Pet Wearable Market by Component (GPS Chips, RFID Chips, Sensors, Wi-Fi, Cellular, Bluetooth Chips, Processors, Memory, Displays, Batteries), Product (Smart Collars, Smart Cameras, Smart Harnesses), and Region - Global Forecast to 2025-2036

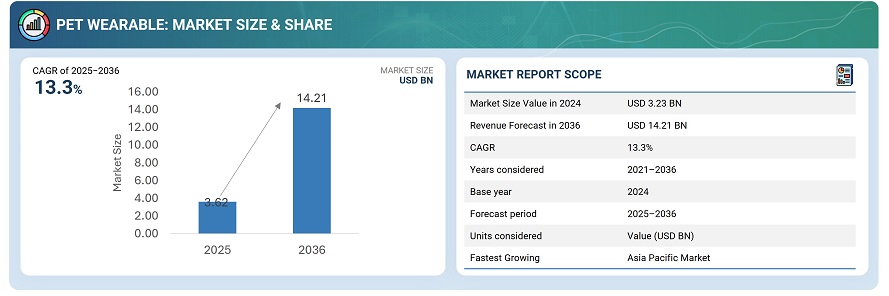

The global Pet Wearable market was valued at USD 3.23 billion in 2024 and is estimated to reach USD 14.21 billion by 2036, at a CAGR of 13.3% between 2025 and 2036.

The Pet Wearable Market is growing strongly, driven by the rising focus on pet health, safety, and overall well-being. Pet wearables include devices such as GPS trackers, fitness and activity monitors, and smart collars that help owners track their pets’ location, behavior, and vital signs in real time. Advances in IoT connectivity, artificial intelligence, and sensor technology are leading to smarter and smaller devices that offer better performance and ease of use. As more people adopt pets and spend more on high-quality pet care, these wearables are moving from niche gadgets to important tools in connected pet care. With ongoing innovation and greater integration with mobile and cloud platforms, pet wearables are expected to become a key part of modern pet management in the recent future.

The growing need for advanced monitoring and communication technologies is further driving the growth of the Pet Wearable Market. Companies are investing heavily in research and development to create smarter, more reliable, and energy-efficient wearable devices for pets. Simultaneously, rapid expansion of connected technologies and mobile applications is increasing the demand for real-time tracking and health monitoring solutions. Furthermore, the global rise in pet ownership and spending on premium pet care are creating strong opportunities for market growth.

Market by Product

Smart Collars

Smart collars are expected to hold the largest share of the Pet Wearable Market, facilitated by their growing use in real-time tracking, health monitoring, and activity management. These devices combine key functions such as GPS tracking, heart rate monitoring, and behavior analysis in a compact design, making them the most preferred choice among pet owners. The rising demand for connected solutions that improve pet safety and overall well-being, along with continuous advancements in sensor technology and mobile connectivity is further strengthening the position of smart collars. As pet owners look for convenient and reliable ways to care for their pets, smart collars are becoming an essential product in the pet care ecosystem.

Smart Harnesses

Smart harnesses are expected to witness significant CAGR in this market from 2025–2036. This growth is primarily driven by their inherent design advantages, which cater to the escalating demand for advanced physiological monitoring and enhanced pet safety. Smart harnesses provide a larger, more stable surface area, facilitating the integration of sophisticated sensors which are capable of capturing detailed data on heart rate variability, respiration, and body temperature with greater accuracy. These capabilities make them indispensable for medical diagnosis and treatment applications. Furthermore, harnesses offer a safer, more ergonomic option for weight distribution, particularly for larger dog breeds or those with existing neck or tracheal sensitivities. As manufacturers continue to embed features like posture & behavior analysis, behavior, and communication functions directly into the fabric of the harness, this product segment is expected to grow significantly.

Market by Component

Sensors

Sensors are expected to hold a considerable market share in the Pet Wearable Market from 2025 to 2036. They play a crucial role in monitoring pet health, activity levels, and behavioral patterns, making them fundamental to most smart collars and pet wearables. The ability of sensors to provide accurate and real-time data ensures that pet owners can track their pets effectively. As the demand for connected pet care solutions grows, sensors remain crucial component in enabling core functionalities. Their integration across a wide range of devices contributes to consistent and widespread adoption and this strong utility results in this segment’s considerable dominance in the market.

Connectivity Integrated Circuits

Connectivity integrated circuits, especially cellular chips, are projected to have a significant CAGR during the forecast period. The rising preference for real-time tracking and remote pet monitoring is driving the rapid growth of these components. Advances in mobile network technologies and cloud-based pet management platforms are further accelerating adoption. Cellular chips allow seamless communication between devices and mobile applications, enhancing user experience and convenience. As pet owners are inclined towards connected solutions, demand for these connectivity components is expected to grow significantly.

