Positron Emission Tomography Market by Product (Standalone PET Systems, PET/CT Systems, PET/MRI Systems), Application (Oncology, Cardiology, Neurology), End User (Hospitals & Surgical Centers, Diagnostic & Imaging Clinics) & Region - Global Forecasts to 2028

Market Growth Outlook Summary

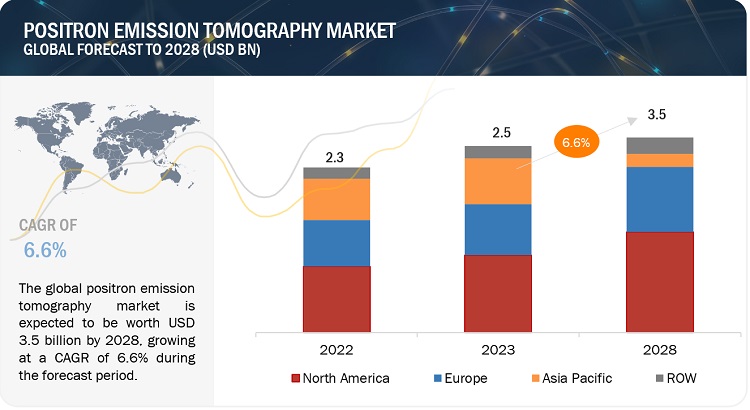

The global positron emission tomography market, valued at US$2.3 billion in 2022, stood at US$2.5 billion in 2023 and is projected to advance at a resilient CAGR of 6.6% from 2023 to 2028, culminating in a forecasted valuation of US$3.5 billion by the end of the period. Technological advancements and new product launches in the radiopharmaceuticals and PET systems, coupled with a growing target patient population, are the key factors driving the adoption of PET systems globally. PET scans are commonly used in the diagnosis, staging, and monitoring of cancer, as well as in the evaluation of neurological and cardiovascular diseases. With the growth in the geriatric population, the incidence of chronic diseases, such as cancer, Alzheimer's disease, and CVD, is increasing. This, in turn, is driving the demand for PET scans. In addition, the development of new PET tracers and the expansion of PET imaging into new clinical applications are also contributing to the increased use of PET scanners.

Global Positron Emission Tomography Market Growth

To know about the assumptions considered for the study, Request for Free Sample Report

Positron Emission Tomography Market Dynamics

Driver: Growing adoption of multimodal PET imaging devices

An emerging trend in the diagnostic imaging industry is the use of hybrid imaging modalities in the field of nuclear imaging. The integration of PET/CT machines has significantly improved imaging capabilities and the diagnosis of cancer. The introduction of a high-precision, low-radiation dose PET/CT machine with strong prognostic power based on value has led to a surge in the uptake of PET/CT equipment by hospitals and diagnostic centers.

For example, in October 2020, Siemens Healthineers launched the Biograph Vision Quadra, a new PET/CT scanner with a 106-cm axial PET field of view (FOV). Biograph Vision Quadra facilitates whole-body imaging from the top of the head to the thigh concurrently. The system is intended for both clinical and research purposes, with a particular emphasis on translational research that leverages scientific discoveries to create novel therapies and techniques.

In November 2021, Minfound Medical System Co., Ltd officially launched MinFound high-end ScintCare TOF PET/CT in Hangzhou, China.

Restraint: High Capital and operational costs

The high cost of purchasing and operating PET scanners can limit their availability and use in healthcare settings. The initial capital costs of PET scanners are expensive, ranging from several hundred thousand to over a million dollars, which can be a significant barrier for hospitals and medical centers with limited budgets. Moreover, PET scanners require ongoing maintenance, calibration, and repair, as well as specialized personnel to operate and interpret the results, leading to additional ongoing costs that can be significant and accumulate over time. These factors make PET scanners a costly investment for many healthcare providers. The high cost of PET scanners can make it difficult for smaller hospitals and medical centers in rural areas to purchase and operate these devices. As a result, patients in these areas may have limited access to PET scans, which can lead to delayed diagnosis and treatment.

According to national service and technology review advisory committee, the cost of capital investment for this option is projected to be more than USD 13 million, while the estimated annual operating expenses are expected to range from USD 2 to USD 3 million.

