Micro Injection Molded Plastic Market by Material Type (LCP, PEEK, PC, PE, POM, PMMA, PEI, PBT), Application (Medical, Automotive, Optics, Electronics), and Region (North America, Asia Pacific, Europe, MEA, South America) - Global Forecast to 2028

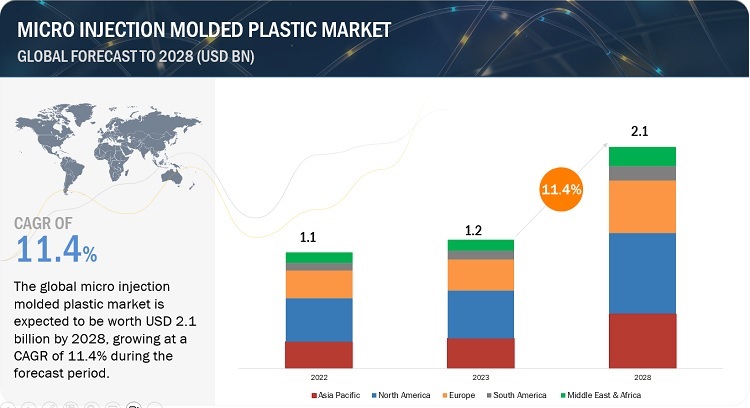

In terms of value, the micro injection molded plastics market is estimated to grow from USD 1.2 billion in 2023 to USD 2.1 billion by 2028, at a CAGR of 11.4%. Medical industry is one of the major consumer of micro injection molded plastic. Medical devices are becoming increasingly smaller and more compact, especially those used in minimally invasive procedures and implantable devices. Micro injection molding ensures consistent manufacture of small, complicated parts by offering outstanding precision and reproducibility. This skill is greatly desired for producing components like catheters, connections, valves, and surgical tools in the medical industry, where accuracy is essential.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growth in automotive sector

The demand for automotive is significantly increasing in countries like China, India, South Korea, and Japan. This is driving the demand for Micro Injection Molded Plastic Industry in automotive application. In order to improve fuel efficiency and optimize performance, the automotive industry has become more and more concerned with component size and weight reduction. Micro injection molding is appropriate for miniature automotive applications because it enables the creation of small, complicated plastic parts with great precision and reproducibility. Connectors, sensors, switches, microfluidic devices, micro-optics, and other crucial parts used in electronic systems, lighting, interior controls, safety features, are typical applications of micro injection molded plastic components in the car sector.

Restraints : High initial and maintenance cost

Micro injection molding machines are specialized pieces of machinery made for highly accurate, minimal manufacturing. Due of their sophisticated features, exact controls, and unique tooling needs, they are typically more expensive than regular injection moulding machines. The initial investment cost can be significant, especially for high-end machines with advanced capabilities. Due to its need for precise control over small amounts of material and faster cycle times, micro injection molding machines may use more energy than regular injection molding machines. All these factors can restrict the market growth.

Opportunities: Rising trend of electric vehicles

Due to their capacity to meet the needs of miniaturisation, accuracy, and functional integration, micro injection molded plastic components are widely used in electric vehicles (EVs). Consumer opinions on electric cars are changing. Consumers are warming up to the idea of electric mobility as EV technology develops. The demand for electric vehicles is rising as a result of factors like reduced running costs, quieter operation, and the availability of fashionable and high-performance electric versions. The increasing demand for electric vehicles will in turn drive the market for micro injection molded plastics.

Challenges: Requirement of skilled personnel for the operation of micro injection molding machine

Production of micro injection molded products require skilled labor due to its complex operating system. Micro injection molded plastic parts which are used in medical industry require special attention and critical process as the applications of these molded plastics is very complex. One of the major challenges faced by the manufacturers in the micro injection molded plastic market is the lack of skilled labor, especially in developed economies.

