Network Traffic Analyzer Market by Component (Solutions and Professional Services), Deployment Mode (Physical, Virtual, and Cloud), End users (Service Providers and Enterprises), Enterprise Size, and Region - Global Forecast to 2024

Network Traffic Analyzer Market Size - Global

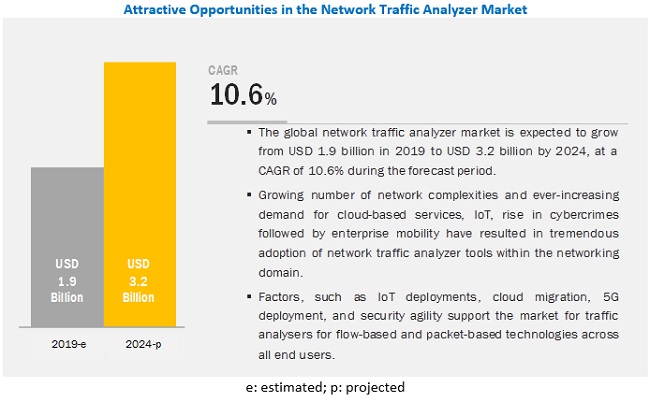

The Network Traffic Analyzer Market size as per revenue was surpassed $1.9 billion in 2019. Throughout the projection period, the network traffic analyzer industry is anticipated to increase at CAGR of 10.6% in between 2019-2024 to reach around $3.2 billion in 2024.

The network traffic analyzer market growth is driven by the major factors include the growing need for advanced network management systems to handle the increasing network traffic and complexities.

The solutions segment to record a higher growth rate during the forecast period

Solutions are an amalgamation of sensors, virtual machines, and software that are involved in carrying out network analyzing operations. Network traffic analyzer solutions collect data about the response time in interactions between clients and servers encompassing connectivity-level and application-level transactions. This metadata enables network administrators to regulate network traffic. The generated metadata further enables administrators to tackle network and application issues by determining the cause of slowdowns, bottlenecks, and downtime.

The vitual deployment mode segment to hold the largest market size during the forecast period

Virtualization within the networking domain has transformed drastically, as many legacy hardware have started being abstracted on a single device to enable a smooth virtual transition. Virtual sensors are usually deployed over virtual machines in the software-defined environment to monitor traffic flow. The virtual deployment model is largely scalable, and can be deployed over various platforms and within remotely located offices and large manufacturing units. Organizations have started implementing Virtualized Network Function Infrastructure (VNFI) on a large scale to enable easy deployment and scalability.

By end user, the enterprise vertical to grow at a higher CAGR during the forecast period

The enterprise customers are rapidly adopting network traffic analyzer solutions, as it offers significant benefits, such as improved network efficiency through centralized management, enhanced Information Technology (IT) agility, and network customization through fast and reliable application services. The enterprises segment is further categorized into different verticals, which cover Banking, Financial Services and Insurance (BFSI), government and utilities, healthcare, retail, media and entertainment, and others (manufacturing, transportation and logistics, education and hospitality).

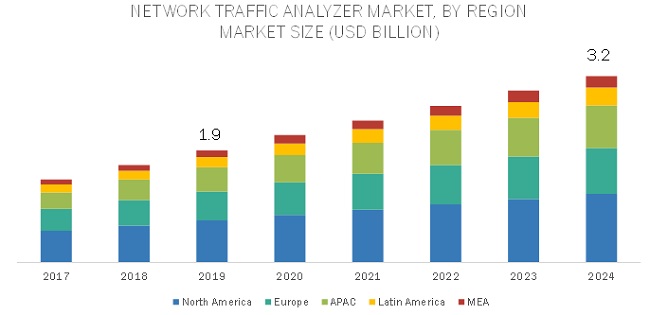

North America to lead the global network traffic analyzer market in 2019

North America is estimated to account for the major share of the network traffic analyzer market in 2019. It is a market with high growth potential. The North American market is aided by the early and fast adoption of technologies, such as cloud computing and Internet of Things (IoT). High industrialization in countries, such as the US and Canada acts as a positive factor to aid fast growth in various business verticals. Countries in North America have favorable standards and networking regulations that help boost market growth. North America is a home to numerous infrastructure providers, including SolarWinds and Netscout. It is also a potential market for investments, opening up new opportunities for the adoption of complex network infrastructure. Due to increased 5G deployments, the adoption of network traffic analyzer solutions is high in the region.

