Lighting Contactor Market by End-User (Smart Residential Complexes, Commercial, Industrial, and Municipal), Type (Electrically Held and Mechanically Held), Application (Indoor and Outdoor), and Region - Global Forecast to 2023

[113 Pages Report] The global lighting contactor market was valued at USD 683.7 million in 2017 and is projected to reach USD 1,111.0 million by 2023, at a CAGR of 8.53%, during the forecast period. The factors driving the market include the growing adoption of lighting control and management systems by commercial and industrial end-user segments in Asia Pacific. Also, government authorities in many countries across Europe are adopting smart street lighting to reduce energy cost and increase energy efficiency.

Objectives of the Study

- To define, describe, and forecast the size of the market in terms of value

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To estimate and forecast the size of the lighting contactor based on end-user, type, application, and region

- To study the individual growth trends of the key players of the lighting contactor market, their future expansions, and contributions to the market

- To track and analyze competitive developments such as expansions & investments, mergers & acquisitions, new product developments, contracts & agreements, and joint ventures & collaborations in the market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related rental markets; newsletters and databases such as Hoovers, Bloomberg, Businessweek, and Factiva, among others, to identify and collect information useful for a technical, market-oriented, and commercial study of the global lighting contactor market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of major players providing market.

- Analysis of the major technology and application of the market.

- Assessment of future trends and growth of market on the basis of investments in commercial, industrial, smart residential complexes, and municipal.

- Study of contracts & developments related to the market by key players across different regions.

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chains, and annual revenues of companies manufacturing lighting contactor market across the globe.

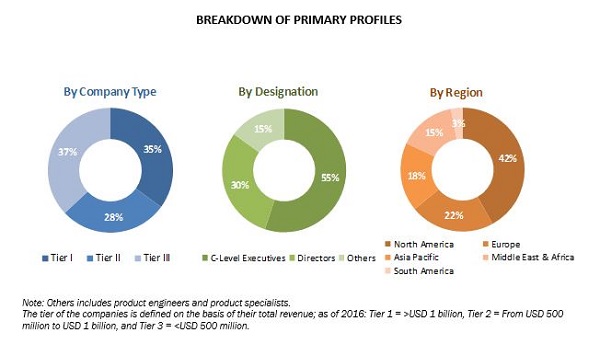

After arriving at the overall market size, the lighting contactor market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the lighting contactor market include Schlumberger (US), Halliburton (US), BHGE (US), Weatherford (Switzerland), and National Oilwell Varco (US).

Target Audience:

- Government Agencies

- Investment Banks

- Lighting Contactor OEM

- Lighting Control Association

- Lighting Management Association

- Lighting Control System OEM

- Regulatory Authorities

Scope of the Report:

- Commercial

- Industrial

- Smart Residential Complexes

- Municipal

- Mechanically Held

- Electrically Held

- Indoor

- Outdoor

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

By End-User

By Type

By Application

By Region

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

Detailed analyses and profiling of additional market players (up to Five)

The global lighting contactor market is estimated to be USD 737.8 million in 2018 and is projected to reach USD 1,111.0 million by 2023, at a CAGR of 8.53% from 2018 to 2023. Increasing adoption of IoT in the lighting industry and rising demand for energy-efficient lighting systems are the major drivers of the lighting contactor market.

The report segments the lighting contactor market, by end-user, into commercial, smart residential complexes, industrial, and municipal. Governments across the world are working toward introducing regulations that encourage the adoption of energy-efficient lighting systems, with the eventual goal of mandating the use of such technology and completely phasing out old lighting systems. Moreover, lighting control systems integrated with dimmers and switches are playing an important role in reducing the energy consumption. Thus, the demand for lighting contactor is likely to increase with the rising adoption of lighting control systems.

Based on the type, the lighting contactor market has been segmented into mechanically held and electrically held. The electrically held segment is expected to hold the largest market share in 2018. Electrically held contactors operate quietly and consume very less amount of control power. They are cost-effective than mechanically held contactors. Electrically held contactors are majorly used in smart residential complexes, commercial, and industrial sectors.

