PET Foam Market by Raw Material (Virgin PET and Recycled PET), Grade (Low-density and High-density), Application (Wind Energy, Transportation, Marine, Building & Construction, Packaging) and Region - Global Forecast to 2027

Updated on : September 02, 2025

PET Foam Market

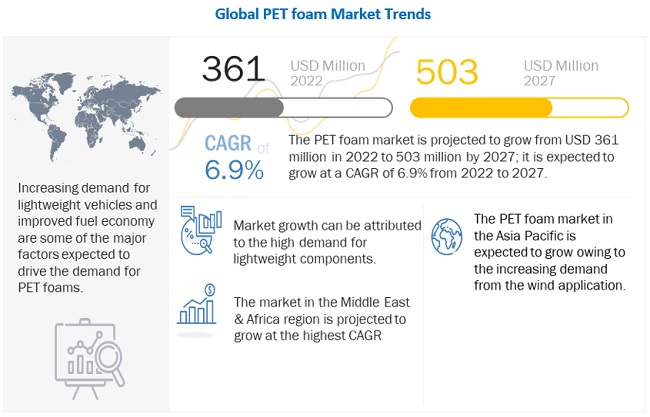

The PET foam market was valued at USD 361 million in 2022 and is projected to reach USD 503 million by 2027, growing at 6.9% cagr from 2022 to 2027. The PET foam performs efficiently for several applications, which in turn, has contributed significantly to the growth this market over the last five years.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global PET foam Market

The pandemic is estimated to have an adverse impact on various factors of the value chain of PET foam market, which is expected to reflect during the forecast period, especially in the year 2020.

Impact on marine industry:

Corrosion is a major concern that increases expenditure in the marine industry. PET foam used in the sandwich composite structure in the marine industry helps minimize this challenge, majorly because it does not corrode or rot like metals or wood.

The coronavirus pandemic led to various challenges in cargo transportation, impacting shippers and transport companies around the world. The losses to shipping services providers are expected to impact their purchasing power of new marines. This, in turn, is expected to impact the production of new marines and negatively impact the growth of the market for PET foam as well. However, this impact is expected to be for a short period of time, as shipment services are expected to resume in 2021.

PET Foam Market Dynamics

Driver: Growing demand for lightweight vehicles worldwide

Increasing demand for lightweight vehicles and improved fuel economy are some of the major factors expected to drive the demand for PET foams from the automotive industry during the forecast period. Advanced materials and thermoplastics are replacing metals used in these vehicles to reduce the total weight of the vehicle. PET foams are being used as an ideal solution for vehicle weight reduction and are replacing metal parts in the automotive industry as they can be easily molded and mass-produced.

Restraint: Increasing competition from substitutes

Several core foams such as Polyvinyl Chloride (PVC), Polymethacrylimide (PMI), Styrene Acrylonitrile (SAN) offer ratio of strength-to-weight along with easy processing and shape. These foams, developed in the market, can be considered as a potential substitute for PET foam. In addition, they have their use across a wide range of applications such as marine, wind energy, transportation, and aerospace & defense. Hence, the availability of several substitutes is considered a key restraint for market growth.

Opportunity: Rising trend of using recycled materials

Rising environmental concerns and sustainability are propelling the demand for recyclable materials across industries. PET foams are safer and have lower toxicity than widely used PS foams. Market players, such as 3A Composites (US), and Diab Group (Sweden), are offering PET foams and increasing their efforts to comply with the latest market trends. Thus, the rising trend of using recycled materials worldwide acts as an opportunity for the PET foam market.

Challenge: Impact of COVID-19 on various end-use industries

Due to the pandemic the manufacturing of non-essential goods was put on hold in several major economies. This affected the end users of PET foam marketincluding wind energy, transportation, and marine industries. As a result there was a slowdown in these industries, which eventually affected the demand for PET foam. The decrease was estimated to prevail over the next two to three quarters.

High-density PET foam is estimated to be the fastest-growing segment during the forecast period, by value

High-density foam helps fix screws without compromising the sandwich structure stability. The high-density PET foam as a core material offers the highest pull-out load compared to plywood or high-density polyurethane foam. It also offers improved mechanical properties and is useful for niche applications, such as packaging and other general industrial applications.