Network Traffic Analyzers Market Players

The key players profiled in the Network Traffic Analyzer Market include SolarWinds (US), Netscout (US), Broadcom (US), Nokia (Finland), Opmantek (US), Progress (US), Kentik (US), Colasoft (China), ManageEngine (US), NEC (Japan), NetVizura (Serbia), Plixer (US), MixMode (US), Opsview (UK), Inmon (US), Nagios (US), Corelight (US), Awake (US), IdeaData (Australia), Qosmos (France), Dynatrace (US), Sandvine (Canada), Extrahop (US), LiveAction (US) and LogRhythm (US). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations and new product launches and product enhancements to further expand their presence in the network traffic analyzer market and increase their customer base.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

USD Billion |

|

Market Segmentation |

Component (Solutions and Professional Services), Deployment Mode (Physical, Virtual, and Cloud), End User (Service Providers and Enterprises), Organization Size (SMEs and Large Enterprises), and Regions |

|

Regional Segmentation |

North America, Europe, APAC, Latin America, and MEA |

|

List of Network Traffic Analyzer Companies |

SolarWinds (US), Netscout (US), Broadcom (US), Nokia (Finland), Opmantek (US), Progress (US), Kentik (US), Colasoft (China), ManageEngine (US), NEC (Japan), NetVizura (Serbia), Plixer (US), MixMode (US), Opsview (UK), Inmon (US), Nagios (US), Corelight (US), Awake (US), IdeaData (Australia), Qosmos (France), Dynatrace (US), Sandvine (Canada), Extrahop (US), LiveAction (US) and LogRhythm (US). |

This research report categorizes the Network Traffic Analyzer Market to forecast revenue and analyze trends in each of the following submarkets:

Network Traffic Analyzer Market Based on Components:

- Solutions

- Professional Services

Network Traffic Analyzer Industry Based on Deployment Mode

- Physical

- Virtual

- Cloud

Network Traffic Analyzer Market Based on End Users:

- Service Providers

-

Enterprises

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Media and Entertainment

- Government and Utilities

- Others (Hospitality, education, transportation and logistics, and manufacturing)

Network Traffic Analyzer Industry Based on Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Network Traffic Analyzer Market Based on Regions:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Network Traffic Analyzer Market

- In November 2019, Plixer acquired Great Bay Software, a provider of endpoint visibility solutions that identifies managed, unmanaged, and unauthorized devices across complex networks. It collects, models, and maintains contextual endpoint data.

- In August 2019, Colasoft enhanced its product nChronos Network Performance Analysis solution and launched its new version nChronos Network Performance Analysis Solution v5.6.

- In July 2019, Colasoft announced the release of Capsa Network Analyzer v12 with a new analysis profile, enhanced with the function of packet filter.

- In June 2019, Kentik partnered with PacketFabric. The partnership was aimed at providing high scalable networking solutions for enterprises and service providers globally to secure network traffic visibility.

- In August 2019, Progress announced Ipswitch WhatsUp Gold 2019.1. The version introduced new features to the product, such as new public REST Application Performance Interface (API), better Nested vCenter support, and improved network mapping and discovery.

- In February 2019, NEC Corporation partnered with Telekom Srbija. This partnership provided the system, with high-level of data communications traffic control and improved the Quality of Experience (QoE) for users.

Frequently Asked Questions (FAQ):

What is the current Traffic Analyzer Market Size?

What is the Network Traffic Analyzer Market Growth?

Which segment components of the network traffic analyzer market expected to hold the larger market share?

Which are the top Network Traffic Analyzer Companies include in this report?

