Metaverse Market by Component (Hardware (AR Devices, VR Devices, MR Devices), Software, Professional Services), Vertical (Consumer, Commercial, Industrial Manufacturing), & Region(North America, APAC, Europe,MEA, Latin America) - Global Forecast to 2030

Updated on : Feb 25, 2026

Metaverse Market Overview

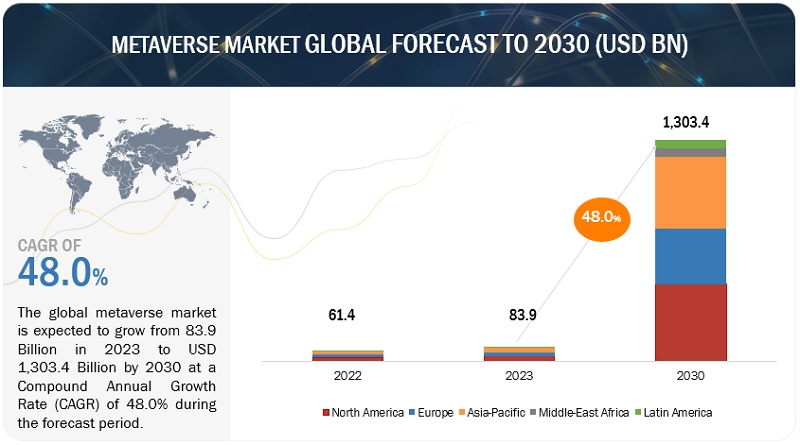

The global Metaverse Market size was reached $83.9 billion in 2023 and is projected to reach over $1,303.4 billion by the end of 2030, at a robust CAGR of 48.0% during the forecast period. The growth of the market is the growing demand of the global entertainment and gaming industry. It has witnessed the fastest growth owing to the increasing adoption of AR, VR, and MR technologies.

The key reasons for adopting these technologies are that the devices, such as VR headsets, MR headsets, HUD, HMD, smart glasses, and smart helmets, can offer the first-person perspective, act as natural user interfaces, provide 6-degree freedom, etc., to create realistic-looking virtual scenarios to enhance the overall gaming experience of end users. Prominent gaming and digital technology players are channeling substantial investments into developing tailored metaverses. A primary driver behind this surge in metaverse technology expenditure is the immense potential for marketing a wide array of products within these metaverses.

The metaverse allows gamers to immerse themselves in virtual reality while engaging in gameplay fully. Numerous companies strive to construct digitally captivating platforms that offer customers deeply satisfying gaming experiences. Several key factors propelling the growth of market revenue encompass a steadily expanding user base in the gaming industry, the rising popularity of play-to-earn games, and the rapid advancements in AR, VR, and metaverse (XR) technologies.

Key Trends & Insights

- Healthcare sector adoption enables virtual consultations, medical training with digital twins, and personalized patient engagement.

- Aerospace and defense leverage XR and metaverse technologies for training, simulations, and skill transfer.

- Strategy and business consulting services support metaverse adoption, platform selection, and market entry.

- Consumer vertical dominates the market, led by gaming and social media, facilitated by interactive 3D content creation tools.

- AR technology enhances user immersion by augmenting real-world environments in mobile, tablet, and portable gaming platforms.

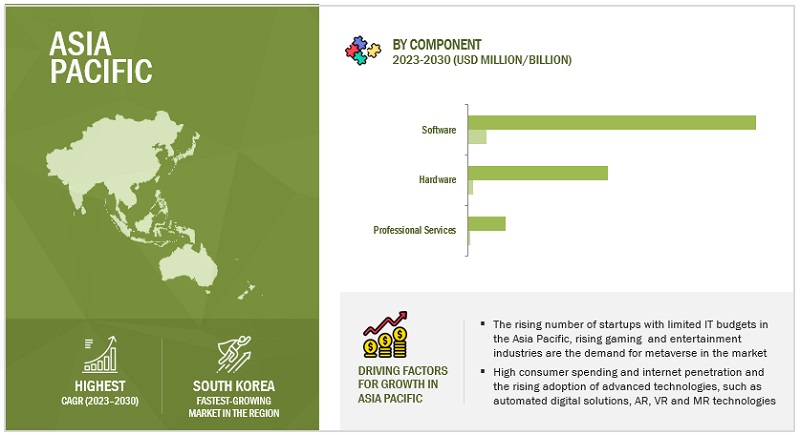

- Asia Pacific expected to grow at the highest CAGR, supported by government initiatives, device adoption, and strong digital infrastructure.

Metaverse Market Size & Forecast

- 2022 Market Size: USD 61.4 Billion

- 2023 Market Size: USD 83.9 Billion

- 2030 Projected Market Size: USD 1,303.4 Billion

- CAGR (2023–2030): 48.0%

- Largest Segment by Vertical: Consumer (gaming and social media)

- Highest Growth Region: Asia Pacific

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Metaverse Market Growth Dynamics

Drivers: Increasing adoption of metaverse in the healthcare sector

Using metaverse in the healthcare sector opens new opportunities for medical practitioners and holds a promising future, especially for modern healthcare organizations. It enables doctors and patients to connect virtually for sessions without geographical limitations and assists virtual wellness, fitness, mental health, and doctor-patient interaction. Various technologies in the metaverse, such as AR, VR, MR, digital twin, blockchain , AI, and ML, will transform the medical sector. For instance, using metaverse, doctors can perform virtual surgeries on the dummies created using digital twins. Further, the blockchain ensures safe transactions and anonymous data storage of patient records. With advancements in artificial intelligence (AI) and machine learning, XR applications will soon be able to adapt to individual users’ needs and preferences; this will provide personalized experiences for medical training, patient education, and therapy, which can lead to improved engagement, retention, and overall effectiveness. By tailoring these experiences to each user, healthcare providers can ensure that their patients receive the most relevant and engaging information, leading to better outcomes.

Restraint: Regulating the metaverse concerning cybersecurity, privacy, and usage standards

Security and privacy issues are the significant challenges faced by the VR, AR, and MR industries. These issues have emerged due to the inconsistencies in programming and negligence and oversight of both the developers and end users of apps and devices. Many consumer AR applications available on the Play Store and App Stores do not have the capabilities to secure user identity and privacy, thereby raising cybersecurity concerns. Further, there are no regulations or defined standards in the metaverse industry at a global level stating the dos and don’ts associated with the metaverse environment. In addition, there is a need to regulate and define taxation in digital real estate, which further hinders the adoption of a metaverse in the entertainment sector. Such factors would slow the market’s smooth growth soon.

Opportunities: Incorporation of metaverse and adjacent technologies in the aerospace and defense sector

Technologies like XR, AI, and analytics in the aerospace and defense sector are expected to be useful for training and simulating applications. These technologies, coupled with metaverse, are expected to be helpful for experiential training by using real-time data-driven applications. Thus, the metaverse is projected to enable the improved and efficient transfer of accurate skills and enhanced knowledge retention by trainees. Metaverse is used to train the ground crew for pre-flight checks in airlines. It also enables the ground crew to perform the required procedures before the aircraft takes off. In integration with XR, the metaverse can also help in weapon training, flight training, and simulations, thereby boosting the market growth.