Wind energy application is estimated to be the fastest-growing segment during the forecast period, by value

Power consumption is increasing at a rapid pace, and therefore there is a need for an increase in the supply of energy across the globe. Depletion of fossil fuels and their volatile prices result in the rise in energy costs as demand is constantly increasing. These developments are expected to necessitate significant investments and developments in power generation and grid infrastructure.

Middle East & Africa region is estimated to be the fastest-growing segment during the forecast period, by value

The growing demand for energy in Middle East & Africa region acts as an opportunity to shift from conventional to renewable as well as natural power sources like wind energy. This creates a huge potential for the growth of the wind energy sector and thereby, the PET foam market in the region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

PET Foam Market Players

Armacell International SA (Luxembourg), 3A Composites (Switzerland), Gurit Holding (Switzerland), DIAB Group (Sweden), Changzhou Tiansheng New Materials Co. Ltd (China), Sekisui Plastics (Japan), Petro Polymer Shargh (Iran), and Carbon-Core Corp. (US) are some of the key players operating in the PET foam market. These players have adopted strategies such as agreements, partnerships & joint ventures, new product & technology launches, and expansions to enhance their business revenue and market share. Expansion of manufacturing plants and offices globally is the key strategy adopted by these players to cater to the increasing demand for PET foam.

PET Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million ) and Volume (Tons) |

|

Segments Covered |

Raw Material,Grade, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Armacell International SA (Luxembourg), 3A Composites (Switzerland), Gurit Holding (Switzerland), DIAB Group (Sweden), Changzhou Tiansheng New Materials Co. Ltd (China), Sekisui Plastics (Japan), Petro Polymer Shargh (Iran), and Carbon-Core Corp. (US) are some of the key players in the PET foam market (Total of 13 companies) |

This research report categorizes the PET foam market based on raw material, grade, application, and region.

Based on Raw Material, the PET foam Market has been segmented as follows:

- Virgin PET

- Recycled PET

Based on Grade, the PET foam Market has been segmented as follows:

- Low-density

- High-density

Based on Application, the PET foam Market has been segmented as follows:

- Wind Energy

- Transportation

- Marine

- Building & Construction

- Packaging

- Others (Industrial, healthcare, and sporting goods)

Based on Region, PET foam Market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In April 2021, Armacell collaborated with METYX, a high-performance technical textiles company based in Turkey to jointly serve the Turkish composite manufacturing market. The partnership provides PET-based foam products locally produced by Armacell for core kitting and distribution operations of METYX.

- In February 2021, Diab Group chose innovative LNPTM COLORCOMP nanotechnology compound of SABIC, one of the major manufacturers of petrochemicals. The compound enables weight reduction and improves the mechanical qualities of sandwich constructions using PET foams which are utilized as the core materials for wind turbine blades.

Frequently Asked Questions (FAQ):

What is the size of the global PET foam market?

The PET foam market is projected to grow from USD 361 million in 2022 to USD 503 million by 2027, at a CAGR of 6.9% from 2022 to 2027.

Who are the major players in the global PET foam market?

Some of the major players in the PET foam market include 3A Composites (Switzerland), Armacell International S.A. (Luxembourg), Gurit Holding AG (Switzerland), Diab Group (Sweden), and CoreLite (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 COMPETITIVE INTELLIGENCE

1.3 MARKET DEFINITION

1.4 INCLUSIONS & EXCLUSIONS

TABLE 1 PET FOAM MARKET: INCLUSIONS & EXCLUSIONS

1.5 MARKET SCOPE

FIGURE 1 PET FOAM MARKET: MARKET SEGMENTATION

1.5.1 REGIONAL SCOPE

1.6 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

1.8 PACKAGE SIZE

1.9 STAKEHOLDERS

1.10 RESEARCH LIMITATIONS

1.11 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 PET FOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Breakdown of primary interviews

2.1.1.3 Key primary insights

2.2 MATRIX CONSIDERED FOR DEMAND SIDE

FIGURE 3 MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR PET FOAM

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 METHODOLOGY FOR SUPPLY SIDE SIZING OF PET FOAM MARKET (1/2)