Market by Geography

Geographically, the Pet Wearable market is experiencing widespread adoption across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. The Pet Wearable Market in the Asia Pacific region is experiencing strong growth due to rising pet ownership and increasing awareness of pet health and well-being. Growing disposable incomes and urban lifestyles are encouraging pet owners to invest in smart solutions for tracking, monitoring, and managing their pets. Technological advancements along with affordable sensors and mobile connectivity are making wearable devices more accessible to a broader population of pet owners. In addition, e-commerce penetration and the availability of connected pet care products are driving adoption across key markets such as China, Japan, and India. The combination of cultural shifts, technological improvements, and expanding retail channels is fueling the rapid expansion of the pet wearable market in the region.

Market Dynamics

Driver: Rising Pet Population and Humanization

The increasing pet population and trend of pet humanization are one of the key drivers of the Pet Wearable Market. Pet owners treat their pets as family members and seek advanced solutions to monitor their health and daily activities. This shift in consumer behavior is creating strong demand for smart collars and wearable devices that provide real-time insights. As pet owners prioritize the well-being and safety of their pets, adoption of connected pet care technologies is steadily rising.

Restraint: High Power Consumption and Limited Battery Life

High power consumption and limited battery life of pet wearable devices remain significant restraints for market expansion. Many smart collars require frequent charging, which can cause inconvenience to the pet owners and reduce device usage. The need for compact designs often limits battery capacity, creating a trade-off between functionality and endurance. These factors can slow adoption, particularly among users seeking long-lasting and low-maintenance solutions. Manufacturers are focusing on optimizing battery efficiency to address this limitation.

Opportunity: Exponential Demand for Pet Wearables from Developing Countries in APAC

Developing countries in the APAC region present a major opportunity for the Pet Wearable Market. Rising disposable incomes and growing awareness of pet health are driving the adoption of smart collars and connected devices. Increasing urbanization and access to e-commerce platforms are making these products more available to a broader consumer base. As pet ownership grows in these markets, companies can leverage the demand for innovative and affordable wearable solutions. This trend is expected to significantly contribute to regional market expansion.

Challenge: High Cost and Requirement for Continuous Subscriptions

The high cost of pet wearable devices and the need for ongoing subscriptions pose a key challenge for market growth. Premium devices with advanced tracking and monitoring features can be expensive, thereby limiting accessibility for some consumers. Subscription models for cloud services or mobile applications add recurring costs which may deter adoption. Companies must balance pricing and service offerings to attract and retain users. Addressing affordability while maintaining technological functionality is critical for market penetration.

Future Outlook

Between 2025 and 2036 the Pet Wearable Market is expected to witness significant growth as demand for connected and intelligent pet care solutions rises across the globe. Advancements in sensor technology and mobile connectivity will enable devices to provide more accurate health monitoring and real-time activity tracking for pets. Increasing adoption of smart collars and wearable devices in urban households will further accelerate market expansion. As product designs become more compact and affordable and awareness of pet health grows the market is likely to see widespread adoption. Pet wearables are expected to become an integral part of the connected pet care ecosystem driving innovation and enhancing the overall well-being of pets worldwide.

Key Market Players

Top Pet Wearable companies: Garmin Ltd. (US), FitBark (US), PetPace (US), Tractive (Austria), and Link My Pet (US)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 12)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in Pet Wearable Market

4.2 Market, By Product (Thousand Units)

4.3 Market for Sensors, By Product (Thousand Units)

4.4 Market in APAC

4.5 Market, By Geography

5 Market Overview (Page No. - 29)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Surging Demand for IoT in Pet Tracking Devices

5.1.1.2 Increasing Concerns Toward Pet Health and Well Being

5.1.1.3 Rising Pet Population and Pet Humanization

5.1.1.4 Growing Expenditure on Pets Due to High Disposal Income

5.1.2 Restraint

5.1.2.1 High Power Consumption and Limited Battery Life of Pet Wearable Devices

5.1.3 Opportunity

5.1.3.1 Rapid Advancements in Wan and Lpwan Technologies

5.1.3.2 Exponential Demand for Pet Wearables From Developing Countries in APAC

5.1.4 Challenges

5.1.4.1 High Cost and Requirement for Continuous Subscriptions

6 Market, By Component (Page No. - 33)

6.1 GPS Chips

6.2 RFID Chips

6.3 Connectivity Integrated Circuits

6.3.1 Bluetooth Chips

6.3.2 Wi-Fi Chips

6.3.3 Cellular Chips

6.4 Sensors

6.5 Processors

6.6 Memory

6.7 Displays

6.8 Batteries

6.9 Others

7 Pet Wearable Market, By Product (Page No. - 40)

7.1 Introduction

7.2 Smart Collars

7.2.1 Smart Collars Accounted for The Largest Share of The Overall Pet Wearable Market in 2018.

7.3 Smart Cameras

7.3.1 Potential of AI to Bring New Capabilities to Pet Smart Camera Market

7.4 Smart Harnesses

7.4.1 Smart Harness Expected to Grow at Highest CAGR During The Forecast Period

8 Market, By Region (Page No. - 46)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 US Accounted for Largest Share of North American Market in 2018

