Military Computers Market by Computer Type (Rugged (Wearable, Portable), Embedded (Flight Control, Utility Control, Fire Control, Positioning, Vetronics, Air Defense Systems), Platform (Aircraft, Naval, Ground), and Region - Global Forecast to 2023

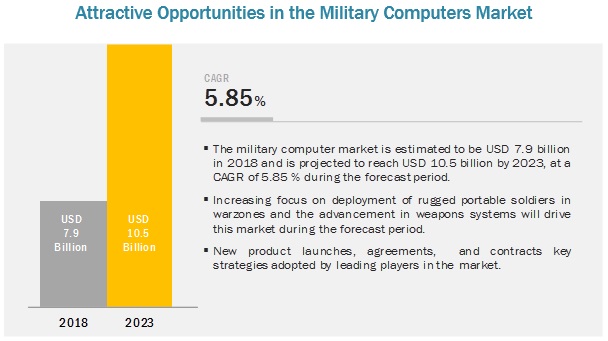

[169 Pages Report] The military computers market is estimated at USD 7.9 billion in 2018 and is projected to reach USD 10.5 billion by 2023, at a CAGR of 5.85 % from 2018 to 2023. The factors expected to fuel the military computers market growth is the increasing focus on deployment of rugged portable and wearable computers in military warzones. In addition, advancements in warfare technologies and modernization of military weapon systems are also expected to drive the market during the forecast period.

By type, the rugged segment is expected to grow at a higher CAGR during the forecast period.

The rugged segment is projected to grow at a higher CAGR during the forecast period due to the significant demand for rugged computers and wearables by militaries across the globe. The militaries are focusing on more portable and technologically-advanced computers to be deployed on warzones. Ruggedness of military devices such as laptops, handhelds, and wearables is necessary to survive and function properly in extreme environmental and operational conditions.

The wearable subsegment is expected to lead the rugged segment of the military computers market from 2018 to 2023.

Militaries around the world are showing interest in wearable computers for delivering fast and accurate information to soldiers on ground. Wearable systems not only help in tracking real-time data about soldiers easily but also in tracking the health of soldiers. The easy portability and accuracy in terms of information transfer are expected to drive this segment in the near future. Wearable technologies enable soldiers to either track or be tracked in real-time and great precision which ensures their safety as well as diminishes the chances of failure in high-risk operations. Also, the easiness with which these devices can be carried by soldiers in warzones makes these devices preferable.

The aircraft segment to grow at the highest CAGR among the different platforms of military computers market from 2018 to 2023.

Based on platform, the military computers market has been segmented and analyzed in terms of embedded computers deployed on different platforms, namely, aircraft, naval, and ground. The high procurement of military aircraft around the world and advancements in military aircraft technology are expected to drive the market for aircraft platform at the highest CAGR during the forecast period.

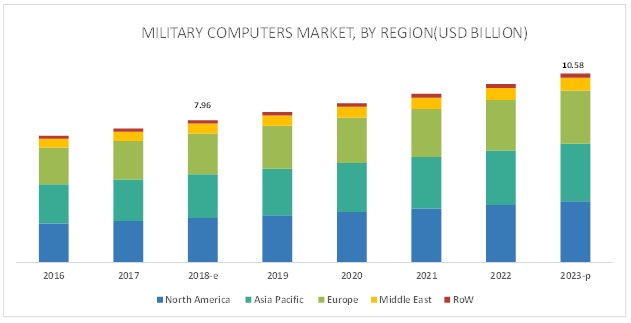

The North American region is expected to dominate the military computers market from 2018 to 2023.

The North America military computers market is expected to grow at the highest CAGR during the forecast period. This growth is due to the high military budget of the US and high level of sophistication and advancements in the technology of US military defense systems. s the US Army uses advanced systems, the scope of adoption of embedded computers is high. The undergoing R&D for the military weapons and equipment for the US Army would also drive the adoption of military computers.

Key Market Players

Major players in the military computers market include Curtiss-Wright Corporation (US), Zebra Technologies Corp. (US), Cobham plc (UK), Saab (Sweden), Rockwell Collins, Inc (US), Thales Group (France), Northrop Grumman Corporation (US), Getac Technology Corporation (Taiwan), and Panasonic Corporation (Japan), among others.

