Pharmaceutical Grade Lithium Carbonate Market by Application (Extended Release, Immediate Release), Purity (99%, Above 99%), and Region (Asia Pacific, Europe, North America, Middle East & Africa, and South America) - Global Forecast to 2028

Updated on : March 20, 2024

Pharmaceutical Grade Lithium Carbonate Market

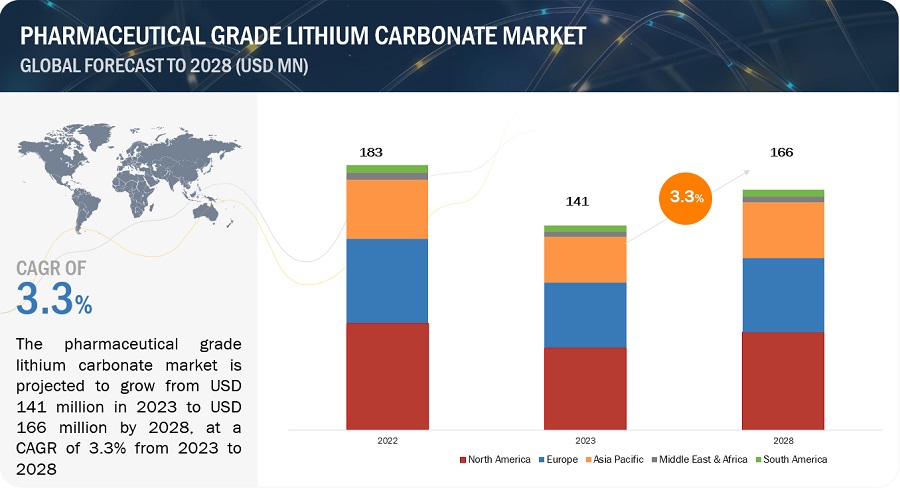

The global pharmaceutical grade lithium carbonate market size was valued at USD 141 million in 2023 and is projected to reach USD 166 million by 2028, growing at 3.3% cagr from 2023 to 2028. Pharmaceutical grade lithium carbonate is available in two main formulations, namely immediate-release and extended release. These formulations are made to release the active ingredient into the body at various rates, which can have an impact on frequency of a dose, blood pressure stability, and treatment outcomes.

Attractive Opportunities in the Pharmaceutical Grade Lithium Carbonate Market

To know about the assumptions considered for the study, Request for Free Sample Report

