Oxygen Concentrators Market Size, Growth, Share & Trends Analysis

Oxygen Concentrators Market by Type (Portable, Stationary), Technology (Continuous and Pulse Flow), Flowrate (0-5L/Min, 5-10L/Min, Above 10L/Min), Application (Chronic Obstructive Pulmonary Disorder), End User (Home Care Settings) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The oxygen concentrators market is projected to reach USD 1.71 billion by 2030 from USD 1.27 billion in 2025, at a CAGR of 6.1% during the forecast period. The market includes medical devices that extract and concentrate oxygen from ambient air to provide supplemental oxygen therapy for patients with respiratory conditions such as COPD, asthma, and hypoxemia. It covers both portable and stationary concentrators used in hospitals, clinics, and home care settings, along with related accessories and services. Market growth is driven by rising chronic respiratory disease prevalence, aging populations, and advancements in portable, energy-efficient, and connected device technologies.

KEY TAKEAWAYS

- Middle East & Africa is expected to register the highest CAGR of 7.2%

- By Type, portable segment dominated the market, with a share of 65.0% in 2024

- By Technology, Continuous Flow segment domminated the market, with a share of 55.0% in 2024

- By Flowrate, 0-5L/min dominated the market, with a share of 60.0% in 2024

- By Application, COPD will be the fastest-growing segment in the forecast period.

- By End User, home care settings will be the fastest-growing segment in the forecast period.

- Inogen, Inc., Jiangsu Yuyue Medical Equipment & Supply Co., Ltd., Caire, Inc., Drive DeVilbiss Healthcare, and Koninklijke Philips N.V. were identified as Star players in the plant-based supplements market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

- Hoyo Scitech, Foshan Keyhub, Oxymed and XNUO have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The oxygen concentrators (OC) market is witnessing steady growth, driven by the growing prevalence of chronic respiratory diseases, preference for home-based oxygen therapy, and technological advancements in portable oxygen concentrators, along with expansion in emerging markets and integration with remote monitoring and telehealth, further supported by the global expansion of oxygen concentrators. However, the market faces challenges such as high initial cost and limited reimbursement in some markets and operational limitations in remote and power-constrained areas. Despite these, the industry is poised for advancement through the development of integrated and multifunctional care technologies, particularly across emerging markets, which offer significant growth potential due to improved healthcare access.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The oxygen concentrators market is undergoing a significant transformation, fueled by the growing incidence of respiratory diseases, rising demand for home-based care, and advancements in portable and connected healthcare technologies. Traditional oxygen delivery systems are being rapidly replaced or augmented by next-generation solutions such as wearable concentrators, miniaturized devices, and continuous flow systems that prioritize mobility, battery efficiency, and integration with digital health platforms. These innovations are reshaping both the competitive landscape and business models, as end-users, including hospitals, home care providers, and ambulatory care centers, demand smarter, more flexible, and patient-centric solutions. The shift toward automation, telehealth compatibility, and AI-driven respiratory care is encouraging companies to invest in smarter, connected ecosystems to remain agile and competitive in this fast-evolving space.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Prevalence of Chronic Respiratory Diseases

-

Preference for Home-based Oxygen Therapy

Level

-

High Initial Cost and Limited Reimbursement in Some Markets

Level

-

Expansion in Emerging Markets

-

Integration with Remote Monitoring and Telehealth

Level

-

Operational Limitations in Remote and Power-constrained Areas

-

Quality Variability and Regulatory Compliance Challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Prevalence of Chronic Respiratory Diseases

The global increase in chronic respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and pulmonary fibrosis has become a major health concern. According to the Global Burden of Disease study, COPD alone causes over 3 million deaths each year, making it one of the leading causes of death worldwide. The rising rates of smoking, environmental pollution, occupational exposure to hazardous air, and an aging population are key factors driving this trend. Asia Pacific countries like China and India are experiencing a surge in respiratory illnesses due to poor air quality, industrial emissions, and urban growth. These countries, with their large populations and aging demographics, show strong potential demand for oxygen concentrators.

