Low GI & Diabetic Friendly Food Market - Global Forecast to 2030

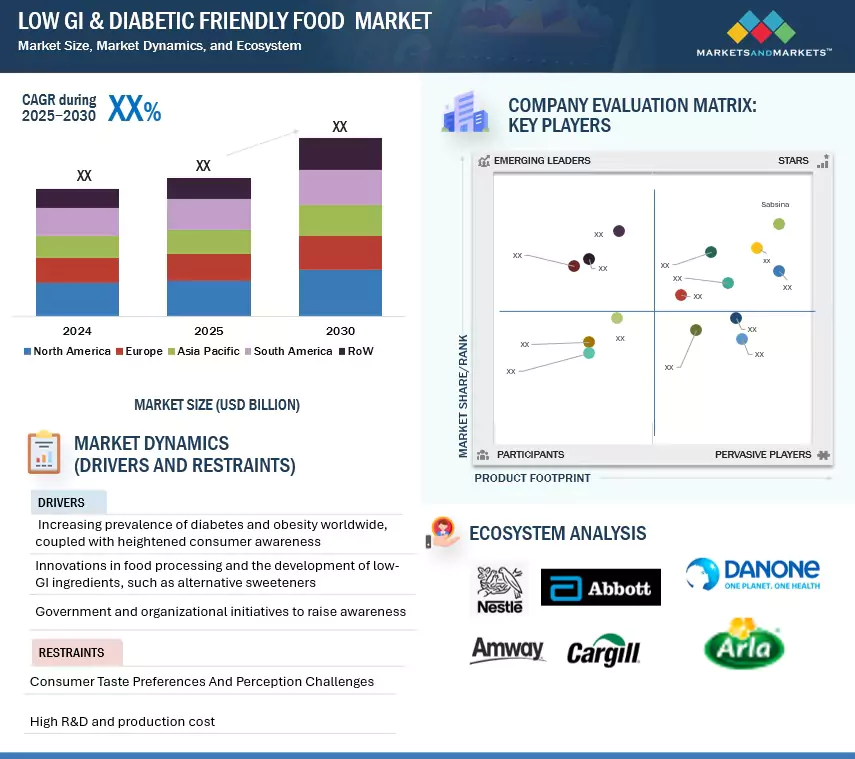

The global market for Low GI & Diabetic Friendly Food has been estimated to be USD XX billion in 2025 and is projected to grow at XX% between 2025 and 2030.

The Low GI (Glycemic Index) & Diabetic Friendly Food market is a specialized segment within the broader functional and health food sector. This market is projected to have robust growth during the study period of 2025 to 2030. According to the most recent data from the International Diabetes Federation (IDF), globally, 11.1%, or 1 in 9, of adults aged 20 to 79 have diabetes, and more than 40% are not aware that they have the condition. It is also projected that by 2050, 1 in 8 adults, approximately 853 million, will be living with diabetes, an increase of a whopping 46%. Diabetes is a lifestyle disorder caused by factors such as decreasing levels of physical activity and increasing prevalence of obesity, among other reasons like ageing. Preventive healthcare can help manage this condition. One such method to manage diabetes is consuming low GI & diabetic friendly food. Foods with a GI of 55 or less are considered low GI as they raise blood sugar levels gradually after eating, which makes them perfect for diabetics or those trying to control their blood sugar levels.

Market Dynamics

Drivers: Increasing Prevalence of Diabetes Globally

The rising prevalence of diabetes worldwide, coupled with the growing awareness among consumers of the low glycemic index (GI) diets, drives this market. Health-conscious consumers are seeking food that helps them manage blood sugar levels, driven by health campaigns through various platforms and medical advice.

Over 460 million people worldwide suffer from diabetes, according to the World Health Organization (WHO), and this number is predicted to grow at a higher pace. In response to such rising cases, global food & beverage manufacturers like Nestlé and Unilever have expanded the range of diabetic-friendly products in their portfolio. For instance, Nestle’s Milo and Morning sun range are a few of the low GI products the company has introduced. Abbott’s Glucerna, a low-GI nutritional drink intended to help manage diabetes. Unilever’s Horlicks Diabetes Plus, a nutritional beverage introduced in India for diabetics and at-risk individuals is another example. Low-GI foods are highlighted in public health campaigns and dietary recommendations from groups such as the American Diabetes Association, which encourages consumers to select blood sugar-stabilizing products. Low-GI & diabetic-friendly foods are therefore in high demand as consumers place a higher priority on preventive and therapeutic nutrition, when it comes to managing blood sugar levels.

