Referral Management Market by Component (Software (Integrated, Standalone), Services), Delivery Mode (Cloud Based, On Premise), Type (Inbound, Outbound), End User (Providers, Payers) – Analysis & Global Forecasts to 2027

Market Growth Outlook Summary

The global referral management market growth forecasted to transform from USD 3.2 billion in 2022 to USD 6.1 billion by 2027, driven by a CAGR of 13.6%. Growth in the referral management market can be attributed to factors such as technological advancements in healthcare facilitiesand risingadoption of referral management solutions by healthcare providers to offer better care delivery.

To know about the assumptions considered for the study, Request for Free Sample Report

Referral Management Market Dynamics

Driver: Government initiatives to incorporate IT solutions in healthcare systems

Governments across various countries are focusing their efforts on promoting healthcare IT solutions for the optimization of healthcare productivity and reduction of costs. Governments across the world are working with healthcare providers to accelerate seamless data exchange between healthcare systems to coordinate care effectively and reduce avoidable costs. For instance, In 2020, the Argentine Ministry of Health built a national digital health network, which would allow care centers to access patient data more securely through a standardized integration process, for which it adopted Red Hat container, integration, and automation solutions.

Restraint: Dearth of skilled healthcare IT professionals

The unavailability of adequate IT staff in the healthcare industry, especially among healthcare providers, leads to gaps in program implementation. The effective utilization of technology-integrated solutions requires strong IT infrastructure and support within the organization as well as at the solution provider’s end. There is a continuous requirement for technical support for maintaining the server and network in the healthcare organizations. The shortage of in-house IT experts, and a trained workforce with cross-functional skills, is expected to restrain the growth of this market during the forecast period.

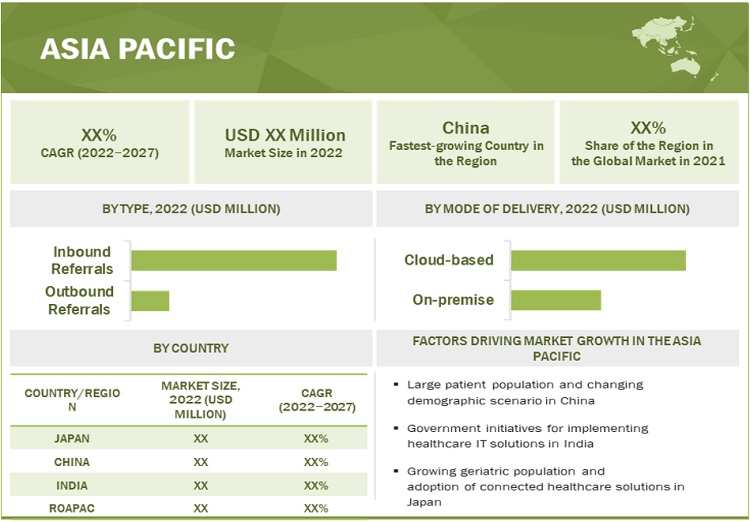

Opportunity: Asia Pacific market to offer high growth potential

Several factors, such as the implementation of government initiatives to implement HCIT solutions, increasing government spending on healthcare systems, and the presence of large patient pool in highly populous countries such as China and India, are expected to boost the growth of referral management market in the Asia Pacific region. In addition, risinggeriatric population in the region and the subsequent burden on hospitals and healthcare organizations will offer growth opportunities in the referral management market.

Challenge: Hesitant to adopt HCIT solutions

Healthcare IT systems are high-priced software solutions, due to which, various hospitals and physicians, particularly in small and rural areas, continue to rely on existing basic methods, such as fax-based and unorganized patient referral methods.Additionally, the health care providers are hesitant to adopt advanced technology-based solutions due to the costs attached to the software purchase and implementation, periodic software upgrades, concerns regarding data security, and lack of operating skills for using these advanced tools.

“Software segment accounted for the largest share of the global referral management for component”

Based on the component, the referral management market is bifurcated into software and services. The software segment that includes integrated and standalone software, accounted for the largest share of the referral management market in 2021 also expected to grow at the highest CAGR from 2022 to 2027. Increased use of integrated or standalone referral management software in various healthcare facilities for improving efficiency and quality of medical care delivery systems are some of the key factors for the market growth of this segment.

