Phytosterols Market by Composition (Beta-Sitosterol, Campesterol, Stigmasterol), Application (Food & Beverages, Pharmaceutical, Cosmetics & Personal Care Products, and Feed), Form( Dry, Liquid), Source and Region - Global Forecast to 2028

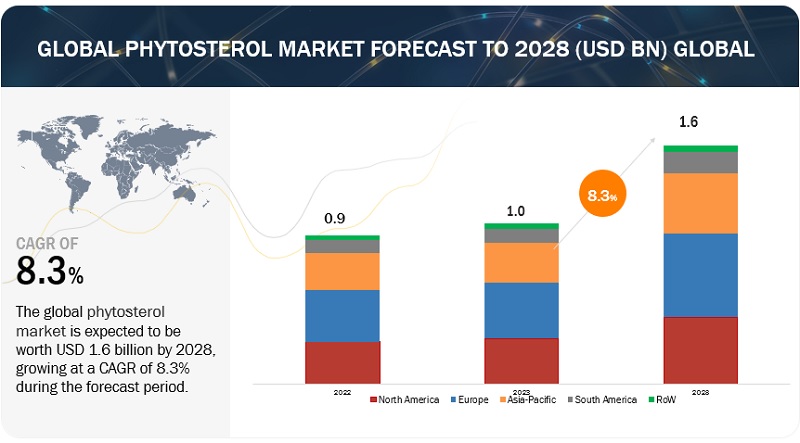

The phytosterol market is projected to reach USD 1.6 billion by 2028 from USD 1.0 billion by 2023, at a CAGR of 8.3% during the forecast period in terms of value. Owing to the increase in demand for health awareness and nutritional foods.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

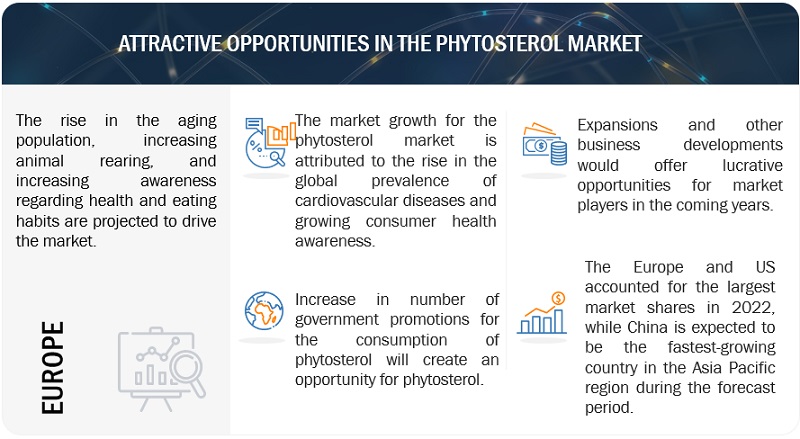

Driver : Growing Demand for Personal and Healthcare Products Fueled by Aging Populations

The World Health Organization predicts that the aging population will continue to grow, with 1 in 6 individuals being aged above 60 years by 2030. Furthermore, Asian economies such as Japan, South Korea, and Singapore are considered to be "advanced agers," with over 14% of their populations being over 60 years of age. As a consequence, the demand for high-quality personal and healthcare products is increasing, especially in the Asia Pacific region. Phytosterols, which are frequently used in anti-aging creams and suncare lotions, are among the key ingredients used in the cosmetics and personal care industry. Additionally, phytosterols' anti-inflammatory effects make them suitable for the treatment of atopic eczema and infant skin protection.

Restraint : Vitamin Deficiency and its Serious Consequences on Physiological Processes

Vitamins are categorized as either water-soluble or fat-soluble, and are absorbed by the body in a similar manner to dietary fats such as cholesterol. Since phytosterols bear a resemblance to cholesterol in terms of structure, their high consumption could lead to a reduction in the absorption of fat-soluble vitamins that are crucial for maintaining good vision, strong bones, and a healthy immune system. Research published in PubMed in 2011 confirmed this fact, demonstrating that phytosterols market can impede the intestinal absorption of vitamin D in vitro as well as in mice. This, in turn, could lead to deficiencies in fat-soluble vitamins, which could severely impact these physiological processes. Consequently, concerns regarding vitamin deficiency pose a restriction on the phytosterols market to some extent.

Opportunity: Rise in the prevalence of Chronic diseases

Cardiovascular illnesses (CVD) are becoming a rising global problem, with study released in February 2021 stating that CVD, which includes heart disease and stroke, was responsible for one-third of all fatalities globally in 2019. According to the World Health Organisation (WHO), CVD was responsible for 38% of the 17 million premature deaths (under 70 years old) caused by noncommunicable illnesses in 2019. According to the Centres for Disease Control and Prevention, high cholesterol is a key risk factor for a variety of cardiac illnesses. Diabetes, overweight and obesity, poor eating habits, physical inactivity, and excessive alcohol intake are all key contributors to the increased prevalence of heart disease.