Curtiss Wright: Curtis Wright is continuously expanding its product offerings in the aircraft computers market through research and development. It is also spending heavily on the upgradation of existing products and adding new and improved capabilities such as software and processor. It has entered into strategic partnerships with various companies such as Lynx Software, Green Hill Software, Intel, Nvidia, etc., which helps increase its customer base. The companys acquisition of Teletronics Technology also strengthened its position in the military computers market.

Cobham: Cobham recorded an outstanding operating performance in 2017, with a revenue of USD 2.39 billion. The companys strategy for sustainable long-term growth aligns with the emerging global trends, drive for information, and demand for efficiency and cost-effectiveness. The company has strengthened its position in the military sector through innovations, strategic partnerships, and a wide range of reliable product offerings. Cobham also provides on-field services for off-site testing at customer premises.

Saab AB: Saab offers a wide range of embedded ground computers. As a part of its growth strategy, the company majorly focuses on technological development and working constantly to shorten lead times and increase production efficiency. The company does business around the world and has good relationships with customers and other stakeholders on every continent. This would the help the company continue growing and receiving major contracts from governments of various countries across the globe. In 2017, Saab received an order from the Swedish Defense Material Administration (FMV) to deliver Trackfire Remote Weapon Stations (RWS) to the Swedish Navy from Q3 2018 to Q3 2019.

Recent Developments

- In May 2018, DRS received a USD 842 million deal to deliver new rugged tablets for Army Battle Command Platform.

- In August 2018, General Dynamics received a contract from the US Army to provide rugged Commercial Off-The-Shelf (COTS) computers and networking equipment modified for military operations.

- In October 2017, Curtiss Wright launched a new family of rugged pre-integrated avionics computers. The new computer system features an extensive range of field-proven rugged chassis (2-6 3U OpenVPX slots) pre-integrated with safety certifiable modules, including Single Board Computers (SBC), graphics controllers, and avionics I/O cards.

- In June 2017, Raytheon received a contract worth USD 600 million from the US Army for the upgrade of software on missile defense and other strategic systems.

Key Questions Addressed by the Report

What are your views on the growth perspective of the military computers market? What are the key dynamics and trends, such as drivers and opportunities, that govern the market?

- What are the key sustainability strategies adopted by leading players operating in the military computers market?

- What are the new emerging technologies and use cases disrupting the military computers industry?

- Which are the key applications where military computers play a significant role?

- What are the key trends and opportunities in the military computers market across different regions and respective countries?

- Who are the key players and innovators in the partnership ecosystem?

- How is the competitive landscape changing in the client ecosystem and impacting their revenue shares?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

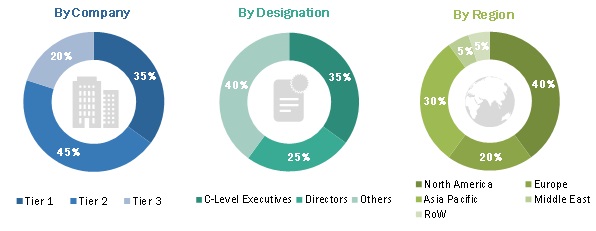

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Growth Opportunities in Military Computers Market

4.2 Military Computer Market, By Type

4.3 Embedded Military Computers Market, By Platform

4.4 Military Aircraft Computers Market, By Type

4.5 Military Computers Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Increased Demand for New and Advanced Electronic Combat Systems

5.3.2 Adoption of Rugged Wearables and Handheld Devices for Effective Battlefield Operations

5.4 Restraints

5.4.1 Risk of Cyberattacks on Computer-Based Defense Systems

5.5 Opportunities

5.5.1 Scope for Software Innovation in Military Computers

5.6 Challenges

5.6.1 Increased Complexity in the Designs of Electronic Equipment and Computer Systems

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.1.1 Emergence of Commercial Off-The-Shelf (COTS) Products