Opportunity: Increase in PET utilization for the detection of breast cancer

The use of PET scanners for breast cancer is an area of increasing opportunity, as PET imaging can provide valuable information about the extent of disease and treatment response. In breast cancer patients, PET scans can be used to evaluate the extent of the disease and the involvement of lymph nodes, as well as to detect metastases to other organs. In addition, PET scanning can be used to monitor treatment response and to detect recurrent disease. This is particularly important in patients who have undergone neoadjuvant chemotherapy, as PET scanning can help to determine the effectiveness of the treatment and guide further management decisions. The use of PET scanning in breast cancer has been shown to improve the accuracy of staging and to impact treatment decisions in a significant proportion of patients.

A systematic review and meta-analysis published in the journal Cancer Imaging in 2020 evaluated the use of PET scanning in the diagnosis and staging of breast cancer. The analysis found that PET scanning had high diagnostic accuracy for detecting both primary breast tumors and metastatic disease and was particularly useful in detecting bone and distant organ metastases.

As breast cancer incidence continues to rise globally, PET scanners have become an important tool for diagnosis and staging of the disease. PET scanning can help determine the extent and spread of cancer, which can inform treatment decisions and improve outcomes for patients. According to the world health organization in the year 2020, around 2.3 million women were diagnosed with breast cancer, resulting in approximately 685,000 deaths globally.

Challenge: Availability of alternate imaging technologies

While PET scanners are powerful diagnostic tools, they are not the only option available. Other imaging technologies, such as MRI and CT scans, can also provide valuable diagnostic information and may be more widely available and affordable. While PET scanning offers unique advantages, such as its ability to detect metabolic activity in tissues, it may not always be the most appropriate or cost-effective option for every patient. The availability of these alternate imaging technologies means that healthcare providers may need to carefully consider the best imaging modality for each individual patient, taking into account factors such as the patient's age, overall health, and the stage of their cancer.

By product, the spectroscopy segment of the positron emission tomography industry accounted for the largest share in 2022

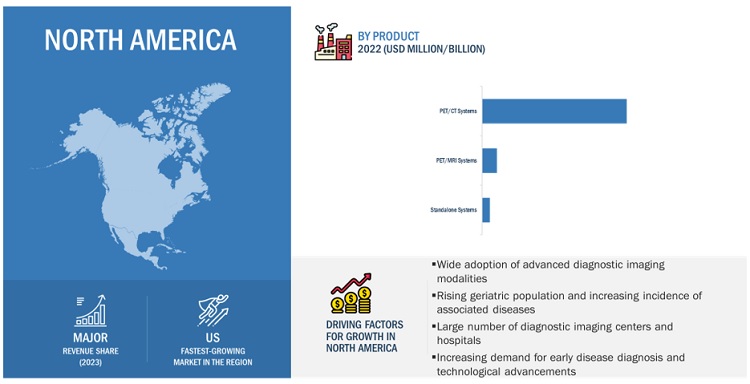

Based on product, the global positron emission tomography market is segmented into standalone PET systems, PET/CT systems, and PET/MRI systems. In 2022, the PET/CT system segment accounted for the largest market share. The rising use of advanced instruments in oncology research and the need for better turnaround time and enhanced precision is driving the segment growth.

By end user, the hospitals and surgical centers companies segment accounted for the largest share of the positron emission tomography industry in 2022

Based on end user, the global positron emission tomography market is segmented into hospitals and surgical centers, diagnostic and imaging clinics, ambulatory surgical centers, and other end users. In 2022, hospitals and surgical centers accounted for the largest market share. The highest share of this segment is attributed to prevailing cases of chronic diseases and increased healthcare investments.

By application, the oncology applications segment of the positron emission tomography industry to register significant growth in the near future

Based on application, the global positron emission tomography market is segmented into oncology, cardiovascular, neurology, and other applications. Oncology applications register the highest growth rate during the forecast period. The major factors responsible for the highest growth rate of this segment are the advanced modalities and increasing cancer cases.

By region, North America is expected to be the largest region of the global positron emission tomography market during the forecast period

North America, comprising the US and Canada, accounted for the largest market share in 2022. Factors such as growing funding for oncology studies, increasing applications in the healthcare/medical sector, and the presence of major players in the region are driving market growth in North America.