FIGURE 7 METHODOLOGY FOR SUPPLY SIDE SIZING OF PET FOAM MARKET (2/2)

2.3.2.1 Calculations for supply side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 8 PET FOAM MARKET: DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 9 SCENARIO ANALYSIS: PET FOAM MARKET

3.1 PRE-COVID-19 SCENARIO

TABLE 2 PRE-COVID-19 SCENARIO: PET FOAM MARKET, 2018–2027 (USD MILLION)

3.2 OPTIMISTIC

TABLE 3 OPTIMISTIC SCENARIO: PET FOAM MARKET, 2018–2027 (USD MILLION)

3.3 PESSIMISTIC SCENARIO

TABLE 4 PESSIMISTIC SCENARIO: PET FOAM MARKET, 2018–2027 (USD MILLION)

3.4 REALISTIC SCENARIO

TABLE 5 REALISTIC SCENARIO: PET FOAM MARKET, 2018–2027 (USD MILLION)

TABLE 6 PET FOAM MARKET SNAPSHOT (2022 VS. 2027)

FIGURE 10 WIND ENERGY SEGMENT PROJECTED TO DOMINATE PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VALUE

FIGURE 11 HIGH-DENSITY PET FOAM SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD, IN TERMS OF VALUE

FIGURE 12 MIDDLE EAST & AFRICA PROJECTED TO BE FASTEST-GROWING MARKET FOR PET FOAM DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN PET FOAM MARKET

FIGURE 13 INCREASING USE OF PET FOAM IN WIND ENERGY AND PACKAGING APPLICATIONS EXPECTED TO DRIVE MARKET

4.2 PET FOAM MARKET, BY REGION

FIGURE 14 ASIA PACIFIC PROJECTED TO LEAD PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VOLUME

4.3 ASIA PACIFIC PET FOAM MARKET, BY COUNTRY

FIGURE 15 CHINA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC PET FOAM MARKET IN 2022, IN TERMS OF VOLUME

4.4 PET FOAM MARKET, BY RAW MATERIAL

FIGURE 16 RECYCLED PET MATERIAL SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD, IN TERMS OF VOLUME

4.5 PET FOAM MARKET, BY APPLICATION

FIGURE 17 WIND ENERGY SEGMENT PROJECTED TO DOMINATE PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VOLUME

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth of the wind energy sector

5.2.1.2 Growing demand for lightweight vehicles worldwide

TABLE 7 AUTOMOTIVE APPLICATIONS OF PET FOAM

TABLE 8 PROPERTIES OF PET FOAM

5.2.2 RESTRAINTS

5.2.2.1 Increasing competition from substitutes

TABLE 9 COMMON SUBSTITUTES TO PET FOAM AND THEIR APPLICATIONS

5.2.3 OPPORTUNITIES

5.2.3.1 Rising trend of using recycled materials

5.2.4 CHALLENGES

5.2.4.1 Impact of COVID-19 on various end-use industries

6 INDUSTRY TRENDS (Page No. - 52)

6.1 INTRODUCTION

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

6.2.1 DEGREE OF COMPETITION

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF BUYERS

6.2.4 BARGAINING POWER OF SUPPLIERS

6.2.5 THREAT 0F NEW ENTRANTS

7 MACROECONOMIC OVERVIEW AND KEY TRENDS (Page No. - 55)

7.1 INTRODUCTION

7.1.1 ECONOMIC OUTLOOK

TABLE 10 TABLE BELOW PRESENTS ECONOMIC OUTLOOK FOR 2020, 2021, AND 2022

7.2 GROWTH IN WIND ENERGY INDUSTRY

TABLE 11 WIND ENERGY INSTALLATION, BY COUNTRY, 2019–2020 (MW)

FIGURE 20 NEW WIND POWER CAPACITY BY REGION, 2020

7.3 TRENDS IN THE AUTOMOTIVE INDUSTRY

TABLE 12 AUTOMOTIVE PRODUCTION, BY COUNTRY, 2020–2021 (UNIT)

7.4 TRENDS IN THE CONSTRUCTION INDUSTRY

TABLE 13 NORTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017–2024 (USD BILLION)