What are the top driving factors in network traffic analyzer market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Breakup of Primaries

2.1.2 Key Industry Insights

2.2 Data Triangulation

2.3 Market Size and Growth Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.3.3 Growth Defining Factors

2.4 Assumptions for the Study

2.5 Microquadrant Methodology

2.6 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Global Network Traffic Analyzer Market

4.2 Network Traffic Analyzer Market, By Deployment Mode, 2019

4.3 North America: Market By Component and End User, 2019

4.4 Asia Pacific: Market By Component and End User, 2019

5 Network Traffic Analyzer Maket Overview and Industry Trends (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ability to Monitor Ip Traffic for Complex It Infrastructure Environments

5.2.1.2 Increase in Demand for Network Traffic Analyzer Tools Among Cloud Service Providers for End-To-End Visibility

5.2.1.3 Increase in Adoption of Cloud and Iot

5.2.2 Restraints

5.2.2.1 Lack of Technical Granularity of Network Analyzer Tools to Match Every Aspect of Network Monitoring

5.2.3 Opportunities

5.2.3.1 Increase in Cyber Threats and Targeted Attacks

5.2.3.2 Technological Advancements in Communication and Network Infrastructures

5.2.4 Challenges

5.2.4.1 Strong Preference of End Users for Bundled Solutions

6 Network Traffic Analyzer Market By Component (Page No. - 39)

6.1 Introduction

6.2 Solutions

6.2.1 Solutions: Market Driver

6.2.2 Bandwidth Monitoring

6.2.3 Network Security

6.2.4 Auditing Trials

6.2.5 Application Monitoring

6.2.6 Others

6.3 Professional Services

6.3.1 Consulting

6.3.1.1 Consulting: Market Driver

6.3.2 Training and Support

6.3.2.1 Training and Support: Market Driver

6.3.3 Integration and Deployment

6.3.3.1 Integration and Deployment: Market Driver

7 Market, By Deployment Mode (Page No. - 46)

7.1 Introduction

7.2 Physical

7.2.1 Physical: Market Driver

7.3 Virtual

7.3.1 Virtual: Market Driver

7.4 Cloud

7.4.1 Cloud: Market Driver

8 Network Traffic Analyzer Market, By End User (Page No. - 50)

8.1 Introduction

8.2 Service Providers

8.2.1 Telecom Operators

8.2.1.1 Telecom Operators: Market Driver

8.2.2 Internet Service Providers and Cable Operators

8.2.2.1 Internet Service Providers and Cable Operators: Market Driver

8.2.3 Managed Service Providers

8.2.3.1 Managed Service Providers: Market Driver

8.3 Enterprises

8.3.1 Banking, Financial Services, and Insurance

8.3.1.1 Banking, Financial Services, and Insurance: Market Driver

8.3.2 Healthcare

8.3.2.1 Healthcare: Market Driver

8.3.3 Government and Utilities

8.3.3.1 Government and Utilities: Market Driver

8.3.4 Retail

8.3.4.1 Retail: Market Driver

8.3.5 Media and Entertainment

8.3.5.1 Media and Entertainment: Market Driver

8.3.6 Others

9 Network Traffic Analyzer Market, By Enterprise Size (Page No. - 61)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Small and Medium-Sized Enterprises: Market Driver

9.3 Large Enterprises

9.3.1 Large Enterprises: Market Driver

10 Market, By Region (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 United States: Market Drivers

10.2.2 Canada

10.2.2.1 Canada: Market Driver

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 United Kingdom: Market Drivers

10.3.2 Germany

10.3.2.1 Germany: Market Driver

10.3.3 France

10.3.3.1 France: Market Driver

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China: Market Driver

10.4.2 Japan

10.4.2.1 Japan: Market Driver

10.4.3 India

10.4.3.1 India: Market Drivers

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Brazil: Network Traffic Analyzer Market Driver

10.5.2 Mexico

10.5.2.1 Mexico: Market Driver

10.6 Middle East and Africa

10.6.1 Middle East

10.6.1.1 Middle East: Market Driver

10.6.2 Africa

10.6.2.1 Africa: Market Driver

11 Competitive Landscape (Page No. - 100)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Strength of Product Portfolio

