Longevity Ingredients Market - Global Forecast to 2030

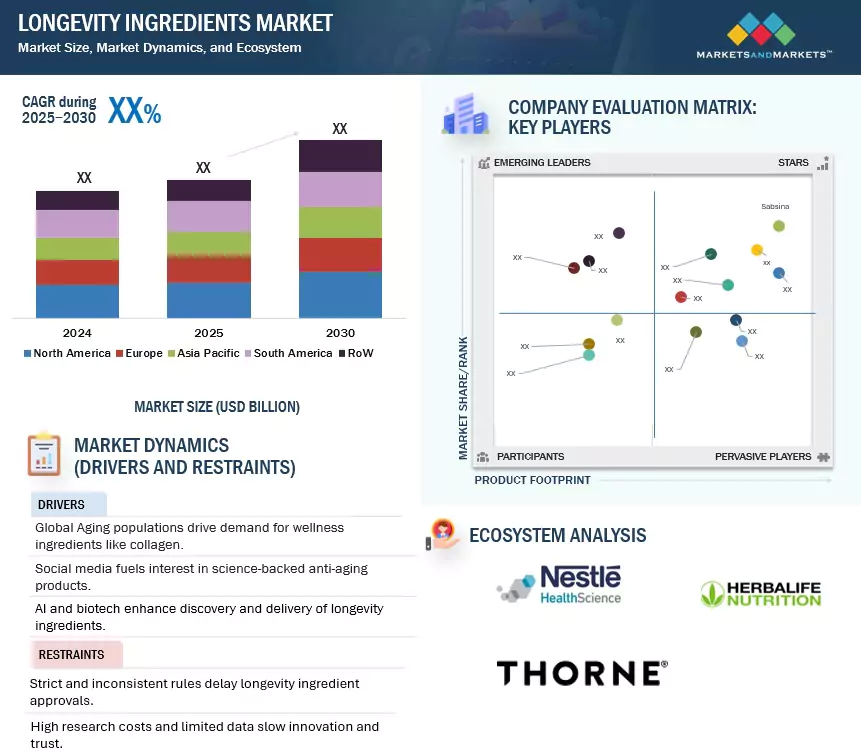

Global Longevity Ingredients Market Valued at approximately USD XX billion in 2024, this market is projected to grow at a Compound Annual Growth Rate (CAGR) of X.X% through 2030, reaching USD XX billion.

Market Overview

The Longevity Ingredients Market is pivotal in addressing the needs of an aging global population, expected to reach 1.5 billion individuals aged 65 and older by 2050, according to the World Health Organization. These ingredients are integrated into dietary supplements, functional foods, beverages, cosmeceuticals, and pharmaceuticals, offering targeted solutions for age-related conditions such as cardiovascular disease, cognitive decline, and skin aging. Key factors propelling the market include:

Consumer Awareness: A growing focus on preventive healthcare has led to increased adoption of longevity-enhancing products.

Scientific Innovation: Advances in genomics, biotechnology, and nutritional science are unlocking new compounds like nicotinamide mononucleotide (NMN) and senolytics.

Economic Growth: Rising disposable incomes, particularly in emerging markets, are enabling greater investment in premium wellness products.

The market’s evolution is marked by a shift toward natural, sustainable ingredients, reflecting broader consumer trends toward clean-label and eco-friendly solutions.

The Longevity Ingredients Market is a rapidly expanding segment within the global health and wellness industry, driven by an increasing desire to extend healthspan and mitigate the effects of aging. Longevity ingredients encompass a diverse range of bioactive compounds, including antioxidants, NAD+ precursors, polyphenols, omega-3 fatty acids, probiotics, collagen, and senolytics, each designed to support cellular health, reduce inflammation, and enhance vitality.

This growth is fueled by demographic shifts, scientific advancements, and rising consumer demand for preventive healthcare solutions. This article provides a comprehensive analysis of the market, exploring its dynamics, regional insights, segmentation, growth drivers, competitive landscape, and future outlook, with detailed insights to guide stakeholders.