To know about the assumptions considered for the study, download the pdf brochure

As of 2021, prominent players in the market are GE Healthcare (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherland), Canon Inc. (Japan), Shanghai United Imaging Healthcare Co., Ltd (China), and Shimadzu Corporation (Japan).

Positron Emission Tomography Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

USD 2.5 billion |

|

Projected Revenue by 2028 |

USD 3.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.6% |

|

Market Driver |

Growing adoption of multimodal PET imaging devices |

|

Market Opportunity |

Increase in PET utilization for the detection of breast cancer |

This report categorizes the global positron emission tomography market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

PET/CT Systems

- Low Slice Scanners

- Medium Slice Scanners

- High Slice Scanners

- PET/MRI Systems

By Application

- Oncology Applications

- Neurological Applications

- Cardiovascular Applications

- Other Applications

By End User

- Hospital & Surgical Centers

- Diagnostic & Imaging Clinics

- Ambulatory Care Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Positron Emission Tomography Market

- In May 2021, Zionexa, a top innovator in in-vivo biomarkers for oncology and neurology, has been acquired by GE Healthcare. This acquisition will enable GE Healthcare to advance Zionexa's pipeline biomarkers, as well as the recently FDA-approved PET imaging agent, Cerianna (fluoroestradiol F-18). Cerianna can be used in conjunction with biopsy to detect estrogen receptor (ER) positive lesions, providing valuable information for treatment selection in patients with recurrent or metastatic breast cancer. The aim is to bring these biomarkers to market and promote more personalized healthcare.

- In February 2023, United Imaging, a renowned global leader in advanced medical imaging and radiotherapy equipment, participated as a Platinum partner at Arab Health 2023 held in Dubai, UAE from January 30 to February 2. They showcased an extensive range of cutting-edge medical imaging devices including the HD TOF PET/MR uPMR 790, which is capable of producing high-quality images; the uCT 960+, a 16cm detector/640 slice CT scanner that is the fastest cardiac CT scanner in the world; the uMI 780, an ultra-fast high-resolution digital PET/CT scanner; the uMR 680, a 1.5T Wide Bore MRI System with "3T-like" performance, powered by uAiFI; and the uDR 380i Pro, the most compact mobile DR system.

- In May 2022, Mediso Ltd has recently acquired Bartec Technologies Ltd, a UK-based company that specializes in providing and supporting Nuclear Medicine and Molecular Imaging equipment and accessories.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global positron emission tomography market between 2023 and 2028?

The global positron emission tomography market is projected to grow from USD 2.5 billion in 2023 to USD 3.5 billion by 2028, at a CAGR of 6.6%, driven by technological advancements and a growing target patient population.

What are the key factors driving the positron emission tomography market?

Key factors driving the positron emission tomography market include the growing adoption of multimodal PET imaging devices, advancements in radiopharmaceuticals, and an increasing incidence of chronic diseases such as cancer, Alzheimer's, and cardiovascular diseases.

What are the main challenges facing the positron emission tomography market?

The positron emission tomography market faces challenges such as high capital and operational costs associated with PET scanners, which can limit their availability and access in healthcare settings.

Which regions are expected to show growth in the positron emission tomography market?

North America is expected to be the largest region for the positron emission tomography market, driven by growing funding for oncology studies, increased applications in healthcare, and the presence of major players.

What are the key applications of positron emission tomography?

Key applications of positron emission tomography include oncology, cardiology, and neurology, with oncology applications registering the highest growth due to increasing cancer cases.

How is the growing geriatric population affecting the positron emission tomography market?

The rising geriatric population is increasing the incidence of chronic diseases, thereby driving the demand for positron emission tomography for effective diagnosis and treatment monitoring.

What technological advancements are influencing the positron emission tomography market?

Technological advancements such as the development of hybrid imaging modalities like PET/CT and PET/MRI systems are significantly enhancing the imaging capabilities and diagnostic accuracy of PET scans.

What role do hospitals play in the positron emission tomography market?

Hospitals and surgical centers account for the largest share of the positron emission tomography market, driven by the prevalence of chronic diseases and increased healthcare investments.

What recent developments are shaping the positron emission tomography market?

Recent developments include advancements in PET technology, such as GE Healthcare's acquisition of Zionexa for oncology biomarkers and the launch of new PET/CT scanners, which enhance diagnostic capabilities.

