Mood Ingredients Market - Global Forecast to 2030

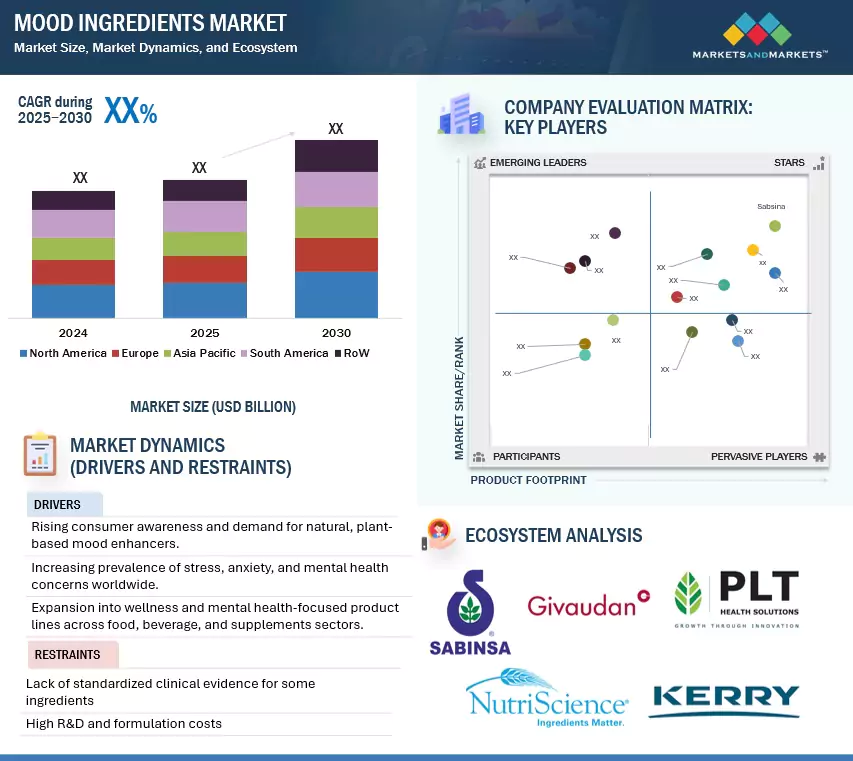

The global market for mood ingredients has been estimated to be USD XX billion in 2025 and is projected to grow at XX% between 2025 and 2030.

The mood ingredients market is a specialized segment within the broader nutraceutical and functional ingredient industry. This market focuses on compounds that promote emotional well-being, stress resilience, cognitive clarity, and sleep health. As consumer awareness of mental wellness rises, the demand for scientifically supported ingredients is rapidly increasing. This includes adaptogenic botanicals like ashwagandha and rhodiola, amino acids such as L-theanine and tryptophan, omega-3 fatty acids, and psychobiotics. These ingredients are being incorporated into dietary supplements, functional foods, and beverages. Manufacturers in this sector supply standardized, clinically studied ingredients to formulators and brand owners who are looking to create products that cater to the growing demand for natural, non-pharmaceutical solutions for mood support.

Market Dynamics

Drivers: The Market focuses on clinical research and ingredient branding

A key factor driving growth in the mood ingredients market is the increasing investment in clinical research and the branding of standardized ingredients. Unlike generic herbal extracts, branded mood ingredients undergo rigorous clinical trials to validate their efficacy, safety, and mechanisms of action. For instance, KSM-66® Ashwagandha, Sensoril®, and Relora® are standardized for their active compounds and are supported by numerous human studies demonstrating their benefits in stress reduction, anxiety management, and mood enhancement. This level of scientific validation enhances the credibility of these ingredients among formulators, healthcare professionals, and increasingly discerning consumers.

