Network Function Virtualization (NFV) Market by Component (Solutions, Orchestration and Automation, and Professional Services), Virtualized Network Function, Application (Virtual Appliance and Core Network), End User, and Region - Global Forecast to 2035

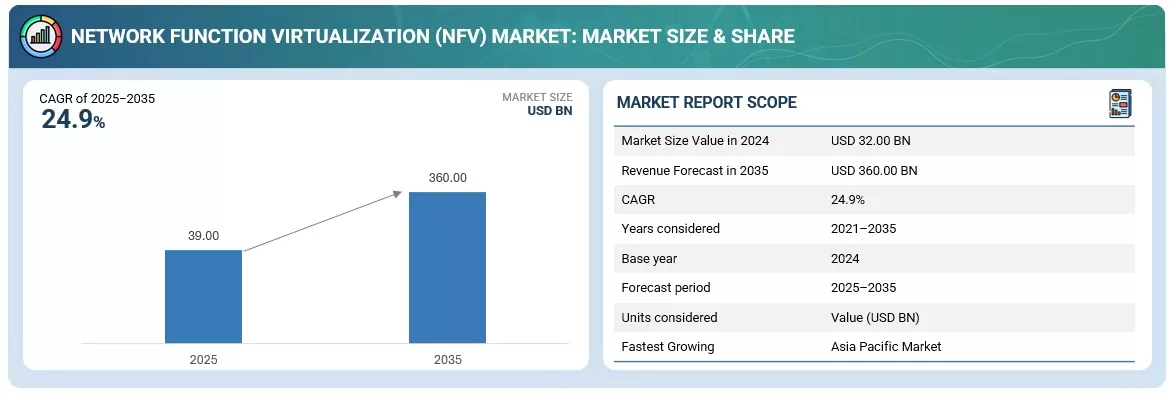

The global Network Function Virtualization market was valued at USD 39.0 billion in 2025 and is projected to reach USD 360.0 billion by 2035, growing at a CAGR of 24.9% between 2025 and 2035.

The Network Functions Virtualization (NFV) market is experiencing robust growth, with forecasts indicating a double-digit compound annual growth rate (CAGR) ranging between 20% and 30% through 2030. This expansion is primarily driven by the increasing adoption of 5G networks, the telecommunications industry’s transition toward cloud-native architectures, and the growing demand for flexible and scalable network infrastructure to support edge computing.

Network function virtualization refers to the virtualization of all networking components, such as compute, network, and storage, of enterprises and service providers to organize them, improve network agility, and lower operational cost. In a nutshell, the networking features are abstracted from the networking hardware to a single device, enabling network administrators to manage the entire networking infrastructure from a single software console.

Telecommunications operators currently lead NFV adoption, deploying virtualized solutions across core, RAN, and edge networks, while enterprises are increasingly embracing NFV for applications such as virtual customer premises equipment (vCPE), SD-WAN, and network security services. Despite challenges related to integration complexity, interoperability between legacy and cloud-native systems, and a shortage of skilled professionals, the development of advanced NFV infrastructure (NFVI), orchestration platforms, and vendor ecosystems is accelerating the market’s maturity and facilitating broader adoption.

Market by Enterprise

BFSI (Banking, Financial Services, and Insurance)

The BFSI sector is increasingly adopting NFV to enhance network agility, security, and scalability in support of digital banking, mobile transactions, and cloud-based financial services. NFV enables financial institutions to virtualize critical functions such as firewalls, intrusion detection, and load balancing, reducing dependence on costly hardware. It also supports secure remote connectivity, real-time fraud detection, and faster deployment of digital services while maintaining compliance and data protection standards.

Manufacturing

In the manufacturing sector, NFV facilitates the creation of flexible, software-defined industrial networks that support Industry 4.0 initiatives. It enables seamless connectivity across factories, supply chains, and IoT devices while improving automation, monitoring, and remote management. Manufacturers use NFV to support predictive maintenance, real-time production analytics, and low-latency applications powered by 5G and edge computing, thereby increasing operational efficiency and reducing downtime.

Retail

Retailers are adopting NFV to modernize their IT infrastructure and deliver connected, customer-centric experiences across physical and digital channels. NFV allows virtualization of network functions like point-of-sale connectivity, content delivery, and secure payment processing, improving service availability and scalability. It also supports rapid rollout of new digital services, data analytics for customer insights, and secure connectivity for distributed retail outlets, enhancing both operational agility and customer engagement.