“The cloud-based mode of delivery segment is expected to hold the largest share of the referral management market in 2022”

Based on mode of delivery, the referral management market is bifurcated into cloud-based and on-premise solutions. The cloud-based segment is expected to hold the largest share of the referral management market in 2022. The high growth rate of this segment can be attributed to the increase in demand for cloud-based solutions owing to its benefits including on-demand self-serving analytics, no up-front capital investment for hardware, and extreme capacity flexibility among others.

“Inbound referrals segment accounted for the largest market share in 2021”

Based on type, the global referral management market is bifurcated into inbound and outbound referrals. The inbound type segment accounted the largest share of the market in 2021. High volume of inbound referrals received by hospitals and specialist centres from multiple channels are the factors driving the growth of this segment.

“Providers segment in the end users accounted for the largest and the fastest share of the referral management market”

Based on end user, the market is bifurcated into providers, payers, and others. In 2021, providers segment accounted for the largest and the fastest share of the referral management market. The demand for referral management among healthcare providers is primarily driven by the expanding focus on streamlining patient referral process and enabling seamless communication throughout the process.

“Asia Pacific to emerge as a potential market for referral management solutions”

The global referral management market has been bifurcated based on four major regional segments—North America, Europe, Asia Pacific, and the Rest of the World. Asia Pacific is expected to grow at the highest CAGR. The rising demand for quality care at affordable costs, rising geriatric population, and subsequent increase in the prevalence of various chronic diseases are key factors driving the growth of the referral management market in the Asia Pacific. The rising patient volume that has resulted in the increased demand for a platform ensuring end-to-end patient care to ensure complete recovery, will fuel the growth of the referral management market in the APAC.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in this market are Cerner Corporation (US), CarePort Health (US), eHealth Technologies, Inc. (US), Optum, Inc. (US), Change Healthcare (US), ReferralMD (US), Kyruus (US), Eceptionist (US), Persistent Systems (India), HealthViewX (US), Conifer Health Solutions, LLC (US), EcoSoft Health (US), DentalCareLinks (US), BlockitNow, Inc. (US), Cloudmed (US), EZ Referral (Canada), ReferWell (US), Arcadia (US), HealthWare Systems (US), Netsmart Technologies, Inc. (US), Advanced (UK), Innovaccer, Inc. (US), Lightbeam Health Solutions (US), MDfit (US), and Medcohere Inc. (US). These players are increasingly focusing on product launches, expansions, acquisitions, and partnerships to expand their product offerings in the referral management market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, By Type, By Mode of Delivery, By End User & By Region |

|

Geographies covered |

North America (US, Canada), Europe (Germany, France, UK, Italy, and the RoE), Asia Pacific (Japan, China, India, and RoAPAC), ROW |

|

Companies covered |

GetWellNetwork (US), Epic Systems Corporation (US), Cerner Corporation (US), CarePort Health (US), eHealth Technologies, Inc. (US), Optum, Inc. (US), Change Healthcare (US), ReferralMD (US), Kyruus (US), Eceptionist (US), Persistent Systems (India), HealthViewX (US), Conifer Health Solutions, LLC (US), EcoSoft Health (US), DentalCareLinks (US), BlockitNow, Inc. (US), Cloudmed (US), EZ Referral (Canada), ReferWell (US), Arcadia (US), HealthWare Systems (US), Netsmart Technologies, Inc. (US), Advanced (UK), Innovaccer, Inc. (US), Lightbeam Health Solutions (US), MDfit (US), and Medcohere Inc. (US). |

This research report categorizes the referral management market based on component, type, mode of delivery, end user, and region.

By Component

- Software

- Services

By Type

- Inbound Referrals

- Outbound Referrals

By Mode of Delivery

- Cloud-based

- On-premise

By End User

- Providers

- Payers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- RoW

Recent Developments

- In 2022, eHealth Technologies partnered with N1X10 to empower cancer patients to retrieve and transform massive amounts of medical data to overcome the limitations of standard care.

