Pyrogen Testing Market by Product & Service (Assays, Kits, Reagents, Instruments, Services), Test Type (LAL, Chromogenic, Turbidimetric, Gel Clot, In Vitro, Rabbit), End User (Pharmaceutical, Biotechnology, Medical Device) & Region - Global Forecasts to 2025

Market Growth Outlook Summary

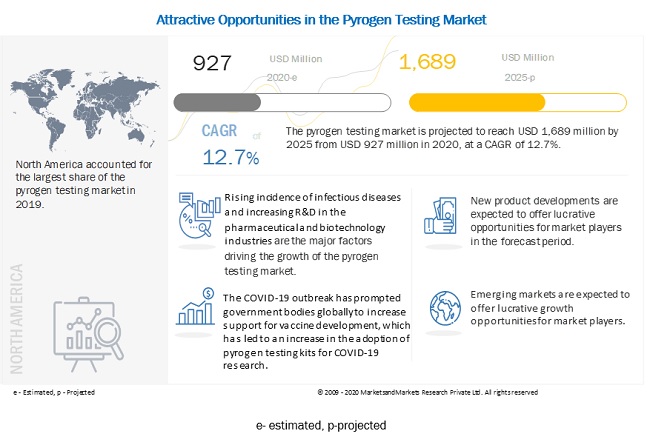

The global pyrogen testing market growth forecasted to transform from $927 million in 2020 to $1,689 million by 2025, driven by a CAGR of 12.7%. Market drivers include increasing demand for personalized medicine, R&D in pharmaceuticals and biotechnology, rising chronic and infectious diseases, and growing awareness of food safety. Key opportunities lie in emerging markets, such as India and South Korea, with substantial biotech growth initiatives. The market is dominated by major players like Charles River Laboratories, Lonza, and Merck KGaA, which control a significant share due to high entry barriers. The assays, kits, and reagents segment holds the largest market share, with LAL tests being the dominant test type. North America is the largest regional market. Companies such as bioMérieux, FUJIFILM Wako, and Eurofins Scientific are key players in driving market innovation and expansion through acquisitions and new product launches.

To know about the assumptions considered for the study, Request for Free Sample Report

Pyrogen Testing Market Dynamics

Drivers: Rising incidence of infectious diseases and increasing frequency of pandemics

The demand for pyrogen testing techniques has witnessed a steady growth during the past decade due to the increasing prevalence of major infectious diseases and epidemics. With an increase in the incidence of infectious diseases globally, the demand for pyrogen testing techniques (utilized for endotoxin and microbial identification) is expected to increase during the forecast period. Endotoxin identification products can improve the management of infectious diseases, especially in areas with inadequate healthcare infrastructure.

Opportunities: Emerging markets offer lucrative opportunities

Countries across the APAC are highly lucrative markets for the life sciences industry. For instance, India has been taking significant initiatives, including encouraging public-private partnerships (PPPs) in biopharmaceutical R&D projects, to establish itself as the world’s leading major biopharmaceutical innovation hub. South Korea is also taking initiatives to become a global biotech hub with a focus on biosimilars, vaccine production, and stem cell therapies. The growing demand for remedial treatments for life-threatening diseases, such as cancer and diabetes, highlights the need for drug R&D and thereby the demand for pyrogen testing kits for effective quality testing and control.

Restraints: High degree of consolidation

The global market is highly consolidated. The top players—Charles River Laboratories, Inc. (US), Lonza (Switzerland), Merck KGaA (Germany), Thermo Fisher Scientific, Inc. (US), and Associates of Cape Cod, Inc. (US)—in the global market accounted for a combined majority market share in 2019. There is a high degree of competition among the market players. Only major companies can afford high-capital investments as well as the high cost of R&D and manufacturing. Moreover, this will prevent new entrants from entering this market. Furthermore, the top players in this market are large and well-established and enjoy a high degree of brand loyalty.

