Pharmaceutical Processing Seals Market by Material (Metals, PTFE, Nitrile Rubber, Silicone, EPDM, FKM, FFKM, UHMWPE, PU), Type (O-Ring Seals, Gaskets, Lip Seals, D Seals), Application (Manufacturing Equipment), and Region - Global Forecast to 2026

Updated on : September 02, 2025

Pharmaceutical Processing Seals Market

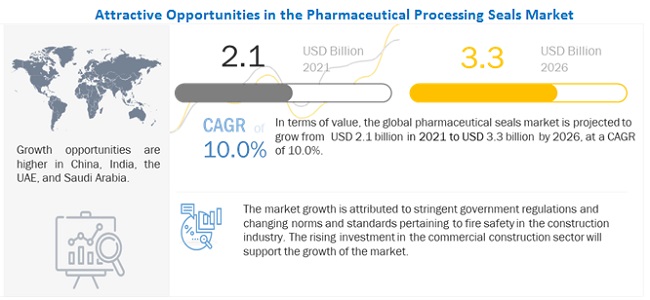

The global pharmaceutical processing seals market was valued at USD 2.1 billion in 2021 and is projected to reach USD 3.3 billion by 2026, growing at 10.0% cagr from 2021 to 2026. The market is witnessing growth on account of trends prevailing in the global pharmaceutical industry such as increasing demand for new and innovative pharmaceutical manufacturing equipment and continuous R&D for new product development due to technological advancements. The increase in pharmaceutical manufacturing in APAC region, mainly in India, China, Korea and the South East Asian countries has boosted the pharmaceutical manufacturing equipment market, thereby, driving the market for pharmaceutical processing seals in the region. In addition, the growing healthcare sector in the region is expected to increase the demand for pharmaceutical equipment and drive the pharmaceutical processing seals market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on pharmaceutical processing seals market

Due to COVID-19 pandemic, the suspension of manufacturing operation, disruption of supply chain, and declining demand for industrial goods had significant impact on the market. However, due to COVID-19 pandemic, the demand for pharmaceutical industry goods has risen, which, in turn, support for the growth of pharmaceutical processing seals market. At the same time, due to panic situation, people stock the hygiene products across the globe that drives the market.

Pharmaceutical Processing Seals Market Dynamics

Drivers: Increasing instances of chronic diseases

Increasing environmental issues, unhealthy lifestyles, and consumption of junk food have increased the risk of chronic diseases. Malnutrition, unhealthy diet, smoking, alcohol consumption, drug abuse, stress, and others are examples of an unhealthy lifestyle, which gives rise to diseases such as metabolic disorders, joint problems, cardiovascular diseases, hypertension, and obesity. An unhealthy lifestyle is one of the major reasons for the increasing incidences of chronic health conditions.

According to WHO (World Health Organization), some leading chronic diseases are cardiovascular diseases, cancer, respiratory problems, and diabetes. The number of deaths attributable to chronic diseases was 3.78 million in 1990 (40.4% of all deaths), and it is expected to be 7.63 million in 2020 (66.7% of all deaths). 80% of chronic disease deaths occur in low and middle-income countries or emerging economies. These factors are leading to the growth in pharmaceutical manufacturing, boosting the demand for pharmaceutical processing seals.

Restraints: Growing preference for refurbished equipment

Refurbished equipment is a viable alternative compared to new instruments for pharmaceutical manufacturers in cases where time (taken to deliver and set up new machinery) and cost (new instruments being comparatively high-priced) are the concerns. Many Asian and European companies are moving toward the refurbishment of machinery to save costs and to comply with the requirement of GMP (Good Manufacturing Process). The adoption of this new trend by pharmaceutical manufacturers is negatively affecting the business of pharmaceutical equipment OEMs and pharmaceutical processing seals manufacturers. The prime reason for the increasing preference for refurbished equipment is that it can save approximately 40–45% of the costs incurred on new machinery, thereby lowering the capital expenditure. All these factors prove to be a restraint for the pharmaceutical processing seals' growth.