Restraint: High Initial Cost and Limited Reimbursement in Some Markets

The upfront cost of oxygen concentrators, particularly portable and smart-enabled models, poses a significant barrier to adoption—especially in developing and underinsured regions. Depending on the configuration and features, units can cost between USD 500 to over USD 3,000. While this cost may be offset by long-term savings when compared to cylinder-based delivery, the initial expenditure remains a challenge for many patients and small clinics. In macroeconomic terms, several low- and middle-income countries (LMICs) in Asia, Africa, and Latin America operate with limited healthcare budgets and fragmented insurance coverage. Out-of-pocket healthcare expenditure exceeds 50% in countries like Nigeria, Bangladesh, and the Philippines, making access to expensive medical equipment financially burdensome for households. In countries like Mexico or Brazil, reimbursement policies for oxygen therapy vary across public and private insurance schemes.

Opportunity: Expansion in Emerging Markets

Emerging economies across the Asia Pacific, Latin America, and Sub-Saharan Africa present one of the most promising growth avenues for the oxygen concentrator market. Macroeconomic developments in these regions include rising per capita incomes, growing health insurance penetration, and increased public spending on healthcare infrastructure. In countries like India, Brazil, Indonesia, and Nigeria, the demand for respiratory care devices is accelerating due to rising pollution levels, urbanization, and expanding middle-class populations with growing health awareness. The COVID-19 pandemic exposed critical gaps in oxygen delivery systems in many of these countries. In response, governments and multilateral organizations such as the World Bank, UNICEF, and WHO have pledged substantial funding toward upgrading medical oxygen infrastructure. As a result, procurement of oxygen concentrators—especially stationary and mid-flow variants—has increased significantly. India, for instance, launched national schemes such as the PM Cares Fund Oxygen Distribution Plan to distribute concentrators across district hospitals and rural health centers.

Challenge: Operational Limitations in Remote and Power-Constrained Areas

Oxygen concentrators require a stable power supply to operate effectively, and this reliance creates limitations in many rural and low-resource settings. Most concentrators require continuous electricity for compressor function, oxygen filtration, and electronic control systems. Power outages or voltage fluctuations can compromise device function, oxygen purity, and patient safety. In macro terms, countries with underdeveloped electrical infrastructure—such as large parts of Sub-Saharan Africa, rural India, or parts of Southeast Asia—struggle with inconsistent electricity access. The International Energy Agency (IEA) estimates that over 700 million people worldwide lack reliable electricity, many of whom reside in oxygen-deficient regions. In these contexts, oxygen concentrators are not always viable unless backed by battery or solar solutions, which come with added cost. Manufacturers have begun to design units with low power consumption and external battery support. However, few of these products are widely distributed or adopted. NGOs such as PATH and Clinton Health Access Initiative (CHAI) are piloting solar-powered oxygen systems, but scale remains a concern. On the microeconomic level, healthcare facilities in remote areas must manage costs associated with backup generators or inverters, leading some to prefer oxygen cylinders despite refill and safety issues. For homecare patients in rural settings, electricity reliability is often cited as the top reason for preferring alternatives. Unless power infrastructure is improved or hybrid devices become affordable, this barrier will continue to limit adoption in many of the most oxygen-deficient markets.

Oxygen Concentrators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides stationary and portable oxygen concentrators widely used in hospitals, clinics, and homecare for chronic respiratory diseases (COPD, asthma, sleep apnea) | Ensures reliable long-term oxygen therapy, enhances patient comfort with user-friendly devices, and reduces dependence on cylinder refills |

|

Specializes in portable oxygen concentrators for homecare and travel use, targeting patients with active lifestyles and mobility needs | Enables patient independence, increases adherence to oxygen therapy, and improves quality of life |

|

Offers a range of oxygen concentrators for clinical, homecare, and emergency applications, including compact units for mobility | Provides versatile, cost-effective solutions, reduces hospital burden, and supports patients across both acute and chronic care needs |

