Lubricity Improver Market by Product Type (Acidic Lubricity Improver, Non-Acidic Lubricity Improver), End-use Industry (Automobile, Agriculture, Manufacturing and Others), and Region - Global Forecast to 2030

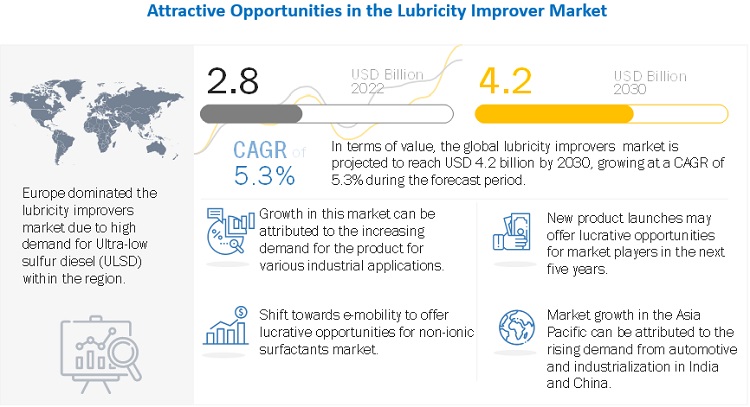

The lubricity improver market is projected to reach USD 4.2 billion by 2030, at a CAGR of 5.3% from USD 2.8 billion in 2022. Lubricity improver do not have any charge on their hydrophilic part. Lubricity improvers refer to category of fuel additives incorporating various fuel types to improve the lubricity of the said product. The modifications in diesel fuels are a reduced levels of sulfur content in them after governments regulated the content of sulfur in fuels. Reduced sulfur quantity causes lower lubricity requiring use of additives helping complement the ULSD (Ultra-Low Sulfur Diesel).

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: The implementation of stringent environmental norms to drive the market

The implementation of stringent environmental norms acts as one of the major factors driving the growth of lubricity improvers market. The continuous advancements in vehicle hardware and improvements in the materials used in critical areas, and stringent regulations keeping check of quality of diesel fuel in order to ensure the fuel used is good accelerate the market growth. The increase in usage of complex fuels and increased usage of these products in order to decline the maintenance cost of various other equipment further influence the market.

Restraints: Complications in the production process to pose as a threat for market growth

The complications in the production process of these products requiring extra care and precautionary measures are expected to obstruct the market growth. Some negative factors such as the increasing consumption of bio-based product offerings and relatively slow growth of regional dynamics restrict the progress of the lubricity improvers market.

Opportunities: Increasing demand for efficient lubricants with advanced functionalities can drive the growth of market

Increasing demand for efficient lubricants with advanced functionalities across various applications such as automobile, manufacturing, and agriculture is expected to fuel the growth over the forecast period. This factor will result in increased penetration rates by manufacturers which also lead to an increase in consumption levels resulting in higher revenue generation.

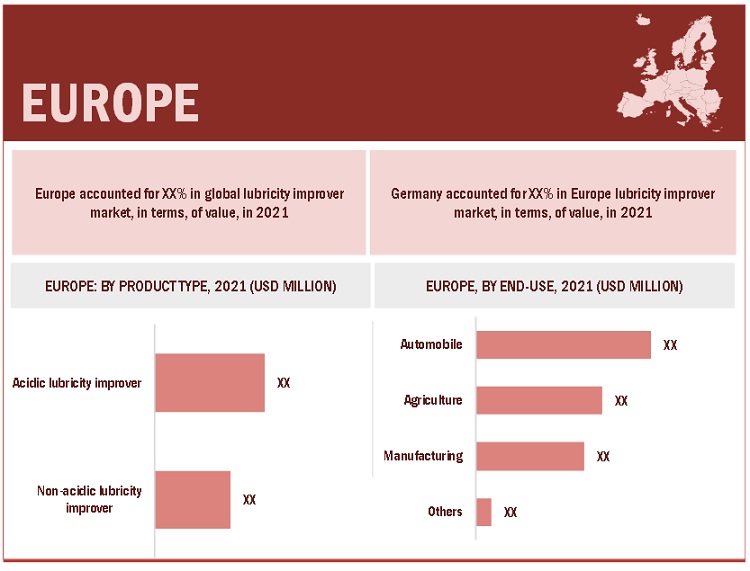

“Acidic lubricity improver was the largest product type of Lubricity improver market in 2021, in terms of value”

