Meta-aramid Fiber Market by Type (Staple, Filament, Paper), Application (Nonwoven Bagfilter, Apparel, Turbohose, Electric Insulation, Honeycomb Reinforcement), and Region (Asia Pacific, Europe, North America, MEA, South America) - Global Forecast to 2027

Updated on : November 11, 2025

Meta-aramid Fiber Market

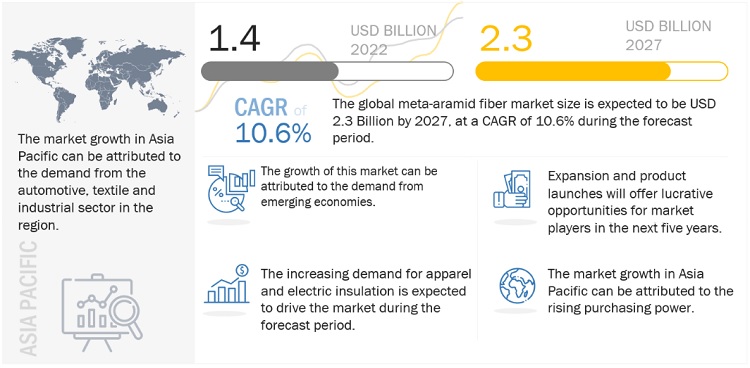

The global meta-aramid fiber market is projected to grow from USD 1.4 billion in 2022 to USD 2.3 billion by 2027, at a CAGR of 10.6%. An opportunity in the resorbable polymers market is increasing demand for meta-aramid fiber from defence sector. The rising domestic and foreign conflicts worldwide has accelerated the need for precautionary safety measures for military personnel. This is expected to drive the demand for advanced weaponry and personal protective equipment. Carbon fiber, glass fiber, ceramics, high-strength PE fiber, polyphenylene sulfide, the possible substitutes remains as the major challenges of this market. Europe is the largest market for meta-aramid fiber, globally, in terms of value. Asia Pacific is the fastest-growing region in the market.

Attractive Opportunities in the Meta-Aramid Fiber Market

To know about the assumptions considered for the study, Request for Free Sample Report

Meta-aramid Fiber Market Dynamics

Driver: Rising need for lightweight materials offering significant emission reduction in vehicles

According to the United States Environmental Protection Agency (EPA), a passenger vehicle emits around 4.7 metric tons of CO2 per year. Hence, governments worldwide are emphasizing on the need for stringent environmental regulations. The US EPA has regularly modified and enforced several norms for reducing vehicular emissions. Furthermore, the European Union (EU) has imposed stringent rules that are to be followed by manufacturers of passenger vehicles and light-duty vehicles under the EU light-duty vehicle CO2 regulation by 2020. As per the EU regulation, the target was to reduce CO2 emissions by 3.1% annually between 2017 and 2020. There is a mandatory CO2 emission standard for new passenger cars and light commercial vehicles, while a regulation on CO2 standards for heavy-duty vehicles was proposed in 2018. These stringent regulations are resulting in the reduction of emissions from vehicles, further driving the need for lightweight materials offering significant emission reduction in vehicles.

Restraints: Non-biodegradable nature of meta-aramid fibers

Although meta-aramid fibers have many desirable properties that make them useful in several applications in various industries, however, they are also harmful to the environment as they do not decompose readily, causing pollution. Waste meta-aramid fibers can cause massive landfills and blockage in drainage systems. The dust of cut meta-aramid fibers, if inhaled, can also cause respiratory problems.

Challenges: Available alternatives with similar properties

There are various types of high-performance fibers other than aramid that offer different solutions; these fibers include carbon fiber, glass fiber, ceramics, high-strength PE fiber, polyphenylene sulfide, and others. Furthermore, the non-biodegradability of meta-aramid fiber makes its usage a concern in various end-use industries. Contrarily, glass fibers offer a suitable solution of being environment-friendly and cost-effective.

Opportunities: Advancements in aramid materials manufacturing technology

Technological advancements have led to the development of advanced variants of meta-aramid fibers that exhibit higher strength bearing capacity and thermal resistance. These developments are opening up new sectors for aramid materials where they could not be applied initially due to the availability of better substitutes or high costs. New advanced material composites combine the desirable properties of meta-aramid fibers with those of other advanced materials, such as carbon fiber or ultra-high molecular weight polyurethanes (UHMWPE), to enhance the quality and performance of the composite to be used.

