Non-Fungible Tokens Market by Offering (Business Strategy Formulation, NFT Creation, and Management, NFT Platform Marketplace), End-user (Media and Entertainment, Gaming), Region (Americas, Europe, MEA, APAC) - Global forecast to 2027

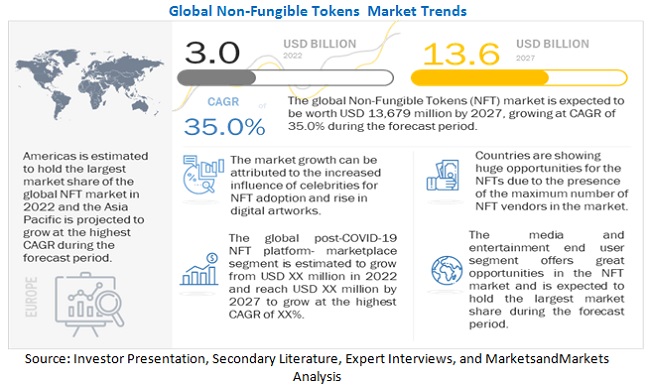

[111 Pages Report] The Non-Fungible Tokens Market size is expected to grow from USD 3.0 billion in 2022 to USD 13.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 35.0% from 2022 to 2027.

The major factors fueling the NFT market include the increasing influence of celebrities to fuel the momentum of NFT adoption, revolutionizing the gaming industry and the slow but continuing rise in demand for digital artworks. Moreover, increasing use cases of NFT in supply chain management, retail, and fashion, efforts of industry giants toward making Metaverse a reality, and personalization of NFT would provide lucrative opportunities for NFT vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

NFT is a very niche topic with a lot of speculations still going around the same, COVID-19 fast-forwarded the adoption of NFT technology in addition to many other traditional markets, especially NFT related to art. In the beginning of the pandemic, since art gelleries and other NFT related assets were closed due to lockdown, art sellers and collectors were pushed to adopt the digital space. According to FuelArts, art fairs went online, galleries mastered VR, and auction houses offered mixed bids combining art and luxury goods due to which the demand for innovation in the art market increased and attracted various startups and venture capital. This further resulted into boom in new payment methods, instruments to help create, manage, and sell NFTs creating opportunities for users to take advantage of the Art+Tech fueled NFT technology. Compared to over the last 20 years before the pandemic, art-fueled tech companies received USD 640 million. According to industry experts, the exponential rise in digital marketplaces post the outbrek of COVID 19 pandemic contributed the most in the adoption and growth of NFT. These platforms attracted online shoppers with may enticing offers, and a new, informative way to represent art. Art collectors also preferred marketplaces for static online auctions of NFT offered by most galleries. Marketplaces have benefited most from the NFT hype as sales of digital collectibles surged to USD 10.7 billion in Q3 of 2020, up from USD 1.3 billion in Q2 of 2020.

Market Dynamics

Driver: Revolutionizing the gaming industry

One of the important factors behind the exponential increase in demand for NFTs is that NFTs have extended their horizon from music, videos, and sports to other streams, such as Metaverse and especially gaming. In 2017, Enjin was one of the first mainstream gaming companies that merged blockchain technology with its infrastructure and issued a gaming cryptocurrency, ENJ, that is officially whitelisted for use in Japan. Also, with the advent of Pplay-to-Eearn (P2E), players can buy, sell, and trade earned in -in-game assets items. For example, games such as Axie Infinity and Splinterlands enable users to mint rare in-game assets into NFT, and buying or selling of these gaming-related asset transactions pile up. Data on DappRadar shows that Splinterlands alone generated more than 4 million transactions per day on Aug. 7, 8, and 9, 2021, while the entire Ethereum network generated an average of 1.2 million transactions per day. NFTs enable gamers to generate revenue through their in-game assets by converting them into NFTs. Also, according to Forbes, Axie Infinity witnessed a surge in user growth in the Philippines when it offered players an alternative source of income during the pandemic. Hence, the gaming industry, especially the play-to-earn blockchain gaming model, has established itself as an immense growth opportunity for NFT.