Market by Technology

Cloud Platforms

Cloud platforms play a critical role in the NFV ecosystem by providing the scalable, flexible, and distributed infrastructure needed to host and manage virtual network functions. They enable service providers to deploy VNFs across public, private, or hybrid cloud environments, ensuring agility, cost efficiency, and faster service rollout. Cloud-native architectures, containerization, and microservices further enhance NFV’s adaptability, allowing seamless orchestration and integration with edge and multi-cloud environments.

Software-Defined Networking (SDN)

SDN complements NFV by separating the control and data planes, enabling centralized network management and dynamic configuration of virtualized network resources. Through programmable interfaces, SDN allows NFV architectures to optimize traffic flow, automate network provisioning, and improve service agility. Together, NFV and SDN enhance network flexibility, simplify operations, and accelerate the delivery of on-demand network services.

Predictive Analytics

Predictive analytics in NFV leverages big data and machine learning algorithms to forecast network performance, detect anomalies, and prevent potential failures before they impact services. By analyzing historical and real-time data, it enables proactive maintenance, resource optimization, and service assurance. This data-driven approach enhances network reliability, reduces downtime, and supports intelligent decision-making in virtualized environments.

AI-driven Optimization

AI-driven optimization enhances NFV by automating complex network management tasks such as resource allocation, fault detection, and performance tuning. Artificial intelligence algorithms analyze network patterns and dynamically adjust configurations to optimize throughput, latency, and energy efficiency. This not only increases operational efficiency but also supports self-healing, self-optimizing networks that can adapt autonomously to changing conditions and service demands.

Market by Geography:

Geographically, the Network Function Virtualization (NFV) market is witnessing growing adoption across North America, Europe, Asia Pacific, and the Rest of the World. North America represents one of the most mature markets for NFV adoption, driven by early digital transformation initiatives and widespread deployment of 5G networks. The United States leads the region, with major telecom operators such as AT&T, Verizon, and T-Mobile investing heavily in virtualized core and edge networks to enhance scalability and reduce operational costs. The strong presence of cloud and IT giants, along with ongoing advancements in SDN and automation, further accelerates NFV implementation. Regulatory frameworks such as the FCC’s network neutrality policies and data privacy regulations (e.g., CCPA) emphasize transparency, data security, and interoperability, shaping the region’s NFV ecosystem and promoting innovation under clear compliance guidelines.

Europe’s NFV market is characterized by steady adoption across both telecom and enterprise sectors, supported by strong regulatory focus on data protection, network resilience, and interoperability. Countries such as the UK, Germany, and France are at the forefront, integrating NFV to modernize telecom infrastructure and enhance digital services. The European Union’s General Data Protection Regulation (GDPR) and Digital Decade policy framework influence NFV deployments by enforcing strict data governance and encouraging digital infrastructure modernization. Additionally, collaborative initiatives under ETSI (European Telecommunications Standards Institute) play a key role in defining NFV standards, ensuring interoperability, and fostering a unified regional ecosystem.

Asia Pacific is witnessing the fastest growth in NFV adoption, fueled by rapid 5G rollouts, expanding cloud ecosystems, and government-led digitalization programs. Countries such as China, Japan, South Korea, and India are heavily investing in NFV to support smart cities, industrial IoT, and large-scale enterprise connectivity. The region’s regulatory environment varies — China promotes NFV through state-driven telecom innovation policies, Japan emphasizes interoperability and security under the Telecommunications Business Act, and India’s National Digital Communications Policy supports network virtualization and open architecture adoption. The combination of government incentives, growing telecom competition, and strong edge computing demand positions Asia Pacific as a key growth hub for NFV over the coming decade.

Market Dynamics

Driver: Accelerating shift toward cloud-native network architectures

The key driver for the NFV market is the widespread rollout of 5G networks and the accelerating shift toward cloud-native network architectures. NFV allows telecom operators and enterprises to decouple network functions from proprietary hardware, leading to significant cost savings, flexibility, and scalability. The growing demand for on-demand services, network slicing, and low-latency applications is further promoting NFV adoption, especially as organizations seek to modernize infrastructure to support IoT and edge computing. Additionally, the trend toward network automation and virtualization across core, RAN, and edge domains is fueling continuous investment in NFV platforms worldwide.

