Medical Device Services Market - Global Forecast 2030

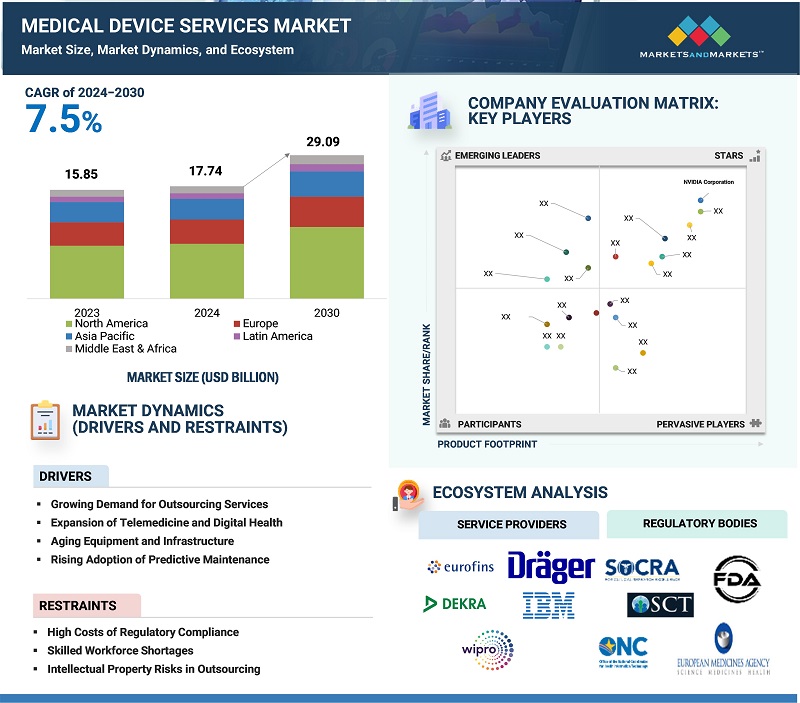

The global medical device services market, valued at US$15.85 billion in 2023, is forecasted to grow at a robust CAGR of 7.5%, reaching US$17.74 billion in 2024 and an impressive US$29.09 billion by 2030. In order to support the lifecycle and advancement of various devices such as diagnostic devices, therapeutic devices, and surgical devices, the medical device services offer expertise in regulatory adherence, manufacturing and design, maintenance, and testing, among other services. The major growth factors involve increased outsourcing, rigorous regulatory requirements, and increasing demand for sophisticated and advanced equipment in the healthcare industry. Moreover, the growth propelled by technological innovations such as telehealth services, AI, IoT, alongside the rising emphasis on wearable health devices and patient-centered care.

Global Medical Device Services Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Global Medical Device Services Market Dynamics

Driver: Growing Demand for Outsourcing

Outsourcing has emerged as a critical factor boosting the growth of the global medical device services market. It allows various healthcare organizations such as medical devices, healthcare facilities, pharma, among others to focus on their core expertise like advancement and expansion by lowering operational cost, access external expertise, and supporting in upgrading & advancement. The outsourcing of regulatory compliance, product testing, manufacturing, and other services has transformed the healthcare industry by offering significant advantages in an increasingly competitive and regulated environment.

Restraint: Skilled Workforce Shortages

The rising demand for the skilled expertise in the areas including AI integration, cybersecurity, and regulatory compliance has established a substantial talent gap in the medical device services market. Nowadays, devices are becoming more advanced, connected, and complex, thereby, rising the need for professionals to manage IT systems, ensure cybersecurity, and navigate complex regulatory environments. According to the EIT Health report, 71% of biotech-focused venture capital firms recognize hiring skilled professionals as a considerable challenge. This scarcity of talent hinders the product development and compliance procedures and further also rises the operational costs for the companies as they compete for a restricted group of experienced individuals. Focusing on this gap is vital in order to sustain revolution and maintain the growth curve of the medical device services globally.