Challenge: Lack of consumer awareness in developing and under-developed world

The phytosterols market is mainly driven by its health-imparting properties awareness. As a result, developed regions with high health awareness are a major market for this industry particularly in food, feed, and cosmetics applications. Phytosterols is a very distant concept for people in underdeveloped world and some emerging economies such as Africa and Asia. Most of the phytosterols in these countries are used in pharmaceutical applications. Players and countries in the Asian markets are mostly export-oriented, with respect to phytosterols market.

Various macroeconomic factors such as low development, political instability, poverty, and unemployment are responsible for this status quo in the underdeveloped world. There is a significant lack of health awareness in these regions. They also lack high incomes to dispose in such high-end functional food and personal care products. These factors together pose a major challenge for the players in the phytosterol industry to penetrate the underdeveloped market.

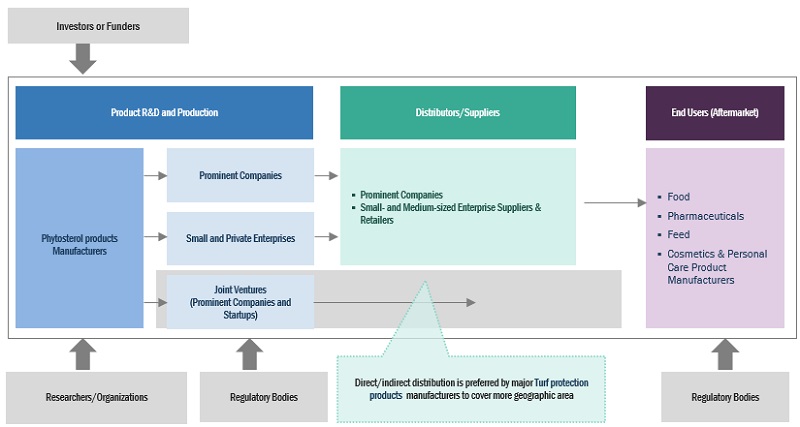

Phytosterol Market Ecosystem

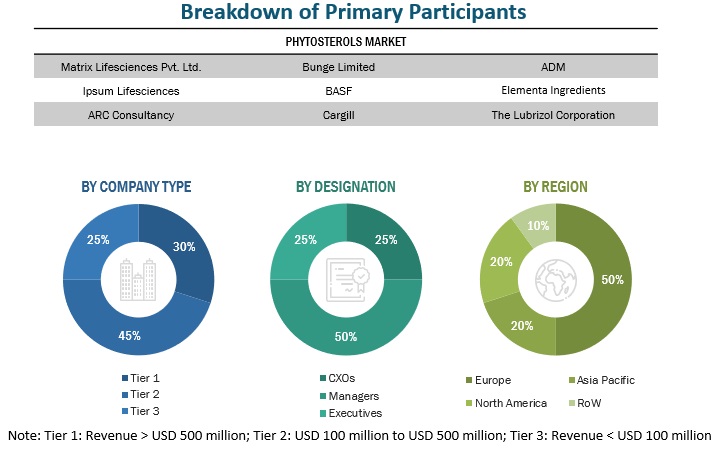

Prominent companies in phytosterols market include well-established, financially stable manufacturers of phytosterol products. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ADM (US), BASF SE (Germany), Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), Ashland (US)Matrix Life Science (India), AOM (Argentina), Lipofoods (Spain), Avanti Polar Lipids (US), DRT (France), Wilmar International Ltd (Singapore), VITAE NATURALS (Spain), TAMA BIOCHEMICALS CO., LTD (Japan), BOC Sciences (US), Herbo Nutra (India).

Adoption of food and beverages application is projected to drive the demand for phytosterol market

Aside from the health advantages of phytosterols, there is a growing need for nutritious and healthful foods and drinks. Consumers are becoming more conscious of the influence of their diet on their health and are seeking for items that will assist them in maintaining a healthy lifestyle. This has resulted in an increased interest in functional foods, which are goods that give health advantages in addition to basic nourishment. Because of their cholesterol-lowering qualities, phytosterols are commonly employed as a component in functional meals. They may be found in a variety of food products including as spreads, dairy products, and baked goods. The demand for these items is likely to increase as people become more health-conscious and seek methods to enhance their diet.

