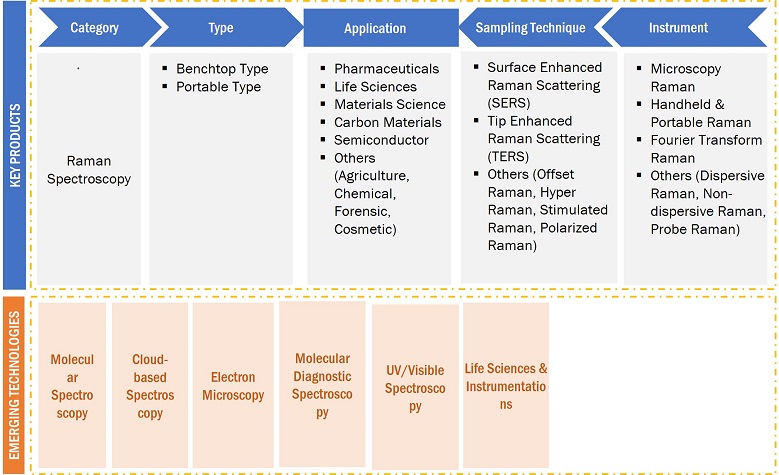

Raman Spectroscopy Market by Type (Benchtop, Portable), Instrument (Microscopy, FT, Handheld & Portable), Sampling Technique (Surface-enhanced Raman Scattering, Tip-enhanced Raman Scattering), Application and Region- Global Forecast to 2028

Updated on : October 22, 2024

Raman Spectroscopy Market Size & Growth

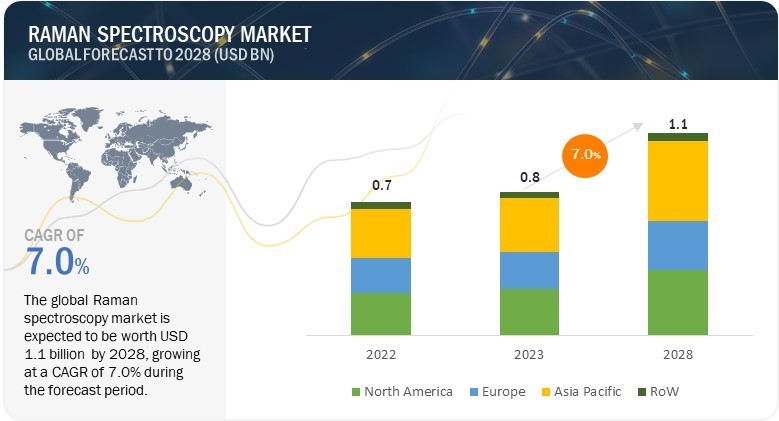

The Raman Spectroscopy Market size is expected to reach USD 1.1 Billion by 2028 from USD 0.8 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2023 to 2028.

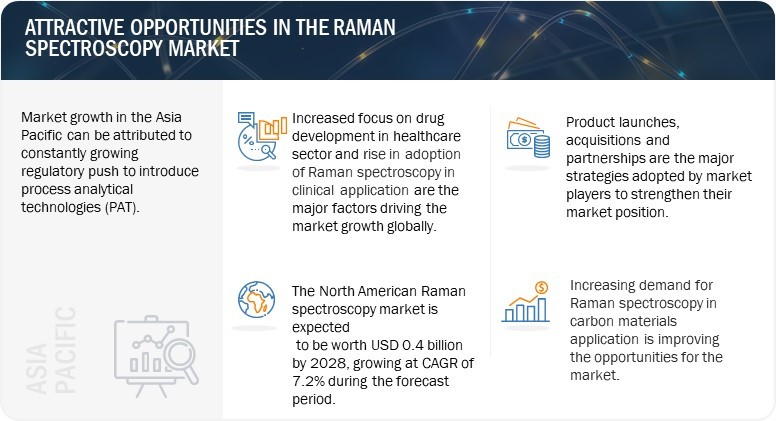

The increased focus on drug development in healthcare is a major factor driving the Raman spectroscopy market. The rising demand for cloud-based spectroscopy will likely provide market growth opportunities. However, the high cost of ownership hinders the growth of the Raman Spectroscopy Industry. The rising demand for precise, accurate, and high-quality Raman spectrometers from end users is propelling the growth of the Raman spectroscopy market worldwide.