- In 2022, ReferWell partnered with NexHealth to make it easier for physicians to schedule patient referral appointments at the point of care and increase show rates at these specialist visits.

- In 2021, Cloudmed acquired par8o. This acquisition progresses the capabilities of Cloudmed’s 340B Discovery Services and elevates its CloudmedAI platform with par8o’s sophisticated machine learning technology.

- In 2020, Blockit (US) partnered with One Touch Telehealth (US) to offer telehealth solutions in its existing infrastructure

Frequently Asked Questions (FAQ):

What is the market size of Referral Management Market?

The referral management market is projected to reach USD 6.1 billion by 2027 from USD 3.2 billion in 2022, at a CAGR of 13.6%.

What are some of the major drivers for this market?

The market is primarily driven by the government initiatives for implementing HCIT solutions to offer cost-effective and quality care, growing disease burden that requires effective management of patient flow and several partnerships and collaborations between stakeholders for improving care delivery.

Who are the major players in the referral management market?

The major players include Cerner Corporation (US), CarePort Health (US), and eHealth Technologies (US) Change Healthcare (US), Optum (US) and EZ Referral (Canada).

What are the major type in the referral management market?

Based on type, the referral management market is segmented into inbound and outbound referrals. The inbound referrals segment accounted for the largest share of the global referral management market.

What are the major component in the referral management market?

Based on component, the referral management market is segmented into software and services. The software segment accounted for the largest share of the global referral management market

What are the major end user in the referral management market?

Based on end user, the referral management market is segmented into providers, payers and other end users. Providers accounted for the largest share of the global referral management market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 1 RESEARCH METHODOLOGY

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY RESEARCH

2.3 PRIMARY SOURCES

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3.1 KEY INSIGHTS FROM PRIMARY SOURCES

2.4 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.5 PROVIDER-BASED MARKET ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: MARKET ESTIMATION

2.6 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN REFERRAL MANAGEMENT MARKET (2022–2027)

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.7 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.8 ASSUMPTIONS

2.9 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: REFERRAL MANAGEMENT MARKET

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 9 REFERRAL MANAGEMENT MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 REFERRAL MANAGEMENT MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF REFERRAL MANAGEMENT MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 REFERRAL MANAGEMENT MARKET OVERVIEW

FIGURE 14 FOCUS OF GOVERNMENTS ON HEALTHCARE DIGITIZATION TO SUPPORT MARKET GROWTH

4.2 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY TYPE AND COUNTRY (2021)

FIGURE 15 INBOUND REFERRALS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN REFERRAL MANAGEMENT MARKET IN 2021

4.3 REFERRAL MANAGEMENT MARKET SHARE, BY TYPE, 2022 VS. 2027

FIGURE 16 INBOUND REFERRALS WILL CONTINUE TO DOMINATE REFERRAL MANAGEMENT MARKET IN 2027

4.4 REFERRAL MANAGEMENT MARKET SHARE, BY COMPONENT, 2022 VS. 2027

FIGURE 17 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.5 REFERRAL MANAGEMENT MARKET SHARE, BY MODE OF DELIVERY, 2022 VS. 2027

FIGURE 18 CLOUD-BASED SOLUTIONS DOMINATE REFERRAL MANAGEMENT MARKET

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

FIGURE 19 REFERRAL MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increasing government initiatives to incorporate IT solutions in healthcare

5.1.1.2 Benefits offered by automated referral processes

5.1.1.3 Rising geriatric population and subsequent increase in incidence of chronic diseases

TABLE 2 RISE IN AGING POPULATION (MILLION)

5.1.2 RESTRAINTS

5.1.2.1 Lack of skilled healthcare IT professionals

5.1.3 OPPORTUNITIES

5.1.3.1 Asia Pacific market to offer high growth potential

5.1.3.2 Cloud-based models offer significant growth opportunities

5.1.4 CHALLENGES

5.1.4.1 Reluctance to adopt HCIT solutions and data security concerns

5.1.4.2 Lack of awareness

6 REFERRAL MANAGEMENT MARKET, BY COMPONENT (Page No. - 58)

6.1 INTRODUCTION

TABLE 3 REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 4 REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOFTWARE

TABLE 5 REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 6 REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 7 REFERRAL MANAGEMENT SOFTWARE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 8 REFERRAL MANAGEMENT SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 INTEGRATED SOFTWARE

6.2.1.1 Integration of referral management systems with EMRs increases referral volume by 250−300%

TABLE 9 INTEGRATED SOFTWARE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 10 INTEGRATED SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 STANDALONE SOFTWARE

6.2.2.1 Standalone software provides high data security

TABLE 11 STANDALONE SOFTWARE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 12 STANDALONE SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 NEED FOR SOFTWARE INTEROPERABILITY AND TRAINING FOR ADVANCED SOLUTIONS WILL BOOST MARKET GROWTH

TABLE 13 REFERRAL MANAGEMENT SERVICES MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 14 REFERRAL MANAGEMENT SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7 REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY (Page No. - 66)

7.1 INTRODUCTION

TABLE 15 PROS AND CONS OF ON-PREMISE MODE OF DELIVERY

TABLE 16 PROS AND CONS OF CLOUD-BASED MODE OF DELIVERY

TABLE 17 REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 18 REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

7.2 CLOUD-BASED DELIVERY

7.2.1 CLOUD-BASED DELIVERY ELIMINATES UPFRONT HARDWARE EXPENSES

TABLE 19 REFERRAL MANAGEMENT MARKET FOR CLOUD-BASED DELIVERY, BY REGION, 2019–2021 (USD MILLION)

TABLE 20 REFERRAL MANAGEMENT MARKET FOR CLOUD-BASED DELIVERY, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISE DELIVERY

7.3.1 ON-PREMISE DELIVERY ALLOWS CUSTOMIZATION OF SOLUTIONS ACCORDING TO VENDOR REQUIREMENTS

TABLE 21 REFERRAL MANAGEMENT MARKET FOR ON-PREMISE DELIVERY, BY REGION, 2019–2021 (USD MILLION)

TABLE 22 REFERRAL MANAGEMENT MARKET FOR ON-PREMISE DELIVERY, BY REGION, 2022–2027 (USD MILLION)

8 REFERRAL MANAGEMENT MARKET, BY TYPE (Page No. - 71)

8.1 INTRODUCTION

TABLE 23 REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 24 REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2 INBOUND REFERRALS

8.2.1 HIGH VOLUME OF INBOUND REFERRALS FROM MULTIPLE REFERRING CHANNELS TO DRIVE MARKET

TABLE 25 INBOUND REFERRAL MANAGEMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 26 INBOUND REFERRAL MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 OUTBOUND REFERRALS

8.3.1 INCREASED DEMAND FOR PATIENT REFERRAL SYSTEMS BY FOHCS AND CHCS TO SUPPORT MARKET GROWTH

TABLE 27 OUTBOUND REFERRAL MANAGEMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 OUTBOUND REFERRAL MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9 REFERRAL MANAGEMENT MARKET, BY END USER (Page No. - 75)

9.1 INTRODUCTION

TABLE 29 REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 30 REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

9.2 PROVIDERS

9.2.1 REFERRAL MANAGEMENT SOLUTIONS IMPROVE PROFITABILITY OF HEALTHCARE PROVIDERS BY REDUCING PATIENT REFERRAL LEAKAGES

TABLE 31 REFERRAL MANAGEMENT MARKET FOR PROVIDERS, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 REFERRAL MANAGEMENT MARKET FOR PROVIDERS, BY REGION, 2022–2027 (USD MILLION)

9.3 PAYERS

9.3.1 REFERRAL MANAGEMENT SOLUTIONS HELP PAYERS INCREASE OPERATIONAL EFFICIENCY

TABLE 33 REFERRAL MANAGEMENT MARKET FOR PAYERS, BY REGION, 2019–2021 (USD MILLION)

TABLE 34 REFERRAL MANAGEMENT MARKET FOR PAYERS, BY REGION, 2022–2027 (USD MILLION)