Restraint: Integration complexity and interoperability issues

Despite its potential, NFV adoption is hindered by integration complexity and interoperability issues between legacy and virtualized systems. Many operators still operate in hybrid environments, making migration to NFV architectures resource-intensive and operationally challenging. The lack of standardized frameworks and skilled network virtualization professionals adds to deployment difficulties. Moreover, high initial investments in orchestration tools, software licenses, and staff training often discourage smaller service providers from large-scale NFV implementation. Ensuring smooth coexistence between virtualized and traditional network elements remains a significant barrier to seamless transformation.

Opportunity: Incorporation of AI, machine learning, and predictive analytics into network orchestration and lifecycle management.

The NFV market presents immense opportunities through the incorporation of AI, machine learning, and predictive analytics into network orchestration and lifecycle management. These technologies enable autonomous optimization, dynamic resource allocation, and real-time fault prediction, improving overall network performance and reliability. The rising demand for private 5G networks, industrial IoT applications, and smart edge services offers NFV vendors new vertical markets beyond telecom. Furthermore, open-source NFV frameworks and partnerships between cloud hyperscalers and telecom operators are fostering innovation, lowering entry barriers, and expanding the global NFV ecosystem.

Challenge: Maintaining security, reliability, and regulatory compliance

The biggest challenge in the NFV market lies in maintaining security, reliability, and regulatory compliance across highly virtualized and distributed networks. As network functions are migrated to cloud or multi-vendor environments, organizations face increased risks of data breaches, service disruptions, and performance inconsistencies. Meeting stringent SLAs and ensuring consistent QoS (Quality of Service) in dynamic, software-driven networks is complex. Additionally, evolving regional data privacy regulations and telecom compliance standards require continuous adaptation of NFV systems. Balancing automation, security, and operational control remains an ongoing challenge for service providers and enterprises adopting NFV at scale.

Future Outlook

The global Network Function Virtualization (NFV) market is experiencing significant growth, driven by the increasing demand for scalable, cost-effective, and agile network infrastructures. Organizations are adopting NFV to enhance network agility, reduce capital expenditures, and accelerate service deployment. This shift is particularly evident in sectors such as telecommunications, financial services, and healthcare, where NFV enables dynamic resource allocation and supports emerging technologies like 5G, edge computing, and Internet of Things (IoT) applications.

Regionally, North America leads the NFV adoption curve, propelled by robust investments in 5G infrastructure, cloud-native technologies, and a favorable regulatory environment. The United States, for instance, is witnessing a surge in NFV deployments, with projections indicating substantial market growth in the coming years. In the Asia Pacific region, countries like China and India are rapidly embracing NFV, driven by digital transformation initiatives, smart city projects, and the need for efficient network management in densely populated areas.

Despite the promising outlook, the NFV market faces challenges such as interoperability issues, security concerns, and the complexity of integrating NFV solutions with existing legacy systems. Organizations must address these hurdles to fully realize the benefits of NFV. The demand for NFV solutions is expected to continue growing, fueled by the ongoing digitalization efforts across industries and the need for flexible, automated network infrastructures.

Key Market Players

Key Network Function Virtualization companies include Cisco Systems, Inc. (US), Broadcom Inc. (US), Huawei Corporation (China), Ericsson (Sweden), Nokia Corporation (Finland), Hewlett Packard Enterprise (US), Juniper Networks, Inc. (US), NEC Corporation (Japan), ZTE Corporation (China), Fujitsu Limited (Japan), among others.

These players focus on expanding their NFV capabilities through AI-driven analytics, software-defined networking, real-time monitoring, and predictive analytics. Strategic partnerships, product innovations, and cloud-based platform enhancements remain the primary approaches to strengthening their global footprint and addressing evolving requirements.

