Marine Coatings Market by Resin (Epoxy, Alkyd, Polyurethane), Product Type (Anti-Corrosion Coatings, Antifouling Coatings), Application (Cargo Ships, Passenger Ships, Boats), Region - Global Forecast to 2022

To get the latest information, inquire now!

Marine Coatings Market

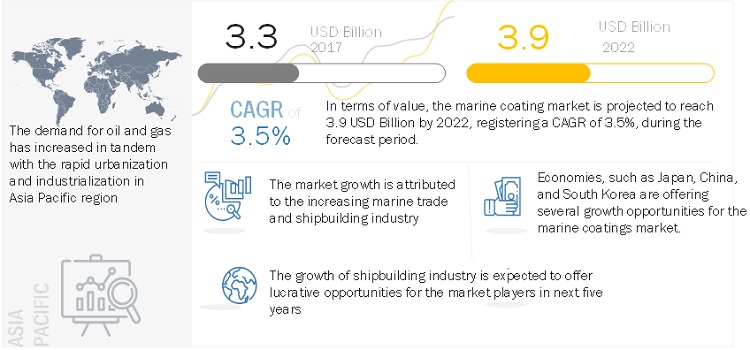

The marine coatings market was valued at USD 3.19 billion in 2016 and is projected to reach USD 3.93 billion by 2022, growing at a cagr 3.50% from 2017 to 2022. The increase in the overall international trade has resulted in the increased use of sea routes for carrying out trade activities across the globe. This has led to rise in the number of bulk carriers, container ships, and general cargo ships being manufactured across the globe, thereby widening the scope of the marine coatings market. In addition, the increasing demand for marine coatings from emerging economies such as China and South Korea is expected to fuel the growth of the marine coatings market across the globe.

Global Marine Coatings Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Marine Coatings Market Dynamics

Drivers: Increasing shipbuilding activities in APAC

Shipping is considered to be the cheapest transport. Hence, about 90% of goods traded across geographies is carried out by sea. The APAC marine coatings market is expected to witness steady growth, owing to the rapid development of the shipbuilding and offshore engineering industries in the region. Since ships are subject to harsh environments, there is a constant need for their maintenance and repair. All these factors act as drivers for the market.

Opportunities: Increasing demand from the oil & gas industry

The oil & gas industry is steadily growing as it is continuously redefining the production possibilities. Technological innovation has made it possible to extract fossil fuels that were not accessible just a decade or two ago. Oil & gas companies are moving to deep water and ultra-deep water for finding new oil & gas reserves. The Gulf countries, however, have the largest crude oil reserves. There are opportunities for rising import and export of crude oil, LNG, and chemicals between countries involving the usage of large ships and vessels, such as crude, LNG, LPG, and chemical, and other carriers. This growth will automatically lead to an increase in the demand for marine coatings in the construction of large ships and vessels during the forecast period.

Challenges : Fluctuating raw material prices

Fluctuating raw material costs are a major challenge for the marine coatings market. The raw materials used for manufacturing marine coatings are petrochemicals obtained from the processing of crude oil. Hence, the current slump in oil prices has a direct impact on the coatings market. The dip in prices will benefit coating producers in the long-term though low prices can trouble manufacturers in the short-term as past inventory costs will affect production. The overall marine coatings market is estimated to register a good growth on account of increasing demand from developing regions such as APAC and the Middle East & Africa.

Epoxy-based marine coatings segment to dominate the market in 2016

- The epoxy-based marine coatings market accounted for the largest share in terms of value, in 2016. This is mainly due to the properties such as good corrosion resistance and abrasion resistance. In addition, epoxy-based marine coatings are used in multi-component coatings with other types.