9.4 OTHER END USERS

TABLE 35 REFERRAL MANAGEMENT MARKET FOR OTHER END USERS, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 REFERRAL MANAGEMENT MARKET FOR OTHER END USERS, BY REGION, 2022–2027 (USD MILLION)

10 REFERRAL MANAGEMENT MARKET, BY REGION (Page No. - 80)

10.1 INTRODUCTION

FIGURE 20 NORTH AMERICA WILL CONTINUE TO DOMINATE REFERRAL MANAGEMENT MARKET IN FORECAST PERIOD

TABLE 37 REFERRAL MANAGEMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 38 REFERRAL MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: REFERRAL MANAGEMENT MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Adoption of healthcare IT solutions to curtail rising healthcare costs

TABLE 51 US: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 52 US: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 53 US: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 54 US: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 55 US: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 56 US: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 57 US: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 58 US: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 59 US: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 60 US: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Developments in healthcare infrastructure to drive market

TABLE 61 CANADA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 62 CANADA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 63 CANADA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 64 CANADA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 65 CANADA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 66 CANADA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 67 CANADA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 68 CANADA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 69 CANADA: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 70 CANADA: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3 EUROPE

TABLE 71 EUROPE: REFERRAL MANAGEMENT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 72 EUROPE: REFERRAL MANAGEMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 EUROPE: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 74 EUROPE: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 76 EUROPE: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 78 EUROPE: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 80 EUROPE: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 82 EUROPE: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to register highest growth in European referral management market

TABLE 83 GERMANY: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 84 GERMANY: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 85 GERMANY: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 86 GERMANY: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 87 GERMANY: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 88 GERMANY: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 89 GERMANY: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 90 GERMANY: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 91 GERMANY: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 92 GERMANY: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Government initiatives to drive adoption of HCIT solutions

TABLE 93 UK: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 94 UK: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 95 UK: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 96 UK: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 97 UK: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 98 UK: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 UK: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 100 UK: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 101 UK: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 102 UK: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Rising geriatric population to support growth of referral management market

TABLE 103 FRANCE: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 104 FRANCE: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 105 FRANCE: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 106 FRANCE: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 107 FRANCE: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 108 FRANCE: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 109 FRANCE: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 110 FRANCE: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 111 FRANCE: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 112 FRANCE: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 High prevalence of chronic diseases to support market growth

TABLE 113 ITALY: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 114 ITALY: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 115 ITALY: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 116 ITALY: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 117 ITALY: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 118 ITALY: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 ITALY: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 120 ITALY: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 121 ITALY: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 122 ITALY: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 123 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 124 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 125 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 126 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 127 REST OF EUROPE: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 128 REST OF EUROPE: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 129 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 130 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 131 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 132 REST OF EUROPE: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET SNAPSHOT

TABLE 133 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Healthcare reforms in Japan emphasize on use of healthcare information technology

TABLE 145 JAPAN: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 146 JAPAN: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 147 JAPAN: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 148 JAPAN: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 149 JAPAN: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 150 JAPAN: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 151 JAPAN: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 152 JAPAN: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 153 JAPAN: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 154 JAPAN: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China—fastest-growing market for referral management solutions

TABLE 155 CHINA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 156 CHINA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 157 CHINA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 158 CHINA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 159 CHINA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 160 CHINA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 161 CHINA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 162 CHINA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 163 CHINA: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 164 CHINA: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing government initiatives to improve healthcare system to support market growth

TABLE 165 INDIA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 166 INDIA: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 167 INDIA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 168 INDIA: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 169 INDIA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 170 INDIA: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 INDIA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 172 INDIA: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 173 INDIA: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 174 INDIA: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 175 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 185 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 186 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 187 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 188 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 189 REST OF THE WORLD: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 190 REST OF THE WORLD: REFERRAL MANAGEMENT SOFTWARE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 191 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2019–2021 (USD MILLION)

TABLE 192 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY MODE OF DELIVERY, 2022–2027 (USD MILLION)

TABLE 193 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 194 REST OF THE WORLD: REFERRAL MANAGEMENT MARKET, BY END USER, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 140)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN REFERRAL MANAGEMENT MARKET

11.3 MARKET RANKING

FIGURE 23 RANKING OF KEY COMPANIES IN REFERRAL MANAGEMENT MARKET (2021)

