Remote Work Security Market by Offering (Solutions and Services), Security Type (Endpoint & IoT, Network, Cloud), Remote Work Model (Fully, Hybrid, Temporary), Vertical (BFSI, Retail & eCommerce, IT & ITeS) and Region - Global Forecast to 2028

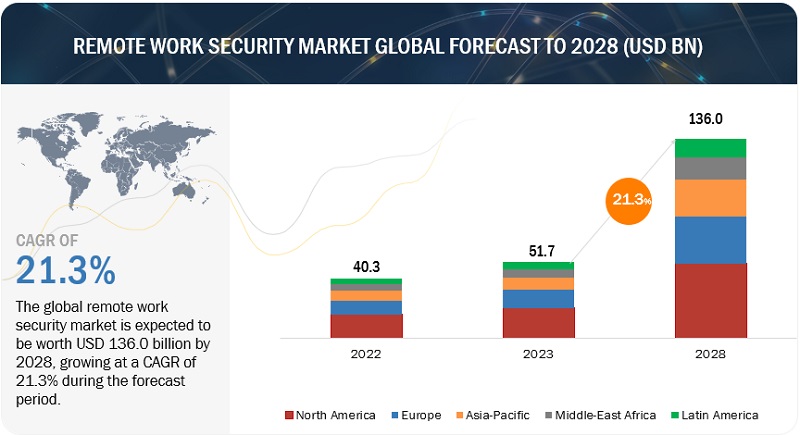

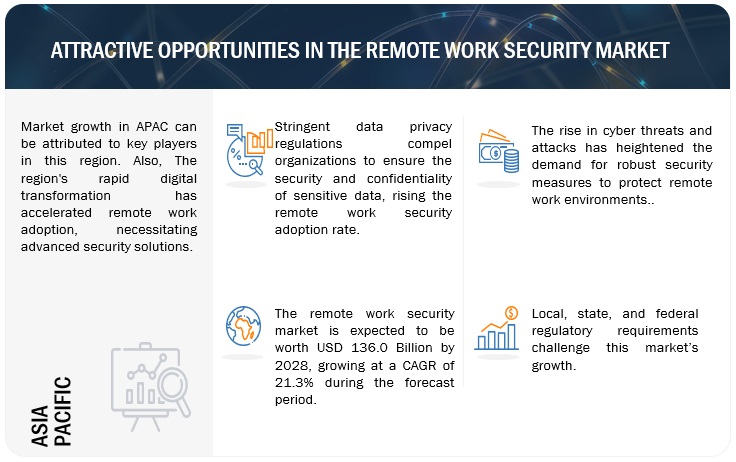

[277 Pages Report] The remote work security market size is projected to grow from USD 51.7 billion in 2023 to USD 136.0 billion by 2028 at a CAGR of 21.3% during the forecast period. Adopting the Zero Trust Network Access (ZTNA) framework is a significant driver in the remote work security market. ZTNA operates on the principle of “never trust, always verify,” continuously verifying users and devices to enhance security in remote work scenarios. It offers adaptive access controls, micro-segmentation, and enhanced data protection, aligning well with the dynamic nature of remote work. This framework ensures that access is based on real-time risk assessments and can restrict access in unusual situations, reducing the risk of data breaches and unauthorized sharing. Overall, ZTNA is recognized for its effectiveness in mitigating security risks associated with remote work, making it a key factor in the remote work security market’s growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Remote Work Security Market Dynamics

Driver: Growing demand for cloud-based security solutions

Cloud-based security solutions are becoming increasingly popular as they offer several advantages over traditional on-premises setups. Cloud-based solutions are often more scalable and easier to manage, and they can be accessed from anywhere. The growing demand for these solutions is fueled by the ever-changing needs of businesses, which require adaptable and flexible security measures to keep pace with the dynamic threat landscape. Additionally, the cost-effectiveness of cloud security is an attractive proposition for organizations, as it allows them to avoid significant upfront investments in hardware and infrastructure. However, the importance of robust cloud security measures is highlighted by the findings of the Cost of data breach research conducted by IBM, which revealed that 45% of breaches occurred in cloud environments. Interestingly, breaches in the public cloud were found to cost considerably more than breaches in organizations with a hybrid cloud model. This emphasizes the need for comprehensive security solutions specifically designed for the cloud environment. With the rise of remote work and a mobile workforce, cloud-based security's ability to protect data and applications regardless of the user's location further solidifies its position as a preferred choice.