TABLE 14 EUROPE: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017–2024 (USD BILLION)

TABLE 15 ASIA PACIFIC: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017–2024 (USD BILLION)

TABLE 16 MIDDLE EAST & AFRICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017–2024 (USD BILLION)

TABLE 17 SOUTH AMERICA: CONTRIBUTION OF THE CONSTRUCTION INDUSTRY TO GDP, BY COUNTRY, 2017–2024 (USD BILLION)

7.5 PRICING ANALYSIS

7.6 VALUE CHAIN ANALYSIS

FIGURE 21 PET FOAM VALUE CHAIN ANALYSIS

7.7 ECOSYSTEM/MARKET MAP

FIGURE 22 PET FOAM MARKET: ECOSYSTEM/MARKET MAP

TABLE 18 PET FOAM MARKET: ECOSYSTEM

7.8 TECHNOLOGY ANALYSIS

7.9 PATENT ANALYSIS

7.10 TARIFF AND REGULATORY LANDSCAPE

7.11 CASE STUDY

7.11.1 USE CASES

TABLE 19 CASE STUDY 1: IMPROVED MECHANICAL PROPERTIES AND COST-EFFECTIVE PRODUCT

7.12 TRADE DATA

7.13 YCC SHIFT IN PET FOAM MARKET

FIGURE 23 PET FOAM MARKET: YCC SHIFT

8 PET FOAM MARKET, BY RAW MATERIAL (Page No. - 66)

8.1 INTRODUCTION

FIGURE 24 RECYCLED PET SEGMENT PROJECTED TO DOMINATE PET FOAM MARKET DURING FORECAST PERIOD, IN TERMS OF VALUE

TABLE 20 PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (USD MILLION)

TABLE 21 PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (TONS)

8.2 RECYCLED PET

8.2.1 SHIFT TOWARDS SUSTAINABLE USE OF PET BOTTLES IS EXPECTED TO DRIVE THIS SEGMENT

8.3 VIRGIN PET

8.3.1 VIRGIN PET FOAM MATERIALS HAVE HIGH APPLICABILITY IN VARIED APPLICATIONS

9 PET FOAM MARKET, BY GRADE (Page No. - 70)

9.1 INTRODUCTION

FIGURE 25 LOW-DENSITY SEGMENT PROJECTED TO LEAD PET FOAM MARKET FROM 2022 TO 2027, IN TERMS OF VALUE

TABLE 22 PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 23 PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

9.2 LOW-DENSITY

9.2.1 WIDE RANGING APPLICATIONS AND PROPERTIES OF LOW-DENSITY PET FOAM ARE DRIVING THIS SEGMENT

TABLE 24 PET FOAM MARKET SIZE, BY LOW-DENSITY, 2018–2027 (USD MILLION)

TABLE 25 PET FOAM MARKET SIZE, BY LOW-DENSITY, 2018–2027 (TONS)

9.3 HIGH-DENSITY

9.3.1 HIGH DEMAND IN PACKAGING APPLICATION DRIVING HIGH-DENSITY PET FOAM SEGMENT

TABLE 26 PET FOAM MARKET SIZE, BY HIGH-DENSITY, 2018–2027 (USD MILLION)

TABLE 27 PET FOAM MARKET SIZE, BY HIGH-DENSITY, 2018–2027 (TONS)

10 PET FOAM MARKET, BY APPLICATION (Page No. - 75)

10.1 INTRODUCTION

FIGURE 26 WIND ENERGY SEGMENT EXPECTED TO LEAD PET FOAM MARKET DURING FORECAST PERIOD

TABLE 28 PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 29 PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

10.2 WIND ENERGY

10.2.1 PET FOAM EXPECTED LEAD IN WIND ENERGY SEGMENT AS IT ENABLES LIGHTWIEGHT WIND BLADES

TABLE 30 PET FOAM MARKET IN WIND ENERGY, BY REGION,2018–2027 (USD MILLION)

TABLE 31 PET FOAM MARKET IN WIND ENERGY, BY REGION, 2018–2027 (TONS)