Technologies like Metaverse (XR), Artificial Intelligence (AI) , and analytics will find substantial utility within the aerospace and defense sector, primarily in training and simulation applications. The convergence of these technologies with the metaverse can revolutionize experiential training, employing data-driven applications in real-time scenarios; this suggests that the metaverse can facilitate the enhancement and efficiency of skill transfer and knowledge retention among trainees in this particular industry. An instance of utilizing metaverse is observed in training ground crew members responsible for pre-flight inspections in the aviation sector. These technologies can empower ground crew personnel to execute essential protocols before aircraft take-off. For instance, in November 2022, SimX, a medical device manufacturing company, received a research and development contract from the US Air Force to create an improved virtual reality (VR) medical simulation training program. The goal was to adapt their current VR medical simulation system to produce a platform that guarantees increased flexibility and consistency for tactical combat casualty care training.

Challenges: Health and mental issues from excessive use

The devices used to experience metaverse, such as HMDs, are highly sophisticated but have also become the focus of health concerns. The most common risk is injuries caused to users due to their bumping into real objects while engrossed in the virtual world. Several users have also reported headaches, eye strain, dizziness, and nausea after using such devices. According to research by the University of Leeds, exposure to VR for 20 minutes will affect the ability of some children to discern the distance between objects. Moreover, the regular use of such devices will accelerate the propagation of myopia at a global level.

Another limitation is the low resolution of VR-enabled devices. Low resolution causes difficulty in viewing and can also aggravate symptoms of virtual sickness, such as irritation and nausea. Fixing the resolution can cause a more significant burden on the processing and graphical processing units, affecting the performance.

Apart from these, these devices also expose users to harmful electromagnetic frequency radiation, which may cause illness. Researchers from the National Toxicology Program (NTP), a federal inter-agency program under the National Health Institutes (US), experimented on mice to demonstrate that subjects exposed to electromagnetic radiation might be highly vulnerable to cancer. Therefore, excessive use of metaverse devices can cause health issues, limiting the growth of the metaverse market.

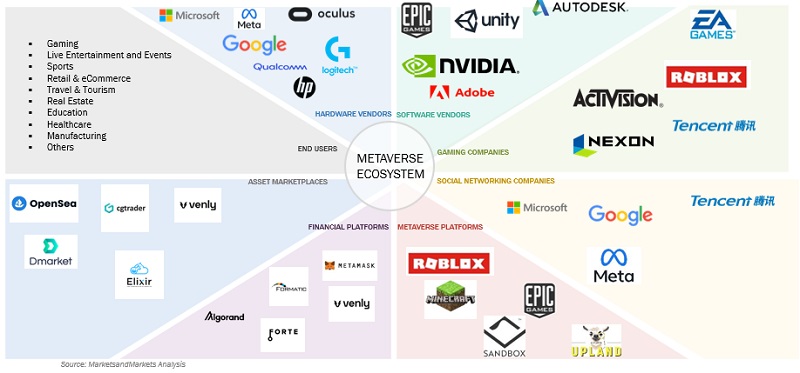

Metaverse Ecosystem

Based on the component, the strategy and business consulting services under the professional services segment significantly contribute the highest market share to the metaverse market during the forecast period.

Consulting services deal with complex inquiries and have numerous clients that demand constant changes in their solutions and service offerings. These services focus more on offering superior customer service. The business consulting service focuses on user pain points, goals, and timelines while considering the technology and human resource bandwidths. Service providers offer consulting services to help clients implement new methodologies for recognizing additional revenue streams. Consulting services help in defining deployable use cases for achieving better business performance. Strategy and business consulting services in the metaverse are becoming increasingly crucial as virtual and augmented reality technologies evolve and shape new business opportunities. Here are some areas where strategy and consulting services can be valuable in the metaverse:

-

Market Analysis and Entry Strategy:

- Assessing market potential in the metaverse.

- Identifying target customer segments and their preferences.

- Determining the feasibility and timing of entry into metaverse markets.

-

Platform and Technology Selection:

- Evaluating different metaverse platforms and technologies.

- Advising on hardware and software requirements.

- Assessing compatibility with existing IT infrastructure.

Based on the vertical, the consumer segment will dominate the metaverse market more during the forecast period.

Interaction plays a vital role in the metaverse. Metaverse is highly empirical and interactive because students can connect and interact in real-time and change their choices to improve performance. Corporates have added gameplay to their Learning and Development (L&D) programs to enjoy higher employee engagement and performance. Continuous advancements in VR, AR, AI, and computer graphics make the metaverse more immersive, accessible, and appealing to consumers. User-friendly content creation tools like 3D modeling software and game engines like Unity and Unreal Engine enable individuals and small teams to develop and contribute to metaverse content and experiences. Brands and advertisers are exploring metaverse-based marketing campaigns and virtual events, leveraging these environments’ immersive and engaging nature to connect with consumers in new ways. Gaming and social media hold the largest share of the consumer vertical market in 2023. The high percentage is attributable to the increasing user base of decentralized play-to-earn games and the rise of a metaverse in social media. The video games industry has been the earliest and foremost user of extended reality technology. It employs various tools and frameworks to develop extended reality games. Several game developers create interactive 3D media experiences and comprehensive participation effects, allowing players to dive into a completely different reality. The video games industry has been the early and foremost user of metaverse technology. It employs various tools and frameworks to develop VR and AR games. A few game developers create interactive 3D media experiences and comprehensive participation effects, allowing players to dive into a completely different reality.

AR technology has transformed the gaming industry over the past few years by enhancing users’ immersion in the gaming experience. This technology uses the existing environments in gaming applications to develop playing fields within it. AR technology provides users an interactive experience of a real-world climate wherein real-world objects are augmented. It superimposes animated objects on a live view of the real world. AR games are mostly mobile-based or tablet-based. They are also available for portable gaming systems.

Asia Pacific to grow at the highest CAGR during the forecast period.

E-commerce has become a key area of focus for retailers in the Asia Pacific, with China being the largest e-commerce market worldwide. The high demand for metaverse devices and metaverse software from the commercial sector is expected to drive the market’s growth in Asia Pacific. Asia Pacific registers the highest demand for consumer products such as smartphones, tablets, laptops, and TV sets. The region is an attractive market for cell phones, tablets, laptops, and television manufacturers. Companies such as Samsung and LG are in South Korea. In contrast, Sony, Sharp, and Panasonic are significant suppliers of legacy metaverse hardware in Japan and facilitate metaverse experience through their latest smartphones and tablets.