Scope of the Network Function Virtualization Market Report

|

Report Metrics |

Details |

|

Market size value in 2024 |

USD 32.00 billion |

|

Revenue forecast in 2035 |

USD 360.00 billion |

|

Growth Rate |

22.9% CAGR |

|

Historical data |

2021-2035 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025-2035 |

|

Quantitative units |

Value (USD Billion) |

|

Segments covered |

Components (Solutions, Orchestration and Automation, and Services), Virtualized Network Functions (Compute, Storage, and Network), Applications (Virtual Appliance and Core Network), End Users (Service Providers, Data Centers, and Enterprises), Organization Size (Small and Medium-sized Enterprises [SME]s and Large Enterprises), and Regions |

|

Regions covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Cisco (US), Ericsson (US), Huawei (China), VMware(US), Nokia (Finland), HPE (US), Dell EMC (US), Juniper Networks (US), Affirmed Networks (US), NETSCOUT (US), NEC (Japan), Ribbon Communications (US), ZTE Corporation (China), Fujitsu (Japan), Ciena (US), ECI Telecom (Israel), Metaswitch (UK), Mavenir (US), Radisys (US), and Wind River (US) |

This research report categorizes the network function virtualization market to forecast revenue and analyze trends in each of the following submarkets:

Based on Components:

- Solutions

- Orchestration and Automation

- Services

Based on virtualized Network Functions

- Compute

- Storage

- Network

Based on Applications:

- Virtual Appliance

- Core Network

Based on End Users:

- Service Providers

- Data Centers

-

Enterprises

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail

- Manufacturing

- Government and Defense

- Education

- IT-enabled Services

- Others (Hospitality, transportation and logistics, media and entertainment, and utilities)

Based on Enterprise Size

- SMEs

- Large enterprises

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2019, VMware expanded its partnership with Nokia to simplify large-scale, multi-cloud operations. This partnership also aims at increasing investments, along with technology collaboration and advanced research & development, to develop integrated solutions.

- In October 2019, Ericsson collaborated with NVIDIA to provide 5G radio access networks (RAN). Under this collaboration, both the companies will focus on developing the technologies that will enable communication service providers to build virtualized 5G RAN. It will accelerate the introduction of new AI- and IoT-based services.

- In October 2019, Nokia launched new packet-optical switches for 5G cloud RAN. This newly introduced packet-optical transport switches offer Time-Sensitive Networking (TSN), ultra-low latency, and cloud-native radio architectures required to support time-critical services in 5G.

- In September 2019, Cisco released the latest version 3.12.x of Cisco Enterprise NFVIS. The newly added enhanced features include Data Plane Development Kit (DPDK) enhancements, such as service bridge extension to platforms and migration for Virtual Machines (VMs) with Physical Network Adapter (PNIC) () associated to DPDK bridge.

- In March 2019, Huawei launched a new solution, Telco Cloud Networking. The solution will assist carriers in providing innovative services that will empower 5G, IoT, and Virtual Reality (VR). )

Frequently Asked Questions (FAQ):

What is the projected market value of Network Function Virtualization Market?

What is the estimated growth rate (CAGR) of the global Network Function Virtualization Market?

What is Network Function Virtualization?

What are the top trends in the Network Function Virtualization Market?

- The emergence of cloud services, data center consolidation, and server virtualization

- Rising demand for network virtualization and automation

- Need for an enhanced network management system to handle the growing network traffic and complexity

- Adoption of NFV for the IoT technology

- Increasing demand for private cloud solutions and services ]

- Development of open-source SDN and NFV

Who are the prominent players in the Network Function Virtualization Market?

What are the major NFV-based applications?

- Virtual Appliance

-

Core Network

- Multi-access Edge Computing (MEC)

- Virtualized Radio Access Network (vRAN)

- Virtualized Evolved Packet Core (vEPC)

- Virtualized IP Multimedia Subsystem (vIMS)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

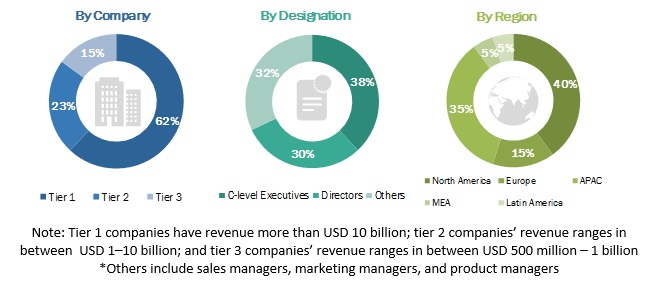

2.1.1 Breakup of Primaries

2.1.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Assumptions for the Study