Restraint: Lack of awareness of remote work security risks

Lack of awareness regarding remote work security risks presents a significant challenge for remote work security as many individuals and organizations fail to grasp the potential threats and vulnerabilities associated with remote work, leading to complacency and inadequate protection measures. Consequently, sensitive data becomes exposed, and susceptibility to cyberattacks increases, resulting in potential financial losses. The Lookout State of Remote Work Security Report highlighted that 95% of cybersecurity breaches are caused by human error, often due to unintentional mistakes made by remote workers. Therefore, raising awareness about these risks is crucial to ensure remote workers and organizations remain vigilant, adopt robust security protocols, and effectively safeguard their digital assets.

Opportunity: Increasing demand for mobile security solutions

The reliance on mobile devices for business has increased as the global workforce embraces flexible work arrangements. However, this transition has also led to an increase in cyber threats and data breaches. According to the 2022 workforce security report by Checkpoint, 97% of organizations faced mobile threats, and 46% reported incidents where employees downloaded malicious mobile applications. Consequently, organizations seek comprehensive mobile security solutions to protect their remote workforce and sensitive information. These solutions encompass a range of advanced authentication methods, encryption protocols, secure mobile device management, and real-time threat monitoring. By implementing these robust measures, companies can fortify remote work environments, ensuring enhanced data protection and mitigating potential cyber-attacks. The deployment of mobile security solutions shields business assets and fosters confidence and peace of mind among remote employees, empowering them to work efficiently and productively from any location without compromising data integrity and confidentiality.

Challenge: Securing remote access to corporate resources

Securing remote access to corporate resources presents a significant challenge for organizations due to the diverse range of devices and networks used by remote workers. Personal devices and networks can expose vulnerabilities, making them potential cyberattack targets. According to the Lookout report on the state of remote work security, it has been found that 46% of remote employees opt to store the work files on personal devices rather than using the employer’s network drive, further heightening the security risks. The growing sophistication of cyberattacks poses an ongoing threat, requiring constant vigilance to counter emerging risks. Implementing VPNs and 2FA can be complex, demanding seamless integration with existing systems while ensuring user-friendliness. Maintaining security measures across various platforms and educating employees about security risks are crucial to preventing potential breaches and safeguarding sensitive corporate data.

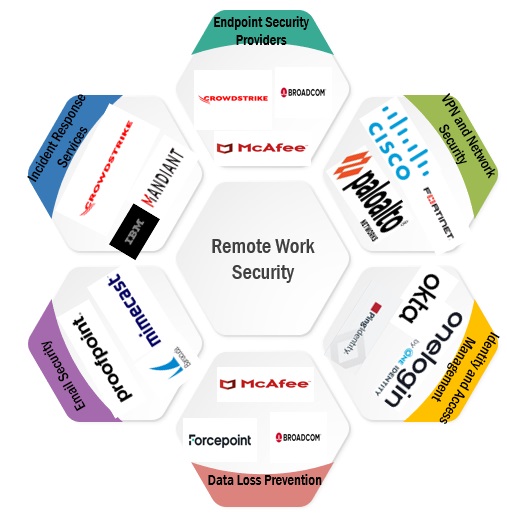

Ecosystem of Remote Work Security Market

The application security type registers the highest CAGR in the remote work security market during the forecast period.

Application security refers to identifying, mitigating, and preventing security vulnerabilities and threats within software applications. Application security is critical as remote employees rely heavily on various software applications to perform their tasks. These applications may include communication tools, collaboration platforms, and business-critical applications. Ensuring the security of these applications is essential to prevent unauthorized access, data leaks, and cyber threats that could compromise remote work environments. Adequate application security in remote work settings includes regular vulnerability assessments, patch management, secure coding practices, and continuous monitoring of applications for suspicious activities. By prioritizing application security, organizations can enable remote employees to work confidently with software tools, minimizing the risks associated with application vulnerabilities and enhancing the overall security posture in remote work scenarios.

