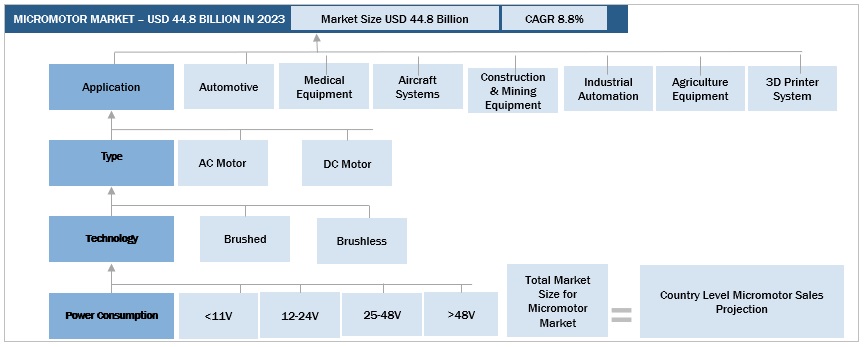

Micromotor Market by Application (Automotive, Medical Equipment System, Industrial Automation, Construction & Mining Equipment, Agriculture Equipment System), Type, Technology, Power Consumption & Region - Global Forecast to 2028

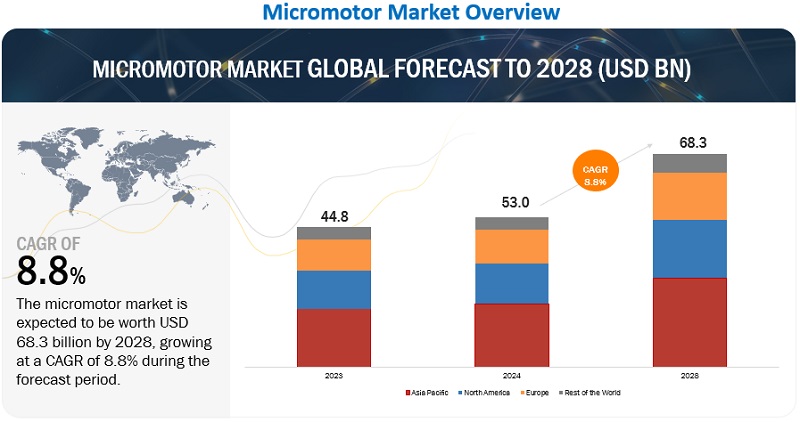

[248 Pages Report] The micromotor market is projected to grow from USD 44.8 billion in 2023 to USD 68.3 billion by 2028, at a CAGR of 8.8% during the forecast period. The micromotor market is being propelled by a range of factors, such as the desire for miniaturization of devices, the upsurge in demand for medical implants, the advancement of manufacturing technology, the augmented adoption of automation and robotics, and the escalating demand for electric vehicles. The growth of the market is predicted to persist in the future due to the increasing demand for motors that are smaller, more efficient, and more precise. Additionally, with technology advancement and the availability of cost-effective manufacturing techniques, micromotors have become more extensively available and affordable, making them ideal for diverse applications in numerous industries.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Growing trend of industrial automation

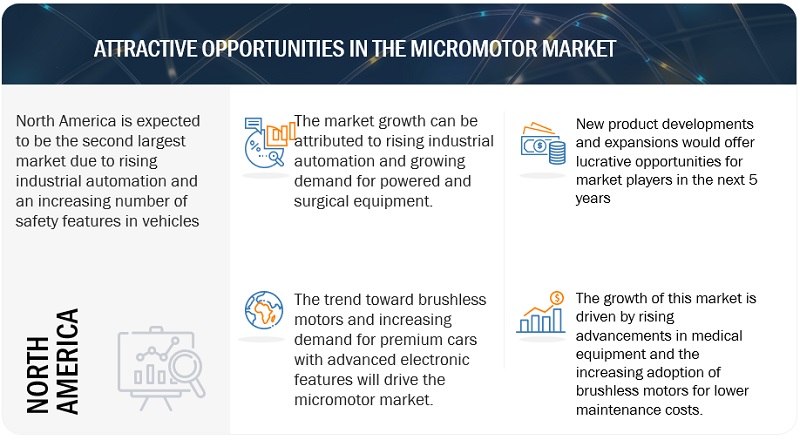

The demand for micromotors is being driven by the increasing trend of automation in different industrial processes. To stay competitive in the market, manufacturing industries are focusing on optimizing resources, reducing waste, and increasing productivity. Industrial control and factory automation have become imperative for industries with low profitability, such as oil & gas, metal, and packaging. The automotive industry also requires precise assembly to avoid manufacturing defects that result in enormous losses. To achieve this, factory automation devices and equipment such as 5-axis CNC systems, automated testing probes, custom conveyor belts, pick-and-place machines, and robotic welding require numerous micromotors. The use of factory automation is mostly seen in the manufacturing industry to ensure quick turnaround and precise assembly. Many countries, including the US, Germany, China, Italy, and South Korea, have high levels of factory automation. The trend towards automation in different industrial processes is expected to drive the demand for micromotors in the forecast period, as they provide the speed, precision, and control required for modern manufacturing processes.

RESTRAINT: High cost of advanced technologies and services in micromotor production.

Producing micromotors involves using advanced technologies and specialized manufacturing processes that can be costly to develop and maintain. The industry also requires the use of advanced materials, which further increases the costs. Besides, the demand for micromotors is often small compared to other industrial products, making it challenging to achieve economies of scale and keep costs low. This is especially true for specialized micromotors that cater to niche applications, where significant customization and development are necessary, leading to even higher costs.

OPPORTUNITY: Rising advancements in medical equipment

The micromotor market is driven by several factors, including the increasing technological advancements in medical equipment. With the growing rates of chronic diseases and healthcare costs, there is a growing demand for advanced medical devices that are more precise and accurate. Micromotors play a crucial role in meeting this demand since they are used in various medical devices, such as surgical robots, implantable technology, dental handpieces, and diagnostic tools. Furthermore, the ability to incorporate micromotors into compact and portable medical devices has also contributed to their growing demand in the medical sector. For example, dental clinics have developed miniaturized and lightweight motors that can be easily carried around. Dental micromotors, which are low-speed motors connected to handpieces, contra-angles, and hose pieces, have made treating teeth easier and more efficient.