Additionally, branded ingredients differentiate themselves in a crowded marketplace where mood-related claims are often made without sufficient evidence. Ingredient branding allows manufacturers to build trust by emphasizing attributes such as purity, bioavailability, and clinical performance—features that generic versions may not possess. As regulatory scrutiny intensifies, particularly in developed markets like the EU and North America, branded and scientifically supported ingredients provide a safer pathway for product developers to make structure/function claims related to mood, relaxation, or cognitive well-being. This trend has shifted the ingredient business from commodity supply to value-added solution partnerships. Ingredient suppliers now collaborate with their B2B customers to co-develop marketing assets and clinical data packages. The outcome is beneficial for both parties: end-product brands gain credibility and consumer trust, while ingredient manufacturers can command premium pricing and foster long-term customer relationships.

Restraints: High R&D and Standardization Costs

One significant barrier to entry and scalability in the mood ingredients market is the high cost associated with research, development, and standardization, particularly for botanical-based actives. Unlike synthetic compounds that can be precisely engineered in controlled environments, natural mood ingredients—such as ashwagandha, saffron, and lemon balm—are subject to variability due to factors like soil quality, climate, harvest time, and post-harvest processing. To ensure consistency in active compound concentration, manufacturers must invest in robust standardization techniques, often utilizing advanced technologies such as HPLC, mass spectrometry, or DNA barcoding.

In addition to controlling raw materials, companies must also invest significantly in clinical research and development (R&D) to validate efficacy, determine optimal dosages, and establish safety across various populations. This is especially critical for ingredients making mood-related claims, as regulatory bodies increasingly require scientific substantiation to ensure consumer safety and avoid misleading claims. For example, clinical trials assessing an ingredient's effect on stress, anxiety, or sleep require controlled environments, placebo groups, long-term monitoring, and mental health assessment tools—all of which are time-consuming and expensive. Moreover, formulation challenges, such as improving the bioavailability of poorly absorbed compounds (e.g., curcumin or saffron's safranal), may necessitate the development of novel delivery systems like liposomes, microencapsulation, or emulsification. These not only increase development costs but also often require regulatory review and patent filing.

Opportunities: Rise of corporate wellness initiatives and a growing focus on preventive health

The rise of corporate wellness initiatives and an increasing focus on preventive health have created significant opportunities for manufacturers of mood-enhancing ingredients. As stress, anxiety, and burnout become more common among working professionals—especially in the post-pandemic work-from-home environment—employers are actively seeking solutions to support their employees' mental well-being and productivity. This demand has opened up a new channel for daily-use mental performance enhancers, such as nootropics, adaptogens, and mood-stabilizing ingredients. Many forward-thinking companies are expanding their employee wellness offerings beyond traditional gym memberships and physical health checkups to include mental wellness programs. These initiatives often involve partnerships with supplement brands or wellness platforms that provide stress-reducing formulations, sleep support, and cognitive function enhancers. Ingredients like L-theanine, Bacopa monnieri, ashwagandha, and rhodiola rosea—known for promoting calmness, reducing cortisol levels, and enhancing focus—are gaining popularity in these formulations.

Moreover, the corporate wellness sector offers a valuable B2B distribution route for ingredient manufacturers, allowing them to scale their products through institutional channels rather than relying solely on traditional retail or direct-to-consumer approaches. This strategy enables manufacturers to position their ingredients not just as nutritional solutions, but as tools for enhancing productivity and performance, which aligns well with the ROI-driven mindset of corporate buyers. This trend reflects a broader shift in consumer attitudes, moving from a reactive approach to mental health treatment to proactive daily management of mental wellness. As the lines between supplements, functional foods, and performance-enhancing wellness products continue to blur, mood-enhancing ingredients are set to play a central role in the next generation of corporate health strategies.

