Lithium-ion Battery Anode Market

Lithium-ion Battery Anode Market by Material (Active Anode Materials and Anode Binders), Battery Product (Cell and Battery Pack), End-use (Automotive and Non-automotive), Production Technology, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global lithium-ion battery anode market is projected to grow from USD 19.06 billion in 2025 to USD 81.24 billion by 2030, at a CAGR of 33.6% during the forecast period. The lithium-ion battery anode market is experiencing growth due to many reasons including the wide increase in demand for electric vehicles (EVs), advancing usage of renewable sources of energy, and the ongoing advancements in the consumer electronics space. New technological discoveries in battery chemistry and material science are achieving better energy densities, charging rates, and cycle lifetimes of Li-ion batteries making them more technologically efficient and appealing. The environmental effects of Li-ion batteries and the growing global movement of reducing emissions have caused many governments and companies to aggressively invest in sustainable energy storage. Therefore, large amounts of research and investments are currently taking place for anode material improvements and sustainability, often focusing on silicon and composite blends in the form of more cost-effective and functional materials. Each participant in the industry including manufacturers, suppliers, and research institutions is scaling up and investing in production, forming partnerships, and utilizing innovative manufacturing practices. These forces will continue to expand the lithium-ion battery anode market internationally.

KEY TAKEAWAYS

-

BY BATTERY PRODUCTThe lithium-ion battery anode market, by battery product, has been segmented into Cells and Battery Packs. Lithium-ion battery packs are used in applications that require a higher amount of energy density. For instance, a series of battery packs is used in an electric vehicle. Battery packs are also used in off-grid energy systems, industrial applications, and backup power systems.

-

BY PRODUCTION TECHNOLOYThe lithium-ion battery anode market, by production technology, has been segmented Chemical Vapor Deposition (CVD), Slurry Coating, and Other Production Technologies. Lithium-ion battery anode production uses various technologies to balance performance and cost. Slurry coating is the most common due to its low cost and ease of use. Chemical vapor deposition (CVD) provides high-purity, uniform coatings, ideal for advanced materials like silicon. Dry electrode manufacturing is a solvent-free, energy-efficient method gaining traction for its stability and scalability. Physical vapor deposition (PVD) offers precise coatings but is limited due to higher costs. Each method supports evolving battery performance needs across industries.

-

BY MATERIALThe lithium-ion battery anode market, by material has been segmented into Active Anode Materials ( Natural Graphite, Synthetic Graphite, Silicon, Li-Compounds & Li-Metals), and Anode Binders. Active anode materials are key to lithium-ion battery performance, with natural graphite offering cost-effectiveness, and synthetic graphite providing faster charging and longer life. Silicon delivers the highest charge capacity and is gaining traction with advances like nanowires to improve stability. Lithium-metal and lithium-compound anodes are also emerging for their fast charging and high energy density, driving innovation across battery applications.

-

BY END USEThe lithium-ion battery anode market, by end use has been segmented into Automotive, and Non-Automotive (Energy Storage, Aerospace, Marine, and Other End Uses). The demand for lithium-ion battery anodes is increasing due to the high demand for lithium-ion batteries in various industries such as automotive, energy storage, marine, and industrial sectors. Significant investments are also being made in R&D to make batteries more compatible with different devices, which is also expected to contribute to the growth of the market for lithium-ion battery anodes.

-

BY REGIONThe lithium-ion battery anode market has been segmented into Asia Pacific, North America, Europe, and Rest of the World. Asia Pacific and Europe are expected to be the leading markets for lithium-ion battery anodes. The Asia Pacific is the largest market, with countries such as China, Japan, and Australia witnessing an increase in demand for lithium-ion battery anodes. Europe is projected to be the second-largest market due to significant growth in the demand for EVs and energy storage systems.

-

COMPETITIVE LANDSCAPENingbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), SGL Carbon (Germany), JFE Chemical Corporation (Japan), KUREHA Corporation (Japan), NIPPON Carbon Co., Ltd. (Japan), NEI Corporation (US) are some the leading manufacturers of lithium-ion battery anodes. They focus on expanding their geographic reach to meet consumer demand. These companies have adopted acquisitions, agreements, partnerships, collaboration, product launches, joint ventures, and expansions to acquire new projects, strengthen their product & service portfolios, and tap into untapped markets.