2.5 Competitive Leadership Mapping

2.6 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Global Market

4.2 Network Function Virtualization Market, By Virtualized Network Function, 2019

4.3 North America: Market By Application and End User, 2019

4.4 Asia Pacific: Market By Application and End User, 2019

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Need for an Enhanced Network Management System to Handle the Growing Network Traffic and Complexity

5.1.1.2 Increased Emergence of Cloud Services, Data Center Consolidation, and Server Virtualization

5.1.1.3 Rise in Demand for Network Virtualization and Automation

5.1.2 Restraints

5.1.2.1 Growing Number of Security Risks Across the NFV Infrastructure

5.1.2.2 Difficulties in Troubleshooting Across the NFV Network

5.1.3 Opportunities

5.1.3.1 Adoption of NFV for IoT Technology

5.1.3.2 Increased Demand for Private Cloud Solutions and Services

5.1.3.3 Development of Open-Source SDN and NFV

5.1.4 Challenges

5.1.4.1 Complexities Introduced By Third-Party Integrations, Acquisitions, and Collaborations

5.1.4.2 Reliability Concerns for NFV

5.1.4.3 Balancing Network Infrastructure Between Traditional and NFV Technologies

5.2 Use Cases

5.2.1 SD-WAN

5.2.2 VCPE

5.2.3 NFV-Based Service Orchestration

5.2.4 Augmentation Service Offering Through NFV

5.2.5 Virtual Managed Services for Small and Medium Enterprises

6 Network Function Virtualization Market By Component (Page No. - 45)

6.1 Introduction

6.2 Solutions

6.2.1 Hardware

6.2.1.1 Hardware: NFV Market Drivers

6.2.2 Software

6.2.2.1 Software: NFV Market Drivers

6.3 Orchestration and Automation

6.3.1 Orchestration and Automation: Network Function Virtualization Market Drivers

6.4 Professional Services

6.4.1 Consulting

6.4.1.1 Consulting: NFV Market Drivers

6.4.2 Implementation

6.4.2.1 Implementation: NFV Market Drivers

6.4.3 Training and Support

6.4.3.1 Training and Support: NFV Market Drivers

7 Network Function Virtualization Market By Virtualized Network Function (Page No. - 54)

7.1 Introduction

7.2 Compute

7.2.1 Compute: Market Drivers

7.3 Storage

7.3.1 StoraGE: Market Drivers

7.4 Network

7.4.1 Network: Market Drivers

8 Network Function Virtualization Market By Application (Page No. - 59)

8.1 Introduction

8.2 Virtual Appliance

8.2.1 Virtual Appliance: Market Drivers

8.3 Core Network

8.3.1 Mobile Edge Computing

8.3.1.1 MEC: NFV Market Drivers

8.3.2 Virtualized Radio Access Network

8.3.2.1 VRAN: NFV Market Drivers

8.3.3 Virtualized Evolved Packet Core

8.3.3.1 VEPC: NFV Market Drivers

8.3.4 Virtual Internet Protocol Multimedia Subsystem

8.3.4.1 VIMS: NFV Market Drivers

9 Network Function Virtualization Market, By End User (Page No. - 66)

9.1 Introduction

9.2 Service Providers

9.2.1 Service Providers: Market Drivers

9.2.2 Network Service Providers

9.2.3 Telecom Operators

9.3 Data Centers

9.3.1 Data Centers: Market Drivers

9.4 Enterprises

9.4.1 Enterprises: Market Drivers

9.4.2 Banking, Financial Services, and Insurance

9.4.3 Manufacturing

9.4.4 Retail

9.4.5 Healthcare

9.4.6 Education

9.4.7 Government and Defense

9.4.8 Others

10 Network Function Virtualization Market By Enterprise Size (Page No. - 78)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.2.1 Small and Medium-Sized Enterprises: Market Drivers

10.3 Large Enterprises

10.3.1 Large Enterprises: Market Drivers

11 Network Function Virtualization Market By Region (Page No. - 82)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 United States: NFV Market Drivers

11.2.2 Canada

11.2.2.1 Canada: NFV Market Drivers

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 United Kingdom: NFV Market Drivers