Raman Spectroscopy Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Raman Spectroscopy Market Trends and Dynamics:

Driver: Growing awareness regarding food safety

Technologies for food detection are essential for assuring food safety in supply chains. Conventional food contamination detection techniques involve a lot of work, are costly, take a lot of time, and frequently change the food samples. Due to these drawbacks, the food business must create more useful food detection tools that can find contaminants in all three classes. Widespread food safety evaluation using Raman spectroscopy is non-destructive, simple to use, precise, and quick. Food testing has become more popular as the packaged and convenience food industries have expanded. The globalization of the food trade and the increased public knowledge of foodborne illnesses have resulted in stringent guidelines and testing procedures from the food regulatory authorities. Diseases caused by contaminated food are more common in developing and impoverished nations. Many nations are enacting strict food laws to control foodborne diseases. Raman spectroscopy equipment is widely used for quality checks and tracking the levels of preservatives in food, so the development of food safety testing will significantly impact the market. The ability to identify food contaminants has recently been improved by Raman spectroscopic techniques, which significantly broaden their applications in food safety.

Restraint: Lack of awareness regarding potential applications of Raman spectroscopy among end users

Although the scope of the Raman spectroscopy market is immensely high in the food & beverage and pharmaceutical industries, carbon materials, and clinical applications in developing nations, the awareness among the end users of all these applications is low. As it is a relatively newer technique, its usage is more restricted and confined to research institutes and laboratories. This confinement is due to the fact that not many end users are aware of the potential applications that Raman spectroscopy can cater to.

Opportunity: Increasing demand for Raman spectroscopy in carbon materials application

There is a high demand for methods that can be used to characterize carbon nanomaterials due to the degree of interest in the processing, modification, and customization of these materials. One method that has been demonstrated to be particularly effective for many of the characterization needs with these materials is Raman spectroscopy. Highly symmetric covalent links with little to no natural dipole moment are the ones to which Raman spectroscopy is most sensitive. The carbon-carbon bonds that make up these materials precisely meet this criterion, making Raman spectroscopy extremely sensitive to them and able to reveal structural information. Raman spectroscopy is an extremely useful technique for characterizing carbon nanomaterials because it can detect even minute structural changes. Raman spectroscopy can facilitate the analysis of fullerenes, diamonds, graphene, graphite, carbon nanotubes, etc.

Raman micro-spectroscopy is the best technique for examining jewels with commercial potential. Raman analysis is perfect for analyzing even high-value gems like diamonds because it is non-destructive and does not require sample preparation. A stone’s micro-Raman analysis also offers a distinct record for identifying needs. For instance, EnSpectr L365 Spectrometer, a low-cost, handheld spectral analysis tool that provides a fast and easy solution to the issue of identifying colorless natural diamonds, is offered by Enhanced Spectrometry, Inc.

Challenge: Lack of development of low-cost, highly efficient Raman spectrometers

Currently, a Raman analyzer with an excellent signal-to-noise ratio and resolution is very costly. On the other hand, low-cost Raman analyzer devices are required as standard laboratory equipment. However, those systems generally have low signal-to-noise ratios, low-power visible lasers with poor resolution, and are inefficient for any high-performance chemical analysis. Therefore, more affordable and higher-resolution Raman systems are essential for promoting and allowing Raman spectroscopy. As a consequence, high ownership costs limit market growth. These are the primary factors that pose a challenge to the expansion of the global market during the projection era.

Raman Spectroscopy Market Ecosystem

The prominent players in the Raman spectroscopy market are Thermo Fisher Scientific Inc. (US), Mettler Toledo (Switzerland), Agilent Technologies Inc. (US), Bruker (US), and Renishaw Plc (UK). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

Raman Spectroscopy Market Segmentation

The surface-enhanced Raman scattering sampling technique is projected to grow at the fastest rate of the Raman spectroscopy market during the forecast period

Surface enhanced Raman scattering (SERS) is a vibrational spectroscopy technique that produces precise molecular fingerprints and enables direct identification of target materials, down to the single-molecule level. Raman spectroscopy has evolved as a highly efficient method to analyze the structural details of a complex molecular structure. Owing to its ultra-high sensitivity and selectivity, SERS has a vast array of applications in surface and interface chemistry, catalysis, nanotechnology, biology, biomedicine, food science, environmental analysis and other areas. SERS is a technique that provides an opportunity to overcome the limitation of the low Raman scattering cross section, which has been widely used for detecting the vibration and chemical information on molecules. Randomly adsorbed molecules make SERS signals the averaged information on all vibrations.