Restraint: Issues with copyright protection

Presently, the NFT marketplace does not have a dedicated legal framework and regulations to validate the true ownership of an NFT and the associated copyright evidence. Due to this, there is a threat of duplication of genuine works, such as images, photographs, music pieces, etc. Without the consent of the creator, and such duplicated assets can be personalized and spread online very easily. This is restraining the baseline of the NFT market, viz. NFTs being good for digital artists as it enables complete ownership to the original creators and earns from their work.

Opportunity: Efforts of industry giants towards making Metaverse a reality

The Metaverse is a vision of an internet-enabled virtual world where people have avatars and interact with digital assets with Augmented Reality (AR), Virtual Reality (VR), and Extended Reality (XR). This is developing rapidly with the evolution of blockchain technology. Industry experts believe that NFT is going to be the revenue model for the Metaverse. Presently, virtual items are the revenue model in video gaming viz USD 175 billion business annually. Since the Metaverse will have digital avatars, NFTs will enable direct access to real-life identities and digital avatars into the Metaverse. NFTs are expected to be used in various metaverse use cases, such as user interaction, socialization, and transactions. For example, in 2019, an NFT-based token was used as an entry ticket for NFT.NYC event. After the success of this event, many other events started using NFTs as entry- tickets, fueling the further adoption of NFTs in the Metaverse. With major players, such as Meta and, Microsoft, etc., investing in the Metaverse projects are focused on introducing massive transformations for online interaction. For example, Decentraland enables the virtual purchase of the real estate in Metaverse and also shows the places where users own Metaverse real estate by using land tokens. Industry experts also believe that in Metaverse, NFTs can be used in the form of currency, which can be used for transactions as well as purchase and trading of virtual digital assets, such as virtual property. Hence, the Metaverse is expected to be the biggest opportunity for NFTs.

Challenge: High and hidden fees

NFT transactions are associated with high and hidden gas fees, which most first-time users are either unaware of or ignorant of it. Many NFTs are based on the Ethereum blockchain, and ERC-20, ERC-721, ERC-1155, and some other token standards are used for issuing smart contracts. The Ethereum blockchain, in particular, uses the proof of work mechanism to determine its value, which causes high gas fees, and this is one of the challenges faced by the NFT Marketplace these days. As discussed above, Ethereum is working on reducing this limitation by moving from a proof-of-work model to a proof-of-stake model through which the energy per transaction could be reduced to as low as 35Wh, which would also result in reduced gas fees.

By end-user, the media and entertainment segment is expected to have the largest market share during the forecast period

In the media & entertainment industry, NFTs have the potential to completely transform the way films are made, produced, and distributed, democratizing this unilateral industry in the process. To demonstrate the future of NFTs in the world, the NFT community Arabian Camels is making a USD 50 million Hollywood film called Antara. NFT is especially useful for budding filmmakers and artists who are hardly visible in the industry. For big production and elite film franchises that have millions of followers, NFTs provide a unique opportunity to solidify their fandom in the Metaverse. Multiple production houses, such as Disney and Lionsgate, are already working on developing their own NFT marketplace. The integration of NFTs into the entertainment industry can lead to enabling users to actively participate in every step of the film production and distribution. NFTs will allow viewers and creators to connect beyond the screen and thus take the industry to unimaginable dimensions.