Market Dynamics

Market Drivers

The world’s aging population is growing rapidly, especially in regions like Japan, where a significant portion of people are elderly. This demographic shift drives demand for longevity ingredients like collagen, which supports joint health and vitality. For instance, collagen drinks in Japan have seen a surge in popularity as older consumers seek solutions to maintain mobility and overall wellness, reflecting a broader trend of focusing on healthy aging.

Awareness of anti-aging solutions is on the rise, fueled by social media platforms like TikTok, where longevity topics trend widely. Consumers are increasingly drawn to products with scientific backing, such as Elysium’s Basis, which boosts cellular health. This growing awareness reflects a shift toward proactive health management, with people prioritizing ingredients that promise to slow aging and enhance well-being.

Innovations in technology, such as AI and biotech, are transforming the longevity market. AI accelerates the discovery of new anti-aging compounds, while biotech enables plant-based collagen production, making ingredients more sustainable. Advanced delivery methods, like liposomal technology, improve how well the body absorbs ingredients like NMN, making them more effective and appealing to health-conscious consumers.

Rising incomes in emerging markets like China are enabling more people to invest in premium longevity products. The expanding longevity economy caters to wealthier consumers who value health, driving demand for high-end supplements like Thorne’s ResveraCel. This economic shift supports a growing market for luxury wellness solutions that promise to enhance life quality as people age.

Market Restraints

Strict regulations in regions like the EU slow down the approval of new longevity ingredients, such as senolytics, delaying their market entry. In China, temporary bans on ingredients like NMN have disrupted sales, showing how regulatory inconsistencies can hinder growth. These challenges increase costs for companies and limit the pace of innovation in the market.

Developing new longevity ingredients is expensive, especially for emerging compounds like senolytics, which lack extensive human studies. This scarcity of data fuels consumer skepticism, as many doubt the effectiveness of unproven ingredients. The high financial burden of research restricts smaller companies from competing, slowing the introduction of new solutions.

Some longevity ingredients pose risks if overused, such as certain antioxidants increasing health concerns in high doses. Meanwhile, false claims about products reversing aging have led to regulatory crackdowns, eroding consumer trust. These issues create hesitation among buyers, particularly in regions where health education is limited, impacting overall market growth.

Opportunities

Advances in genomics and wearables allow for tailored longevity solutions, meeting individual health needs. Partnerships like those between 23andMe and Thorne enhance product efficacy by customizing recommendations, appealing to consumers seeking personalized health strategies. This trend taps into the growing demand for bespoke wellness solutions.

Eco-friendly ingredients, such as algae-based omega-3s and plant-based collagen, align with consumer preferences for sustainable products. Brands like DSM and Nestlé are seeing increased sales by offering green alternatives that reduce environmental impact. This shift toward sustainability attracts environmentally conscious buyers, boosting market appeal.

Regions like Asia-Pacific and Latin America, with aging populations and rising incomes, present untapped potential. In China, elderly consumers drive demand for traditional ingredients like ginseng, while Brazil sees growth in collagen beauty products. These markets offer a chance for companies to expand by catering to local health preferences and economic growth.

The integration of longevity ingredients with digital platforms like health apps and telehealth enhances consumer engagement. Apps recommend supplements based on diet, while telehealth platforms provide personalized advice, making it easier for users to adopt longevity products. This digital synergy improves accessibility and adherence, driving market growth.

Challenges

Producing advanced ingredients like senolytics is costly, making them less affordable than traditional supplements. Supply chain disruptions further increase expenses, particularly for ingredients like omega-3s, challenging scalability. High costs limit accessibility, especially in price-sensitive regions like India, where affordability is a key concern.

The antioxidant segment is overcrowded with numerous brands, leading to price declines and fierce competition. Many startups struggle to stand out, with some failing due to lack of differentiation. The rise of counterfeit products online also undermines trust, making it harder for legitimate brands to maintain credibility in a saturated market.

Many consumers misunderstand the benefits of ingredients like NAD+, expecting unrealistic outcomes like curing aging. High-profile product recalls, such as contaminated collagen in the EU, further erode confidence. Educating consumers through initiatives like webinars is effective but costly, requiring significant investment to bridge knowledge gaps and rebuild trust.