Additionally, only developed regions use phytosterols in nutritious and healthy foods. There is a chance for the phytosterol business to expand its market to undeveloped and emerging nations as knowledge of the health advantages of phytosterols rises in these countries. As was stated in the original article, there are a number of obstacles to be addressed, such as low incomes and the high price of functional meals. Nevertheless, by facilitating access to functional foods that can enhance people's diets and general health, the phytosterol industry has the potential to have a positive impact on the health and well-being of people in these areas.

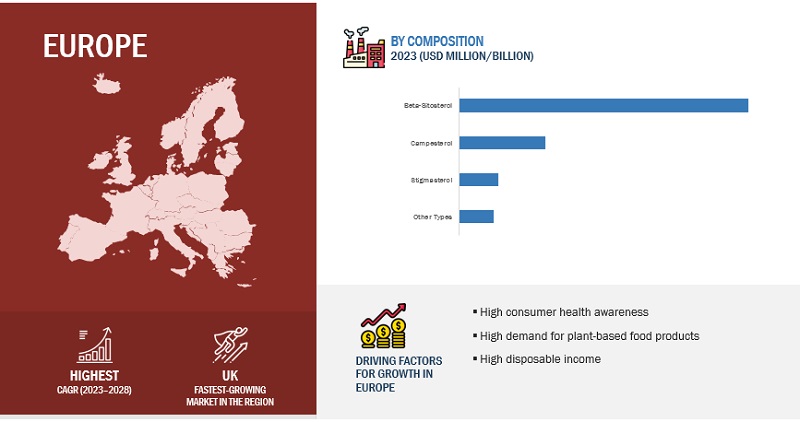

Use of beta-sitosterol in phytosterol is expected to boost the phytosterols market growth

A popular phytosterol because of its many health advantages is beta-sitosterol. Alcohol can dissolve this waxy, white powder that has a unique smell. Due to its greater absorption, its effectiveness surpasses that of other phytosterols. Because beta-sitosterol and cholesterol share a similar structural makeup, they compete for absorption in the intestine, preventing absorption of cholesterol and lowering blood cholesterol levels. Avocados, pumpkin seeds, cashew fruit, excellent bran, wheat germ, maize oils, soybeans, dandelion coffee and cashews are some of the foods that are high in beta-sitosterol. With beta-sitosterols available in their product portfolios for both human and animal use, major market participants including Balso Plc. (Finland), BASF SE (Germany), and Bunge Limited (US) occupy a sizeable portion of the worldwide phytosterol market. Beta-sitosterol is commonly used as a dietary supplement to improve prostate health and to alleviate symptoms of BPH (Benign Prostatic Hyperplasia), a common condition in older men

Use of dry form in phytosterol is expected to rise the phytosterols market growth

The demand for dry form of phytosterols is being fueled by factors such as longer shelf life, lesser processing, and convenient packaging. Phytosterols are typically manufactured in granular and powdered form as this is an easy and efficient process. The dry segment is heavily commercialized due to the fact that phytosterols are naturally available in this form, requiring less processing than their liquid counterparts, which may involve complex techniques such as esterification and ansesterification of phytosterols and fatty acids. Moreover, using phytosterols in dry form ensures precise dosage incorporation in products, making them a preferred choice for use in animal feed, pet food, and feed meals. The Global Food Outlook published in June 2021 reported that compound feed production is increasing globally. As a result, with the rise in food and phytosterol-based meal manufacturing, the demand for phytosterols in dry form is also expected to rise. Additionally, powdered or dry form food ingredients and additives such as phytosterols offer numerous benefits, including longer shelf life, convenient packaging, ease of use in recipes, and ease of storage and transportation.

Europe is expected to dominate the market during the forecast period

The greatest market share belongs to the phytosterols sector in Europe, which is largely driven by increased consumer knowledge of the health advantages of functional food products and their capacity to spend money on luxury personal care items because of high disposable incomes. The well-established cosmetics business in Europe is also active in terms of innovation, and the popularity of cosmetics made from sustainable and natural extracts is what motivates the incorporation of phytosterols into these goods.

In addition, the European Commission encourages the use of plant-based goods and is developing ways for doing so. The per capita consumption of pig, beef, and sheep meat in Europe and other industrialized nations is anticipated to drastically fall by 2030, according to the Agricultural Outlook 2021-2030 by the Organization for Economic Co-operation and Development-Food and Agriculture Organisation (OECD-FAO). The demand for phytosterols in the region is being fueled by the shift in European consumers' eating habits towards flexitarian and vegan diets, since they are utilised in vegan butter substitutes such margarines and spreads. The phytosterols market, especially in the margarine category, will be driven by this change in consumer desire for plant-based food items.

