LATAM Angiography Equipment Market - Global Forecast 2030

The Latin America angiography equipment market is projected to grow exponentially by 2031, growing at a high CAGR from 2026 to 2031. The growth of angiography equipment in Latin America is primarily driven by the rising prevalence of cardiovascular and cerebrovascular diseases, along with an ageing population that increases demand for advanced diagnostic and interventional imaging solutions. The region has seen significant progress in adopting minimally invasive and catheter-based procedures, which rely heavily on modern angiography systems. Technological advancements, such as flat-panel detector technology, hybrid operating rooms, and enhanced image processing with lower radiation doses, have further supported clinical adoption. Moreover, the post-pandemic recovery of hospital procedure volumes, expansion of private healthcare infrastructure, and growing medical tourism in key countries like Brazil and Mexico are prompting hospitals to invest in new angiography systems to enhance clinical capacity and competitiveness. However, the market’s growth is restrained by high equipment and maintenance costs, which create barriers for public hospitals and smaller clinics. Inadequate reimbursement frameworks, slow regulatory approvals, and uneven government funding further hinder large-scale procurement.

Driver: Rising Burden of Cardiovascular and Cerebrovascular Diseases in Latin America

Across Latin America, the rising incidence of cardiovascular and cerebrovascular diseases has significantly accelerated the demand for advanced diagnostic imaging technologies, particularly angiography systems. With ageing populations and growing urbanization, lifestyle-related conditions such as hypertension, diabetes, and obesity are becoming more prevalent, leading to a higher number of cardiac and vascular interventions. Governments in countries like Brazil, Mexico, and Colombia are increasingly investing in healthcare infrastructure, expanding cardiac care centers, and promoting minimally invasive procedures that depend on high-performance angiography equipment. In addition, technological innovations—such as flat-panel detector systems, hybrid operating rooms, and dose-optimized digital imaging—are enhancing procedural accuracy and patient safety, further encouraging adoption. The resurgence of elective cardiovascular procedures post-pandemic, coupled with growing private sector participation and medical tourism, is also driving hospitals to upgrade or install modern angiography suites, thus fueling market growth across the region.

Restraint: High Equipment Cost and Limited Healthcare Access

Despite the growing clinical need, the high capital and maintenance costs associated with angiography systems remain a significant restraint on market expansion in Latin America. Many public hospitals and smaller healthcare facilities face budget constraints, limiting their ability to invest in advanced imaging equipment. Additionally, uneven healthcare infrastructure, particularly in rural and semi-urban regions, restricts access to advanced cardiac diagnostics and interventional procedures. Regulatory delays, inconsistent reimbursement policies, and limited availability of skilled professionals—such as interventional cardiologists and radiologic technologists—further impede market penetration. The lack of sufficient training and operational support for complex imaging systems also contributes to underutilization in some facilities. These financial, infrastructural, and workforce-related challenges collectively slow the overall growth of the angiography equipment market in Latin America, despite the region’s rising clinical demand.

Opportunity: Expansion of Healthcare Infrastructure and Technological Advancement

The Latin American angiography equipment market presents strong opportunities driven by ongoing expansion and modernization of healthcare infrastructure across the region. Governments in major economies such as Brazil, Mexico, and Colombia are increasingly prioritizing the enhancement of cardiovascular care networks through hospital modernization projects, establishment of new catheterization laboratories, and the integration of digital and AI-enabled imaging systems. The growing focus on value-based healthcare and early disease diagnosis has encouraged investments in advanced interventional cardiology and radiology units. Additionally, public–private partnerships are helping bridge equipment and service gaps, creating avenues for manufacturers to supply cost-effective, high-performance angiography systems. Technological innovations—such as portable angiography systems, 3D imaging, and hybrid operating rooms—are further opening new possibilities for both urban and remote healthcare settings. Rising collaborations between international imaging companies and local distributors are also enhancing access to modern technologies, offering a promising landscape for market expansion in the coming years.

Challenge: Economic Instability and Reimbursement Limitations

However, the angiography equipment market in Latin America continues to face challenges stemming from economic instability, currency fluctuations, and uneven healthcare funding across countries. These macroeconomic factors affect hospitals’ purchasing power and delay capital-intensive projects. Inadequate reimbursement mechanisms for angiographic procedures and limited insurance coverage for advanced cardiovascular interventions reduce hospitals’ return on investment, discouraging new equipment adoption. Bureaucratic hurdles, including complex procurement processes and varying regulatory frameworks between nations, further complicate market entry for global manufacturers. Moreover, shortages of trained healthcare professionals—especially interventional cardiologists and radiologic technologists, pose operational challenges, impacting utilization rates of existing systems. Together, these factors hinder consistent market growth and highlight the need for stable economic policies, streamlined reimbursement systems, and regional training initiatives to sustain long-term development of the angiography equipment sector in Latin America.