CHALLENGE: Availability of inferior products in local markets at lower prices

Organized suppliers are increasingly concerned about the availability of low-quality, locally made micromotors in the market. Although these micromotors are cheaper, they may not meet the required OEM specifications and can lead to various issues such as reduced durability, inferior performance, and even potential health risks. As the Asian region, particularly China, is the largest producer of such micromotors, it raises concerns about fraudulent manufacturing practices such as replicating patented or copyrighted products, altering the original product, or misrepresenting its properties. This situation poses a significant challenge to the micro motor market, impacting its share and profitability. To overcome this challenge, micromotor manufacturers can establish strategic partnerships with OEMs and other end-use industry players. These partnerships can include agreements on delivery schedules, pricing, and quality control measures to ensure that the micromotors meet OEMs' requirements. Additionally, major micromotor manufacturers can collaborate with regional administrations and business associations to create policies and initiatives that promote the growth of regional motor manufacturing sectors. This can help reduce reliance on imports and increase the availability of motors in local markets while maintaining quality standards.

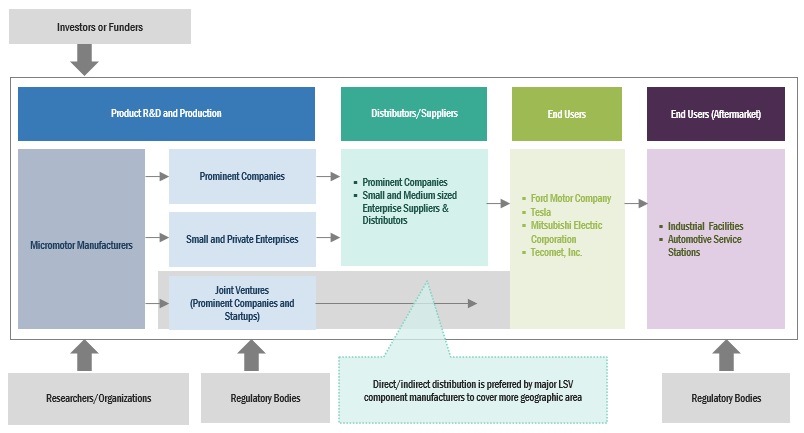

Micromotor Market Ecosystem.

The major players of the micromotor market have latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the market are MITSUBA Corporation (Japan), Nidec Corporation (Japan), Johnson Electric Holdings Limited (China), Mabuchi Motor Co., Ltd. (Japan), Maxon (Switzerland) and Constar Micromotor Co., Ltd. (China).

AC type motor segment is predicted to be the fastest growing in the micromotor market

The micromotor segment is expected to experience a surge in demand for AC type motors, primarily due to their superior performance and energy efficiency. Compared to DC motors, AC motors have a simpler design and fewer moving parts, making them more dependable and long-lasting. Moreover, AC motors can operate at higher speeds and with lower power consumption, which is critical for applications that require accurate control and minimal energy usage. They are also better suited for use in industrial and commercial settings, such as compressors, pumps, and HVAC systems, where they can provide efficient and consistent operation. Consequently, the demand for AC micromotors is predicted to increase in the foreseeable future, fueled by the growing adoption of sophisticated automation and control systems across various industries.

>48V power consumtion segment to be the fastest growing segment in the micromotor market

Micromotors that operate at voltages higher than 48 volts are expected to see a surge in demand in the coming years. These micromotors are utilized in applications that require high power output, energy efficiency, precision, durability, and other advanced features. They are frequently employed in heavy-duty industrial machinery, such as conveyors, cranes, and large-scale manufacturing equipment, where high power and durability are critical. Furthermore, micromotors with more than 48 volts are increasingly utilized in the aerospace industry, including aircraft actuation systems, missile guidance systems, and unmanned aerial vehicles (UAVs), where high speed, precision, and reliability are essential. They are also used in aircraft flap and landing gear systems, where high torque and sustainability are critical.

Portable Devices is expected to be lead the medical equipment system segment for micromotors, by application.

The healthcare industry has undergone a significant transformation through the development of portable medical devices, which allow medical professionals to provide high-quality care beyond conventional medical settings. These devices have the potential to reduce hospitalization rates and improve patient outcomes by facilitating early disease detection and reducing healthcare costs. Micromotors have revolutionized surgical procedures, allowing surgeons to control surgical instruments with greater precision, resulting in less invasive and more effective procedures. Portable medical devices are compact and easy-to-use medical instruments and equipment that can be transported and used in various settings, such as ambulances, clinics, homes, and remote locations. Micromotors are increasingly being used in portable medical devices for drug delivery, surgery, and diagnostics.

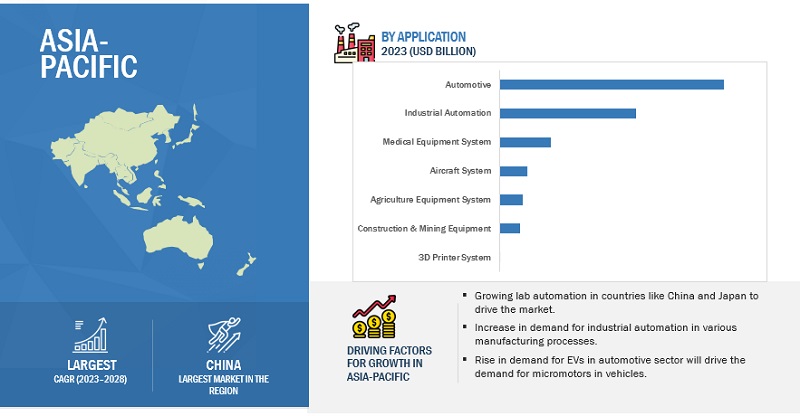

Asia Pacific is the largest market for micromotors.

