Online Travel Booking Platform Market - Global Forecast to 2027

Online travel booking platform helps customers to book travel tickets on their preferred locations, dates, times and according to their budget. These platforms provide different kinds of travel media options along with information about availability on all other nearby dates and times as well. There are many commercial as well as government platforms available online that also provides customer care support on call, live chat assistance and on email. Online travel booking platform is gaining customers trust and increased usage as it provides ease of travel booking anytime and from anywhere. Some of these platforms also provide other information like how-to travel, where to food and accommodation, how-much budget is required, different tour packages, other places to visit and mind-blowing offers. COVID19 impacted travel and tourism industry badly but now it is gaining momentum.

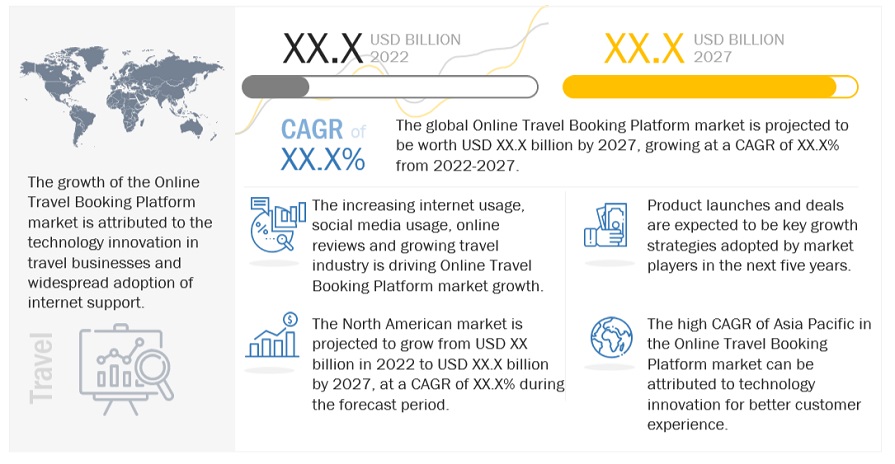

The global online travel booking platform market is expected to grow from USD XX.X billion in 2022 to USD XX.X million by 2027, at a CARG of XX.X%. Growing travel industry, social media influence, online reviews and rating visibility, easy booking facility, online information availability, and need and desire to travel are key factors booting the growth of the market. These platforms can be accessed on any kind of internet enabled devices such as mobiles, laptops, tablets thus providing flexibility to the user.

Drivers: increase in travel industry, internet usage and online reviews

The increasing in internet usage, smartphone penetration, social media usage and travel industry are notable factors that are driving the market growth. The mass customer attraction to these platforms is due to easy booking of other services like Airbnb, hotels, food, cabs, restaurants, price comparing options, easy payment plans and other amenities.

Challenges: Customer queries handling, Cancellation & refund policies

The main challenges faced by online travel booking platforms are handling customers queries and cancellation policies. Customer care services adds to the customer experience and thus have effects on customer reviews. The customers look for flexible cancellation policies and refund policies which is challenging for these platforms. These travel booking platforms must ensure drivers and riders safety, COVID19 safety which is of utmost importance and thus provide insurance policy options.

Key market players

Booking Holdings (Netherlands), Expedia (US), Trip.com (Singapore), MakeMyTrip (India), TripAdvisor (US), Trivago (Germany), Amadius (Spain), Yatra (India), Webjet (Australia), Edreams Odigeo (Luxembourg), OnTheBeach (UK), Despegar (Argentina), Holidaycheck (Germany), Travelzoo (US) and EaseMyTrip (India) are few market players in the Online travel booking platform market globally.

Recent Developments

- In May 2022, Expedia Group announced a new technology platform called Expedia Group™ Open World for delivering great traveller experiences, developing traveller focused technology that displays the right information for booking confidence and improved travel ecosystem.

- In Oct 2022, On World Architecture Day, Booking.com made a list of lesser-known monuments in India and World that every traveller should visit at least once

- In May 2022, Indian airlines company ‘Air India’ migrated its Passenger Service System (PSS) to Amadeus Altéa as the airline share the same reservation platform and services include components such as revenue accounting, retailing, revenue management; merchandising, website, mobile; IT support and frequent flyer programme management.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 ONLINE TRAVEL BOOKING PLATFORM MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 FACTOR ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL ONLINE TRAVEL BOOKING PLATFORM MARKET

4.2 MARKET, BY COMPONENT

4.3 MARKET, BY INDUSTRY AND REGION

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.3.1 ECOSYSTEM: ONLINE TRAVEL BOOKING PLATFORM MARKET

5.3.2 CASE STUDIES

5.3.2.1 Use Case 1

5.3.2.2 Use Case 2

5.3.2.3 Use case 3

5.3.2.4 Use Case 4

5.3.2.5 Use Case 5

5.3.3 PATENT ANALYSIS

5.3.3.1 Methodology

5.3.3.2 Types of Patents

5.3.3.3 Innovation And Patent Applications

5.3.3.3.1 Top applicants

5.3.4 VALUE CHAIN ANALYSIS

5.3.5 PORTER’S FIVE FORCES ANALYSIS

5.3.5.1 Threat of new entrants

5.3.5.2 Threat of substitutes

5.3.5.3 Bargaining power of suppliers

5.3.5.4 Bargaining power of buyers

5.3.5.5 Intensity of competitive rivalry

5.3.6 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.7 PRICING ANALYSIS

5.3.7.1 Pricing models and indicative price points

5.3.8 TECHNOLOGY ANALYSIS

5.3.8.1 Platform eCommerce

5.3.8.2 Headless Custom Stack

5.3.9 KEY CONFERENCES AND EVENTS IN 2022-2023

5.3.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.11 REGULATORY LANDSCAPE