Assays, kits, & reagents segment accounted for the largest share of the pyrogen testing market, by product & service

Based on product & service, the global market is segmented into assays, kits, and reagents; instruments; and services. The assays, kits, & reagents segment accounted for the largest share in this market in 2019. The rising preference for kit-based testing and the frequent requirement of assays, kits, and reagents in large numbers as compared to instruments are the major factors driving the growth of this segment.

LAL tests segment accounted for the largest share in the pyrogen testing market, by test type

The global market is segmented into LAL tests, in vitro tests, and rabbit tests based on test type. In 2019, the LAL tests segment accounted for the largest share. This can be attributed to the rapid growth in the pharmaceutical and biotechnology industries, increasing demand for medical devices, increasing health standards, rising need for innovative laboratory testing procedures, and the growing drug pipelines.

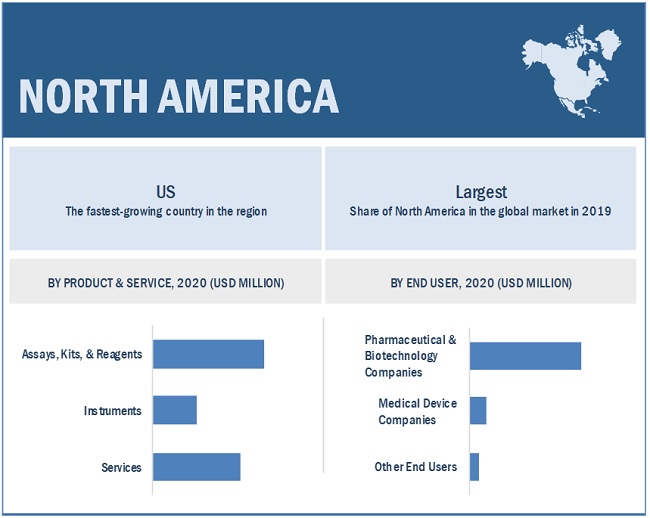

North America is the largest region for the global pyrogen testing market

The global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2019, North America accounted for the largest share of the global market. The North American market's growth can be attributed to the high spending on pharmaceutical and biopharmaceutical research, increasing pharmaceutical drug pipelines, a growing number of drug approvals, and rising consumer awareness about product safety.

To know about the assumptions considered for the study, download the pdf brochure

The major players operating in this market are Charles River Laboratories, Inc. (US), Lonza (Switzerland), Merck KGaA (Germany), Thermo Fisher Scientific, Inc. (US), Associates of Cape Cod, Inc. (US), GenScript Biotech Corporation (China), bioMérieux SA (France), FUJIFILM Wako Pure Chemical Corporation (Japan), Eurofins Scientific (Luxembourg), WuXi AppTec (China), Hycult Biotech (Netherlands), Ellab A/S (Denmark), Microcoat Biotechnologie GmbH (Germany), InvivoGen (US), Nelson Laboratories, LLC (US), Almac Group (UK), Pacific Biolabs (US), STERIS plc (US), Accugen Laboratories, Inc. (US), TOXIKON (US), Minerva Analytix GmbH (Germany), Indoor Biotechnologies, Inc. (US), Creative Bioarray (US), Lucideon Limited (UK), and North American Science Associates, Inc. (US).

Pyrogen Testing Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Product & service, test type, end user, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

Charles River Laboratories, Inc. (US), Lonza (Switzerland), Merck KGaA (Germany), Thermo Fisher Scientific, Inc. (US), Associates of Cape Cod, Inc. (US), GenScript Biotech Corporation (China), bioMérieux SA (France), FUJIFILM Wako Pure Chemical Corporation (Japan), Eurofins Scientific (Luxembourg), WuXi AppTec (China), Hycult Biotech (Netherlands), Ellab A/S (Denmark), Microcoat Biotechnologie GmbH (Germany), InvivoGen (US), Nelson Laboratories, LLC (US), Almac Group (UK), Pacific Biolabs (US), STERIS plc (US), Accugen Laboratories, Inc. (US), TOXIKON (US), Minerva Analytix GmbH (Germany), Indoor Biotechnologies, Inc. (US), Creative Bioarray (US), Lucideon Limited (UK), and North American Science Associates, Inc. (US). |