Initiatives and funding by governments to support the research and development of the metaverse would boost regional growth. For instance, in 2022, in collaboration with a global technology company, the Centre for Civil Society and Governance of the University of Hong Kong announced a proposal request (RFP) for AR/VR Policy Research in the Asia Pacific region. This initiative encouraged the academic community to undertake solutions-focused research to facilitate the responsible development of AR and VR technologies. The industry intended to award six grants, each worth about USD 100,000. The digital currency market is growing in Asia Pacific. Japanese cryptocurrency exchanges are speeding up the listing of cryptocurrency traders. In February 2021, MAXST Co., Ltd. (South Korea) launched its spatial AR platform, MAXST VPS, a technology that detects a user’s location by constructing a 3D spatial map for indoor and outdoor AR content creation. It will connect all real-world aspects with the virtual world or metaverse. In August 2021, WIMI Hologram Cloud, an AR application technology provider in China, announced the establishment of the “Holographic Metaverse Division” to develop the underlying metaverse holographic technology and to explore next-generation internet services. South Korea’s strength in music shows, TV, and video games makes the country a fertile ground for developing the NFTs framework in the country. For instance, in November 2021, HYBE Corporation, a Korean entertainment company, partnered with Dunamu, a blockchain company, to establish a joint venture for launching the NFT marketplace.

Key Players

Microsoft (US), Sony (Japan), Meta (US), HTC (Taiwan), Google (US), Apple (US), Qualcomm (US), Samsung (South Korea), Activision Blizzard (US), NetEase (China), Electronic Arts (US), Take-Two (US), Tencent (China), Nexon (Japan), Epic Games (US), Unity (US), Valve (US), Accenture (Ireland), Adobe (US), HPE (US), Deloitte (UK), Tech Mahindra (India), Ansys (US), Autodesk (US), Intel (US), ByteDance (China), NVIDIA (US), Epson (Japan), Panasonic (Japan), EON Reality (US), Roblox (US), Lenovo (China), Razer (US), Nextech AR Solutions (Canada), ZQGame (China), Talecraft (US), VR Chat (US), Decentraland (US), Sandbox VR (US), and Quidient (US) are the key players in the metaverse market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

Million/Billion (USD) |

|

Segments Covered |

Component, Vertical, and region |

|

Geographies covered |

North America, Asia Pacific, Latin America, Europe, and the Middle East & Africa |

|

Companies covered |

Microsoft (US), Sony (Japan), Meta (US), HTC (Taiwan), Google (US), Apple (US), Qualcomm (US), Samsung (South Korea), Activision Blizzard (US), NetEase (China), Electronic Arts (US), Take-Two (US), Tencent (China), Nexon (Japan), Epic Games (US), Unity (US), Valve (US), Accenture (Ireland), Adobe (US), HPE (US), Deloitte (UK), Tech Mahindra (India), Ansys (US), Autodesk (US), Intel (US), ByteDance (China), NVIDIA (US), Epson (Japan), Panasonic (Japan), EON Reality (US), Roblox (US), Lenovo (China), Razer (US), Nextech AR Solutions (Canada), ZQGame (China), Talecraft (US), VR Chat (US), Decentraland (US), Sandbox VR (US), and Quidient (US). |

This research report categorizes the Metaverse Market based on service types, verticals, and regions.

Based on Components, the Metaverse market segments are as follows:

-

Hardware

-

AR devices

- AR devices: by Type (qualitative)

- AR Head-Mounted Displays (HMD)

- AR smart glasses

- Smart helmets

- AR Head-Up Displays (HUD)

-

VR devices

- VR devices: by Type (qualitative)

- VR Head-Mounted Displays (HMD)

- Gesture-tracking devices and haptics

- MR devices

-

Displays

- Displays: By Type (qualitative)

- 3D displays

- Holographic Displays

- Virtual Mirrors

-

AR devices

-

Software

- Extended Reality Software

- Gaming Engines

- 3D Mapping, Modeling, and Reconstruction

- Metaverse Platforms

- Financial Platforms

- Other Software

-

Professional Services

- Application Development and System Integration

- Strategy and Business Consulting Services

Based on vertical, the Metaverse market segments are as follows:

-

Consumer

- Gaming and Social Media

- Live Entertainment and Events

-

Commercial

- Retail and eCommerce

- Education and Corporate

- Travel and Tourism

- Real Estate

- Industrial Manufacturing

- Healthcare

- Other verticals

Based on regions, the Metaverse market segments are as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

- Rest of the Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2023, Google launched XR Immersive Stream, which is a cloud-based graphics rendering service that utilizes Google Cloud’s graphics processing units to deliver high-quality, intricate images and videos to any device. Developers can use this service to craft various immersive experiences without requiring robust hardware or specialized applications on the user’s end. Essentially, the critical benefit of XR Immersive Stream is its ability to eliminate the necessity for devices to possess potent hardware or specialized applications to submerge users in 3D or AR environments fully.

- In October 2022, Meta and Microsoft partnered to create a more immersive future for work and play. They plan to introduce Mesh for Microsoft Teams to Meta Quest devices; this technology is the culmination of years of research and innovation, including Azure Digital Twins, Dynamics 365 Remote Assist, and Teams video meetings. It allows people to meet virtually in the place where work happens, using any device, from smartphones to laptops and mixed-reality headsets. By using Mesh for Teams with Meta Quest Pro and Meta Quest 2 devices, people can collaborate as they are in the exact location.

- In November 2021, Samsung acquired an American optics company, DigiLens, to develop a new type of lens iteration called holographic waveguides featuring a wider FoV (Field of View) than other waveguides.

Frequently Asked Questions (FAQ):

What is the future for Metaverse?

The global Metaverse Market size is anticipated to grow from $83.9 Billion in 2023 to $1,303.4 Billion by 2030 at a Compound Annual Growth Rate (CAGR) of 48.0% during the forecast period.

Which region has the highest market share in the metaverse market?

North America has the highest market share in the metaverse market.

What is the Metaverse?

Metaverse is an online experience of shared 3D virtual worlds created by combining physical and digital worlds. These virtual worlds are created by leveraging state-of-the-art technologies, such as Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Real-Time 3D (RT3D), and interactive video.

Which are the major vendors in the metaverse market?

Microsoft (US), Sony (Japan), Meta (US), HTC (Taiwan), Google (US), Apple (US), Qualcomm (US), Samsung (South Korea), Activision Blizzard (US), NetEase (China), Electronic Arts (US), Take-Two (US), Tencent (China), Nexon (Japan), Epic Games (US), Unity (US), Valve (US), Accenture (Ireland), Adobe (US), HPE (US), Deloitte (UK), Tech Mahindra (India), Ansys (US), Autodesk (US), Intel (US), ByteDance (China), NVIDIA (US), Epson (Japan), Panasonic (Japan), EON Reality (US), Roblox (US), Lenovo (China), Razer (US), Nextech AR Solutions (Canada), ZQGame (China), Talecraft (US), VR Chat (US), Decentraland (US), Sandbox VR (US), and Quidient (US) are the key vendors in the metaverse market.