Pharmaceutical Grade Lithium Carbonate Market Dynamics

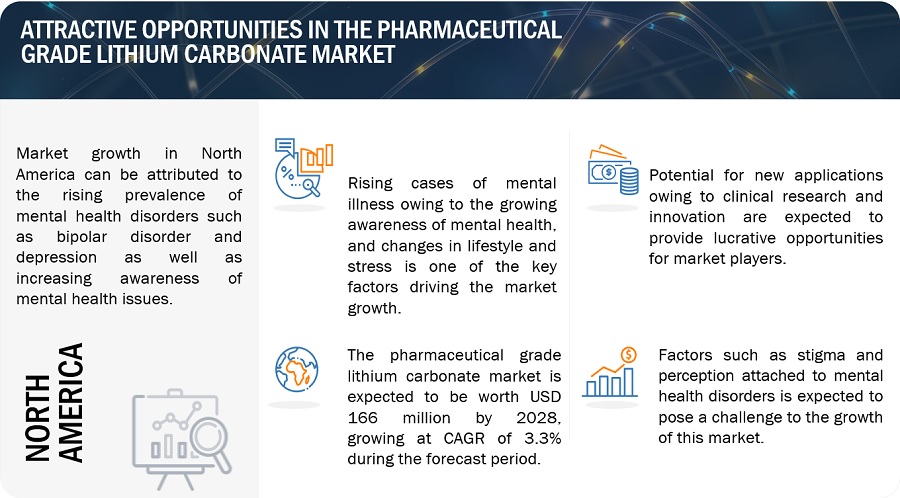

Driver: Rising cases of mental illness

The demand for pharmaceutical grade lithium carbonate is significantly influenced by the increasing number of mental health conditions. The rise in mental illness cases is a major concern that has severe consequences for people, communities, and healthcare systems. The growth can be attributed to some of the factors including growing awareness of mental health, and changes in lifestyle and stress. Having a better awareness of mental illness, for instance, can help identify people struggling with anxiety, depression, or other conditions that have an impact on their mental health. This also leads to a self-realization of mental health issues. Changes in lifestyle and stress can disrupt the brain's neurotransmitter balance, which can lead to mood disorders. Thus, the rise in the number of mental illness cases is one of the major drivers of pharmaceutical grade lithium carbonate market.

Restraint: Side effects and safety concerns

The market is expected to experience restraints due to side effects and safety concerns associated with pharmaceutical grade lithium carbonate. Lithium toxicity is closely linked to serum lithium levels and can occur at doses close to therapeutic levels. Lithium toxicity's neurological symptoms can range from mild to moderate to severe, including clonus, confusion, seizure, coma, and death. Mild symptoms include fine tremor, lightheadedness, lack of coordination, and weakness. Moderate symptoms include giddiness, apathy, drowsiness, hyperreflexia, muscle twitching, ataxia, blurred vision, tinnitus, and slurred speech. Hence, patients and medical professionals can be reluctant to use lithium carbonate due to safety concerns, restraining the growth of pharmaceutical grade lithium carbonate market.

Opportunity: Potential for new applications owing to clinical research and innovation

Beyond its existing usage, pharmaceutical grade lithium carbonate may find new therapeutic indications through clinical research and innovation. This diversification can increase the market presence and offer potential opportunities to address a broader range of mental health disorders. Medical professionals and patients are more likely to use pharmaceutical grade lithium carbonate if clinical data supports its usage. Thus, new uses for pharmaceutical grade lithium carbonate could be discovered through clinical research and innovation, expanding its effectiveness, and addressing a larger range of mental health conditions. These opportunities can spur commercial expansion, improve patient care, and contribute to advancements in the field of mental health treatment.

Challenge: Stringent pharmaceutical standards and regulations

The pharmaceutical grade lithium carbonate market is highly regulated by various protocols and standards such as Regulation (EC) No 1272/2008, The Environmental Protection Agency (EPA), and FDA (U.S. Food and Drug Administration), among others. To prove the safety and effectiveness of pharmaceutical grade lithium carbonate, extensive clinical trials are required to be conducted. This can be costly as well as time-consuming to meet the regulatory agency's demands for evidence. Thus, the pharmaceutical grade lithium carbonate market in particular may face regulatory barriers with regard to clinical trial requirements, safety and effectiveness standards, manufacturing procedures, labelling, and post-market monitoring. This further poses a challenge to the growth of the market.

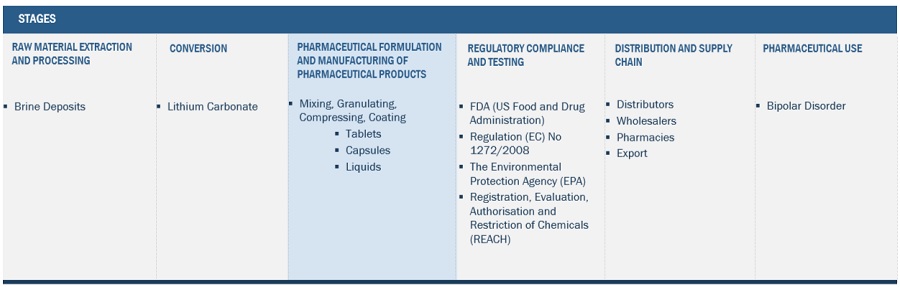

Pharmaceutical Grade Lithium Carbonate Market : Value Chain

Prominent companies in this market include well-established, financially stable pharmaceutical grade lithium carbonate manufacturers. These companies have been operating in the market for several years and possess a strong product portfolio and strong global sales and marketing networks. Prominent companies in this market include Livent Corporation (US), Albemarle Corporation (US), Jiangsu Lianhuan Pharmaceutical Co., Ltd. (China), American Elements (US), Globe Química (US), Jiangsu Nhwa Pharmaceutical Co., Ltd. (China), Panchsheel Organics Ltd (POLTD) (India), Blanver (Brazil).