The professional services are expected to register a higher CAGR during the forecast period.

Professional services offer expert guidance, implementation, and ongoing support to organizations in remote work security. These services encompass various activities, including risk assessments, security policy development, infrastructure design, and security audits. Professionals in this field assist organizations in identifying vulnerabilities, designing and implementing robust security measures, and ensuring compliance with industry standards and regulations. They provide training and awareness programs for remote employees, equipping them with the knowledge and skills to recognize and respond to security threats. Moreover, professional services offer incident response planning and management, helping organizations swiftly mitigate and recover from security incidents. Professional services are instrumental in creating a secure remote work environment, adapting security strategies to evolving threats, and ensuring that organizations can harness the benefits of remote work without compromising on cybersecurity.

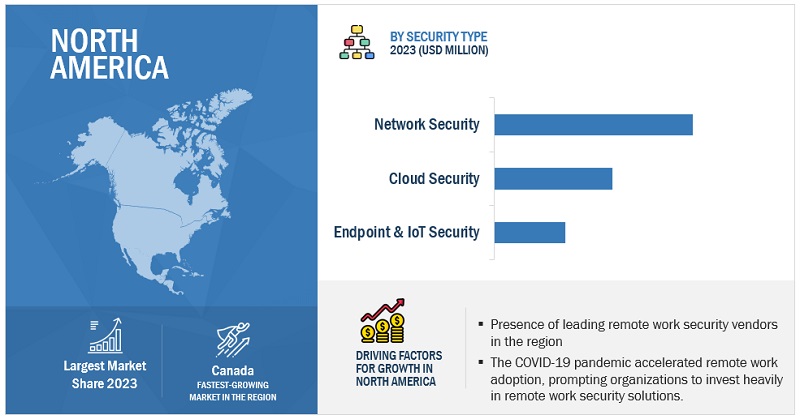

Based on region, North America is expected to hold the largest market size during the forecast.

The global remote work security market is set to witness North America as its most significant contributor in market size, with a considerable impact from the United States and Canada. Within the region, organizations heavily invest in cutting-edge technologies like AI, 5G, machine learning, blockchain, big data, and cloud computing. This tech-driven approach is fueling the demand for cloud-based security solutions, including Software-Defined Wide Area Networking (SD-WAN), Zero Trust Network Access (ZTNA), Secure Web Gateways (SWG), and Cloud Access Security Brokers (CASB). Projections from the Mobile Economy North America 2022 report suggest that 5G connections (excluding IoT) will reach a staggering 280 million by 2025, constituting 64% of all mobile connections in North America. Additionally, the sudden shift to remote work in 2020 amplified security concerns, prompting organizations to establish a distributed security perimeter. As a result, the market for remote work security solutions in North America is expected to experience substantial growth in the coming years.

Market Players:

The major vendors in this market include Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the remote work security market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Offering security type, remote work model, vertical, and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

The major players in the Remote work security market are Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US) |

This research report categorizes the Remote work security market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Solutions

-

Services

-

Professional Services

- Training & Consulting

- Integration & Implementation

- Support & Maintenance

- Managed Services

-

Professional Services

Based on Security Type:

- Endpoint & IoT Security

- Network Security

- Cloud Security

- Application Security

Based on the Remote Work Model:

- Fully Remote

- Hybrid

- Temporary Remote

Based on Vertical:

- BFSI

- Telecommunications

- IT & ITeS

- Education

- Retail & eCommerce

- Government

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2023, VMware and Lookout partnered to offer a secure access service edge (SASE) solution, integrating the Lookout Cloud Security Platform with VMware SD-WAN. The partnership ensures optimized network connectivity, data protection, and enhanced visibility for cloud-first enterprises, providing reliable and secure remote access to applications from any device and location.

- In April 2023, Palo Alto Networks and Accenture joined forces to offer AI-powered Prisma SASE solutions, enhancing cyber resilience and enabling secure access control for organizations amidst the complexities of remote work and multi-cloud environments.