10.3 TRANSPORTATION

10.3.1 UTILIZATION OF PET FOAM IN TRANSPORTATION LEADING TO DECREASING FUEL CONSUMPTION

TABLE 32 PET FOAM MARKET IN TRANSPORTATION, BY REGION,2018–2027 (USD MILLION)

TABLE 33 PET FOAM MARKET IN TRANSPORTATION, BY REGION,2018–2027 (TONS)

10.4 MARINE

10.4.1 CORROSION-RESISTANCE PROPERTY EXPECTED TO INCREASE USE OF PET FOAM IN MARINE SEGMENT

TABLE 34 PET FOAM MARKET IN MARINE, BY REGION, 2018–2027 (USD MILLION)

TABLE 35 PET FOAM MARKET IN MARINE, BY REGION, 2018–2027 (TONS)

10.5 PACKAGING

10.5.1 FACTORS SUCH AS RECYCLABILITY AND LOW WEIGHT EXPECTED TO INCREASE USE OF PET FOAM IN PACKAGING INDUSTRY

TABLE 36 PET FOAM MARKET IN PACKAGING, BY REGION,2018–2027 (USD MILLION)

TABLE 37 PET FOAM MARKET IN PACKAGING, BY REGION, 2018–2027 (TONS)

10.6 BUILDING & CONSTRUCTION

10.6.1 ENERGY EFFICIENT PROPERTY OF PET FOAM EXPECTED TO PROPEL DEMAND IN BUILDING & CONSTRUCTION INDUSTRY

TABLE 38 PET FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2018–2027 (USD MILLION)

TABLE 39 PET FOAM MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2018–2027 (TONS)

10.7 OTHERS

TABLE 40 PET FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2027 (USD MILLION)

TABLE 41 PET FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2027 (TONS)

11 PET FOAM MARKET, BY REGION (Page No. - 84)

11.1 INTRODUCTION

FIGURE 27 MARKET IN MIDDLE EAST & AFRICA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 GLOBAL: PET FOAM MARKET SIZE, BY REGION, 2018–2027 (USD MILLION)

TABLE 43 GLOBAL: PET FOAM MARKET SIZE, BY REGION, 2018–2027 (TONS)

11.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC PET FOAM MARKET SNAPSHOT

TABLE 44 ASIA PACIFIC: PET FOAM MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: PET FOAM MARKET, BY COUNTRY, 2018–2027 (TONS)

TABLE 46 ASIA PACIFIC: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (TONS)

TABLE 48 ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 50 ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 51 ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.2.1 CHINA

11.2.1.1 Growth of the wind energy sector and the presence of leading PET foam manufacturers drive the market in China

TABLE 52 CHINA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 53 CHINA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 54 CHINA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 55 CHINA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.2.2 INDIA

11.2.2.1 High demand for PET foam in wind energy application is driving the market growth in India

TABLE 56 INDIA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 57 INDIA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 58 INDIA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 59 INDIA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.2.3 JAPAN

11.2.3.1 Growth of automotive & transportation industries is expected to boost the demand for PET foam

TABLE 60 JAPAN: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 61 JAPAN: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 62 JAPAN: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 63 JAPAN: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.2.4 SOUTH KOREA

11.2.4.1 Rising demand for renewable energy is driving the PET foam market

TABLE 64 SOUTH KOREA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 65 SOUTH KOREA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 66 SOUTH KOREA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 67 SOUTH KOREA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.2.5 REST OF ASIA PACIFIC

TABLE 68 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 69 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 70 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 71 REST OF ASIA PACIFIC: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA PET FOAM MARKET SNAPSHOT

TABLE 72 NORTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018–2027 (TONS)

TABLE 74 NORTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (TONS)

TABLE 76 NORTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 78 NORTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.3.1 US

11.3.1.1 High demand for marine applications expected to drive market

TABLE 80 US: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 81 US: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 82 US: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 83 US: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.3.2 CANADA

11.3.2.1 Increased demand for PET foam in wind energy applications is expected to boost the market

TABLE 84 CANADA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 85 CANADA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 86 CANADA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 87 CANADA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.3.3 MEXICO