The surface enhancement process in SERS works on the basis of 2 mechanisms: electromagnetic theory and chemical enhancement theory. In electromagnetic models, the molecule is modeled as a point dipole that responds to elevated local fields at or near the metal surface. The roughness that establishes the relation of the incident field with surface plasmons provides these augmented fields. Chemical models relate SERS intensity to the changed molecular polarization caused by interactions with metals, resulting in molecular resonance and enhancement.

Pharmaceuticals application is expected to grow at the highest CAGR of the Raman spectroscopy market during the forecast period

The pharmaceutical application segment is expected to record the highest CAGR during the forecast period. The segment’s growth can be attributed to the surge in the usage of solid-state pharmaceutical products in both industries and academia. Current pharmaceutical applications cover a broad range, from discovery to manufacturing of drugs in the pharmaceuticals industry, like identifying polymorphs, monitoring real-time processes, detecting counterfeit & adulterated pharmaceutical products, and imaging solid dosage formulations. Due to its ability to visualize the drug and excipients distribution in pharmaceutical formulations such as tablets, creams and ointments, Raman spectroscopy is in great demand in the pharmaceutical industry.

Raman Spectroscopy Industry Regional Analysis

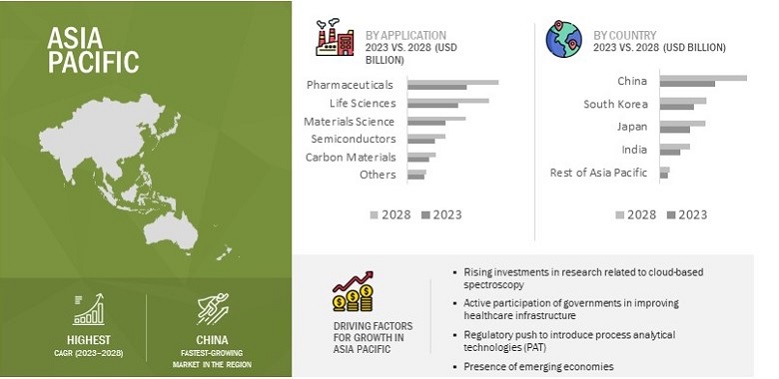

Asia Pacific is projected to grow at the highest CAGR of the Raman spectroscopy market by 2028

The Raman spectroscopy market in Asia Pacific has been studied for China, Japan, South Korea, India, and Rest of Asia Pacific. Asia Pacific is likely to be the fastest-growing Raman spectroscopy market owing to the ongoing technological advancements and innovations and expanding healthcare sector in emerging countries in the region. The growth of the regional market can be attributed to the active participation of governments in improving healthcare infrastructure, rapid urbanization, rise in the GDP of emerging markets, and support provided by governments and several companies to expand the pharmaceuticals and life sciences industries in developing countries in the region.

Raman Spectroscopy Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Raman Spectroscopy Companies - Key Market Players

The major players in the Raman Spectroscopy Companies include

- Thermo Fisher Scientific Inc. (US),

- Mettler Toledo (Switzerland),

- Agilent Technologies Inc. (US),

- Bruker (US),

- Renishaw Plc (UK),

- Rigaku Corporation (Japan),

- Oxford Instruments (UK),

- Endress+Hauser Group Services AG (Switzerland),

- HORIBA Ltd. (Japan),

- PerkinElmer Inc. (US),

- Hamamatsu Photonics K.K (Japan),

- Metrohm AG (Switzerland),

- Anton Paar GmbH (Austria).