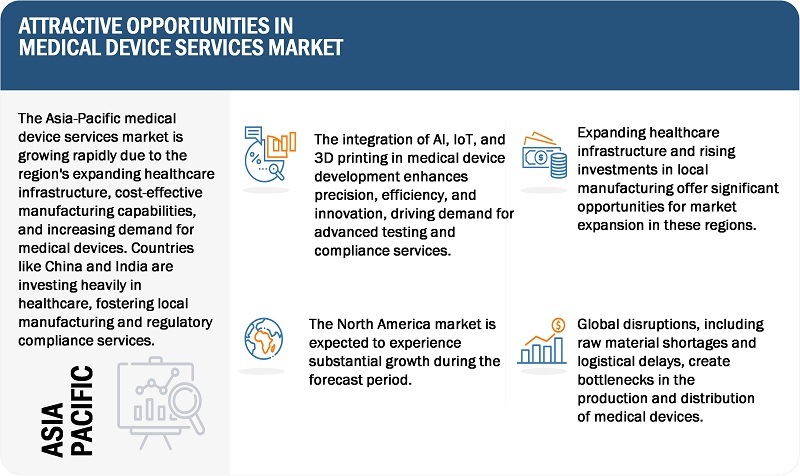

Opportunity: Rising Adoption of Connected and Digital Health Technologies

The increasing adoption of IoT-enabled medical devices and telehealth/telemedicine solutions is driving significant opportunities for the medical device services market. Telemedicine, which grew from USD 23.85 billion in 2018 to USD 37.08 billion in 2021 (European Union data), relies heavily on IoT-enabled medical devices for real-time monitoring, data collection, and integration across healthcare systems. This growth highlights the need for expert services such as cybersecurity, IT integration, and device interoperability to enable data security and further provide seamless functionality of advance equipment.

The medical device service providers play a major role in supporting telemedicine by offering software solutions, analytics platforms, and device management services. Major players including Medtronic and Philips are heavily investing in AI-driven devices and connected ecosystems which results in need of specialized services. The rising dependency on these medical devices and technologies is increasing the demand for medical device services to offer effective telemedicine solutions, boost innovation, and provide healthcare platforms that are safe & secure and compatible.

Additionally, AI enhances patient engagement through virtual assistants and personalized health recommendations, fostering better adherence to care plans.

Challenge: High Costs of Regulatory Compliance

The high costs associated with meeting rigorous regulatory guidelines presents a considerable challenge, hampering the market growth. Compliance with guidelines such as U.S. FDA and European Union Medical Device Regulation requirements mandates requires significant investment in examining, testing, certification, documentation & authorization processes. This burden is particularly faced by small and mid-sized companies, which frequently face the shortage of the resources and infrastructure to manage these expenditures efficiently.

For instance, compliance with EU MDR, implemented to ensure stricter safety and quality standards, has reportedly increased operational costs for manufacturers by 10-20%. This includes expenses for re-certifying existing products, updating technical documentation, and investing in additional testing and clinical trials.

Such financial difficulties overly effect smaller companies, potentially slowing down product releases and lowering their competitiveness in the market.