However, a major chunk of these seals is used in the aftermarket. In pharmaceutical manufacturing, seals have less lifespan as compared to machinery in which the seals are used. Seals require frequent replacement due to wear and tear as these bear extreme pressure and temperatures. The growing use of refurbished equipment is expected not to impact the use of seals in the aftermarket, though the limited requirement of OEMs is likely to hamper the demand for seals to some extent.

Challenges: Increasing overall cost owing to dynamic regulatory measures

The pharmaceutical industry is one of the most regulated industries. The compounds manufactured in the pharmaceutical industry need to meet the standards of safety, efficacy, and quality. Every country has its own set of regulations governing the pharmaceutical industry. Seals are an important part of pharmaceutical manufacturing as they are used in the process media while manufacturing. It is necessary for pharmaceutical processing seal manufacturers to adhere to the rules and regulations imposed by the government. Pharmaceutical processing seals must undergo various testing and trials with continuous R&D to discover their potential side effects failures during pharmaceutical processing. High costs are involved in this process, making it a potential barrier to entry into the market. This increases the responsibility of pharmaceutical seal manufacturers to validate each side effect of the seals to be manufactured. This increases the cost burden of the manufacturers. Although the demand for pharmaceutical processing seals is increasing with the growth in the pharmaceutical business, the market growth is likely to be hampered by the huge costs for R&D, trials, and testing. Owing to relatively longer shelf-life and stringent safety standards required for pharmaceutical production and packaging, the efforts put by pharmaceutical processing seals manufacturers and raw material suppliers need to be thorough and error-free.

Opportunities: Growing elderly population

The increasing older population is due to the growing life expectancy rate, increased awareness about healthcare, and improved pharmaceutical services. These factors are boosting the growth of the pharmaceutical industry, which has fueled the demand for pharmaceutical processing seals globally. According to the Department of Economic and Social Affairs, the elderly population is expected to double and touch 2.1 billion by 2050. Europe and North America have the largest elderly population. The elderly population in other regions is growing as well; in 2050, the older population is expected to account for 35% of the total population in Europe, 28% in North America, 25% in Latin America and the Caribbean, 24% in Asia, 23% in Oceania, and 9% in Africa. All these factors are expected to contribute to the growth of the pharmaceutical industry globally, which will provide ample opportunities to pharmaceutical processing seals manufacturers in the near future to expand their product offerings, manufacturing facilities, and services.

Metals dominate the pharmaceutical processing seals, by material.

By material, metals accounted for the largest share of the market, globally. Metals are preferred for pharmaceutical processing seals due to their ability to withstand chemicals reactions and extreme temperatures and pressure, resistance to toxic chemicals, non-reactive from process fluids, high friction & speed and prevention from contamination and leakage. Metals are used for making O-rings, lip seals, and gaskets which are used in as agitators, mixers, reactors, and gearboxes.

O-rings dominate the pharmaceutical processing seals market, by type.

O-rings are widely used in pharmaceutical equipment owing to its low cost. O-rings are used in different types of dynamic and static applications in the pharmaceutical sealing industry. Static applications such as fluid or gas sealing applications majorly consume O-rings. The increasing demand for different types of pharmaceutical equipment such as agitators, hydraulic cylinders, HPLCs, batch reactors, and centrifuges in the developing regions such as APAC, South America, and the Middle East & Africa are expected to drive the demand for pharmaceutical processing seals.

Manufacturing equipment is the largest application of pharmaceutical processing seals.

Manufacturing equipment application dominated the pharmaceutical processing seals market in 2020. The increasing global demand for manufacturing equipment due to the growth of pharmaceutical manufacturing and healthcare industry is expected to drive the pharmaceutical processing seals market. Manufacturing equipment is used in pharmaceutical industry for the production of pharmaceutical compounds. Factors leading to the demand for manufacturing equipment is due to the growth of the healthcare industry owing to increasing global population, growing incidences of chronic diseases, and increasing healthcare expenditure. Hence, the demand for pharmaceutical processing seals used in manufacturing equipment is expected to increase in the future.