Meta-aramid Fiber Market Ecosystem

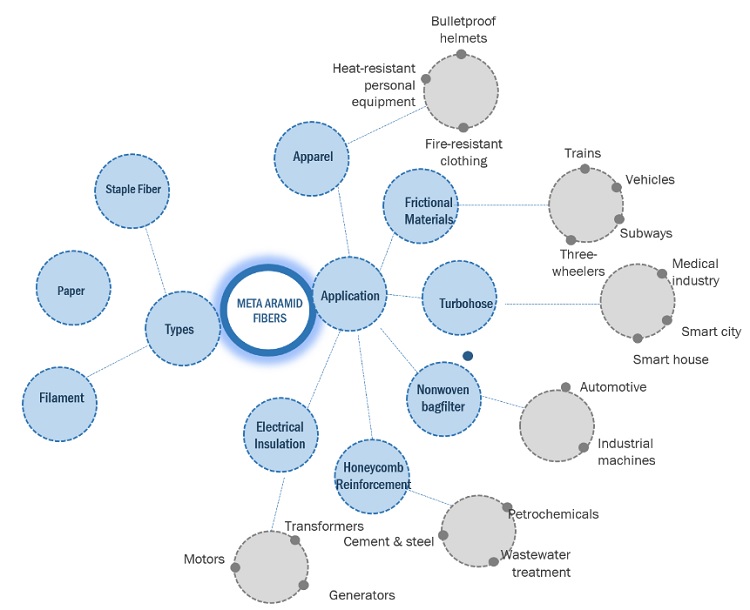

“Staple is estimated to be the largest type in the meta-aramid fiber market in 2021.”

Staple fiber is a non-continuous fiber of relatively short length. Because of its short length they have to be twisted together to form a long continuous yarn. The staple length of staple fibers range starts from about 1 cm to many cm in length. The increased demand for protective material drives the market for advanced protective clothing which in turn drives the demand for staple fibers.

“Apparel was the largest application for meta-aramid fiber market in 2021”

Meta-aramid is made from poly-meta phenylene isophalamide, offering the advantage of chemical and high-temperature resistance. Stronger meta-aramid is produced by combining it with other performance materials. Meta-aramid is primarily used for security & protection applications such as ballistics, protective clothing for firefighters, and others. They do not ignite or melt at normal oxygen level. These properties of meta-aramid make it appropriate for use in protective clothing in various end-use industries.

“Europe is estimated to be the largest region in meta-aramid fiber market in 2021.”

The automotive industry plays an important role in generating the government’s revenue and providing employment. Governments of European countries are providing huge incentives to promote electric vehicles. As a result, the demand for electric vehicles has increased tremendously in the region. The region is home to electric vehicle manufacturers such as Groupe Renault (France), Volkswagen AG (Germany), Audi AG (Germany), BMW AG (Germany), and Daimler AG (Germany), among others. Europe has set a very ambitious goal of reducing 80% CO2 emission by 2050 and has created a roadmap for the same. The governments of various countries in Europe are subsidizing electric infrastructure, and the focus will continue to be on electric vehicles in the long run.

To know about the assumptions considered for the study, download the pdf brochure

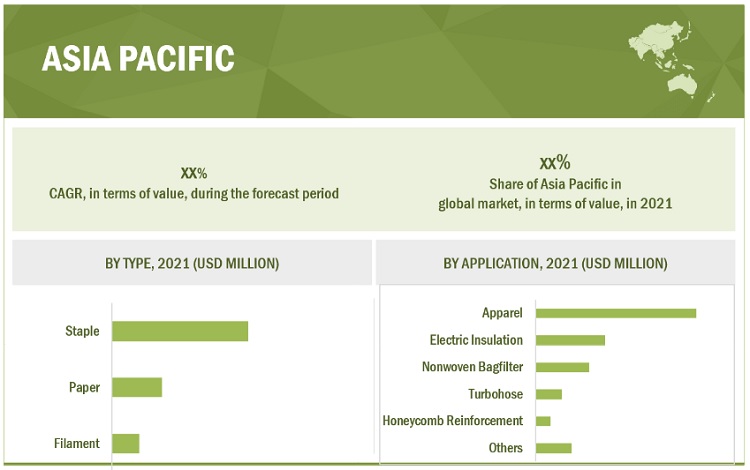

“Asia Pacific is projected to be the fastest growing meta-aramid fiber market during the forecast period, in terms of value”

Asia Pacific is an attractive meta-aramid fiber market globally and has huge growth potential in the future due to increasing demand from the industrial, construction, marine, and automotive industries. The growing population and rising standard of living mark the huge developments undergoing in the region. The increase in employment rate, rise in disposable income of the people, and an increase in foreign investments in various sectors of the economy are some of the factors that make Asia Pacific an attractive meta-aramid fiber market.