This report categorizes the pyrogen testing market into the following segments and sub-segments:

By Product & Service

- Assays, Kits, & Reagents

- Instruments

- Services

By Test Type

-

LAL Tests

- Chromogenic Tests

- Turbidimetric Tests

- Gel Clot Tests

- In Vitro Tests

- Rabbit Tests

By End User

- Pharmaceutical & Biotechnology Companies

- Medical Device Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Recent Developments

- In October 2020, Lonza (Switzerland) launched the PyroCell Monocyte Activation Test System for reliable and sustainable in vitro pyrogen testing.

- In December 2018, Eurofins Scientific acquired EAG Laboratories. This acquisition will further strengthen Eurofins’ global offering in the biopharmaceutical testing markets.

- In May 2018, bioMérieux SA (France) launched ENDOZYMEII GO, an innovative test for detecting endotoxins in pharmaceutical grade water, injectable drugs, and other pharmaceutical products.

Frequently Asked Questions (FAQs):

What is the size of Pyrogen Testing Market ?

The global pyrogen testing market size is projected to reach USD 1,689 million by 2025, growing at a CAGR of 12.7%.

What are the major growth factors of Pyrogen Testing Market ?

Market growth is driven by the growing focus on personalized medicine, increasing R&D in the pharmaceutical and biotechnology industries, rising prevalence of chronic diseases, the growing awareness of food safety, and the rising incidence of infectious diseases and increasing frequency of pandemics.

Who all are the prominent players of Pyrogen Testing Market ?

Some of the prominent players in the Pyrogen Testing Market are Charles River Laboratories, Inc.(US), Lonza(Switzerland), Merck KGaA(Germany) and Thermo Fisher Scientific, Inc. (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 PYROGEN TESTING MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 LIMITATIONS OF THE CURRENT EDITION

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 GLOBAL MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.2.1 Key data from primary sources

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 GLOBAL MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 GLOBAL MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 7 PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY TEST TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 11 INCREASING R&D IN THE PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES IS DRIVING THE GROWTH OF THE GLOBAL MARKET

4.2 GLOBAL MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 ASSAYS, KITS, & REAGENTS SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2025

4.3 GLOBAL MARKET SHARE, BY END USER, 2020 VS. 2025

FIGURE 13 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ARE THE LARGEST END USERS OF PYROGEN TESTING PRODUCTS & SERVICES

4.4 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 14 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH RATE IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 PYROGEN TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND TRENDS

5.2.1 DRIVERS

5.2.1.1 Rising incidence of infectious diseases and increasing frequency of pandemics

5.2.1.2 Increasing R&D in the pharmaceutical & biotechnology industries

FIGURE 16 GLOBAL PHARMACEUTICAL & BIOPHARMACEUTICAL R&D EXPENDITURE, 2017–2024

5.2.1.3 Growing focus on personalized medicine

TABLE 1 GROWTH IN THE NUMBER OF PERSONALIZED MEDICATIONS, 2008−2016

5.2.1.4 Growing awareness about food safety

FIGURE 17 NUMBER OF FOODBORNE DISEASE OUTBREAKS REPORTED TO ORU/NICD, SOUTH AFRICA, 2013-2017

5.2.1.5 High prevalence of chronic diseases

FIGURE 18 INCIDENCE OF DIABETES, BY REGION, 2017 VS. 2045 (MILLION CASES)

5.2.2 RESTRAINTS

5.2.2.1 High degree of consolidation

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing pharmaceutical outsourcing

5.2.3.2 Emerging markets offer lucrative opportunities

5.2.4 TRENDS

5.2.4.1 Shift from animal-based testing to in vitro testing

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.4 PRICING ANALYSIS

TABLE 2 PRICE OF PYROGEN TESTING PRODUCTS (2020)