Asia Pacific is the largest market for micromotors, where China, India and Japan lead with market demand with nearly 78% in 2023. The leading market position of these countries in Asia Pacific is mainly due to higher demand coming from increasing automation in industrial processes, growth of medical equipment production, rise in and automobile sales. Other countries, such as South Korea, Singapore and Thailand, are experiencing increased demand in recent years. Furthermore, the rising adoption of Industry 4.0 and automation is driving the demand for micromotors in the region. The increasing adoption of automation and robotics in industries such as automotive, electronics, and manufacturing is leading to a rise in demand for efficient and precise micromotors. The region is also witnessing a growing demand for electric vehicles, which is driving the demand for micromotors.

Some of the major players are MITSUBA Corporation (Japan), Nidec Corporation (Japan), Johnson Electric Holdings Limited (China), Mabuchi Motor Co., Ltd. (Japan), DENSO Coporation (Japan) and Constar Micromotor Co., Ltd. (China)

Key Market Players

The micrmotor market is moderately fragmented market. MITSUBA Corporation (Japan), Nidec Corporation (Japan), Johnson Electric Holdings Limited (China), Mabuchi Motor Co., Ltd. (Japan), Maxon (Switzerland) and Constar Micromotor Co., Ltd. (China) are the key companies operating in the micromotor market.

These companies adopted new product launches, partnerships, and joint ventures to gain traction in the micromotor market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Volume (Million Units) and Value (USD Million/Billion) |

|

Segments covered |

By application, type, technology, power consumption and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World |

|

Companies covered |

MITSUBA Corporation (Japan), Nidec Corporation (Japan), Johnson Electric Holdings Limited (China), Mabuchi Motor Co., Ltd. (Japan), Maxon (Switzerland) and Constar Micromotor Co., Ltd. (China) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

The study segments the micromotor market:

By Application

- Automotive

- Medical Equipment System

- Industrial Automation

- Aircraft Systems

- Construction & Mining

- Agriculture Equipment System

- 3D Printer System

By Type

- AC Motor

- DC Motor

By Technology

- Brushed

- Brushless

By Power Consumption

- <11V

- 12–24V

- 25-48V

- >48 KW

By Region

- Asia Pacific

- North America

- Europe

- Rest of the World

Recent Developments

- In February 2023, Mabuchi Motor Co., Ltd. launched a new range of DC brushless motors with features like an enhanced lineup, waterproof structure, and reduced vibrations. These motors can be used in speed reducers, electromagnetic brakes, and drive units.

- In December 2022, Nidec Corporation launched a single-phase brushless DC motor for electric fans. This newly developed motor costs less than traditional three-phase brushless DC motors while offering high energy efficiency, controllability, and other benefits.

- In August 2022, Johnson Electric Holdings Limited launched a steering wheel adjuster motor, which allows a comfortable drive experience for drivers with an appropriate driving posture. This automatic steering wheel adjuster motor offers optimum linear and height adjustments. The “intelligent mode,” which features “welcome mode” and “one-button switching mode,” helps the driver achieve the most comfortable driving posture.

- In March 2022, Nidec Corporation developed Slider, a thin linear vibration motor used in smartphones and smartwatches. The vibrations are used to notify users about incoming messages or calls on the device.

- In August 2021, Johnson Electric Holdings Limited launched the ECI-040 brushless DC motor platform. The product accepts direct mains AC power through the controller as input to simplify integration. The electronically commutated motor also offers better controllability, greater reliability, greater efficiency, and reduced noise. The motor offers strong and consistent torque output that is suitable for a variety of applications, such as window shutters, intelligent furniture, and coffee makers.

Frequently Asked Questions (FAQ):

What is the current size of the global micromotor market?

The micromotor market is projected to grow from USD 44.8 billion in 2023 to USD 68.3 billion by 2028, at a CAGR of 8.8%.

Which application type is currently leading the micromotor market?

Industrial Automation application type is leading in the micromotor market.

Many companies are operating in the micromotor market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The micrmotor market is moderately fragmented market. MITSUBA Corporation (Japan), Nidec Corporation (Japan), Johnson Electric Holdings Limited (China), Mabuchi Motor Co., Ltd. (Japan), Maxon (Switzerland) and Constar Micromotor Co., Ltd. (China) are the key companies operating in the micromotor market.

How is the demand for a micromotor varies by region?

Asia Pacifc is estimated to be the largest market for the micromotor during the forecast period, followed by North America. The growth of the micromotor market in Asia Pacific is mainly attributed to the higher demand from the China, Japan and India.

What are the growth opportunities for the micromotor supplier?

Advancements in medical equipment, rise in automation, growth of aerospace industry, and increase of EV demand would create growth opportunities for the micromotor market. Also, the development of brushless DC motors technology in micromotor can create growth opportunities for the micromotor market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing trend of industrial automation- Increasing number of safety and comfort features in vehiclesRESTRAINTS- High cost of advanced technologies and services in micromotor productionOPPORTUNITIES- Rising advancements in medical equipment- Increasing adoption of brushless motors for low maintenanceCHALLENGES- Availability of inferior products in local markets at lower prices

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 RECESSION IMPACT ON MICROMOTOR MARKETINTRODUCTIONREGIONAL MACROECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC OUTLOOK/PROJECTIONS

-

5.5 IMPACT ON AUTOMOTIVE SECTORANALYSIS OF AUTOMOTIVE VEHICLE SALES- Europe- Asia Pacific- AmericasAUTOMOTIVE SALES OUTLOOK

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM

-

5.8 TRADE ANALYSISIMPORT DATA- US: Imports share- Canada: Imports share- China: Imports share- Japan: Imports share- India: Imports share- Germany: Imports share- France: Imports shareEXPORT DATA- US: Exports share- Canada: Exports share- China: Exports share- Japan: Exports share- India: Exports share- Germany: Exports share- France: Exports share