In regions like India, traditional remedies like Ayurveda are preferred over Western ingredients, creating resistance to products like NMN. Vegan consumers also reject animal-derived collagen, favoring plant-based alternatives that aren’t widely available. These cultural preferences reduce market penetration, necessitating tailored approaches to align with local health practices.

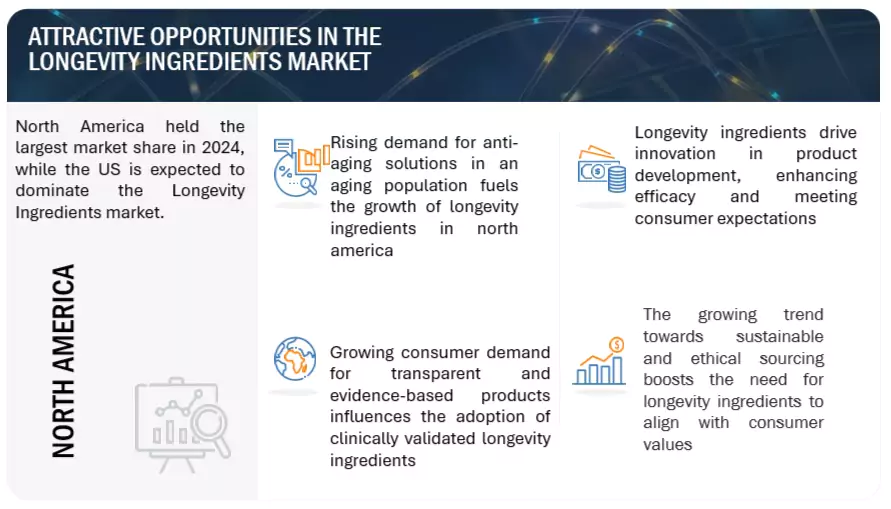

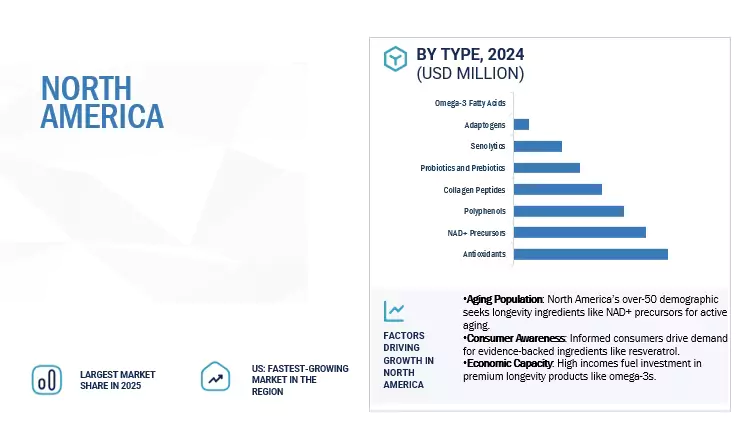

The North America region has a significant share in the Longevity Ingredients market during the forecast period.

North America dominates the longevity ingredients market, driven by high consumer awareness—particularly in the U.S., where a significant portion of adults aged 50+ use anti-aging supplements and functional foods. The region benefits from a robust R&D ecosystem supported by institutions like the National Institute on Aging and innovative firms like Calico Labs. Additionally, it hosts major industry players such as Nestlé Health Science and Life Extension, reinforcing its market leadership.

Europe holds the second-largest share, backed by strong regulatory oversight from EFSA and growing consumer demand for natural ingredients, especially in countries like Germany and France. Meanwhile, the Asia-Pacific region is the fastest-growing market, fueled by rapidly aging populations in Japan and China and a cultural affinity for traditional wellness ingredients like ginseng. This region is expected to witness the highest growth rate through 2030.

"In terms of product type, the segment Antioxidants accounts for the largest share of the Longevity Ingredients market."