What are the drivers in the metaverse market?

Rising demand in the global media, entertainment, and gaming sectors, primarily due to the increased use of AR, VR, and MR technologies, are the primary factors driving the growth of the Metaverse Market internationally. The main reasons for adopting these technologies are that the gadgets, such as VR headsets, MR headsets, HUD, HMD, smart glasses, and intelligent helmets, can provide a first-person perspective that acts as natural user interfaces, and so on, to create virtual scenarios that look realistic and improve end users’ overall gaming experience. Also over the projected period, tremendous potential prospects in biotechnology and healthcare sector are expected to fuel the growth of the metaverse market.

What are some challenges in the metaverse market?

One of the most challenging difficulties is the lack of interoperability and uniformity among the numerous metaverse platforms. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in demand from entertainment and gaming industries- Emerging opportunities from adjacent markets- Virtualization in fashion, art, and retail industries- Surge in deployment in education sector and industrial training- Increase in adoption of metaverse in healthcare sector- Availability of affordable hardware- Increase in ‘zoom fatigue’ resulting in rise in adoption of metaverse technologiesRESTRAINTS- High installation and maintenance costs of high-end metaverse components- Regulations pertaining to cybersecurity, privacy, and usage standardsOPPORTUNITIES- Incorporation of metaverse and adjacent technologies in aerospace & defense sector- Continuous developments in 5G technology- Emergence of virtual experiences in corporate and hospitality sectorsCHALLENGES- Local government restrictions coupled with environmental impact- Health and mental issues from excessive use

-

5.3 CASE STUDY ANALYSISREZZIL DEPLOYED RIGOROUS TRAINING ASSISTANCE FOR PROFESSIONAL ATHLETES TO PARTICIPATE IN WITHOUT PHYSICAL STRAINSAMSUNG CREATED VIRTUAL STORE IN NEW YORK VIA DECENTRALANDUNITY HELPED HYUNDAI WITH META-FACTORY SETUPH&M LAUNCHED VIRTUAL STORE, ENTERING FASHION SPACE OF METAVERSETANISHQ ENTERED JEWELRY RETAIL SPACE OF METAVERSETECH MAHINDRA AIMED TO LEVERAGE METAVERSE CAPABILITIES FOR AUTOMOTIVE INDUSTRYSTANFORD ENTERED METAVERSE TO MAKE VIRTUAL INTERACTION ENGAGINGGUANAJUATO INTERNATIONAL FILM FESTIVAL WENT VIRTUAL DURING PANDEMICVIRTUAL 3D RETAIL CPG STORE INTRODUCEDKALEIDOSCOPE INNOVATION PLATFORMED VIRTUAL ENVIRONMENT OF CANON MEDICALAWS AIMED TO HELP VOLKSWAGEN GROUP SPEED UP PREPARING 3D DATA AND REMOTE RENDERING PROCESSMICROSOFT OFFERED TIME-EFFICIENT AIRPLANE WIRING APPROACH TO BOEINGAMD USED MAP BUILDING TO ELEVATE FORTNITE GAMING EXPERIENCEZEPETO CREATED SEAMLESS INTEGRATION OF VIRTUAL EXPERIENCES AND FASHION USING METAVERSE

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 TECHNOLOGICAL ANALYSISTECHNOLOGY STACKINFRASTRUCTURE LEVEL- 5G network- Internet of things- Cloud and edge computingDESIGN AND DEVELOPMENT LEVEL- Blockchain- 3D modeling and real-time rendering- Artificial intelligence, natural language processing, and computer visionHUMAN INTERACTION LEVEL- Virtual reality- Augmented reality- Mixed reality

-

5.7 PATENT ANALYSIS

-

5.8 PORTER’S FIVE FORCES MODELTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWAREAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWAREAVERAGE SELLING PRICE TREND OF HARDWARE, BY REGION

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.11 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.14 METAVERSE MARKET: BUSINESS MODEL ANALYSISBUSINESS MODEL FOR HARDWARE VENDORSBUSINESS MODEL FOR SOFTWARE VENDORSBUSINESS MODEL FOR SERVICE VENDORSREVENUE GENERATION MODELSPARTNERSHIPS & ECOSYSTEM

- 5.15 KEY CONFERENCES AND EVENTS

- 5.16 POTENTIAL OUTLOOK OF METAVERSE INDUSTRY BEYOND 2030

- 6.1 INTRODUCTION

-

6.2 HARDWAREHARDWARE INNOVATION TO BE SIGNIFICANT IN SHAPING HOW PEOPLE ENGAGE WITH VIRTUAL WORLDS AND DIGITAL CONTENTHARDWARE: METAVERSE MARKET DRIVERSAR DEVICES- AR Head-Mounted Displays (HMD)- AR Head-up Displays (HUD)VR DEVICES- VR Head-mounted Display (HMD)- Gesture-tracking devices & hapticsMR DEVICESDISPLAYS- 3D displays- Holographic displays- Virtual mirrors

-

6.3 SOFTWARETOOLS TO DESIGN, CREATE, AND TEST AR, VR, AND MR EXPERIENCESSOFTWARE: METAVERSE MARKET DRIVERSEXTENDED REALITY SOFTWARE- Software Development Kits- Cloud-based ServicesGAMING ENGINES3D MAPPING, MODELING, AND RECONSTRUCTION- Volumetric videoMETAVERSE PLATFORMS- Centralized metaverse platforms- Decentralized metaverse platformsFINANCIAL PLATFORMS- Traditional finance in metaverse- Decentralized finance in metaverseOTHER SOFTWARE

-

6.4 PROFESSIONAL SERVICESDELIVERING VARIOUS SPECIALIZED EXPERTISE AND SOLUTIONS WITHIN VIRTUAL ENVIRONMENTSPROFESSIONAL SERVICES: METAVERSE MARKET DRIVERSAPPLICATION DEVELOPMENT & SYSTEM INTEGRATIONSTRATEGY & BUSINESS CONSULTING SERVICES

- 7.1 INTRODUCTION

-

7.2 CONSUMERGAMERS: EARLY ADOPTERS OF METAVERSE TECHNOLOGIES WITH NEW DIMENSIONS OF GAMEPLAY, SOCIAL INTERACTION, AND EXPLORATIONCONSUMER VERTICAL: METAVERSE MARKET DRIVERSGAMING & SOCIAL MEDIA- Gaming- Social mediaLIVE ENTERTAINMENT & EVENTS- Sports- Music concerts- Other events & conferences- Live entertainment & events: Metaverse use cases