To know about the assumptions considered for the study, download the pdf brochure

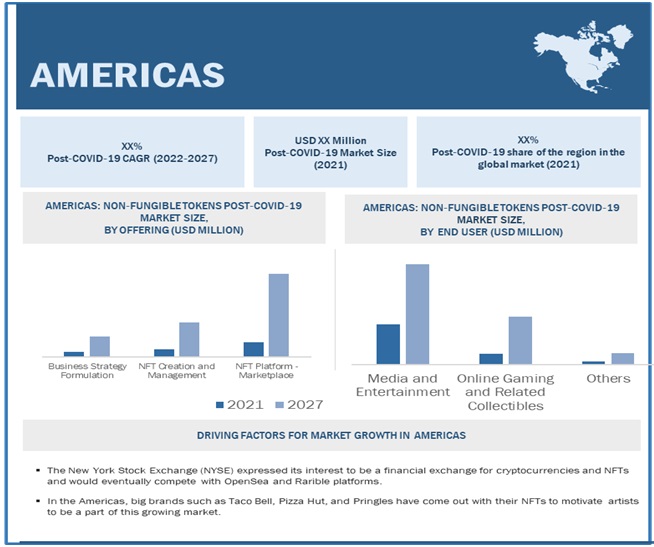

North America to hold the largest market size during the forecast period

The Americas is expected to be the largest contributor in terms of the market size in the global Non-Fungible Tokens market. An American company, OpenSea, unlike other platforms, does not impose a fee to mint NFTs. The platform charges a payment on the final sale price, which is presently 2.5%. Organizations are coming up front with many developments and partnerships to explore and make people aware of the trends and uses of NFTs to help them monetize their work. For example, Lagunitas Brewing Company recently became the first beer brand to enter the NFT segment in Latin America. With their partnership with Byte, Lagunitas has minted NFTs representing the quintessential elements of a traditional backyard. The presence of major NFT marketplace vendors such as OpenSea, Larva Labs, Cloudflare, Dapper Labs, etc., is also expected to create lucrative opportunities for NFT users in North America.

Asia Pacific to grow at the highest CAGR during the forecast period

In Asia Pacific, various organizations are emerging with NFT marketplaces, such as Animoca Brands, a Hong Kong-based blockchain gaming company, which is now valued at USD 5 billion. Aside from NFTs for its games, Animoca is also a primary investor in Axie Infinity. Though Chinese authorities are taking a cautious approach toward NFTs adoption, China government will take a different business model for NFT developments than the overseas world to avoid scams and frauds. China has a popular collection of NFTs such as Bored Apes and Phanta Bear. NFT Asia, a community for Asian NFT artists, has around 2,700 followers on Discord and over 9,000 followers on Twitter. One NFT game that saw rapid growth in Asia was the Play-To-Earn Axie Infinity game from Vietnamese company Sky Mavis. When the pandemic hit the Philippines, over 4.5 million Filipinos lost their jobs, and Axie Infinity became an alternate source of income for many. Daily active Axie players jumped from over 10,000 players in January 2020 to over two million users in 2021, revealed Gaming analytics site ActivePlayer.IO.

Key Market Players

Major vendors in the global Non-Fungible Tokens market include Cloudflare (US), Gemini Trust (US), OpenSea (US), Semidot Infotech (US), Dapper Labs (Canada), The Sandbox (China), Axie Infinity (Vietnam), Rarible (US), Art Blocks (US), Foundation (US), Superrare (US), Mintbase (Portugal), Larva Labs (US), Appdupe (India), CryptoKitties (Canada), Sorare (France), Yellow Heart (US), Onchain Labs (China), Solanart (France), Gala Games (US)

SuperRare is a peer-to-peer NFT marketplace built on the Ethereum blockchain and is fully developed for creators and collectors to buy and sell digital artworks through this platform. Each artwork is authentically created by an artist in the network and tokenized as a crypto-collectible digital item that users can own and trade. SuperRare is a marketplace where users can collect and trade unique and single edition artworks in digital form. Each artwork on SuperRare is a digital collectible and tracked on the blockchain. Each digital artwork on SuperRare is a digital collectible that is completely secured by cryptography and is tracked on blockchain technology. In August 2021, SuperRare announced three major updates across the solution: SuperRare Spaces, SuperRare DAO, and Sovereign Smart Contracts. The USD RARE curation token will be the primary vehicle to onboard a growing network of curators, galleries, and collectives.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size available for years |