|

Supplies affordable oxygen concentrators across hospitals, homecare, and wellness segments, with strong penetration in emerging markets | Improves accessibility, expands adoption in price-sensitive markets, and supports healthcare system strengthening |

|

Focuses on high-purity stationary and portable oxygen concentrators for healthcare, aviation, military, and emergency applications | Delivers high-efficiency oxygen supply, supports critical missions and specialized use cases, and ensures safety in demanding environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The oxygen concentrators market ecosystem includes a wide range of stakeholders such as manufacturers, component suppliers, regulatory agencies, healthcare providers, home care agencies, distributors, and end users. Each plays a vital role in the development, approval, distribution, and use of oxygen concentrators, which are essential for managing respiratory conditions like copd and asthma. The ecosystem is driven by increasing respiratory disease rates, an aging population, and the move toward home-based care. Technological progress and supportive reimbursement policies further promote product adoption. Strong collaboration among stakeholders enhances supply chains, lowers costs, and increases product accessibility. Understanding this ecosystem is key to identifying strategic opportunities, simplifying regulatory processes, and improving oxygen therapy delivery in both developed and emerging healthcare markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oxygen Concentrator Market, By Type

Based on type, the market is divided into portable oxygen concentrators and stationary oxygen concentrators. In 2024, the portable oxygen concentrator (POC) segment held the largest share of the overall market due to the growing demand for mobility-friendly and user-centric oxygen therapy solutions.

Oxygen Concentrator Market, By Technology

Based on technology, the market of oxygen concentrators is divided into continuous flow and pulse flow. In 2024, the continuous flow segment held the largest share of the global oxygen concentrators market, owing to its widespread use in hospitals and homecare settings for consistent oxygen delivery. Its reliability and suitability for patients with severe respiratory conditions further support its dominance

Oxygen Concentrator Market, By Flowrate

ased on flowrate, the OC market has been categorized into 0-5L/Min, 5-10L/Min, and Above-10L/Min. In 2024, 0-5L/Min held the largest market share in the OC market, driven by its suitability for the majority of patients requiring low to moderate oxygen support. Its wide adoption in homecare and clinical settings enhances its market dominance.

Oxygen Concentrator Market, By Application

Based on application, the OC market has been categorized into COPD, asthma, respiratory distress, and others. In 2024, Chronic Obstructive Pulmonary Disease (COPD) held the largest market share in the OC market. It is highly prevalent among adults due to smoking and environmental pollution. Advanced COPD cases often escalate to acute respiratory failure requiring OC intervention.

Oxygen Concentrator Market, By End User

Based on end user, the OC market has been categorized into home care settings, hospitals and clinics, ambulatory surgical centers, and physicians' offices. The home care settings segment is expected to dominate the oxygen concentrators market, fueled by the rising preference for cost-effective, at-home treatment of chronic respiratory diseases. Increasing demand for portable and user-friendly devices further boosts segmental growth.

REGION

Asia Pacific to be fastest-growing region in global oxygen concentrators market during forecast period

The Asia Pacific region is projected to lead the global oxygen concentrators market during the forecast period, driven by its large population base, rising healthcare needs, and growing incidence of respiratory illnesses. Countries like China and India, which together account for over one-third of the world’s population, are witnessing increasing cases of asthma, COPD, and other chronic lung diseases—largely due to urbanization, air pollution, and smoking prevalence. This massive patient base generates sustained demand for oxygen therapy and related equipment. Additionally, rising income levels, expanding middle-class populations, and improving healthcare infrastructure are making respiratory care devices more accessible. Governments in the region are also increasing investments in public health systems, while private players are enhancing distribution networks. Moreover, densely populated urban regions with high pollution levels further intensify the need for oxygen concentrators. These combined factors make the Asia Pacific not only the largest but also the fastest-growing regional market for oxygen concentrators globally