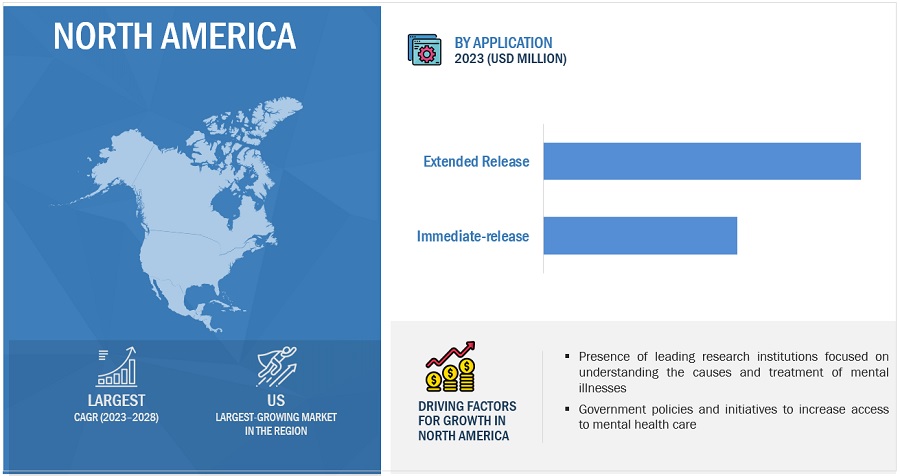

Based on application, the extended release was the larger segment in 2022, by volume.

The pharmaceutical grade lithium carbonate market is segmented into extended release and immediate release pharmaceutical grade lithium carbonate, on the basis of application. Medical, technological, regulatory, and market-related factors, among others, all have an impact on the development of extended release pharmaceutical grade lithium carbonate. Extended release formulations have lower dose frequency which helps to increase a patients' compliance with their drug schedule. By requiring fewer daily dosages, extended release drugs can provide patients with additional convenience. People with hectic schedules or those who have trouble remembering to take their medicines several times a day may find this to be especially helpful. Such factors are expected to fuel the demand for extended release pharmaceutical grade lithium carbonate segment.

Based on region, North America is projected to account for the largest market share during the forecast period, in terms of value.

North America is home to leading research institutions focused on understanding the causes and treatment of mental illnesses. Governments in the region have also introduced policies and initiatives to increase access to mental health care, increase public awareness, and promote research. The market for pharmaceutical grade lithium carbonate has expanded as a result of rising awareness and bipolar illness diagnostic rates. More than one in five American individuals (57.8 million in 2021), as estimated by the National Institutes of Health, live with a mental disease in the US alone. Thus, the rise in demand of mood stabilizers such as pharmaceutical grade lithium carbonate has fueled the market's development.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Livent Corporation (US), Albemarle Corporation (US), Jiangsu Lianhuan Pharmaceutical Co., Ltd. (China), American Elements (US), Globe Química (US), Jiangsu Nhwa Pharmaceutical Co., Ltd. (China), Panchsheel Organics Ltd (POLTD) (India), Blanver (Brazil), are among the major players leading the market through their geographical presence, enhanced production capacities, and efficient distribution channels.

Pharmaceutical Grade Lithium Carbonate Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 141 million |

|

Revenue Forecast in 2028 |

USD 166 million |

|

CAGR |

3.3% |

|

Market Size Available for Years |

2019 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million), Volume (Ton) |

|

Segments Covered |

Application, Purity, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Livent Corporation (US), Albemarle Corporation (US), Jiangsu Lianhuan Pharmaceutical Co., Ltd. (China), American Elements (US), Globe Química (US), Jiangsu Nhwa Pharmaceutical Co., Ltd. (China), Panchsheel Organics Ltd (POLTD) (India), Blanver (Brazil), and others |

This research report categorizes the pharmaceutical grade lithium carbonate market based on application, purity, and region.