2018-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Unit |

Value(USD) |

|

Segments covered |

Offerings, End Users, and Region |

|

Geographies covered |

Americas, Europe, Middle East and Africa |

|

Companies Covered |

Cloudflare (US), Gemini Trust (US), OpenSea (US), Semidot Infotech (US), Dapper Labs (Canada), The Sandbox (China), Axie Infinity (Vietnam), Rarible (US), Art Blocks (US), Foundation (US), Superrare (US), Mintbase (Portugal), Larva Labs (US), Appdupe (India), CryptoKitties (Canada), Sorare (France), Yellow Heart (US), Onchain Labs (China), Solanart (France), Gala Games (US) |

The research report categorizes the market into the following segments and subsegments:

Non-Fungible Tokens Market, By Offering

- Business Strategy Formulation

- NFT Creation and Management

- NFT Platform - Marketplace

NFT Market, By End Users

- Media and Entertainment

- Gaming

- Others (Finance, Healthcare, Retail, Research and Academia)

Non-Fungible Tokens Market, by Region

- Americas

- Europe, Middle East and Africa

- Asia Pacific

Recent Developments

- In March 2022, The Sandbox partnered with the first of its kind NFT community, World of Women, to provide them grand funding of USD 25 million to amplify the representation of women in the digital spaces.

- In January 2022, Dapper Labs, in collaboration with UFC, the worlds premier mixed martial arts organization, officially launched their highly anticipated NFT collectible product, UFC Strike. UFC Strike Moment NFT is designed to capture, memorialize, and celebrate a specific instance of UFC history.

- In November 2021, with the integration with Adobe, OpenSea had added new features such as a new collection review pop-up, updates in the activity page, creator address on collection pages, and homepage top collection, among others.

- In May 2020, Torus did its latest DApp integration with OpenSea. With this integration, Torus customers can buy, sell, make bids, and auction over ten million unique digital collectibles on OpenSea.

Frequently Asked Questions (FAQ):

What are the top trends that are impacting the Non-Fungible Tokens market?

Trends that are impacting the Non-Fungible Tokens market include:

- Increasing influence of celebrities to fuel momentum of NFT adoption

- Revolutionizing gaming industry

- Slow but continuing rise in demand for digital artworks

- Issues with copyright protection

- Increasing use cases of NFT into supply chain management, retail, and fashion

- Efforts of industry giants toward making Metaverse a reality

- Personalization of NFT

What does Non-Fungible Tokens Market mean?

Who are the prominent players in the Non-Fungible Tokens market?

What are the major service types of Non-Fungible Tokens?

There various service types of Non-Fungible Tokens are as follows:

- Business Strategy Formulation

- NFT Creation and Management

- NFT Platform - Marketplace

What is the Non-Fungible Tokens market size?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction (Page No. - 13)

1.1 Objectives Of The Study

1.2 Market Definition

1.2.1 Inclusions And Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered

1.4 Currency Considered

Table 1 United States Dollar Exchange Rate,20182022

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

Figure 1 Non-Fungible Tokens Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup Of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup And Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

Table 2 Factor Analysis

2.5 Assumptions

2.6 Limitations

3 Executive Summary (Page No. - 23)

Table 3 Non-Fungible Tokens Market Size And Growth, 20182020 (Usd Million, Y-O-Y %)

Table 4 NFT Market Size And Growth, 20222027 (Usd Million, Y-O-Y %)

Figure 2 Market To Grow Moderately From 2022 To 2027 Due To The Covid-19 Pandemic

Figure 3 North America To Account For The Largest Market Share In 2022

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities In The Non-Fungible Tokens Market

Figure 4 Increased Influence Of Celebrities For NFT Adoption And Rise In Digital Artworks To Drive The NFT Market Growth

4.2 Market, By Offering, 20222027

Figure 5 Nft Platform-Marketplace Segment To Hold The Largest Market Size During The Forecast Period