11.3 Business Strategy Excellence

11.4 Market Ranking of Vendors in the Network Traffic Analyzer Market, 2019

12 Company Profiles (Page No. - 105)

(Business Overview, Products Offered, Solutions Offered, Recent Developments & SWOT Analysis)*

12.1 Introduction

12.2 Solarwinds

12.3 Netscout

12.4 Broadcom (CA Technologies)

12.5 Nokia

12.6 NEC

12.7 Opmantek

12.8 Progress (Ipswitch)

12.9 Dynatrace

12.10 Kentik

12.11 Colasoft

12.12 ManageEngine (Division of Zoho Corporation)

12.13 Netvizura

12.14 Flowmon Networks

12.15 Plixer

12.16 Qosmos

12.17 MixMode

12.18 Riverbed Technology

12.19 Opsview

12.20 IdeaData

12.21 Extrahop Networks

12.22 Inmon Corporation

12.23 Nagios

12.24 Corelight

12.25 Awake

12.26 LogRhythm

12.27 Sandvine

*Details on Business Overview, Products Offered, Solutions Offered, Recent Developments & SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 146)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (105 Tables)

Table 1 United States Dollar Exchange Rate, 2017–2019

Table 2 Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 3 Solutions: Market Size By Region, 2017–2024 (USD Million)

Table 4 Professional Services: Market Size By Region, 2017–2024 (USD Million)

Table 5 Professional Services: Market Size By Type, 2017–2024 (USD Million)

Table 6 Consulting Market Size By Region, 2017–2024 (USD Million)

Table 7 Training and Support Market Size, By Region, 2017–2024 (USD Million)

Table 8 Integration and Deployment Market Size, By Region, 2017–2024 (USD Million)

Table 9 Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 10 Physical: Market Size By Region, 2017–2024 (USD Million)

Table 11 Virtual: Market Size By Region, 2017–2024 (USD Million)

Table 12 Cloud: Market Size By Region, 2017–2024 (USD Million)

Table 13 Network Traffic Analyzer Market Size, By End User, 2017–2024 (USD Million)

Table 14 Service Providers: Market Size By Region, 2017–2024 (USD Million)

Table 15 Service Providers: Market Size By Type, 2017–2024 (USD Million)

Table 16 Telecom Operators Market Size, By Region, 2017–2024 (USD Million)

Table 17 Internet Service Providers and Cable Operators Market Size, By Region, 2017–2024 (USD Million)

Table 18 Managed Service Providers Market Size, By Region, 2017–2024 (USD Million)

Table 19 Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 20 Enterprises: Market Size By Vertical, 2017–2024 (USD Million)

Table 21 Banking, Financial Services, and Insurance Market Size, By Region, 2017–2024 (USD Million)

Table 22 Healthcare Market Size, By Region, 2017–2024 (USD Million)

Table 23 Government and Utilities Market Size, By Region, 2017–2024 (USD Million)

Table 24 Retail Market Size, By Region, 2017–2024 (USD Million)

Table 25 Media and Entertainment Market Size, By Region, 2017–2024 (USD Million)

Table 26 Others Market Size, By Region, 2017–2024 (USD Million)

Table 27 Network Traffic Analyzer Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 28 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 29 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 30 Market Size, By Region, 2017–2024 (USD Million)

Table 31 North America: Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 32 North America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 33 North America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 34 North America: Market Size By End User, 2017–2024 (USD Million)

Table 35 North America: Market Size By Service Provider, 2017–2024 (USD Million)

Table 36 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 37 North America: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 38 North America: Market Size By Country, 2017–2024 (USD Million)

Table 39 United States: Market Size, By Component, 2017–2024 (USD Million)

Table 40 United States: Market Size By Professional Service, 2017–2024 (USD Million)

Table 41 United States: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 42 United States: Market Size By End User, 2017–2024 (USD Million)