Lithium-ion battery anode is a negative electrode in a lithium-ion battery, paired with a cathode electrode. It acts as a host to reversibly allow lithium-ion intercalation, discharge cycles, and deintercalation during charge. The lithium-ion battery anode is used mainly in lithium-ion batteries. It is a strong reducing agent, highly electropositive, has high electrochemical equivalence with high capacity & energy density, is a strong conducting agent, and has high mechanical stability. Lithium-ion batteries, along with the lithium anode as an electrode, are mainly rechargeable batteries used for portable electronic products. These batteries have a low self-discharge rate and slow loss of charge when not in use. They are used in industries such as automotive, industrial & energy storage, and consumer electronics. The lithium-ion battery anode market is experiencing significant growth driven by the increase in demand for EVs, consumer electronics, and energy storage systems. This growth is primarily attributed to the transition towards clean energy sources and the need for more efficient energy storage solutions and this will further fuel the lithium-ion battery anode market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The increasing demand for battery-operated devices from various industries and the growth of the EV sector are driving the lithium-ion battery market, which is indirectly leading to an increase in demand for lithium-ion battery anodes. The inherent advantages of lithium-ion batteries, rising adoption of lithium-ion batteries for plug-in vehicles, high demand for lithium-ion batteries in the renewable energy sector, and advancements of smart electronic devices are driving the lithium-ion battery market, which, in turn, is enhancing the market for lithium-ion battery anodes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for Evs

-

Growing need for automation and battery-operated equipment in industries

Level

-

Safety issues related to storage and transportation of batteries

Level

-

Increasing adoption of lithium-ion batteries in new applications

-

Innovation and technological advances in lithium-ion battery anode materials

Level

-

Overheating issues of lithium-ion batteries

-

High cost of lithium-ion battery-operated industrial vehicles

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for EVs, Growing need for automation and battery-operated equipment in industries, Rising demand for lithium-ion batteries in industrial applications, and Increasing R&D initiatives by lithium-ion battery manufacturers

The use of lithium-ion batteries in electric vehicles (EVs) continues to significantly influence anode demand, particularly with anticipated growth in battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The transition to cleaner, energy-efficient transportation is driving the increasing adoption of EVs in consumer life. Bloomberg NEF estimates that EV sales surpassed 2 million in 2018 with estimates of growth from 10 million in 2025 to 28 million in 2030, and 56 million by 2040. Major automakers including Tesla, General Motors, Toyota, Ford, and Nissan are investing previously inconceivable amounts in EV production. The anticipated growth rate in EVs is substantiated by recent technological improvements in battery technology, less engine maintenance, less hazardous waste, and reduction of pollution from IC engines. The reality of EVs will be fundamental to aspiring projections of future transportation, and battery factories and anodes will enjoy considerable future demand.

Restraints: Safety issues related to storage and transportation of batteries

Batteries can contain hazardous materials (like acids, mercury, and lead) that can be dangerous. For example, in July 2007, lithium-based batteries caught fire, which ignited more than 132,000 liters of burning chemicals, and forced authorities to close two major highways in the UK. Battery-initiated fires on airplanes is another area that has begun to concern aviation safety experts because related incidents occur due to passenger devices carried onboard. Some of these incidents are serious enough to cause emergency landings and found entire crews sitting on the tarmac; with the incineration still fresh in mind. The FAA recorded 18 lithium-ion battery incidents in the air in 2016; while there were 31 incidents reported in 2017. For example, in March 2107, a JetBlue flight returned for an early landing due to a fire rehearsal for a charging electronic cigarette whole in the carry-on. Security incidents with small devices led to a company recall of the Galaxy Note7 smartphone. Battery safety is an issue in airlines, since it is easy to discriminate lithium batteries from other types; many types of batteries are based on nickel or lead, lithium can ignite as indicated by some battery materials for Cathode deposits. In the case of batteries, it is important to use watertight containers to avoid contact with flammable materials and proximity to its Class D extinguishers or sand. The important thing to remember is that all batteries contain a charge, mishandling has the real potential to injure humans and property damage as a result. All batteries also present an ingestion hazard to children when they eject batteries. Finally, large lithium batteries may be confused with lead-acid batteries if not labeled correctly; contain the necessary ampage. Hence, good purpose is to label batteries in the containers, batteries should be sorted and labeled accurately, and complying with government standards are necessary for the safe storage and transport of batteries.