How does the availability of alternative imaging technologies impact the positron emission tomography market?

The availability of alternative imaging technologies like MRI and CT scans presents challenges for the positron emission tomography market, as healthcare providers must consider the best imaging modality for each patient based on various factors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising target patient population- Growing adoption of multimodal PET imaging devices- Technological advancements in radiopharmaceuticals and PET systems- Increasing investments, funds, and grants by public-private organizationsRESTRAINTS- High capital and operational costs- Unfavorable regulatory guidelinesOPPORTUNITIES- Improving healthcare infrastructure across emerging economies- Increasing use of PET in breast cancer detection- Promising product pipelineCHALLENGES- Availability of alternate imaging technologies

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTPROCUREMENT AND PRODUCT DEVELOPMENTMARKETING, SALES AND DISTRIBUTION, AND POST-SALES SERVICES

-

5.5 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED ENTERPRISESEND USERS

-

5.6 ECOSYSTEM COVERAGE

-

5.7 PATENT ANALYSIS

-

5.8 TRADE ANALYSISTRADE ANALYSIS: POSITRON EMISSION TOMOGRAPHY MARKET

- 5.9 KEY CONFERENCES AND EVENTS (2023–2025)

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 CASE STUDIESTECHNOLOGICAL CHALLENGESLOWERING DEPENDENCE ON CONTRACT MANUFACTURING

- 5.12 PRICING ANALYSIS

-

5.13 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia

- 6.1 INTRODUCTION

-

6.2 STANDALONE PET SYSTEMSFEWER TECHNOLOGICAL ADVANCEMENTS TO AFFECT MARKET GROWTH

-

6.3 PET/CT SYSTEMSLOW-SLICE SCANNERS- Smaller size and lower cost of scanners to drive growthMEDIUM-SLICE SCANNERS- Better picture resolution to propel growthHIGH-SLICE SCANNERS- Increased patient throughput to boost growth

-

6.4 PET/MRI SYSTEMSINCREASING NUMBER OF INSTALLED SYSTEMS TO PROPEL GROWTH

- 7.1 INTRODUCTION

-

7.2 ONCOLOGY APPLICATIONSLAUNCH OF ADVANCED PET SCANNERS FOR DIAGNOSING AND TREATING CANCER TO DRIVE GROWTH

-

7.3 NEUROLOGICAL APPLICATIONSINCREASING PREVALENCE OF NEUROLOGICAL DISORDERS TO DRIVE GROWTH

-

7.4 CARDIOVASCULAR APPLICATIONSINCREASING GERIATRIC POPULATION TO DRIVE GROWTH

- 7.5 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HOSPITALS AND SURGICAL CENTERSMODALITY INTEGRATION ADVANTAGES TO DRIVE GROWTH

-

8.3 DIAGNOSTIC AND IMAGING CLINICSGROWING GERIATRIC POPULATION AND CLINICAL VOLUMES TO SUPPORT MARKET GROWTH

-

8.4 AMBULATORY CARE CENTERSENHANCED COLLABORATION BETWEEN HOSPITALS AND AMBULATORY CENTERS TO DRIVE GROWTH

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Rising geriatric population to boost growthCANADA- Focus on reducing healthcare costs and government investments to drive growth

-

9.3 EUROPEGERMANY- Increasing prevalence of chronic diseases to boost growthFRANCE- Increasing target patient population to propel growthUK- Government initiatives to support market growthITALY- Availability of reimbursement coverage to fuel growthSPAIN- Increasing prevalence of cancer to drive growthREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Healthcare reforms and investments to drive growthJAPAN- Fast adoption of advanced technologies to propel growthINDIA- Improving healthcare infrastructure to drive growthAUSTRALIA- Increasing investments in research to provide opportunities for growthSOUTH KOREA- Presence of advanced healthcare system to drive growthREST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 10.1 OVERVIEW

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN POSITRON EMISSION TOMOGRAPHY MARKET

- 10.3 REVENUE SHARE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPETITIVE LEADERSHIP MAPPING FOR KEY PLAYERS (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