-

5.9 TECHNOLOGY ANALYSISGROWING TREND OF MINIATURE BRUSHLESS DC MOTORSDEVELOPMENT OF SHAPE MEMORY ALLOY (SMA) MICROMOTORSIOT IN AUTOMOTIVE MICROMOTOR SYSTEMS

-

6.1 INTRODUCTIONPRIMARY INSIGHTS

-

6.2 POWER WINDOWSRISE IN DEMAND FOR ELECTRONICALLY CONTROLLED WINDOWS IN AUTOMOBILES TO PROMOTE MARKET GROWTH

-

6.3 POWER MIRRORSINCREASING NEED FOR CONVENIENCE FEATURES IN VEHICLES TO DRIVE MARKET

-

6.4 WIPER MOTORSNEED FOR BETTER GLASS VISION TO DRIVE DEMAND FOR MICROMOTORS IN WIPERS

-

6.5 INFOTAINMENT SYSTEMSDEMAND FOR ADVANCED ENTERTAINMENT FEATURES TO PROMOTE USE OF MICROMOTORS IN INFOTAINMENT SYSTEMS

-

6.6 LIGHTINGINCREASED DEMAND FOR BETTER NIGHT VISION TO PROMOTE USE OF MICROMOTORS IN ELECTRONICALLY CONTROLLED HEADLAMPS

-

6.7 DOOR LOCKSNEED FOR ENHANCED VEHICLE SAFETY TO PROMOTE USE OF MICROMOTORS IN VEHICLE DOOR LOCKS

-

6.8 HVACDEMAND FOR BETTER HEAT MANAGEMENT FOR IMPROVED VEHICLE PERFORMANCE TO PROMOTE USE OF MICROMOTORS IN HVAC SYSTEMS

-

6.9 FUEL INJECTION SYSTEMSRISING DEMAND FOR IMPROVED FUEL FLOW IN VEHICLES TO PROMOTE USE OF MICROMOTORS IN FIS

-

6.10 POWER SEATSINCREASED DEMAND FOR ENHANCED SEATING COMFORT TO PROMOTE USE OF MICROMOTORS

-

6.11 ADJUSTABLE SHOCK ABSORBERSGROWING DEMAND FOR SMOOTH DRIVING EXPERIENCE TO PROMOTE USE OF MICROMOTORS IN ADJUSTABLE SHOCK ABSORBERS IN VEHICLES

-

7.1 INTRODUCTIONPRIMARY INSIGHTS

-

7.2 PORTABLE DEVICESRISING NEED FOR EASILY TRANSPORTABLE MEDICAL DEVICES TO CREATE DEMAND FOR MICROMOTORS

-

7.3 POWERED SURGICAL EQUIPMENTINCREASED DEMAND FOR HIGH ACCURACY, SPEED, AND SAFETY TO PROMOTE USE OF MICROMOTORS IN SURGICAL EQUIPMENT

-

7.4 LAB AUTOMATIONGROWING DEMAND FOR FASTER AND ACCURATE LAB ANALYSIS TO PROMOTE USE OF MICROMOTORS IN LAB AUTOMATION PROCESSES

-

7.5 DENTAL SYSTEMS & EQUIPMENTLESS NOISE FEATURE OF MICROMOTORS TO PROMOTE THEIR USE IN DENTAL EQUIPMENT

-

8.1 INTRODUCTIONPRIMARY INSIGHTS

-

8.2 INDUSTRIAL AUTOMATIONGROWING DEMAND FOR AUTOMATED PROCESSES IN VARIOUS INDUSTRIAL APPLICATIONS TO DRIVE MARKET- Industrial electric drive & control- Automation equipment & light industry machinery

-

8.3 AIRCRAFT SYSTEMSRISING DEMAND FOR LIGHTWEIGHT AND COMPACT COMPONENTS IN AIRCRAFT SYSTEMS TO DRIVE MARKET

-

8.4 AGRICULTURE EQUIPMENT SYSTEMGROWING DEMAND FOR PRECISION CONTROL COMPONENTS TO PROMOTE USE OF MICROMOTORS IN AGRICULTURE EQUIPMENT

-

8.5 CONSTRUCTION & MINING EQUIPMENTRISING DEMAND FOR ENVIRONMENT-FRIENDLY COMPONENTS FOR CONTROLLING NOISE POLLUTION TO PROMOTE USE OF NOISELESS MICROMOTORS IN CONSTRUCTION & MINING EQUIPMENT

-

8.6 3D PRINTER SYSTEMNEED FOR COMPACT COMPONENTS TO PROMOTE USE OF MICROMOTORS IN 3D PRINTER SYSTEMS

-

9.1 INTRODUCTIONPRIMARY INSIGHTS

-

9.2 AC MICROMOTORRISING INDUSTRIAL AUTOMATION TO DRIVE DEMAND FOR AC MICROMOTORS

-

9.3 DC MICROMOTORHIGH POWER-TO-WEIGHT RATIO TO DRIVE DEMAND FOR DC MICROMOTORS IN AUTOMOTIVE SECTOR

-

10.1 INTRODUCTIONPRIMARY INSIGHTS

-

10.2 BRUSHED MICROMOTORSIMPLE DESIGN AND CONSTRUCTION TO DRIVE DEMAND FOR BRUSHED MICROMOTORS IN MANY APPLICATIONS

-

10.3 BRUSHLESS MICROMOTORHIGH POWER OUTPUT AND INCREASED EFFICIENCY FEATURE TO DRIVE DEMAND FOR BRUSHLESS MICROMOTORS IN DIFFERENT INDUSTRIES