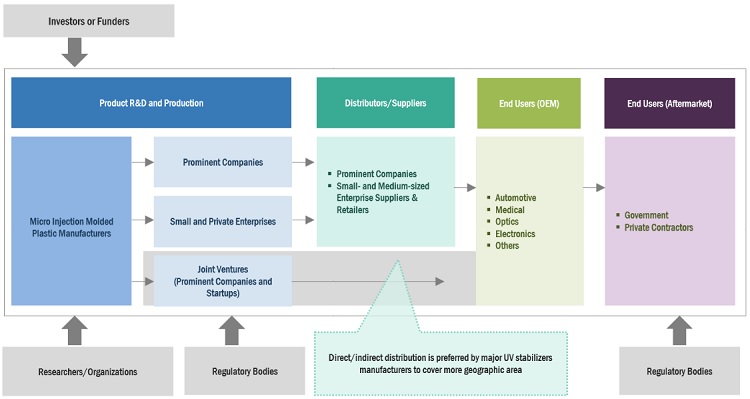

Micro injection molded plastic MARKET ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of micro injection molded plastic. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include Accumold LLC (US), Paragon Medical (US), SMC Ltd. (US), Spectrum Plastics Group, Inc. (US), Isometric Micro Molding, Inc. (US), Makuta Micro Molding (US), Precikam Inc. (Canada), MTD Micro Molding (US), among others.

Based on material type, PC was the largest segment for micro injection molded plastic market, in terms of value, in 2022.

PC accounted for the largest market share, in the micro injection molded plastic market, in terms of value, in 2022. Increasing usage of modern medical devices, micro components for electric vehicles and various components for electronics industry drives the market for PC material type. PC exhibits excellent mechanical properties, including high tensile strength and impact resistance. Due of these qualities, it can be used to create complicated and microscopic parts that need to be durable and resistant to outside influences. The strength and impact resistance of PC are especially useful in micro injection molding, where components can be exposed to higher stress concentrations.

Based on application, medical was the largest segment for micro injection molded plastic market, in terms of value, in 2022.

The medical segment led the micro injection molded plastic market in terms of value, in 2022. There is a significant demand for micro injection molded plastic in the medical industry as it is specialized in in the production of small, intricate plastic parts with high precision. Most of the medical devices and components are designed for single-use or disposable application in order to minimize the risk of contamination and infection. Micro injection molding enables cost-effective production of such disposable items. All these factors fuel the demand for micro injection molded plastic in medical industry.

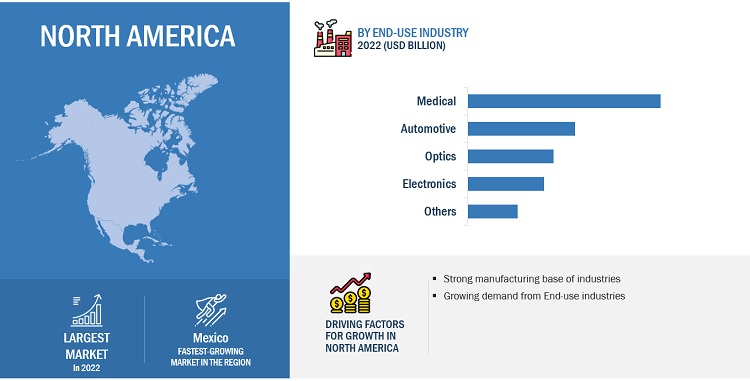

North America accounted for the largest market share for micro injection molded plastic market, in terms of value in 2022.

North American countries such as US, Canada and Mexico are home to robust medical device industry and a well-established healthcare system. The North American region is at the forefront of medical technology innovations. There is a continuous demand for smaller and more complex components used in medical devices, surgical instruments, diagnostics, and drug delivery systems. By enabling the creation of accurate and complicated parts, micro injection molding is essential in achieving these expectations. Other factors such as aging population, advancement in medical technology, regulatory standards, and strong healthcare systems drive the market demand in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players profiled in the report include Accumold LLC (US), Paragon Medical (US), SMC Ltd. (US), Spectrum Plastics Group, Inc. (US), Isometric Micro Molding, Inc. (US), Makuta Micro Molding (US), Precikam Inc. (Canada), MTD Micro Molding (US), among others, these are the key manufacturers that secured major market share in the last few years.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million) |

|

Segments covered |

Material Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include Accumold LLC (US), Paragon Medical (US), SMC Ltd. (US), Spectrum Plastics Group, Inc. (US), Isometric Micro Molding, Inc. (US), Makuta Micro Molding (US), Precikam Inc. (Canada), MTD Micro Molding (US), among others. |

This report categorizes the global micro injection molded plastic market based on type, application, and region.

