Process Analytical Technology Market by Technology (Spectroscopy, Chromatography), Measurement (On-line, In-line, At-line), Product & Service (Analyzers, Probes, Sensors), End User (Pharmaceutical Manufacturers, CROs, CDMO) & Region - Global Forecast to 2027

Process Analytical Technology Market Overview and Growth Projections

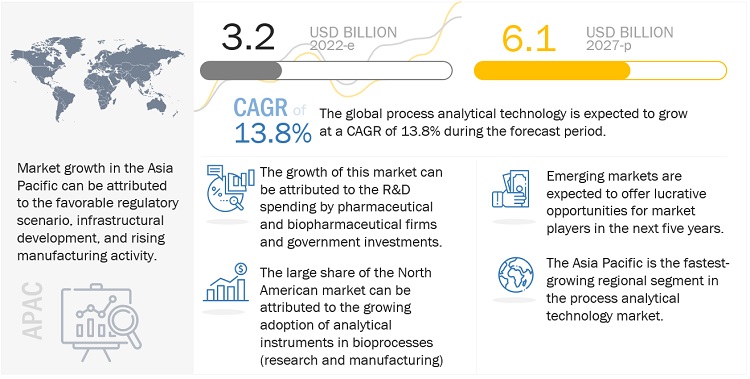

Process analytical technology market growth forecasted to transform from USD 3.2 billion in 2021 to USD 6.1 million by 2027, driven by a CAGR of 13.8%. Growing direct and indirect financial investments in analytical instruments; strategic alliances for drug discovery; growth in the global biosimilar market; and conferences and symposia related to analytical technologies, are driving the growth of this market. While, emerging markets are expected to offer lucrative opportunities for market players in the next five years.

e- Estimated; p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Process Analytical Technology Market Dynamics

Driver: Rising need for quality improvements in manufacturing processes

PAT instruments are robust tools used to analyze and control Critical Quality Attributes (CQAs) in pharmaceutical and biopharmaceutical manufacturing processes by measuring Critical Process Parameters (CPPs). These tools are implemented to increase the efficiency of the production process to obtain quality products and improve the final product's overall performance. PAT allows continuous monitoring of pharmaceutical production by generating real-time product quality information and reduces final batch discarding or reprocessing. The technology aids in controlling costs in the manufacturing process and provides financial benefits through faster product release by eliminating post-production testing. It also reduces the cycle time and energy consumption to run the equipment. Automation in the process thus reduces the overall labor cost.

These benefits of PAT in improving manufacturing process efficiencies are expected to drive market growth during the forecast period.

Restraint: High cost of PAT deployment

The technological developments have increased the prices of these systems. For instance, the cost of a new spectroscopy instrument may vary from USD 75,000 to USD 500,000. The price for an HPLC system ranges from USD 10,000 to USD 40,000, while a dynamic light-scattering particle size analyzer may cost around USD 30,000 to USD 60,000, depending on the associated accessories. Despite the operational and cost-saving benefits of PAT implementation in the pharmaceutical industry, its adoption has been slow in emerging economies.

Opportunity: Emerging markets

Emerging Asian markets such as China, South Korea, Indonesia, and India are expected to offer significant growth opportunities for PAT. This can primarily be attributed to the presence of less-stringent regulatory policies, an increasing number of pharmaceutical companies, the availability of a skilled workforce, and government initiatives to boost local manufacturing. Countries such as China and India present various opportunities for the growth of the market. China and India generate a huge demand for devices such as spectrometers and chromatography instruments due to the Greenfield projects being set up in various end-user industries in these countries. The biopharmaceutical industry in these countries is robust and is expected to contribute largely to the growth of the spectroscopy and chromatography markets in the coming years.