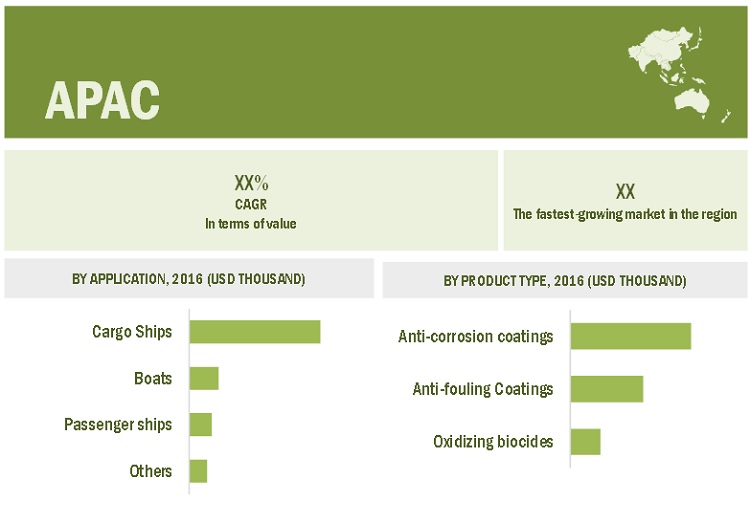

Cargo ships to hold largest share on application of the marine coating market in 2016

- Cargo ships have not only led to increased exports but have also resulted in a reduced cost of goods. According to Herald Publications, countries such as China have 47% of their goods and passenger traffic on the water. Korea and Japan have 43% and 44%, respectively, of their goods and passenger traffic on the water. In the European countries, 40% of goods and passenger traffic is on water. The cost of transportation through water is substantially lesser than what it is through other modes. These factors are expected to increase the demand for cargo ships and, thus, the demand for marine coatings.

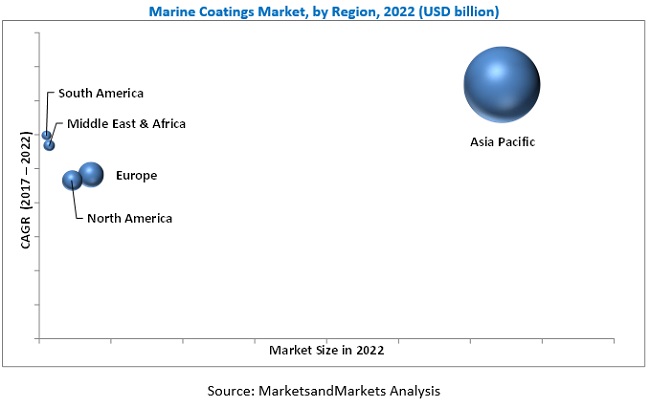

Asia Pacific is expected to be the fastest growing region during the forecast period.

According to United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), in 2016, Asia led the global maritime trade, with 37.5% of world imports and 40% of world exports. It is considered to be a lucrative region for maritime trade. The countries such as China, Japan, South Korea, India, Vietnam, and Indonesia are considered as the major ship manufacturing hubs. Over the past few years, this region has witnessed rapid economic development as well as the growth of the manufacturing and energy sectors, thereby resulting in an increase in the maritime trade.

To know about the assumptions considered for the study, download the pdf brochure

The marine coating market is dominated by a few globally established players such as PPG Industries, AkzoNobel, Sherwin-Williams, Hempel, and Jotun (Norway), among others.

Marine Coatings Market Report Scope

The research report categorizes the marine coatings market into the following segments:

Marine Coatings Market, by Resin:

- Epoxy

- Alkyd

- Polyurethane

- Others (Acrylic, Polyester, and Fluoropolymer)

Marine Coatings Market, by Product Type

- Anti-Corrosion Coatings

- Antifouling Coatings

- Others (Foul Release and Moisture Cure)

Marine Coatings Market, by Application

- Cargo Ships

- Passenger Ships

- Boats

- Others (Offshore Vessels, Service Ships, and Tugs)

Marine Coatings Market, by Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In November 2017, PPG launched a new water-based primer, namely, PPG AQUACRON 834. This is an economical anti-corrosion primer for steel applications.

- In October 2017, Sherwin-Williams (US)launched zinc-based epoxy coating, namely, Zinc Clad 4100. This coating has self-healing properties and is widely used in barges and ships..