This study involves the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process for the Latin America Angiography Equipment Market involves extensive utilization of credible secondary sources, directories, and databases to gather reliable and validated information. Key databases such as Bloomberg Businessweek, Factiva, D&B Hoovers, and Statista were consulted to analyse market performance, technological trends, and competitive landscapes. In addition, annual reports, investor presentations, and SEC filings of leading angiography equipment manufacturers such as GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Shimadzu Corporation were reviewed to understand their regional operations, product portfolios, and strategic initiatives.

Publications and reports from government and international health organizations such as the World Health Organization (WHO), Pan American Health Organization (PAHO), World Bank, Inter-American Development Bank (IDB), and the Economic Commission for Latin America and the Caribbean (ECLAC) were referred to assess healthcare infrastructure development, disease prevalence, and investment trends in cardiovascular care. Furthermore, national health ministries and regulatory bodies such as Brazil’s Agência Nacional de Vigilância Sanitária (ANVISA), Mexico’s Comisión Federal para la Protección contra Riesgos Sanitarios (COFEPRIS), and Argentina’s Administración Nacional de Medicamentos, Alimentos y Tecnología Médica (ANMAT) provided data on device approvals, healthcare policies, and equipment procurement.

Academic and clinical research from journals such as the Journal of the American College of Cardiology (JACC), Revista Española de Cardiología, and Latin American Journal of Interventional Cardiology (SOLACI Journal) were analyzed to identify procedural trends, advancements in interventional techniques, and adoption rates of angiographic systems. These sources collectively helped establish an evidence-based understanding of the market structure, growth dynamics, and key technological developments in the Latin America Angiography Equipment Market.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the Latin America Angiography Equipment market. The primary sources from the demand side include hospitals & clinics, diagnostic and imaging centers. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

Market Estimation Methodology

For the Latin America market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the Latin America Angiography Equipment Market. All the major product manufacturers were identified at the Latin America Regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 80-85% of the market share at the regional level). Also, the Latin America Angiography Equipment Market was split into various segments based on:

- List of major players operating in the Latin America Angiography Equipment market at the regional level

- Mapping of annual revenue generated by listed major players from Latin America Angiography Equipment (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 80-85% of the regional market share as of 2024.

- Extrapolation of the revenue mapping of the listed major players to derive the Latin America market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the Latin America Angiography Equipment Market

The above-mentioned data was consolidated and added with detailed input and analysis from MarketsandMarkets and presented in this report.

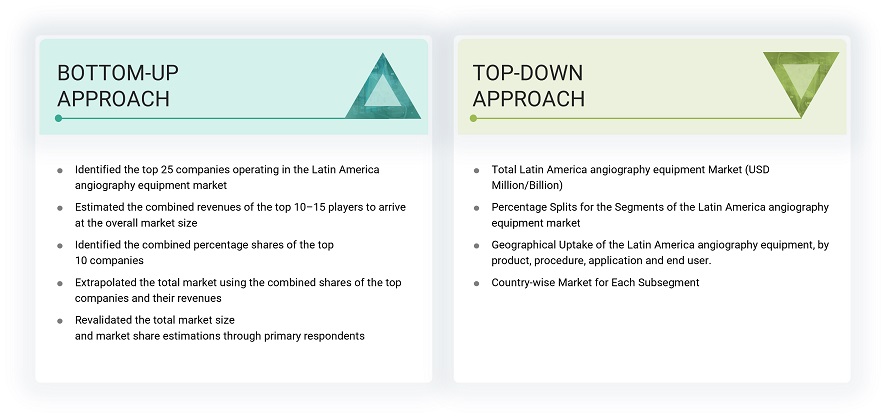

Market Size Estimation (Bottom-Up approach & Top-down approach)

Data Triangulation

After arriving at the overall size of the Latin America Angiography Equipment Market through the above-mentioned methodology, this market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Report Objectives

- To define, measure, and describe the Latin America Angiography Equipment Market by product, procedure, application and end user

- To provide detailed information about the major factors influencing market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze the regulatory scenario, pricing, value chain analysis, supply chain analysis, ecosystem analysis, technology analysis, Porter’s Five Forces analysis, pipeline analysis, and patent analysis

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To strategically analyze the market structure, profile the key players in the Latin America Angiography Equipment Market, and comprehensively analyze their core competencies