Process Analytical Technology Market Ecosystem:

Source: Knowledge Store

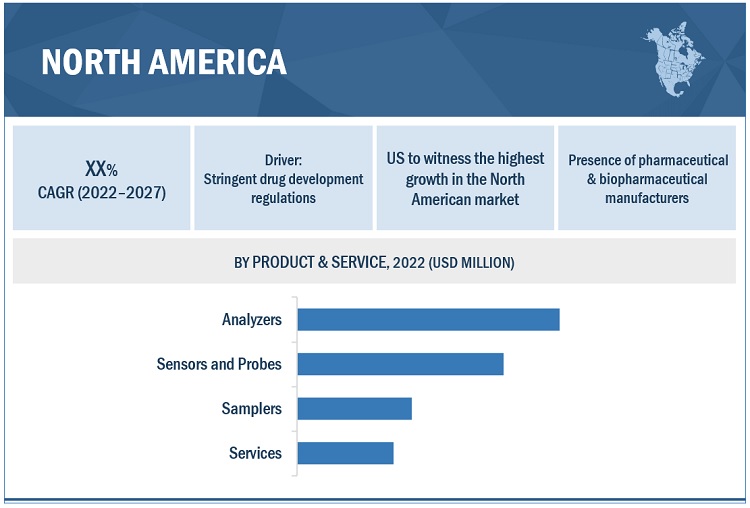

By product & service, analyzers segment accounted for the largest share of the process analytical technology market during the forecast period.

Process analytical products include analyzers, sensors & probes, and samplers, which are used in the R&D and manufacturing process to measure various quality attributes of a sample. The need for effective and efficient drug manufacturing processes, stringent regulations to provide assured product quality and performance, and a growing number of research and development activities in the biopharmaceutical industry are the major factors driving the demand for analyzers in drug manufacturing.

By technology, spectroscopy segment of the process analytical technology market, is expected to grow at the fastest rate during the forecast period.

Based on the type of technology, the global market has been classified into spectroscopy, chromatography, particle size analysis, capillary electrophoresis, and other technologies. The spectroscopy segment is expected to grow at the fastest rate during the forecast period. Mass spectrometry (MS) is used to derive quantitative data for pharmacokinetic & pharmacodynamic drug development along with chromatography. Owing to the broad use of spectroscopy in qualitative and quantitative analysis of pharmaceutical and biopharmaceutical products, the spectroscopy segment to register robust growth in near future.

In terms of application, large molecule segment of the process analytical technology market, to register the highest growth from 2022 to 2027

Based on application, the market is broadly segmented into small molecules, large molecules, manufacturing applications, and other applications. The large molecule segment to register the highest growth from 2022 to 2027. In recent years, biologics research has been at the forefront of drug development, offering treatment options for many medical conditions such as cancer, Rheumatic Arthritis, Psoriasis, Crohn’s disease, and diabetes, among others. Thus, rising incidences of chronic diseases coupled with growing research for developing novel molecules to drive segment growth.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to be the largest market of the process analytical technology market during the forecast period.

North America held major share of the market in 2021 and the trend is expected to continue over the forecast period. The large share of North America can primarily be attributed to the stringent FDA regulations on drug approval & safety; the significant presence of pharmaceutical manufacturers, the high adoption rate of novel technologies. Other factors favoring the growth of this market in North America are increased funding for pharmaceutical and biotechnology research activities and a growing market for biologics.

The key players operating in the global market are Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Shimadzu Corporation (Japan), Waters Corporation (US), Bruker Corporation (US), Emerson Electric Co. (US), ABB Ltd. (Switzerland), PerkinElmer, Inc. (US), Mettler-Toledo International Inc. (US), and Carl Zeiss AG (Germany), among others.

Agilent Technologies, Inc.: Agilent Technologies, Inc. has adopted organic and inorganic growth strategies to ensure its key position in the global analytical technology market. The company's R&D efforts are centered on potential new products and product improvements covering various technologies. The company also focuses on strategic joint ventures to enhance its production and development capabilities.

Process Analytical Technology Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$3.2 billion |

|

Projected Revenue by 2027 |

$6.1 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 13.8% |

|

Market Driver |

Rising need for quality improvements in manufacturing processes |

|

Market Opportunity |

Emerging markets |

This report categorizes the Process Analytical Technology Market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

-

Spectroscopy

-

Molecular Spectroscopy

- Raman Spectroscopy

- IR Spectroscopy

- Other Molecular Spectroscopy

- Atomic Spectroscopy

- Mass Spectrometry

-

Molecular Spectroscopy

-

Chromatography

- High performance liquid chromatography

- Gas Chromatography

- Others

- Particle Size Analysis

- Capillary Electrophoresis

- Other Technologies

By Product & Service

- Analyzers

- Sensors & Probes

- Samplers

- Service

By Application

- Small Molecules

- Large Molecules

- Manufacturing Applications

- Other Applications

By Measurement

- Off-line Measurement

- In-line Measurement

- At-line Measurement

- On-line Measurement

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments:

- In September 2022, Agilent and Mettler Toledo collaboratively introduced a new sample preparation workflow for chromatographic instruments. The new solution delivers fully automated and digitized liquid or gas chromatography workflows.