Meta-aramid Fiber Market Players

The key market players profiled in the report include Teijin Ltd. (Japan), DuPont De Numerous, Inc. (US), Yantai Tayho Advanced Materials Co., Ltd. (China), Toray Industries, Inc. (Japan), Huvis Corporation (South Korea), Kermel (France), X-FIPER New Material Co., Ltd. (China), Aramid HPM, LLC (US), Shanghai J&S New Materials Co., Ltd. (China) and Lydall Industrial Filtration (UK).

Read More: Meta-aramid Fiber Companies

Meta-aramid Fiber Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Ton); Value (USD Million/USD Billion) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Teijin Ltd. (Japan), DuPont De Numerous, Inc. (US), Yantai Tayho Advanced Materials Co., Ltd. (China), Toray Industries, Inc. (Japan), Huvis Corporation (South Korea), Kermel (France), X-FIPER New Material Co., Ltd. (China), Aramid HPM, LLC (US), Shanghai J&S New Materials Co., Ltd. (China) and Lydall Industrial Filtration (UK) |

This report categorizes the global meta-aramid fiber market based on type, application, and region.

On the basis of type, the meta-aramid fiber market has been segmented as follows:

- Staple

- Paper

- Filament

On the basis of application, the meta-aramid fiber market has been segmented as follows:

- Nonwoven Bagfilter

- Apparel

- Turbohose

- Electric Insulation

- Honeycomb Reinforcement

- Others

On the basis of region, the meta-aramid fiber market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In August 2021, Based on Teijinconex neo fibers, professional racing suits are the latest products to emerge from Teijin Aramid’s longstanding collaboration with OMP Racing, a market-leading producer of premium motorsport safety equipment.

- In February 2021, the company expanded its Teijin Aramid production capacity in the Netherlands. The company is expecting to complete the program by mid-2022, expanding its capacity by 25%. Furthermore, installing new equipment is the latest step in a multi-year program designed to increase both production capacity and sustainability at Teijin Aramid locations.

- In August 2020, Teijin Ltd. and Kinoshita Fishing Net Mfg. Co., Ltd. jointly developed the world’s first high-performance knotless fishing net made with an ultra-high molecular weight polyethylene (UHMWPE) film, Endumax.

- In June 2020, Bulwark Protection and DuPont Safety & Construction announced the iQ Series garment collection made exclusively with DuPont Nomex Comfort fabric.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of meta-aramid fiber?

Market is growing in tandem with the rise in spending on defense and national security in countries such as India, China, Singapore, Thailand, and Australia. These factors are anticipated to fuel the growth of the meta-aramid fiber market

What are the major types of meta-aramid fiber?

Staple, filament and paper

What are different type of major applications of meta-aramid fiber?

Based on application, the global meta-aramid fiber market is segmented into nonwoven bag filters, apparels, electric insulation, honeycomb reinforcement, turbo hose, and others.

What is the biggest Restraint for meta-aramid fiber?

Non-biodegradability of meta-aramid fibers.

Who are the biggest players in meta-aramid fiber market?

Teijin Ltd., DuPont De Numerous, Inc, Yantai Tayho Advanced Materials Co. Ltd., Toray Industries, Inc., Huvis Corporation and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for lightweight materials in security & protection applications- Rising need for lightweight materials to reduce emissions from vehicles- Potential substitute for steel and asbestosRESTRAINTS- High R&D cost- Non-biodegradability of meta-aramid fiberOPPORTUNITIES- Increasing demand for homeland security- Growing aerospace & defense sector- Advancement in aramid material manufacturing technologyCHALLENGES- High cost of production- Available alternatives with similar properties

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

5.6 SUPPLY CHAIN ANALYSISRAW MATERIALSMETA-ARAMID FIBER MANUFACTURERSDISTRIBUTIONAPPLICATIONS

-

5.7 META-ARAMID FIBER MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOSNON-COVID-19 SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE FOR TOP 3 APPLICATIONS, BY KEY PLAYERSAVERAGE SELLING PRICE, BY REGION

-

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND REVENUE POCKETS FOR META-ARAMID FIBER MANUFACTURERS

-

5.10 ECOSYSTEM MAPPING

-

5.11 CASE STUDY ANALYSISMETA-ARAMID FIBER USED FOR LIGHTWEIGHT PROTECTIVE RACING SUITSMETA-ARAMID FIBER USED FOR FLAME-RESISTANT COMFORT WEAR