Restraints: High R&D and Standardization Costs

One significant barrier to entry and scalability in the Low GI & diabetic-friendly food market is the high cost associated with research and development. For instance, compared to conventional sugar or refined flour, manufacturers such as Unilever, which creates low-GI spreads and snacks, must pay more to source ingredients like erythritol or inulin. These expenses are transferred to customers, which reduces the competitiveness of products in markets where affordability is a top concern, especially in developing nations of Asia and Africa. Despite rising demand, premium pricing for diabetic-friendly products may restrict market penetration among low-income consumers.

Opportunities: Expansion into Emerging Markets

Manufacturers have the opportunity to launch low-GI and diabetic-friendly products that are suited to local preferences and dietary practices due to the rapidly rising rates of diabetes in regions like Asia-Pacific and Latin America.

According to the International Diabetes Federation, more than 230 million people were diagnosed with diabetes in 2023, with a large percentage of new cases occurring in Asia-Pacific, especially in China and India. To accommodate regional cuisines, companies such as Nestlé are introducing products that are specific to a given region. For example, in India, they are introducing low-GI atta (flour) blends. A thriving market for diabetic-friendly foods is created by the expanding middle class and rising health consciousness in these areas, particularly if producers modify their products to accommodate cultural preferences (e.g., low-GI rice alternatives). The growing disposable incomes of the urban population increase this opportunity by making it possible for consumers to purchase specialized health foods.

Challenges: Consumer Taste Preferences and Perception Challenges

Market expansion may be hampered by consumers' perceptions that low-GI and diabetic-friendly foods are less tasty or fulfilling than traditional foods. Even with advancements, some diabetic-friendly foods still cannot compete with high-sugar or high-carb substitutes in terms of sensory appeal. Consumer acceptance of low-GI foods is largely dependent on sensory quality, according to a study published in the Journal of Food Science (2022). Negative perceptions can endure, particularly among non-diabetic consumers who might not place a higher value on taste than health benefits. These sensory barriers can impede product development and market expansion. Therefore, manufacturers need to make investments to overcome these perception-related challenges.

Convenient health foods are becoming more and more popular due to urbanization and fast-paced lifestyles. Manufacturers such as Rebar have developed portable, easily consumable diabetic-friendly beverages in partnership with healthcare facilities. The growing popularity of functional foods with extra benefits like fiber or protein appeals to both diabetics and health-conscious consumers. Manufacturers can reach the needs of diabetics and tap into the larger wellness market by emphasizing convenience and multifunctionality, which might tackle the challenge of taste & perception against the benefits of low GI food.

Market Ecosystem

In terms of product type, beverages to grow the fastest during the forecast period

Consumer trends, especially the rising desire for quick, on-the-go options, are probably contributing to beverages' dominance. Beverages are a perfect fit for the portable, easily consumable products that are in high demand due to urbanization and fast-paced lifestyles. According to industry reports, diabetic-friendly beverages appear to have an advantage due to their extreme convenience. This is in line with consumers' growing health consciousness, which leads them to look for products that control blood sugar levels without sacrificing convenience. Beverages often provide the convenience to consume protein powders and even meal replacement shakes, which are found to be beneficial for weight management and blood sugar management. Technological developments in food processing that improve taste and texture, as well as rising health consciousness, are driving the market for low-GI products like diabetic-friendly beverages.

The diabetes management application accounts for the largest share of the Low GI & Diabetic Friendly Food market.

Low glycemic index (GI) foods release glucose gradually to avoid spikes, a tactic recommended by manufacturers and health organizations. They are essential for managing diabetes by stabilizing blood sugar levels and enhancing glycemic control. The American Diabetes Association (ADA) suggests low-GI foods like yogurt and legumes to improve insulin sensitivity, while the International Diabetes Federation (IDF) states that low-GI diets can reduce HbA1c levels by up to 0.5%, assisting in the long-term management of diabetes. Manufacturers’ efforts to meet the needs of diabetics are exemplified by Nestlé's Glucerna, a low-GI nutritional drink with slow-release carbohydrates, and Danone's low-sugar yogurts further meet this demand. The World Health Organization estimates that over 460 million people worldwide suffer from diabetes, and consumers, especially in Asia-Pacific, are demanding more convenient, nutrient-dense options. This has led to a trend toward functional low-GI foods for diabetes management in various regions.