- In June 2022, Merck and Agilent Technologies entered into a partnership to further expand Agilent Technologies’ (PAT) portfolio of products.

- In April 2022, Thermo Fisher Scientific Inc. released its Ramina Process Analyzer, a Raman spectroscopic analyzer for process monitoring of biopharmaceutical manufacturing

- In March 2022, Thermo Fisher acquired Max Analytical Technologies, a manufacturer of Fourier-transform infrared (FT-IR) spectroscopy-based gas analyzer solutions for process monitoring, source testing, and ambient air monitoring.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global process analytical technology market?

The global process analytical technology market boasts a total revenue value of $6.1 billion by 2027.

What is the estimated growth rate (CAGR) of the global process analytical technology market?

The global market for process analytical technology has an estimated compound annual growth rate (CAGR) of 13.8% and a revenue size in the region of $3.2 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 MARKETS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 PROCESS ANALYTICAL TECHNOLOGY MARKET: RESEARCH DESIGN METHODOLOGY

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARIES: MARKET

2.2 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach 1: Company revenue estimation approach

2.2.1.2 Approach 2: Customer-based market estimation

FIGURE 6 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION

2.2.1.3 Growth forecast

FIGURE 7 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

2.2.2 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

2.5.1 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 9 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY MEASUREMENT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 PROCESS ANALYTICAL MARKET: GEOGRAPHIC MARKET SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 PROCESS ANALYTICAL TECHNOLOGY MARKET OVERVIEW

FIGURE 14 GROWING HEALTHCARE SPENDING BY PHARMACEUTICAL & BIOPHARMACEUTICAL FIRMS TO DRIVE MARKET

4.2 MARKET SHARE, BY TECHNOLOGY 2022 VS. 2027

FIGURE 15 SPECTROSCOPY SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.3 MARKET: BY REGION AND TECHNOLOGY

FIGURE 16 SPECTROSCOPY SEGMENT OF APAC MARKET ACCOUNTED FOR LARGEST SHARE IN 2022

4.4 MARKET: BY REGION AND APPLICATION

FIGURE 17 SMALL MOLECULES SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE IN NORTH AMERICA DURING FORECAST PERIOD

4.5 GEOGRAPHICAL SNAPSHOT OF MARKET

FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 46)

5.1 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Growing pharmaceutical industry & increasing R&D investments by biopharmaceutical firms

5.1.1.2 Government regulations on drug safety

5.1.1.3 Rising need for quality improvements in manufacturing processes

5.1.1.4 Technological advancements in analytical devices

TABLE 1 TECHNOLOGICAL ADVANCEMENTS AND PRODUCT LAUNCHES IN PAT MARKET

5.1.2 RESTRAINTS

5.1.2.1 High cost of PAT deployment

5.1.3 OPPORTUNITIES

5.1.3.1 Emerging markets

5.1.3.2 Growing adoption of analytical instruments in biopharmaceutical processes

5.1.4 CHALLENGES

5.1.4.1 Shortage of skilled professionals

5.2 CURRENT TRENDS

5.2.1 OUTSOURCING SERVICES TO CONTRACT MANUFACTURING ORGANIZATIONS

5.2.2 ADOPTION OF QUALITY BY DESIGN (QBD) PRINCIPLES

5.2.3 EMERGENCE OF IOT AND CLOUD-BASED TECHNOLOGY IN PRODUCTION PROCESSES

5.3 REGULATORY LANDSCAPE

5.3.1 US

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.4 REST OF THE WORLD

5.4 PRICING ANALYSIS

TABLE 2 PRICING TREND ANALYSIS OF MAJOR PAT TECHNOLOGIES, 2020 (USD THOUSAND)