-

7.3 COMMERCIALCOMMERCIAL INTERESTS INSTRUMENTAL IN ADVANCING METAVERSE'S DEVELOPMENTCOMMERCIAL VERTICAL: METAVERSE MARKET DRIVERSRETAIL & ECOMMERCE- Jewelry & luxury goods- Beauty and cosmetics- Apparel fitting- Home furnishing- Virtual shopping- Retail & eCommerce: Metaverse use casesEDUCATION & CORPORATE- Education & corporate: Metaverse use casesTRAVEL & TOURISM- Virtual hotel tours- Virtual theme parks- Museums, zoos, and aquariums- Travel & tourism: Metaverse use casesREAL ESTATE- Virtual property & real estate- Real estate: Metaverse use cases

-

7.4 INDUSTRIAL MANUFACTURINGENGINEERS AND DESIGNERS IN VIRTUAL ENVIRONMENTS CREATE AND OPTIMIZE PRODUCT DESIGNSDIGITAL FACTORYDIGITAL TWINSINDUSTRIAL TRAININGINDUSTRIAL MANUFACTURING: METAVERSE USE CASES

-

7.5 HEALTHCAREINCREASE IN DEMAND FOR VIRTUAL THERAPY AND MENTAL HEALTH SERVICES WITH SAFETY AND PRIVACY ENSUREDDIAGNOSTICS & TREATMENTAR/VR BASED TRAININGHEALTHCARE: METAVERSE USE CASES

-

7.6 OTHER VERTICALSOTHER VERTICALS: METAVERSE USE CASES

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: METAVERSE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATIONSUS- Home to leading technology companies focusing on VR, AR, and other metaverse-related technologiesCANADA- Investments in pioneering technologies and expansion programs

-

8.3 EUROPEEUROPE: METAVERSE MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATIONSUK- Increase in focus on digitizationGERMANY- Surge in adoption of new technologies in manufacturing sectorREST OF EUROPE

-

8.4 ASIA PACIFICASIA PACIFIC: METAVERSE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTREGULATIONSCHINA- Rise in number of local players producing metaverse devicesJAPAN- Technology innovations and growing gaming marketSOUTH KOREA- Presence of tech giants, gaming industry, and government supportREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: METAVERSE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTREGULATIONS

-

8.6 LATIN AMERICALATIN AMERICA: METAVERSE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTREGULATIONS

- 9.1 OVERVIEW

-

9.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 9.3 REVENUE ANALYSIS

- 9.4 MARKET RANKING OF KEY PLAYERS

- 9.5 BRAND COMPARISON/VENDOR PRODUCT LANDSCAPE

- 9.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

9.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSKEY COMPANY FOOTPRINT

-

9.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESCOMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 9.9 VALUATION AND FINANCIAL METRICS OF METAVERSE VENDORS

-

9.10 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND PRODUCT ENHANCEMENTSDEALS

- 10.1 INTRODUCTION

-

10.2 KEY PLAYERSGOOGLE- Business overview- Products offered- Recent developments- MnM viewAPPLE- Business overview- Products offered- Recent developments- MnM viewMETA- Business overview- Products offered- Recent developments- MnM viewMICROSOFT- Business overview- Products offered- Recent developments- MnM viewSAMSUNG- Business overview- Products offered- Recent developments- MnM viewSONY- Business overview- Products offered- Recent developmentsHTC- Business overview- Products offered- Recent developmentsACTIVISION BLIZZARD- Business overview- Products offered- Recent developmentsQUALCOMM- Business overview- Products offered- Recent developmentsNETEASE- Business overview- Products offered- Recent developmentsELECTRONIC ARTS- Business overview- Products offered- Recent developmentsTAKE-TWO- Business overview- Products offered- Recent developmentsTENCENT- Business overview- Products offered- Recent developmentsNEXON- Business overview- Products offered- Recent developmentsEPIC GAMES- Business overview- Products offered- Recent developmentsUNITY- Business overview- Recent developmentsVALVE- Business overview- Products offered

-

10.3 OTHER COMPANIESACCENTUREADOBEHPEDELOITTEANSYSAUTODESKINTELTECH MAHINDRABYTEDANCENVIDIASEIKO EPSONPANASONICEON REALITYROBLOXLENOVORAZERNEXTECH AR SOLUTIONSZQGAMETALECRAFTVR CHATDECENTRALANDSANDBOX VRQUIDIENT- Recent developments

-

11.1 INTRODUCTIONRELATED MARKETS

- 11.2 METAVERSE IN GAMING MARKET

- 11.3 EXTENDED REALITY MARKET

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 METAVERSE MARKET SIZE AND GROWTH, 2018–2022 (USD MILLION, Y-O-Y)

- TABLE 5 METAVERSE MARKET SIZE AND GROWTH, 2023–2030 (USD MILLION, Y-O-Y)

- TABLE 6 MARKET SIZE AND GROWTH RATES OF ADJACENT MARKETS

- TABLE 7 METAVERSE MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 8 USE CASES OF MOBILEAR

- TABLE 9 USE CASES OF WEBAR

- TABLE 10 US: TOP TEN PATENT OWNERS

- TABLE 11 KEY PATENTS IN METAVERSE MARKET

- TABLE 12 METAVERSE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 AVERAGE SELLING PRICE OF METAVERSE HEADSETS OFFERED BY KEY PLAYERS

- TABLE 14 AVERAGE SELLING PRICE TREND OF SDKS OFFERED BY KEY PLAYERS

- TABLE 15 AVERAGE SELLING PRICE TREND OF METAVERSE SOFTWARE OFFERED BY KEY PLAYERS

- TABLE 16 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 17 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END-USE VERTICALS

- TABLE 23 KEY BUYING CRITERIA FOR MAJOR END-USE VERTICALS

- TABLE 24 METAVERSE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 25 METAVERSE MARKET SCENARIO

- TABLE 26 METAVERSE TECHNOLOGY FUTURE ROADMAP

- TABLE 27 IMPACT OF WEB 2.0 AND 3.0

- TABLE 28 METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 29 METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 30 METAVERSE HARDWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 METAVERSE HARDWARE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 32 METAVERSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 33 METAVERSE HARDWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 34 AR DEVICES IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 AR DEVICES IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 36 VR DEVICES IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 VR DEVICES IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 38 MR DEVICES IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 MR DEVICES IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 40 DISPLAYS IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 DISPLAYS IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 42 METAVERSE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 METAVERSE SOFTWARE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 44 METAVERSE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 45 METAVERSE SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 46 EXTENDED REALITY SOFTWARE IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 EXTENDED REALITY SOFTWARE IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 48 GAMING ENGINES IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 GAMING ENGINES IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 50 3D MAPPING, MODELING, AND RECONSTRUCTION IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 3D MAPPING, MODELING, AND RECONSTRUCTION IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 52 METAVERSE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 METAVERSE PLATFORMS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 54 FINANCIAL PLATFORMS IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 FINANCIAL PLATFORMS IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 56 OTHER METAVERSE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 OTHER METAVERSE SOFTWARE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 58 METAVERSE PROFESSIONAL SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 METAVERSE PROFESSIONAL SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 60 METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 61 METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 62 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 64 STRATEGY & BUSINESS CONSULTING SERVICES IN METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 STRATEGY & BUSINESS CONSULTING SERVICES IN METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 66 METAVERSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 67 METAVERSE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 68 METAVERSE MARKET IN CONSUMER VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 METAVERSE MARKET IN CONSUMER VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 70 METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 71 METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 72 METAVERSE MARKET IN GAMING & SOCIAL MEDIA, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 METAVERSE MARKET IN GAMING & SOCIAL MEDIA, BY REGION, 2023–2030 (USD MILLION)