5.5 VALUE CHAIN ANALYSIS

FIGURE 19 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASE

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 20 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.7 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

FIGURE 21 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 HIGH CAPITAL INVESTMENTS TO RESTRICT THE ENTRY OF NEW PLAYERS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 BARGAINING POWER OF SUPPLIERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

6 PYROGEN TESTING MARKET, BY PRODUCT & SERVICE (Page No. - 55)

6.1 INTRODUCTION

TABLE 3 GLOBAL MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

6.2 ASSAYS, KITS, & REAGENTS

6.2.1 REPEAT PURCHASES OF ASSAYS, KITS, & REAGENTS TO DRIVE THE MARKET GROWTH

TABLE 4 PYROGEN TESTING ASSAYS, KITS, & REAGENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 NORTH AMERICA: PYROGEN TESTING ASSAYS, KITS, & REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 EUROPE: PYROGEN TESTING ASSAYS, KITS, & REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 7 ASIA PACIFIC: PYROGEN TESTING ASSAYS, KITS, & REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 INSTRUMENTS

6.3.1 CONTINUOUS INNOVATION IN TECHNOLOGICALLY ADVANCED PRODUCTS TO SUPPORT MARKET GROWTH

TABLE 8 PYROGEN TESTING INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 NORTH AMERICA: PYROGEN TESTING INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 EUROPE: PYROGEN TESTING INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 11 ASIA PACIFIC: PYROGEN TESTING INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4 SERVICES

6.4.1 LACK OF EXPERTISE AND INFRASTRUCTURE FOR ANALYTICAL & QUALITY TESTING DRIVES RELIANCE ON SERVICE PROVIDERS

TABLE 12 PYROGEN TESTING SERVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 NORTH AMERICA: PYROGEN TESTING SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 EUROPE: PYROGEN TESTING SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 ASIA PACIFIC: PYROGEN TESTING SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7 PYROGEN TESTING MARKET, BY TEST TYPE (Page No. - 64)

7.1 INTRODUCTION

TABLE 16 GLOBAL MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

7.2 LAL TESTS

TABLE 17 LAL TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

7.2.1 CHROMOGENIC TESTS

7.2.1.1 Ease of use & cost-effectiveness of chromogenic tests to support market growth

TABLE 19 KEY PRODUCTS IN THE CHROMOGENIC TESTS MARKET, BY COMPANY

TABLE 20 CHROMOGENIC TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.2 TURBIDIMETRIC TESTS

7.2.2.1 Higher precision of kinetic turbidimetric tests have supported their adoption

TABLE 21 KEY PRODUCTS IN THE TURBIDIMETRIC TESTS MARKET, BY COMPANY

TABLE 22 TURBIDIMETRIC TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.3 GEL CLOT TESTS

7.2.3.1 Endotoxin determination with gel clot test method is simpler and more economical

TABLE 23 KEY PRODUCTS IN THE GEL CLOT TESTS MARKET, BY COMPANY

TABLE 24 GEL CLOT TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 IN VITRO TESTS

7.3.1 APPLICABILITY TO A GREATER VARIETY OF PRODUCTS IS DRIVING THE GROWTH OF THIS SEGMENT

TABLE 25 IN VITRO TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 RABBIT TESTS

7.4.1 INCREASING FOCUS ON THE USE OF NON-ANIMAL-BASED TESTING METHODS TO LIMIT MARKET GROWTH

TABLE 26 RABBIT TESTS MARKET, BY REGION, 2018–2025 (USD MILLION)

8 PYROGEN TESTING MARKET, BY END USER (Page No. - 73)

8.1 INTRODUCTION

TABLE 27 GLOBAL MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

8.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ARE THE LARGEST END USERS OF PYROGEN TESTING PRODUCTS

TABLE 28 GLOBAL MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2018–2025 (USD MILLION)