5.5 VALUE CHAIN ANALYSIS

5.5.1 RESEARCH & DEVELOPMENT

5.5.2 PROCUREMENT AND PRODUCT DEVELOPMENT

5.5.3 MARKETING, SALES & DISTRIBUTION, AND POST-SALES SERVICES

FIGURE 20 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

5.6 SUPPLY CHAIN ANALYSIS

5.6.1 PROMINENT COMPANIES

5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.6.3 END USERS

TABLE 3 SUPPLY CHAIN ECOSYSTEM

FIGURE 21 SUPPLY CHAIN ANALYSIS

5.7 MARKET: ECOSYSTEM MAP

5.8 PATENT DETAILS

5.8.1 PATENT DETAILS: PROCESS ANALYTICAL TECHNOLOGY

FIGURE 22 PATENT DETAILS FOR PROCESS ANALYTICAL TECHNOLOGY (JANUARY 2012– SEPTEMBER 2022)

5.8.2 PATENT DETAILS: CHROMATOGRAPHY

FIGURE 23 PATENT DETAILS FOR CHROMATOGRAPHY (JANUARY 2012–SEPTEMBER 2022)

5.8.3 PATENT DETAILS: SPECTROSCOPY

FIGURE 24 PATENT DETAILS FOR SPECTROSCOPY (JANUARY 2012–SEPTEMBER 2022)

5.9 TRADE ANALYSIS

5.9.1 TRADE ANALYSIS: CHROMATOGRAPHY SYSTEMS

TABLE 4 IMPORT DATA FOR CHROMATOGRAPHY SYSTEMS (HS CODE 902720) BY COUNTRY, 2017–2021 (USD)

TABLE 5 EXPORT DATA FOR CHROMATOGRAPHY SYSTEMS (HS CODE 902720) BY COUNTRY, 2017–2021 (USD)

5.9.2 TRADE ANALYSIS: SPECTROMETERS & SPECTROPHOTOMETERS

TABLE 6 IMPORT DATA FOR SPECTROMETERS & SPECTROPHOTOMETERS (HS CODE 902730) BY COUNTRY, 2017–2021 (USD)

TABLE 7 EXPORT DATA FOR SPECTROMETERS & SPECTROPHOTOMETERS (HS CODE 902730) BY COUNTRY, 2017–2021 (USD)

6 PROCESS ANALYTICAL TECHNOLOGY MARKET, BY TECHNOLOGY (Page No. - 64)

6.1 INTRODUCTION

TABLE 8 PROCESS ANALYTICAL MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

6.2 SPECTROSCOPY

TABLE 9 MARKET FOR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 10 MARKET FOR SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

6.2.1 MOLECULAR SPECTROSCOPY

6.2.1.1 Stringent regulatory guidelines for drug development & safety to drive segment growth

TABLE 11 MARKET FOR MOLECULAR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 12 MARKET FOR MOLECULAR SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 MARKET FOR MOLECULAR SPECTROSCOPY, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 14 MARKET FOR MOLECULAR SPECTROSCOPY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 15 MARKET FOR MOLECULAR SPECTROSCOPY, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.1.2 Raman Spectroscopy

6.2.1.2.1 Growing adoption across various industries to drive segment growth

TABLE 16 MARKET FOR RAMAN SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

6.2.1.3 Infrared Spectroscopy (IR)

6.2.1.3.1 Rising technological advancements to support segment growth

TABLE 17 MARKET FOR INFRARED SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

6.2.1.4 Other Molecular Spectroscopy

TABLE 18 MARKET FOR OTHER MOLECULAR SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

6.2.2 MASS SPECTROMETRY

6.2.2.1 Growing demand for dual mass analyzers to drive segment growth

TABLE 19 MARKET FOR MASS SPECTROMETRY, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 MARKET FOR MASS SPECTROMETRY, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 21 MARKET FOR MASS SPECTROMETRY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 22 MARKET FOR MASS SPECTROMETRY, BY APPLICATION, 2020–2027 (USD MILLION)

6.2.3 ATOMIC SPECTROSCOPY

6.2.3.1 Wide applications in drug research to drive market

TABLE 23 MARKET FOR ATOMIC SPECTROSCOPY, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 MARKET FOR ATOMIC SPECTROSCOPY, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 25 MARKET FOR ATOMIC SPECTROSCOPY, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 26 MARKET FOR ATOMIC SPECTROSCOPY, BY APPLICATION, 2020–2027 (USD MILLION)

6.3 CHROMATOGRAPHY

TABLE 27 PROCESS ANALYTICAL TECHNOLOGY MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 28 MARKET FOR CHROMATOGRAPHY, BY REGION, 2020–2027 (USD MILLION)