Key Market Players

The key players phytosterols market include ADM (US), BASF SE (Germany), Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), Ashland (US)Matrix Life Science (India), AOM (Argentina), Lipofoods (Spain), Avanti Polar Lipids (US), DRT (France), Wilmar International Ltd (Singapore), VITAE NATURALS (Spain), TAMA BIOCHEMICALS CO., LTD (Japan), BOC Sciences (US), Herbo Nutra (India). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 1.0 billion |

|

Market size value in 2028 |

USD 1.6 billion |

|

Market growth rate |

CAGR of 8.3% |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By Composition, By Application, By Form, By Source, and By Region |

|

Regions covered |

North America, South America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Report Scope:

Phytosterols Market:

By Composition

- Beta-Sitosterol

- Campesterol

- Stigmasterol

- Other Compositions2

By Application

- Food & Beverage

- Dairy Products

- Bakery & Confectionery

- Nutritional Products

- Snacks & Cereals

- Beverages

- Other Food & Beverage Applications1

- Pharmaceuticals

- Cosmetics & Personal Care Products

By Form

- Dry

- Liquid

By Source

- Vegetable Oils

- Nuts and Seeds

- Whole Grains

- Other Sources3

By Region

- North America

- Europe

- Asia Pacific

- South America

- RoW

2Other Compositions include avenasterol, ergosterol, brassicasterol, lupeol, and cycloartenol

3Other Sources include legumes, fruits, and vegetables

Recent Developments

- In January 2022, ADM recently announced the opening of its first Science and Technology (S&T) Center in China. This opening is an important milestone in the Company’s continued investment in order to bring new nutrition and health innovation to meet growing demand in China.

- In November 2021, AOM leading producer of specialty Natural Tocopherols, Vitamin E and Plant Sterols, has recently announced the launch of a major industrial expansion. This project will enhance the company’s manufacturing operations in Spain, making it the first fully integrated manufacturer of tocopherols, sterols and sterol esters in Europe.

Frequently Asked Questions (FAQ):

Which are the major companies in the Phytosterol market? What are their major strategies to strengthen their market presence?

The key players in this ADM (US), BASF SE (Germany), Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), Ashland (US)Matrix Life Science (India), AOM (Argentina), Lipofoods (Spain), Avanti Polar Lipids (US), DRT (France), Wilmar International Ltd (Singapore), VITAE NATURALS (Spain), TAMA BIOCHEMICALS CO., LTD (Japan), BOC Sciences (US), Herbo Nutra (India). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the Phytosterol market?

The phytosterol market is expected to witness significant growth in the future with an increasing global rise in the prevalence of chronic diseases. Developing markets such as China, Brazil, Argentina, and India are emerging as growth prospects for phytosterols fueled by increasing investments in nutritional and functional foods.

Which region is expected to hold the highest market share?

The market in Europe will dominate the market share in 2022, showcasing strong demand from phytosterol products in the region. As consumers become more health conscious and environmentally aware, there is a growing demand for nutritional and functional foods. Phytosterol products are expected to grow in the coming years, driven by increasing population and changing lifestyle.

Which are the key technology trends prevailing in the Phytosterols market?

Phytosterols is a research-intensive industry. With high R&D investments by health-food and plant-based cosmetics & personal care players, new technologies and innovations are expected to thrive in the market. Multiple chemical modification techniques, such as esterification to enhance solubility, and continuous advancements in effective extraction methods are coming up in the market. Newer sources like pumpkin seeds are being explored to derive phytosterols. The usage of phytosterols in end-use industries is promoted with new research and commercialization in the form of hydrophilic phytosterols derivatives. Thus, with gearing market drivers, the demand for phytosterols is expected to grow, pushing innovations and technology breakthroughs in the industry.

What is the total CAGR expected to be recorded for the phytosterol market during 2023-2028?

The CAGR is expected to record a CAGR of 8.3 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASE IN RETAIL SALESGROWTH OPPORTUNITIES IN DEVELOPING COUNTRIES OF ASIA PACIFIC AND SOUTH AMERICA

-

5.3 MARKET DYNAMICSDRIVERS- Rise in consumer health awareness post-COVID-19 pandemic for functional food & beverages- Rising demand for livestock products- Growing demand for superior personal and healthcare productsRESTRAINTS- Side-effects of phytosterols- Concerns regarding vitamin deficiencyOPPORTUNITIES- Global rise in prevalence of chronic diseasesCHALLENGES- High popularity of other functional ingredients- Lack of consumer awareness in developing and under-developed countries

- 6.1 INTRODUCTION

-

6.2 VALUE CHAINRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING & SALES

-

6.3 TECHNOLOGY ANALYSISHYDROPHILIC PHYTOSTEROL DERIVATIVES

-

6.4 PRICING ANALYSIS: PHYTOSTEROLS MARKETAVERAGE SELLING PRICE, BY FORM

-

6.5 MARKET MAPPING AND ECOSYSTEM OF PHYTOSTEROLSDEMAND SIDESUPPLY SIDE

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.7 PHYTOSTEROL MARKET: PATENT ANALYSIS