8.3 MEDICAL DEVICE COMPANIES

8.3.1 RISING NEED TO ENSURE THE SAFETY OF MANUFACTURED MEDICAL DEVICES HAS DRIVEN THE ADOPTION OF PYROGEN TESTING PRODUCTS

TABLE 29 GLOBAL MARKET FOR MEDICAL DEVICE COMPANIES, BY REGION, 2018–2025 (USD MILLION)

8.4 OTHER END USERS

TABLE 30 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

9 PYROGEN TESTING MARKET, BY REGION (Page No. - 80)

9.1 INTRODUCTION

TABLE 31 MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: PYROGEN TESTING MARKET SNAPSHOT

TABLE 32 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the North American market

TABLE 37 US: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 38 US: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 39 US: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Support from government organizations is driving the growth of the pyrogen testing market in Canada

TABLE 41 CANADA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 42 CANADA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 43 CANADA: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3 EUROPE

TABLE 45 EUROPE: PYROGEN TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany holds the largest share of the European market

TABLE 50 GERMANY: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 51 GERMANY: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 52 GERMANY: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Growth of the pharmaceutical & biotechnology industry to drive the market in the UK

TABLE 54 UK: PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 55 UK: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 56 UK: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Increasing investments in life science R&D infrastructure development to support market growth

TABLE 58 FRANCE: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 59 FRANCE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 60 FRANCE: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growth in this market is mainly driven by increasing life science R&D

TABLE 62 ITALY: PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 63 ITALY: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 64 ITALY: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing outsourcing of microbial testing services to fuel the adoption of pyrogen testing

TABLE 66 SPAIN: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 67 SPAIN: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 68 SPAIN: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 70 ROE: PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 71 ROE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 72 ROE: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 74 APAC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 APAC: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 76 APAC: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 77 APAC: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 APAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China dominates the market in the APAC

TABLE 79 CHINA: PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 80 CHINA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 81 CHINA: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Expansion of pharmaceutical manufacturing plants in Japan to create market growth opportunities

TABLE 83 JAPAN: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 84 JAPAN: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 85 JAPAN: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 India’s growing contract research and manufacturing industry will favor the global market

TABLE 87 INDIA: PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 88 INDIA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 89 INDIA: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 91 ROAPAC: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 92 ROAPAC: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 93 ROAPAC: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 GROWING CONTRACT RESEARCH & MANUFACTURING ACTIVITIES TO SUPPORT THE MARKET GROWTH

TABLE 95 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 97 LATIN AMERICA: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 INCREASING R&D INVESTMENTS AND FOCUS ON THE DEVELOPMENT OF NEW DRUGS ARE CONTRIBUTING TO MARKET GROWTH

TABLE 99 MIDDLE EAST & AFRICA: PYROGEN TESTING MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: LAL TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 121)

10.1 OVERVIEW

FIGURE 25 KEY DEVELOPMENTS IN THE PYROGEN TESTING MARKET

10.2 MARKET SHARE ANALYSIS

FIGURE 26 GLOBAL MARKET SHARE, BY KEY PLAYER (2019)

10.3 COMPANY EVALUATION QUADRANT

10.3.1 VENDOR EXCLUSION CRITERIA

10.3.2 STARS

10.3.3 EMERGING LEADERS

10.3.4 PERVASIVE PLAYERS

10.3.5 PARTICIPANTS

FIGURE 27 PYROGEN TESTING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES

TABLE 103 KEY PRODUCT LAUNCHES

10.4.2 ACQUISITIONS

TABLE 104 KEY ACQUISITIONS

10.4.3 EXPANSIONS

TABLE 105 KEY EXPANSIONS

10.4.4 AGREEMENTS

TABLE 106 KEY AGREEMENTS

10.4.5 PARTNERSHIPS

TABLE 107 KEY PARTNERSHIPS

11 COMPANY PROFILES (Page No. - 129)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1.1 CHARLES RIVER LABORATORIES, INC.