8.2.2 Canada

8.2.2.1 Pet Ownership is on Rise in Canada

8.2.3 Mexico

8.2.3.1 Mexico is Third-Largest Country in North American Market in 2018

8.3 Europe

8.3.1 UK

8.3.1.1 Growing Dog Population Increases Demand for Pet Health and Fitness Trackers in UK

8.3.2 Germany

8.3.2.1 Increasing Trend of Pet Humanization

8.3.3 France

8.3.3.1 Higher Focus on Pet Health in France

8.3.4 RoE

8.4 Asia Pacific

8.4.1 Japan

8.4.1.1 Rising Focus on Pet Ownership

8.4.2 China

8.4.2.1 China Held Largest Market Share of Market in APAC

8.4.3 Australia

8.4.3.1 Australian Market is Also Trending Toward Pet Humanization

8.4.4 RoAPAC

8.5 RoW

8.5.1 South America

8.5.1.1 Rise in Pet Population Contributes to Continual Growth of Pet Wearable Industry

8.5.2 Middle East & Africa

8.5.2.1 Market in MEA is at Emerging Stage and has Significant Potential for Growth During Forecast Period

9 Competitive Landscape (Page No. - 59)

9.1 Introduction

9.2 Market Ranking Analysis: Market

9.3 Competitive Situations and Trends

9.3.1 Product Launches and Developments

9.3.2 Partnerships and Collaborations

9.3.3 Acquisitions

9.4 Competitive Leadership Mapping

9.4.1 Visionary Leaders

9.4.2 Innovators

9.4.3 Dynamic Differentiators

9.4.4 Emerging Companies

10 Company Profiles (Page No. - 64)

10.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.1.1 Petpace

10.1.2 Garmin

10.1.3 MotoRoLA Mobiltiy (Binatone)

10.1.4 Fitbark

10.1.5 Whistle Labs

10.1.6 Tractive

10.1.7 Link AKC (WAGZ)

10.1.8 Num’axes (Eyenimal)

10.1.9 Kyon

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

10.2 Other Companies

10.2.1 Gopro

10.2.2 Pawbo

10.2.3 Loc8tor

10.2.4 Pod Trackers

10.2.5 Felcana

10.2.6 Scollar

10.2.7 Invoxia

10.2.8 Dogtra

10.2.9 Xiomi

10.2.10 RAWR

11 Appendix (Page No. - 86)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (33 Tables)

Table 1 Pet Wearable Market for GPS Chips, By Product, 2016–2024 (Thousand Units)

Table 2 Market for RFID Chips, By Product, 2016–2024 (Thousand Units)

Table 3 Market for Bluetooth Chips, By Product, 2016–2024 (Thousand Units)

Table 4 Market for Wi-Fi Chips, By Product, 2016–2024 (Thousand Units)

Table 5 Market for Cellular Chips, By Product, 2016–2024 (Thousand Units)

Table 6 Market for Sensors, By Product, 2016–2024 (Thousand Units)

Table 7 Market for Processors, By Product, 2016–2024 (Thousand Units)

Table 8 Market for Memory, By Product, 2016–2024 (Thousand Units)

Table 9 Market for Displays, By Product, 2016–2024 (Thousand Units)

Table 10 Market for Batteries, By Product, 2016–2024 (Thousand Units)

Table 11 Market for Other Components, By Product, 2016–2024 (Thousand Units)

Table 12 Global Market, By Product, 2016–2024 (USD Million)

Table 13 Global Market, By Product, 2016–2024 (Thousand Units)

Table 14 Market for Smart Collars, By Component, 2016–2024 (Million Units)

Table 15 Market for Smart Collars, By Region, 2016–2024 (USD Million)

Table 16 Market for Smart Cameras, By Component, 2016–2024 (Thousand Units)

Table 17 Market for Smart Cameras, By Region, 2016–2024 (USD Million)

Table 18 Market for Smart Harnesses, By Component, 2016–2024 (Thousand Units)

Table 19 Market for Smart Harnesses, By Region, 2016–2024 (USD Million)

Table 20 Global Market, By Region, 2016–2024 (USD Million)

Table 21 Market in North America, By Product, 2016–2024 (USD Million)

Table 22 Market in North America, By Country, 2016–2024 (USD Million)

Table 23 Market in Europe, By Product, 2016–2024 (USD Million)