- In June 2017, the company expanded its US R&D facility in Texas. The company invested USD 3.5 million for this expansion activity. This R&D facility supports the company’s protective coatings and marine coatings businesses.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the marine coating market during 2017-2022?

The global marine coating market is expected to record a CAGR of 3.5% from 2017–2022.

What are the driving factors for the marine coating?

The marine coatings market is primarily dependent on the shipbuilding industry. The increasing demand from the emerging economies is expected to fuel the growth of the marine coatings market. APAC is the most dominant and fastest-growing marine coatings market

Which are the significant players operating in the marine coating market?

PPG Industries, AkzoNobel, Sherwin-Williams, Hempel, and Jotun (Norway).

Which region will lead the marine coating market in the future?

Asia Pacific is expected to lead the marine coating market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Marine Coatings Market

4.2 APAC Marine Coatings Market, By Resin and Country

4.3 Marine Coatings Market, By Application

4.4 Marine Coatings Market, By Product Type

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Shipbuilding Activities in APAC

5.2.1.2 Upcoming Shipbuilding Projects and Plans

5.2.1.3 Reduction in Fuel Consumption

5.2.2 Opportunities

5.2.2.1 Increasing Demand From the Oil & Gas Industry

5.2.2.2 Advancements in Marine Coating Technologies

5.2.3 Challenges

5.2.3.1 Fluctuating Raw Material Prices

5.2.3.2 Environmental Regulations

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Forecast of Major Economies

5.4.2 Trends and Forecast of Oil & Gas Industry and Its Impact on the Marine Coatings Market

5.4.3 Trends and Forecast of Shipping Industry and Its Impact on the Marine Coatings Market

6 Marine Coatings Market, By Resin (Page No. - 45)

6.1 Introduction

6.2 Epoxy

6.3 Alkyd

6.4 Polyurethane

6.5 Others

7 Marine Coatings Market, By Product Type (Page No. - 52)

7.1 Introduction

7.2 Anti-Corrosion Marine Coatings

7.3 Antifouling Coatings

7.4 Others

8 Marine Coatings Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Cargo Ships

8.3 Passenger Ships

8.4 Boats

8.5 Others

9 Marine Coatings Market, By Region (Page No. - 65)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 Turkey

9.3.3 Netherlands

9.3.4 Romania

9.3.5 Italy

9.3.6 Spain

9.3.7 Norway

9.3.8 UK

9.3.9 Russia

9.3.10 France

9.4 APAC

9.4.1 China

9.4.2 South Korea

9.4.3 Japan

9.4.4 Singapore

9.4.5 Indonesia

9.4.6 Malaysia

9.4.7 India

9.5 Middle East & Africa

9.5.1 UAE

9.5.2 South Africa

9.6 South America

9.6.1 Brazil

10 Competitive Landscape (Page No. - 107)

10.1 Introduction

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 New Product Launches

10.3.2 Expansions

10.3.3 Mergers & Acquisitions

10.3.4 Partnerships

11 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 PPG Industries

11.2 AkzoNobel

11.3 Sherwin-Williams

11.4 Hempel

11.5 Jotun

11.6 Chugoku Marine Paints

11.7 Nippon Paint

11.8 Axalta

11.9 BASF Coatings

11.10 Kansai Paint

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

11.11 Other Key Market Players

11.11.1 Rpm International

11.11.2 Asian Paints

11.11.3 Berger Paints

11.11.4 Shalimar Paints

11.11.5 Dupont

11.11.6 Tohpe

11.11.7 Cloverdale Paint

11.11.8 Tiger Coatings

11.11.9 Brunel Marine Coating Systems

11.11.10 Epifanes

12 Appendix (Page No. - 134)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (125 Tables)

Table 1 Trends and Forecast of Real Gdp, 2017—2022 (USD Billion)

Table 2 Global Oil Production Vs. Consumption (MBPD), 2012—2016

Table 3 Global Crude Oil Production, 2015—2018 (MBPD)