Based on application, the pharmaceutical grade lithium carbonate market has been segmented as follows:

- Immediate Release

- Extended Release

Based on purity, the pharmaceutical grade lithium carbonate market has been segmented as follows:

- 99%

- Above 99%

Based on the region, the pharmaceutical grade lithium carbonate market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

-

South America

-

- Brazil

- Rest of South America

-

Recent Developments

- In May 2023, Livent signed an agreement with Allkem, a specialty lithium chemicals company, to merge and form a market-leading producer of lithium chemicals known as NewCo. The combined business will have a substantial footprint of low-cost assets spread across major geographies, products, and customers. The transaction is expected to be completed by the end of 2023.

- In January 2021, Albemarle Corporation announced the capacity expansion of the lithium production facility at Silver Peak, Nevada, and a program to assess clays and other potential Nevada resources for commercial production of lithium.

Frequently Asked Questions (FAQ):

What is the current size of the pharmaceutical grade lithium carbonate market?

The pharmaceutical grade lithium carbonate market is projected to grow from USD 141 million in 2023 to USD 166 million by 2028, at a CAGR of 3.3% from 2023 to 2028.

Which region is expected to hold the largest market share in the pharmaceutical grade lithium carbonate market?

The pharmaceutical grade lithium carbonate market in North America is estimated to hold the largest market share.

Which is the major application of pharmaceutical grade lithium carbonate?

The extended release segment is the major application of pharmaceutical grade lithium carbonate.

Who are the major players operating in the pharmaceutical grade lithium carbonate market?

The major players operating in the market include Livent Corporation (US), Albemarle Corporation (US), Jiangsu Lianhuan Pharmaceutical Co., Ltd. (China), American Elements (US), Globe Química (US), Jiangsu Nhwa Pharmaceutical Co., Ltd. (China), Panchsheel Organics Ltd (POLTD) (India), Blanver (Brazil).

What is the total CAGR expected to record for the pharmaceutical grade lithium carbonate market during 2023-2028?

The market is expected to record a CAGR of 3.3% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising cases of mental illnessRESTRAINTS- Availability of substitutes- Side effects and safety concernsOPPORTUNITIES- Potential for new applications owing to clinical research and innovationCHALLENGES- Stringent pharmaceutical standards and regulations- Stigma and perception of mental disorders

-

6.1 ECOSYSTEM MAPPING

-

6.2 VALUE CHAIN ANALYSISLITHIUM RESOURCE EXTRACTION AND PROCESSINGCONVERSION TO LITHIUM CARBONATEPURIFICATION AND QUALITY CONTROLPHARMACEUTICAL FORMULATION AND MANUFACTURING OF PHARMACEUTICAL PRODUCTSREGULATORY COMPLIANCE AND TESTINGDISTRIBUTION AND SUPPLY CHAINPHARMACEUTICAL USE

- 6.3 TECHNOLOGY ANALYSIS

-

6.4 REGULATORY LANDSCAPEREGULATIONS RELATED TO PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

6.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.8 CASE STUDY ANALYSISOBJECTIVEDESCRIPTIONMETHODRESULTS

-

6.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

6.10 TRADE ANALYSISIMPORT-EXPORT SCENARIO

-

6.11 PRICING ANALYSISAVERAGE SELLING PRICE FOR PHARMACEUTICAL GRADE LITHIUM CARBONATE, BY REGION IN 2022

- 7.1 INTRODUCTION

- 7.2 99.0%

- 7.3 ABOVE 99%

- 8.1 INTRODUCTION

-

8.2 IMMEDIATE RELEASEIMMEDIATE-RELEASE MEDICINES PROVIDE RAPID RELIEF OF SYMPTOMS

-

8.3 EXTENDED RELEASEEXTENDED-RELEASE MEDICINES REDUCE RISK OF SIDE EFFECTS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTCHINA- Expansion of treatment facilities pertaining to mental disorders to drive marketINDIA- Government initiatives for encouraging mental health treatments to drive demandJAPAN- Increasing need for treatment of mental illnesses to drive marketSOUTH KOREA- Presence of mental health centers to improve research and increase demandREST OF ASIA PACIFIC