- 10.7 COMPETITIVE SCENARIO AND TRENDS

-

11.1 KEY PLAYERSGE HEALTHCARE- Business overview- Products offered- Recent developments- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Products offered- MnM viewSIEMENS HEALTHINEERS- Business overview- Products offered- Recent developments- MnM viewSHANGHAI UNITED IMAGING HEALTHCARE CO., LTD- Business overview- Products offered- Recent developments- MnM viewCANON INC.- Business overview- Products offered- Recent developments- MnM viewSHIMADZU CORPORATION- Business overview- Products offered- Recent developmentsMEDISO LTD.- Business overview- Products offered- Recent developmentsMINFOUND MEDICAL SYSTEMS CO., LTD- Business overview- Products offered- Recent developmentsNEUSOFT CORPORATION- Business overview- Products offeredONCOVISION- Business overview- Products offeredPOSITRON- Business overview- Products offered- Recent developmentsMOLECUBES NV- Business overview- Products offeredCMR NAVISCAN- Business overview- Products offeredKINDSWAY BIOTECH- Business overview- Products offeredBRAIN BIOSCIENCES, INC.- Business overview- Products offered

-

11.2 OTHER PLAYERSSOFIE BIOSCIENCESPRESCIENT MEDICAL IMAGINGREFLEXIONCUBRESA INC.SYNCHROPET, INC.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 POSITRON EMISSION TOMOGRAPHY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 SUPPLY CHAIN ECOSYSTEM

- TABLE 3 IMPORT DATA FOR POSITRON EMISSION TOMOGRAPHY (HS CODE 902212), BY COUNTRY, 2018–2022 (USD)

- TABLE 4 EXPORT DATA FOR POSITRON EMISSION TOMOGRAPHY (HS CODE 902212), BY COUNTRY, 2018–2022 (USD)

- TABLE 5 POSITRON EMISSION TOMOGRAPHY MARKET: LIST OF MAJOR CONFERENCES AND EVENTS

- TABLE 6 CASE STUDY 1: DEVELOPING AND IMPROVING MEDICAL IMAGING TECHNOLOGIES

- TABLE 7 CASE STUDY 2: DEPENDENCE ON CONTRACT MANUFACTURING AND OUTSOURCING

- TABLE 8 REGION-WISE PRICE RANGE FOR PET SYSTEMS

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 11 POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (UNITS)

- TABLE 12 STANDALONE PET SYSTEMS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 13 STANDALONE PET SYSTEMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 14 STANDALONE PET SYSTEMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 15 PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 16 PET/CT SYSTEMS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 17 PET/CT SYSTEMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 18 PET/CT SYSTEMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 19 PET/CT SYSTEMS MARKET FOR LOW-SLICE SCANNERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 20 PET/CT SYSTEMS MARKET FOR LOW-SLICE SCANNERS, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 21 PET/CT SYSTEMS MARKET FOR LOW-SLICE SCANNERS, BY END USER, 2020–2028 (USD MILLION)

- TABLE 22 PET/CT SYSTEMS MARKET FOR MEDIUM-SLICE SCANNERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 23 PET/CT SYSTEMS MARKET FOR MEDIUM-SLICE SCANNERS, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 24 PET/CT SYSTEMS MARKET FOR MEDIUM-SLICE SCANNERS, BY END USER, 2020–2028 (USD MILLION)

- TABLE 25 PET/CT SYSTEMS MARKET FOR HIGH-SLICE SCANNERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 26 PET/CT SYSTEMS MARKET FOR HIGH-SLICE SCANNERS, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 27 PET/CT SYSTEMS MARKET FOR HIGH-SLICE SCANNERS, BY END USER, 2020–2028 (USD MILLION)

- TABLE 28 PET/MRI SYSTEMS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 29 PET/MRI SYSTEMS MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 30 PET/MRI SYSTEMS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 31 POSITRON EMISSION TOMOGRAPHY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 32 POSITRON EMISSION TOMOGRAPHY MARKET FOR ONCOLOGY APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 33 POSITRON EMISSION TOMOGRAPHY MARKET FOR NEUROLOGICAL APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 34 POSITRON EMISSION TOMOGRAPHY MARKET FOR CARDIOVASCULAR APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 35 POSITRON EMISSION TOMOGRAPHY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 36 POSITRON EMISSION TOMOGRAPHY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 37 POSITRON EMISSION TOMOGRAPHY MARKET FOR HOSPITALS AND SURGICAL CENTERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 38 POSITRON EMISSION TOMOGRAPHY MARKET FOR DIAGNOSTIC AND IMAGING CLINICS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 39 POSITRON EMISSION TOMOGRAPHY MARKET FOR AMBULATORY CARE CENTERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 40 POSITRON EMISSION TOMOGRAPHY MARKET FOR OTHER END USERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 41 POSITRON EMISSION TOMOGRAPHY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: POSITRON EMISSION TOMOGRAPHY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: POSITRON EMISSION TOMOGRAPHY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: POSITRON EMISSION TOMOGRAPHY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 47 US: KEY TARGET DISEASE STATISTICS