- 5.12 TECHNOLOGY ANALYSIS

-

5.13 TRADE DATA ANALYSISIMPORT SCENARIO OF META-ARAMID FIBEREXPORT SCENARIO OF META-ARAMID FIBER

-

5.14 TARIFF AND REGULATORY LANDSCAPEGLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON META-ARAMID FIBER MARKET- REACH- EPA- NFPA

- 5.15 KEY CONFERENCES AND EVENTS, 2023

-

5.16 PATENT ANALYSISAPPROACHDOCUMENT TYPELEGAL STATUS OF PATENTSJURISDICTION ANALYSISANALYSIS OF TOP APPLICANTS

- 6.1 INTRODUCTION

-

6.2 STAPLEDEMAND FROM APPAREL APPLICATION TO PROPEL MARKET

-

6.3 PAPEREXCELLENT PROPERTIES OF PAPER TO BOOST MARKET

-

6.4 FILAMENTDEMAND FOR FIREFIGHTER APPAREL TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 NONWOVEN BAG FILTERLIMITED MAINTENANCE AND LOW OPERATIONAL COST OF NONWOVEN FABRICS TO PROPEL MARKET

-

7.3 APPARELSTRINGENT GOVERNMENT REGULATIONS FOR TEXTILE PRODUCTS IN DEVELOPED ECONOMIES TO SUPPORT MARKET

-

7.4 TURBO HOSEIMPROVED ENGINE PERFORMANCE OFFERED BY TURBOCHARGERS TO DRIVE MARKET

-

7.5 ELECTRIC INSULATIONINCREASING DEMAND FOR ELECTRIC VEHICLES TO BOOST MARKET

-

7.6 HONEYCOMB REINFORCEMENTDURABILITY AND TOUGHNESS OF META-ARAMID FIBER TO DRIVE MARKET

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVEFOCUS ON REDUCING FUEL CONSUMPTION TO DRIVE MARKET

-

8.3 AEROSPACE & DEFENSEINCREASING DEMAND FOR HIGH-PERFORMANCE MATERIALS TO BOOST MARKET

-

8.4 ELECTRICAL & ELECTRONICSABILITY TO PERFORM IN EXTREME TEMPERATURE AND PRESSURE CONDITIONS TO DRIVE DEMAND FOR META-ARAMID FIBER

-

8.5 OIL & GASINCREASING ONSHORE AND OFFSHORE DRILLING ACTIVITIES TO PROPEL MARKET

-

8.6 INDUSTRIALSTRINGENT ENVIRONMENTAL REGULATIONS TO CURB AIR POLLUTION TO DRIVE MARKET

- 8.7 OTHERS

- 9.1 INTRODUCTION

- 9.2 IMPACT OF RECESSION

-

9.3 ASIA PACIFICASIA PACIFIC: META-ARAMID FIBER MARKET, BY TYPEASIA PACIFIC: META-ARAMID FIBER MARKET, BY APPLICATIONASIA PACIFIC: META-ARAMID FIBER MARKET, BY COUNTRY- China- Japan- India- South Korea

-

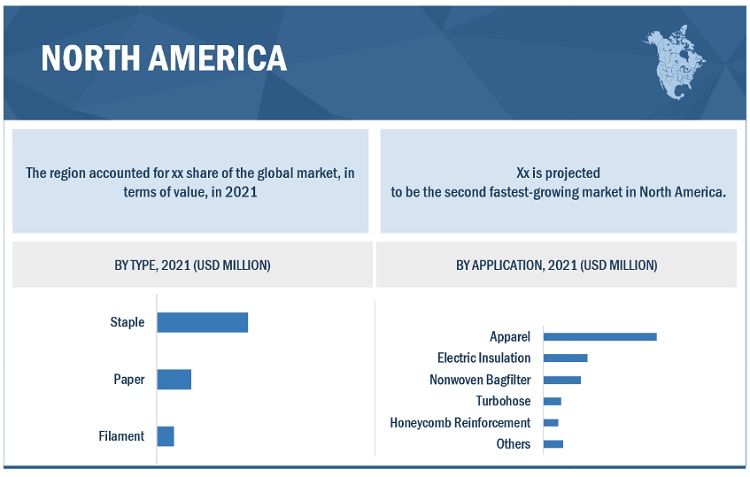

9.4 NORTH AMERICANORTH AMERICA: META-ARAMID FIBER MARKET, BY TYPENORTH AMERICA: META-ARAMID FIBER MARKET, BY APPLICATIONNORTH AMERICA: META-ARAMID FIBER MARKET, BY COUNTRY- US- Canada- Mexico