11.3.3.1 Growing investment in renewable power generation is expected to drive the market

TABLE 88 MEXICO: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 89 MEXICO: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 90 MEXICO: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 91 MEXICO: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4 EUROPE

FIGURE 30 EUROPE PET FOAM MARKET SNAPSHOT

TABLE 92 EUROPE: PET FOAM MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 93 EUROPE: PET FOAM MARKET, BY COUNTRY, 2018–2027 (TONS)

TABLE 94 EUROPE: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (USD MILLION)

TABLE 95 EUROPE: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (TONS)

TABLE 96 EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 97 EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 98 EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 99 EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4.1 GERMANY

11.4.1.1 Wind energy largest consumer of PET foam

TABLE 100 GERMANY: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 101 GERMANY: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 102 GERMANY: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 103 GERMANY: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4.2 FRANCE

11.4.2.1 Growing investments in wind energy will propel the demand in the country

TABLE 104 FRANCE: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 105 FRANCE: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 106 FRANCE: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 107 FRANCE: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4.3 UK

11.4.3.1 Growing initiatives in reduction of greenhouse gases expected to drive the market

TABLE 108 UK: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 109 UK: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 110 UK: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 111 UK: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4.4 ITALY

11.4.4.1 Growth of the marine industry will fuel the market for PET foam

TABLE 112 ITALY: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 113 ITALY: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 114 ITALY: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 115 ITALY: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4.5 SPAIN

11.4.5.1 Government initiatives towards the growth of wind energy will propel the demand for PET foams

TABLE 116 SPAIN: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 117 SPAIN: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 118 SPAIN: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 119 SPAIN: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.4.6 REST OF EUROPE

TABLE 120 REST OF EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 121 REST OF EUROPE: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 122 REST OF EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 123 REST OF EUROPE: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.5 MIDDLE EAST & AFRICA

TABLE 124 MIDDLE EAST & AFRICA: PET FOAM MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: PET FOAM MARKET, BY COUNTRY, 2018–2027 (TONS)

TABLE 126 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (TONS)

TABLE 128 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 130 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.5.1 MIDDLE EAST

11.5.1.1 Growth of the wind energy sector is expected to propel the demand for PET foams

TABLE 132 MIDDLE EAST: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 133 MIDDLE EAST: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 134 MIDDLE EAST: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 135 MIDDLE EAST: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.5.2 AFRICA

11.5.2.1 Growth of the wind energy and construction sectors in Africa is expected to drive the demand for PET foams

TABLE 136 AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 137 AFRICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 138 AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 139 AFRICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.6 SOUTH AMERICA

TABLE 140 SOUTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 141 SOUTH AMERICA: PET FOAM MARKET, BY COUNTRY, 2018–2027 (TONS)

TABLE 142 SOUTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (USD MILLION)

TABLE 143 SOUTH AMERICA: PET FOAM MARKET SIZE, BY RAW MATERIAL, 2018–2027 (TONS)

TABLE 144 SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 145 SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 146 SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 147 SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.6.1 BRAZIL

11.6.1.1 Growth of wind energy sector propel the demand for PET foams

TABLE 148 BRAZIL: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 149 BRAZIL: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 150 BRAZIL: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 151 BRAZIL: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

11.6.2 REST OF SOUTH AMERICA

TABLE 152 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (USD MILLION)

TABLE 153 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY GRADE, 2018–2027 (TONS)

TABLE 154 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (USD MILLION)

TABLE 155 REST OF SOUTH AMERICA: PET FOAM MARKET SIZE, BY APPLICATION, 2018–2027 (TONS)