- To track and analyze company developments such as mergers and acquisitions, partnerships, expansions, and product launches and approvals in the Latin America Angiography Equipment market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2031 |

|

Base year considered |

2025 |

|

Forecast period |

2026–2031 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Product, Procedure, Application and End user |

|

Geographies covered |

Brazil, Mexico, Argentina, Peru, Rest of Latin America |

|

Companies covered |

GE HealthCare (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Canon Medical Systems (Japan), Medtronic (Ireland), Abbott (United States),. AngioDynamics Inc. (United States), Shimadzu Corporation (Japan), Fujifilm (Japan), Boston Scientific Corporation (United States), MicroPort (China), Curatia Medical Inc. (United States), HealthCare (Belgium), Ziehm Imaging (Germany), Advin Health Care (India), First Medical International (United States),. |

Recent Developments

- In May 2024, GE HealthCare (US) announced a strategic collaboration with Hospital Israelita Albert Einstein (Brazil) to advance precision imaging and interventional cardiology practices through AI-integrated angiography systems. This initiative focuses on improving real-time image analysis and patient outcomes, marking a step toward strengthening Brazil’s capacity for minimally invasive cardiovascular procedures.

- In February 2024, Siemens Healthineers (Germany) expanded its footprint in Latin America by partnering with Hospital Ángeles (Mexico) to install next-generation Artis zee and Artis Q angiography systems. The collaboration aims to support the hospital’s advanced cardiovascular and neurointerventional programs while providing training for local clinicians on image-guided therapy techniques.

- In April 2024, Philips Healthcare (Netherlands) partnered with the Ministry of Health in Colombia to supply digital angiography suites for public hospitals as part of a national cardiovascular disease management program. The partnership is designed to modernize diagnostic infrastructure, reduce waiting times for interventional procedures, and enhance accessibility in underserved areas.

- In August 2023, Canon Medical Systems (Japan) launched its Alphenix Core+ angiography system in Mexico and Chile, highlighting dose optimization and enhanced workflow efficiency for hybrid operating rooms. The launch reinforced Canon’s strategy to expand its Latin American presence through local distribution partnerships and targeted clinical education initiatives.

- In July 2023, Shimadzu Corporation (Japan) collaborated with Instituto Nacional de Cardiología Ignacio Chávez (Mexico) to establish a state-of-the-art interventional imaging training center. This facility focuses on skill development for cardiologists and radiologic technologists across Latin America, promoting knowledge exchange and increasing angiography system adoption in tertiary care centers.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Latin America Angiography Equipment market into Colombia, Chile, and Ecuador and others

Competitive Landscape Assessment

- Market share analysis, by country (Brazil, Mexico, Argentina, Peru), which provides market shares of the top 3-5 key players in the Latin America Angiography Equipment market

- Competitive leadership mapping for established players in the LATAM

- 5.1 PORTER’S FIVE FORCES ANALYSIS

-

5.2 MACROECONOMICS INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN LATIN AMERICA HEALTHCARE INDUSTRYTRENDS IN LATIN AMERICA MEDICAL DEVICE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2025AVERAGE SELLING PRICE TREND, BY PRODUCT, 2023-2025AVERAGE SELLING PRICE TREND, BY COUNTRY, 2023-2025AVERAGE SELLING PRICE TREND, BY PROCEDURE, 2023-2025

-

5.7 TRADE ANALYSISIMPORT SCENARIO (HS CODE 9018.39)EXPORT SCENARIO (HS CODE 9018.39)

- 5.8 KEY CONFERENCES AND EVENTS, 2026–2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS/SUCCESS STORIES AND REAL-WORLD APPLICATIONS

-

5.12 IMPACT OF 2025 US TARIFF – LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON LATIN AMERICA COUNTRIESIMPACT ON END-USE INDUSTRIES

-

6.1 KEY EMERGING TECHNOLOGIESAI-DRIVEN IMAGE PROCESSING AND AUTOMATION3D AND 4D ANGIOGRAPHIC IMAGING

-

6.2 COMPLEMENTARY TECHNOLOGIESPORTABLE AND COMPACT ANGIOGRAPHY SYSTEMSHYBRID OPERATING ROOMS (HYBRID ORS)

-

6.3 ADJACENT TECHNOLOGIESROBOTIC-ASSISTED INTERVENTIONAL SYSTEMSDIGITAL SUBTRACTION ANGIOGRAPHY (DSA) AND FLUOROSCOPY ENHANCEMENTS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 FUTURE APPLICATIONS