- TABLE 74 GAMING: METAVERSE USE CASES

- TABLE 75 METAVERSE MARKET IN LIVE ENTERTAINMENT & EVENTS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 METAVERSE MARKET IN LIVE ENTERTAINMENT & EVENTS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 77 LIVE ENTERTAINMENT & EVENTS: METAVERSE USE CASES

- TABLE 78 METAVERSE MARKET IN COMMERCIAL VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 79 METAVERSE MARKET IN COMMERCIAL VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 80 METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 81 METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 82 METAVERSE MARKET IN RETAIL & ECOMMERCE VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 83 METAVERSE MARKET IN RETAIL & ECOMMERCE VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 84 RETAIL & ECOMMERCE: METAVERSE USE CASES

- TABLE 85 METAVERSE MARKET IN EDUCATION & CORPORATE VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 METAVERSE MARKET IN EDUCATION & CORPORATE VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 87 EDUCATION & CORPORATE: METAVERSE USE CASES

- TABLE 88 METAVERSE MARKET IN TRAVEL & TOURISM VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 89 METAVERSE MARKET IN TRAVEL & TOURISM VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 90 TRAVEL & TOURISM: METAVERSE USE CASES

- TABLE 91 METAVERSE MARKET IN REAL ESTATE VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 92 METAVERSE MARKET IN REAL ESTATE VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 93 REAL ESTATE: METAVERSE USE CASES

- TABLE 94 METAVERSE MARKET IN INDUSTRIAL MANUFACTURING VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 95 METAVERSE MARKET IN INDUSTRIAL MANUFACTURING VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 96 INDUSTRIAL MANUFACTURING: METAVERSE USE CASES

- TABLE 97 METAVERSE MARKET IN HEALTHCARE VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 98 METAVERSE MARKET IN HEALTHCARE VERTICAL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 99 HEALTHCARE: METAVERSE USE CASES

- TABLE 100 METAVERSE MARKET IN OTHER VERTICALS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 101 METAVERSE MARKET IN OTHER VERTICALS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 102 OTHER VERTICALS: METAVERSE USE CASES

- TABLE 103 METAVERSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 104 METAVERSE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: REGULATIONS

- TABLE 106 NORTH AMERICA: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: METAVERSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: METAVERSE HARDWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: METAVERSE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: METAVERSE SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: METAVERSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: METAVERSE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: METAVERSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: METAVERSE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 122 US: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 123 US: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 124 CANADA: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 125 CANADA: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 126 EUROPE: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 127 EUROPE: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 128 EUROPE: METAVERSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 129 EUROPE: METAVERSE HARDWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 130 EUROPE: METAVERSE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 131 EUROPE: METAVERSE SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 132 EUROPE: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 133 EUROPE: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 134 EUROPE: METAVERSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 135 EUROPE: METAVERSE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 136 EUROPE: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 137 EUROPE: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 138 EUROPE: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 139 EUROPE: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 140 EUROPE: METAVERSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 141 EUROPE: METAVERSE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 142 UK: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 143 UK: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 144 GERMANY: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 145 GERMANY: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 147 REST OF EUROPE: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: METAVERSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: METAVERSE HARDWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: METAVERSE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: METAVERSE SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: METAVERSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: METAVERSE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: METAVERSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: METAVERSE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 164 CHINA: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 165 CHINA: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 166 JAPAN: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 167 JAPAN: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 168 SOUTH KOREA: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 169 SOUTH KOREA: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: METAVERSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: METAVERSE HARDWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: METAVERSE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: METAVERSE SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: METAVERSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: METAVERSE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 186 LATIN AMERICA: METAVERSE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: METAVERSE MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: METAVERSE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: METAVERSE HARDWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: METAVERSE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: METAVERSE SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: METAVERSE PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: METAVERSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: METAVERSE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: METAVERSE MARKET IN CONSUMER VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2018–2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: METAVERSE MARKET IN COMMERCIAL VERTICAL, BY SUBVERTICAL, 2023–2030 (USD MILLION)

- TABLE 200 STRATEGIES ADOPTED BY KEY METAVERSE MARKET VENDORS

- TABLE 201 MAJOR AR COMPANIES

- TABLE 202 MAJOR VR COMPANIES

- TABLE 203 MAJOR MR COMPANIES

- TABLE 204 BRAND COMPARISON/VENDOR PRODUCT LANDSCAPE

- TABLE 205 KEY COMPANY REGIONAL FOOTPRINT

- TABLE 206 KEY COMPANY COMPONENT FOOTPRINT

- TABLE 207 OVERALL KEY COMPANY FOOTPRINT

- TABLE 208 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 209 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 210 METAVERSE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, FEBRUARY 2020–AUGUST 2023

- TABLE 211 METAVERSE MARKET: DEALS, JANUARY 2020–SEPTEMBER 2023

- TABLE 212 GOOGLE: BUSINESS OVERVIEW

- TABLE 213 GOOGLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 214 GOOGLE: PRODUCT LAUNCHES

- TABLE 215 GOOGLE: DEALS

- TABLE 216 APPLE: BUSINESS OVERVIEW

- TABLE 217 APPLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 218 APPLE: PRODUCT LAUNCHES

- TABLE 219 APPLE: DEALS

- TABLE 220 META: BUSINESS OVERVIEW

- TABLE 221 META: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 222 META: PRODUCT LAUNCHES

- TABLE 223 META: DEALS

- TABLE 224 MICROSOFT: BUSINESS OVERVIEW

- TABLE 225 MICROSOFT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 226 MICROSOFT: PRODUCT LAUNCHES

- TABLE 227 MICROSOFT: DEALS

- TABLE 228 SAMSUNG: BUSINESS OVERVIEW

- TABLE 229 SAMSUNG: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 230 SAMSUNG: PRODUCT LAUNCHES

- TABLE 231 SAMSUNG: DEALS

- TABLE 232 SONY: BUSINESS OVERVIEW

- TABLE 233 SONY: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 234 SONY: PRODUCT LAUNCHES

- TABLE 235 SONY: DEALS

- TABLE 236 HTC: BUSINESS OVERVIEW

- TABLE 237 HTC: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 238 HTC: PRODUCT LAUNCHES

- TABLE 239 HTC: DEALS

- TABLE 240 ACTIVISION BLIZZARD: BUSINESS OVERVIEW

- TABLE 241 ACTIVISION BLIZZARD: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 242 ACTIVISION BLIZZARD: PRODUCT LAUNCHES