North America is projected to be the largest market for pharmaceutical processing seals.

North America (comprising the US, Canada, and Mexico) accounted for the largest share of the global pharmaceutical processing seals market in 2018. Huge consumption and demand for new and innovative pharmaceutical products owing to the presence of strong healthcare sector has boosted the pharmaceutical manufacturing in the region leading to the development of pharmaceutical manufacturing equipment market. The huge consumption of pharmaceutical manufacturing equipment is expected to drive the pharmaceutical processing seals market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Pharmaceutical Processing Seals Market Players

Trelleborg AB (Sweden), Freudenberg Group (Germany), Flowserve Corporation (US), James Walker (UK), Parker Hannifin Corporation (US), Saint-Gobain S.A. (France), Garlock (US), John Crane (US), IDEX Corporation (US), and Morgan Advanced Materials PLC (UK) are the key players operating in the pharmaceutical processing seals market.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2020 to strengthen their position in the market. New product development, merger & acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for pharmaceutical processing seals in the emerging economies.

Pharmaceutical Processing Seals Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, Material, Application, and Region |

|

Geographies covered |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

Trelleborg AB (Sweden), Freudenberg Group (Germany), Flowserve Corporation (US), James Walker (UK), Parker Hannifin Corporation (US), Saint-Gobain S.A. (France), Garlock (US), John Crane (US), IDEX Corporation (US), Morgan Advanced Materials Plc (UK) |

This research report categorizes the pharmaceutical processing seals market based on type, material, application, and region.

Pharmaceutical Processing Seals Market, by Type:

- O-rings

- Gaskets

- Lip seals

- D seals

- Others (Diaphragms and X-rings)

Pharmaceutical Processing Seals Market, by Material:

- Metals

- PTFE

- Silicone

- Nitrile Rubber

- EPDM

- FKM

- FFKM

- UHMWPE

- PU

Pharmaceutical Processing Seals Market, by Application:

- Manufacturing equipment

- Others (R&D, quality control, and packaging equipment)

Pharmaceutical Processing Seals Market, by Region:

- North America

- APAC

- Europe

- Middle East & Africa

- South America

Recent Developments

- In 2021, Parker Hannifin Corporation reported that it had reached an agreement on the terms of a recommended cash acquisition of all of Meggitt Plc's issued and future ordinary share capital (Meggitt).

- In 2019, Trelleborg AB acquired Sil-Pro, LLC, a privately held contract manufacturer in the US that specializes in high-tolerance silicone and thermoplastic components and medical device assembly.

- In 2020, Freudenberg Klüber Lubrication München SE and Co. KG, Munich, Germany (part of the Freudenberg Chemical Specialities Business Group), purchased all of the shares of Traxit International GmbH, Schwelm, Germany. As part of the Freudenberg Group, the company is fully consolidated. A total of USD 55.5 million in assets was purchased.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for pharmaceutical processing seals market?

The major hot bets for pharmaceutical processing seals are the increased demand from OTC drug.

How is the market dynamics changing for different types of pharmaceutical processing seals?

Increasing environmental issues, unhealthy lifestyles, and consumption of junk food have increased the risk of chronic diseases. These factor will drive the demand for different pharmaceutical processing seals.

How is the market dynamics changing for different applications of pharmaceutical processing seals?

Increasing incidences of chronic and lifestyle diseases, the growing elderly population in developed countries, and favorable rules and regulations for pharmaceutical manufacturing in developing countries. These factors are expected to drive the demand for seals in different application during the forecast period.

Who are the major manufacturers of pharmaceutical processing seals?

Trelleborg AB (Sweden), Freudenberg Group (Germany), Flowserve Corporation (US), James Walker (UK), Parker Hannifin Corporation (US), Saint-Gobain S.A. (France), Garlock (US), John Crane (US), IDEX Corporation (US), and Morgan Advanced Materials Plc (UK) are the major pharmaceutical processing seals manufacturers.