6.3.1 LIQUID CHROMATOGRAPHY (LC) SYSTEMS

6.3.1.1 High adoption of HPLC systems in analytical & preparative analytical applications to support market growth

TABLE 29 DIFFERENTIATION OF LIQUID CHROMATOGRAPHY SYSTEMS

TABLE 30 MARKET FOR LIQUID CHROMATOGRAPHY SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 31 MARKET FOR LIQUID CHROMATOGRAPHY SYSTEMS, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 32 MARKET FOR LIQUID CHROMATOGRAPHY SYSTEMS, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 33 MARKET FOR LIQUID CHROMATOGRAPHY SYSTEMS, BY APPLICATION, 2020–2027 (USD MILLION)

6.3.2 GAS CHROMATOGRAPHY (GC) SYSTEMS

6.3.2.1 Increasing utilization of miniaturized GC systems in production plants to support segment growth

TABLE 34 MARKET FOR GAS CHROMATOGRAPHY SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 MARKET FOR GAS CHROMATOGRAPHY SYSTEMS, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 36 MARKET FOR GAS CHROMATOGRAPHY SYSTEMS, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 37 MARKET FOR GAS CHROMATOGRAPHY SYSTEMS, BY APPLICATION, 2020–2027 (USD MILLION)

6.3.3 OTHER CHROMATOGRAPHY SYSTEMS

TABLE 38 MARKET FOR OTHER CHROMATOGRAPHY SYSTEMS, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 MARKET FOR OTHER CHROMATOGRAPHY SYSTEMS, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 40 MARKET FOR OTHER CHROMATOGRAPHY SYSTEMS, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 41 MARKET FOR OTHER CHROMATOGRAPHY SYSTEMS, BY APPLICATION, 2020–2027 (USD MILLION)

6.4 PARTICLE SIZE ANALYSIS

6.4.1 RISING NEED FOR QUALITY DRUGS WITH FEWER SIDE EFFECTS TO SUPPORT MARKET ADOPTION

TABLE 42 MARKET FOR PARTICLE SIZE ANALYSIS, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 MARKET FOR PARTICLE SIZE ANALYSIS, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 44 MARKET FOR PARTICLE SIZE ANALYSIS, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 45 MARKET FOR PARTICLE SIZE ANALYSIS, BY APPLICATION, 2020–2027 (USD MILLION)

6.5 CAPILLARY ELECTROPHORESIS

6.5.1 COMPLETE AUTOMATION AND HIGH EFFICIENCY & RESOLUTION TO DRIVE MARKET

TABLE 46 MARKET FOR CAPILLARY ELECTROPHORESIS, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 MARKET FOR CAPILLARY ELECTROPHORESIS, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 48 MARKET FOR CAPILLARY ELECTROPHORESIS, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 49 MARKET FOR CAPILLARY ELECTROPHORESIS, BY APPLICATION, 2020–2027 (USD MILLION)

6.6 OTHER TECHNOLOGIES

TABLE 50 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 MARKET FOR OTHER TECHNOLOGIES, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 52 MARKET FOR OTHER TECHNOLOGIES, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 53 MARKET FOR OTHER TECHNOLOGIES, BY APPLICATION, 2020–2027 (USD MILLION)

7 PROCESS ANALYTICAL TECHNOLOGY MARKET, BY PRODUCT & SERVICE (Page No. - 91)

7.1 INTRODUCTION

TABLE 54 MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

7.2 PRODUCT

TABLE 55 MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 56 MARKET BY REGION, 2020–2027 (USD MILLION)

7.2.1 ANALYZERS

7.2.1.1 Rising technological advancements to support segment growth

TABLE 57 MARKET FOR ANALYZERS, BY REGION, 2020–2027 (USD MILLION)

7.2.2 SENSORS AND PROBES

7.2.2.1 Automated and high turnaround time to support market adoption

TABLE 58 MARKET FOR SENSORS AND PROBES, BY REGION, 2020–2027 (USD MILLION)

7.2.3 SAMPLERS

7.2.3.1 Accuracy and high reproducibility to drive market

TABLE 59 MARKET FOR SAMPLERS, BY REGION, 2020–2027 (USD MILLION)

