analytical test along with the verification of the accuracy and reliability of its testing; PT can also be used to validate the entire testing process, including competency of the testing personnel. Proficiency testing comprises an inter-laboratory system for the regular testing of the accuracy that the participant laboratories can achieve. In its usual form, the organizers of the scheme distribute portions of a homogeneous material to each of the participants who analyze the material under typical conditions and report the result to the organizers. The organizers compile the results and inform the participants of the outcome, usually in the form of a score relating to the accuracy of the result.

Key Stakeholders

- Healthcare analytical testing service providers

- Laboratory proficiency testing service providers

- Hospitals and clinical diagnostic laboratories

- Pharmaceutical & biotechnology companies

- Contract research organizations (CROs)

- Food & animal feed testing service providers

- Water and environmental testing companies

- Cannabis/opioid testing service providers

- Commercial beverages and cosmetics testing companies

- Venture capitalists and investors

- Group purchasing organizations (GPOs)

- Research institutes and government organizations

- Market research and consulting firms

- Contract manufacturing organizations (CMOs)

Report Objectives

- To define, describe, and forecast the global laboratory proficiency testing market on the basis of industry, technology, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall laboratory proficiency testing market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for key market players

- To forecast the size of the laboratory proficiency testing market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players in the global laboratory proficiency testing market and comprehensively analyze their core competencies2 and market shares in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as mergers and acquisitions, expansions, partnerships, product launches, collaborations, and agreements of leading players in the global laboratory proficiency testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix: Detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the Latin American laboratory proficiency testing market into Brazil, Mexico, and others.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Proficiency Testing Market