-

11.1 INTRODUCTIONPRIMARY INSIGHTS

-

11.2 <11 VRISING DEMAND FOR SMALL-SCALE APPLICATIONS TO PROMOTE USE OF <11 V MICROMOTORS

-

11.3 12–24 VCOST-EFFECTIVE FEATURE TO DRIVE DEMAND FOR 12–24 V MICROMOTORS IN MULTIPLE APPLICATIONS

-

11.4 25–48 VGROWING NEED FOR HIGH-POWER OUTPUT APPLICATIONS TO DRIVE DEMAND FOR 25–48 V MICROMOTORS

-

11.5 >48 VINCREASING DEMAND FOR >48 V MICROMOTORS IN HIGH-SPEED INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 ASIA PACIFICRECESSION IMPACTCHINA- Growing lab automation to drive marketJAPAN- Increase in demand for automation to drive marketINDIA- Rising EV market to drive demand for micromotorsREST OF ASIA PACIFIC

-

12.3 EUROPERECESSION IMPACTGERMANY- New technological developments in various industries to create demand for micromotorsFRANCE- Adoption of advanced technologies in various industrial processes to drive marketUK- Medical equipment advancements to drive demandREST OF EUROPE

-

12.4 NORTH AMERICARECESSION IMPACTUS- Growing demand for advanced technology to drive marketCANADA- Healthcare and manufacturing sectors to drive demandMEXICO- Rising demand for industrial automation to drive market

-

12.5 REST OF THE WORLDRECESSION IMPACTBRAZIL- Expansion of automotive and medical sectors to drive demandRUSSIA- Rising aerospace industry to influence market growthOTHERS

- 13.1 AFTERMARKET VALUE CHAIN ANALYSIS

- 13.2 PRIVATE LABELING

- 13.3 COUNTERFEIT PRODUCTS

- 13.4 E-TAILING

- 13.5 OEMS MEETING NEW REGULATORY DEMANDS TO AFFECT AFTERMARKET DRAMATICALLY

- 13.6 INCREASE IN PARTICIPATION OF OEMS IN AFTERMARKET

- 14.1 ASIA PACIFIC TO BE MAJOR MARKET FOR MICROMOTORS

- 14.2 INCREASED APPLICATION IN AUTOMOTIVE TO CREATE DEMAND FOR MICROMOTORS

- 14.3 CONCLUSION

- 15.1 OVERVIEW

- 15.2 MARKET SHARE ANALYSIS

- 15.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

-

15.4 COMPANY EVALUATION MATRIXTERMINOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 15.5 COMPETITIVE BENCHMARKING

-

15.6 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALSEXPANSIONS

-

16.1 KEY PLAYERSMITSUBA CORPORATION- Business overview- Products offered- Recent developments- MnM viewNIDEC CORPORATION- Business overview- Products offered- Recent developments- MnM viewJOHNSON ELECTRIC HOLDINGS LIMITED- Business overview- Products offered- Recent developments- MnM viewMABUCHI MOTOR CO., LTD.- Business overview- Products offered- Recent developments- MnM viewABB LTD.- Business overview- Products offered- MnM viewCONSTAR MICROMOTOR CO., LTD.- Business overview- Products offered- Recent developmentsMAXON- Business overview- Products offered- Recent developmentsBÜHLER MOTOR GMBH- Business overview- Products offered- Recent developmentsROBERT BOSCH GMBH- Business overview- Products offered- Recent developmentsDENSO CORPORATION- Business overview- Products offered- Recent developments

- 17.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

17.4 CUSTOMIZATION OPTIONSMICROMOTOR MARKET FOR AEROSPACE INDUSTRY BY APPLICATIONMICROMOTOR MARKET FOR OTHER APPLICATIONSMICROMOTOR MARKET FOR MEDICAL EQUIPMENT SYSTEMS BY INDIVIDUAL APPLICATION SEGMENTMICROMOTOR MARKET FOR CONSTRUCTION AND MINING EQUIPMENT BY APPLICATIONMICROMOTOR MARKET FOR OFFICE DEVICES

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 CURRENCY EXCHANGE RATES

- TABLE 2 PASSENGER CARS WITH FEATURES USING MICROMOTORS

- TABLE 3 TECHNOLOGIES INVOLVED IN MICROMOTOR PRODUCTION

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021−2022

- TABLE 6 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024−2027 (% GROWTH)

- TABLE 7 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- TABLE 8 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- TABLE 9 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- TABLE 10 ROLE OF COMPANIES IN MICROMOTOR MARKET ECOSYSTEM

- TABLE 11 US: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 12 CANADA: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 13 CHINA: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 14 JAPAN: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 15 INDIA: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 16 GERMANY: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 17 FRANCE: MICROMOTOR IMPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 18 US: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 19 CANADA: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 20 CHINA: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 21 JAPAN: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 22 INDIA: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 23 GERMANY: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 24 FRANCE: MICROMOTOR EXPORTS SHARE, BY COUNTRY (VALUE%)

- TABLE 25 AUTOMOTIVE MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 26 AUTOMOTIVE MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 27 AUTOMOTIVE MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 28 AUTOMOTIVE MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 29 POWER WINDOWS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 30 POWER WINDOWS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 31 POWER WINDOWS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 32 POWER WINDOWS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 33 POWER MIRRORS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 34 POWER MIRRORS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 35 POWER MIRRORS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 36 POWER MIRRORS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 37 WIPER MOTORS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 38 WIPER MOTORS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 39 WIPER MOTORS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 40 WIPER MOTORS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 41 INFOTAINMENT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 42 INFOTAINMENT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 43 INFOTAINMENT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 44 INFOTAINMENT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 45 LIGHTING: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 46 LIGHTING: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 47 LIGHTING: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 48 LIGHTING: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 49 DOOR LOCKS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 50 DOOR LOCKS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 51 DOOR LOCKS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 52 DOOR LOCKS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 53 HVAC: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 54 HVAC: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 55 HVAC: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 56 HVAC: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 57 FUEL INJECTION SYSTEMS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 58 FUEL INJECTION SYSTEMS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 59 FUEL INJECTION SYSTEMS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 60 FUEL INJECTION SYSTEMS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 61 POWER SEATS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 62 POWER SEATS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 63 POWER SEATS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 64 POWER SEATS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 65 ADJUSTABLE SHOCK ABSORBERS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 66 ADJUSTABLE SHOCK ABSORBERS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 67 ADJUSTABLE SHOCK ABSORBERS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 68 ADJUSTABLE SHOCK ABSORBERS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 69 MEDICAL EQUIPMENT SYSTEM MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 70 MEDICAL EQUIPMENT SYSTEM MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 71 MEDICAL EQUIPMENT SYSTEM MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 72 MEDICAL EQUIPMENT SYSTEM MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 73 PORTABLE DEVICES: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 74 PORTABLE DEVICES: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 75 PORTABLE DEVICES: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 76 PORTABLE DEVICES: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 77 POWERED SURGICAL EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 78 POWERED SURGICAL EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 79 POWERED SURGICAL EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 80 POWERED SURGICAL EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 81 LAB AUTOMATION: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 82 LAB AUTOMATION: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 83 LAB AUTOMATION: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 84 LAB AUTOMATION: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 85 DENTAL SYSTEMS & EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 86 DENTAL SYSTEMS & EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 87 DENTAL SYSTEMS & EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 88 DENTAL SYSTEMS & EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 89 MICROMOTOR MARKET, BY INDUSTRY, 2018–2022 (MILLION UNITS)