Table 4 Merchandise Trade By Group of Economies, 2016

Table 5 Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 6 Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 7 Epoxy-Based Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 8 Epoxy-Based Marine Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 9 Alkyd-Based Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 10 Alkyd-Based Marine Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 11 Polyurethane-Based Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 12 Polyurethane-Based Marine Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 13 Other Resins-Based Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 14 Other Resins-Based Marine Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 15 Marine Coatings Market Size, By Product Type, 2015—2022 (USD Million)

Table 16 Marine Coatings Market Size, By Product Type, 2015—2022 (Million Liter)

Table 17 Anti-Corrosion Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 18 Anti-Corrosion Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 19 Antifouling Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 20 Antifouling Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 21 Other Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 22 Other Marine Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 23 Marine Coatings Market Size, By Application, 2015—2022 (USD Million)

Table 24 Marine Coatings Market Size, By Application, 2015—2022 (Million Liter)

Table 25 Marine Coatings Market Size in Cargo Ships, By Region, 2015—2022 (USD Million)

Table 26 Marine Coatings Market Size in Cargo Ships, By Region, 2015—2022 (Million Liter)

Table 27 Marine Coatings Market Size in Passenger Ships, By Region, 2015—2022 (USD Million)

Table 28 Marine Coatings Market Size in Passenger Ships, By Region, 2015—2022 (Million Liter)

Table 29 Marine Coatings Market Size in Boats, By Region, 2015—2022 (USD Million)

Table 30 Marine Coatings Market Size in Boats, By Region, 2015—2022 (Million Liter)

Table 31 Marine Coatings Market Size in Other Applications, By Region, 2015—2022 (USD Million)

Table 32 Marine Coatings Market Size in Other Applications, By Region, 2015—2022 (Million Liter)

Table 33 Marine Coatings Market Size, By Region, 2015—2022 (USD Million)

Table 34 Marine Coatings Market Size, By Region, 2015—2022 (Million Liter)

Table 35 North America: Marine Coatings Market Size, By Country, 2015—2022 (USD Million)

Table 36 North America: Marine Coatings Market Size, By Country, 2015—2022 (Million Liter)

Table 37 North America: Marine Coatings Market Size, By Product Type, 2015—2022 (USD Million)

Table 38 North America: Marine Coatings Market Size, By Product Type, 2015—2022 (Million Liter)

Table 39 North America: Marine Coatings Market Size, By Application, 2015—2022 (USD Million)

Table 40 North America: Marine Coatings Market Size, By Application, 2015—2022 (Million Liter)

Table 41 North America: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 42 North America: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 43 US: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 44 US: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 45 Canada: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 46 Canada: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 47 Mexico: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 48 Mexico: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 49 Europe: Marine Coatings Market Size, By Country, 2015—2022 (USD Million)

Table 50 Europe: Marine Coatings Market Size, By Country, 2015—2022 (Million Liter)

Table 51 Europe: Marine Coatings Market Size, By Product Type, 2015—2022 (USD Million)

Table 52 Europe: Marine Coatings Market Size, By Product Type, 2015—2022 (Million Liter)

Table 53 Europe: Marine Coatings Market Size, By Application, 2015—2022 (USD Million)

Table 54 Europe: Marine Coatings Market Size, By Application, 2015—2022 (Million Liter)

Table 55 Europe: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 56 Europe: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 57 Germany: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 58 Germany: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 59 Turkey: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 60 Turkey: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 61 Netherlands: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 62 Netherlands: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 63 Romania: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 64 Romania: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 65 Italy: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 66 Italy: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 67 Spain: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 68 Spain: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 69 Norway: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 70 Norway: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 71 UK: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 72 UK: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 73 Russia: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 74 Russia: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 75 France: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 76 France: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 77 APAC: Marine Coatings Market Size, By Country, 2015—2022 (USD Million)

Table 78 APAC: Marine Coatings Market Size, By Country, 2015—2022 (Million Liter)

Table 79 APAC: Marine Coatings Market Size, By Product Type, 2015—2022 (USD Million)