The Longevity Ingredients Market is segmented by type, showcasing a diverse range of bioactive compounds that address aging. Antioxidants like resveratrol, coenzyme Q10, and vitamin C lead the segment, dominating due to their well-researched ability to combat oxidative stress—a key aging factor—making them versatile for use in supplements, foods, and skincare. NAD+ precursors, such as nicotinamide riboside and NMN, follow, driven by their role in enhancing cellular energy and repair, with strong validation from prestigious studies, including those at Harvard Medical School, highlighting their growing appeal in premium health products. Polyphenols, including curcumin and green tea extract, are valued for their anti-inflammatory benefits, finding a strong foothold in functional foods and beverages that promote overall wellness.

Collagen peptides are a popular choice in cosmeceuticals and functional foods, supporting skin elasticity and joint health, catering to consumers focused on visible anti-aging benefits. Probiotics, which support gut health—an area increasingly linked to longevity—are gaining traction in dietary supplements and fortified foods, appealing to those prioritizing holistic health. Lastly, senolytics, an emerging category targeting senescent cells to reduce inflammation, are poised for rapid growth as ongoing research continues to unlock their potential in anti-aging therapies.

This segmentation reflects consumer preferences and scientific validation, with antioxidants and NAD+ precursors leading due to their broad applicability and proven efficacy.

Key Market Players

The Longevity Ingredients Market is highly competitive, with a mix of established corporations and innovative startups. The longevity and healthy aging market features key players such as Nestlé Health Science, Amway, DSM, Elysium Health, Life Extension, Juvenescence, and Calico Labs. These players drive innovation through partnerships with research institutions and investments in clinical validation.

Recent Developments

- October 2023: Elysium Health launched an enhanced version of Basis, incorporating a new NMN formulation with improved bioavailability, marking a significant advancement in NAD+ supplementation.

- June 2022: Nestlé partnered with the Nestlé Institute of Health Sciences to release a collagen-infused beverage targeting skin and joint health, reflecting the trend toward functional foods.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the Longevity Ingredients Market?

North America dominates, valued at USD XX.X billion in 2024, projected to reach USD XX.X billion by 2030 at a CAGR of X.X %, driven by high adoption rates and R&D strength.

What is the current size of the global Longevity Ingredients Market?

The market is valued at USD XX billion in 2024, expected to grow to USD XX billion by 2030, with a CAGR of X.X %, fueled by aging demographics and innovation.

Who are the key players in the market?

Leading companies include Nestlé Health Science, Amway, DSM, Elysium Health, Life Extension, Juvenescence, and Calico Labs, each contributing to product development and market expansion.

What are the factors driving the Longevity Ingredients Market?

- Rising demand for anti-aging solutions: Aging populations seek products to enhance vitality.

- Growth in functional foods and supplements: Consumers favor convenient health options.

- Technological advancements: AI and biotech innovations accelerate ingredient discovery.

Which segment accounted for the largest market share?

Antioxidants hold the largest share (XX%, USD XX billion) in 2024, due to their proven efficacy and widespread use across industries. .

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

-

1.3 STUDY SCOPEMARKET SEGMENTATIONINCLUSIONS & EXCLUSIONSREGIONS COVEREDYEARS CONSIDERED

-

1.4 UNIT CONSIDEREDCURRENCY/ VALUE UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

-

2.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key insights from industry experts- Breakdown of Primary Interviews

-

2.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

-

2.4 RESEARCH ASSUMPTIONSASSUMPTIONS OF THE STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

-

5.3 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.4 IMPACT OF GEN AI ON LONGEVITY INGREDIENTS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

-

6.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- KEY TECHNOLOGY 1- KEY TECHNOLOGY 2COMPLEMENTARY TECHNOLOGIESADJACENT TECHNOLOGIES

-

6.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, INGREDIENT TYPEAVERAGE SELLING PRICE TREND, BY INGREDIENT TYPEAVERAGE SELLING PRICE TREND, BY REGION