Challenges: lack of consistent scientific validation and standardization

A key challenge in the mood ingredients market is the lack of consistent scientific validation and standardization, particularly for many botanical-derived compounds. While consumer interest in natural mood enhancers—such as ashwagandha, lemon balm, and saffron—is growing, a significant proportion of these ingredients still lack robust, peer-reviewed clinical evidence to support their efficacy, recommended dosages, and long-term safety. This presents a major obstacle not only for consumer acceptance but also for regulatory approval, especially in regions with strict health claims regulations, like the EU (EFSA) and the U.S. (FDA). Even in cases where traditional use or preliminary studies suggest potential benefits, the quality of research often varies significantly. Many studies have small sample sizes, unclear methodologies, or insufficient blinding. This inconsistency makes it challenging for formulators and end-product companies to confidently present mood ingredients as effective solutions without risking non-compliance or consumer backlash. Additionally, the placebo effect is particularly strong in mood and mental health interventions, making rigorous randomized controlled trials (RCTs) essential to confirm actual benefits.

Compounding the issue is the inconsistency in standardization among suppliers. Mood-related botanicals can vary widely in their active compound content due to differences in source, processing methods, and formulation. For example, the concentration of withanolides in ashwagandha or safranal in saffron can differ greatly unless the ingredient is precisely standardized. Without this consistency, the reproducibility of results—and by extension, the consumer experience—becomes unreliable. This lack of standardization also complicates label claims, dosage recommendations, and formulation planning, making it more difficult for manufacturers to build trust with retailers, healthcare professionals, and scientifically minded consumers. Consequently, while the potential of mood ingredients is promising, the absence of uniform scientific backing and ingredient consistency remains a barrier to broader mainstream adoption and regulatory approval.

Market Ecosystem

The adaptogens in the ingredient type segment are growing the fastest during the forecast period.

Among ingredient types in the mood ingredients market, adaptogens—particularly botanicals like ashwagandha, rhodiola rosea, and holy basil—are experiencing the fastest growth rate. This surge is driven by increasing consumer demand for natural stress and anxiety relief, especially in the wake of post-pandemic mental health concerns. Adaptogens appeal to a wide demographic due to their perceived safety, multifunctionality (supporting both mood and energy), and growing body of clinical evidence supporting their efficacy. The success of standardized, branded adaptogens such as KSM-66® and Sensoril® has further accelerated growth by enabling clear marketing, trust-building, and integration into mainstream supplement, food, and beverage products..

In terms of functionality, the segment for stress and anxiety relief accounts for the largest share of the mood ingredients market.

By functionality, the stress and anxiety relief segment holds the largest market share in the mood ingredients market. This dominance is fueled by a rising global mental health burden, with stress becoming a common concern across all age groups—from working professionals to students and even the elderly. Consumers are actively seeking natural, non-pharmaceutical solutions to manage daily stress, leading to high demand for ingredients like ashwagandha, L-theanine, GABA, and magnesium. Brands are increasingly formulating these into supplements, functional beverages, and gummies, often positioning them as daily mood stabilizers or calming aids. This segment's broad appeal, coupled with growing clinical support and mainstream acceptance, has cemented its leadership within the market.

The North America region has a significant share in the mood ingredients market during the forecast period.

By region, North America holds the largest market share in the mood ingredients market. This dominance is driven by several factors, including high consumer awareness of mental health, strong demand for natural and preventive wellness solutions, and a well-established dietary supplements industry. The U.S. in particular leads due to widespread use of mood-enhancing nutraceuticals, the presence of major ingredient suppliers and supplement brands, and growing employer-driven wellness programs. Additionally, North America’s relatively flexible regulatory environment for dietary supplements (compared to Europe) supports faster product innovation and commercial adoption of mood-support ingredients such as adaptogens, nootropics, and amino acids.

Key Market Players

The key players in this market include DSM-Firmenich, Givaudan, Kerry, PLT Health Solutions, Nura USA, NutriScience Innovations, Ixoreal Biomed, Laila Nutraceuticals, OmniActive Health, DolCas Biotech, Suan Farma, NEXIRA, Vidya Herbs, Arjuna Natural, Martin Bauer Group, Kancor Ingredients, Olene Life Sciences, Bioprex Labs, Nattura Bio, Sami-Sabinsa, Indena, Alchem International, Sabinsa Japan, Vidya Europe, and Avestia Pharma.