An Acidic Lubricity Improver is a kind of oil additive with acidic material. It mainly uses special additives to increase the acid number, also known as "acid value". The higher the acid value, the better its effect on friction and wear resistance.

“Automobile was the largest end-use industry for lubricity improver market in 2021, in terms of value”

The use of lubricity improver in automobiles is to increase lubrication performance and reduce motor power loss. Lubricating oil film, which was formed by this additive, can be used as a medium for hydraulic brake system on vehicles to achieve effective braking with proper control.

“Europe was the largest market for Lubricity improver in 2021, in terms of value.”

The European region accounts for a high share as compared to other regions due to its highly developed economy along with increased per capita income levels. This factor results in an increase in demand for premium quality lubricants that reduces friction leading to better operational efficiency.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are Afton Chemical Corporation (US), Dow Inc. (US), TotalEnergies SE (France), BASF SE (Germany), The Lubrizol Corporation (US), Innospec Inc. (US), Chevron Corporation (US), Dorf Ketal Chemicals (India), Huntsman Corporation (US), and Baker Hughes Company (US) . Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of lubricity improver have opted for new product launches to sustain their market position.

Scope Of The Report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2030 |

|

Base Year |

2021 |

|

Forecast period |

2022–2030 |

|

Units considered |

Volume (Kiloton); Value (USD Million) |

|

Segments |

Product Type, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Afton Chemical Corporation (US), Dow Inc. (US), TotalEnergies SE (France), BASF SE (Germany), The Lubrizol Corporation (US), Innospec Inc. (US), Chevron Corporation (US), Dorf Ketal Chemicals (India), Huntsman Corporation (US), and Baker Hughes Company (US) |

This report categorizes the global lubricity improver market based on product type, end-use industry, and region.

On the basis of product type, the lubricity improver market has been segmented as follows:

- Acidic lubricity improver

- Non-acidic lubricity improver

On the basis of end-use industry, the lubricity improver market has been segmented as follows:

- Automobile

- Agriculture

- Manufacturing

- Others

On the basis of region, the lubricity improver market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the expected growth rate of lubricity improver market?

The lubricity improver market is projected to reach USD 4.2 billion by 2030, at a CAGR of 5.3% from USD 2.8 billion in 2022.

Who are the major key players in lubricity improver market?

Afton Chemical Corporation (US), Dow Inc. (US), TotalEnergies SE (France), BASF SE (Germany), The Lubrizol Corporation (US), Innospec Inc. (US), Chevron Corporation (US), Dorf Ketal Chemicals (India), Huntsman Corporation (US), and Baker Hughes Company (US).

What is the average selling price trend for lubricity improver market?

Prices are low in Asian countries (primarily China and India) compared to those in Europe and North America due to the low prices of raw materials and the availability of low-cost workforces in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of content