-

6.7 ECOSYSTEM ANALYSIS/ MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

-

6.9 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKETKEY CONFERENCES & EVENTS IN 2024-2025TARIFF & REGULATORY LANDSCAPE- TARIFF RELATED TO LONGEVITY INGREDIENTS- REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONSPORTER’S FIVE FORCES ANALYSIS- INTENSITY OF COMPETITIVE RIVALRY- THREAT OF NEW ENTRANTS- THREAT OF SUBSTITUTES- BARGAINING POWER OF SUPPLIERS- BARGAINING POWER OF BUYERSKEY STAKEHOLDERS AND BUYING CRITERIA- KEY STAKEHOLDERS IN THE BUYING PROCESS- BUYING CRITERIACASE STUDY ANALYSISINVESTMENT AND FUNDING SCENARIO

- 7.1 INTRODUCTION

- 7.2 ANTIOXIDANTS

- 7.3 NAD+ PRECURSORS

- 7.4 POLYPHENOLS

- 7.5 COLLAGEN PEPTIDES

- 7.6 PROBIOTICS AND PREBIOTICS

- 7.7 SENOLYTICS

- 7.8 ADAPTOGENS

- 7.9 OMEGA-3 FATTY ACIDS

- 8.1 INTRODUCTION

- 8.2 DIETARY SUPPLEMENTS

- 8.3 FUNCTIONAL FOODS AND BEVERAGES

- 8.4 COSMECEUTICALS

- 8.5 PHARMACEUTICALS

- 8.6 SPORTS NUTRITION

- 8.7 PET CARE

- 9.1 INTRODUCTION

- 9.2 NATURAL

- 9.3 SYNTHETIC

- 9.4 MICROBIAL

-

9.5 MARINE-BASEDLONGEVITY INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- 10.2 ONLINE STORES

- 10.3 PHARMACIES AND HEALTH STORES

- 10.4 SUPERMARKETS AND HYPERMARKETS

- 10.5 SPECIALTY STORES

- 10.6 DIRECT SALES

-

11.1 NORTH AMERICAUSCANADAMEXICO

-

11.2 EUROPEGERMANYUKFRANCEITALYSPAINREST OF EUROPE

-

11.3 ASIA PACIFICCHINAINDIAJAPANAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC

-

11.4 SOUTH AMERICABRAZILARGENTINAREST OF SOUTH AMERICA

-

11.5 REST OF THE WORLDAFRICAMIDDLE EAST

-

12.1 OVERVIEW

-

12.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

-

12.3 REVENUE ANALYSIS

-

12.4 MARKET SHARE ANALYSIS, 2023

-

12.5 BRAND/ PRODUCT COMPARISON

-

12.6 KEY PLAYER ANNUAL REVENUE VS GROWTH

-

12.7 KEY PLAYER EBIT/EBITDA

-

12.8 COMPANY VALUATION AND FINANCIAL METRICES

-

12.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTSCOMPANY EVALUATION MATRIX: KEY PLAYERS, 2023- STARS- EMERGING LEADERS- PERVASIVE PLAYERS- PARTICIPANTS- COMPANY FOOTPRINT: KEY PLAYER, 2023COMPANY EVALUATION MATRIX: START-UP/SME, 2023- PROGRESSIVE COMPANIES- RESPONSIVE COMPANIES- DYNAMIC COMPANIES- STARTING BLOCKS- COMPETITIVE BENCHMARKING: START-UPS. SMES, 2023COMPETITIVE SCENARIO AND TRENDS- NEW PRODUCT LAUNCHES- DEALS- OTHERS- OTHER DEVELOPMENTS

-

13.1 KEY PLAYERSNESTLÉ HEALTH SCIENCETHORNE RESEARCHHERBALIFE NUTRITIONGNCCHROMADEXVITAL PROTEINSNORDIC NATURALSPURE ENCAPSULATIONSGARDEN OF LIFE- DOCTOR’S BEST- AMAZENTIS- TIMELINE NUTRITION- ORGAIN- ELYSIUM HEALTH- NATURE’S WAY- BIOENERGY LIFE SCIENCE- MONTELOEDER- BASF

-

13.2 OTHER PLAYERSNUTRAFOLPERSONA NUTRITIONLIPOTRUE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Longevity Ingredients Market