Table 43 United States: Market Size By Service Provider, 2017–2024 (USD Million)

Table 44 United States: Market Size By Vertical, 2017–2024 (USD Million)

Table 45 United States: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 46 Europe: Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 47 Europe: Market Size By Professional Service, 2017–2024 (USD Million)

Table 48 Europe: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 49 Europe: Market Size By End User, 2017–2024 (USD Million)

Table 50 Europe: Market Size By Service Provider, 2017–2024 (USD Million)

Table 51 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 52 Europe: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 53 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 54 United Kingdom: Market Size, By Component, 2017–2024 (USD Million)

Table 55 United Kingdom: Market Size By Professional Service, 2017–2024 (USD Million)

Table 56 United Kingdom: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 57 United Kingdom: Market Size By End User, 2017–2024 (USD Million)

Table 58 United Kingdom: Market Size By Service Provider, 2017–2024 (USD Million)

Table 59 United Kingdom: Market Size By Vertical, 2017–2024 (USD Million)

Table 60 United Kingdom: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 61 Asia Pacific: Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 62 Asia Pacific: Market Size By Professional Service, 2017–2024 (USD Million)

Table 63 Asia Pacific: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 64 Asia Pacific: Market Size By End User, 2017–2024 (USD Million)

Table 65 Asia Pacific: Market Size By Service Provider, 2017–2024 (USD Million)

Table 66 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 67 Asia Pacific: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 68 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 69 China: Market Size, By Component, 2017–2024 (USD Million)

Table 70 China: Market Size By Professional Service, 2017–2024 (USD Million)

Table 71 China: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 72 China: Market Size By End User, 2017–2024 (USD Million)

Table 73 China: Market Size By Service Provider, 2017–2024 (USD Million)

Table 74 China: Market Size By Vertical, 2017–2024 (USD Million)

Table 75 China: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 76 Latin America: Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 77 Latin America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 78 Latin America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 79 Latin America: Market Size By End User, 2017–2024 (USD Million)

Table 80 Latin America: Market Size By Service Provider, 2017–2024 (USD Million)

Table 81 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 82 Latin America: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 83 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 84 Brazil: Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 85 Brazil: Market Size By Professional Service, 2017–2024 (USD Million)

Table 86 Brazil: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 87 Brazil: Market Size By End User, 2017–2024 (USD Million)

Table 88 Brazil: Market Size By Service Provider, 2017–2024 (USD Million)

Table 89 Brazil: Market Size By Vertical, 2017–2024 (USD Million)

Table 90 Brazil: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 91 Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 92 Middle East and Africa: Market Size By Professional Service, 2017–2024 (USD Million)

Table 93 Middle East and Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 94 Middle East and Africa: Market Size By End User, 2017–2024 (USD Million)

Table 95 Middle East and Africa: Market Size By Service Provider, 2017–2024 (USD Million)

Table 96 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 97 Middle East and Africa: Market Size By Enterprise Size, 2017–2024 (USD Million)

Table 98 Middle East and Africa: Market Size By Sub-Region, 2017–2024 (USD Million)

Table 99 Middle East: Network Traffic Analyzer Market Size, By Component, 2017–2024 (USD Million)

Table 100 Middle East: Market Size By Professional Service, 2017–2024 (USD Million)

Table 101 Middle East: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 102 Middle East: Market Size By End User, 2017–2024 (USD Million)

Table 103 Middle East: Market Size By Service Provider, 2017–2024 (USD Million)

Table 104 Middle East: Market Size By Vertical, 2017–2024 (USD Million)

Table 105 Middle East: Market Size By Enterprise Size, 2017–2024 (USD Million)

List of Figures (37 Figures)

Figure 1 Network Traffic Analyzer Market: Research Design

Figure 2 Research Methodology

Figure 3 Market Top-Down Approach

Figure 4 Market Bottom-Up Approach

Figure 5 Market Growth Defining Factors

Figure 6 Microquadrant Matrix: Criteria Weightage

Figure 7 Market, By Deployment Mode, 2019– 2024

Figure 8 Enterprises Segment to be a Larger Revenue Contributor During the Forecast Period