- TABLE 90 MICROMOTOR MARKET, BY INDUSTRY, 2023–2028 (MILLION UNITS)

- TABLE 91 MICROMOTOR MARKET, BY INDUSTRY, 2018–2022 (USD BILLION)

- TABLE 92 MICROMOTOR MARKET, BY INDUSTRY, 2023–2028 (USD BILLION)

- TABLE 93 INDUSTRIAL AUTOMATION: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 94 INDUSTRIAL AUTOMATION: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 95 INDUSTRIAL AUTOMATION: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 96 INDUSTRIAL AUTOMATION: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 97 INDUSTRIAL ELECTRIC DRIVE & CONTROL: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 98 INDUSTRIAL ELECTRIC DRIVE & CONTROL: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 99 INDUSTRIAL ELECTRIC DRIVE & CONTROL: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 100 INDUSTRIAL ELECTRIC DRIVE & CONTROL: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 101 AUTOMATION EQUIPMENT & LIGHT INDUSTRY MACHINERY: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 102 AUTOMATION EQUIPMENT & LIGHT INDUSTRY MACHINERY: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 103 AUTOMATION EQUIPMENT & LIGHT INDUSTRY MACHINERY: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 104 AUTOMATION EQUIPMENT & LIGHT INDUSTRY MACHINERY: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 105 AIRCRAFT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 106 AIRCRAFT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 107 AIRCRAFT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 108 AIRCRAFT SYSTEMS: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 109 AGRICULTURE EQUIPMENT SYSTEM: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 110 AGRICULTURE EQUIPMENT SYSTEM: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 111 AGRICULTURE EQUIPMENT SYSTEM: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 112 AGRICULTURE EQUIPMENT SYSTEM: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 113 CONSTRUCTION & MINING EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 114 CONSTRUCTION & MINING EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 115 CONSTRUCTION & MINING EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 116 CONSTRUCTION & MINING EQUIPMENT: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 117 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 118 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 119 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 120 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 121 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 122 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 123 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 124 3D PRINTER SYSTEM: MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 125 MICROMOTOR MARKET, BY TYPE, 2018–2022 (MILLION UNITS)

- TABLE 126 MICROMOTOR MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 127 MICROMOTOR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 128 MICROMOTOR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 129 AC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 130 AC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 131 AC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 132 AC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 133 DC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 134 DC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 135 DC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 136 DC MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 137 MICROMOTOR MARKET, BY TECHNOLOGY, 2018–2022 (MILLION UNITS)

- TABLE 138 MICROMOTOR MARKET, BY TECHNOLOGY, 2023–2028 (MILLION UNITS)

- TABLE 139 MICROMOTOR MARKET, BY TECHNOLOGY, 2018–2022 (USD BILLION)

- TABLE 140 MICROMOTOR MARKET, BY TECHNOLOGY, 2023–2028 (USD BILLION)

- TABLE 141 BRUSHED MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 142 BRUSHED MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 143 BRUSHED MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 144 BRUSHED MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 145 BRUSHLESS MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 146 BRUSHLESS MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 147 BRUSHLESS MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 148 BRUSHLESS MICROMOTOR: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 149 MICROMOTOR MARKET, BY POWER CONSUMPTION, 2018–2022 (MILLION UNITS)

- TABLE 150 MICROMOTOR MARKET, BY POWER CONSUMPTION, 2023–2028 (MILLION UNITS)

- TABLE 151 MICROMOTOR MARKET, BY POWER CONSUMPTION, 2018–2022 (USD BILLION)

- TABLE 152 MICROMOTOR MARKET, BY POWER CONSUMPTION, 2023–2028 (USD BILLION)

- TABLE 153 <11 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 154 <11 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 155 <11 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 156 <11 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 157 12–24 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 158 12–24 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 159 12–24 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 160 12–24 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 161 25–48 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 162 25–48 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 163 25–48 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 164 25–48 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 165 >48 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 166 >48 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 167 >48 V: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 168 >48 V: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 169 MICROMOTOR MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 170 MICROMOTOR MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 171 MICROMOTOR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 172 MICROMOTOR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 173 ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 174 ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 175 ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 176 ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 177 CHINA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 178 CHINA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 179 CHINA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 180 CHINA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 181 JAPAN: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 182 JAPAN: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 183 JAPAN: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 184 JAPAN: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 185 INDIA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 186 INDIA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 187 INDIA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 188 INDIA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 189 REST OF ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 190 REST OF ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 191 REST OF ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 192 REST OF ASIA PACIFIC: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 193 EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 194 EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 195 EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 196 EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 197 GERMANY: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 198 GERMANY: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 199 GERMANY: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 200 GERMANY: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 201 FRANCE: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 202 FRANCE: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 203 FRANCE: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 204 FRANCE: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 205 UK: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 206 UK: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 207 UK: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 208 UK: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 209 REST OF EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 210 REST OF EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 211 REST OF EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 212 REST OF EUROPE: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 213 NORTH AMERICA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 214 NORTH AMERICA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 215 NORTH AMERICA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 216 NORTH AMERICA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 217 US: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 218 US: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 219 US: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 220 US: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 221 CANADA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 222 CANADA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 223 CANADA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 224 CANADA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 225 MEXICO: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 226 MEXICO: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 227 MEXICO: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 228 MEXICO: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 229 REST OF THE WORLD: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 230 REST OF THE WORLD: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 231 REST OF THE WORLD: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 232 REST OF THE WORLD: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 233 BRAZIL: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 234 BRAZIL: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 235 BRAZIL: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 236 BRAZIL: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 237 RUSSIA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 238 RUSSIA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 239 RUSSIA: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 240 RUSSIA: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 241 OTHERS: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (MILLION UNITS)