Oxygen Concentrators Market: COMPANY EVALUATION MATRIX

Players in this category receive high scores for most evaluation criteria. They have strong and established product portfolios and a vast geographic presence. The star player in the oxygen concentrators market is Koninklijke Philips N.V. (Netherlands). Emerging leaders are vendors with substantial product innovations compared to their competitors. While they have broad product portfolios, they do not have a strong growth strategy for business development. The emerging leader in the oxygen concentrators market is React Health (US).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.21 BN |

| Revenue Forecast in 2030 | USD 1.71 BN |

| Growth Rate | 6.1% |

| Actual data | 2023–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: Oxygen Concentrators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of oxygen concentrators by type (portable vs. stationary), technology (continuous flow vs. pulse flow), and flow rate (0–5 L/min, 6–10 L/min, >10 L/min); Assessment of product innovations such as lightweight designs, battery-powered concentrators, noise reduction, and smart connectivity features | Enables clients to evaluate competitive product positioning, identify technological differentiators, and understand emerging innovations driving adoption in both home care and hospital settings |

| Company Information | Profiles of key players such as Philips Healthcare, Inogen, Drive DeVilbiss, Yuwell, CAIRE Inc., and Invacare. Benchmarking of the top 3–5 companies by revenue, market presence, and product portfolio across North America, Europe, the Asia Pacific, and Latin America | Provides clients with competitive intelligence, market share insights, and strategic benchmarking of leading manufacturers to support partnership and investment decisions |

| Geographic Analysis | Detailed regional analysis of North America, Europe, Asia Pacific, and emerging markets (LATAM, Middle East, Africa); country-level sizing and growth forecasts for high-demand regions, including the US, Germany, Japan, China, India, and Brazil | Helps identify growth hotspots, track demand patterns, and prioritize markets with the highest revenue potential for oxygen concentrator manufacturers |

RECENT DEVELOPMENTS

- June 2025 : Inogen, Inc. introduced the Voxi 5 Stationary Oxygen Concentrator, which combines affordability and durability, setting a new standard in oxygen therapy. It is designed to improve access to high-quality oxygen therapy for long-term care patients in the US.

- January 2025 : Caire Inc. introduced the IntenOxy 5 stationary oxygen concentrator. The IntenOxy 5 provides effective oxygen delivery with up to 95.5 percent concentration and flow settings from 0.5 to 5 liters per minute (LPM), covering a wide range of prescription needs.

- October 2025 : Inogen, Inc. launched the Rove 4 Portable Oxygen Concentrator, which delivers the highest oxygen output in the lightest weight 4-setting POC. Rove 4 utilizes Inogen’s patented pulse-dose Intelligent Delivery Technology3. This technology provides unparalleled triggering sensitivity to quickly detect a breath and deliver oxygen within the first 250 milliseconds of inspiration, where oxygen has the most effect on lung gas exchange.

- January 2024 : O2 Concepts introduced the new Oxlife LIBERTY 2 POC, which now provides 2.0 LPM continuous flow in a portable device.

Table of Contents

Methodology

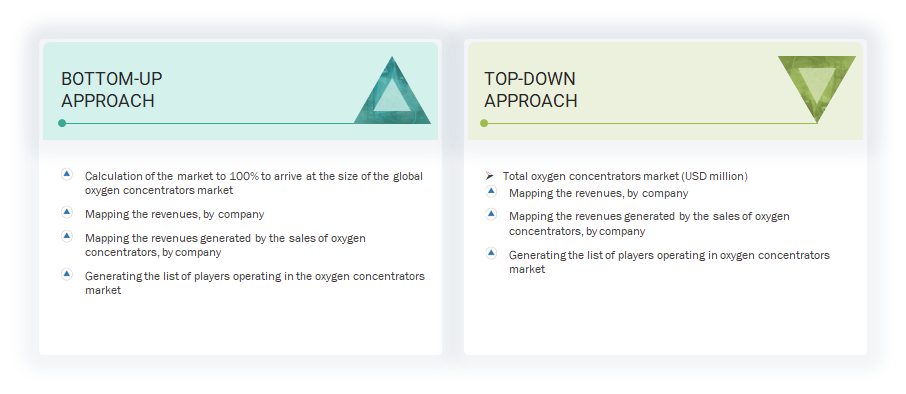

The study involved major activities in estimating the current market size for the OC market. Exhaustive secondary research was done to collect information on the OC market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the OC market.