FIGURE 28 CHARLES RIVER LABORATORIES, INC.: COMPANY SNAPSHOT (2019)

11.1.2 LONZA

FIGURE 29 LONZA: COMPANY SNAPSHOT (2019)

11.1.3 MERCK KGAA

FIGURE 30 MERCK KGAA: COMPANY SNAPSHOT (2019)

11.1.4 THERMO FISHER SCIENTIFIC, INC.

FIGURE 31 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

11.1.5 ASSOCIATES OF CAPE COD, INC.

11.1.6 BIOMÉRIEUX SA

FIGURE 32 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2019)

11.1.7 GENSCRIPT BIOTECH CORPORATION

FIGURE 33 GENSCRIPT BIOTECH CORPORATION: COMPANY SNAPSHOT (2019)

11.1.7.2 Products offered

11.1.8 EUROFINS SCIENTIFIC

FIGURE 34 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2019)

11.1.9 WUXI APPTEC

FIGURE 35 WUXI APPTEC: COMPANY SNAPSHOT (2019)

11.1.10 STERIS PLC

FIGURE 36 STERIS PLC: COMPANY SNAPSHOT (2019)

11.2 OTHER PLAYERS

11.2.1 ELLAB A/S

11.2.2 FUJIFILM WAKO PURE CHEMICAL CORPORATION

11.2.3 INVIVOGEN

11.2.4 NELSON LABORATORIES, LLC

11.2.5 MICROCOAT BIOTECHNOLOGIE GMBH

11.2.6 HYCULT BIOTECH

11.2.7 ALMAC GROUP

11.2.8 PACIFIC BIOLABS

11.2.9 ACCUGEN LABORATORIES, INC.

11.2.10 TOXIKON

11.2.11 MINERVA ANALYTIX GMBH

11.2.12 INDOOR BIOTECHNOLOGIES, INC.

11.2.13 CREATIVE BIOARRAY

11.2.14 LUCIDEON LIMITED

11.2.15 NORTH AMERICAN SCIENCE ASSOCIATES, INC.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 164)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

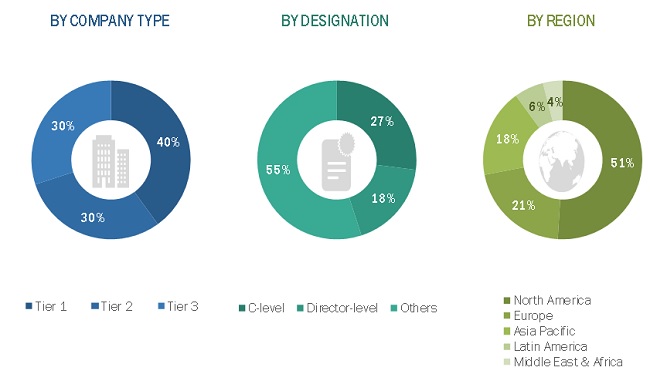

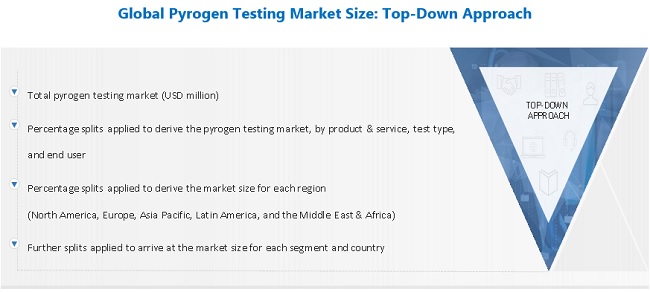

This study involved four major activities in estimating the current size of the pyrogen testing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the pyrogen testing market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the pyrogen testing market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global pyrogen testing market by product & service, test type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and trends)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall pyrogen testing market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches, partnerships, expansions, and acquisitions in the pyrogen testing market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Pyrogen testing market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the pyrogen testing market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pyrogen Testing Market