These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Raman Spectroscopy Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 0.8 Billion in 2023 |

|

Projected Market Size in 2028 |

USD 1.1 Billion by 2028 |

|

Growth Rate |

CAGR of 7.0% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million), Volume (Thousand Units) |

|

Segments covered |

By Instrument, Sampling Technique,, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The major players in the Raman spectroscopy market are Thermo Fisher Scientific Inc. (US), Mettler Toledo (Switzerland), Agilent Technologies Inc. (US), Bruker (US), Renishaw Plc (UK), Rigaku Corporation (Japan), Oxford Instruments (UK), Endress+Hauser Group Services AG (Switzerland), HORIBA Ltd. (Japan), PerkinElmer Inc. (US), Hamamatsu Photonics K.K (Japan), Metrohm AG (Switzerland), Anton Paar GmbH (Austria), JASCO (Japan), Tornado Spectral Systems (Canada), Enhanced Spectrometry, Inc. (US), Zolix (China), Smiths Detection (UK), Ocean Insight (US), Ostec (US), TSI (US), Laser Detect System (Israel), Photon Systems, Inc. (US), B&W Tek (US), and Real Time Analyzers (US). |

Raman Spectroscopy Market Highlights

The study segments the Raman spectroscopy market share based on instrument, sampling technique, application, and region at the regional and global level.

|

Segment |

Subsegment |

|

By Instrument |

|

|

By Sampling Technique |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Raman Spectroscopy Industry

- In February 2023, Agilent Technologies Inc. introduced Vaya handheld Raman spectrometer’s latest software update, which facilitates raw material identification and has extended features to the customers through opaque and transparent container analysis.

- In June 2022, Renishaw plc launched the inLux SEM Raman interface, which provides a scanning electron microscope (SEM) chamber with superior Raman capabilities. Raman spectra can be gathered to create 2D and 3D pictures while also imaging in the SEM.

- In Mary 2022, Bruker and TOFWERK AG (Switzerland) entered a partnership to focus on Bruker’s commercial scale to accelerate penetration in selected market segments, including TOFWERK’s compact time-of-flight mass spectrometers (TOF-MS) for small molecule and volatiles analyses that require exceptional speed and sensitivity.

- In April 2022, Thermo Fisher Scientific Inc. announced the release of a new Raman spectroscopic analyzer for process monitoring and applications such as biopharmaceutical manufacturing. In August 2020, National Instruments Corporation launched the enterprise version of SystemLink Software. This new version enables increased visibility and control of test systems across an organization.

Frequently Asked Questions (FAQ):

What is the current size of the global Raman spectroscopy market?

The Raman spectroscopy market is estimated to be worth USD 0.8 billion in 2023 and is projected to reach USD 1.1 billion by 2028, at a CAGR of 7.0% during the forecast period.

Who are the winners in the global Raman spectroscopy market share?

Companies such as Thermo Fisher Scientific Inc. (US), Mettler Toledo (Switzerland), Agilent Technologies Inc. (US), Bruker (US), and Renishaw Plc (UK), fall under the winners category.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the Raman spectroscopy market during forecast period. Presence of established manufacturing companies, increasing yearly production and rising investments in research related to cloud-based spectroscopy are some of the major factors driving the market growth in the region.

What are the major drivers and opportunities related to Raman spectroscopy market share?

Increased focus on drug development in healthcare sector and rise in adoption of Raman spectroscopy in clinical application are some of the major drivers and opportunities for Raman spectroscopy market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the Raman spectroscopy market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased focus on drug development in healthcare sector- Rising adoption of Raman spectroscopy in clinical applications- Advancements in Raman spectroscopic techniques used in catalysts and catalytic reactions- Growing awareness regarding food safety- Growing requirement for mineral analysisRESTRAINTS- High ownership cost- Requirement for highly skilled workforce to keep up with advancements in Raman spectroscopy- Lack of awareness regarding potential applications of Raman spectroscopy among end users- Unsuitability of Raman spectroscopy with metals and alloysOPPORTUNITIES- Rising demand for cloud-based spectroscopy- Rising demand for process analytical technology (PAT) in pharmaceutical industry- Increasing demand for Raman spectroscopy in carbon materials application- Rising demand for Raman spectroscopy in semiconductor industry- Increasing research and development (R&D) expenditure on Raman spectroscopyCHALLENGES- Lack of improvements in Raman spectrometer design- Lack of development of low-cost, highly efficient Raman spectrometers

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 AVERAGE SELLING PRICE (ASP) ANALYSIS

-

5.6 TRENDS/DISRUPTIONS IMPACTING MARKET PLAYERS AND RAW MATERIAL SUPPLIERS

-

5.7 TECHNOLOGY ANALYSISINELASTIC NEUTRON SCATTERING (INS)FLUORESCENCE SPECTROSCOPYINFRARED SPECTROSCOPYSPATIALLY OFFSET RAMAN SPECTROSCOPY (SORS)RAMAN OPTICAL ACTIVITY (ROA)ELECTRON MICROSCOPYCLOUD-BASED SPECTROSCOPYPROCESS ANALYTICAL TECHNOLOGY (PAT)