Table 80 APAC: Marine Coatings Market Size, By Product Type, 2015—2022 (Million Liter)

Table 81 APAC: Marine Coatings Market Size, By Application, 2015—2022 (USD Million)

Table 82 APAC: Marine Coatings Market Size, By Application, 2015—2022 (Million Liter)

Table 83 APAC: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 84 APAC: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 85 China: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 86 China: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 87 South Korea: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 88 South Korea: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 89 Japan: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 90 Japan: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 91 Singapore: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 92 Singapore: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 93 Indonesia: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 94 Indonesia: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 95 Malaysia: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 96 Malaysia: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 97 India: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 98 India: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 99 Middle East & Africa: Marine Coatings Market Size, By Country, 2015—2022 (USD Million)

Table 100 Middle East & Africa: Marine Coatings Market Size, By Country, 2015—2022 (Million Liter)

Table 101 Middle East & Africa: Marine Coatings Market Size, By Product Type, 2015—2022 (USD Million)

Table 102 Middle East & Africa: Marine Coatings Market Size, By Product Type, 2015—2022 (Million Liter)

Table 103 Middle East & Africa: Marine Coatings Market Size, By Application, 2015—2022 (USD Million)

Table 104 Middle East & Africa: Marine Coatings Market Size, By Application, 2015—2022 (Million Liter)

Table 105 Middle East & Africa: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 106 Middle East & Africa: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 107 UAE: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 108 UAE: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 109 South Africa: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 110 South Africa: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 111 South America: Marine Coatings Market Size, By Country, 2015—2022 (USD Million)

Table 112 South America: Marine Coatings Market Size, By Country, 2015—2022 (Million Liter)

Table 113 South America: Marine Coatings Market Size, By Product Type, 2015—2022 (USD Million)

Table 114 South America: Marine Coatings Market Size, By Product Type, 2015—2022 (Million Liter)

Table 115 South America: Marine Coatings Market Size, By Application, 2015—2022 (USD Million)

Table 116 South America: Marine Coatings Market Size, By Application, 2015—2022 (Million Liter)

Table 117 South America: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 118 South America: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 119 Brazil: Marine Coatings Market Size, By Resin, 2015—2022 (USD Million)

Table 120 Brazil: Marine Coatings Market Size, By Resin, 2015—2022 (Million Liter)

Table 121 Market Ranking of Key Players, 2016

Table 122 New Product Launches, 2013—2017

Table 123 Expansions, 2013—2017

Table 124 Mergers & Acquisitions, 2013–2017

Table 125 Partnerships, 2013—2017

List of Figures (28 Figures)

Figure 1 Marine Coatings Market: Research Design

Figure 2 Marine Coatings Market: Data Triangulation

Figure 3 Epoxy to be the Leading Resin Segment of Marine Coatings

Figure 4 Cargo Ships to be the Dominant Application of Marine Coatings

Figure 5 Antifouling to be the Fastest-Growing Product Type of Marine Coatings

Figure 6 India to be the Fastest-Growing Marine Coatings Market

Figure 7 APAC Dominated the Marine Coatings Market in 2016

Figure 8 Growth Opportunities in Marine Coatings Market

Figure 9 China Led the Market in APAC

Figure 10 Cargo Ships Was the Largest Application of Marine Coatings in 2016

Figure 11 Anti-Corrosion to be the Largest Product Type of Marine Coatings

Figure 12 Factors Governing the Marine Coatings Market

Figure 13 Marine Coatings Market: Porter’s Five Forces Analysis

Figure 14 Polyurethane-Based Marine Coatings to Register the Highest CAGR

Figure 15 Antifouling Coatings to Register the Highest CAGR

Figure 16 Passenger Ships to be the Fastest-Growing Application of Marine Coatings

Figure 17 APAC to be the Fastest-Growing Marine Coatings Market

Figure 18 Companies Adopted New Product Launches as the Key Growth Strategy Between 2013 and 2017