Opportunity: Increasing adoption of lithium-ion batteries in new applications, and Innovation and technological advances in lithium-ion battery anode materials

An energy storage medium is a system to store electrical energy. The concept is new, but it is quickly gaining traction. Evidence of the device's overwhelming acceptance is the device's role in addressing the issue of global warming. Energy storage devices are being embraced for use in hybrid vehicles and renewable energy systems. Lithium-ion batteries have gained significant attention for their high capacity and high performance and are perfectly suited for energy storage purpose at the utility scale. Large data centers use uninterruptible power supply (UPS) systems so that the data center operations are not jeopardized in case of power outages. The usage of UPS systems speaks to the sustainability of the UPS system, as power outages are unpredictable, and large batteries capacity are used by the infrastructure provider. The increased barrel of batteries used used energy storage systems drives demand for lithium-ion battery anode materials. The function of battery storage can also provide some level of stability to the power fluctuations and provide stable often uninterrupted energy. UPS and battery energy storage systems use element of the energy storage devices that sends a signal to ensure maintain reliable energy during utility operational fails. With the growth of data centers, the reliability of systems to have power must maintain high levels of capacity to act as back-up, therefore the contingent reliance that lithium-ion and lead-acid battery technologies play in timely operational. Implementation of Battery Management Systems (BMS) furthers the idea of reliability, as with BMS, the systems can monitor power deliverables like charging cycle of batteries or even the state of charge of batteries. The use of high-performance anode materials allows energy storage system have long life cycles and performance.

Challenge: Overheating issues of lithium-ion batteries, and High cost of lithium-ion battery-operated industrial vehicles

The utilization of lithium-ion batteries is widespread in consumer electronics, electric vehicles, electrical power systems, commercial aircraft, automated guided vehicles (AGVs), forklifts, pallet trucks, and material handling equipment. Lithium-ion batteries have the capacity to store a large amount of energy in a small package, however, when they fail, they can become so hot that they may ignite into flames. Overheating occurs for a number of reasons. Lithium is a reactive material, so when the integrity of the separator between the anode and cathode is compromised for whatever the reason is (including mechanical damage), it may cause the lithium to short out, creating a heat event. If there is a failure in the battery allowing fluids to leak from the battery, the fluid may contact other battery materials and may lead to chemical reactions producing heat. A software failure leading to overcharging of a battery could result from shutdown signals required for charging being missing, causing the battery to potentially utilize more energy causing the battery to swell. All the potential issues with the characteristics of lithium-ion batteries create ongoing challenges for lithium-ion battery producers and creates pressure to continually develop higher levels of current carrying and thermally stable anode materials to prevent overheating and enhance battery safety.

Lithium-ion Battery Anode Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Resonac Holdings Corporation produces graphite anode materials used in lithium-ion batteries for electric vehicles, consumer electronics, and energy storage systems. | Offers high capacity and stable cycling performance, supporting long battery life and consistent power output in EVs and portable devices. |

|

JFE Chemical manufactures artificial graphite anode materials for lithium-ion batteries utilized in automotive and industrial energy storage applications. | Provides uniform particle structure for improved conductivity and reliability, ensuring stable battery performance under demanding conditions. |

|

Kureha develops carbon materials and polymer binders for lithium-ion battery anodes, widely used in electric mobility and electronics sectors. | Enhances anode structural integrity and charge efficiency, contributing to greater durability and safety of lithium-ion batteries. |

|

SGL Carbon supplies synthetic graphite and composite materials for lithium-ion battery anodes used in electric vehicles and stationary energy storage systems. | Delivers high electrical conductivity and thermal stability, improving energy density and overall efficiency of battery systems. |

|

Ningbo Shanshan produces both natural and artificial graphite anode materials for lithium-ion batteries used in EVs, consumer electronics, and industrial applications. | Ensures high performance, fast charging capability, and extended battery cycle life, supporting the growing electrification trend across sectors. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The lithim-ion battery anode market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of lithium-ion battery anode. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Lithium-ion Battery Anode Market, By End Use