- TABLE 242 OTHERS: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 243 OTHERS: MICROMOTOR MARKET, BY APPLICATION, 2018–2022 (USD BILLION)

- TABLE 244 OTHERS: MICROMOTOR MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 245 KEY SMES

- TABLE 246 COMPETITIVE BENCHMARKING OF KEY SMES

- TABLE 247 MICROMOTOR MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JULY 2019− FEBRUARY 2023

- TABLE 248 MICROMOTOR MARKET: DEALS, SEPTEMBER 2020−MARCH 2023

- TABLE 249 MICROMOTOR MARKET: EXPANSIONS, 2021−2022

- TABLE 250 MITSUBA CORPORATION: BUSINESS OVERVIEW

- TABLE 251 MITSUBA CORPORATION: PRODUCTS OFFERED

- TABLE 252 MITSUBA CORPORATION: DEALS

- TABLE 253 NIDEC CORPORATION: BUSINESS OVERVIEW

- TABLE 254 NIDEC CORPORATION: PRODUCTS OFFERED

- TABLE 255 NIDEC CORPORATION: PRODUCT LAUNCHES

- TABLE 256 NIDEC CORPORATION: DEALS

- TABLE 257 JOHNSON ELECTRIC HOLDINGS LIMITED: BUSINESS OVERVIEW

- TABLE 258 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCTS OFFERED

- TABLE 259 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCT LAUNCHES

- TABLE 260 JOHNSON ELECTRIC HOLDINGS LIMITED: DEALS

- TABLE 261 MABUCHI MOTOR CO., LTD.: BUSINESS OVERVIEW

- TABLE 262 MABUCHI MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 263 MABUCHI MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 264 MABUCHI MOTORS CO., LTD.: DEALS

- TABLE 265 ABB LTD.: BUSINESS OVERVIEW

- TABLE 266 ABB LTD.: PRODUCTS OFFERED

- TABLE 267 CONSTAR MICROMOTOR CO., LTD.: BUSINESS OVERVIEW

- TABLE 268 CONSTAR MICROMOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 269 CONSTAR MICROMOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 270 MAXON: BUSINESS OVERVIEW

- TABLE 271 MAXON: PRODUCTS OFFERED

- TABLE 272 MAXON: PRODUCT LAUNCHES

- TABLE 273 MAXON: DEALS

- TABLE 274 MAXON: OTHERS

- TABLE 275 BÜHLER MOTOR GMBH: BUSINESS OVERVIEW

- TABLE 276 BÜHLER MOTOR GMBH: PRODUCTS OFFERED

- TABLE 277 BÜHLER MOTOR GMBH: DEALS

- TABLE 278 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 279 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 280 ROBERT BOSCH GMBH: OTHERS

- TABLE 281 DENSO CORPORATION: BUSINESS OVERVIEW

- TABLE 282 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 283 DENSO CORPORATION: PRODUCT LAUNCHES

- FIGURE 1 MARKET SEGMENTATION: MICROMOTOR MARKET

- FIGURE 2 RESEARCH DESIGN: MICROMOTOR MARKET

- FIGURE 3 RESEARCH METHODOLOGY MODEL

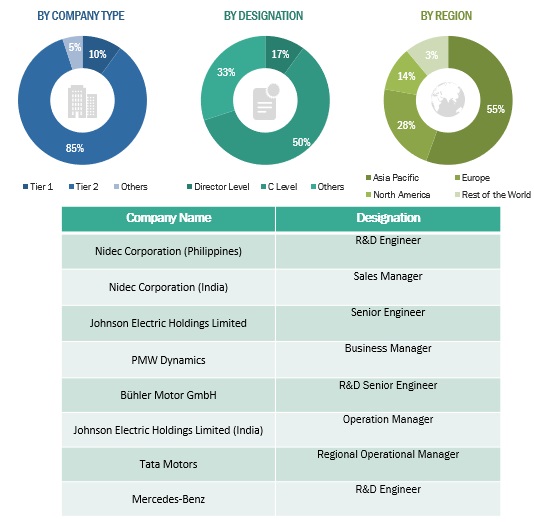

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MICROMOTOR MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 MICROMOTOR MARKET, BY REGION, 2023 VS. 2028

- FIGURE 9 INCREASING DEMAND FOR INDUSTRIAL AUTOMATION TO DRIVE MICROMOTOR MARKET

- FIGURE 10 BRUSHLESS MICROMOTOR SEGMENT TO REGISTER HIGHER GROWTH RATE, BY VALUE, FROM 2023 TO 2028

- FIGURE 11 12–24 V SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 POWER WINDOWS AND HVAC SEGMENTS TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 13 PORTABLE DEVICES SEGMENT TO BE LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 14 INDUSTRIAL AUTOMATION SEGMENT TO BE LARGEST SEGMENT IN TERMS OF VALUE, 2023 VS 2028