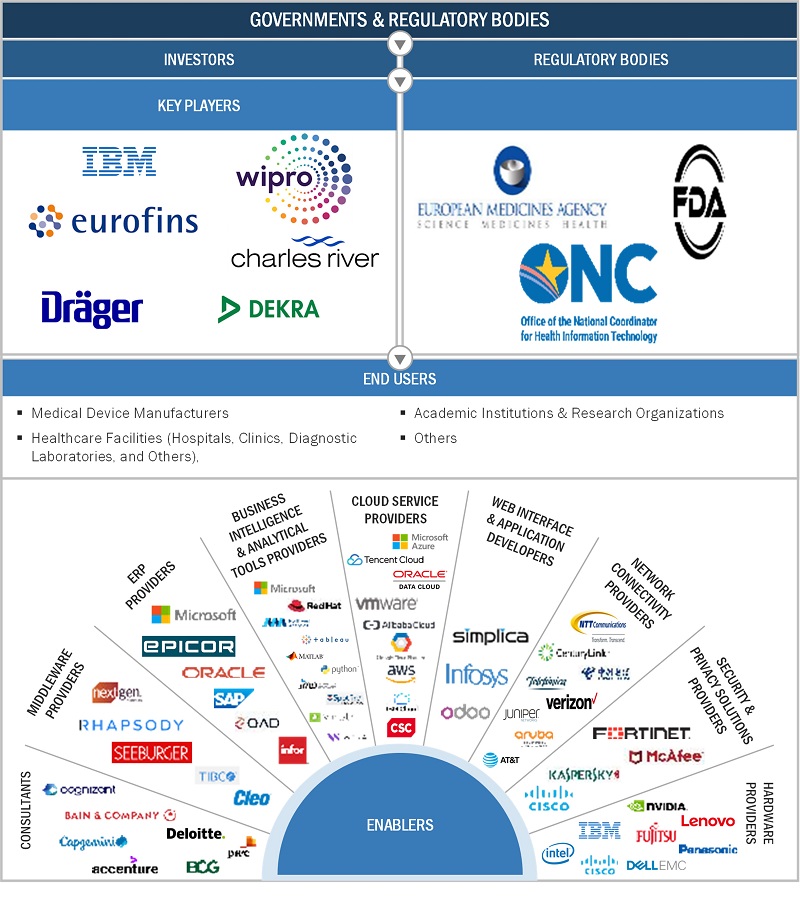

Global Medical Device Services Market Ecosystem Analysis

The “Global Medical Device Services Market Ecosystem” is a holistic framework designed to ensure seamless management and integration of medical device services across healthcare systems. This ecosystem interconnects multiple stakeholders, advanced technologies, and regulatory standards to streamline operations and enhance the lifecycle of medical devices. The primary goal is to create a unified, vendor-neutral platform that empowers healthcare providers to enhance clinical decision-making, reduce operational expenses, and improve patient care outcomes. Below is a detailed breakdown of the core components, stakeholders, and technological drivers that define the global medical device services market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

By service type, manufacturing services accounted for the largest share of the market for medical device services in 2023.

Based on service type, the market for medical device services is segmented into regulatory & quality compliance, product design & development, product testing & certification, manufacturing services, maintenance & calibration, post-market surveillance, and others (IT and software solutions, supply chain management). The manufacturing services segment holds the largest market share in the medical device services market. This is because of the increasing outsourcing of the manufacturing functions to contract manufacturers, who have skills to meet requirements, lower costs, and increase the scale of production. CMOs assist in the manufacture of complex medical devices such as implants as well as other surgical and diagnostic instruments while catering to as many regulatory needs as possible. One of the reasons that this segment continues to grow is because of the increased demand for high-quality precision-engineered components, the advance of technology in manufacturing (like additive manufacturing and robotics), and the demand for speedy deployment of new products. Furthermore, outsourcing enables medical device firms to concentrate on key functions such as development, marketing, and customer assistance while taking advantage of the capabilities of experienced manufacturers. Therefore, this trend is especially strong in geographies like North America, Europe and Asia Pacific where the CMOs have established strong infrastructures that can meet the various demands of the medical device sector.

The patient monitoring devices segment is set to register the highest CAGR during the forecast period.

Based on device type, the market for medical device services is segmented diagnostic devices, therapeutic devices, surgical devices, patient monitoring devices, and others. The patient monitoring devices segment registered the highest growth rate during the forecast period. This development is triggered by the increasing use of remote monitoring and wearable technology, largely because of the surge in telehealthcare and homecare requirements. New technologies in the internet, AI and the analysis of large data have increased the capabilities of the devices making them helpful in the management of chronic diseases such as diabetes, cardiovascular illnesses and diseases linked to respiration. In addition, this segment has been growing rapidly as a result of an increase in aging population, rising aversion to illness, and the penetration of connected health technologies into mainstream medical practice.

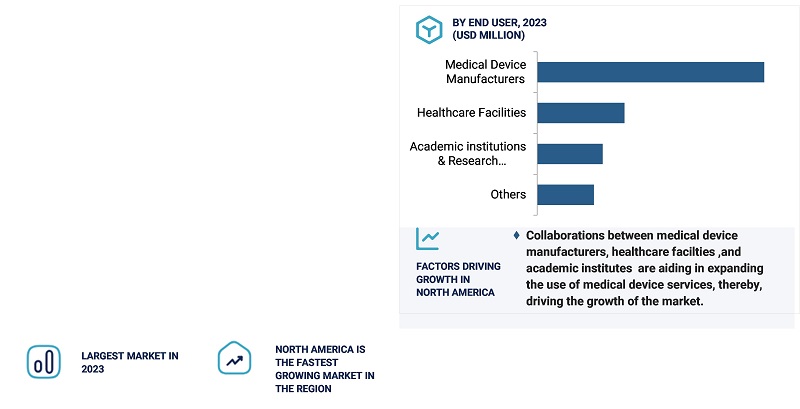

By end-user, the medical device manufacturers segment accounted for the largest share of the market for medical device services in 2023.