12 COMPETITIVE LANDSCAPE (Page No. - 129)

12.1 OVERVIEW

TABLE 156 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

12.2 MARKET SHARE ANALYSIS

12.2.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE PET FOAM MARKET

FIGURE 31 REVENUE ANALYSIS OF LEADING COMPANIES IN PET FOAM MARKET, 2017-2020

12.3 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

12.3.1 STAR

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE

12.3.4 PARTICIPANTS

FIGURE 32 PET FOAM MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

12.4 COMPETITIVE BENCHMARKING

12.4.1 STRENGTH OF PRODUCT PORTFOLIOS

12.4.2 BUSINESS STRATEGY EXCELLENCE

12.5 KEY MARKET DEVELOPMENTS

TABLE 157 DEALS, 2017–2021

TABLE 158 OTHERS, 2017–2021

TABLE 159 PRODUCT LAUNCHES, 2017–2021

13 COMPANY PROFILE (Page No. - 139)

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

13.1 3A COMPOSITES

TABLE 160 3A COMPOSITES: COMPANY OVERVIEW

FIGURE 33 3A COMPOSITES: COMPANY SNAPSHOT

13.2 DIAB GROUP

TABLE 161 DIAB GROUP: COMPANY OVERVIEW

FIGURE 34 DIAB GROUP: COMPANY SNAPSHOT

13.3 GURIT HOLDING AG

TABLE 162 GURIT HOLDING AG: COMPANY OVERVIEW

FIGURE 35 GURIT HOLDING AG: COMPANY SNAPSHOT

13.4 ARMACELL INTERNATIONAL S.A.

TABLE 163 ARMACELL INTERNATIONAL S.A.: COMPANY OVERVIEW

FIGURE 36 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

13.5 SEKISUI CHEMICAL CO LTD

TABLE 164 SEKISUI CHEMICAL CO LTD: COMPANY OVERVIEW

FIGURE 37 SEKISUI CHEMICAL CO LTD: COMPANY SNAPSHOT

13.6 CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD

TABLE 165 CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD.: COMPANY OVERVIEW

FIGURE 38 CHANGZHOU TIANSHENG NEW MATERIALS CO. LTD.: COMPANY SNAPSHOT

13.7 PETRO POLYMER SHARGH (PPS)

TABLE 166 PETRO POLYMER SHARGH (PPS): COMPANY OVERVIEW

13.8 CARBON-CORE CORP.

TABLE 167 CARBON-CORE CORP.: COMPANY OVERVIEW

13.9 COMPOSITE ESSENTIAL MATERIALS LLC

TABLE 168 COMPOSITE ESSENTIAL MATERIALS LLC: COMPANY OVERVIEW

13.1 VISIGHT COMPOSITE MATERIAL CO., LTD

TABLE 169 VISIGHT COMPOSITE MATERIAL CO., LTD: COMPANY OVERVIEW

13.11 CORELITE

TABLE 170 CORELITE: COMPANY OVERVIEW

13.12 HUNAN RIFENG COMPOSITE CO., LTD

TABLE 171 HUNAN RIFENG COMPOSITE CO., LTD: COMPANY OVERVIEW

13.13 XTX COMPOSITES

TABLE 172 XTX COMPOSITES: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 165)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.2.1 PET FOAM INTERCONNECTED MARKETS

14.3 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.4 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET, BY POLYMER TYPE

14.4.1 ACRYLIC POLYMERS

14.4.2 SBR LATEX

TABLE 173 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018–2025 (USD MILLION)

TABLE 174 POLYMER MODIFIED CEMENTITIOUS COATINGS MARKET SIZE, BY POLYMER TYPE, 2018–2025 (KILOTONS)

14.5 STRUCTURAL CORE MATERIALS MARKET

14.5.1 MARKET DEFINITION

14.5.2 MARKET OVERVIEW

14.6 STRUCTURAL CORE MATERIALS MARKET, BY TYPE

14.6.1 FOAM

14.6.2 HONEYCOMB

14.7 BALSA

TABLE 175 STRUCTURAL CORE MATERIALS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 176 STRUCTURAL CORE MATERIALS MARKET SIZE, BY TYPE, 2015–2022 (KILOTON)

15 APPENDIX (Page No. - 169)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Foam Market Overview

Foam is a lightweight material that is produced by trapping pockets of gas in a solid or liquid. It is used in a variety of industries such as automotive, construction, packaging, and furniture, among others. The global foam market is expected to experience significant growth in the coming years due to the increasing demand for foam in various applications.

PET foam is a type of foam that is made from polyethylene terephthalate, a thermoplastic polymer resin. It is commonly used in the aerospace and marine industries due to its excellent mechanical properties and resistance to water absorption. The foam market is connected with the PET foam market because PET foam is a type of foam that is used in various industries.