-

9.3 NORTH AMERICARECESSION IMPACTUS- Laws pertaining to mental health and disorder treatment to drive demandCANADA- Investment in quality mental health treatment to drive growthMEXICO- Campaigns and educational initiatives to influence growth

-

9.4 EUROPERECESSION IMPACTGERMANY- Well-established healthcare system to drive marketFRANCE- Support and initiative from government toward mental health issues to drive demandUK- Growing cases of mental illness to drive demandREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Growing awareness and government support for mental illness to drive demandUAE- Growing investment to improve drug sector to drive demand- Rest of Middle East & Africa

-

9.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing efforts to raise awareness about mental health issues to drive marketREST OF SOUTH AMERICA

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- Livent Corporation- Albemarle Corporation- Jiangsu Lianhuan Pharmaceutical Co., Ltd.REVENUE ANALYSIS OF TOP PLAYERS

- 10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSLIVENT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALBEMARLE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewJIANGSU LIANHUAN PHARMACEUTICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewAMERICAN ELEMENTS- Business overview- Products/Solutions/Services offeredGLOBE QUÍMICA- Business overview- Products/Solutions/Services offeredJIANGSU NHWA PHARMACEUTICAL CO., LTD.- Business overview- Products/Solutions/Services offeredPANCHSHEEL ORGANICS LTD (POLTD)- Business overview- Products/Solutions/Services offeredBLANVER- Business overview- Products/Solutions/Services offered

-

11.2 OTHER PLAYERSZHENJIANG POWORKS CO., LTD.AXIOM CHEMICALS PVT. LTD.HUBEI RISON CHEMICAL CO., LTD.PHARMAFFILIATES ANALYTICS AND SYNTHETICS P. LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET SNAPSHOT: 2023 VS. 2028

- TABLE 3 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: ECOSYSTEM MAPPING

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: CONFERENCES AND EVENTS, 2023–2024

- TABLE 9 PATENTS: OROCOBRE LIMITED

- TABLE 10 PATENTS: CONTITECH USA INC.

- TABLE 11 TOP PATENT OWNERS DURING LAST 10 YEARS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 14 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 LITHIUM CARBONATE EXPORT TRADE DATA, 2022

- TABLE 16 LITHIUM CARBONATE IMPORT TRADE DATA, 2022

- TABLE 17 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 18 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 19 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 20 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 21 IMMEDIATE RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2019–2022 (TON)

- TABLE 22 IMMEDIATE RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2023–2028 (TON)

- TABLE 23 IMMEDIATE RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 IMMEDIATE RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 EXTENDED RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2019–2022 (TON)

- TABLE 26 EXTENDED RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2023–2028 (TON)

- TABLE 27 EXTENDED RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 EXTENDED RELEASE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2019–2022 (TON)

- TABLE 32 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY REGION, 2023–2028 (TON)

- TABLE 33 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 36 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 37 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 40 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 41 CHINA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 CHINA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 CHINA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 44 CHINA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 45 INDIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 INDIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 INDIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 48 INDIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 49 JAPAN: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 JAPAN: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 JAPAN: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 52 JAPAN: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 53 SOUTH KOREA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 SOUTH KOREA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 SOUTH KOREA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 56 SOUTH KOREA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 57 REST OF ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 60 REST OF ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 61 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 64 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 65 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 68 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 69 US: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 US: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 US: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 72 US: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 73 CANADA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 CANADA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 76 CANADA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 77 MEXICO: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 MEXICO: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 MEXICO: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 80 MEXICO: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 81 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 84 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 85 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 88 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 89 GERMANY: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 GERMANY: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 GERMANY: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 92 GERMANY: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 93 FRANCE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 FRANCE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 FRANCE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 96 FRANCE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 97 UK: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 UK: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 UK: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 100 UK: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 101 REST OF EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 REST OF EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 104 REST OF EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 105 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 108 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 109 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 112 MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 113 SAUDI ARABIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 SAUDI ARABIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 SAUDI ARABIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 116 SAUDI ARABIA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 117 UAE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 UAE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 UAE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 120 UAE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 121 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 125 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2019–2022 (TON)