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.10 BUYING CRITERIA

-

5.11 CASE STUDY ANALYSISDEVELOPMENT OF NEW RAMAN MICRO-SPECTROSCOPY TECHNIQUE THAT CAN IMAGE POLYMER PHASE DISTRIBUTIONSRESEARCH AND DEVELOPMENT OF GROUND-BREAKING BIOSENSOR PLATFORM FOR EARLY-STAGE CANCER DIAGNOSISIMPLEMENTATION OF TRANSMISSION RAMAN SPECTROSCOPY FOR FAST CONTENT UNIFORMITY TESTINGENHANCEMENTS IN RAMAN MEASUREMENTS USING HIGH-THROUGHPUT VIRTUAL SLIT SPECTROMETERSUSE OF RAMAN SPECTROSCOPY IN ARCHAEOLOGICAL SITES

-

5.12 TRADE DATA ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 STANDARDS AND REGULATORY LANDSCAPETARIFFS AND REGULATIONS- Tariffs- Regulatory compliance

-

5.16 REGULATORY SCENARIONORTH AMERICAEUROPEASIA PACIFICROWREGULATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 BENCHTOPWIDELY USED IN FORENSIC, PHARMACEUTICAL, NANOTECHNOLOGY, AND ACADEMIC RESEARCH APPLICATIONS

-

6.3 PORTABLEENABLES USERS TO MAKE REAL-TIME DECISIONS

- 7.1 INTRODUCTION

-

7.2 MICROSCOPY RAMANONE OF BEST INSTRUMENTS TO IDENTIFY PIGMENTS

-

7.3 FT RAMANDOES NOT REQUIRE SPECIALIZED SAMPLE PRE-TREATMENT

-

7.4 HANDHELD & PORTABLE RAMANINCREASINGLY USED IN PHARMACEUTICAL AND CHEMICAL INDUSTRIES

-

7.5 OTHERSDISPERSIVE RAMANNON-DISPERSIVE RAMANPROBE RAMAN

- 8.1 INTRODUCTION

-

8.2 SURFACE-ENHANCED RAMAN SCATTERING (SERS)AMPLIFIES RAMAN SIGNALS FROM MOLECULES BY SEVERAL ORDERS OF MAGNITUDE, ALLOWING THEM TO UNDERGO SCATTERING WITH MUCH HIGHER EFFICIENCIES

-

8.3 TIP-ENHANCED RAMAN SCATTERING (TERS)WELL-SUITED FOR INVESTIGATING SAMPLES IN AQUEOUS MEDIUM

- 8.4 OTHERS

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICALSRISING USE OF RAMAN SPECTROSCOPY IN SOLID-STATE PHARMACEUTICAL MANUFACTURING

-

9.3 MATERIALS SCIENCEPOWERFUL TECHNIQUE TO EXTRACT PHYSICAL AND CHEMICAL INFORMATION ABOUT MATERIALS

-

9.4 LIFE SCIENCESPROVIDES VALUABLE INSIGHTS INTO CHARACTERISTICS OF DIFFERENT LIFE SCIENCES MATERIALS

-

9.5 CARBON MATERIALSUSED TO RESEARCH, DEVELOP, AND CONTROL QUALITY OF CARBON MATERIALS

-

9.6 SEMICONDUCTORSUSED TO CHARACTERIZE AND GENERATE IMAGES OF ALL SEMICONDUCTOR TYPES

-

9.7 OTHERSAGRICULTURECHEMICALFORENSICCOSMETIC

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Large presence of Raman spectroscopy instrument manufacturing companiesCANADA- High investments in research and development (R&D) by government and non-government organizationsMEXICO- Increasing investments in healthcare sectorNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEUK- Rising investments in facilitation of research and development (R&D) centersGERMANY- Increasing demand for Raman spectroscopy in life sciences applicationsFRANCE- Significant presence of laboratories specializing in Raman spectroscopyREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- Rising demand for Raman spectroscopy in pharmaceuticals, life sciences, and materials science applicationsJAPAN- Increasing healthcare expenditureSOUTH KOREA- Large presence of universities and research institutes using Raman spectroscopyINDIA- Expanding pharmaceutical industryREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 ROWMIDDLE EAST & AFRICA- Rising adoption of Raman spectrometers by research institutes, distributors, and universitiesSOUTH AMERICA- Increasing investments in pharmaceutical and life science researchROW: RECESSION IMPACT