-

9.5 EUROPEEUROPE: META-ARAMID FIBER MARKET, BY TYPEEUROPE: META-ARAMID FIBER MARKET, BY APPLICATIONEUROPE: META-ARAMID FIBER MARKET, BY COUNTRY- Germany- UK- France- Spain

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET, BY TYPEMIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET, BY COUNTRY- Saudi Arabia- UAE

-

9.7 SOUTH AMERICASOUTH AMERICA: META-ARAMID FIBER MARKET, BY TYPESOUTH AMERICA: META-ARAMID FIBER MARKET, BY APPLICATIONSOUTH AMERICA: META-ARAMID FIBER MARKET, BY COUNTRY- Brazil- Argentina

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021MARKET SHARE OF KEY PLAYERS- DuPont De Nemours, Inc.- Teijin Ltd.- Yantai Tayho Advanced Materials Co., Ltd.- Toray Industries, Inc.- Huvis CorporationREVENUE ANALYSIS OF TOP 5 PLAYERS

- 10.4 COMPANY PRODUCT FOOTPRINT

-

10.5 COMPANY EVALUATION QUADRANTTERMINOLOGY/NOMENCLATURE- Stars- Emerging leaders- Pervasive players- Participants

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 START-UP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE SITUATIONS AND TRENDSDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSTEIJIN LTD.- Business overview- Products offered- Recent developments- MnM viewDUPONT DE NEMOURS, INC.- Business overview- Products offered- Recent developments- MnM viewYANTAI TAYHO ADVANCED MATERIALS CO., LTD.- Business overview- Products offered- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewHUVIS CORPORATION- Business overview- Products offered- Recent developments- MnM viewKERMEL- Business overview- Products offeredX-FIPER NEW MATERIAL CO., LTD.- Business overview- Products offered- MnM viewARAMID HPM, LLC- Business overview- Products offeredSHANGHAI J&S NEW MATERIALS CO., LTD.- Business overview- Products offeredLYDALL INDUSTRIAL FILTRATION- Business overview- Products offered

-

11.2 OTHER KEY PLAYERSYF INTERNATIONAL BVBARNET INTELLIGENT MATERIALSPRO-SYSTEMS SPALABON TECHNICAL FIBERCNV SPECIAL CHEMICAL FIBER CO., LTD.GD TEXTILES (MADURAI). PVT. LTD.COATS GROUP PLC

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 ARAMID FIBER MARKETMARKET DEFINITIONMARKET OVERVIEWARAMID FIBER MARKET, BY REGION- APAC- Europe- North America- South America- Middle East & Africa

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 META-ARAMID FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES (%)

- TABLE 3 KEY BUYING CRITERIA FOR TOP 3 TYPES

- TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2019–2027 (USD BILLION)

- TABLE 5 META-ARAMID FIBER MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

- TABLE 6 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS, BY KEY PLAYERS (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE OF META-ARAMID FIBER, BY REGION, (USD/KG)

- TABLE 8 META-ARAMID FIBER MARKET: ECOSYSTEM MAPPING

- TABLE 9 ARAMID FIBER IMPORTS, BY REGION, 2012–2021 (USD MILLION)

- TABLE 10 ARAMID FIBER EXPORTS, BY REGION, 2012–2021 (USD MILLION)

- TABLE 11 META-ARAMID FIBER MARKET: LIST OF CONFERENCES AND EVENTS, 2023

- TABLE 12 PATENTS REGISTERED BETWEEN 2011 AND 2021

- TABLE 13 TOP 7 PATENT OWNERS (US) DURING 2011–2021

- TABLE 14 META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 15 META-ARAMID FIBER MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 16 META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (TON)

- TABLE 17 META-ARAMID FIBER MARKET SIZE, BY TYPE, 2021–2027 (TON)

- TABLE 18 STAPLE META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 USD MILLION)

- TABLE 19 STAPLE: META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 20 STAPLE META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 21 STAPLE META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 22 PAPER META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 23 PAPER META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 24 PAPER META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 25 PAPER META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 26 FILAMENT META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 27 FILAMENT META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 28 FILAMENT META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 29 FILAMENT META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 30 META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 31 META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 32 META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 33 META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 34 META-ARAMID FIBER MARKET SIZE IN NONWOVEN BAG FILTER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 35 META-ARAMID FIBER MARKET SIZE IN NONWOVEN BAG FILTER APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 36 META-ARAMID FIBER MARKET SIZE IN NONWOVEN BAG FILTER APPLICATION, BY REGION, 2017–2020 (TON)