6.1.2 Multicore Processors

6.1.3 Swap-Optimized Rugged Computers

6.2 Procedure of Testing Military Rugged Computers

6.2.1 Mil-Std -810g Test

6.2.2 Ingress Protection Scale

7 Military Computers Market, By Type (Page No. - 42)

7.1 Introduction

7.2 Rugged Computers

7.2.1 Portable Computers

7.2.1.1 Rugged Laptops

7.2.1.2 Rugged Tablets

7.2.1.3 Rugged Notebooks

7.2.1.4 Rugged Handhelds

7.2.2 Wearable Computers

7.2.2.1 Rugged Smart Glasses

7.2.2.2 Wearable Cuffs

7.3 Embedded Computers

8 Military Computers Market, By Platform (Page No. - 47)

8.1 Introduction

8.2 Airborne

8.2.1 By Type

8.2.1.1 Flight Control Computers (FCC)

8.2.1.1.1 Flight Augmentation Computers (FACS)

8.2.1.1.2 Flight Guidance Computers (FGC)

8.2.1.1.3 Flight Director Computers (FDC)

8.2.1.1.4 Air Data Computers

8.2.1.1.5 Sensor Management Computers (SMC)

8.2.1.1.6 Autopilot Computers

8.2.1.1.7 Fly-By-Wire Computers

8.2.1.2 Engine Control Computers

8.2.1.2.1 Full Authority Digital Engine Control (FADEC)

8.2.1.2.2 Electronic Engine Control

8.2.1.2.3 Mission Control Computers

8.2.1.2.4 Flight Management Computers

8.2.1.3 Utility Control Computers

8.2.1.3.1 Central Maintenance Computers

8.2.1.3.2 Display Processing Computers

8.2.1.3.3 Fuel Management Computers

8.2.1.4 Navigational Computers

8.2.1.4.1 Digital Map Computers (DMC)

8.2.1.4.2 Digital Video Map Computers (DVMC)

8.3 Naval

8.3.1 By Type

8.3.1.1 Data Recording Computers

8.3.1.1.1 Voyage Data Recorders (VDR)

8.3.1.1.2 Mission Computers

8.3.1.2 Video and Imagery Computers

8.3.1.2.1 Radar Video Processors (RVP)

8.3.1.2.2 Beam Steering Computers

8.3.1.3 Positioning Computers

8.3.1.3.1 Receiver Computers

8.3.1.3.2 Dead Reckoning Analyzer Indicator Computers

8.3.1.3.3 External Computers

8.3.1.3.4 Gridlock Computers

8.3.1.3.5 Naval Tactical Data System (NTDS) Computers

8.3.1.4 Intelligence System Computers

8.3.1.4.1 Cabinet Processing Computers

8.3.1.4.2 Weather Extractor Computers (WEC)

8.3.1.4.3 Electronic Warfare Computers

8.3.1.4.4 Digital Rf Memory (Drfm) Computer

8.3.1.4.5 Hull Electronics Computers

8.3.1.4.6 Fire Control Computers

8.3.1.5 Ship Weapon System Computers

8.3.1.5.1 Stores Management Computers (SMC)

8.3.1.5.2 Weapon Control Group Computers

8.3.1.5.3 Target Acquisition System (TAS) Computers

8.4 Ground

8.4.1 Ground Military Computers, By Type

8.4.1.1 Air Defense Computers

8.4.1.1.1 Weapon Control Computers (WCC)

8.4.1.1.2 Ballistic Computers

8.4.1.1.3 Command & Control Server Computers

8.4.1.2 Military Computers for Vehicles

8.4.1.2.1 Hull Electronics Computers

8.4.1.2.2 Fire Control Computers

8.4.1.2.3 Rugged Security Computers

8.4.1.2.4 Video Server and Processor Computers

8.4.1.2.5 Automated Computerized Mobility Equipment Computers (ACMEC)

9 Regional Analysis (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Highest Military Budget in the World and Heavy Investment in Research & Development is Driving the Market for Military Computers in US

9.2.2 Canada

9.2.2.1 High Focus on Modernization of Soldiers to Drive the Market for Military Computers in Canada

9.3 Europe

9.3.1 UK

9.3.1.1 The Advancements in the Fields of Military Automation and Increasing Investments in R&D is Increasing the Market for Military Computers in UK.

9.3.2 Germany

9.3.2.1 Various Governments Initiatives for Automation in Military Applications and the Deployment of German Soldiers Across the Globe is Expected to Drive the Market in This Region

9.3.3 France

9.3.3.1 Increasing Focus on Modernization of Ground Forces and Heavy Orders for Military Aircrafts From Different Countries is Driving the Market for Military Computers

9.3.4 Russia

9.3.4.1 Tensions With Ukraine and Other Nato Countries and Contracts Received From Developing Countries for Military Equipments is Increasing the Market for Military Computers in This Country.