- TABLE 128 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 129 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 132 SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 133 BRAZIL: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 134 BRAZIL: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 BRAZIL: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 136 BRAZIL: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 137 REST OF SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 REST OF SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 REST OF SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2019–2022 (TON)

- TABLE 140 REST OF SOUTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 141 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 142 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: DEGREE OF COMPETITION

- TABLE 143 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: PURITY FOOTPRINT

- TABLE 144 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: COMPANY REGION FOOTPRINT

- TABLE 145 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: KEY STARTUPS/SMES

- TABLE 146 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 147 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: DEALS, 2019–2023

- TABLE 148 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: EXPANSIONS AND INVESTMENTS, 2019–2023

- TABLE 149 LIVENT CORPORATION: COMPANY OVERVIEW

- TABLE 150 LIVENT CORPORATION: PRODUCTS OFFERED

- TABLE 151 LIVENT CORPORATION: DEALS

- TABLE 152 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- TABLE 153 ALBEMARLE CORPORATION: PRODUCTS OFFERED

- TABLE 154 ALBEMARLE CORPORATION: OTHERS

- TABLE 155 JIANGSU LIANHUAN PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 156 JIANGSU LIANHUAN PHARMACEUTICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 157 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 158 AMERICAN ELEMENTS: PRODUCTS OFFERED

- TABLE 159 GLOBE QUÍMICA: COMPANY OVERVIEW

- TABLE 160 GLOBE QUÍMICA: PRODUCTS OFFERED

- TABLE 161 JIANGSU NHWA PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 162 JIANGSU NHWA PHARMACEUTICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 163 PANCHSHEEL ORGANICS LTD (POLTD): COMPANY OVERVIEW

- TABLE 164 PANCHSHEEL ORGANICS LTD (POLTD): PRODUCTS OFFERED

- TABLE 165 BLANVER: COMPANY OVERVIEW

- TABLE 166 BLANVER: PRODUCTS OFFERED

- TABLE 167 ZHENJIANG POWORKS CO., LTD.: COMPANY OVERVIEW

- TABLE 168 AXIOM CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 169 HUBEI RISON CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 170 PHARMAFFILIATES ANALYTICS AND SYNTHETICS P. LTD.: COMPANY OVERVIEW

- FIGURE 1 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET SEGMENTATION

- FIGURE 2 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR PHARMACEUTICAL GRADE LITHIUM CARBONATE

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET (2/2)

- FIGURE 8 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: DATA TRIANGULATION

- FIGURE 9 EXTENDED-RELEASE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD THE PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET DURING FORECAST PERIOD

- FIGURE 11 RISE IN CASES OF MENTAL ILLNESS TO DRIVE MARKET

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 EXTENDED-RELEASE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 EXTENDED-RELEASE APPLICATION ACCOUNTS FOR LARGER MARKET SHARE

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET

- FIGURE 16 PREVALENCE OF MENTAL DISORDERS ACROSS WHO REGIONS, 2019

- FIGURE 17 ECOSYSTEM MAP OF PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET

- FIGURE 18 VALUE CHAIN ANALYSIS OF PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET

- FIGURE 19 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 20 PUBLICATION TRENDS IN LAST 10 YEARS

- FIGURE 21 LEGAL STATUS OF PATENTS

- FIGURE 22 TOP JURISDICTION, BY DOCUMENT

- FIGURE 23 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- FIGURE 26 PORTER’S FIVE FORCES ANALYSIS OF PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET

- FIGURE 27 AVERAGE SELLING PRICE, BY REGION

- FIGURE 28 EXTENDED RELEASE TO BE LARGER MARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA TO DRIVE PHARMACEUTICAL GRADE LITHIUM CARBONATE DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC: PHARMACEUTICAL GRADE LITHIUM CARBONATE SNAPSHOT

- FIGURE 31 NORTH AMERICA: PHARMACEUTICAL GRADE LITHIUM CARBONATE SNAPSHOT

- FIGURE 32 EUROPE: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET SNAPSHOT