- TABLE 37 META-ARAMID FIBER MARKET SIZE IN NONWOVEN BAG FILTER APPLICATION, BY REGION, 2021–2027 (TON)

- TABLE 38 META-ARAMID FIBER MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 39 META-ARAMID FIBER MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 40 META-ARAMID FIBER MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2017–2020 (TON)

- TABLE 41 META-ARAMID FIBER MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2021–2027 (TON)

- TABLE 42 META-ARAMID FIBER MARKET SIZE IN TURBO HOSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 43 META-ARAMID FIBER MARKET SIZE IN TURBO HOSE APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 44 META-ARAMID FIBER MARKET SIZE IN TURBO HOSE APPLICATION, BY REGION, 2017–2020 (TON)

- TABLE 45 META-ARAMID FIBER MARKET SIZE IN TURBO HOSE APPLICATION, BY REGION, 2021–2027 (TON)

- TABLE 46 META-ARAMID FIBER MARKET SIZE IN ELECTRIC INSULATION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 47 META-ARAMID FIBER MARKET SIZE IN ELECTRIC INSULATION APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 48 META-ARAMID FIBER MARKET SIZE IN ELECTRIC INSULATION APPLICATION, BY REGION, 2017–2020 (TON)

- TABLE 49 META-ARAMID FIBER MARKET SIZE IN ELECTRIC INSULATION APPLICATION, BY REGION, 2021–2027 (TON)

- TABLE 50 META-ARAMID FIBER MARKET SIZE IN HONEYCOMB REINFORCEMENT APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 51 META-ARAMID FIBER MARKET SIZE IN HONEYCOMB REINFORCEMENT APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 52 META-ARAMID FIBER MARKET SIZE IN HONEYCOMB REINFORCEMENT APPLICATION, BY REGION, 2017–2020 (TON)

- TABLE 53 META-ARAMID FIBER MARKET SIZE IN HONEYCOMB REINFORCEMENT APPLICATION, BY REGION, 2021–2027 (TON)

- TABLE 54 META-ARAMID FIBER MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

- TABLE 55 META-ARAMID FIBER MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

- TABLE 56 META-ARAMID FIBER MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (TON)

- TABLE 57 META-ARAMID FIBER MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (TON)

- TABLE 58 META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 59 META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 60 META-ARAMID FIBER MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 61 META-ARAMID FIBER MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 62 ASIA PACIFIC: META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 63 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 64 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (TON)

- TABLE 65 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2027 (TON)

- TABLE 66 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 69 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 70 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 71 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 73 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 74 CHINA: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 75 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 76 CHINA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 77 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 78 JAPAN: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 79 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 80 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 81 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 82 INDIA: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 83 INDIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 84 INDIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 85 INDIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 86 SOUTH KOREA: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 87 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 88 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 89 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 90 NORTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (TON)

- TABLE 93 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (TON)

- TABLE 94 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 97 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 98 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION

- TABLE 100 NORTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 101 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 102 US: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 103 US: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 104 US: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 105 US: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 106 CANADA: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 107 CANADA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 108 CANADA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 109 CANADA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 110 MEXICO: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 111 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 112 MEXICO: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 113 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 114 EUROPE: META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 115 EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 116 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (TON)

- TABLE 117 EUROPE: MARKET SIZE, BY TYPE, 2021–2027 (TON)

- TABLE 118 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 119 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 120 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 123 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 125 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 126 GERMANY: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 127 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 128 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 129 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 130 UK: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 131 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 132 UK: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 133 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 134 FRANCE: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 135 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 136 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 137 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 138 SPAIN: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 139 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 140 SPAIN: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 141 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 142 MIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (TON)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2027 (TON)

- TABLE 146 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 149 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 150 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 153 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 154 SAUDI ARABIA: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 155 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 156 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 157 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 158 UAE: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 159 UAE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 160 UAE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 161 UAE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 162 SOUTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 163 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 164 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (TON)

- TABLE 165 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2027 (TON)

- TABLE 166 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 167 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 168 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 169 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 170 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 171 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 172 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 173 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 174 BRAZIL: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 175 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 176 BRAZIL: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 177 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 178 ARGENTINA: META-ARAMID FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 179 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 180 ARGENTINA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 181 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 182 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF META-ARAMID FIBER

- TABLE 183 META-ARAMID FIBER MARKET: DEGREE OF COMPETITION

- TABLE 184 META-ARAMID FIBER MARKET: TYPE FOOTPRINT

- TABLE 185 META-ARAMID FIBER MARKET: APPLICATION FOOTPRINT

- TABLE 186 META-ARAMID FIBER MARKET: COMPANY REGION FOOTPRINT

- TABLE 187 META-ARAMID FIBER MARKET: LIST OF KEY START-UPS/SMES

- TABLE 188 META-ARAMID FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 189 META-ARAMID FIBER MARKET: DEALS, 2018–2022