- TABLE 243 ACTIVISION BLIZZARD: DEALS

- TABLE 244 QUALCOMM: BUSINESS OVERVIEW

- TABLE 245 QUALCOMM: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 246 QUALCOMM: PRODUCT LAUNCHES

- TABLE 247 QUALCOMM: DEALS

- TABLE 248 QUALCOMM: OTHERS

- TABLE 249 NETEASE: BUSINESS OVERVIEW

- TABLE 250 NETEASE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 251 NETEASE: PRODUCT LAUNCHES

- TABLE 252 NETEASE: DEALS

- TABLE 253 ELECTRONIC ARTS: BUSINESS OVERVIEW

- TABLE 254 ELECTRONIC ARTS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 255 ELECTRONIC ARTS: PRODUCT LAUNCHES

- TABLE 256 ELECTRONIC ARTS: DEALS

- TABLE 257 TAKE-TWO: BUSINESS OVERVIEW

- TABLE 258 TAKE-TWO: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 259 TAKE-TWO: PRODUCT LAUNCHES

- TABLE 260 TAKE-TWO: DEALS

- TABLE 261 TENCENT: BUSINESS OVERVIEW

- TABLE 262 TENCENT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 263 TENCENT: DEALS

- TABLE 264 NEXON: BUSINESS OVERVIEW

- TABLE 265 NEXON: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 266 NEXON: PRODUCT LAUNCHES

- TABLE 267 EPIC GAMES: BUSINESS OVERVIEW

- TABLE 268 EPIC GAMES: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 269 EPIC GAMES: PRODUCT LAUNCHES

- TABLE 270 EPIC GAMES: DEALS

- TABLE 271 UNITY: BUSINESS OVERVIEW

- TABLE 272 UNITY: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 273 UNITY: PRODUCT LAUNCHES

- TABLE 274 UNITY: DEALS

- TABLE 275 VALVE: BUSINESS OVERVIEW

- TABLE 276 VALVE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 277 QUIDIENT: PRODUCT LAUNCHES

- TABLE 278 METAVERSE IN GAMING MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 279 METAVERSE IN GAMING MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 280 METAVERSE IN GAMING MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 281 METAVERSE IN GAMING MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 282 METAVERSE IN GAMING MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 283 METAVERSE IN GAMING MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 284 METAVERSE IN GAMING MARKET, BY GAME GENRE, 2019–2022 (USD MILLION)

- TABLE 285 METAVERSE IN GAMING MARKET, BY GAME GENRE, 2023–2028 (USD MILLION)

- TABLE 286 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 287 EXTENDED REALITY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 288 EXTENDED REALITY MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 289 EXTENDED REALITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 290 EXTENDED REALITY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 291 EXTENDED REALITY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- FIGURE 1 METAVERSE MARKET: RESEARCH DESIGN

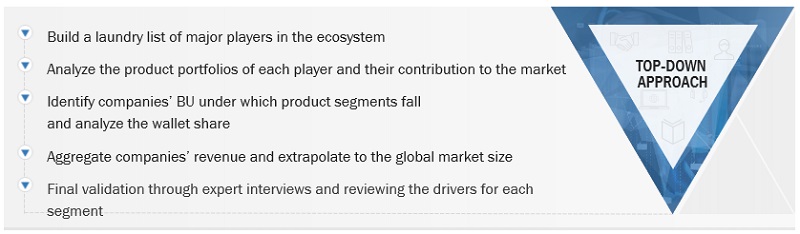

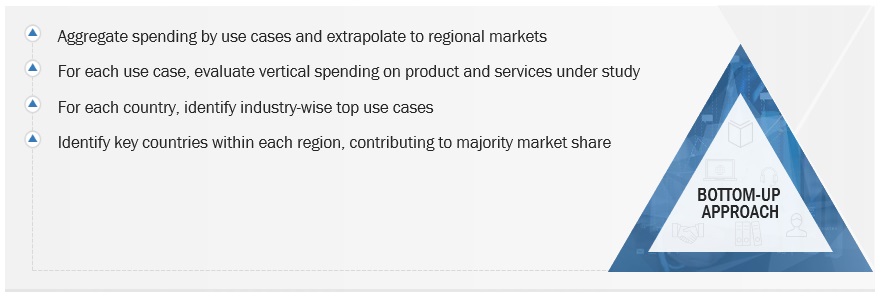

- FIGURE 2 METAVERSE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 METAVERSE MARKET: RESEARCH FLOW

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE OF VENDORS OFFERING METAVERSE HARDWARE, SOFTWARE, AND SERVICES

- FIGURE 8 MARKET PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 DEMAND-SIDE APPROACH: REVENUE GENERATED FROM DIFFERENT VERTICALS

- FIGURE 10 MARKET PROJECTIONS FROM DEMAND-SIDE

- FIGURE 11 METAVERSE MARKET: DATA TRIANGULATION

- FIGURE 12 GLOBAL METAVERSE MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 FASTEST-GROWING SEGMENTS OF METAVERSE MARKET

- FIGURE 15 XR-BASED TECHNOLOGICAL TRANSFORMATIONS IN SOCIAL NETWORKING, ONLINE VIDEO GAMING, AND LIVE ENTERTAINMENT TO DRIVE METAVERSE MARKET GROWTH

- FIGURE 16 METAVERSE SOFTWARE TO BE DOMINANT MARKET IN 2023 AND 2030

- FIGURE 17 VR DEVICES TO ACCOUNT FOR LARGEST METAVERSE HARDWARE MARKET SHARE IN 2023 AND 2030

- FIGURE 18 EXTENDED REALITY SOFTWARE TO BE LARGEST SOFTWARE MARKET IN 2023 AND 2030

- FIGURE 19 CONSUMER VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023 AND 2030

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT SEVEN YEARS

- FIGURE 21 MARKET DYNAMICS: METAVERSE MARKET

- FIGURE 22 NUMBER OF MOBILEAR ACTIVE USER DEVICES WORLDWIDE FROM 2019 TO 2024 (BILLION)

- FIGURE 23 EVOLUTION OF METAVERSE

- FIGURE 24 5G USERS SPEND MORE TIME IN METAVERSE (HOURS/WEEK)

- FIGURE 25 METAVERSE MARKET: SUPPLY CHAIN

- FIGURE 26 METAVERSE MARKET: ECOSYSTEM

- FIGURE 27 METAVERSE MARKET: TECHNOLOGIES

- FIGURE 28 NUMBER OF PATENTS GRANTED, 2012–2022

- FIGURE 29 TOP FIVE GLOBAL PATENT OWNERS

- FIGURE 30 METAVERSE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF METAVERSE MR HEADSETS OFFERED BY KEY PLAYERS (USD)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF MR DEVICES, BY REGION