-

6.8 TRADE ANALYSISSOYBEAN (2021)

- 6.9 KEY CONFERENCES AND EVENTS

-

6.10 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAUSCANADAEUROPEAN UNION- EU Food Law- European Food Safety Authority (EFSA)- EU Cosmetics Regulation (EC) No. 1223/2009ASIA PACIFICCHINAJAPANINDIASOUTH AMERICABRAZILMIDDLE EASTUAE

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 CASE STUDIESADM: SCIENCE AND TECHNOLOGY (S&T) CENTER IN CHINA

- 7.1 INTRODUCTION

-

7.2 FOOD & BEVERAGECONSUMER SHIFT TOWARD HEALTHY AND NUTRITIVE LIFESTYLES TO DRIVE MARKETDAIRY PRODUCTSBAKERY AND CONFECTIONERY PRODUCTSNUTRITIONAL PRODUCTSSNACKS & CEREALSBEVERAGESOTHER FOOD APPLICATIONS

-

7.3 PHARMACEUTICALSINCREASING NUMBER OF AGED POPULATION WORLDWIDE TO SUPPORT MARKET GROWTH

-

7.4 COSMETICS & PERSONAL CARE PRODUCTSHIGH STRESS ON PERSONAL GROOMING TO FUEL DEMAND FOR COSMETIC PRODUCTS- FEEDRISING DEMAND FOR LIVESTOCK PRODUCTS AND CONCERNS REGARDING ANIMAL NUTRITION TO FUEL DEMAND FOR PHYTOSTEROLS

- 8.1 INTRODUCTION

-

8.2 BETA-SITOSTEROLGROWING INCIDENCES OF PROSTATE CANCER AND AGEING POPULATION TO DRIVE DEMAND- CAMPESTEROLGROWTH IN SPORTS AND VETERINARY MEDICINE INDUSTRY TO DRIVE MARKET FOR CAMPESTEROLS- STIGMASTEROLRISE IN DEMAND FOR VITAMIN D3 AND STEROIDS TO DRIVE MARKET

- 8.3 OTHER COMPOSITIONS

- 9.1 INTRODUCTION

-

9.2 VEGETABLE OILSHIGHER CONCENTRATION OF PHYTOSTEROLS IN VEGETABLE OILS TO GIVE RISE TO ITS POPULARITY

-

9.3 NUTS & SEEDSHIGH FIBER CONTENT IN NUTS & SEEDS TO DRIVE MARKET FOR PHYTOSTEROL

-

9.4 WHOLE GRAINSVERSATILITY OF WHOLE GRAINS TO FUEL MARKET FOR PHYTOSTEROLS

- 9.5 OTHER SOURCES

- 10.1 INTRODUCTION

-

10.2 DRYLONGER SHELF LIFE, LESSER PROCESSING, AND CONVENIENT PACKAGING TO FUEL DEMAND

-

10.3 LIQUIDRISE IN DEMAND FOR FOOD AND COSMETIC PRODUCTS IN AQUEOUS MATRIX

- 11.1 INTRODUCTION

- 11.2 MACRO INDICATORS OF RECESSION

-

11.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Consumer inclination toward functional food products due to rise in chronic diseases to drive marketCANADA- Booming food & beverage industry to drive demand for phytosterolsMEXICO- Change in diet patterns and rise in disposable income to propel market- Asia PacificASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Growing demand for phytosterols-based pharma active ingredientsINDIA- Consumer willingness to spend on fortified and enriched food productsJAPAN- Expanding aging population and consumer demandAUSTRALIA & NEW ZEALAND- Rise in aging population and health awarenessREST OF ASIA PACIFIC

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Strong food & beverage retail sales and increasing consumption of plant-based foodFRANCE- Government measures to increase production of healthy and sustainable plant-based productsUK- Large consumer base with increased health awarenessITALY- Dominant position in pharmaceutical sector and rising consumer preference for healthy food productsSPAIN- High demand for non-dairy products such as margarineREST OF EUROPE

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Boost in soybean production to drive marketARGENTINA- Rise in market volume of plant-based sector to impact phytosterols industryREST OF SOUTH AMERICA

-

11.6 ROWROW: RECESSION IMPACT ANALYSISAFRICA- Surge in cases of CVDs to drive demandMIDDLE EAST- Rising incidences of diabetes and cardiac diseases to fuel demand