- TABLE 190 META-ARAMID FIBER MARKET: OTHER DEVELOPMENTS, 2018–2022

- TABLE 191 TEIJIN LTD.: COMPANY OVERVIEW

- TABLE 192 TEIJIN LTD: PRODUCTS OFFERED

- TABLE 193 TEIJIN LTD.: DEALS

- TABLE 194 TEIJIN LTD.: OTHER DEVELOPMENTS

- TABLE 195 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 196 DUPONT DE NEMOURS, INC.: PRODUCTS OFFERED

- TABLE 197 DUPONT DE NEMOURS, INC.: DEALS

- TABLE 198 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 199 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.: PRODUCTS OFFERED

- TABLE 200 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 201 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 202 TORAY INDUSTRIES, INC.: DEALS

- TABLE 203 HUVIS CORPORATION: COMPANY OVERVIEW

- TABLE 204 HUVIS CORPORATION: PRODUCTS OFFERED

- TABLE 205 HUVIS CORPORATION: DEALS

- TABLE 206 KERMEL: COMPANY OVERVIEW

- TABLE 207 KERMEL: PRODUCTS OFFERED

- TABLE 208 X-FIPER NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 209 X-FIPER NEW MATERIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 210 ARAMID HPM, LLC: COMPANY OVERVIEW

- TABLE 211 ARAMID HPM, LLC: PRODUCTS OFFERED

- TABLE 212 SHANGHAI J&S NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 213 SHANGHAI J&S NEW MATERIALS CO., LTD.: PRODUCTS OFFERED

- TABLE 214 LYDALL INDUSTRIAL FILTRATION: COMPANY OVERVIEW

- TABLE 215 LYDALL INDUSTRIAL FILTRATION: PRODUCTS OFFERED

- TABLE 216 YF INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 217 BARNET INTELLIGENT MATERIALS: COMPANY OVERVIEW

- TABLE 218 PRO-SYSTEMS SPA: COMPANY OVERVIEW

- TABLE 219 LABON TECHNICAL FIBER: COMPANY OVERVIEW

- TABLE 220 CNV SPECIAL CHEMICAL FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 221 GD TEXTILES (MADURAI). PVT. LTD.: COMPANY OVERVIEW

- TABLE 222 COATS GROUP PLC: COMPANY OVERVIEW

- TABLE 223 ARAMID FIBER MARKET SIZE, BY REGION, 2016–2019 (TON)

- TABLE 224 ARAMID FIBER MARKET SIZE, BY REGION, 2020–2026 (TON)

- TABLE 225 ARAMID FIBER MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

- TABLE 226 ARAMID FIBER MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

- TABLE 227 APAC: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

- TABLE 228 APAC: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

- TABLE 229 APAC: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 230 APAC: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 231 EUROPE: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

- TABLE 232 EUROPE: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

- TABLE 233 EUROPE: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 234 EUROPE: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 235 NORTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

- TABLE 236 NORTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

- TABLE 237 NORTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 238 NORTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 239 SOUTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

- TABLE 240 SOUTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

- TABLE 241 SOUTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 242 SOUTH AMERICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

- TABLE 244 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

- TABLE 245 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

- FIGURE 1 META-ARAMID FIBER MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1, BOTTOM-UP (SUPPLY SIDE), COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (TOP-DOWN)

- FIGURE 5 META-ARAMID FIBER MARKET: DATA TRIANGULATION

- FIGURE 6 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- FIGURE 7 DEMAND-SIDE MARKET GROWTH: DRIVERS AND OPPORTUNITIES

- FIGURE 8 STAPLE META-ARAMID FIBER MARKET ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 9 ELECTRIC INSULATION TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- FIGURE 10 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 11 APPAREL APPLICATION TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 APPAREL SEGMENT AND GERMANY ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 STAPLE META-ARAMID FIBER DOMINATED MARKET ACROSS REGIONS

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN META-ARAMID FIBER MARKET

- FIGURE 17 META-ARAMID FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES

- FIGURE 19 KEY BUYING CRITERIA FOR TOP 3 TYPES

- FIGURE 20 META-ARAMID FIBER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 22 AVERAGE SELLING PRICE FOR TOP 3 APPLICATIONS, BY KEY PLAYERS