-

6.7 IMPACT OF AI/GEN AI ON LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKETTOP USE CASES AND MARKET POTENTIALBEST PRACTICES IN LATIN AMERICA ANGIOGRAPHY EQUIPMENTCASE STUDIES OF AI IMPLEMENTATION IN THE LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT GENERATIVE AI IN LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKET

-

7.1 REGIONAL REGULATIONS AND COMPLIANCEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSINDUSTRY STANDARDS

-

7.2 SUSTAINABILITY INITIATIVESENVIRONMENTALLY RESPONSIBLE MANUFACTURING AND RECYCLING

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES IN THE LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKET

- 8.5 MARKET PROFITABILITY

- 9.1 INTRODUCTION

- 9.2 ANGIOGRAPHY SYSTEMS

- 9.3 ANGIOGRAPHY CATHETERS

- 9.4 ANGIOGRAPHY CONTRAST MEDIA INJECTORS

- 9.5 VASCULAR CLOSURE DEVICES

- 9.6 ANGIOGRAPHY BALLOONS

- 9.7 ANGIOGRAPHY GUIDEWIRES

-

9.8 OTHER ANGIOGRAPHY PRODUCTS & ACCESSORIES

LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKET, BY PROCEDURE (MARKET SIZE & FORECAST TO 2031 – IN VALUE, USD MILLION & VOLUME UNITS)

- 10.1 INTRODUCTION

- 10.2 CORONARY ANGIOGRAPHY

- 10.3 ENDOVASCULAR ANGIOGRAPHY

- 10.4 NEUROANGIOGRAPHY

- 10.5 TUMOR VASCULAR IMAGING

- 10.6 OTHER ANGIOGRAPHY PROCEDURES

- 11.1 INTRODUCTION

- 11.2 DIAGNOSTIC

- 11.3 THERAPEUTIC

- 12.1 INTRODUCTION

-

12.2 HOSPITALSPUBLICPRIVATE

- 12.3 CLINICS

- 12.4 DIAGNOSTIC AND IMAGING CENTERS

- 12.5 OTHER END USERS

- 13.1 INTRODUCTION

- 13.2 BRAZIL

- 13.3 ARGENTINA

- 13.4 PERU

- 13.5 REST OF LATIN AMERICA

- 14.1 OVERVIEW

- 14.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2023-2025)

- 14.4 MARKET SHARE ANALYSIS, 2025

-

14.5 LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKET, BRAND/PRODUCT COMPARATIVE ANALYSISGE HEALTHCARESIEMENS HEALTHINEERSKONINKLIJKE PHILIPS N.VCANON MEDICAL SYSTEMSMEDTRONIC

-

14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2025- COMPANY FOOTPRINT- REGION FOOTPRINT- PRODUCT FOOTPRINT- PROCEDURE FOOTPRINT

-

14.7 COMPANY EVALUATION MATRIX: STARTUPS/SME’S, 2025PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SME’S, 2025- DETAILED LIST OF KEY STARTUPS/SME’S- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME’S

- 14.8 LATIN AMERICA ANGIOGRAPHY EQUIPMENT MARKET: VALUATION AND FINANCIAL MATRICS OF KEY PLAYERS

-

14.9 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

-

15.1 KEY PLAYERSGE HEALTHCARESIEMENS HEALTHINEERSKONINKLIJKE PHILIPS N.V.CANON MEDICAL SYSTEMSMEDTRONICABBOTTANGIODYNAMICS INC.SHIMADZU CORPORATIONFUJIFILMBOSTON SCIENTIFIC CORPORATIONMICROPORTCURATIA MEDICAL INC.AGFA HEALTHCAREZEIHM IMAGING

-

15.2 OTHER PLAYERSADVIN HEALTH CARE.FIRST MEDICAL INTERNATIONALNEUSOFT MEDICAL SYSTEMS

-

16.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key primary participants- Breakdown of primary interviews- Key industry insights

-

16.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACHBASE NUMBER CALCULATION

-

16.3 MARKET FORECAST APPROACHSUPPLY SIDEDEMAND SIDE

- 16.4 DATA TRIANGULATION

- 16.5 FACTOR ANALYSIS

- 16.6 RESEARCH ASSUMPTIONS

- 16.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- 17.1 INSIGHTS OF INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

17.4 AVAILABLE CUSTOMIZATIONGEOGRAPHIC ANALYSISCOUNTRY-LEVEL MARKET SHARE ANALYSISCOMPANY INFORMATIONPRODUCT ANALYSISCOUNTRY-LEVEL VOLUME ANALYSISANY CONSULTS/CUSTOM REQUIREMENTS AS PER CLIENT REQUEST

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

Growth opportunities and latent adjacency in LATAM Angiography Equipment Market