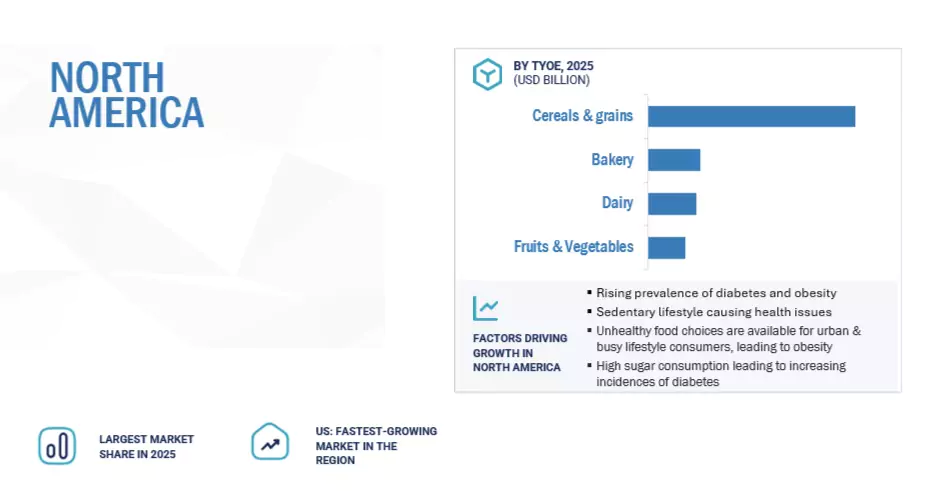

The North America region is expected to dominate the Low GI & Diabetic Friendly Food market during the forecast period.

The market for low-GI and diabetic-friendly foods is anticipated to be dominated by the North American region. This dominance is mainly due to high diabetes and obesity rates, advanced healthcare infrastructure, strong manufacturer presence, and health-conscious consumer trends. As of August 2021–August 2023, 40.3% of U.S. adults were obese (39.2% in men, 41.3% in women), according to CDC data. Severe obesity affects 9.2% of adults, according to the National Health and Nutrition Examination Survey (NHANES) data. According to the International Diabetes Federation (IDF), there is a 13.7% prevalence in adults (20–79 years) in 2024, equating to approximately 38.5 million cases out of a 245.5 million adult population having diabetes in the US. According to Statistics Canada, over 60% of adults are overweight or obese, aligning with high-income country trends in the country. Approximately 10% of Canadian adults (about 3.8 million) had diabetes in 2021, as per WHO estimates, with 90% being type 2 diabetic. As per OECD and WHO data, Mexico ranks high globally, with 36.8% of Mexican adults being obese. In 2021, 14.7% of Mexican adults had diabetes, as per the IDF data. This is one of the highest rates in North America. These factors create a high demand for low-GI products, supported by innovations from companies like Nestlé and Chobani. The presence of a high-income population reinforced by public health initiatives drives the demand. While Asia-Pacific is poised for rapid growth, North America’s established market and consumer base make it the largest market currently.

Key Market Players

The key players in this market include Nestlé Health Science, Danone S.A., Unilever, Kellogg Company, Fifty50 Foods, The Coca-Cola Company, PepsiCo Inc., Mondelez International, Abbott Laboratories, Kellogg Company, General Mills, PepsiCo, Mondelez International, Arla Foods, Kraft Heinz Company, Glanbia, Cargill, Ingredion, and Tate & Lyle among Others

Recent Developments

- March 2025: Gut health start-up—Supergut has raised significant funding to expand its clinically backed, prebiotic fiber-rich products that support digestive health, improved glycemic control, and modest weight loss.

- September 2024: Nestlé launched the Vital Pursuit product line, which offers high-protein, portion-controlled frozen meals designed to support GLP-1 users and consumers focused on weight management. These meals align with low glycemic index dietary strategies that help stabilize blood sugar and promote healthy weight loss.

- January 2024: Rebar launched diabetic-friendly beverages in partnership with DMC Medical Center. These products aim to cater to the growing demand for convenient, low-GI beverages that support blood sugar management, aligning with trends toward healthier and functional drinks.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the Low GI & Diabetic Friendly Food market?

North America dominated the Low GI & Diabetic Friendly Food market, worth USD XX billion in 2025, and is projected to reach USD XX billion by 2030, at a CAGR of XX% during the forecast period.

What is the current size of the global Low GI & Diabetic Friendly Food market?

The global Low GI & Diabetic Friendly Food market was valued at USD XX billion in 2025. It is projected to reach USD XX billion by 2030, recording a CAGR of XX% during the forecast period.

Who are the key players in the market?

The key players in this market are Nestlé Health Science, Danone S.A., Unilever, Kellogg Company, The Coca-Cola Company, PepsiCo Inc., Mondelez International, Abbott Laboratories, Kellogg Company, General Mills, PepsiCo, Mondelez International, Arla Foods, Kraft Heinz Company, Glanbia, Cargill, Ingredion, and Tate & Lyle among others

What are the factors driving the Low GI & Diabetic Friendly Food market?

The rising rates of diabetes and obesity around the world, along with growing consumer awareness of the role of low GI diet, are major factors propelling the growth of the low GI and diabetic-friendly food market. These food products help control blood sugar levels and support general health, and they are in high demand among key food & beverage categories as more people receive diagnoses of diabetes and metabolic diseases, owing to busy and sedentary lifestyles.