11.3.2 Germany

11.3.2.1 Germany: NFV Market Drivers

11.3.3 France

11.3.3.1 France: NFV Market Drivers

11.4 Asia Pacific

11.4.1 Japan

11.4.1.1 Japan: NFV Market Drivers

11.4.2 China

11.4.2.1 China: NFV Market Drivers

11.4.3 India

11.4.3.1 India: NFV Market Drivers

11.5 Latin America

11.5.1 Brazil

11.5.1.1 Brazil: NFV Market Drivers

11.5.2 Mexico

11.5.2.1 Mexico: NFV Market Drivers

11.6 Middle East and Africa

11.6.1 Middle East

11.6.1.1 Middle East: NFV Market Drivers

11.6.2 Africa

11.6.2.1 Africa: NFV Market Drivers

12 Competitive Landscape (Page No. - 110)

12.1 Introduction

12.2 Competitive Leadership Mapping (Overall Market)

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Strength of Product Portfolio

12.4 Business Strategy Excellence

12.5 Market Ranking for the Network Function Virtualization Market, 2018

13 Company Profiles (Page No. - 115)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Cisco

13.2 VMware

13.3 Huawei

13.4 Ericsson

13.5 Nokia

13.6 HPE

13.7 Dell EMC

13.8 Juniper Networks

13.9 NEC

13.10 Affirmed Networks

13.11 Ribbon Communications

13.12 ZTE

13.13 NETSCOUT

13.14 Fujitsu

13.15 Ciena

13.16 ECI Telecom

13.17 Metaswitch Networks

13.18 Mavenir

13.19 Radisys

13.20 Wind River

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 151)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (98 Tables)

Table 1 United States Dollar Exchange Rate, 2017–2019

Table 2 Network Function Virtualization Market Size, By Component, 2017–2024 (USD Million)

Table 3 Solutions: Market Size By Region, 2017–2024 (USD Million)

Table 4 Solutions: Market Size By Type, 2017–2024 (USD Million)

Table 5 Hardware Market Size, By Region, 2017–2024 (USD Million)

Table 6 Software Market Size, By Region, 2017–2024 (USD Million)

Table 7 Orchestration and Automation: Network Function Virtualization Market Size, By Region, 2017–2024 (USD Million)

Table 8 Professional Services: Market Size By Region, 2017–2024 (USD Million)

Table 9 Professional Services: Market Size By Type, 2017–2024 (USD Million)

Table 10 Consulting Market Size, By Region, 2017–2024 (USD Million)

Table 11 Implementation Market Size, By Region, 2017–2024 (USD Million)

Table 12 Training and Support Market Size, By Region, 2017–2024 (USD Million)

Table 13 Network Function Virtualization Market Size, By Virtualized Network Function, 2017–2024 (USD Million)

Table 14 Compute: Market Size By Region, 2017–2024 (USD Million)

Table 15 Storage: Market Size By Region, 2017–2024 (USD Million)

Table 16 Network: Market Size By Region, 2017–2024 (USD Million)

Table 17 Network Function Virtualization Market Size, By Application, 2017–2024 (USD Million)

Table 18 Virtual Appliance: Market Size By Region, 2017–2024 (USD Million)

Table 19 Core Network: Market Size By Region, 2017–2024 (USD Million)

Table 20 Core Network: Market Size By Type, 2017–2024 (USD Million)

Table 21 Mobile Edge Computing Market Size, By Region, 2017–2024 (USD Million)

Table 22 Virtualized Radio Access Network Market Size, By Region, 2017–2024 (USD Million)

Table 23 Virtualized Evolved Packet Core Market Size, By Region, 2017–2024 (USD Million)

Table 24 Virtual Internet Protocol Multimedia Subsystem Market Size, By Region, 2017–2024 (USD Million)

Table 25 Network Function Virtualization Market Size, By End User, 2017–2024 (USD Million)

Table 26 Service Providers: Market Size By Region, 2017–2024 (USD Million)

Table 27 Service Providers: Market Size By Type, 2017–2024 (USD Million)

Table 28 Network Service Providers Market Size, By Region, 2017–2024 (USD Million)

Table 29 Telecom Operators Market Size, By Region, 2017–2024 (USD Million)

Table 30 Data Centers: Network Function Virtualization Market Size, By Region, 2017–2024 (USD Million)

Table 31 Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 32 Enterprises: Market Size By Vertical, 2017–2024 (USD Million)

Table 33 Banking, Financial Services, and Insurance Market Size, By Region, 2017–2024 (USD Million)