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 PRODUCT FOOTPRINT

-

12.7 GLOBAL PHYTOSTEROLS MARKET: EVALUATION QUADRANT FOR START-UPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

12.8 COMPETITIVE SCENARIODEALSOTHERS

-

13.1 KEY COMPANIESADM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASHLAND- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMATRIX LIFE SCIENCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLIPOFOODS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVANTI POLAR LIPIDS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDRT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWILMAR INTERNATIONAL LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVITAE NATURALS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTAMA BIOCHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOC SCIENCES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHERBO NUTRA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCD BIOPARTICLES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFOODCHEM INTERNATIONAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPIONEER ENTERPRISE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGFN & SELCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMMP INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSLIFESCIENCES LLPXI'AN HEALTHFUL BIOTECHNOLOGY CO., LTDEVONIK INDUSTRIES AGHYPHYTO INC.CANNOILS LLC

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 CAROTENOIDS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 FUNCTIONAL FOOD INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 PHYTOSTEROLS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 PHYTOSTEROLS: AVERAGE SELLING PRICE, BY FORM, 2020–2022 (USD/TON)

- TABLE 4 DRY PHYTOSTEROLS: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 5 LIQUID PHYTOSTEROLS: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 6 PHYTOSTEROLS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 7 PATENTS PERTAINING TO PHYTOSTEROLS MARKET, 2021–2022

- TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF SOYBEAN, 2021 (KG)

- TABLE 9 KEY CONFERENCES AND EVENTS IN PHYTOSTEROLS AND RELATED INDUSTRIES, 2023–2024

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PHYTOSTEROLS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FORMS OF PHYTOSTEROLS (%)

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 16 AOM: INDUSTRIAL EXPANSION IN SPAIN

- TABLE 17 PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 18 PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 19 FOOD & BEVERAGE: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 FOOD & BEVERAGE: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 FOOD & BEVERAGE: PHYTOSTEROLS MARKET, BY SUB-APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 FOOD & BEVERAGE: PHYTOSTEROLS MARKET, BY SUB-APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 PHARMACEUTICALS: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 PHARMACEUTICALS: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 COSMETICS & PERSONAL CARE PRODUCTS: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 COSMETICS & PERSONAL CARE PRODUCTS: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 FEED: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 FEED: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 PHYTOSTEROLS MARKET, BY COMPOSITION, 2019–2022 (USD MILLION)

- TABLE 30 PHYTOSTEROLS MARKET, BY COMPOSITION, 2023–2028 (USD MILLION)

- TABLE 31 BETA-SITOSTEROL: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 BETA-SITOSTEROL: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 CAMPESTEROL: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 CAMPESTEROL: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 STIGMASTEROL: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 STIGMASTEROL: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 OTHER COMPOSITIONS: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 OTHER COMPOSITIONS: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 40 PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 41 PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (KT)

- TABLE 42 PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (KT)

- TABLE 43 DRY: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 DRY: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 DRY: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 46 DRY: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 47 LIQUID: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 LIQUID: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 LIQUID: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 50 LIQUID: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 51 PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 54 PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 55 NORTH AMERICA: PHYTOSTEROLS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: PHYTOSTEROLS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: PHYTOSTEROLS MARKET, BY COMPOSITION, 2019–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: PHYTOSTEROLS MARKET, BY COMPOSITION, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (KT)

- TABLE 64 NORTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (KT)

- TABLE 65 US: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 US: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 CANADA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 CANADA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 MEXICO: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 MEXICO: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY COMPOSITION, 2019–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY COMPOSITION, 2023–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (KT)

- TABLE 80 ASIA PACIFIC: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (KT)

- TABLE 81 CHINA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 CHINA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 INDIA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 INDIA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 JAPAN: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 JAPAN: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 AUSTRALIA & NEW ZEALAND: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 AUSTRALIA & NEW ZEALAND: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: PHYTOSTEROLS MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: PHYTOSTEROLS MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: PHYTOSTEROLS MARKET, BY COMPOSITION, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: PHYTOSTEROLS MARKET, BY COMPOSITION, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 96 EUROPE: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (KT)

- TABLE 100 EUROPE: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (KT)

- TABLE 101 GERMANY: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 GERMANY: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 FRANCE: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 FRANCE: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 UK: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 UK: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 ITALY: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 ITALY: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 SPAIN: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 SPAIN: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY COMPOSITION, 2019–2022 (USD MILLION)

- TABLE 116 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY COMPOSITION, 2023–2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 120 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 121 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (KT)

- TABLE 122 SOUTH AMERICA: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (KT)

- TABLE 123 BRAZIL: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 124 BRAZIL: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 ARGENTINA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 ARGENTINA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 REST OF SOUTH AMERICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 128 REST OF SOUTH AMERICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 ROW: PHYTOSTEROLS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 130 ROW: PHYTOSTEROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 ROW: PHYTOSTEROLS MARKET, BY COMPOSITION, 2019–2022 (USD MILLION)