- TABLE 48 US: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 49 US: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 50 CANADA: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 51 CANADA: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 52 EUROPE: POSITRON EMISSION TOMOGRAPHY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 53 EUROPE: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 54 EUROPE: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 55 EUROPE: POSITRON EMISSION TOMOGRAPHY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 56 EUROPE: POSITRON EMISSION TOMOGRAPHY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 57 GERMANY: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 58 GERMANY: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 59 FRANCE: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 60 FRANCE: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 61 UK: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 62 UK: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 63 ITALY: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 64 ITALY: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 65 SPAIN: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 66 SPAIN: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 67 REST OF EUROPE: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 74 CHINA: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 75 CHINA: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 76 JAPAN: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 77 JAPAN: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 78 INDIA: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 79 INDIA: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 80 AUSTRALIA: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 81 AUSTRALIA: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 82 SOUTH KOREA: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 83 SOUTH KOREA: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 86 REST OF THE WORLD: POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 87 REST OF THE WORLD: PET/CT SYSTEMS MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 88 REST OF THE WORLD: POSITRON EMISSION TOMOGRAPHY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 89 REST OF THE WORLD: POSITRON EMISSION TOMOGRAPHY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 90 POSITRON EMISSION TOMOGRAPHY MARKET: DEGREE OF COMPETITION

- TABLE 91 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS

- TABLE 92 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 93 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 94 PRODUCT LAUNCHES

- TABLE 95 DEALS

- TABLE 96 OTHER DEVELOPMENTS

- TABLE 97 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 98 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 99 SIEMENS HEALTHINEERS: COMPANY OVERVIEW

- TABLE 100 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD: COMPANY OVERVIEW

- TABLE 101 CANON INC.: COMPANY OVERVIEW

- TABLE 102 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 103 MEDISO LTD.: COMPANY OVERVIEW

- TABLE 104 MINFOUND MEDICAL SYSTEMS CO., LTD: COMPANY OVERVIEW

- TABLE 105 NEUSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 106 ONCOVISION: COMPANY OVERVIEW

- TABLE 107 POSITRON: COMPANY OVERVIEW

- TABLE 108 MOLECUBES NV: COMPANY OVERVIEW

- TABLE 109 CMR NAVISCAN: COMPANY OVERVIEW

- TABLE 110 KINDSWAY BIOTECH: COMPANY OVERVIEW

- TABLE 111 BRAIN BIOSCIENCES, INC.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 MARKET SIZE ESTIMATION FOR PET SYSTEMS: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 6 REVENUE SHARE ANALYSIS: ILLUSTRATIVE EXAMPLE OF GE HEALTHCARE

- FIGURE 7 POSITRON EMISSION TOMOGRAPHY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 POSITRON EMISSION TOMOGRAPHY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 POSITRON EMISSION TOMOGRAPHY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 POSITRON EMISSION TOMOGRAPHY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT: POSITRON EMISSION TOMOGRAPHY MARKET

- FIGURE 14 RISING PREVALENCE OF TARGET DISEASES TO DRIVE GROWTH

- FIGURE 15 PET/CT SYSTEMS SEGMENT TO DOMINATE NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 16 HOSPITALS AND SURGICAL CENTERS FORM LARGEST END-USER SEGMENT IN ASIA PACIFIC MARKET

- FIGURE 17 LOW-SLICE SCANNERS SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 18 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 POSITRON EMISSION TOMOGRAPHY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 NUMBER OF PET PROCEDURES, BY COUNTRY, 2019 VS. 2022