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 24 REFERRAL MANAGEMENT MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

11.5 COMPETITIVE SCENARIO

TABLE 195 SOLUTION LAUNCHES, JANUARY 2018–JUNE 2022

TABLE 196 DEALS, JANUARY 2018–JUNE 2022

TABLE 197 OTHER DEVELOPMENTS, JANUARY 2018–JUNE 2022

12 COMPANY PROFILES (Page No. - 151)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 CERNER CORPORATION

TABLE 198 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 25 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.2 CAREPORT HEALTH

TABLE 199 CAREPORT HEALTH: BUSINESS OVERVIEW

FIGURE 26 ALLSCRIPTS: COMPANY SNAPSHOT (2020)

12.1.3 EHEALTH TECHNOLOGIES, INC.

TABLE 200 EHEALTH TECHNOLOGIES, INC.: BUSINESS OVERVIEW

12.1.4 OPTUM, INC.

TABLE 201 OPTUM, INC.: BUSINESS OVERVIEW

FIGURE 27 OPTUM: COMPANY SNAPSHOT (2021)

12.1.5 CHANGE HEALTHCARE

TABLE 202 CHANGE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 28 CHANGE HEALTHCARE: COMPANY SNAPSHOT (2021)

12.1.6 PERSISTENT SYSTEMS

TABLE 203 PERSISTENT SYSTEMS: BUSINESS OVERVIEW

FIGURE 29 PERSISTENT SYSTEMS: COMPANY SNAPSHOT (2022)

12.1.7 ECEPTIONIST

TABLE 204 ECEPTIONIST: BUSINESS OVERVIEW

12.1.8 REFERRALMD

TABLE 205 REFERRALMD: BUSINESS OVERVIEW

12.1.9 KYRUUS

TABLE 206 KYRUUS: BUSINESS OVERVIEW

12.1.10 HEALTHVIEWX

TABLE 207 HEALTHVIEWX: BUSINESS OVERVIEW

12.1.11 CONIFER HEALTH SOLUTIONS, LLC

TABLE 208 CONIFER HEALTH SOLUTIONS, LLC: BUSINESS OVERVIEW

12.1.12 ECOSOFT HEALTH

TABLE 209 ECOSOFT HEALTH: BUSINESS OVERVIEW

12.1.13 DENTALCARELINKS

TABLE 210 DENTALCARELINKS: BUSINESS OVERVIEW

12.1.14 BLOCKITNOW, INC.

TABLE 211 BLOCKITNOW, INC: BUSINESS OVERVIEW

12.1.15 CLOUDMED

TABLE 212 CLOUDMED: BUSINESS OVERVIEW

12.1.16 EZ REFERRAL

TABLE 213 EZ REFERRAL: BUSINESS OVERVIEW

12.1.17 REFERWELL

TABLE 214 REFERWELL: BUSINESS OVERVIEW

12.1.18 ARCADIA

TABLE 215 ARCADIA: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 HEALTHWARE SYSTEMS

12.2.2 NETSMART TECHNOLOGIES, INC.

12.2.3 ADVANCED

12.2.4 INNOVACCER, INC.

12.2.5 LIGHTBEAM HEALTH SOLUTIONS

12.2.6 MDFIT

12.2.7 MEDCOHERE, INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 192)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities to estimate the current market size for referral management. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, D&B, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The referral management market comprises several stakeholders such as referral management and related device manufacturing companies, suppliers and distributors of referral management, hospital and diagnostic centers, ambulatory surgery centers, medical colleges, teaching hospitals, and academic medical centers. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the referral management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the referral management industry.

Report Objectives

- To define, describe, and measure the global referral management market by type, mode of delivery, component, end users, and region

- To provide detailed information about major factors influencing market growth (such as drivers, restraints, growth opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the global referral management market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the world (RoW)

- To strategically analyze the market structure and profile key players and their core competencies3 in the global referral management market

- To track and analyze competitive developments such as product launches & approvals, acquisitions & expansions, partnerships, agreements & collaborations; in the referral management market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global referral management market report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Referral Management Market