On the basis of material type, the Micro injection molded plastic market has been segmented as follows:

- LCP

- PEEK

- PC

- PE

- POM

- PMMA

- PEI

- PBT

- Others

On the basis of application, the Micro injection molded plastic market has been segmented as follows:

- Automotive

- Electronics

- Medical

- Optics

- Others

On the basis of region, the Micro injection molded plastic market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In March 2023, Paragon Medical invested in innovative technologies by providing additive manufacturing capabilities through its partnership with 3D Systems.

- In September 2021, Paragon Medical Breaks Ground on New Additive Manufacturing Facility in Pierceton, US.

- In April 2021, SMC Ltd. announces expansion of its Costa Rica facility in the Coyol Free Zone Park in Alajuela, Costa Rica. The expansion will double its current facility bringing it to 120,000 square feet in Costa Rica.

- In June 2021, Company acquired KCS Plastics LTD. Based in Langley, British Columbia, KCS Plastics offers complete polyethylene packaging solutions for customers across Canada and the United States. Spectrum Plastics Group Adds Blown Films Capacity and New Capabilities with Acquisition of KCS Plastics LTD.

- In December 2020, Spectrum Plastics Group Acquires PeelMaster. The company has now increased the sterile medical flexible packaging capabilities with its acquisition of PeelMaster Medical Packaging Co

Frequently Asked Questions (FAQ):

Which are the major players in micro injection molded plastic market?

The key players profiled in the report include Accumold LLC (US), Paragon Medical (US), SMC Ltd. (US), Spectrum Plastics Group, Inc. (US), Isometric Micro Molding, Inc. (US), Makuta Micro Molding (US), Precikam Inc. (Canada), MTD Micro Molding (US), among others.

What are the drives and opportunities for the micro injection molded plastic market?

The increasing demand from automotive and medical industries are the major drives for micro injection molded plastic market. Also, the expansion in electric vehicle industry is expected to create new opportunities for the market.

What are the various strategies key players are focusing within micro injection molded plastic market?

New product launches, expansion and partnership are some of the strategies atoped by key players to expand their global presence.

What are the major factors restraining micro injection molded plastic market growth during the forecast period?

High initial and maintenance cost of micro injection molding machines is expected to restrict the market demand.

What are the major challenges faced by the manufacturers in the micro injection molded plastic market?

Requirement of skilled employees for operating micro injection molding machine can be a major challenge for the manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of automotive sector- Rising demand in medical applications- Increase in healthcare expenditure and favorable reimbursement scenarioRESTRAINTS- High maintenance cost of machinesOPPORTUNITIES- Rising trend of electric vehiclesCHALLENGES- Less economical for small production capacities- Requirement of skilled personnel

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURINGDISTRIBUTION NETWORKEND-USER INDUSTRIES

- 6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.3 ECOSYSTEM MAPPING

-

6.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.5 INDICATIVE PRICING ANALYSISINDICATIVE SELLING PRICE OF KEY PLAYERS, BY MATERIAL TYPE

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 CASE STUDY ANALYSISARBURG AND PLASTIKOSSUMITOMO AND RENYMED

-

6.8 IMPORT–EXPORT SCENARIOIMPORT SCENARIO OF MICRO INJECTION MOLDED PLASTICEXPORT SCENARIO OF MICRO INJECTION MOLDED PLASTIC

- 6.9 KEY CONFERENCES AND EVENTS, 2023

- 6.10 GLOBAL REGULATORY FRAMEWORK

-

6.11 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 LIQUID CRYSTAL POLYMERSINCREASING CONSUMPTION IN AUTOMOTIVE AND ELECTRONICS SECTORS

-

7.3 POLYETHER ETHER KETONEHIGH DEMAND FROM MEDICAL INDUSTRY

-

7.4 POLYCARBONATEGOOD THERMAL RESISTANCE AND HIGH VISCOSITY

-

7.5 POLYETHYLENEWIDELY USED IN FABRICATION AND PACKAGING

-

7.6 POLYOXYMETHYLENEHIGH DEMAND IN AUTOMOTIVE AND INDUSTRIAL SECTORS

-

7.7 POLYMETHYL METHACRYLATEDIVERSE APPLICATIONS IN VARIOUS INDUSTRIES

-

7.8 POLYETHERIMIDEINCREASING CONSUMPTION IN BIOMEDICAL APPLICATIONS

-

7.9 POLYBUTYLENE TEREPHTHALATEHIGH DEMAND IN ELECTRONICS INDUSTRY

- 7.10 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 MEDICALUSE OF MOLDED PLASTIC IN MINIATURIZATION AND NANOTECHNOLOGY