5.3.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

6 ONLINE TRAVEL BOOKING PLATFORM MARKET SIZE, BY COMPONENT

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.2 SOLUTION

6.3.1 FLIGHT BOOKING SYSTEM

6.3.2 HOTEL BOOKING SYSTEM

6.3.3 BUS AND CAB BOOKING SYSTEM

6.3.3 PACKAGE BOOKING SYSTEM

6.3 SERVICES

6.3.3 CUSTOMER SUPPORT SERVICE

6.3.3 ADVERTISING SERVICE

7 ONLINE TRAVEL BOOKING PLATFORM MARKET SIZE, BY TYPE

7.1 INTRODUCTION

7.1.1 INDUSTRY: MARKET DRIVERS

7.2 PACKAGES

7.3 DIRECT

8 MARKET SIZE, BY BOOKING DEVICE

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.2 LAPTOP/DEKSTOP

8.3 MOBILE/TABLETS

9 ONLINE TRAVEL BOOKING PLATFORM MARKET SIZE, BY REGION

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: PESTLE ANALYSIS

9.2.2 UNITED STATES

9.2.3 CANADA

9.3 EUROPE

9.3.1 EUROPE: PESTLE ANALYSIS

9.3.2 UNITED KINGDOM

9.3.3 GERMANY

9.3.4 FRANCE

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: PESTLE ANALYSIS

9.4.2 CHINA

9.4.3 INDIA

9.4.4 SOUTH KOREA

9.4.4 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

9.5.2 SAUDI ARABIA

9.5.3 UNITED ARAB EMIRATES

9.5.4 SOUTH AFRICA

9.5.4 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: PESTLE ANALYSIS

9.6.2 BRAZIL

9.6.3 MEXICO

9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ONLINE TRAVEL BOOKING PLATFORM SERVICE PROVIDERS

10.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

10.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

10.5 KEY COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

10.6 COMPETITIVE BENCHMARKING

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

10.8 COMPETITIVE SCENARIO AND TRENDS

10.8.1 PRODUCT LAUNCHES

10.8.2 DEALS

10.8.3 OTHERS

11 COMPANY PROFILES

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 BOOKING HOLDINGS

11.2.1.1 Business and Financial overview

11.2.1.2 Recent developments

11.2.1.3 MNM VIEW

11.2.1.3.1 Key strengths/right to win

11.2.1.3.2 Strategic choices made

11.2.1.3.3 Weaknesses and competitive threats

11.2.2 EXPEDIA GROUP

11.2.2.1 Business and Financial Overview

11.2.2.2 Recent developments

11.2.2.3 MNM VIEW

11.2.2.3.1 Key strengths/right to win

11.2.2.3.2 Strategic choices made

11.2.2.3.3 Weaknesses and competitive threats

11.2.3 TRIP.COM GROUP LTD

11.2.3.1 Business and Financial Overview

11.2.3.2 Recent developments

11.2.3.3 MNM VIEW

11.2.3.3.1 Key strengths/right to win

11.2.3.3.2 Strategic choices made

11.2.3.3.3 Weaknesses and competitive threats

11.2.4 MAKEMYTRIP

11.2.4.1 Business and Financial Overview

11.2.4.2 Recent Developments

11.2.4.3 MNM VIEW

11.2.4.3.1 Key strengths/right to win

11.2.4.3.2 Strategic choices made

11.2.4.3.3 Weaknesses and competitive threats

11.2.5 TRIPADVISOR

11.2.5.1 Business and Financial Overview

11.2.5.2 Recent Developments

11.2.5.3 MnM View

11.2.5.3.1 Key strengths/right to win

11.2.5.3.2 Strategic choices made

11.2.5.3.3 Weaknesses and competitive threats

11.2.6 TRIVAGO

11.2.6.1 Business and Financial Overview

11.2.6.2 Recent developments

11.2.7 AIRBNB

11.2.7.1 Business and Financial Overview

11.2.7.2 Recent developments

11.2.8 AMADIUS

11.2.8.1 Business and Financial Overview

11.2.8.2 Recent developments

11.2.9 WEBJET

11.2.9.1 Business and Financial Overview

11.2.9.2 Recent developments

11.2.10 EDREAMS ODIGEO

11.2.10.1 Business and Financial Overview

11.2.10.2 Recent developments

11.2.11 ON THE BEACH PLC

11.2.12.1 Business and Financial Overview

11.2.12.2 Recent developments

11.2.12 DESPEGAR.COM CORP

11.2.13 LASTMINUTE.COM

11.2.14 HOLIDAYCHECK

11.2.15 TRAVELZOO

11.2.16 HOSTELWORLD

11.2.17 YATRA

11.2.18 EASEMYTRIP

(The list of players is subject to further modification over the course of research)

Growth opportunities and latent adjacency in Online Travel Booking Platform Market