The growth of the foam market is expected to have a positive impact on the PET foam market. As the demand for foam increases in various industries, the demand for PET foam is also likely to increase. PET foam is already a popular choice in the aerospace and marine industries, and its use is expected to expand into other industries in the future.

Foam Market Trends

Some futuristic growth use-cases of the foam market include the use of foam in the development of electric vehicles, the increasing demand for foam in the construction industry due to its insulation properties, and the use of foam in the medical industry for wound dressings and prosthetic devices.

Top Players in Foam Market

The top players in the foam market include BASF SE, The Dow Chemical Company, Huntsman Corporation, Recticel, Rogers Corporation, Armacell International S.A., Foamcraft Inc., and UFP Technologies, Inc.

Impact of Foam Market on Different Industries

The foam market is expected to have a significant impact on various industries in the future. For example, the use of foam in the automotive industry is expected to increase due to the growing demand for electric vehicles. Foam is also used in the construction industry for insulation purposes. The medical industry is another industry that is likely to be impacted by the foam market, with the use of foam in wound dressings and prosthetic devices.

Speak to our Analyst today to know more about Foam Market!

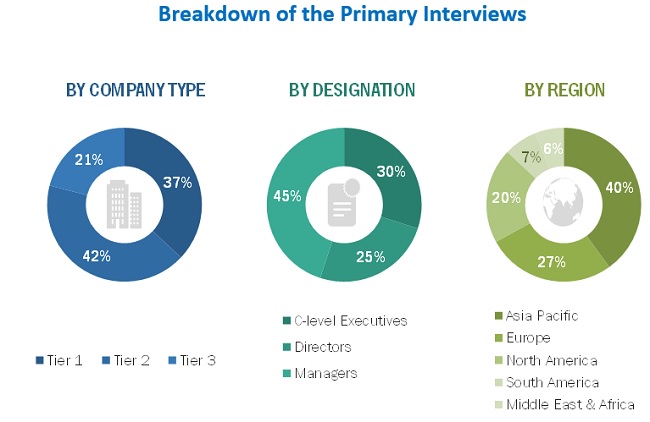

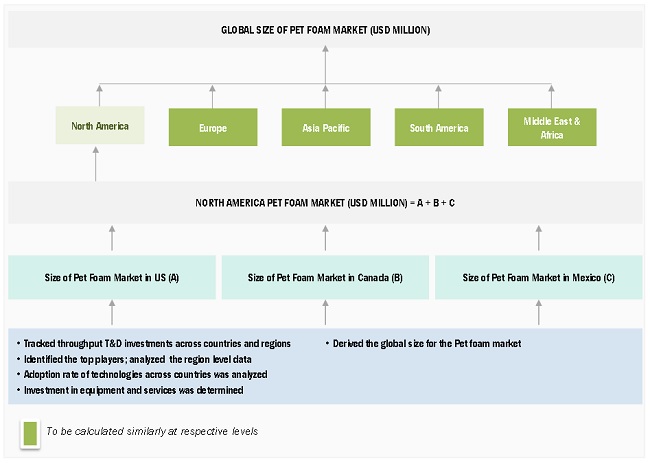

The study involved four major activities in estimating the current size of the PET foam market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the PET foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The PET foam market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, service providers, end-product manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the PET foam market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the PET foam market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the PET foam market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the PET foam market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global PET foam Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

MARKET INTELLIGENCE

- To determine and project the size of the PET foam market with respect to raw material, grade, application, and region, from 2018 to 2027

- To identify attractive opportunities in the market by determining the largest and the fastest-growing segments across key regions

- To project the size of the market segments, in terms of value and volume, with respect to five regions: Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, restraints, and challenges)

- To analyze competitive developments, such as expansions, acquisitions, and product launches in the PET foam market

- To analyze the demand-side factors based on the impact of macroeconomic and microeconomic factors on different segments of the market across different regions

COMPETITIVE INTELLIGENCE

- To identify and profile key players in the PET foam market

- To determine the market share of key players operating in the market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Europe into Denmark and Poland in the PET foam market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in PET Foam Market