- TABLE 132 ROW: PHYTOSTEROLS MARKET, BY COMPOSITION, 2023–2028 (USD MILLION)

- TABLE 133 ROW: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 134 ROW: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 ROW: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 136 ROW: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 137 ROW: PHYTOSTEROLS MARKET, BY FORM, 2019–2022 (KT)

- TABLE 138 ROW: PHYTOSTEROLS MARKET, BY FORM, 2023–2028 (KT)

- TABLE 139 AFRICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 140 AFRICA: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST: PHYTOSTEROLS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 MIDDLE EAST: PHYTOSTEROLS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 GLOBAL PHYTOSTEROLS MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 144 STRATEGIES ADOPTED BY KEY PHYTOSTEROLS MANUFACTURERS

- TABLE 145 COMPANY FORM FOOTPRINT

- TABLE 146 COMPANY APPLICATION FOOTPRINT

- TABLE 147 COMPANY REGIONAL FOOTPRINT

- TABLE 148 OVERALL COMPANY FOOTPRINT

- TABLE 149 GLOBAL PHYTOSTEROLS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 150 GLOBAL PHYTOSTEROLS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 151 PHYTOSTEROLS: DEALS, 2018–2022

- TABLE 152 PHYTOSTEROLS: OTHERS, 2019–2022

- TABLE 153 ADM: BUSINESS OVERVIEW

- TABLE 154 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 ADM: OTHERS

- TABLE 156 BASF SE: BUSINESS OVERVIEW

- TABLE 157 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 159 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 CARGILL, INCORPORATED: DEALS

- TABLE 161 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 162 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 164 ASHLAND: BUSINESS OVERVIEW

- TABLE 165 ASHLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 MATRIX LIFE SCIENCE: BUSINESS OVERVIEW

- TABLE 167 MATRIX LIFE SCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 AOM: BUSINESS OVERVIEW

- TABLE 169 AOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 AOM: OTHERS

- TABLE 171 LIPOFOODS: BUSINESS OVERVIEW

- TABLE 172 LIPOFOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 AVANTI POLAR LIPIDS: BUSINESS OVERVIEW

- TABLE 174 AVANTI POLAR LIPIDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 AVANTI POLAR LIPIDS: DEALS

- TABLE 176 DRT: BUSINESS OVERVIEW

- TABLE 177 DRT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 DRT: DEALS

- TABLE 179 WILMAR INTERNATIONAL LTD: BUSINESS OVERVIEW

- TABLE 180 WILMAR INTERNATIONAL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 VITAE NATURALS: BUSINESS OVERVIEW

- TABLE 182 VITAE NATURALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 TAMA BIOCHEMICALS CO., LTD.: BUSINESS OVERVIEW

- TABLE 184 TAMA BIOCHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 BOC SCIENCES: BUSINESS OVERVIEW

- TABLE 186 BOC SCIENCES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 HERBO NUTRA: BUSINESS OVERVIEW

- TABLE 188 HERBO NUTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 CD BIOPARTICLES: BUSINESS OVERVIEW

- TABLE 190 CD BIOPARTICLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 192 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 193 PIONEER ENTERPRISE: BUSINESS OVERVIEW

- TABLE 194 PIONEER ENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 GFN & SELCO: BUSINESS OVERVIEW

- TABLE 196 GFN & SELCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 MMP INC.: BUSINESS OVERVIEW

- TABLE 198 MMP INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 IPSUM LIFESCIENCES LLP: COMPANY OVERVIEW

- TABLE 200 XI’AN HEALTHFUL BIOTECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 201 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 202 HYPHYTO INC.: COMPANY OVERVIEW

- TABLE 203 CANNOILS LLC: COMPANY OVERVIEW

- TABLE 204 ADJACENT MARKETS

- TABLE 205 CAROTENOIDS MARKET, BY FORMULATION, 2017–2026 (USD MILLION)

- TABLE 206 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 PHYTOSTEROLS MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 PHYTOSTEROLS MARKET, BY COMPOSITION, 2023 VS. 2028 (USD MILLION)

- FIGURE 5 PHYTOSTEROLS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 PHYTOSTEROLS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 PHYTOSTEROLS MARKET (VALUE), BY REGION, 2022

- FIGURE 8 RISING CONSUMER HEALTH AWARENESS AND DEMAND FOR PHYTOSTEROL TO DRIVE MARKET

- FIGURE 9 BETA-SITOSTEROL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 10 BETA-SITOSTEROL COMPOSITION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 BAKERY & CONFECTIONERY PRODUCTS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 DRY FORM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 RETAIL AND FOOD SERVICE SALES IN US (USD BILLION)