What are the industry trends in coating equipment market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for pharmaceutical processing seals and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on expanding their regional presence particularly in the Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

FIGURE 1 PHARMACEUTICAL PROCESSING SEALS MARKET: RESEARCH METHODOLOGY

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 PHARMACEUTICAL PROCESSING SEALS: DATA TRIANGULATION

2.3.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 27)

FIGURE 5 METALS TO BE LARGEST TYPE OF MATERIAL FOR PHARMACEUTICAL PROCESSING SEALS

FIGURE 6 O-RINGS TO BE LARGEST TYPE OF PHARMACEUTICAL PROCESSING SEALS

FIGURE 7 MANUFACTURING EQUIPMENT WAS LARGEST APPLICATION OF PHARMACEUTICAL PROCESSING SEALS IN 2020

FIGURE 8 NORTH AMERICA WAS LARGEST PHARMACEUTICAL PROCESSING SEALS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PHARMACEUTICAL PROCESSING SEALS MARKET

FIGURE 9 GROWING MANUFACTURING EQUIPMENT APPLICATION TO DRIVE MARKET DURING FORECAST PERIOD (2021–2026)

4.2 PHARMACEUTICAL PROCESSING SEALS MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION, 2020

FIGURE 10 MANUFACTURING EQUIPMENT WAS LARGEST APPLICATION OF PHARMACEUTICAL PROCESSING SEALS IN NORTH AMERICA, 2020

5 MARKET OVERVIEW (Page No. - 33)

5.1 INTRODUCTION

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES GOVERNING PHARMACEUTICAL PROCESSING SEALS MARKET

5.1.1 DRIVERS

5.1.1.1 Increasing demand for OTC drugs

5.1.1.2 Increasing instances of chronic diseases

5.1.2 RESTRAINTS

5.1.2.1 Growing preference for refurbished equipment

5.1.3 OPPORTUNITIES

5.1.3.1 Growing elderly population

5.1.3.2 Growth of pharmaceutical manufacturing in the emerging economies

FIGURE 12 PERCENTAGE OF FINISH DOSAGE FORMS (FDF) MANUFACTURING FACILITIES FOR HUMAN DRUGS IN US MARKET BY COUNTRY OR REGION, 2020

5.1.4 CHALLENGES

5.1.4.1 Increasing overall costs owing to dynamic regulatory measures

5.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 13 PHARMACEUTICAL PROCESSING SEALS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 MACROECONOMIC INDICATORS

5.3.1 GLOBAL GDP OUTLOOK

TABLE 1 WORLD GDP GROWTH PROJECTION

6 PHARMACEUTICAL PROCESSING SEALS MARKET, BY MATERIAL (Page No. - 41)

6.1 INTRODUCTION

FIGURE 14 METALS TO LEAD PHARMACEUTICAL PROCESSING SEALS MARKET IN MATERIAL SEGMENT

TABLE 2 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

6.2 METALS

6.2.1 ABILITY TO WITHSTAND HIGH PRESSURE AND TEMPERATURES MAKES METALS IDEAL FOR USE IN PHARMACEUTICAL PROCESSING SEALS

TABLE 3 METAL-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 PTFE

6.3.1 GROWING MARKETS FOR O-RINGS AND GASKETS ARE DRIVING DEMAND FOR PTFE IN PHARMACEUTICAL PROCESSING SEALS

TABLE 4 PTFE-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026(USD MILLION)

6.4 SILICONE

6.4.1 INHERENT PROPERTIES OF SILICONE BOOST ITS DEMAND FOR PHARMACEUTICAL PROCESSING SEALS

TABLE 5 SILICONE-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.5 NITRILE RUBBER

6.5.1 INCREASING DEMAND FOR NITRILE RUBBER-BASED O-RINGS DUE TO THEIR LOW COMPRESSION SET, HIGH TENSILE STRENGTH, AND HIGH ABRASION RESISTANCE PROPERTIES

TABLE 6 NITRILE RUBBER-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.6 EPDM

6.6.1 RESISTANCE TO CHEMICALS AND THERMAL REACTIONS IS ONE OF THE MAJOR PROPERTIES OF EPDM DRIVING ITS DEMAND FOR MAKING PHARMACEUTICAL PROCESSING SEALS