Figure 9 Banking, Financial Services, and Insurance Vertical to be the Largest Revenue Contributor During the Forecast Period

Figure 10 North America to Hold the Highest Market Share During the Forecast Period

Figure 11 Growing Number of IoT and 5g Deployments and Increasing Cybercrimes to Support Market Growth

Figure 12 Virtual Segment to Account for the Highest Market Share in 2019

Figure 13 Solutions and Enterprises Segments to Hold Higher Market Shares in North America in 2019

Figure 14 Solutions and Enterprises Segments to Hold Higher Market Shares in Asia Pacific in 2019

Figure 15 Network Traffic Analyzer Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Solutions Segment to Witness a Higher Growth Rate During the Forecast Period

Figure 17 Consulting Segment to Hold the Largest Market Size During the Forecast Period

Figure 18 Cloud Segment to Record the Highest Growth Rate During the Forecast Period

Figure 19 Enterprises Segment to Hold a Larger Market Size During the Forecast Period

Figure 20 Managed Service Providers Segment to Hold the Largest Market Size During the Forecast Period

Figure 21 Banking, Financial Services, and Insurance Vertical to Hold the Largest Market Size During the Forecast Period

Figure 22 Small and Medium-Sized Enterprises Segment to Record a Higher Growth Rate During the Forecast Period

Figure 23 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Network Traffic Analyzer Market (Global), Competitive Leadership Mapping

Figure 27 Market Ranking, 2019

Figure 28 Solarwinds: Company Snapshot

Figure 29 Solarwinds: SWOT Analysis

Figure 30 Netscout: Company Snapshot

Figure 31 Netscout: SWOT Analysis

Figure 32 Broadcom: Company Snapshot

Figure 33 Nokia: Company Snapshot

Figure 34 NEC: Company Snapshot

Figure 35 NEC: SWOT Analysis

Figure 36 Progress: Company Snapshot

Figure 37 Dynatrace: Company Snapshot

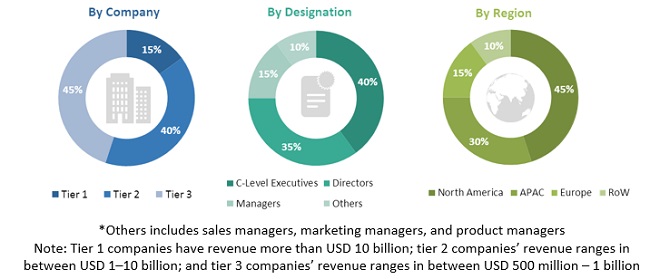

The study involved four major activities to estimate the current market size of the network traffic analyzer market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, for identifying and collecting information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The network traffic analyzer market comprises several stakeholders, such as government agencies, network traffic analyzer Original Equipment Manufacturers (OEMs), network traffic analyzer service providers, System Integrators (SIs), consulting firms, research organizations, resellers and distributors, managed service providers, regulatory authorities and associations, Information Technology (IT) service providers, consultants/consultancies/advisory firms, and training providers. The demand side of the market consists of all the firms operating in several verticals. The supply side includes network traffic analyzer providers offering network traffic analyzer solutions and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global network traffic analyzer market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the market was prepared while using the top-down approach. The market share of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (solutions and services). The aggregate of all companies’ revenue was extrapolated to reach the overall market size.

Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews with industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To determine and forecast the global network traffic analyzer market by component, deployment mode, organization size, end user, and region from 2019 to 2024, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the network traffic analyzer market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, new product/service launches, business expansions, partnerships and collaborations, and Research and Development (R&D) activities in the market

Key questions addressed by the report

- What are the growth opportunities in the network traffic analyzer market?

- What is the competitive landscape scenario in the market?

- What are the regulations that are expected to have an impact on the market?

- How network traffic analyzer solutions and services have evolved from traditional technologies?

- What are the dynamics of the market?

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Growth opportunities and latent adjacency in Network Traffic Analyzer Market