7.3 SERVICES

7.3.1 MANDATORY IMPLEMENTATION OF PAT FRAMEWORK IN PHARMACEUTICAL COMPANIES TO SUPPORT MARKET GROWTH

TABLE 60 MARKET FOR SERVICES, BY REGION, 2020–2027 (USD MILLION)

8 PROCESS ANALYTICAL TECHNOLOGY MARKET, BY APPLICATION (Page No. - 98)

8.1 INTRODUCTION

TABLE 61 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 SMALL MOLECULES

8.2.1 RISING NUMBER OF STARTUPS FOCUSING ON SMALL-MOLECULE DRUG DEVELOPMENT TO DRIVE MARKET

TABLE 62 MARKET FOR SMALL MOLECULES, BY TYPE, 2020–2027 (USD MILLION)

8.2.2 MANUFACTURING QC/QA

8.2.2.1 API manufacturing process widely utilizes chromatography techniques

TABLE 63 SMALL MOLECULES MARKET FOR MANUFACTURING QC/QC, BY REGION, 2020–2027 (USD MILLION)

8.2.3 DRUG DISCOVERY & DEVELOPMENT

8.2.3.1 Rising focus of pharma companies on novel API development to support segment growth

TABLE 64 SMALL MOLECULES MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2020–2027 (USD MILLION)

8.3 LARGE MOLECULES

8.3.1 INCREASING R&D ACTIVITIES IN PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES TO DRIVE MARKET

TABLE 65 MARKET FOR LARGE MOLECULES, BY TYPE, 2020–2027 (USD MILLION)

8.3.2 MANUFACTURING QC/QA

8.3.2.1 Growing applications of IR spectroscopy in biologics manufacturing to support segment growth

TABLE 66 LARGE MOLECULES MARKET FOR MANUFACTURING QC/QC, BY REGION, 2020–2027 (USD MILLION)

8.3.3 DRUG DISCOVERY & DEVELOPMENT

8.3.3.1 Rapid growth in biologics to support segment growth

TABLE 67 LARGE MOLECULES MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2020–2027 (USD MILLION)

8.4 MANUFACTURING APPLICATIONS

8.4.1 UNTAPPED OPPORTUNITIES IN PETROLEUM & CHEMICAL MANUFACTURING INDUSTRIES TO DRIVE MARKET

TABLE 68 MARKET FOR MANUFACTURING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

8.5 OTHER APPLICATIONS

TABLE 69 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

9 PROCESS ANALYTICAL TECHNOLOGY MARKET, BY MEASUREMENT (Page No. - 106)

9.1 INTRODUCTION

TABLE 70 COMPARISON BETWEEN MEASUREMENT METHODS IN PAT

TABLE 71 MARKET, BY MEASUREMENT, 2020–2027 (USD MILLION)

9.2 ON-LINE MEASUREMENT

9.2.1 MOST PREFERRED METHOD OWING TO HIGH CONSISTENCY AND ACCURACY

TABLE 72 MARKET FOR ON-LINE MEASUREMENT, BY REGION, 2020–2027 (USD MILLION)

9.3 IN-LINE MEASUREMENT

9.3.1 SHORTER TURNAROUND TIME TO DRIVE SEGMENT GROWTH

TABLE 73 MARKET FOR IN-LINE MEASUREMENT, BY REGION, 2020–2027 (USD MILLION)

9.4 AT-LINE MEASUREMENT

9.4.1 DETECTION OF MOISTURE CONTENT IN POWDERED PHARMACEUTICAL FORMULATIONS TO SUPPORT SEGMENT GROWTH

TABLE 74 MARKET FOR AT-LINE MEASUREMENT, BY REGION, 2020–2027 (USD MILLION)

9.5 OFF-LINE MEASUREMENT

9.5.1 HIGH TURNAROUND TIME TO RESTRAIN SEGMENT GROWTH

TABLE 75 MARKET FOR OFF-LINE MEASUREMENT, BY REGION, 2020–2027 (USD MILLION)

10 PROCESS ANALYTICAL TECHNOLOGY MARKET, BY REGION (Page No. - 112)

10.1 INTRODUCTION

TABLE 76 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 STRINGENT DRUG DEVELOPMENT REGULATIONS AND PRESENCE OF PHARMA & BIOPHARMA COMPANIES TO DRIVE MARKET