Secondary Research

This research involved extensive use of secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and companies’ house documents. Secondary research was conducted to gather information for this detailed, technical, market-focused, and commercial study of the oxygen concentrators (OC) market. It also aimed to gather key data on top players, market classification and segmentation based on industry trends down to the most detailed levels, geographic markets, and significant market developments. Additionally, a database of leading industry players was created through secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to gather both qualitative and quantitative information for this report. Supply-side primary sources included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and other key executives from different companies and organizations operating in the OC market. Demand-side primary sources encompassed home care settings, hospitals and clinics, ambulatory surgical centers, physician offices, researchers, lab technicians, purchase managers, and stakeholders from corporate and government bodies.

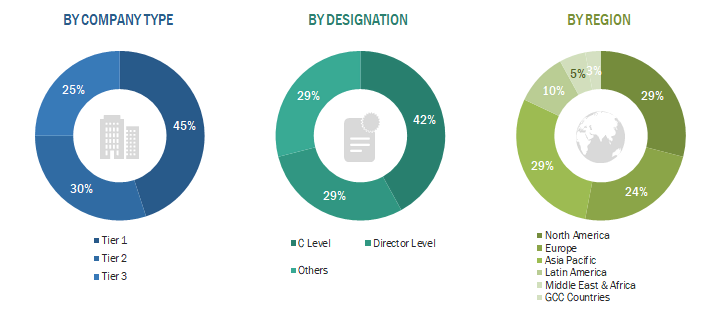

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were employed to estimate and validate the total market size of the OC sector. These methods were also widely used to assess the size of various subsegments within the market. The research methodology for estimating the market size includes the following:

Data Triangulation

The entire market was divided into three segments when determining its size. Data triangulation and market breakdown methods were used to complete the market analysis and obtain accurate statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were established through a comprehensive analysis of their OC sales. Due to data restrictions, the revenue share in some cases was determined by carefully examining the product portfolios of large corporations and their individual sales performance. This information was validated at each stage through in-depth interviews with industry professionals.

Market Definition

An oxygen concentrator is a medical device that extracts and concentrates oxygen from surrounding air to provide high-purity oxygen (90–95%) to patients with respiratory problems. It is mainly used for long-term oxygen therapy in clinical and home care settings.

Stakeholders

- Manufacturers of oxygen concentrators

- Suppliers and distributors of oxygen concentrators

- Hospitals, clinics, ambulatory surgical centers, and physician offices

- Home care settings

- Medical device procurement agencies

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Report Objectives

- To define, describe, and forecast the oxygen concentrators market based on type, technology, flow rate, application, indication, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall oxygen concentrators market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the oxygen concentrators market in six regions: North America (US and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa, and GCC Countries

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions, of the leading players in the market

Key Questions Addressed by the Report

Which are the top industry players in the global oxygen concentrators market?

The top market players include Koninklijke Philips N.V. (Netherlands), Inogen, Inc. (US), Jiangsu Yuyue Medical Equipment & Supply Co., Ltd. (China), Caire, Inc. (US), and Drive DeVilbiss Healthcare (US).

Which segments have been included in this report?

The report includes segments based on type, technology, flowrate, application, end user, and region.

Which geographical region dominates the oxygen concentrators market?

North America dominated the oxygen concentrators market in 2024. The report also includes Europe, Asia Pacific, Latin America, the Middle East and Africa, and GCC countries.

Which is the leading segment in the oxygen concentrators market, by product?

The portable oxygen concentrator segment accounted for the largest share of the oxygen concentrators market by product.

What is the CAGR of the global oxygen concentrators market?

The global oxygen concentrators market is projected to grow at a CAGR of 6.1% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oxygen Concentrators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Oxygen Concentrators Market