Table 34 Manufacturing Market Size, By Region, 2017–2024 (USD Million)

Table 35 Retail Market Size, By Region, 2017–2024 (USD Million)

Table 36 Healthcare Market Size, By Region, 2017–2024 (USD Million)

Table 37 Education Market Size, By Region, 2017–2024 (USD Million)

Table 38 Government and Defense Market Size, By Region, 2017–2024 (USD Million)

Table 39 Other Verticals Market Size, By Region, 2017–2024 (USD Million)

Table 40 Network Function Virtualization Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 41 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 42 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 43 Network Function Virtualization Market Size, By Region, 2017–2024 (USD Million)

Table 44 North America: Market Size By Component, 2017–2024 (USD Million)

Table 45 North America: Market Size By Solution, 2017–2024 (USD Million)

Table 46 North America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 47 North America: Market Size By Virtualized Network Function, 2017–2024 (USD Million)

Table 48 North America: Market Size By Application, 2017–2024 (USD Million)

Table 49 North America: Core Network Market Size, By Type, 2017–2024 (USD Million)

Table 50 North America: Network Function Virtualization Market Size, By End User, 2017–2024 (USD Million)

Table 51 North America: End User Market Size, By Service Provider, 2017–2024 (USD Million)

Table 52 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 53 North America: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 54 North America: Market Size By Country, 2017–2024 (USD Million)

Table 55 Europe: Network Function Virtualization Market Size, By Component, 2017–2024 (USD Million)

Table 56 Europe: Market Size By Solution, 2017–2024 (USD Million)

Table 57 Europe: Market Size By Professional Service, 2017–2024 (USD Million)

Table 58 Europe: Market Size By Virtualized Network Function, 2017–2024 (USD Million)

Table 59 Europe: Market Size By Application, 2017–2024 (USD Million)

Table 60 Europe: Core Network Application Market Size, By Type, 2017–2024 (USD Million)

Table 61 Europe: Market Size By End User, 2017–2024 (USD Million)

Table 62 Europe: End User Market Size, By Service Provider, 2017–2024 (USD Million)

Table 63 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 64 Europe: Vertical Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 65 Europe: Network Function Virtualization Market Size, By Country, 2017–2024 (USD Million)

Table 66 Asia Pacific: Market Size By Component, 2017–2024 (USD Million)

Table 67 Asia Pacific: Market Size By Solution, 2017–2024 (USD Million)

Table 68 Asia Pacific: Market Size By Professional Service, 2017–2024 (USD Million)

Table 69 Asia Pacific: Market Size By Virtualized Network Function, 2017–2024 (USD Million)

Table 70 Asia Pacific: Market Size By Application, 2017–2024 (USD Million)

Table 71 Asia Pacific: Core Network Market Size, By Type, 2017–2024 (USD Million)

Table 72 Asia Pacific: Market Size By End User, 2017–2024 (USD Million)

Table 73 Asia Pacific: End User Market Size, By Service Provider, 2017–2024 (USD Million)

Table 74 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 75 Asia Pacific: Vertical Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 76 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 77 Latin America: Network Function Virtualization Market Size, By Component, 2017–2024 (USD Million)

Table 78 Latin America: Market Size By Solution, 2017–2024 (USD Million)

Table 79 Latin America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 80 Latin America: Market Size By Virtualized Network Function, 2017–2024 (USD Million)

Table 81 Latin America: Market Size By Application, 2017–2024 (USD Million)

Table 82 Latin America: Core Network Application Market Size, By Type, 2017–2024 (USD Million)

Table 83 Latin America: Market Size By End User, 2017–2024 (USD Million)

Table 84 Latin America: End User Market Size, By Service Provider, 2017–2024 (USD Million)

Table 85 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 86 Latin America: Vertical Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 87 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 88 Middle East and Africa: Network Function Virtualization Market Size, By Component, 2017–2024 (USD Million)

Table 89 Middle East and Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 90 Middle East and Africa: Market Size By Professional Service, 2017–2024 (USD Million)

Table 91 Middle East and Africa: Market Size By Virtualized Network Function, 2017–2024 (USD Million)

Table 92 Middle East and Africa: Market Size By Application, 2017–2024 (USD Million)

Table 93 Middle East and Africa: Core Network Application Market Size, By Type, 2017–2024 (USD Million)