Figure 19 PPG Industries Corporation: Company Snapshot

Figure 20 AkzoNobel.: Company Snapshot

Figure 21 Sherwin-Williams: Company Snapshot

Figure 22 Hempel: Company Snapshot

Figure 23 Jotun: Company Snapshot

Figure 24 Chugoku Marine Paints: Company Snapshot

Figure 25 Nippon Paint: Company Snapshot

Figure 26 Axalta: Company Snapshot

Figure 27 BASF Coatings: Company Snapshot

Figure 28 Kansai Paint: Company Snapshot

The marine coatings market is projected to grow from USD 3.31 billion in 2017 to USD 3.93 billion by 2022, at a CAGR of 3.50% during the forecast period from 2017 to 2022. The increase in the overall international trade has resulted in the increased use of sea routes for carrying out trade activities across the globe. This has led to rise in the number of bulk carriers, container ships, and general cargo ships being manufactured across the globe, thereby widening the scope of the marine coatings market. In addition, the increasing demand for marine coatings from emerging economies such as China and South Korea is expected to fuel the growth of the marine coatings market across the globe.

The marine coatings market has been segmented based on resin, product type, application, and region. Among resins, the epoxy segment is expected to lead the marine coatings market during the forecast period, in terms of value. The growth of this segment of the market can be attributed to the outstanding chemical and water resistance offered by epoxy marine coatings. Moreover, these coatings are also extremely durable and have excellent adhesion to a variety of substrates.

Based on product type, the marine coatings market has been segmented into anti-corrosion coatings, antifouling coatings, and others. The antifouling coatings segment of the market is projected to grow at the highest CAGR between 2017 and 2022, in terms of value. The growth of the antifouling coatings segment of the marine coatings market can be attributed to the capability of these coatings to reduce the growth of organisms on the underwater hull of the marine vessels. These antifouling coatings also help in reducing the fuel consumption by marine vessels, which subsequently results in reducing harmful emissions.

Based on application, the marine coatings market has been classified into cargo ships, passenger ships, boats, and others. The passenger ships segment of the marine coatings market is projected to grow at the highest CAGR between 2017 and 2022, in terms of value. The growing coastal and maritime tourism across the globe is contributing significantly to the growth of the shipping industry in the North American and European regions.

The marine coatings market has been studied in North America, Europe, Asia Pacific, South America, and the Middle East & Africa. The Asia Pacific region is the largest market for marine coatings and is expected to continue leading the market till 2022. The growth of the Asia Pacific marine coatings market can be attributed to the recognition of countries such as China, Japan, South Korea, India, Vietnam, and Indonesia as ship manufacturing hubs.

The requirement of making significant investments in R&D activities for developing new marine coatings due to the ongoing developments and modifications in technologies employed for manufacturing marine coatings make the entry of new players in the market difficult. Fluctuating prices of raw materials adversely impact the overall cost of production incurred by the manufacturers of marine coatings. Increasing environmental regulations also pose a challenge for the growth of the marine coatings market across the globe.

New product launches and expansions have been the major developmental strategies adopted by the key players operating in the marine coatings market between 2013 and 2017. Companies such as PPG Industries (US), AkzoNobel (Netherlands), Hempel (Denmark), Sherwin-Williams (US), Jotun (Norway), have adopted these strategies to enhance their product offerings and customer base as well as gain a competitive edge over their peers in the market. These companies are also focusing on investing in R&D activities to introduce new and cost-effective materials to keep up with the changing consumer needs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Marine Coatings Market

Interested in PU coatings and Marine Coatings market

Copper based anti fouling coatings market

Specific information on marine nano coatings makret with specific interest on paints and coatings application

Marine Coatings Market and market insights

Company portfolio analysis and competitive analysis.

Global Marine Coatings Market insights

requirement of report on marine coatings industry

Competitor analysis for the market

Report title not mentioned

Market data for Marine and Protective Coatings market particularly - Epoxy Anticorrosives, Zinc Rich Epoxy Primers, and Antifoulings

Marine Coatings Market and market trends