- FIGURE 15 DC SEGMENT ESTIMATED TO LEAD MARKET IN 2023

- FIGURE 16 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 17 MICROMOTOR MARKET: MARKET DYNAMICS

- FIGURE 18 INDUSTRIAL AUTOMATION: GROWING TREND IN MANUFACTURING

- FIGURE 19 HIGH COST OF PRODUCTION AND TECHNOLOGIES INVOLVED IN MICROMOTOR PRODUCTION

- FIGURE 20 MICROMOTOR MARKET FOR MEDICAL EQUIPMENT SYSTEMS, BY REGION, 2023 VS. 2028 (USD BILLION)

- FIGURE 21 FACTORS DRIVING DEMAND FOR BRUSHLESS MOTORS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 EUROPE: KEY ECONOMIC INDICATORS, 2021−2023

- FIGURE 24 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- FIGURE 25 AMERICAS: KEY ECONOMIC INDICATORS, 2021−2023

- FIGURE 26 PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (UNITS)

- FIGURE 27 SUPPLY CHAIN ANALYSIS: MICROMOTOR MARKET

- FIGURE 28 MICROMOTOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 AUTOMOTIVE MICROMOTOR MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 30 MEDICAL EQUIPMENT SYSTEM MICROMOTOR MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 31 MICROMOTOR MARKET, BY INDUSTRY, 2023 VS. 2028 (USD BILLION)

- FIGURE 32 MICROMOTOR MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 33 MICROMOTOR MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD BILLION)

- FIGURE 34 MICROMOTOR MARKET, BY POWER CONSUMPTION, 2023 VS. 2028 (USD BILLION)

- FIGURE 35 INDUSTRY INSIGHTS

- FIGURE 36 MICROMOTOR MARKET, BY REGION, 2023 VS. 2028 (USD BILLION)

- FIGURE 37 ASIA PACIFIC: MICROMOTOR MARKET SNAPSHOT

- FIGURE 38 EUROPE: MICROMOTOR MARKET, BY COUNTRY, 2023 VS. 2028 (USD BILLION)

- FIGURE 39 NORTH AMERICA: MICROMOTOR MARKET SNAPSHOT

- FIGURE 40 REST OF THE WORLD: MICROMOTOR MARKET, BY COUNTRY, 2023 VS. 2028 (USD BILLION)

- FIGURE 41 AFTERMARKET VALUE CHAIN ANALYSIS

- FIGURE 42 MICROMOTOR MARKET SHARE ANALYSIS, 2022

- FIGURE 43 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019–2021

- FIGURE 44 COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 MITSUBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 NIDEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 48 MABUCHI MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 49 ABB LTD.: COMPANY SNAPSHOT

- FIGURE 50 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 51 DENSO CORPORATION: COMPANY SNAPSHOT

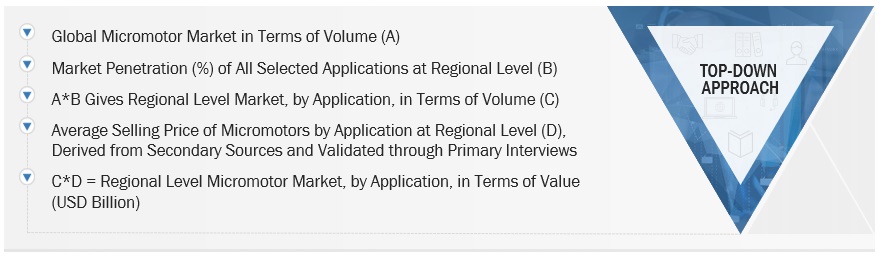

The study involved four major activities in estimating the current size of the micromotor market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down approache was employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments..

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering micromotor and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the C4ISR market, which was validated by primary respondents.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, and product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as micromotor market forecast, current technology trends, and upcoming technologies in the market. Data triangulation of all these points was carried out with the information gathered from secondary research. Stakeholders from the supply side were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from the supply side (micromotor manufacturers) across the major regions, namely, Asia Pacific, Europe, and North America. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the micromotor market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the automotive industry, medical industry, aerospace industry, and other such industries at a regional level. Such procurements provide information on the demand aspects of micromotors in each industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Micromotor Market Size: Top-Down Approach, By Application

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market. was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market. engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Micromotors are small and compact electromechanical components that convert electrical energy into mechanical energy. These motors can generate a maximum power output of 2.5-3 watts and are made up of lightweight materials to improve the power-to-weight ratio.

Key Stakeholders

- Senior Management

- End User Finance/Procurement Department

- R&D Department

Report Objectives

-

To define, describe, and forecast the micromotor market in terms of value (USD billion) and volume (million units) based on the following segments:

- Automotive Micromotor Market, By Application (Power Windows, Power Mirrors, Wiper Motors, Infotainment Systems, Lighting, Door Locks, HVAC, Fuel Injection Systems, Power Seats, and Adjustable Shock Absorbers)

- Medical Equipment System Micromotor Market, By Application (Portable Devices, Powered Surgical Equipment, Lab Automation, and Dental Systems & Equipment)

- Micromotor Market, By Industry (Industrial Automation, Aircraft Systems, Agriculture Equipment System, Construction & Mining Equipment, and 3D Printer System)

- By Type (AC Motor and DC Motor)

- By Technology (Brushed and Brushless)

- By Power Consumption (<11 V, 12–24 V, 25–48 V, and >48 V)

- By Region (Asia Pacific, Europe, North America, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players and evaluate the competitive evaluation quadrant

- To analyze the key player strategies/right to win

- To strategically analyze the market with Porter’s five forces analysis, supply chain analysis, market ecosystem, technology trends, and recession impact

- To analyze recent developments, including supply contracts, new product launches, expansions, and mergers & acquisitions, undertaken by key industry participants in the market

- To determine an aftermarket overview of the micromotor market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Micromotor market for aerospace industry by application

- Micromotor market for other applications

- Micromotor market for medical equipment systems by individual application segment

- Micromotor market for construction and mining equipment by application

- Micromotor market for office devices

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Micromotor Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micromotor Market

I am considering buying this report and would like to better understand the definition of micro motor. What is the specific definition of micro motor? Also, are both servo and stepper motors included in the micro motor categories? is there any differentiation between them in the report.