FIGURE 25 NORTH AMERICA: PROCESS ANALYTICAL TECHNOLOGY MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET FOR MOLECULAR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.3 EUROPE

10.3.1 SIGNIFICANT INVESTMENTS IN API MANUFACTURING TO FUEL DEMAND FOR PAT INSTRUMENTS

TABLE 84 EUROPE: PROCESS ANALYTICAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET FOR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET FOR MOLECULAR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 FAVORABLE GOVERNMENT POLICIES AND INCREASING FOREIGN INVESTMENTS TO DRIVE MARKET

FIGURE 26 ASIA PACIFIC: PROCESS ANALYTICAL TECHNOLOGY MARKET SNAPSHOT

TABLE 91 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET FOR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET FOR MOLECULAR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 GROWING BIOPHARMACEUTICAL & PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

TABLE 98 LATIN AMERICA: PROCESS ANALYTICAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET FOR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET FOR MOLECULAR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 LATIN AMERICA: MARKET, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 103 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 104 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 RISING GOVERNMENT HEALTHCARE SPENDING TO DRIVE MARKET

TABLE 105 MIDDLE EAST & AFRICA: PROCESS ANALYTICAL TECHNOLOGY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: MARKET FOR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MARKET FOR MOLECULAR SPECTROSCOPY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: MARKET FOR CHROMATOGRAPHY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY MEASUREMENT, 2020–2027 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 134)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN PAT MARKET

11.3 REVENUE SHARE ANALYSIS

FIGURE 27 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN PAT MARKET

11.4 PROCESS ANALYTICAL TECHNOLOGY MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2021)

TABLE 112 MARKET: DEGREE OF COMPETITION

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 28 PROCESS ANALYTICAL TECHNOLOGY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR KEY PLAYERS (2021)

11.6 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 29 PROCESS ANALYTICAL TECHNOLOGY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES (2021)

11.7 COMPETITIVE BENCHMARKING

TABLE 113 MARKET: PRODUCT & GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS

TABLE 114 COMPANY TECHNOLOGY FOOTPRINT

TABLE 115 COMPANY GEOGRAPHICAL FOOTPRINT

11.8 COMPETITIVE SITUATION AND TRENDS

TABLE 116 PRODUCT LAUNCHES

TABLE 117 DEALS

TABLE 118 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 147)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 THERMO FISHER SCIENTIFIC INC.

TABLE 119 THERMO FISHER SCIENTIFIC INC: COMPANY OVERVIEW

FIGURE 30 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT (2021)

12.1.2 AGILENT TECHNOLOGIES, INC.

TABLE 120 AGILENT TECHNOLOGIES, INC: COMPANY OVERVIEW

FIGURE 31 AGILENT TECHNOLOGIES, INC: COMPANY SNAPSHOT (2021)

12.1.3 DANAHER CORPORATION (AB SCIEX LLC)

TABLE 121 DANAHER CORPORATION: COMPANY OVERVIEW

FIGURE 32 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.4 WATERS CORPORATION

TABLE 122 WATERS CORPORATION: COMPANY OVERVIEW

FIGURE 33 WATERS CORPORATION: COMPANY SNAPSHOT

12.1.5 BRUKER CORPORATION

TABLE 123 BRUKER CORPORATION: COMPANY OVERVIEW

FIGURE 34 BRUKER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.6 PERKINELMER, INC.

TABLE 124 PERKINELMER, INC: COMPANY OVERVIEW

FIGURE 35 PERKINELMER, INC: COMPANY SNAPSHOT (2021)

12.1.7 CARL ZEISS AG (ZEISS GROUP)

TABLE 125 CARL ZEISS AG: COMPANY OVERVIEW

FIGURE 36 CARL ZEISS AG: COMPANY SNAPSHOT (2021)

12.1.8 EMERSON ELECTRIC CO.

TABLE 126 EMERSON ELECTRIC: COMPANY OVERVIEW

FIGURE 37 EMERSON ELECTRIC CO: COMPANY SNAPSHOT (2021)

12.1.9 METTLER-TOLEDO INTERNATIONAL INC.

TABLE 127 METTLER-TOLEDO INTERNATIONAL INC: COMPANY OVERVIEW

FIGURE 38 METTLER-TOLEDO INTERNATIONAL INC: COMPANY SNAPSHOT (2021)