Based on application, the automotive segment is anticipated to register the highest CAGR within the lithium-ion battery anode industry during the forecast period. Due to the global increase in the adoption of electric vehicles (EV) and hybrid electric vehicles (HEV) being driven by environmental regulations, increased consumer demand, and government incentives to promote transportation through clean energy. As a result of this change and the increase in the demand for electric vehicles, automakers are also investing in high-performance battery production technology to improve the driving range, efficiency, and reliability of vehicles. As the supply of EVs continues to grow, the demand for high-quality anode materials grows as these batteries will contain larger battery packs with longer lifecycle requirements. With EVs being the trend in regions such as North America, Europe, and Asia Pacific, and OEMs rapidly moving to electric mobility, the demand for advanced anode materials should increase as they can improve battery performance and sensibly grow their adoption in the EV sectors. Therefore, the automotive segment represents a key driver for innovation and growth in the lithium-ion battery anode market.

Lithium-ion Battery Anode Market, By Material

The natural graphite segment is projected to grow at the highest CAGR in the lithium-ion battery anode market during the forecast period. This is due in part to the material's excellent electrical conductivity, availability, and comparatively low price versus the synthetic options. Increased production of natural graphite is driven by growing demand for electric vehicles, energy storage systems, and consumer electronics, which is turning to natural graphite in larger-scale battery production. Multiple manufacturing processes and advancements in purification/diffusion have given natural graphite a stronger performance, thus becoming more dependable in high-capacity lithium-ion batteries. Natural graphite's improved performance comes at a time of growing pressure to reduce the cost of batteries without compromising on quality, offering it as a reliable substitute option. Much like synthetic graphite, natural graphite has a strong presence in Asia, but its sustainability profile and lifecycle make it equally valuable for ecological applications, enabling natural graphite to be included in existing battery manufacturing methods faster than historic precedence.

REGION

Asia Pacific is to be the fastest-growing region in global lithium-ion battery anode market during forecast period

The Asia Pacific region is expected to experience the highest CAGR in the lithium-ion battery anode market during the forecast period, due to rapid urbanization and industrialization in the region. This is happening concurrently with existing battery-manufacturing countries like China, Japan, South Korea, and India at the forefront. Support for battery production is backed by government incentives in the region and existing research and technology and established investments for battery production within the fields of electric mobility and renewable energy. Several of the largest battery OEMs and anode material suppliers are also located within the APAC region which allows for integrated supply chains. The increase in demand for lithium-ion batteries, and by extension, anode materials, is driven by an increase in demand for electric vehicles, energy storage systems (ESSs), and portable electronic devices, including laptops, tablets, and smartphones, in Asia Pacific. The well-established and developed automotive and electronics manufacturing sectors in the APAC region only fuel demand for further battery production and demand for anodes. With innovations and unique cost advantages, the need for electric vehicles (EVs) will continue to foster changes in, and ongoing growth for, the anode materials business segment in the Asia-Pacific region.

Lithium-ion Battery Anode Market: COMPANY EVALUATION MATRIX

In the Lithium-ion battery anode market matrix, Ningbo Shanshan Co., Ltd. is recognized as a star player with an established production capacity and a broad portfolio covering both natural and artificial graphite materials. The company’s strong integration across the battery value chain and partnerships with major cell manufacturers position it as a key supplier in the global market. In contrast, Himadri Speciality Chemical Ltd is emerging as a significant player, expanding its presence in advanced anode material production and strategic collaborations. Its growing focus on supplying high-quality graphite anodes underscores its ambition to strengthen its role in the rapidly evolving lithium-ion battery ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.09 BN |

| Market Forecast in 2030 (value) | USD 81.24 BN |

| Growth Rate | CAGR 33.6% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD MN), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: Lithium-ion Battery Anode Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electric Vehicle (EV) Manufacturers |

|

|

| Battery Cell Manufacturers |

|

|

| Energy Storage System (ESS) Providers |

|

|

| Anode Material Producers |

|

|

| Chemical and Material Suppliers |

|

|

RECENT DEVELOPMENTS

- April 2025 : POSCO Group and Hyundai Motor Group signed a strategic partnership to jointly develop low-carbon steel and secondary battery materials. As part of the collaboration, they plan to establish joint ventures for both cathode and anode materials to strengthen the EV battery supply chain. Notably, the agreement confirms cooperation in anode materials, aiming to secure a stable and localized supply for next-generation batteries.