4.3 Market, By End User, 20222027

Figure 6 Media And Entertainment Segment To Hold The Largest Market Size During The Forecast Period

4.4 Market, By Region, 20222027

Figure 7 Americas Segment To Hold The Largest Market Size During The Forecast Period

4.5 Market Investment Scenario

Figure 8 Asia Pacific To Emerge As The Best Market For Investments In The Next Five Years

5 NFT Market Overview And Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

Figure 9 Drivers, Restraints, Opportunities, And Challenges: Non-Fungible Tokens Market

5.2.1 Drivers

5.2.1.1 Increasing Influence Of Celebrities To Fuel Momentum Of Nft Adoption

5.2.1.2 Revolutionizing Gaming Industry

5.2.1.3 Slow But Continuing Rise In Demand For Digital Artworks

5.2.2 Restraints

5.2.2.1 Issues With Copyright Protection

5.2.3 Opportunities

5.2.3.1 Increasing Use Cases Of Nft In Supply Chain Management, Retail, And Fashion

5.2.3.2 Efforts Of Industry Giants Toward Making Metaverse A Reality

5.2.3.3 Personalization Of Nft

5.2.4 Challenges

5.2.4.1 High And Hidden Fees

5.2.4.2 Lack Of Legal Representation, Absence Of Compliance, And Regulations For Nft

5.3 Value Chain

Figure 10 Value Chain Of Non-Fungible Tokens Market

5.4 Ecosystem: Non-Fungible Tokens

5.5 Technology Analysis

5.5.1 Blockchain

5.5.2 Cryptocurrency

5.6 Patent Analysis

Figure 11 Market: Patent Analysis

5.7 Trends And Disruptions Impacting Customers

Figure 12 Market: Trends And Disruptions Impacting Customers

5.8 Porters Five Forces Analysis

Figure 13 Porters Five Forces Model For The Market

Table 5 Porter's Five Forces Analysis Impact On The Non-Fungible Tokens Market

5.8.1 Threat Of New Entrants

5.8.2 Threat Of Substitutes

5.8.3 Bargaining Power Of Suppliers

5.8.4 Bargaining Power Of Buyers

5.8.5 Intensity Of Competitive Rivalry

5.9 Tariff And Regulatory Landscape

5.9.1 Regulatory Bodies, Government Agencies, And Other Organizations

Table 6 North America: List Of Regulatory Bodies, Government Agencies, And Other Organizations

Table 7 Europe And Middle East & Africa: List Of Regulatory Bodies, Government Agencies, And Other Organizations

5.9.2 General Data Protection Regulation

5.9.3 Payment Card Industry-Data Security Standard (Pci-Dss)

5.9.4 Health Insurance Portability And Accountability Act

5.10 Use Cases

5.10.1 Use Cases: Identification, Certification, And Documentation

5.10.2 Use Cases: Real Estate

5.10.3 Use Cases: Event Ticketing

5.11 Key Conferences And Events In 20222023

Table 8 Non-Fungible Tokens Market: List Of Conferences And Events

6 Non Fungible Tokens - Market Trends (Page No. - 44)

6.1 Metaverse

6.2 Play To Earn (P2e)

7 NFT Market, By Offering (Page No. - 45)

7.1 Introduction

Figure 14 Nft Platform - Marketplace Segment To Grow At The Highest Cagr During The Forecast Period

Table 9 Market, By Offering, 20182021 (Usd Million)

Table 10 Market, By Offering, 20222027 (Usd Million)

7.2 Business Strategy Formulation

7.2.1 Business Strategy Formulation: Market Drivers

Table 11 Market: Business Strategy Formulation, By Region, 20182021 (Usd Million)

Table 12 Market: Business Strategy Formulation, By Region, 20222027 (Usd Million)

7.3 Nft Creation And Management

7.3.1 Nft Creation And Management: Market Drivers

Table 13 Market: Nft Creation And Management, By Region, By Region, 20182021 (Usd Million)