9.3.5 Rest of Europe

9.3.5.1 Rapid Militarization in the Region By Newly Added Nato and Allied Countries is Expected to Drive the Demand for Military Computers in Countries Such as Ukraine, Poland, and Other Small Nations.

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Increasing Focus on Modernization of Soldiers and Heavy Investment in Military Assets and Research & Development for Military Segment is Set to Drive the Market for China.

9.4.2 India

9.4.2.1 Large Number of Defense Contracts Signed By India for Procurement of Defense Equipments is Set to Drive the Market for Military Computers in India.

9.4.3 Japan

9.4.3.1 Chinas Attempt to Militaries the South China Sea is Forcing Japan to Increase Its Military Capabilities. This is Set to Increase the Military Computer Market for Japan.

9.4.4 Australia

9.4.4.1 Rising Defense Spending is Driving the Market for Military Computer in Australia.

9.4.5 Rest of APAC

9.4.5.1 Technological Advancements and Increasing Awareness Among Defense Forces Regarding the Adoption of Advanced Computers Technologies are Expected to Drive the Growth of the Military Computers Market

9.5 Middle East

9.5.1 Israel

9.5.1.1 Increasing Counterterrorism Activities in the Country and Rising Defense Exports of Military Hardware and Systems are Driving the Military Computers Market in the Country.

9.5.2 Saudi Arabia

9.5.2.1 Increasing Investment in Military and Tension Between Iran and Saudi Arabia is Factoring the Demand for Military Computers in This Country.

9.5.3 UAE

9.5.3.1 Modernization of Defense Forces and Counterterrorism Measures are Driving the UAE Military Computers Market.

9.5.4 Rest of the Middle East

9.5.4.1 Growing Unrest in Middle Eastern Countries is Expected to Drive the Military Computers Market in These Region.

9.6 Rest of the World (RoW)

9.6.1.1 By Rugged Computers Type

9.6.2 Latin America

9.6.2.1 The Growing Adoption of Military Computers By Brazilian Defense Forces is Expected to Drive the Growth of the Military Computers Market in Latin America.

9.6.3 Africa

9.6.3.1 Rapid Militarization and Rising Concerns Regarding Terrorism are Expected to Drive the Growth of the Military Computers Market in Africa.

10 Competitive Landscape (Page No. - 109)

10.1 Overview

10.2 Ranking of Key Players in Military Computers Market, 2018

10.3 Competitive Scenario

10.3.1 New Product Launches

10.3.2 Acquisitions and Partnerships

10.3.3 Contracts & Agreements

11 Company Profiles (Page No. - 118)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Bae Systems

11.2 Cobham

11.3 Curtiss-Wright

11.4 Esterline Technologies

11.5 Saab AB

11.6 Rockwell Collins

11.7 Thales

11.8 Safran

11.9 Teledyne Technologies

11.10 Raytheon

11.11 Northrop Grumman

11.12 Elbit Systems

11.13 L3 Technologies

11.14 Getac Technology Corp.

11.15 Zebra Technologies Corp.

11.16 Panasonic Corporation

11.17 Key Innovators

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 163)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (99 Tables)

Table 1 Network-Centric Warfare Systems Market, By Region, 2016 & 2021 (USD Million)

Table 2 Electronic Warfare Systems Market, By Region, 2016 & 2021 (USD Million)

Table 3 Military Computer Market, By Type, 20162023 (USD Million)

Table 4 Rugged Military Computers Market, By Subtype, 20162023 (USD Million)

Table 5 Embedded Military Computers Market, By Platform, 20162023 (USD Million)

Table 6 Military Computers Market, By Platform, 2016-2023 (USD Million)

Table 7 Aircraft Military Computers, By Type, 2016-2023 (USD Million)

Table 8 Naval Military Computers Market Size, By Type, 2016-2023 (USD Million)

Table 9 Ground Military Computers, By Type, 2016-2023 (USD Million)

Table 10 Military Computers Market Size, By Region, 20162023 (USD Million)

Table 11 North America Military Computers Market Size, By Country, 20162023 (USD Million)

Table 12 North America Military Computers Market Size, By Type, 20162023 (USD Million)

Table 13 North America Military Computers Market Size, By Type of Rugged Computers, 20162023 (USD Million)

Table 14 North America Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 15 North America Military Computers Market Size, By Aircraft Computers Type, 20162023 (USD Million)