- FIGURE 23 AVERAGE SELLING PRICE OF META-ARAMID FIBER, BY REGION, 2020–2027 (USD/KG)

- FIGURE 24 REVENUE SHIFTS AND REVENUE POCKETS IN META-ARAMID FIBER MARKET

- FIGURE 25 META-ARAMID FIBER MARKET: ECOSYSTEM MAPPING

- FIGURE 26 META-ARAMID FIBER IMPORTS, BY KEY COUNTRIES, 2012–2021

- FIGURE 27 META-ARAMID FIBER EXPORTS, BY KEY COUNTRIES, 2012–2021

- FIGURE 28 PATENTS REGISTERED FOR META-ARAMID FIBER, 2011–2021

- FIGURE 29 PATENT PUBLICATION TRENDS FOR META-ARAMID FIBER, 2011–2021

- FIGURE 30 LEGAL STATUS OF PATENTS FILED FOR META-ARAMID FIBER

- FIGURE 31 TOP 10 PATENT APPLICANTS

- FIGURE 32 NIKE, INC. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- FIGURE 33 STAPLE SEGMENT TO DOMINATE META-ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 34 EUROPE TO BE LARGEST STAPLE META-ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA TO BE SECOND-LARGEST PAPER META-ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING FILAMENT META-ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 37 APPAREL TO BE LARGEST APPLICATION OF META-ARAMID FIBER DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO BE FASTEST-GROWING META-ARAMID FIBER MARKET IN NONWOVEN BAG FILTER APPLICATION DURING FORECAST PERIOD

- FIGURE 39 EUROPE TO BE LARGEST META-ARAMID FIBER MARKET IN APPAREL APPLICATION DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO BE SECOND-LARGEST META-ARAMID FIBER MARKET IN TURBO HOSE APPLICATION

- FIGURE 41 NORTH AMERICA TO BE SECOND-FASTEST GROWING MARKET IN ELECTRIC INSULATION APPLICATION

- FIGURE 42 NORTH AMERICA TO BE LARGEST META-ARAMID FIBER MARKET IN HONEYCOMB REINFORCEMENT APPLICATION

- FIGURE 43 EUROPE TO BE LARGEST META-ARAMID FIBER MARKET IN OTHER APPLICATIONS DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO BE FASTEST-GROWING META-ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC: META-ARAMID FIBER MARKET SNAPSHOT

- FIGURE 46 NORTH AMERICA: META-ARAMID FIBER MARKET SNAPSHOT

- FIGURE 47 EUROPE: META-ARAMID FIBER MARKET SNAPSHOT

- FIGURE 48 RANKING OF TOP 5 PLAYERS IN META-ARAMID FIBER MARKET, 2021

- FIGURE 49 DUPONT DE NEMOURS, INC. IS LEADING PLAYER IN META-ARAMID FIBER MARKET

- FIGURE 50 REVENUE ANALYSIS FOR KEY COMPANIES, 2017–2021

- FIGURE 51 META-ARAMID FIBER MARKET: COMPANY PRODUCT FOOTPRINT

- FIGURE 52 COMPANY EVALUATION QUADRANT FOR META-ARAMID FIBER MARKET (TIER-1 PLAYERS)

- FIGURE 53 START-UP/SME EVALUATION MATRIX FOR META-ARAMID FIBER MARKET

- FIGURE 54 TEIJIN LTD.: COMPANY SNAPSHOT

- FIGURE 55 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- FIGURE 56 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

The study involved four major activities to estimate the market size for meta-aramid fiber. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

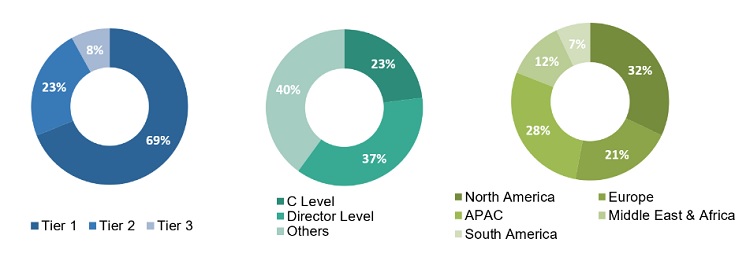

The meta-aramid fiber market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as medical sector. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Notes: Tiers of companies are based on their annual revenues as Tier 1: > USD 5 billion; Tier 2: USD 1 billion–USD 5 billion; and Tier 3: < USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the meta-aramid fiber market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the meta-aramid fiber market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the meta-aramid fiber market on the basis of type, and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, merger & acquisition, and agreement in the meta-aramid fiber market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Meta-aramid Fiber Market