Table 14 Non-Fungible Tokens Market: Nft Creation And Management, By Region, 20222027 (Usd Million)

7.4 Nft Platform - Marketplace

7.4.1 Nft Platform - Marketplace: Market Drivers

Table 15 Market: Nft Platform-Marketplace, By Region, By Region, 20182021 (Usd Million)

Table 16 Market: Nft Platform-Marketplace, By Region, 20222027 (Usd Million)

8 Non-Fungible Tokens Market, By End User (Page No. - 51)

8.1 Introduction

Figure 15 Other End Users Segment To Grow At The Highest Cagr During The Forecast Period

Table 17 Market, By End User, 20182021 (Usd Million)

Table 18 Market, By End User, 20222027 (Usd Million)

8.2 Media And Entertainment

8.2.1 Media And Entertainment: Market Drivers

Table 19 Market: Media And Entertainment, By Region, 20182021 (Usd Million)

Table 20 Market: Media And Entertainment, By Region, 20222027 (Usd Million)

8.3 Online Gaming & Related Collectibles

8.3.1 Online Gaming & Related Collectibles: Non-Fungible Tokens Market Drivers

Table 21 Market: Gaming And Related Collectibles, By Region, 20182021 (Usd Million)

Table 22 Market: Gaming And Related Collectibles, By Region, 20222027 (Usd Million)

8.4 Other End Users

Table 23 Market: Other End Users, By Region, 20182021 (Usd Million)

Table 24 Market: Other End Users, By Region, 20222027 (Usd Million)

9 Non-Fungible Tokens Market, By Region (Page No. - 57)

9.1 Introduction

Figure 16 Asia Pacific To Grow At The Highest Cagr During The Forecast Period

Table 25 Market, By Region, 20182021 (Usd Million)

Table 26 Market, By Region, 20222027 (Usd Million)

9.2 Americas

9.2.1 Americas: NFT Market Drivers

Figure 17 Americas: Market Snapshot

Table 27 Americas: Market, By Offering, 20182021 (Usd Million)

Table 28 Americas: Market, By Offering, 20222027 (Usd Million)

Table 29 Americas: Market, By End User, 20182021 (Usd Million)

Table 30 Americas: Market, By End User, 20222027 (Usd Million)

9.3 Europe, Middle East & Africa

9.3.1 Europe, Middle East & Africa: Non-Fungible Tokens Market Drivers

Table 31 Europe, Middle East & Africa: Market, By Offering, 20182021 (Usd Million)

Table 32 Europe, Middle East & Africa: Market, By Offering, 20222027 (Usd Million)

Table 33 Europe, Middle East & Africa: Market, By End User, 20182021 (Usd Million)

Table 34 Europe, Middle East & Africa: Market, By End User, 20222027 (Usd Million)

9.4 Asia Pacific

9.4.1 Asia Pacific: Non-Fungible Tokens Market Drivers

Figure 18 Asia Pacific: Market Snapshot

Table 35 Asia Pacific: Market, By Offering, 20182021 (Usd Million)

Table 36 Asia Pacific: Market, By Offering, 20222027 (Usd Million)

Table 37 Asia Pacific: Market, By End User, 20182021 (Usd Million)

Table 38 Asia Pacific: Market, By End User, 20222027 (Usd Million)

10 Competitive Landscape (Page No. - 67)

10.1 Overview

10.2 Market Evaluation Framework

Figure 19 Non-Fungible Tokens Market Evaluation Framework

10.3 Market Share Analysis Of Top Market Players

Table 39 Non - Fungible Tokens Market: Degree Of Competition

Table 40 Non-Fungible Tokens: Product Launches And Enhancements

Table 41 Non-Fungible Tokens: Deals

10.4 Ranking Of Key Players In The Nft Market

Figure 20 Key Players Ranking, 2021

10.5 Company Evaluation Matrix And Competitive Leadership Mapping

10.5.1 Company Evaluation Matrix Definitions And Methodology

Table 42 Evaluation Criteria

10.5.2 Stars

10.5.3 Emerging Leaders

10.5.4 Pervasive Players

10.5.5 Participants

Figure 21 Non-Fungible Tokens Market (Global), Competitive Leadership Mapping Of Key Players, 2022