TABLE 7 EPDM-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026(USD MILLION)

6.7 FKM

6.7.1 INCREASING DEMAND FOR HIGH PERFORMANCE SEALS IN PHARMACEUTICAL EQUIPMENT MANUFACTURING TO DRIVE MARKET FOR FKM

TABLE 8 FKM-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.8 FFKM

6.8.1 APPLICATION OF FKKM FOR HIGH-END APPLICATIONS TO DRIVE DEMAND

TABLE 9 FFKM-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026(USD MILLION)

6.9 POLYURETHANE

6.9.1 INCREASING DEMAND FOR NEW AND INNOVATIVE PHARMACEUTICAL PRODUCTS IS DRIVING THE MARKET FOR D SEALS

TABLE 10 POLYURETHANE-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.10 UHMWPE

6.10.1 INCREASING DEMAND FOR NEW AND INNOVATIVE PHARMACEUTICAL PRODUCTS IS DRIVING MARKET FOR UHMWPE

TABLE 11 UHMWPE-BASED PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026(USD MILLION)

7 PHARMACEUTICAL PROCESSING SEALS MARKET, BY TYPE (Page No. - 51)

7.1 INTRODUCTION

FIGURE 15 O-RINGS TO BE THE FASTEST GROWING SEGMENT DURING THE FORECAST PERIOD

7.2 O-RINGS

7.2.1 INCREASING DEMAND FOR O-RINGS IN PHARMACEUTICAL INDUSTRY IS DUE TO THEIR COST-EFFECTIVENESS AND VERSATILITY

TABLE 12 O-RINGS MARKET SIZE FOR PHARMACEUTICAL PROCESSING SEALS, BY REGION, 2019–2026 (USD MILLION)

7.3 GASKETS

7.3.1 INCREASING DEMAND FOR PHARMACEUTICAL MANUFACTURING, ESPECIALLY IN THE DEVELOPING ECONOMIES IS DRIVING THE MARKET FOR GASKETS

TABLE 13 GASKETS MARKET SIZE FOR PHARMACEUTICAL PROCESSING SEALS, BY REGION, 2019–2026 (USD MILLION)

7.4 LIP SEALS

7.4.1 GROWING PHARMACEUTICAL INDUSTRY IS DRIVING THE MARKET FOR LIP SEALS

TABLE 14 LIP SEALS MARKET SIZE FOR PHARMACEUTICAL PROCESSING SEALS, BY REGION, 2019–2026(USD MILLION)

7.5 D SEALS

7.5.1 INCREASING DEMAND FOR NEW AND INNOVATIVE PHARMACEUTICAL PRODUCTS IS DRIVING THE MARKET FOR D SEALS

TABLE 15 D SEALS MARKET SIZE FOR PHARMACEUTICAL PROCESSING SEALS, BY REGION, 2019–2026(USD MILLION)

7.6 OTHERS

TABLE 16 OTHER PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 PHARMACEUTICAL PROCESSING SEALS MARKET, BY APPLICATION (Page No. - 56)

8.1 INTRODUCTION

FIGURE 16 MANUFACTURING EQUIPMENT TO DOMINATE THE PHARMACEUTICAL PROCESSING SEALS MARKET

TABLE 17 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026(USD MILLION)

8.2 MANUFACTURING EQUIPMENT

8.2.1 GROWING PHARMACEUTICAL INDUSTRY IS DRIVING DEMAND IN MANUFACTURING EQUIPMENT SEGMENT

TABLE 18 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE IN MANUFACTURING EQUIPMENT APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.3 OTHERS

TABLE 19 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026(USD MILLION)

9 PHARMACEUTICAL PROCESSING SEALS MARKET, BY REGION (Page No. - 60)

9.1 INTRODUCTION

FIGURE 17 INDIA, CHINA, MEXICO, AND SOUTH KOREA TO EMERGE AS NEW STRATEGIC DESTINATIONS FOR PHARMACEUTICAL PROCESSING SEALS MARKET