Which type of product accounted for the largest share of the Low GI & Diabetic Friendly Food market?

The dominance of Low GI beverages is likely amplified in regions like Asia-Pacific, where diabetes prevalence is high, and urbanization drives demand for convenient options. For example, Nestlé's launches in Malaysia and India include diabetic-friendly beverages, indicating regional focus. Consumers prefer beverages for their ease of use, and a better format to consume meal replacement shakes and protein shakes further supports the demand. .

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

-

1.3 STUDY SCOPEMARKET SEGMENTATIONINCLUSIONS & EXCLUSIONSREGIONS COVEREDYEARS CONSIDERED

-

1.4 UNIT CONSIDEREDCURRENCY/ VALUE UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

-

2.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key insights from industry experts- Breakdown of Primary Interviews

-

2.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

-

2.4 RESEARCH ASSUMPTIONSASSUMPTIONS OF THE STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

-

5.3 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.4 IMPACT OF GEN AI ON LOW GI & DIABETIC FRIENDLY FOOD

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

-

6.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- KEY TECHNOLOGY 1- KEY TECHNOLOGY 2COMPLEMENTARY TECHNOLOGIESADJACENT TECHNOLOGIES

-

6.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, TYPEAVERAGE SELLING PRICE TREND, BY TYPEAVERAGE SELLING PRICE TREND, BY REGION

-

6.7 ECOSYSTEM ANALYSIS/ MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

-

6.9 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKET

- 6.10 KEY CONFERENCES & EVENTS IN 2024-2025

-

6.11 TARIFF & REGULATORY LANDSCAPETARIFF RELATED TO LOW GI & DIABETIC FRIENDLY FOODREGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

-

6.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 6.14 TRUMP TARIFF IMPACT ON LOW GI & DIABETIC FRIENDLY FOOD MARKET

- 6.15 CASE STUDY ANALYSIS

- 6.16 INVESTMENT AND FUNDING SCENARIO

- 7.1 INTRODUCTION

- 7.2 FRUITS & VEGETABLES

- 7.3 DAIRY PRODUCTS

- 7.4 BAKERY PRODUCTS

- 7.5 CEREALS & GRAINS

- 7.6 SNACKS & BARS

- 7.7 BEVERAGES

- 7.8 OTHERS

- 9.2 DIABETES MANAGEMENT

- 9.3 WEIGHT MANAGEMENT

- 9.4 GENERAL HEALTH & WELLNESS

-

10.1 NORTH AMERICAUSCANADAMEXICO

-

10.2 EUROPEGERMANYUKFRANCEITALYSPAINREST OF EUROPE

-

10.3 ASIA PACIFICCHINAINDIAJAPANAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC

-

10.4 SOUTH AMERICABRAZILARGENTINAREST OF SOUTH AMERICA

-

10.5 REST OF THE WORLDAFRICAMIDDLE EAST

-

11.1 OVERVIEW

-

11.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

-

11.3 REVENUE ANALYSIS

-

11.4 MARKET SHARE ANALYSIS, 2023

-

11.5 BRAND/ PRODUCT COMPARISON

-

11.6 KEY PLAYER ANNUAL REVENUE VS GROWTH

-

11.7 KEY PLAYER EBIT/EBITDA

-

11.8 COMPANY VALUATION AND FINANCIAL METRICES

-

11.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS - STARS

-

11.10 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 - EMERGING LEADERS- PERVASIVE PLAYERS- PARTICIPANTS- COMPANY FOOTPRINT: KEY PLAYER, 2023COMPANY EVALUATION MATRIX: START-UP/SME, 2023- PROGRESSIVE COMPANIES- RESPONSIVE COMPANIES- DYNAMIC COMPANIES- STARTING BLOCKS- COMPETITIVE BENCHMARKING: START-UPS. SMES, 2023COMPETITIVE SCENARIO AND TRENDS- NEW PRODUCT LAUNCHES- DEALS- OTHERS- OTHER DEVELOPMENTS

-

12.1 KEY PLAYERSNESTLÉDANONEABBOTT LABORATORIESUNILEVERKELLOGG COMPANYGENERAL MILLSPEPSICOMONDELEZ INTERNATIONALGLANBIA- ARLA FOODS- KRAFT HEINZ COMPANY- CARGILL- INGREDION- TATE & LYLE- DSM-FIRMENICH

-

12.2 OTHER PLAYERSCONAGRANATURE’S PATH FOODSDR. SCHÄREID PARRYBENEOVALBIOTISHAIN CELESTIAL GROUPZENWISE HEALTHLO! FOODS- FIFTY50 FOODS

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- 8.1 INTRODUCTION

Growth opportunities and latent adjacency in Low GI & Diabetic Friendly Food Market