-

8.3 AUTOMOTIVERISING DEMAND FOR MICRO MOLDS IN COMPLEX VEHICLES

-

8.4 OPTICSINCREASING USE OF MOLDED COMPONENTS IN ADVANCED WEARABLE DEVICES

-

8.5 ELECTRONICSUSE OF HIGH-PRECISION THERMOPLASTIC IN MICROELECTRONICS

- 8.6 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACT ON NORTH AMERICANORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPENORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATIONNORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY- US- Canada- Mexico

-

9.3 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPEASIA PACIFIC: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATIONASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY- China- Japan- India

-

9.4 EUROPERECESSION IMPACT ON EUROPEEUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPEEUROPE: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATIONEUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY- Germany- France- UK

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPEMIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY- Saudi Arabia- South Africa

-

9.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICASOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPESOUTH AMERICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATIONSOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY- Brazil- Argentina

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 RANKING OF KEY MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 REVENUE ANALYSIS OF KEY COMPANIES

- 10.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.7 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.8 COMPETITIVE BENCHMARKING

-

10.9 STARTUP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.10 COMPETITIVE SCENARIO AND TRENDSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSACCUMOLD LLC- Business overview- Products/Solutions/Services offered- MnM viewPARAGON MEDICAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSMC LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSPECTRUM PLASTICS GROUP, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewISOMETRIC MICRO MOLDING, INC.- Business overview- Products/Solutions/Services offered- MnM viewMAKUTA MICRO MOLDING- Business overview- Products/Solutions/Services offered- MnM viewPRECIKAM INC.- Business overview- Products/Solutions/Services offered- MnM viewMTD MICRO MOLDING- Business overview- Products/Solutions/Services offered- Recent developmentsMICRO MOLDING INC.- Business overview- Products/Solutions/Services offeredMICRODYNE PLASTICS, INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSOTTO MÄNNER GMBH - BARNES GROUP INC.POLYMERMEDICS LTD.MIKROTECHSOVRIN PLASTICSSTACK PLASTICSAMERICAN PRECISION PRODUCTSD&M PLASTICS, LLCKNIGHTSBRIDGE PLASTICS INC.VEEJAY PLASTIC INJECTION MOLDING COMPANYMICROSYSTEMS UKMATRIX PLASTIC PRODUCTSYOMURA TECHNOLOGIES, INC.

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 PLASTIC INJECTION MOLDING MACHINE MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGIONNORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICASOUTH AMERICA

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 MICRO INJECTION MOLDED PLASTIC MARKET: RISK ASSESSMENT

- TABLE 2 HEALTH EXPENDITURE (% OF GDP), BY COUNTRY, 2014–2019

- TABLE 3 KEY AUTOMAKERS ANNOUNCEMENTS FOR ELECTRIC VEHICLES

- TABLE 4 MICRO INJECTION MOLDED PLASTIC MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 6 MICRO INJECTION MOLDED PLASTIC MARKET: ECOSYSTEM

- TABLE 7 IMPACT ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 8 KEY BUYING CRITERIA

- TABLE 9 INDICATIVE SELLING PRICE OF KEY PLAYERS FOR TOP THREE MATERIAL TYPES (USD)

- TABLE 10 IMPORT OF MICRO INJECTION MOLDED PLASTIC, BY REGION, 2013–2021 (USD MILLION)

- TABLE 11 EXPORT OF MICRO INJECTION MOLDED PLASTIC, BY REGION, 2013–2021 (USD MILLION)

- TABLE 12 MICRO INJECTION MOLDED PLASTIC MARKET: KEY CONFERENCES AND EVENTS

- TABLE 13 REGULATORY BODIES GOVERNING MICRO INJECTION MOLDED PLASTIC

- TABLE 14 REGULATIONS GOVERNING MICRO INJECTION MOLDED PLASTIC

- TABLE 15 GRANTED PATENTS ACCOUNTED FOR HIGHEST PATENT COUNT (2012–2022)

- TABLE 16 RECENT PATENTS BY DOW INC.