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR END-USE VERTICALS

- FIGURE 34 KEY BUYING CRITERIA FOR MAJOR END-USE VERTICALS

- FIGURE 35 METAVERSE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 36 METAVERSE MARKET: BUSINESS MODELS

- FIGURE 37 NUMBER OF GAMERS IN METAVERSE, 2020–2030 (BILLION)

- FIGURE 38 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 39 VR DEVICES TO BE LARGEST HARDWARE MARKET FOR METAVERSE DURING FORECAST PERIOD

- FIGURE 40 EXTENDED REALITY SOFTWARE TO BE LARGEST SOFTWARE MARKET DURING FORECAST PERIOD

- FIGURE 41 STRATEGY & BUSINESS CONSULTING SERVICES TO BE LARGER PROFESSIONAL SERVICES SEGMENT DURING FORECAST PERIOD

- FIGURE 42 CONSUMER VERTICAL TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 46 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY METAVERSE PROVIDERS, 2018–2022 (USD MILLION)

- FIGURE 47 MARKET RANKING OF KEY METAVERSE PLAYERS, 2022

- FIGURE 48 GLOBAL SNAPSHOT OF KEY METAVERSE MARKET PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 50 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 51 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 52 VALUATION AND FINANCIAL METRICS OF METAVERSE VENDORS

- FIGURE 53 GOOGLE: COMPANY SNAPSHOT

- FIGURE 54 APPLE: COMPANY SNAPSHOT

- FIGURE 55 META: COMPANY SNAPSHOT

- FIGURE 56 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 57 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 58 SONY: COMPANY SNAPSHOT

- FIGURE 59 HTC: COMPANY SNAPSHOT

- FIGURE 60 ACTIVISION BLIZZARD: COMPANY SNAPSHOT

- FIGURE 61 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 62 NETEASE: COMPANY SNAPSHOT

- FIGURE 63 ELECTRONIC ARTS: COMPANY SNAPSHOT

- FIGURE 64 TAKE-TWO: COMPANY SNAPSHOT

- FIGURE 65 TENCENT: COMPANY SNAPSHOT

- FIGURE 66 NEXON: COMPANY SNAPSHOT

- FIGURE 67 UNITY: COMPANY SNAPSHOT

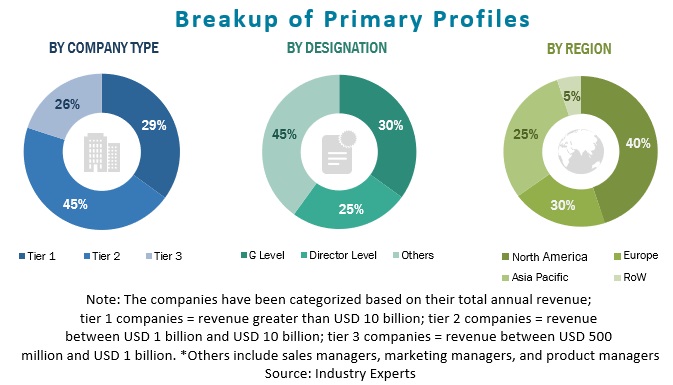

The study involved four major activities in estimating the market size for Metaverse. An exhaustive secondary research helped to collect information on the market, peer, and parent markets. The next step was to validate these assumptions, findings, and sizing with the industry experts across the value chain through primary research. Both bottom-up and top-down approaches were employed to estimate the complete market size. After that, market breakup and data triangulation were used to estimate the overall market size of segments and sub-segments.

Secondary Research

The secondary research process referred to various secondary sources to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, and whitepapers; certified publications; and articles from recognized associations and government publishing sources. We used secondary research to obtain critical information about the industry’s value chain, the pool of key players, market classification, segmentation according to industry trends to the bottom-most level, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, we interviewed various sources from the supply and demand sides to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related executives from metaverse vendors, industry associations, and independent consultants; and key opinion leaders.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), we conducted extensive primary research to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation types, industry trends, key players, a competitive landscape of different market players, and market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. The market engineering process was extensive qualitative and quantitative analysis to record the critical information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the metaverse market and other dependent submarkets. With the bottom-up procedure, we arrived at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size helped estimate the size of other individual markets via percentage splits of the market segments. The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research and their revenue contributions in respective regions through primary and secondary research.

- This procedure included studying top market players’ annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All possible parameters affecting the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed input and analysis from MarketsandMarkets.

Bottom-Up Approach

The bottom-up approach identified the adoption rate of Metaverse by different verticals in critical countries concerning the region that contributes most of the market share. Further, the adoption rate of Metaverse in various industries and use cases concerning their geographies were identified and extrapolated for cross-validation. In addition, later, we assigned weights to the use cases identified in regions such as North America, Europe, etc., for the calculation.

Based on these numbers, we determined the geographic split with primary and secondary sources. The procedure included an analysis of the metaverse market’s region-wise penetration. Various factors considered are – ICT spending and strategic vendor analysis of system integration service providers. Other factors analyzed were the socioeconomic analysis of each country and local and global players’ organic and inorganic business strategies.

With the data triangulation process and data validation via primaries, this study determined and confirmed the exact values of the overall metaverse market and its segments’ market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach

The top-down approach helped prepare an exhaustive list of vendors offering hardware, software, and services in the metaverse market. The revenue contribution for all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. We evaluated vendors based on their offerings and extrapolated all companies’ revenues to reach the overall market size. Each subsegment was further studied and analyzed for its global market size and regional penetration. We triangulated markets through both primary and secondary research. The primary procedure included obtaining critical insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. Analysts derived the metaverse market from metaverse solution subscriptions adopted by different verticals. The MarketsandMarkets repository helped validate the market numbers further.

Data Triangulation

A research technique called data triangulation uses two or more methods to confirm findings and outcomes. It is employed to verify the findings’ integrity and ensure that the data support the hypothesis. Data triangulation, used frequently in qualitative research, entails confirming data by those who collected and analyzed it. With the data triangulation process and data validation through primaries, we established the exact values of the overall metaverse market and its segments’ market size.

Market Definition

Metaverse is an online experience of shared 3D virtual worlds created by combining physical and digital worlds. These virtual worlds are created by leveraging state-of-the-art technologies, such as Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Real-Time 3D (RT3D), and interactive video.

Key Stakeholders

- Metaverse solution and service providers

- Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR) device manufacturers

- Professional service providers and consulting companies

- Raw material suppliers

- Original Equipment Manufacturers (OEM)

- Government organizations, forums, alliances, and associations

- System Integrators (SIs) and Value-added Resellers (VARs)

- Research organizations

- Technology investors

- End-use Verticals

Report Objectives

- To define, describe, and forecast the metaverse market based on components (hardware, software, and professional services), verticals, and regions

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the metaverse market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the metaverse market

- To forecast the size of the market segments concerning five regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the metaverse market and comprehensively analyze their market size and core competencies

- To track and analyze global competitive developments in the metaverse market, such as product enhancements and new product launches, acquisitions, partnerships, and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s requirements. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metaverse Market