- FIGURE 21 VALUE CHAIN ANALYSIS—MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- FIGURE 22 SUPPLY CHAIN ANALYSIS

- FIGURE 23 PATENT DETAILS FOR POSITRON EMISSION TOMOGRAPHY (JANUARY 2013–APRIL 2023)

- FIGURE 24 PATENT DETAILS FOR PET/CT SYSTEMS (JANUARY 2013–APRIL 2023)

- FIGURE 25 PATENT DETAILS FOR PET/MRI SYSTEMS (JANUARY 2013–APRIL 2023)

- FIGURE 26 NORTH AMERICA: POSITRON EMISSION TOMOGRAPHY MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY MARKET SNAPSHOT

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN POSITRON EMISSION TOMOGRAPHY MARKET, 2022

- FIGURE 29 MARKET SHARE ANALYSIS OF TOP PLAYERS IN PET/CT MARKET, 2022

- FIGURE 30 POSITRON EMISSION TOMOGRAPHY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR KEY PLAYERS, 2022

- FIGURE 31 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 32 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 33 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2022)

- FIGURE 34 CANON INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 36 NEUSOFT CORPORATION: COMPANY SNAPSHOT (2022)

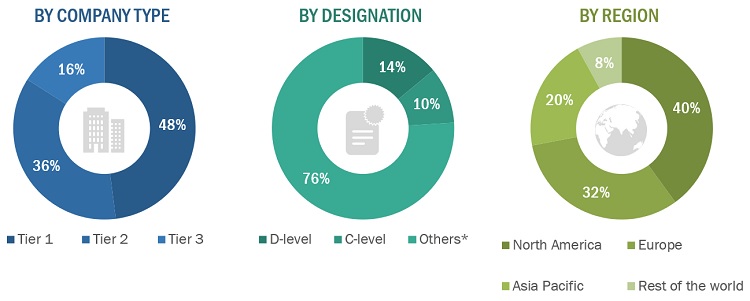

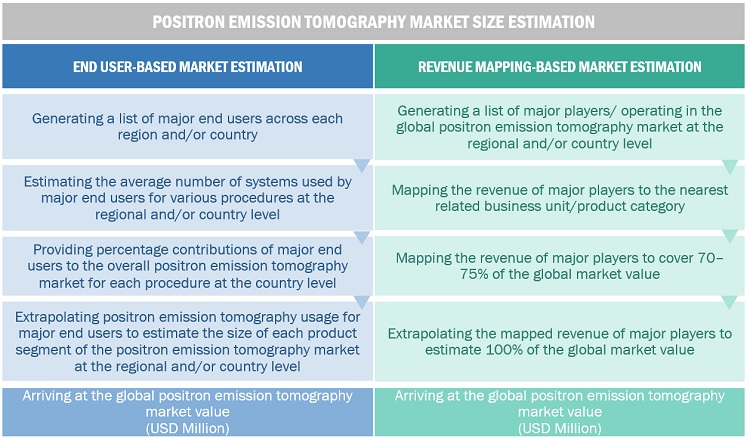

The study involved four major activities in estimating the current size of the positron emission tomography market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial positron emission tomography market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the positron emission tomography market. The primary sources from the demand side include hospitals, diagnostic imaging centers, and ambulatory care centers. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 50 billion, Tier 2 = USD 1 billion to USD 50 billion, Tier 3 = USD 500 million to USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the positron emission tomography market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the positron emission tomography market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2022

- Extrapolating the global value of the positron emission tomography market industry

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global positron emission tomography market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the positron emission tomography market was validated using top-down and bottom-up approaches.

Market Definition

Positron emission tomography (PET) refers to the medical imaging technique that is used to visualize metabolic and functional processes in the body. It involves the use of a radioactive tracer, which emits positrons (positively charged particles) as it decays. PET scans help doctors diagnose and monitor a wide range of medical conditions, including cancer, heart disease, and neurological disorders.

Key Stakeholders

- PET system manufacturers, suppliers, and providers

- PET software solution providers

- Private research institutions

- Private and public hospitals

- Diagnostic centers

- Imaging centers

- Surgical centers

- Consulting firms

Objectives of the Study

- To define, describe, and forecast the positron emission tomography market based on product, type, application, enduser, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to four regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global positron emission tomography market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Positron Emission Tomography Market