12.1.10 SHIMADZU CORPORATION

TABLE 128 SHIMADZU CORPORATION: COMPANY OVERVIEW

FIGURE 39 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2021)

12.1.11 ABB

TABLE 129 ABB: COMPANY OVERVIEW

FIGURE 40 ABB: COMPANY SNAPSHOT (2021)

12.1.12 SARTORIUS AG

TABLE 130 SARTORIUS AG: COMPANY OVERVIEW

FIGURE 41 SARTORIUS AG: COMPANY SNAPSHOT (2021)

12.1.13 PROCESS INSIGHTS INC.

TABLE 131 PROCESS INSIGHTS INC: COMPANY OVERVIEW

12.1.14 MERCK KGAA

TABLE 132 MERCK KGAA: COMPANY OVERVIEW

FIGURE 42 MERCK: COMPANY SNAPSHOT (2021)

12.1.15 VERUM ANALYTICS, LLC

TABLE 133 VERUM ANALYTICS: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 HAMILTON COMPANY: COMPANY OVERVIEW

12.2.2 VIAVI SOLUTIONS: COMPANY OVERVIEW

12.2.3 ENDRESS+HAUSER: COMPANY OVERVIEW

12.2.4 METROHM: COMPANY OVERVIEW

12.2.5 CONTROL DEVELOPMENT: COMPANY OVERVIEW

13 APPENDIX (Page No. - 202)

13.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.2 CUSTOMIZATION OPTIONS

13.3 RELATED REPORTS

13.4 AUTHOR DETAILS

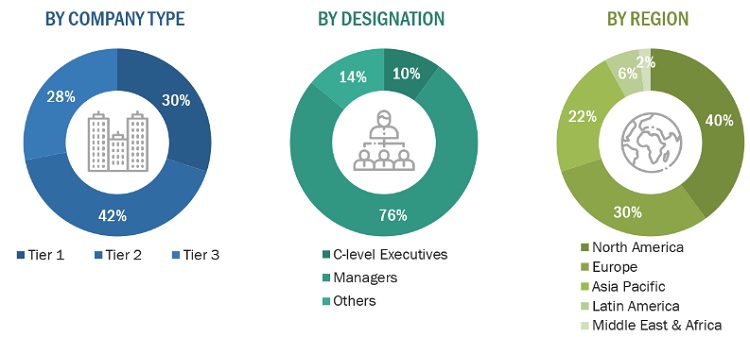

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the process analytical technology market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the process analytical technology market. The primary sources from the demand side include pharmaceutical and biopharmaceutical manufacturer companies, research organizations, academic institutes, and process analytical service providing companies, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*C-level primaries include CEOs, CFOs, COOs, and VPs.

**Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 10 billion, Tier 2 = USD 10 billion to USD 1 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

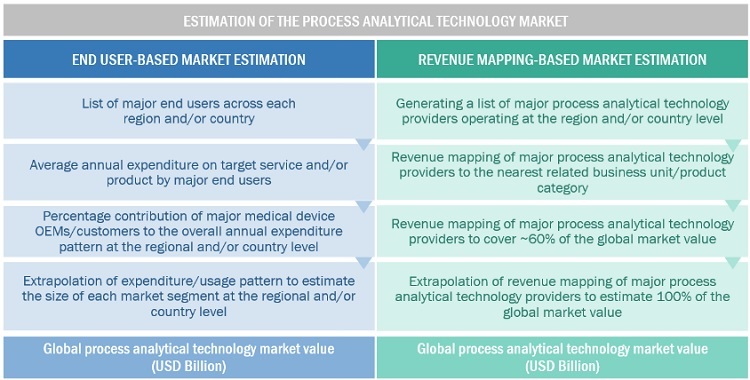

Market Estimation Methodology

In this report, the global process analytical technology market's size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the PAT business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- A list of major players operating in the market at the regional/country level

- Product mapping of various manufacturers for each type of process analytical technology product at the regional/country level

- Mapping of annual revenue generated by listed major players from PAT products segments (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 60% of the global market share as of 2021

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global process analytical technology market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the process analytical technology (PAT) market based on technology, application, measurement, product & service, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the global process analytical technology market

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global market, such as product launches; agreements; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global process analytical technology market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific market into New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Process Analytical Technology Market