Table 16 North America Military Computers Market Size, By Naval Computers Type, 20162023 (USD Million)

Table 17 North America Military Computers Market Size, By Ground Computers Type, 20162023 (USD Million)

Table 18 US Military Computers Market Size, By Type, 20162023 (USD Million)

Table 19 US Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 20 US Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 21 Canada Military Computers Market Size, By Type, 20162023 (USD Million)

Table 22 Canada Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 23 Canada Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 24 Europe Military Computers Market Size, By Country, 20162023 (USD Million)

Table 25 Europe Military Computers Market, By Type, 20162023 (USD Million)

Table 26 Europe Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 27 Europe Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 28 Europe Military Computers Market Size, By Aircraft Computers Type, 20162023 (USD Million)

Table 29 Europe Military Computers Market Size, By Naval Computers, 20162023 (USD Million)

Table 30 Europe Military Computers Market Size, By Ground Computers Type, 20162023 (USD Million)

Table 31 UK Military Computers Market Size, By Type, 20162023 (USD Million)

Table 32 UK Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 33 UK Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 34 Germany Military Computers Market Size, By Type, 20162023 (USD Million)

Table 35 Germany Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 36 Germany Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 37 France Military Computers Market Size, By Type, 20162023 (USD Million)

Table 38 France Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 39 France Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 40 Russia Military Computers Market Size, By Type, 20162023 (USD Million)

Table 41 Russia Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 42 Russia Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 43 Rest of Europe Military Computers Market Size, By Type, 20162023 (USD Million)

Table 44 Rest of Europe Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 45 Rest of Europe Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 46 Asia Pacific Military Computers Market, By Type, 20162023 (USD Million)

Table 47 Asia Pacific Military Computers Market, By Country, 20162023 (USD Million)

Table 48 Asia Pacific Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 49 Asia Pacific Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 50 Asia Pacific Military Computers Market Size, By Aircraft Computers Type, 20162023 (USD Million)

Table 51 Asia Pacific Military Computers Market Size, By Naval Computers Type, 20162023 (USD Million)

Table 52 Asia Pacific Military Computers Market Size, By Ground Computers Type, 20162023 (USD Million)

Table 53 China Military Computers Market Size, By Type, 20162023 (USD Million)

Table 54 China Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 55 China Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 56 India Military Computers Market Size, By Type, 20162023 (USD Million)

Table 57 India Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 58 India Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 59 Japan Military Computers Market Size, By Type, 20162023 (USD Million)

Table 60 Japan Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 61 Japan Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 62 Australia Military Computers Market Size, By Type, 20162023 (USD Million)

Table 63 Australia Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 64 Australia Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 65 Rest of Asia Pacific Military Computers Market Size, By Type, 20162023 (USD Million)

Table 66 Rest of Asia Pacific Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 67 Rest of Asia Pacific Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 68 Middle East Military Computers Market, By Type, 20162023 (USD Million)

Table 69 Middle East Military Computers Market, By Country, 20162023 (USD Million)

Table 70 Middle East Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 71 Middle East Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 72 Middle East Military Computers Market Size, By Aircraft Computers Type, 20162023 (USD Million)

Table 73 Middle East Military Computers Market Size, By Naval Computers Type, 20162023 (USD Million)

Table 74 Middle East Military Computers Market Size, By Ground Computers Type, 20162023 (USD Million)

Table 75 Israel Military Computers Market Size, By Type, 20162023 (USD Million)

Table 76 Israel Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 77 Israel Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 78 Saudi Arabia Military Computers Market Size, By Type, 20162023 (USD Million)

Table 79 Saudi Arabia Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 80 Saudi Arabia Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 81 UAE Military Computers Market Size, By Type, 20162023 (USD Million)

Table 82 UAE Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 83 UAE Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 84 Rest of the Middle East Military Computers Market Size, By Type, 20162023 (USD Million)

Table 85 Rest of the Middle East Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 86 Rest of the Middle East Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 87 RoW Military Computers Market, By Region, 20162023 (USD Million)

Table 88 RoW Military Computers Market, By Type, 20162023 (USD Million)

Table 89 RoW Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 90 RoW Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 91 RoW Military Computers Market Size, By Aircraft Computers Type, 20162023 (USD Million)

Table 92 RoW Military Computers Market Size, By Naval Computers Type, 20162023 (USD Million)

Table 93 RoW Military Computers Market Size, By Ground Computers Type, 20162023 (USD Million)