- FIGURE 33 RANKING OF KEY PLAYERS IN PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET, 2022

- FIGURE 34 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET SHARE ANALYSIS

- FIGURE 35 REVENUE ANALYSIS OF KEY COMPANIES, 2018–2022

- FIGURE 36 PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET: COMPANY FOOTPRINT

- FIGURE 37 COMPANY EVALUATION MATRIX: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET (TIER 1 COMPANIES)

- FIGURE 38 STARTUP/SME EVALUATION QUADRANT: PHARMACEUTICAL GRADE LITHIUM CARBONATE MARKET

- FIGURE 39 LIVENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 ALBEMARLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 JIANGSU LIANHUAN PHARMACEUTICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 42 PANCHSHEEL ORGANICS LTD (POLTD): COMPANY SNAPSHOT

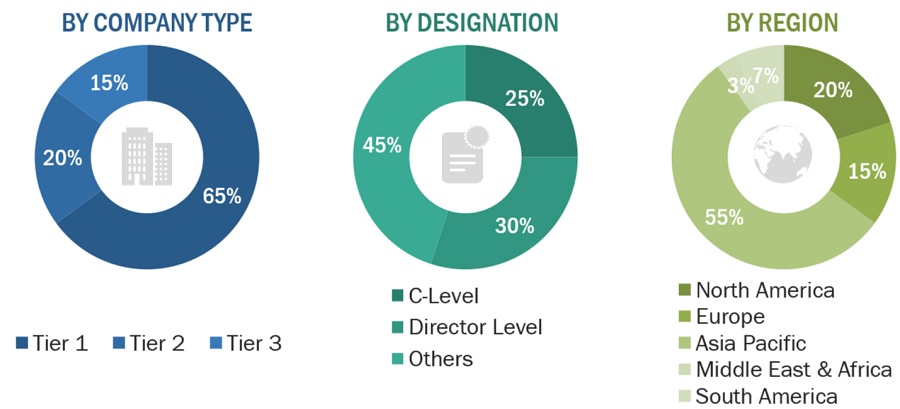

The study involved four major activities in estimating the current market size of pharmaceutical grade lithium carbonate. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of pharmaceutical grade lithium carbonate through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The pharmaceutical grade lithium carbonate market comprises several stakeholders, such as raw material suppliers, pharmaceutical grade lithium carbonate manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the pharmaceutical grade lithium carbonate market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the pharmaceutical grade lithium carbonate market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the pharmaceutical grade lithium carbonate market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Pharmaceutical grade lithium carbonate Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Pharmaceutical grade lithium carbonate Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the pharmaceutical grade lithium carbonate sources.

Market Definition

Pharmaceutical grade lithium carbonate refers to a high-purity form of lithium carbonate that meets stringent quality and purity standards set by regulatory authorities. Pharmaceutical grade lithium carbonate is a compound used primarily used as a mood stabilizer in the treatment of certain mental health conditions, particularly bipolar disorder. Due to the critical nature of its application in treating mental health conditions, the quality and purity of the compound are of utmost importance. As a result, pharmaceutical manufacturers adhere to strict guidelines and regulatory standards to produce and distribute pharmaceutical grade lithium carbonate.

Key Stakeholders

- Manufacturers of pharmaceutical grade lithium carbonate

- Manufacturers in end-use industries

- Traders, distributors, and suppliers of pharmaceutical grade lithium carbonate

- Regional manufacturers and chemical associations

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

- NGOs, governments, investment banks, venture capitalists, and private equity firms

- Environmental support agencies

Report Objectives:

- To analyze and forecast the market size of pharmaceutical grade lithium carbonate in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global pharmaceutical grade lithium carbonate market on the basis of application, and region.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To strategically analyze the micro markets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective key countries.

- To track and analyze competitive developments, such as agreement, joint development, and expansion, in the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the pharmaceutical grade lithium carbonate market

- Profiling of additional market players (up to 8)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Pharmaceutical Grade Lithium Carbonate Market