Based on application, the lighting contactor market has been segmented into indoor and outdoor. The indoor segment is estimated to lead the market in 2018 and is expected to grow at the fastest rate during the forecast period as the demand for lighting control systems is triggered by the increasing awareness to reduce energy consumption as well as the growing need to adhere to environmental regulations in commercial offices, smart residential complexes, and industrial areas.

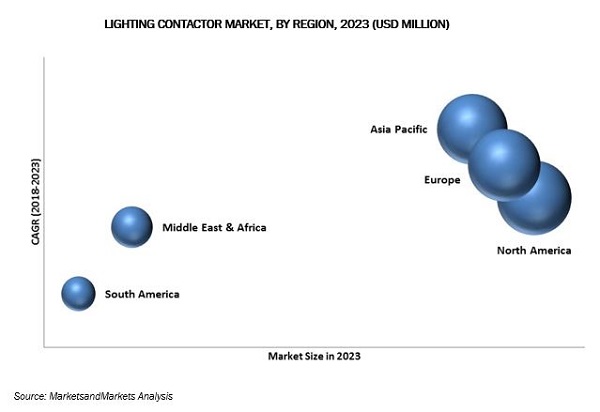

In this report, the lighting contactor market has been analyzed on the basis of 5 regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa. Europe is expected to hold the largest market share in 2018, and Asia Pacific is estimated to be the fastest growing market from 2018 to 2023. Factors such as increasing demand for smart controls in lighting systems and rising adoption of energy-efficient lighting systems are driving the lighting contactor market in the European region.

Government initiatives for energy saving and development of smart cities is expected to create opportunities in the lighting contactor market. However, higher installation cost and limited awareness about the payback period could restrain the growth of the market, leading to declining profits.

Some of the leading players in the lighting contactor market are ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), and Eaton (Republic of Ireland). New product launches was the most widely adopted strategies by players to ensure their dominance in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Market, By Country

4.2 Market, By Type

4.3 Market, By End-User

4.4 Market, By Application

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Smart Control in the Lighting System