Based on end-user, the market for medical device services is segmented into medical device manufacturers, healthcare facilities, academic institutions & research organizations, and others. The medical device manufacturers segment holds the largest market share in the medical device services market. This is because these companies tend to heavily rely on outsourcing such services which include product testing, manufacturing, and regulatory compliance in a bid to concentrate more on innovation.

Manufacturers work with specialized service providers to understand and comply with rigorous country standards, access faster time to market and properly manage costs. Their insistence on high-quality components and advanced testing, as well as precision and sub-assembly manufacturing, places them at the top. Also, the emergence of new technology as well as the need for international standardization has added strength to the growth of this segment.

North America accounted for the largest share of the market for medical device services market in 2023.

In 2023, North America dominated the medical device services market driven by its advanced healthcare infrastructure, rigorous regulatory outlines, and the presence of leading healthcare companies in the region companies such as Medtronic and Stryker. The U.S. accounted for the largest share due to significant R&D investments, outsourcing trends, and technological advancements such as AI-powered diagnostic devices and 3D printing. The region's demand for regulatory compliance, testing, and manufacturing services is further boosted by the FDA's stringent guidelines and rapid adoption of connected health technologies. Strategic expansions and innovative product launches by key players solidify North America's leadership in the market.

For instance, in May 2024, Philips and Radboud University Medical Center have signed a 10-year partnership to implement advanced patient monitoring systems with continuous software updates. The collaboration aims to optimize patient care with AI-driven insights, reduced alarms, and enhanced data accessibility, ensuring a scalable, future-ready healthcare ecosystem.

Key Market Players

- Wipro

- IQVIA

- TATA Consultancy Services Limited

- UL LLC

- SGS

- Cognizant

- Dragerwerk AG & Co. KGaA

- Eurofins Scientific

- L&T Technology Services Limited

- Infosys Limited

- DEKRA

- IBM

- Charles River Laboratories

- Intertek Group plc

- Cardinal Health

- Brighter Health Network, LLC

- Others .

Recent Developments in the Medical Device Services Market:

- In September 2024, Charles River and Insightec partnered to utilize focused ultrasound technology for precise drug delivery in neuroscience, aiming to accelerate therapeutic development for conditions like Parkinson’s and Alzheimer’s.

- In June 2023, IQVIA's MedTech Field Service Program offers tailored field teams to support technical product needs, ensuring seamless operations for MedTech innovation and product value delivery.

- In August 2023, Intertek Medical Notified Body UK Ltd has been officially approved under the UK Medical Devices Regulations 2002 by the MHRA. This designation authorizes Intertek to conduct UKCA conformity assessments and certify non-implantable and non-active medical devices, ensuring continued market access in the UK post-Brexit.

- In June 2021, Intertek, a global leader in Total Quality Assurance, has partnered with Globizz, a Japanese-U.S. consulting firm, to streamline market access for medical device manufacturers in Japan and the United States. This collaboration combines Globizz's expertise in regulatory consulting and product development with Intertek’s technical testing and certification services

Frequently Asked Questions (FAQ):

1. Who are the major market players covered in the report?

The key players in the medical device services market include IBM, Charles River Laboratories, and WIPRO.

2. Define the market for medical device services.

The medical device services market encompasses services supporting the entire lifecycle of medical devices, including design, regulatory compliance, testing, manufacturing, maintenance, and post-market surveillance. These services ensure device quality, safety, and regulatory adherence while driving innovation, reducing time-to-market, and improving patient outcomes for manufacturers and healthcare providers.

3. Which region is projected to account for the largest market share for medical device services?

The medical device services market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is projected to account for the largest share of the market for medical device services during the forecast period.

4. Which end-user segments have been included in the medical device services market report?

The report contains the following end-user segments:

- Medical Device Manufacturers

-

Healthcare Facilities

- Hospitals

- Clinics

- Diagnostic laboratories

- Others

- Academic institutions & Research Organizations

- Others

5. How big is the global medical device services market today?

The global medical device services market is projected to grow from USD 17.74 billion in 2024 to USD 29.09 billion by 2030, at a CAGR of 7.5%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Medical Device Services Market