Recent Developments

- March 2025: PLT Health Solutions launched a new standardized extract aimed at promoting relaxation and mental well-being. The ingredient is backed by clinical studies demonstrating its efficacy in reducing anxiety and improving sleep quality.

- January 2025: Kerry Group announced the development of a new line of natural mood-enhancing ingredients derived from botanical sources. These ingredients are designed for incorporation into functional foods and beverages, targeting stress reduction and cognitive support.

- November 2024: Givaudan advanced its MoodScentz™ platform, integrating neuroscience and AI to create fragrances designed to evoke specific emotional responses. This innovation aims to enhance mood through scent, reflecting the company's commitment to scientifically-backed mood solutions.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the mood ingredients market?

North America dominated the mood ingredients market, worth USD XX billion in 2025, and is projected to reach USD XX billion by 2030, at a CAGR of XX% during the forecast period.

What is the current size of the global mood ingredients market?

The global mood ingredients market was valued at USD XX billion in 2025. It is projected to reach USD XX billion by 2030, recording a CAGR of XX% during the forecast period.

Who are the key players in the market?

The key players in this market DSM-Firmenich, Givaudan, Kerry, PLT Health Solutions, Nura USA, NutriScience Innovations, Ixoreal Biomed, Laila Nutraceuticals, OmniActive Health, DolCas Biotech, Suan Farma, NEXIRA, Vidya Herbs, Arjuna Natural, Martin Bauer Group, Kancor Ingredients, Olene Life Sciences, Bioprex Labs, Nattura Bio, Sami-Sabinsa, Indena, Alchem International, Sabinsa Japan, Vidya Europe, and Avestia Pharma.

What are the factors driving the mood ingredients market?

Increased prevalence of anxiety, stress, and sleep disorders is pushing consumers to seek natural and preventive mental wellness solutions.

Consumer preference is shifting from synthetic pharmaceuticals to botanical, adaptogenic, and clean-label ingredients like ashwagandha, saffron, and L-theanine.

Mood-enhancing ingredients are increasingly incorporated into ready-to-drink beverages, gummies, and snacks, expanding application possibilities.

- Rising Mental Health Awareness

- Shift Toward Natural & Plant-Based Remedies

- Expansion of Functional Food & Beverage Formats

Which type of ingredient accounted for the largest share of the mood ingredients market?

By ingredient type, botanical & herbal extracts hold the largest share in the mood ingredients market. These include well-researched herbs like ashwagandha, saffron, rhodiola rosea, lemon balm, and holy basil, which are widely used due to their natural origin, traditional use in systems like Ayurveda and TCM, and increasing clinical validation. Consumers tend to favor botanicals over synthetic compounds or isolated nutrients because they are perceived as safer, more holistic, and multifunctional—supporting not only mood but also energy, sleep, and stress resilience. Their versatility across delivery formats such as capsules, teas, functional foods, and gummies further reinforces their dominant position in the market. .

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

-

1.3 STUDY SCOPEMARKET SEGMENTATIONINCLUSIONS & EXCLUSIONSREGIONS COVEREDYEARS CONSIDERED

-

1.4 UNIT CONSIDEREDCURRENCY/ VALUE UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

-

2.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key insights from industry experts- Breakdown of Primary Interviews

-

2.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

-

2.4 RESEARCH ASSUMPTIONSASSUMPTIONS OF THE STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

-

5.3 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.4 IMPACT OF GEN AI ON MOOD INGREDIENTS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

-

6.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- KEY TECHNOLOGY 1- KEY TECHNOLOGY 2COMPLEMENTARY TECHNOLOGIESADJACENT TECHNOLOGIES

-

6.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, INGREDIENT TYPEAVERAGE SELLING PRICE TREND, BY INGREDIENT TYPEAVERAGE SELLING PRICE TREND, BY REGION