- 11.1 OVERVIEW

-

11.2 MARKET EVALUATION FRAMEWORKPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 11.3 MARKET SHARE AND RANKING ANALYSIS

- 11.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRUKER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMETTLER TOLEDO- Business overview- Products/Solutions/Services offered- MnM viewRENISHAW PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHORIBA, LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsMETROHM AG- Business overview- Products/Solutions/Services offered- Recent developmentsENDRESS+HAUSER GROUP SERVICES AG- Business overview- Products/Solutions/Services offeredRIGAKU CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsPERKINELMER INC.- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSANTON PAARTORNADO SPECTRAL SYSTEMSOXFORD INSTRUMENTSOCEAN INSIGHTHAMAMATSU PHOTONICSB&W TEKENHANCED SPECTROMETRY, INC.PHOTON SYSTEMS, INC.LASER DETECT SYSTEMOSTECSMITHS DETECTIONJASCOTSIZOLIXREAL TIME ANALYZERS

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF RAMAN SPECTROSCOPY INSTRUMENTS

- TABLE 4 TENTATIVE PRICING OF RAMAN SPECTROSCOPY INSTRUMENTS

- TABLE 5 RAMAN SPECTROSCOPY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 7 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 8 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 MARKET: NOTABLE PATENTS, 2020–2023

- TABLE 11 NUMBER OF PATENTS REGISTERED RELATED TO MARKET IN LAST 10 YEARS

- TABLE 12 MARKET: CONFERENCES AND EVENTS

- TABLE 13 SPECIFICATION COMPARISON BETWEEN BENCHTOP AND PORTABLE RAMAN SPECTROSCOPY

- TABLE 14 MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 15 MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 16 MARKET, BY INSTRUMENT, 2019–2022 (THOUSAND UNITS)

- TABLE 17 MARKET, BY INSTRUMENT, 2023–2028 (THOUSAND UNITS)

- TABLE 18 MICROSCOPY RAMAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 19 MICROSCOPY RAMAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 20 FT RAMAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 21 FT RAMAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 HANDHELD & PORTABLE RAMAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 HANDHELD & PORTABLE RAMAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 SPECIFICATION COMPARISON BETWEEN FT RAMAN AND DISPERSIVE RAMAN SPECTROSCOPY INSTRUMENTS

- TABLE 25 OTHERS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 OTHERS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 RAMAN SPECTROSCOPY MARKET, BY SAMPLING TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY SAMPLING TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 PHARMACEUTICALS: MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 32 PHARMACEUTICALS: MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 33 PHARMACEUTICALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 PHARMACEUTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 PHARMACEUTICALS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 36 PHARMACEUTICALS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 37 PHARMACEUTICALS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 PHARMACEUTICALS: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 PHARMACEUTICALS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 40 PHARMACEUTICALS: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 41 PHARMACEUTICALS: ROW MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 PHARMACEUTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MATERIALS SCIENCE: MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 44 MATERIALS SCIENCE: MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 45 MATERIALS SCIENCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 MATERIALS SCIENCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MATERIALS SCIENCE: NORTH AMERICA RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 48 MATERIALS SCIENCE: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 49 MATERIALS SCIENCE: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 50 MATERIALS SCIENCE: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 51 MATERIALS SCIENCE: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 MATERIALS SCIENCE: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 MATERIALS SCIENCE: ROW MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 MATERIALS SCIENCE: ROW MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 LIFE SCIENCES: MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 56 LIFE SCIENCES: MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 57 LIFE SCIENCES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 LIFE SCIENCES: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 60 LIFE SCIENCES: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 LIFE SCIENCES: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 LIFE SCIENCES: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 LIFE SCIENCES: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 LIFE SCIENCES: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 LIFE SCIENCES: ROW RAMAN SPECTROSCOPY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 LIFE SCIENCES: ROW MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CARBON MATERIALS: MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 68 CARBON MATERIALS: MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 69 CARBON MATERIALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 CARBON MATERIALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 CARBON MATERIALS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 CARBON MATERIALS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 CARBON MATERIALS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 74 CARBON MATERIALS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 CARBON MATERIALS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 CARBON MATERIALS: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 CARBON MATERIALS: ROW MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 CARBON MATERIALS: ROW MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 SEMICONDUCTORS: MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 80 SEMICONDUCTORS: MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 81 SEMICONDUCTORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 SEMICONDUCTORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 SEMICONDUCTORS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 84 SEMICONDUCTORS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 SEMICONDUCTORS: EUROPE RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 86 SEMICONDUCTORS: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 SEMICONDUCTORS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 SEMICONDUCTORS: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 SEMICONDUCTORS: ROW MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 SEMICONDUCTORS: ROW MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 OTHERS: MARKET, BY INSTRUMENT, 2019–2022 (USD MILLION)