1 Introduction

1.1 Objective of the study

1.2 Market definition

1.3 Market Scope

1.3.1 Years considered for the study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key data from secondary sources

2.3 Primary Data

2.3.1 Key data from primary sources

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

2.7 Limitations

3 Executive Summary

4 Premium Insights

4.1 Opportunities in Lubricity improver Market

4.2 Lubricity improver Market, By Product Type

4.3 Lubricity improver Market, By End-use Industry

4.4 Lubricity improver Market, By Region

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Supply Chain Analysis

5.3.1 Raw Material

5.3.2 Manufacturers

5.3.3 Distribution

5.3.4 End-Use Industry

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Average Selling Price

5.6 Regulatory Landscape

5.7 Industry Outlook

6 Lubricity improver Market, By Product Type

6.1 Introduction

6.2 Acidic lubricity improver

6.3 Non-acidic lubricity improver

7 Lubricity improver Market, By End-use Industry

7.1 Introduction

7.2 Automobile

7.3 Agriculture

7.4 Manufacturing

7.5 Others

8 Lubricity improver Market, By Region

8.1 Introduction

8.2 Asia Pacific

8.2.1 China

8.2.2 India

8.2.3 Japan

8.2.4 South Korea

8.2.5 Indonesia

8.2.6 Rest of Asia Pacific

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 Italy

8.4.4 U.K.

8.4.5 Spain

8.4.6 Russia

8.4.7 Poland

8.4.8 Rest of Europe

8.5 Middle East & Africa

8.5.1 UAE

8.5.2 Saudi Arabia

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape

9.1 Introduction

9.2 Market Share Analysis

9.3 Company Evaluation Quadrant

9.4 Competitive Situation & Trends

9.4.1 New Product Launches

9.4.2 Contracts & Agreements

9.4.3 Partnerships & Collaborations

9.4.4 Joint Ventures

9.4.5 Expansions

10 Company Profile

10.1 Afton Chemical Corporation

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Development

10.1.4 MnM View

10.1.4.1 Key Strengths

10.1.4.2 Strategic choices made

10.1.4.3 Threat from competition

10.2 Dow Inc.

10.3 TotalEnergies SE

10.4 BASF SE

10.5 The Lubrizol Corporation

10.6 Innospec Inc.

10.7 Chevron Corporation

10.8 Dorf Ketal Chemicals

10.9 Huntsman International LLC

10.10 Baker Hughes Company

10.11 List of other key market players

11 Appendix

11.1 Insights from Industry Experts

11.2 Discussion Guide

11.3 Related Reports

The study involved four major activities to estimate the size of lubricity improver market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

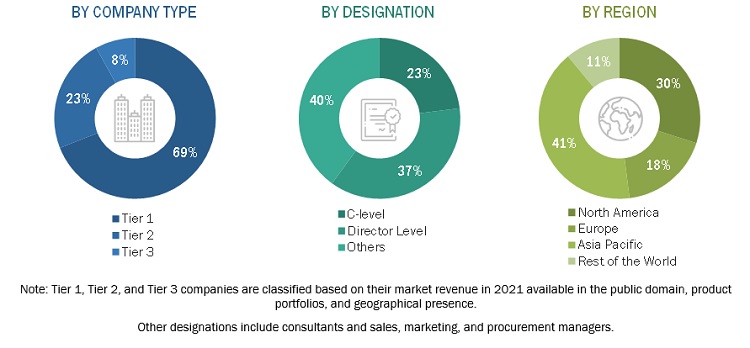

The lubricity improver market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the lubricity improver market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the lubricity improver industry.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

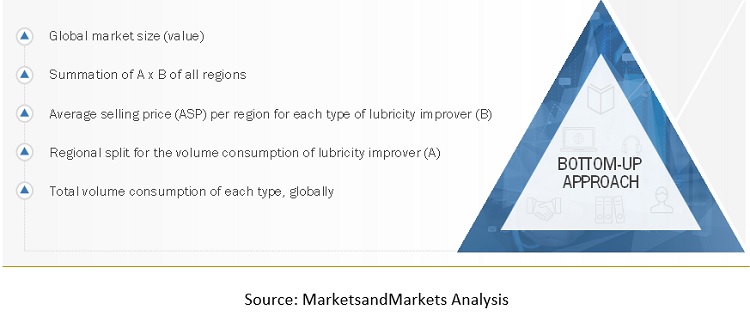

The top-down and bottom-up approaches have been used to estimate and validate the size of the lubricity improver market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Lubricity Improver Market: Bottom-Up Approach 1

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the lubricity improver market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type and end-use industry

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Lubricity Improver Market