Table 94 Middle East and Africa: Market Size By End User, 2017–2024 (USD Million)

Table 95 Middle East and Africa: End User Market Size, By Service Provider, 2017–2024 (USD Million)

Table 96 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 97 Middle East and Africa: Vertical Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 98 Middle East and Africa: Network Function Virtualization Market Size, By Sub-Region, 2017–2024 (USD Million)

List of Figures (44 Figures)

Figure 1 Network Function Virtualization Market: Research Design

Figure 2 Research Methodology

Figure 3 Market: Top-Down and Bottom-Up Approaches

Figure 4 Competitive Leadership Mapping: Criteria Weightage

Figure 5 Market By Component, 2019 and 2024

Figure 6 Market By Virtualized Network Function, 2019 and 2024

Figure 7 Market By Application, 2019 and 2024

Figure 8 Service Providers Segment to be the Largest Revenue Contributor in 2019 and 2024

Figure 9 Asia Pacific to Witness the Highest Growth Rate By 2024

Figure 10 Growing Number of IoT Deployments Followed By 5g Transformation to Support NFV Market Growth

Figure 11 Network Segment to Account for the Highest Market Share in 2019

Figure 12 Virtual Appliance Application and Service Provider End User to Hold Majority of the Market Share in North America

Figure 13 Virtual Appliance Application and Service Provider End User to Hold Majority of the Market Share in Asia Pacific

Figure 14 Drivers, Restraints, Opportunities, and Challenges: Network Function Virtualization Market

Figure 15 Orchestration and Automation Segment to Witness the Highest Growth Rate During the Forecast Period

Figure 16 Storage Segment to Record the Highest Growth Rate During the Forecast Period

Figure 17 Virtual Appliance to Record a Larger Market Size During the Forecast Period

Figure 18 Virtualized Evolved Packet Core to Record the Largest Market Size During the Forecast Period

Figure 19 Service Providers to Account for the Largest Market Size During the Forecast Period

Figure 20 Banking, Financial Services, and Insurance to Account for the Largest Market Size During the Forecast Period

Figure 21 Small and Medium-Sized Enterprises to Record a Higher Growth Rate During the Forecast Period

Figure 22 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Network Function Virtualization Market (Global), Competitive Leadership Mapping

Figure 26 Cisco to Dominate the NFV Market in 2019

Figure 27 Cisco: Company Snapshot

Figure 28 Cisco: SWOT Analysis

Figure 29 VMware: Company Snapshot

Figure 30 VMware: SWOT Analysis

Figure 31 Huawei: Company Snapshot

Figure 32 Huawei: SWOT Analysis

Figure 33 Ericsson: Company Snapshot

Figure 34 Ericsson: SWOT Analysis

Figure 35 Nokia: Company Snapshot

Figure 36 Nokia: SWOT Analysis

Figure 37 HPE: Company Snapshot

Figure 38 Juniper Networks: Company Snapshot

Figure 39 NEC: Company Snapshot

Figure 40 Ribbon Communications: Company Snapshot

Figure 41 ZTE: Company Snapshot

Figure 42 NETSCOUT: Company Snapshot

Figure 43 Fujitsu: Company Snapshot

Figure 44 Ciena: Company Snapshot

The study involved four major activities to estimate the current market size of the Network Function Virtualization market (NFV). Exhaustive secondary research was done to collect information on the NFV market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the NFV market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The NFV market comprises several stakeholders, such as government agencies, NFV Original Equipment Manufacturers (OEMs), NFV service providers, system integrators, consulting firms, research organizations, resellers and distributors, managed service providers, regulatory authorities and associations, Information Technology (IT) service providers, consultants/consultancies/advisory firms, and training providers. The demand side of the NFV market consists of all the firms operating in several verticals. The supply side includes NFV providers offering NFV solutions and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Network Function Virtualization Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global NFV market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer solutions and services in the NFV market was prepared while using the top-down approach. The market share of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (solutions and services). The aggregate of all companies’ revenue was extrapolated to reach the overall market size.

Furthermore, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To determine and forecast the global Network Function Virtualization market by component, Virtualized Network Function (VNF), application. end users, and region from 2019 to 2024, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the NFV market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the NFV market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, new product/service launches, business expansions, partnerships and collaborations, and Research and Development (R&D) activities in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Network Function Virtualization (NFV) Market