TABLE 20 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 21 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 23 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 24 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2016–2018 (USD MILLION)

TABLE 25 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 26 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 27 PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 18 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SNAPSHOT

TABLE 28 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 29 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 31 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2016–2018 (USD MILLION)

TABLE 33 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 35 NORTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Growing pharmaceutical industry and healthcare expenditure are driving US market for pharmaceutical processing seals

TABLE 36 US: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 37 US: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing generic drugs market is influencing the pharmaceutical processing seals market positively in Canada

TABLE 38 CANADA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 39 CANADA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growing aging population and growth in biosimilar drugs segment are expected to drive market for pharmaceutical processing seals

TABLE 40 MEXICO: PHARMACEUTICAL PROCESSING SEALSMARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 41 MEXICO: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3 APAC

FIGURE 19 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SNAPSHOT

TABLE 42 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 43 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 45 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 46 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2016–2018 (USD MILLION)

TABLE 47 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 48 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 49 APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.1 CHINA

9.3.1.1 Increasing aging population and healthcare spending are driving the market for pharmaceutical processing seals in China

TABLE 50 CHINA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 51 CHINA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.2 JAPAN

9.3.2.1 Growing aging population is triggering the demand for pharmaceutical processing seals indirectly in Japan

TABLE 52 JAPAN: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 53 JAPAN: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3 INDIA

9.3.3.1 As largest manufacturer of generic drugs, India is a prominent market for pharmaceutical processing seals

TABLE 54 INDIA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 55 INDIA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4 SOUTH KOREA

9.3.4.1 Growing market for biosimilar drugs is contributing to market growth of pharmaceutical processing seals

TABLE 56 SOUTH KOREA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 57 SOUTH KOREA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.5 INDONESIA

9.3.5.1 Growing middle-class population and healthcare expenditure are driving the market for pharmaceutical processing seals

TABLE 58 INDONESIA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 59 INDONESIA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.6 REST OF APAC

TABLE 60 REST OF APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 61 REST OF APAC: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 20 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SNAPSHOT

TABLE 62 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 63 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 65 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2016–2018 (USD MILLION)

TABLE 67 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 68 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 69 EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Growing pharmaceutical industry due to constant R&D investments and increasing healthcare expenditures are driving the market in Germany

TABLE 70 GERMANY: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 71 GERMANY: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.2 ITALY

9.4.2.1 Strong pharmaceutical manufacturing base and export market are driving the demand for pharmaceutical processing seals

TABLE 72 ITALY: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 73 ITALY: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3 SWITZERLAND

9.4.3.1 Concentration of major pharmaceutical companies propels the pharmaceutical processing seals market in the country

TABLE 74 SWITZERLAND: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 75 SWITZERLAND: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4 UK

9.4.4.1 Growing pharmaceutical industry due to the increasing elderly population, has boosted the demand for pharmaceutical processing seals in the country

TABLE 76 UK: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 77 UK: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.5 FRANCE

9.4.5.1 Strong healthcare system and government support to the healthcare industry are driving the market for pharmaceutical processing seals

TABLE 78 FRANCE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 79 FRANCE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.6 SPAIN

9.4.6.1 High R&D spending in the pharmaceutical industry are driving the market for pharmaceutical processing seals

TABLE 80 SPAIN: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 81 SPAIN: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 82 REST OF EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 83 REST OF EUROPE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 84 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 85 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 87 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2016–2018 (USD MILLION)

TABLE 89 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 90 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 91 SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growing generic drugs market drives the demand for pharmaceutical processing seals in the country

TABLE 92 BRAZIL: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 93 BRAZIL: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Huge investments in R&D activities in the pharmaceutical industry and the presence of strong locally-owned laboratories are the governing factors for the market

TABLE 94 ARGENTINA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 95 ARGENTINA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.3 REST OF SOUTH AMERICA

TABLE 96 REST OF SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 97 REST OF SOUTH AMERICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

TABLE 98 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2016–2018 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.1 SAUDI ARABIA

9.6.1.1 New government initiatives for the development of the pharmaceutical industry is driving the pharmaceutical processing seals market in the country