Table 94 Latin America Military Computers Market Size, By Type, 20162023 (USD Million)

Table 95 Latin America Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 96 Latin America Military Computers Market Size, By Platform, 20162023 (USD Million)

Table 97 Africa Military Computers Market Size, By Type, 20162023 (USD Million)

Table 98 Africa Military Computers Market Size, By Rugged Computers Type, 20162023 (USD Million)

Table 99 Africa Military Computers Market Size, By Platform, 20162023 (USD Million)

List of Figures (41 Figures)

Figure 1 Research Flow

Figure 2 Research Design: Military Computers Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Rugged Computers Estimated to Lead the Military Computers Market During the Forecast Period

Figure 8 Portable Rugged Computers Estimated to Lead the Military Computer Market During the Forecast Period

Figure 9 Ground Computers Segment Projected to Lead the Military Computers Market During the Forecast Period

Figure 10 North America Estimated to Lead Military Computers Market During Forecast Period

Figure 11 Increasing Demand for Portable & Rugged Computers Expected to Drive Military Computers Market

Figure 12 Rugged Computers to Lead Military Computers Market During Forecast Period

Figure 13 Ground Computers Segment Expected to Lead Embedded Computers Market From 2018 to 2023

Figure 14 Flight Control Computers Segment Expected to Grow at Highest CAGR From 2018 to 2023

Figure 15 North America Expected to Lead Military Computers Market From 2018 to 2023

Figure 16 Military Computers Market Dynamics

Figure 17 Rugged Computers Segment Expected to Grow at Higher CAGR During Forecast Period

Figure 18 Wearable Computers Expected to Grow at Higher CAGR During Forecast Period as Compared to Portable Computers Segment

Figure 19 Ground Segment Expected to Lead the Market By Platform During the Forecast Period

Figure 20 Military Computers Market: By Region

Figure 21 North America: Military Computers Market Snapshot

Figure 22 Europe: Military Computers Market Snapshot

Figure 23 Asia Pacific: Military Computers Market Snapshot

Figure 24 Middle East: Military Computers Market Snapshot

Figure 25 Companies Adopted Contracts as Key Growth Strategy Between 2015 and 2018

Figure 26 Bae Systems: Company Snapshot

Figure 27 Cobham: Company Snapshot

Figure 28 Curtiss-Wright: Company Snapshot

Figure 29 Esterline Technologies: Company Snapshot

Figure 30 Saab AB: Company Snapshot

Figure 31 Rockwell Collins, Inc.: Company Snapshot

Figure 32 Thales: Company Snapshot

Figure 33 Safran Electronic & Defense: Company Snapshot

Figure 34 Teledyne Technologies: Company Snapshot

Figure 35 Raytheon: Company Snapshot

Figure 36 Northrop Grumman: Company Snapshot

Figure 37 Elbit Systems: Company Snapshot

Figure 38 L3 Technologies: Company Snapshot

Figure 39 Getac Technology Corp.: Company Snapshot

Figure 40 Zebra Technologies Corp.: Company Snapshot

Figure 41 Panasonic Corporation: Company Snapshot

The study involved four major activities to estimate the current market size for military computers. Exhaustive secondary research was undertaken to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Maritime Magazines have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The military computers market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by various end users, such as military organizations and commercial buyers. The supply side is characterized by advancements in USV technology, development of USVs, and software development. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the military computers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the military computers market.

Report Objectives

- To define, segment, and project the global market size for military computers

- To understand the structure of the military computer market by identifying the various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to five regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World (RoW) (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by market players across regions

- To analyze competitive developments, such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements in the military computers market

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, platform, and region |

|

Geographies covered |

North America, APAC, Europe, Middle East, and RoW |

|

Companies covered |

Curtiss-Wright Corporation (US), Zebra Technologies Corp. (US), Cobham plc (UK), Saab (Sweden), Rockwell Collins, Inc (US), Thales Group (France), Northrop Grumman Corporation (US), Getac Technology Corporation (Taiwan), Panasonic Corporation (Japan), among others |

This research report categorizes the military computer market based on type, platform, and region.

On the basis of type, the military computers market has been segmented as follows:

- Rugged Computers

- Embedded Computers

On the basis of platform, the military computers market has been segmented as follows:

- Aircraft

- Ground

- Naval

On the basis of region, the military computers market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Military Computers Market