- TABLE 92 OTHERS: MARKET, BY INSTRUMENT, 2023–2028 (USD MILLION)

- TABLE 93 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 OTHERS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 OTHERS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 OTHERS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 OTHERS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 OTHERS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 100 OTHERS: ASIA PACIFIC RAMAN SPECTROSCOPY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 OTHERS: ROW MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 OTHERS: ROW MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 ROW: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 120 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 121 MARKET: DEGREE OF COMPETITION

- TABLE 122 COMPANY FOOTPRINT (10 COMPANIES)

- TABLE 123 APPLICATION: COMPANY FOOTPRINT

- TABLE 124 REGION: COMPANY FOOTPRINT

- TABLE 125 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 126 RAMAN SPECTROSCOPY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 127 PRODUCTS LAUNCHES, APRIL 2020–FEBRUARY 2023

- TABLE 128 DEALS, MAY 2020–MARCH 2023

- TABLE 129 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 130 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 131 BRUKER: COMPANY OVERVIEW

- TABLE 132 METTLER TOLEDO: COMPANY OVERVIEW

- TABLE 133 RENISHAW PLC: COMPANY OVERVIEW

- TABLE 134 HORIBA, LTD.: BUSINESS OVERVIEW

- TABLE 135 METROHM AG: COMPANY OVERVIEW

- TABLE 136 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 137 RIGAKU CORPORATION: COMPANY OVERVIEW

- TABLE 138 PERKINELMER INC.: COMPANY OVERVIEW

- FIGURE 1 RAMAN SPECTROSCOPY MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS IN MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF MARKET BASED ON REGION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 MARKET: IMPACT OF RECESSION

- FIGURE 10 HANDHELD & PORTABLE RAMAN SEGMENT HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 11 SURFACE-ENHANCED RAMAN SCATTERING SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 12 PHARMACEUTICALS SEGMENT TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 INCREASED FOCUS ON DRUG DEVELOPMENT IN HEALTHCARE SECTOR

- FIGURE 15 PHARMACEUTICALS SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2023

- FIGURE 16 HANDHELD & PORTABLE RAMAN SEGMENT TO HOLD LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 17 SURFACE ENHANCEMENT RAMAN SCATTERING SEGMENT TO HOLD LARGEST SHARE OF MARKET FROM 2023 TO 2028

- FIGURE 18 PHARMACEUTICALS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2028

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 20 RAMAN SPECTROSCOPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 22 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 23 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 24 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 AVERAGE PRICE TREND

- FIGURE 28 AVERAGE SELLING PRICE OF RAMAN SPECTROSCOPY INSTRUMENTS

- FIGURE 29 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 32 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 33 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 35 MARKET, BY TYPE

- FIGURE 36 HANDHELD & PORTABLE RAMAN SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 SURFACE-ENHANCED RAMAN SCATTERING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 38 MARKET, BY APPLICATION

- FIGURE 39 PHARMACEUTICALS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO DOMINATE MARKET FOR PHARMACEUTICALS SEGMENT FROM 2023 TO 2028

- FIGURE 41 ASIA PACIFIC TO DOMINATE MARKET FOR LIFE SCIENCES SEGMENT DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO DOMINATE MARKET FOR SEMICONDUCTORS SEGMENT FROM 2023 TO 2028