- TABLE 17 RECENT PATENTS BY BRISTOL MYERS SQUIBB

- TABLE 18 TOP 10 PATENT OWNERS IN US (2012–2022)

- TABLE 19 MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017–2021 (USD MILLION)

- TABLE 20 MICRO INJECTION MOLDED PLASTICS MARKET, BY MATERIAL TYPE, 2022–2028 (USD MILLION)

- TABLE 21 LCP: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 22 LCP: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 23 PEEK: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 24 PEEK: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 25 PC: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 26 PC: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 27 PE: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 28 PE: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 29 POM: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 30 POM: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 31 PMMA: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 32 PMMA: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 33 PEI: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 34 PEI: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 35 PBT: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 PBT: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 37 OTHER TYPES: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 38 OTHER TYPES: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 39 MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 40 MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 41 MEDICAL: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 42 MEDICAL: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 43 AUTOMOTIVE: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 AUTOMOTIVE: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 45 OPTICS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 46 OPTICS: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 47 ELECTRONICS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 48 ELECTRONICS: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 49 OTHER APPLICATIONS: MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 50 OTHER APPLICATIONS: MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 51 MICRO INJECTION MOLDED PLASTIC MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 52 MICRO INJECTION MOLDED PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017–2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY MATERIAL TYPE, 2022–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 59 US: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 60 US: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 61 CANADA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 62 CANADA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 63 MEXICO: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 64 MEXICO: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017–2021 (USD MILLION)

- TABLE 66 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTICS MARKET, BY MATERIAL TYPE, 2022–2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 71 CHINA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 72 CHINA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 73 JAPAN: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 74 JAPAN: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 75 INDIA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 76 INDIA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 77 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017–2021 (USD MILLION)

- TABLE 78 EUROPE: MICRO INJECTION MOLDED PLASTICS MARKET, BY MATERIAL TYPE, 2022–2028 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 83 GERMANY: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 84 GERMANY: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 85 FRANCE: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 86 FRANCE: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 87 UK: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 88 UK: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017–2021 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY MATERIAL TYPE, 2022–2028 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 95 SAUDI ARABIA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 96 SAUDI ARABIA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 97 SOUTH AFRICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 98 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 99 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET, BY MATERIAL TYPE, 2017–2021 (USD MILLION)

- TABLE 100 SOUTH AMERICA: MICRO INJECTION MOLDED PLASTICS MARKET, BY MATERIAL TYPE, 2022–2028 (USD MILLION)

- TABLE 101 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 102 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 103 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 104 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 105 BRAZIL: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 106 BRAZIL: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 107 ARGENTINA: MICRO INJECTION MOLDED PLASTIC MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 108 ARGENTINA: MICRO INJECTION MOLDED PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 109 MICRO INJECTION MOLDED PLASTIC MARKET: STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 110 MICRO INJECTION MOLDED PLASTICS MARKET: DEGREE OF COMPETITION

- TABLE 111 MICRO INJECTION MOLDED PLASTIC MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 112 MICRO INJECTION MOLDED PLASTICS MARKET: APPLICATION FOOTPRINT

- TABLE 113 MICRO INJECTION MOLDED PLASTIC MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 114 MICRO INJECTION MOLDED PLASTICS MARKET: KEY STARTUPS/SMES

- TABLE 115 MICRO INJECTION MOLDED PLASTIC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 116 MICRO INJECTION MOLDED PLASTICS MARKET: DEALS (2019–2023)

- TABLE 117 MICRO INJECTION MOLDED PLASTIC MARKET: OTHER DEVELOPMENTS (2019–2023)

- TABLE 118 ACCUMOLD LLC: COMPANY OVERVIEW

- TABLE 119 PARAGON MEDICAL: COMPANY OVERVIEW

- TABLE 120 SMC LTD.: COMPANY OVERVIEW

- TABLE 121 SPECTRUM PLASTICS GROUP, INC.: COMPANY OVERVIEW

- TABLE 122 ISOMETRIC MICRO MOLDING, INC.: COMPANY OVERVIEW

- TABLE 123 MAKUTA MICRO MOLDING: COMPANY OVERVIEW

- TABLE 124 PRECIKAM INC.: COMPANY OVERVIEW

- TABLE 125 MTD MICRO MOLDING: COMPANY OVERVIEW

- TABLE 126 MICRO MOLDING INC.: COMPANY OVERVIEW

- TABLE 127 MICRODYNE PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 128 OTTO MÄNNER GMBH - BARNES GROUP INC.: COMPANY OVERVIEW