TABLE 106 SAUDI ARABIA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 107 SAUDI ARABIA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.2 UAE

9.6.2.1 Growing pharmaceutical industry due to the development of generic drugs market is boosting the market for pharmaceutical processing seals in the UAE

TABLE 108 UAE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 109 UAE: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 110 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 111 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL PROCESSING SEALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 106)

10.1 INTRODUCTION

FIGURE 21 EXPANSION OF FACILITIES IS A KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

10.2 MARKET SHARE ANALYSIS

FIGURE 22 MARKET SHARE, BY KEY PLAYERS (2020)

10.3 KEY MARKET DEVELOPMENT

10.3.1 ACQUISITIONS

10.3.2 NEW PRODUCT LAUNCHES

11 COMPANY PROFILES (Page No. - 110)

(Business overview, Products offered, Recent Developments, MNM view)*

11.1 TRELLEBORG AB

TABLE 112 TRELLEBORG AB: BUSINESS OVERVIEW

FIGURE 23 TRELLEBORG AB: COMPANY SNAPSHOT

TABLE 113 TRELLEBORG AB: PRODUCT OFFERINGS

TABLE 114 TRELLEBORG AB: ACQUISITION

FIGURE 24 TRELLEBORG AB'S CAPABILITY IN PHARMACEUTICAL PROCESSING SEALS MARKET

11.2 FREUDENBERG GROUP

TABLE 115 FREUDENBERG GROUP: BUSINESS OVERVIEW

FIGURE 25 FREUDENBERG GROUP: COMPANY SNAPSHOT

TABLE 116 FREUDENBERG GROUP: PRODUCT OFFERINGS

TABLE 117 FREUDENBERG GROUP: ACQUISITION

FIGURE 26 FREUDENBERG GROUP'S CAPABILITY IN PHARMACEUTICAL PROCESSING SEALS MARKET

11.3 FLOWSERVE CORPORATION

TABLE 118 FLOWSERVE CORPORATION: BUSINESS OVERVIEW

FIGURE 27 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

TABLE 119 FLOWSERVE CORPORATION: PRODUCT OFFERINGS

FIGURE 28 FLOWSERVE CORPORATION'S CAPABILITY IN PHARMACEUTICAL PROCESSING SEALS MARKET

11.4 JAMES WALKER GROUP

TABLE 120 JAMES WALKER GROUP: BUSINESS OVERVIEW

TABLE 121 JAMES WALKER: PRODUCT OFFERINGS

11.5 PARKER HANNIFIN CORPORATION

TABLE 122 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 29 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