- FIGURE 43 MARKET, BY REGION

- FIGURE 44 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA RAMAN SPECTROSCOPY MARKET, BY COUNTRY

- FIGURE 46 NORTH AMERICA: SNAPSHOT OF MARKET

- FIGURE 47 US TO LEAD NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 48 EUROPE MARKET, BY COUNTRY

- FIGURE 49 EUROPE: SNAPSHOT OF MARKET

- FIGURE 50 UK TO RECORD HIGHEST CAGR IN EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC MARKET, BY COUNTRY

- FIGURE 52 ASIA PACIFIC: SNAPSHOT OF MARKET

- FIGURE 53 CHINA TO DOMINATE ASIA PACIFIC MARKET DURING FORECAST PERIOD

- FIGURE 54 ROW MARKET, BY REGION

- FIGURE 55 MIDDLE EAST & AFRICA HELD LARGER SHARE OF MARKET IN 2022

- FIGURE 56 KEY STRATEGIES UNDERTAKEN BY LEADING PLAYERS IN MARKET FROM 2019 TO 2023

- FIGURE 57 MARKET SHARE OF TOP FIVE PLAYERS OFFERING RAMAN SPECTROSCOPY

- FIGURE 58 FIVE-YEAR REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 59 RAMAN SPECTROSCOPY MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 60 RAMAN SPECTROSCOPY (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 61 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 62 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 63 BRUKER: COMPANY SNAPSHOT

- FIGURE 64 METTLER TOLEDO: COMPANY SNAPSHOT

- FIGURE 65 RENISHAW PLC: COMPANY SNAPSHOT

- FIGURE 66 HORIBA, LTD.: COMPANY SNAPSHOT

- FIGURE 67 PERKINELMER INC.: COMPANY SNAPSHOT

The research study involved 4 major activities in estimating the size of the Raman spectroscopy market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information related to the market across four main regions-Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and a few other related key executives from major companies and organizations operating in the Raman spectroscopy market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies market players adopt. Most of the primary interviews have been conducted with the supply side of the market. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used extensively in market engineering. Several data triangulation methods have also been used to perform market forecasting and estimation for the report’s overall market segments and sub-segments. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players offering Raman spectroscopy. The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives have also been conducted to gain insights into the key players and the Raman spectroscopy market. All the market shares have been estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology-Bottom-up Approach

The bottom-up approach has been employed to arrive at the overall size of the Raman spectroscopy market from the calculations based on the revenues of the key players and their shares in the market. Key players in the Raman spectroscopy market, including Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Bruker Corporation, Mettler-Toledo International, Inc., Renishaw PLC, Horiba Ltd., Metrohm AG, Kaiser Optical Systems, Inc., Rigaku Corporation, and PerkinElmer, Inc. have been studied. The market size estimations have been carried out considering the market size of their Raman spectroscopy offerings.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then split into several segments and sub-segments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Raman spectroscopy is an analytical technique where scattered light is used to measure the vibrational energy modes of a sample. This technique got its name after the Indian physicist C. V. Raman who, along with his research partner K. S. Krishnan, was the first to observe Raman scattering in 1928. It is a non-destructive chemical analysis technique that provides detailed information about the chemical structure, phase & polymorphism, crystallinity & molecular interactions, intrinsic stress/strain, and contamination & impurity within a material. The information about any material is extracted by generating a characteristic spectrum known as the “Raman fingerprint.” It is a unique chemical fingerprint for a particular molecule or material and can be used to swiftly recognize the substance or differentiate it from others.

Key Stakeholders

- Suppliers of raw materials

- Technology investors

- Original equipment manufacturers (OEMs)

- Third-party service providers

- Government labs

- In-house testing labs

- System integrators

- Distributors, resellers, and traders

- Research institutions and organizations

- Raman spectroscopy technology forums, alliances, consortiums, and associations

- Market research and consulting firms

- End users

The main objectives of this study are as follows:

- To describe, segment, and forecast the size of the global Raman spectroscopy market based on instrument, sampling technique, and application in terms of value

- To describe and forecast the global market in terms of volume

- To describe and forecast the market size across four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the Raman spectroscopy market

- To provide a detailed overview of the supply chain pertaining to the Raman spectroscopy ecosystem and the average selling prices of Raman spectroscopy instruments

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To describe the detailed impact of the recession on the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide details regarding the competitive landscape of the market

- To analyze competitive developments such as product launches, partnerships, collaborations, and acquisitions in the market

- To strategically profile the key players in the Raman spectroscopy market and comprehensively analyze their market rankings and core competencies2.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Country-wise Information:

- Analysis for additional countries (up to five)

- Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Raman Spectroscopy Market