- TABLE 129 POLYMERMEDICS LTD.: COMPANY OVERVIEW

- TABLE 130 MIKROTECH: COMPANY OVERVIEW

- TABLE 131 SOVRIN PLASTICS: COMPANY OVERVIEW

- TABLE 132 STACK PLASTICS: COMPANY OVERVIEW

- TABLE 133 AMERICAN PRECISION PRODUCTS: COMPANY OVERVIEW

- TABLE 134 D&M PLASTICS, LLC: COMPANY OVERVIEW

- TABLE 135 KNIGHTSBRIDGE PLASTICS INC.: COMPANY OVERVIEW

- TABLE 136 VEEJAY PLASTIC INJECTION MOLDING COMPANY: COMPANY OVERVIEW

- TABLE 137 MICROSYSTEMS UK: COMPANY OVERVIEW

- TABLE 138 MATRIX PLASTIC PRODUCTS: COMPANY OVERVIEW

- TABLE 139 YOMURA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 140 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 141 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 142 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2016–2019 (UNITS)

- TABLE 143 PLASTIC INJECTION MOLDING MACHINE MARKET, BY REGION, 2020–2025 (UNITS)

- TABLE 144 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 145 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 146 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (UNITS)

- TABLE 147 NORTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (UNITS)

- TABLE 148 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 149 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 150 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (UNITS)

- TABLE 151 EUROPE: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (UNITS)

- TABLE 152 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 153 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 154 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (UNITS)

- TABLE 155 ASIA PACIFIC: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (UNITS)

- TABLE 156 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (UNITS)

- TABLE 159 MIDDLE EAST & AFRICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (UNITS)

- TABLE 160 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 162 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2016–2019 (UNITS)

- TABLE 163 SOUTH AMERICA: PLASTIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY, 2020–2025 (UNITS)

- FIGURE 1 MICRO INJECTION MOLDED PLASTIC MARKET SEGMENTATION

- FIGURE 2 MICRO INJECTION MOLDED PLASTIC MARKET: RESEARCH DESIGN

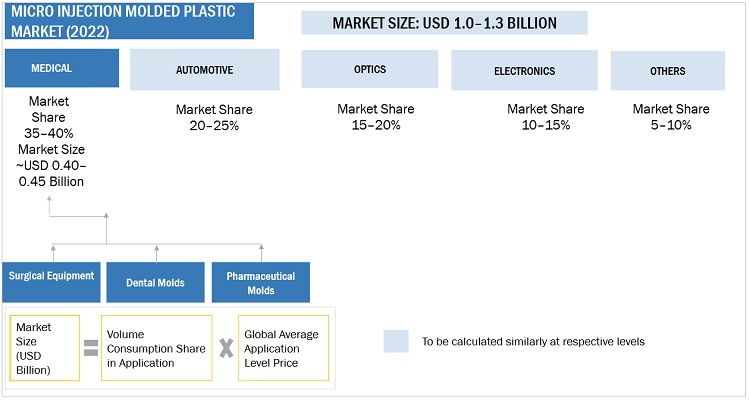

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY-SIDE): PRODUCT REVENUE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 BOTTOM-UP (DEMAND-SIDE): APPLICATIONS SERVED

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 TOP-DOWN

- FIGURE 7 MICRO INJECTION MOLDED PLASTIC MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET GROWTH PROJECTIONS (SUPPLY-SIDE)

- FIGURE 9 MARKET GROWTH PROJECTIONS (DEMAND-SIDE)

- FIGURE 10 PC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 MEDICAL SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR HIGHEST CAGR IN 2022

- FIGURE 13 HIGH DEMAND FOR MOLDED PLASTIC FROM EMERGING ECONOMIES TO DRIVE MARKET

- FIGURE 14 NORTH AMERICA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 US AND PC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 16 MEDICAL APPLICATION TO DOMINATE MARKET ACROSS REGIONS DURING FORECAST PERIOD

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MICRO INJECTION MOLDED PLASTIC MARKET

- FIGURE 19 CAR PRODUCTION, BY COUNTRY, 2022 (MILLION UNITS)

- FIGURE 20 MICRO INJECTION MOLDED PLASTIC MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 SUPPLY CHAIN OF MICRO INJECTION MOLDED PLASTICS MARKET