- FIGURE 15 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020-21

- FIGURE 16 MARKET DYNAMICS

- FIGURE 17 VALUE CHAIN ANALYSIS OF PHYTOSTEROLS MARKET

- FIGURE 18 GLOBAL: AVERAGE SELLING PRICE, BY FORM (USD/TON)

- FIGURE 19 PHYTOSTEROLS: AVERAGE SELLING PRICE, BY COMPANY, 2020–2022 (USD/TON)

- FIGURE 20 PHYTOSTEROLS: MARKET MAP

- FIGURE 21 PHYTOSTEROLS: ECOSYSTEM MAPPING

- FIGURE 22 REVENUE SHIFT FOR PHYTOSTEROLS MARKET

- FIGURE 23 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 24 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 25 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY FORMS

- FIGURE 27 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 28 PHYTOSTEROLS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 GLOBAL PHYTOSTEROLS MARKET, BY COMPOSITION, 2023 VS. 2028 (USD MILLION)

- FIGURE 30 DRY FORM TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 31 PHYTOSTEROLS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 32 INDICATORS OF RECESSION

- FIGURE 33 WORLD INFLATION RATE: 2011-2021

- FIGURE 34 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 35 PHYTOSTEROLS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 36 RECESSION INDICATORS AND THEIR IMPACT ON PHYTOSTEROLS MARKET

- FIGURE 37 GLOBAL PHYTOSTEROLS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 38 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 39 NORTH AMERICAN PHYTOSTEROLS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 40 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 41 ASIA PACIFIC PHYTOSTEROLS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 42 ASIA PACIFIC: PHYTOSTEROLS MARKET SNAPSHOT

- FIGURE 43 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 44 EUROPEAN PHYTOSTEROLS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 45 EUROPE: PHYTOSTEROLS MARKET SNAPSHOT

- FIGURE 46 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 47 SOUTH AMERICAN PHYTOSTEROLS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 49 ROW PHYTOSTEROLS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 50 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022 (USD MILLION)

- FIGURE 51 GLOBAL PHYTOSTEROLS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 52 GLOBAL PHYTOSTEROLS MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UPS/SMES)

- FIGURE 53 ADM: COMPANY SNAPSHOT

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

- FIGURE 55 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 56 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 57 ASHLAND: COMPANY SNAPSHOT

- FIGURE 58 WILMAR INTERNATIONAL LTD: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources—directories and databases, such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial study of the phytosterols market. To obtain and verify critical qualitative and quantitative information and assess prospects, in-depth interviews with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—were conducted. The following figure depicts the research design in drafting this report on the phytosterols market.

Secondary Research

In the secondary research process, various sources, such as the Food and Agriculture Organization (FAO), World Health Organization (WHO), International Association of Consumer Food Organizations (IACFO), Association of Nutrition & Foodservice Professionals (ANFP), Organization of Economic Co-operation and Development (OECD), and academic references pertaining to phytosterols were referred to identify and collect information for this study. The secondary sources also include food journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation, according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include phytosterols manufacturers, suppliers, distributors, and regulatory organizations. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include raw material suppliers, phytosterols manufacturers, food ingredient manufacturers, distributors, and exporters. The primary sources from the demand side include end-user industries such as food & beverage, pharmaceuticals, cosmetics & personal care, and feed.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the phytosterols market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

-

Bottom-up approach:

- The market size was analyzed based on the share of each application of phytosterols market and its penetration within the application and form at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include demand within the supply chain including the food and feed industry; function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the phytosterol market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall phytosterols market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

Phytosterol, also known as plant sterol, is a plant-based compound that competes with dietary cholesterol during intestinal absorption, resulting in lower cholesterol levels. It helps in mitigating cardiovascular and cancer risks. Foods and supplements enriched with phytosterols are consumed globally to meet dietary goals and keep high cholesterol in check. Due to their anti-aging and anti-inflammatory properties, they are also popular in the cosmetics & personal care products industry.

Key Stakeholders

- Raw material suppliers of phytosterols

- Intermediate stakeholders, including distributors, retailers, associations, and regulatory bodies

- Manufacturers and traders of phytosterols

- Manufacturers and traders of food & beverage, pharmaceuticals, cosmetics & personal care products, and feed applications.

- Trade associations and industry bodies

- Government organizations, research organizations, and consulting firms

- Importers and exporters of phytosterols

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- Food Standards Australia New Zealand

- Organization for Economic Co-operation and Development (OECD)

- Good Food Institute (GFI)

- Food Safety and Standards Authority of India (FSSAI)

Report Objectives

Market Intelligence

- Determining and projecting the size of the phytosterols market based on source, type, composition, form, application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the phytosterols market

Competitive Intelligence

- Identifying and profiling the key market players in the phytosterols market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in phytosterols market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European phytosterols market, by key country

- Further breakdown of the Rest of South America phytosterols market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Phytosterols Market