Table 24 Market in Europe, By Country, 2016–2024 (USD Million)

Table 25 Market in APAC, By Product, 2016–2024 (USD Million)

Table 26 Market in APAC, By Country, 2016–2024 (USD Million)

Table 27 Market in RoW, By Product, 2016–2024 (USD Million)

Table 28 Market in RoW, By Region, 2016–2024 (USD Million)

Table 29 Wearable Market in South America, By Country, 2016–2024 (USD Million)

Table 30 Market in Middle East & Africa, By Region, 2016–2024 (USD Million)

Table 31 Product Launches and Developments (2016–2019)

Table 32 Partnerships and Collaborations (2016–2018)

Table 33 Acquisitions (2015–2018)

List of Figures (21 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Data Triangulation

Figure 4 Process Flow of Market Size Estimation

Figure 5 Market in Terms of Value and Volume (2016–2024)

Figure 6 Smart Collars to Hold Largest Size of Market From 2019 to 2024

Figure 7 Market, By Component, in Terms of Volume, 2016–2024

Figure 8 Market in APAC Witnessed Highest CAGR, in Terms of Value, in 2018

Figure 9 Rising Pet Population and Pet Humanization to Spur The Growth of Market During Forcaste Period

Figure 10 Smart Collars to Record Largest Shipment During Forecast Period

Figure 11 Smart Collars to Hold Largest Size, in Terms of Volume, By 2024

Figure 12 China Was Largest Shareholder of Market, in Terms of Value, in APAC in 2018

Figure 13 US to Hold Largest Share of Market, in Terms of Value, By 2018

Figure 14 Market Dynamics

Figure 15 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Europe: Pet Wearable Market Snapshot

Figure 18 Key Growth Strategies Adopted By Top Companies, 2015–2019

Figure 19 Market Ranking of Top 5 Players in Market, 2018

Figure 20 Market (Global) Competitive Leadership Mapping, 2018

Figure 21 Garmin: Company Snapshot

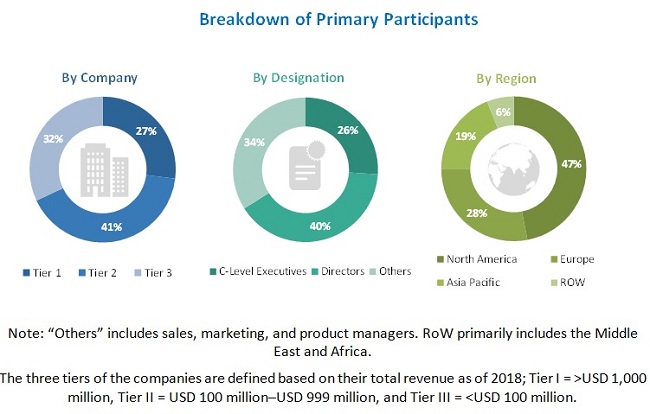

The study involved four major activities for estimating the current market size of the pet wearable market. Exhaustive secondary research was conducted to collect information on the market, as well as its peer and parent markets. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain, i.e., through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include American Pet Products Association (APPA); Association for Pet Obesity Prevention (APOP); Pet Food Manufacturers Association; World Pet Association (WPA); journals; press releases and financials of companies; white papers and certified publications and articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the pet wearable amplifier market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information, as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the pet wearable market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- The market size, in terms of value and volume, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends related to different verticals, identified from both demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

The following are the major objectives of the study.

- To describe and forecast the pet wearable market, in terms of value, segmented based on product, component, and region

- To describe and forecast the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To describe and forecast the pet wearable market, in terms of volume, segmented based on product and component

- To provide detailed information regarding drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and contribution to the overall market

- To provide a detailed overview of the value chain pertaining to the pet wearable ecosystem

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the pet wearable market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze prime growth strategies, such as partnerships and joint ventures, mergers and acquisitions, product launches and developments, expansions, and research and development, implemented by the key players in the pet wearable market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Market size for 2021 and 2023 for product, component, and geography

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Pet Wearable Market

I want to understand the major region and specific interest to U.S. and china. Have you covered this in pet wearable studyjQuery18005392677948146241_1600745325304

What are the product which you have considered? Do you have such information qualitative or quantitative?

We are a start-up and have invented a new type of sensors. I would like to understand the use of Smart Devices and its impact on pet wearable market.

I want to understand the major region and specific interest to U.S and china. Have you covered this in pet wearable study?

What are the major applications and the future trends in the market for pet wearable sensors? Have you considered IoT or smart sensors in the scope of the report?

Have you provided market size of each component covered in pet wearables like GPS Chips, RFID Chips, Sensors, Wi-Fi, Cellular, Bluetooth Chips, Processors, Memory, Displays and Batteries.