- FIGURE 22 REVENUE SHIFT FOR MICRO INJECTION MOLDED PLASTIC MARKET

- FIGURE 23 MICRO INJECTION MOLDED PLASTIC MARKET: ECOSYSTEM MAP

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 26 INDICATIVE SELLING PRICE OF KEY PLAYERS FOR TOP THREE MATERIAL TYPES

- FIGURE 27 MICRO INJECTION MOLDED PLASTIC IMPORT, BY KEY COUNTRY, 2013–2021

- FIGURE 28 MICRO INJECTION MOLDED PLASTIC EXPORT, BY KEY COUNTRY, 2013–2021

- FIGURE 29 PATENTS REGISTERED FOR MICRO INJECTION MOLDED PLASTIC (2012–2022)

- FIGURE 30 PATENT PUBLICATION TRENDS FOR MICRO INJECTION MOLDED PLASTIC (2012–2022)

- FIGURE 31 LEGAL STATUS OF MICRO INJECTION MOLDED PLASTIC PATENTS

- FIGURE 32 MAXIMUM PATENTS FILED BY COMPANIES IN US

- FIGURE 33 DOW INC. REGISTERED HIGHEST NUMBER OF PATENTS (2012–2022)

- FIGURE 34 PEEK TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MEDICAL APPLICATION TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR MICRO INJECTION MOLDED PLASTIC DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: MICRO INJECTION MOLDED PLASTIC MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MICRO INJECTION MOLDED PLASTIC MARKET SNAPSHOT

- FIGURE 39 EUROPE: MICRO INJECTION MOLDED PLASTIC MARKET SNAPSHOT

- FIGURE 40 RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 41 ACCUMOLD LLC LED MICRO INJECTION MOLDED PLASTIC MARKET IN 2022

- FIGURE 42 REVENUE ANALYSIS OF KEY COMPANIES DURING LAST FIVE YEARS

- FIGURE 43 MICRO INJECTION MOLDED PLASTIC MARKET: COMPANY FOOTPRINT

- FIGURE 44 COMPANY EVALUATION QUADRANT FOR MICRO INJECTION MOLDED PLASTIC (TIER 1)

- FIGURE 45 STARTUP/SME EVALUATION QUADRANT FOR MICRO INJECTION MOLDED PLASTIC MARKET

The study involved four major activities in estimating the market size for micro injection molded plastic. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

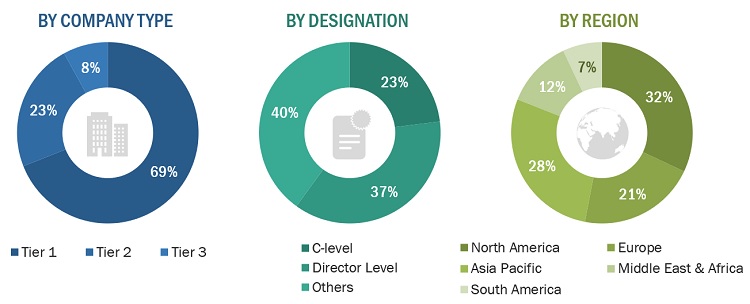

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Micro Injection Molded Plastic Industry comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, medical, electronics, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Accumold LLC |

Director of Marketing |

|

Paragon Medical |

Manager- Sales & Marketing |

|

SMC Ltd. |

Sales Manager |

|

Spectrum Plastics Group, Inc. |

Production Manager |

|

Isometric Micro Molding Inc. |

Operation Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Micro injection molded plastic market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Micro injection molded plastic Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Micro injection molded plastic Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the micro injection molded plastic industry.

Market Definition

Micro injection molded plastics refer to small plastic components or parts that are manufactured using the micro injection molding process. Micro injection molding is a specialized form of injection molding that is capable of producing highly precise and intricate parts with extremely small dimensions. LCP, PEEK, PC, PE, POM, PMMA, PEI, PBT, and others are the major material types of micro injection molded plastics.

Key Stakeholders

- Micro injection molded plastic manufacturers

- Micro injection molded plastic suppliers

- Raw material suppliers

- Service providers

- End users, such as automotive, electronics, and other companies

- Government bodies

Report Objectives

- To define, describe, and forecast the micro injection molded plastic market in terms of value

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by material type, application, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro Injection Molded Plastic Market