10.6 Competitive Benchmarking For Startups

Table 43 Non - Fungible Tokens: List Of Startups/Smes

Table 44 Non - Fungible Tokens: Competitive Benchmarking Of Startups/Smes

11 Company Profiles (Page No. - 74)

11.1 Key Players

(Business Overview, Products, Solutions & Services, Recent Developments, Mnm View)*

11.1.1 Cloudflare

Table 45 Cloudflare: Business Overview

Figure 22 Cloudflare: Company Snapshot

Table 46 Cloudflare: Solutions Offered

Table 47 Cloudflare: Product Launches

11.1.2 Gemini Trust

Table 48 Gemini Trust: Business Overview

Table 49 Gemini Trust: Solutions Offered

Table 50 Gemini Trust: Product Launches

Table 51 Gemini Trust: Deals

11.1.3 Opensea

Table 52 Opensea: Business Overview

Table 53 Opensea: Solutions Offered

Table 54 Opensea: Product Launches

Table 55 Opensea: Deals

11.1.4 Dapper Labs

Table 56 Dapper Labs: Business Overview

Table 57 Dapper Labs: Products/Solutions/Services Offered

Table 58 Dapper Labs: Product Launches

Table 59 Dapper Labs: Deals

11.1.5 Semidot Infotech

Table 60 Semidot Infotech: Business Overview

Table 61 Semidot Infotech: Solutions Offered

11.1.6 The Sandbox

Table 62 The Sandbox: Business Overview

Table 63 The Sandbox: Solutions Offered

Table 64 The Sandbox: Product Launches

Table 65 The Sandbox: Deals

11.2 Other Players

11.2.1 Axie Infinity

11.2.2 Rarible

11.2.3 Art Blocks

11.2.4 Foundation

11.2.5 Superrare

11.2.6 Mintbase

11.2.7 Larva Labs

11.2.8 Appdupe

11.2.9 Cryptokitties

11.2.10 Sorare

11.2.11 Yellowheart

11.2.12 Onchain Labs

11.2.13 Solanart

11.2.14 Gala Games

*Details On Business Overview, Products, Solutions, & Services, Recent Developments, Mnm View Might Not Be Captured In Case Of Unlisted Companies.

12 Adjacent/Related Markets (Page No. - 98)

12.1 Introduction

12.2 Blockchain Market

12.2.1 Market Definition

Table 66 Blockchain Market Size, By Component, 20182025 (Usd Million)

Table 67 Component: Blockchain Market Size, By Region, 20182025 (Usd Million)

Table 68 Blockchain Market Size, By Provider, 20182025 (Usd Million)

Table 69 Providers: Blockchain Market Size, By Region, 20182025 (Usd Million)

Table 70 Blockchain Market Size, By Application Area, 20182025 (Usd Million)

Table 71 Application: Blockchain Market Size, By Region, 20182025 (Usd Million)

Table 72 Blockchain Market Size By Region, 20182025 (Usd Billion)

12.3 Cryptoasset Management Market

12.3.1 Market Definition

Table 73 Post-Covid-19: Crypto Asset Management Market Size, By Solution, 20182026 (Usd Million)

Table 74 Solution: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

Table 75 Custodian Solution: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

Table 76 Wallet Management: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

Table 77 Post-Covid-19: Crypto Asset Management Market Size, By End User, 20182026 (Usd Million)

Table 78 End User: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

Table 79 Individual User: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

Table 80 Enterprise: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

Table 81 Post-Covid-19: Crypto Asset Management Market Size, By Enterprise Vertical, 20182026 (Usd Thousand)

Table 82 Post-Covid-19: Crypto Asset Management Market Size, By Region, 20182026 (Usd Million)

13 Appendix (Page No. - 105)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

The study involved major activities in estimating the current market size for the Non-Fungible Tokens (NFT) Market. Exhaustive secondary research was done to collect information on the NFT industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, and bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the NFT Market.