5.2.1.2 Increasing Adoption of Energy-Efficient Lighting

5.2.1.3 Increasing Adoption of Internet of Thing (IoT) in the Lighting Industry

5.2.2 Restraints

5.2.2.1 Higher Installation Cost and Limited Awareness About the Payback Period

5.2.3 Opportunities

5.2.3.1 Government Initiatives for Energy Saving

5.2.3.2 Development of Smart Cities

5.2.4 Challenges

5.2.4.1 Lack of Standard Regulatory Framework

6 Lighting Contactor Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Electrically Held

6.3 Mechanically Held

7 Lighting Contactor Market, By Application (Page No. - 40)

7.1 Introduction

7.2 Indoor

7.2.1 Residential

7.2.2 Commercial

7.2.3 Industrial

7.2.4 Others

7.3 Outdoor

7.3.1 Highways & Roadways Lighting

7.3.2 Lighting for Public Places

7.3.3 Others

8 Lighting Contactor Market, By End-User (Page No. - 45)

8.1 Introduction

8.2 Commerical

8.3 Municipal (Public)

8.4 Industrial

8.5 Smart Residential Complexes

9 Lighting Contactor Market, By Region (Page No. - 51)

9.1 Introduction

9.2 North America

9.2.1 By End-User

9.2.2 By Type

9.2.3 By Application

9.2.4 By Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3 Europe

9.3.1 By End-User

9.3.2 By Type

9.3.3 By Application

9.3.4 By Country

9.3.4.1 Germany

9.3.4.2 UK

9.3.4.3 France

9.3.4.4 Italy

9.3.4.5 Netherlands

9.3.4.6 Spain

9.3.4.7 Rest of Europe

9.4 Asia Pacific

9.4.1 By End-User

9.4.2 By Type

9.4.3 By Application

9.4.4 By Country

9.4.4.1 China

9.4.4.2 India

9.4.4.3 Japan

9.4.4.4 South Korea

9.4.4.5 Australia

9.4.4.6 Rest of Asia Pacific

9.5 South America

9.5.1 By End-User

9.5.2 By Type

9.5.3 By Application

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.2 Argentina

9.5.4.3 Rest of South America

9.6 Middle East & Africa

9.6.1 By End-User

9.6.2 By Type

9.6.3 By Application

9.6.4 By Country

9.6.4.1 Saudi Arabia

9.6.4.2 South Africa

9.6.4.3 UAE

9.6.4.4 Qatar

9.6.4.5 Rest of the Middle East & Africa

10 Competitive Landscape (Page No. - 81)

10.1 Introduction

10.2 Ranking of Players, 2017

10.3 Competitive Scenario

10.3.1 Partnerhip & Collaboration

10.3.2 New Product Developments

10.3.3 Investments & Expansions

10.3.4 Mergers & Acquisitions

11 Company Profiles (Page No. - 85)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Company Benchmarking

11.2 ABB

11.3 Siemens

11.4 Acuity

11.5 Legrand

11.6 Rockwell Automation

11.7 Schnieder Electric

11.8 Eaton

11.9 Ripley Lighting Controls

11.10 Sprecher Schuh

11.11 Federal Electric

11.12 Hager

11.13 NSI Industries

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 106)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (63 Tables)

Table 1 Global Lighting Contactor Market Snapshot

Table 2 Annual Energy Saving From Lighting Controls, By Sector, Forecast (20152035)

Table 3 Market Size, By Type, 20162023 (USD Million)

Table 4 Electrically Held: Market Size, By Region, 20162023 (USD Million)

Table 5 Mechanically Held: Market Size, By Region, 20162023 (USD Million)

Table 6 Market Size, By Application, 20162023 (USD Million)

Table 7 Indoor: Market Size, By Region, 20162023 (USD Million)

Table 8 Indoor: Market Size, By Application, 20162023 (USD Million)

Table 9 Outdoor: Market Size, By Region, 20162023 (USD Million)

Table 10 Outdoor: Market Size, By Application 20162023 (USD Million)

Table 11 Market Size, By End-User, 20162023 (USD Million)

Table 12 Commercial: Market Size, By Region, 20162023 (USD Million)

Table 13 Municipal: Market Size, By Region, 20162023 (USD Million)

Table 14 Industrial: Market Size, By Region, 20162023 (USD Million)

Table 15 Smart Residential Complexes: Market Size, By Region, 20162023 (USD Million)

Table 16 Market Size, By Region, 20162023 (USD Million)

Table 17 Top 10 Countries for Market Size, By End-User, 20162023 (USD Million)

Table 18 Top 10 Countries for Market Size, By Commercial, 20162023 (USD Million)

Table 19 North America: Market Size, By End-User, 20162023 (USD Million)

Table 20 North America: Market Size, By Type, 20162023 (USD Million)

Table 21 North America: Market Size, By Application, 20162023 (USD Million)

Table 22 North America: Market Size, By Country, 20162023 (USD Million)

Table 23 US: Market Size, By End-User, 20162023 (USD Million)

Table 24 Canada:Market Size, By End-User, 20162023 (USD Million)

Table 25 Mexico: Market Size, By End-User, 20162023 (USD Million)

Table 26 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 27 Europe: Market Size, By Type, 20162023 (USD Million)

Table 28 Europe: Market Size, By Application, 20162023 (USD Million)

Table 29 Europe: Market Size, By Country, 20162023 (USD Million)

Table 30 Germany: Market Size, By End-User, 20162023 (USD Million)

Table 31 UK: Market Size, By End-User, 20162023 (USD Million)

Table 32 France: Market Size, By End-User, 20162023 (USD Million)

Table 33 Italy: Market Size, By End-User, 20162023 (USD Million)

Table 34 Netherlands: Market Size, By End-User, 20162023 (USD Million)

Table 35 Spain: Market Size, By End-User, 20162023 (USD Million)