-

6.7 ECOSYSTEM ANALYSIS/ MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

-

6.9 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKET

- 6.10 KEY CONFERENCES & EVENTS IN 2024-2025

-

6.11 TARIFF & REGULATORY LANDSCAPETARIFF RELATED TO MOOD INGREDIENTSREGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

-

6.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 7.1 INTRODUCTION

- 7.2 ADAPTOGENS

- 7.3 NOOTROPICS

- 7.4 AMINO ACIDS

- 7.5 BOTANICALS & HERBAL EXTRACTS

- 7.6 OMEGA FATTY ACIDS

- 7.7 MINERALS

- 7.8 VITAMINS

- 7.9 PROBIOTICS & POSTBIOTICS

- 8.1 INTRODUCTION

- 8.2 STRESS REDUCTION

- 8.3 RELAXATION & CALM

- 8.4 MOOD ENHANCEMENT / HAPPINESS

- 8.5 SLEEP SUPPORT

- 8.6 MENTAL CLARITY / FOCUS

- 8.7 ENERGY & VITALITY

- 9.1 INTRODUCTION

- 9.2 NATURAL

- 9.3 SYNTHETIC

-

9.4 MICROBIAL

- MOOD INGREDIENTS MARKET, BY APPLICATION

- 9.5 MARINE-BASED

- 10.1 INTRODUCTION

- 10.2 DIETARY SUPPLEMENTS

- 10.3 FUNCTIONAL BEVERAGES

- 10.4 FUNCTIONAL FOODS

- 10.5 PERSONAL CARE & SCENTS

- 10.6 PET CARE

-

11.1 NORTH AMERICAUSCANADAMEXICO

-

11.2 EUROPEGERMANYUKFRANCEITALYSPAINREST OF EUROPE

-

11.3 ASIA PACIFICCHINAINDIAJAPANAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC

-

11.4 SOUTH AMERICABRAZILARGENTINAREST OF SOUTH AMERICA

-

11.5 REST OF THE WORLDAFRICAMIDDLE EAST

-

12.1 OVERVIEW

-

12.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

-

12.3 REVENUE ANALYSIS

-

12.4 MARKET SHARE ANALYSIS, 2023

-

12.5 BRAND/ PRODUCT COMPARISON

-

12.6 KEY PLAYER ANNUAL REVENUE VS GROWTH

-

12.7 KEY PLAYER EBIT/EBITDA

-

12.8 COMPANY VALUATION AND FINANCIAL METRICES

-

12.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS - STARS

-

12.10 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023 - EMERGING LEADERS- PERVASIVE PLAYERS- PARTICIPANTS- COMPANY FOOTPRINT: KEY PLAYER, 2023COMPANY EVALUATION MATRIX: START-UP/SME, 2023- PROGRESSIVE COMPANIES- RESPONSIVE COMPANIES- DYNAMIC COMPANIES- STARTING BLOCKS- COMPETITIVE BENCHMARKING: START-UPS. SMES, 2023COMPETITIVE SCENARIO AND TRENDS- NEW PRODUCT LAUNCHES- DEALS- OTHERS- OTHER DEVELOPMENTS

-

13.1 KEY PLAYERSDSM-FIRMENICHGIVAUDANKSM-66 ASHWAGANDHASABINSA CORPORATIONLONZAGENCOR PACIFICLALLEMAND HEALTH SOLUTIONSINDENAKERRY GROUP- PLT HEALTH SOLUTIONS- NEKTIUM- ARJUNA NATURAL- KANEKA CORPORATION- MAYPRO INDUSTRIES- VIDYA HERBS

-

13.2 OTHER PLAYERSPRINOVA (NAGASE GROUP)NUTRISCIENCE INNOVATIONSNATURES CROPS INTERNATIONALBIOTROPICS MALAYSIAORGANIC TECHNOLOGIES (NOW PART OF GC RIEBER VIVOMEGA)

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Mood Ingredients Market