- March 2025 : POSCO Future M introduced a new silicon-carbon (Si-C) anode material designed to significantly enhance lithium-ion battery performance. This next-generation anode offers approximately five times the storage capacity of traditional graphite-based anodes, contributing to extended driving ranges for electric vehicles. A demonstration plant for the Si-C anode has been operational since May 2024, with plans for mass production by 2027.

- December 2024 : Mitsubishi Chemical Group Corporation announced a significant anode production capacity expansion at its Kagawa Plant in Sakaide, Japan. Starting in October 2026, the facility will ramp up its output of natural-graphite-based anode material to 11,000?t/year, leveraging its proprietary low-swelling natural graphite technology for superior battery life and lower GHG emissions.

- November 2024 : Daejoo Electronic Materials from South Korea is one of the leading global producers of Silicon Anode Materials for lithium-ion batteries (LiB) with Epsilon has announced a joint development program to develop a Silicon-Graphite composite (Graphite-rich) by combining Epsilon’s Graphite and Daejoo’s Silicon material. Under the joint program, the companies have set an ambitious target of developing Gen-1 Graphite Silicon composite Anode Materials for LiB with a capacity of 450 - 600 mAh/g

- July 2024 : Shanghai PTL New Energy Technology Co., Ltd. has entered a strategic collaboration with Liyang CASOL New Energy Technology. As part of the agreement, PTL will supply key components such as silicon-carbon composite anodes and lithium-metal anodes, along with composite electrode materials and production line solutions.

Table of Contents

Methodology

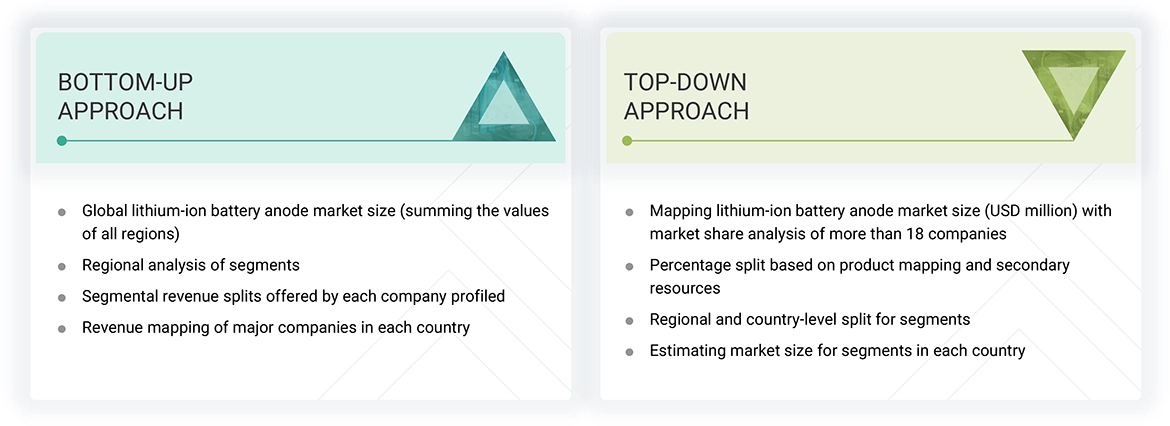

The research encompassed four primary actions in assessing the present market size of lithium-ion battery anode. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the lithium-ion battery anode value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and subsegments.