Secondary Research

The market share and revenue of the companies offering NFT solutions and services for various verticals were identified through the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on performance and quality. In the secondary research process, various sources were referred to identify and collect this study's information. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers (Non-Fungible Tokens: Efinity Whitepaper, NFTs Engaging Today's Fans in Crypto and Commerce by Visa, Whitepaper NetherNFT, Blocksport NFT Platform Whitepaper); journals (A Deep Dive Into Non-fungible Tokens (NFTs) and Its Correlation With The Price Of Bitcoin And Ethereum by Global Journal For Research Analysis (GJRA), Non-Fungible Tokens (NFT's): The Future of Digital Collectibles by International Journal of Law Management & Humanities (IJLMH), Sports Innovation Journal; research papers (The Evolution of Non-fungible Tokens: Complexity and Novelty of NFT Use-Cases by IEEE Xplore, Blockchain Technology and Non-Fungible Tokens by SSR, Non-Fungible Token (NFT) market and its relationship with Bitcoin and Ethereum by SSRN, Non-Fungible Tokens (NFT)). The Analysis of Risk and Return by ResearchGate and certified publications and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspective all of which were further validated by primary sources.

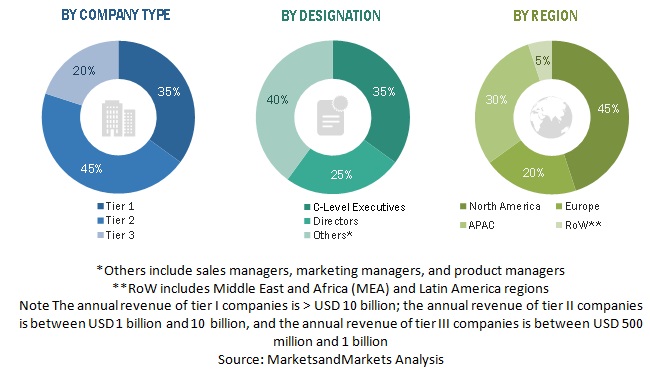

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from NFT vendors, NFT solution providers, industry associations, independent NFT consultants, and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of end users using NFT solutions, were interviewed to understand the buyer's perspective on the suppliers, solution and service providers, and their current use of solutions.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the NFT market. In this market estimation approach, we identified 20 NFT players, including Cloudflare, Axie Infinity, Decentraland, OpenSea, and Rarible. These companies account for ~90% of the global NFT market. After confirming these companies with industry experts through primary interviews, we estimated their total revenue mostly through paid databases since more than 90% companies that we studied for NFT market are private SMEs and startups. Company revenues pertaining to the Business Units (BUs) that offer NFT solutions were identified through similar sources. We then collected the data on the revenue generated through specific NFT services from primary interviews. The consolidated revenue of NFT offerings comprised more than 90% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is held by similar players (part of the unorganized market), the market size of organized players and unorganized players collectively was assumed to be the market size of the global NFT market for FY 2022.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Non-Fungible Tokens (NFT) market by offering (business strategy formulation, NFT creation and management, and NFT platform marketplace), end-user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to three main regions: the Americas (North and Latin), Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC)

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, product developments, and R&D activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company's specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Americas NFT market into sub-regions

- Further breakup of Europe, Middle East, and Africa NFT markets into sub-regions

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Non-Fungible Tokens Market

This Non-Fungible Tokens (NFT) Market report will cover the following quantitative and qualitative data:

Aiming at the NFT game market would like to know the market size of the world. Then decide which countries are the best to expand the new NFT game.