TABLE 123 PARKER HANNIFIN CORPORATION: PRODUCT OFFERINGS

TABLE 124 PARKER HANNIFIN CORPORATION: DEALS

FIGURE 30 PARKER HANNIFIN CORPORATION'S CAPABILITY IN PHARMACEUTICAL SEALS MARKET

11.6 SAINT-GOBAIN SA

TABLE 125 SAINT-GOBAIN SA : BUSINESS OVERVIEW

FIGURE 31 SAINT-GOBAIN SA: COMPANY SNAPSHOT

TABLE 126 SAINT-GOBAIN SA: PRODUCT OFFERINGS

FIGURE 32 SAINT-GOBAIN S.A.'S CAPABILITY IN PHARMACEUTICAL PROCESSING SEALS MARKET

11.7 GARLOCK

TABLE 127 GARLOK: BUSINESS OVERVIEW

TABLE 128 GARLOK: PRODUCT OFFERINGS

11.8 JOHN CRANE

TABLE 129 JOHN CRANE: BUSINESS OVERVIEW

FIGURE 33 JOHN CRANE: COMPANY SNAPSHOT

TABLE 130 JOHN CRANE: PRODUCT OFFERINGS

TABLE 131 JOHN CRANE: ACQUISITION

FIGURE 34 JOHN CRANE'S CAPABILITY IN PHARMACEUTICAL PROCESSING SEALS MARKET

11.9 IDEX CORPORATION

TABLE 132 IDEX GROUP: BUSINESS OVERVIEW

FIGURE 35 IDEX CORPORATION: COMPANY SNAPSHOT

TABLE 133 IDEX CORPORATION: DEALS

FIGURE 36 IDEX GROUP'S CAPABILITY IN PHARMACEUTICAL PROCESSING SEALS MARKET

11.10 TECHNO AD LTD.

TABLE 134 TECHNO AD LTD: BUSINESS OVERVIEW

11.11 PRECISION ASSOCIATES, INC.

TABLE 135 PRECISION ASSOCIATES, INC: BUSINESS OVERVIEW

11.12 MACLELLAN RUBBER LTD.

TABLE 136 MACLELLAN RUBBER LTD: BUSINESS OVERVIEW

11.13 MARCO RUBBER AND PLASTIC PRODUCTS, INC.

TABLE 137 MARCO RUBBER AND PLASTIC PRODUCTS, INC: BUSINESS OVERVIEW

11.14 SEALS AND DESIGN, INC.

TABLE 138 SEALS AND DESIGN, INC: BUSINESS OVERVIEW

11.15 DARCOID OF CALIFORNIA

TABLE 139 DARCOID OF CALIFORNIA: BUSINESS OVERVIEW

11.16 AMERICAN HIGH-PERFORMANCE SEALS

TABLE 140 AMERICAN HIGH-PERFORMANCE SEALS: BUSINESS OVERVIEW

11.17 VULCAN ENGINEERING LIMITED

TABLE 141 VULCAN ENGINEERING LIMITED: BUSINESS OVERVIEW

11.18 CANADA RUBBER GROUP INC.

TABLE 142 CANADA RUBBER GROUP: BUSINESS OVERVIEW

11.19 ETANNOR SEALING SYSTEM

TABLE 143 ETANNOR SEALING SYSTEM: BUSINESS OVERVIEW

11.20 ADDITIONAL COMPANY PROFILES

11.20.1 AESSEAL

11.20.2 EAGLE INDUSTRY CO., LTD.

11.20.3 PERFORMANCE SEALING INC.

11.20.4 TECHNETICS GROUP

11.20.5 C. OTTO GEHRCKENS GMBH AND CO. KG SEAL TECHNOLOGY

11.20.6 WIKA ALEXANDER WIEGAND SE AND CO. KG

11.20.7 INTEC SEALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 155)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for pharmaceutical processing seals. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The pharmaceutical processing seals market comprises several stakeholders such as raw material suppliers, end product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in drug manufacturing industry. The supply side is characterized by market consolidation activities undertaken by the raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

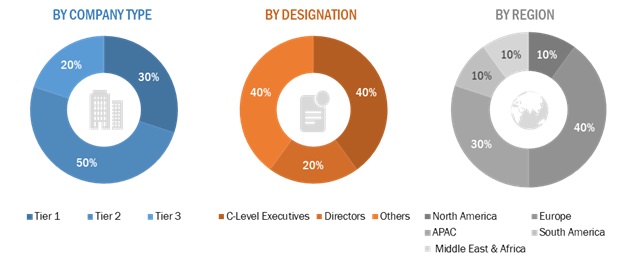

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the pharmaceutical processing seals market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define, describe, and analyze the pharmaceutical processing seals market based on material, type, application, and region

- To forecast and analyze the size of the pharmaceutical processing seals market (in terms of value) in five key regions, namely, (Asia Pacific) APAC, North America, Europe, South America, and the Middle East & Africa

- To forecast and analyze the pharmaceutical processing seals market at the country level in each region

- To strategically analyze each submarket with respect to the individual growth trends and its contribution to the overall pharmaceutical processing seals market

- To analyze the drivers in the pharmaceutical processing seals market for the stakeholders by identifying high-growth segments of the market

- To identify significant market trends and factors driving or inhibiting the growth of the pharmaceutical processing seals market and its submarkets

- To strategically profile the key players in the pharmaceutical processing seals market and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the pharmaceutical processing seals market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pharmaceutical Processing Seals Market