Secondary Research

The research approach employed to assess and project the market begins with the collection of revenue data from prominent suppliers using secondary research. In the course of secondary research, many secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations, white papers, accredited periodicals, writings by esteemed authors, announcements from regulatory agencies, trade directories, and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The lithium-ion battery anode market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of various industries, including automotive, energy storage, aerospace, marine, and others. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

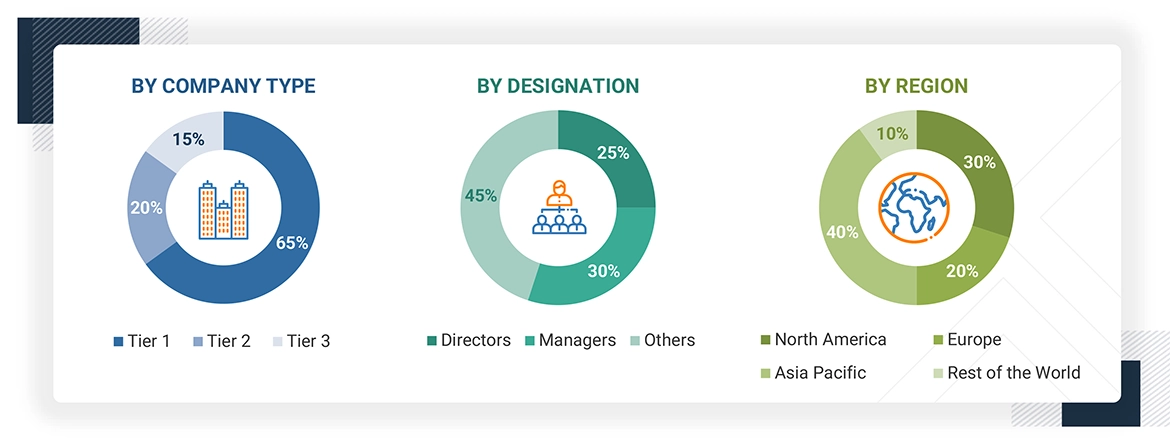

The following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lithium-ion battery anode market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research

- Primary and secondary research determined the value chain and market size of the lithium-ion battery anode market in terms of value and volume

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives

Global Lithium-ion Battery Anode Market Size: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The lithium-ion battery anode is a negative electrode in a lithium-ion battery paired with a cathode electrode. It acts as a host to reversibly allow lithium-ion intercalation, discharge cycles, and deintercalation during charge. The lithium-ion battery anode is used mainly in lithium-ion batteries. It is a strong reducing agent, highly electropositive, has high electrochemical equivalence with high capacity & energy density, is a strong conducting agent, and has high mechanical stability. Lithium-ion batteries, along with the lithium anode as an electrode, are mainly rechargeable batteries used for portable electronic products. These batteries have a low self-discharge rate and slow loss of charge when not in use. They are used in industries such as automotive, industrial & energy storage, and consumer electronics.

Stakeholders

- Lithium-ion Battery Anode Manufacturers

- Lithium-ion Battery Anode Suppliers

- Lithium-ion Battery Anode Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global lithium-ion battery anode market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the global lithium-ion battery anode market

- To analyze and forecast the size of various segments of the lithium-ion battery anode market based on five major regions—North America, Asia Pacific, Europe, and the Rest of the World, along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as acquisitions, agreements, partnerships, collaborations, product launches, expansions, and others, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the key driver for the lithium-ion battery anode market?

The market growth is primarily driven by rising demand from the automotive industry.

Which region is expected to register the highest CAGR in the lithium-ion battery anode market during the forecast period?

The Asia Pacific region is expected to register the highest CAGR during the forecast period.

What is the major end use of lithium-ion battery anode?

Automotive is the major end-use sector for lithium-ion battery anodes.

Who are the major players in the lithium-ion battery anode market?

Major players include Ningbo Shanshan Co., Ltd. (China), Jiangxi Zhengtuo New Energy Technology (China), Resonac Holdings Corporation (Japan), POSCO FUTURE M (South Korea), Mitsubishi Chemical Group Corporation (Japan), and SGL Carbon (Germany).

What is expected to be the CAGR of the lithium-ion battery anode market from 2025 to 2030?

The market is projected to grow at a CAGR of 33.6% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Lithium-ion Battery Anode Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Lithium-ion Battery Anode Market