Table 36 Rest of Europe: Market Size, By End-User, 20162023 (USD Million)

Table 37 Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 38 Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 39 Asia Pacific: Market Size, By Application, 20162023 (USD Million)

Table 40 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 41 China: Market Size, By End-User, 20162023 (USD Million)

Table 42 India: Market Size, By End-User, 20162023 (USD Million)

Table 43 Japan: Market Size, By End-User, 20162023 (USD Million)

Table 44 South Korea: Market Size, By End-User, 20162023 (USD Million)

Table 45 Australia: Market Size, By End-User, 20162023 (USD Million)

Table 46 Rest of Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 47 South America: Market Size, By End-User, 20162023 (USD Million)

Table 48 South America: Market Size, By Type, 20162023 (USD Million)

Table 49 South America: Market Size, By Application, 20162023 (USD Million)

Table 50 South America: Market Size, By Country, 20162023 (USD Million)

Table 51 Brazil: Market Size, By End-User, 20162023 (USD Million)

Table 52 Argentina: Market Size, By End-User, 20162023 (USD Million)

Table 53 Rest of South America: Market Size, By End-User, 20162023 (USD Million)

Table 54 Middle East & Africa: Market Size, By End-User, 20162023 (USD Million)

Table 55 Middle East & Africa: Market Size, By Type, 20162023 (USD Million)

Table 56 Middle East & Africa: Market Size, By Application, 20162023 (USD Million)

Table 57 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 58 Saudi Arabia: Market Size, By End-User, 20162023 (USD Million)

Table 59 South Africa: Market Size, By End-User, 20162023 (USD Million)

Table 60 UAE: Market Size, By End-User, 20162023 (USD Million)

Table 61 Qatar: Market Size, By End-User, 20162023 (USD Million)

Table 62 Rest of the Middle East & Africa: Market Size, By End-User, 20162023 (USD Thousand)

Table 63 ABB & Eaton, the Most Active Player in the Market Between 2011 and July 2018

List of Figures (32 Figures)

Figure 1 Lighting Contactor Market Segmentation

Figure 2 Market for Lighting Contactor: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Europe Held the Largest Share in the Market for Lighting Contactor in 2017

Figure 8 Electrically Held Segment is Expected to Lead the Market During the Forecast Period

Figure 9 Commercial Segment is Expected to Dominate the Market During the Forecast Period

Figure 10 Indoor Segment is Expected to Be Largest Market From 2018 to 2023

Figure 11 Attractive Opportunities in the Market, 20182023

Figure 12 China is Expected to Grow at the Fastest Rate in the Asia Pacific Market During the Forecast Period

Figure 13 Electrically Held Segment is Expected to Dominate the Market in 2023

Figure 14 Municipal Segment is Estimated to Grow at the Fastest Rate During the Forecast Period

Figure 15 Indoor Segment is Expected to Lead the Market in 2023

Figure 16 Market Dynamics for the Market

Figure 17 Lighting Control Led Usage Scenario in the Us

Figure 18 Electrically Held Segment Accounted for the Largest Market During Forecasted Period

Figure 19 Indoor Segment Accounted for the Largest Market Share During the Forecast Period

Figure 20 Commercial Segment Accounts for the Largest Market Share in 2018

Figure 21 Europe Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America: Lighting Contactor Market Snapshot

Figure 23 Europe: Market for Lighting Contactor Snapshot

Figure 24 New Product Development Was the Most Widely Adopted Development Strategy Between 2014 and August 2018

Figure 25 Ranking of Key Players in the Market for Lighting Contactor in 2017

Figure 26 ABB: Company Snapshot

Figure 27 Siemens: Company Snapshot

Figure 28 Acuity: Company Snapshot

Figure 29 Legrand: Company Snapshot

Figure 30 Rockwell Automation: Company Snapshot

Figure 31 Schneider Electric: Company Snapshot

Figure 32 Eaton: Company Snapshot

Growth opportunities and latent adjacency in Lighting Contactor Market