- In July 2022, Cisco and Ricoh formed a strategic partnership, offering Secure Remote Access Solutions, combining network security and Auto VPN elements, to enhance hybrid working and IoT support services in Hong Kong. The collaboration provides comprehensive smart office solutions for businesses.

Frequently Asked Questions (FAQ):

What is remote work security?

Remote work security refers to the practices, technologies, policies, and measures implemented to protect an organization’s data, systems, and network when employees work outside the traditional office environment, typically from remote locations such as their homes or other remote offices. Remote work security aims to ensure that sensitive and confidential information remains safe and secure, even when accessed and transmitted from various remote devices and networks.

What is the market size of the remote work security market?

The major drivers in the remote work security market include the increasing adoption of remote work, rising cybercrime rates, and growing demand for cloud-based security solutions. These factors have led to a rising demand for network emulators.

What are the major drivers in the remote work security market?

North America is expected to hold the highest market share during the forecast period.

Who are the key players operating in the remote work security market?

The key vendors operating in the remote work security market include Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US).

What are the opportunities for new market entrants in remote work security?

New entrants eyeing the remote work security market have various opportunities to establish themselves in this growing sector. Innovating with cutting-edge security solutions, specializing in niche areas, offering cost-effective options, ensuring user-friendly interfaces, forming strategic partnerships, and expanding into emerging markets are all viable strategies. Additionally, expertise in compliance, providing education and training services, scalability, and a robust customer-centric approach can set new entrants apart in this dynamic and competitive landscape.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

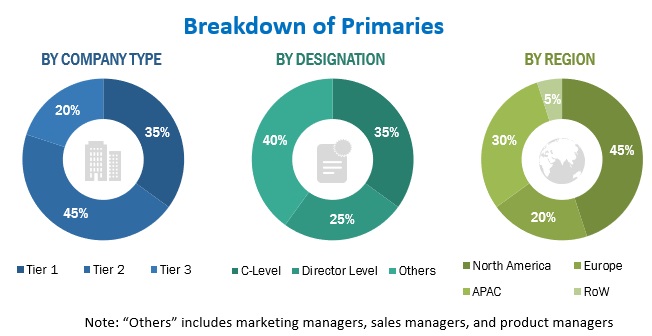

The research study involved four major activities in estimating the Remote Work Security market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain essential information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various supply and demand sources were interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the Remote Work Security market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

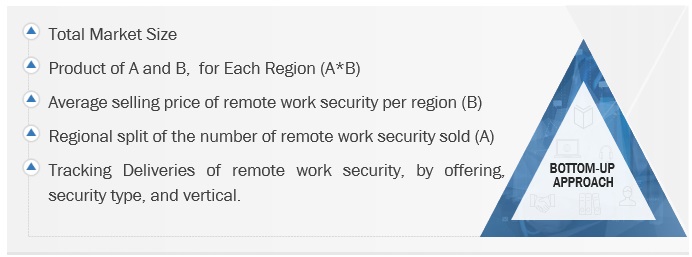

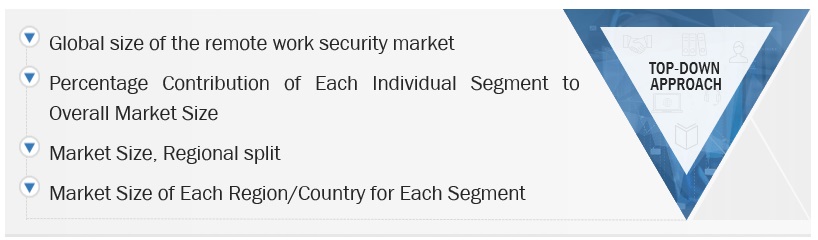

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the Remote Work Security market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the key market area have been considered.

- Analyzing major original equipment manufacturers (OEMs), studying their product portfolios, and understanding different applications of their solutions.

- Analyzing the trends related to adopting different types of authentications and brand protection equipment.

- Tracking the recent and upcoming developments in the Remote Work Security market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to know about different types of authentications and brand protection offerings used and the applications for which they are used to analyze the break-up of the scope of work carried out by major companies.

- Segmenting the market based on technology types concerning applications wherein the types are to be used and deriving the size of the global application market.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The Remote Work Security market has been split into several segments and sub-segments after arriving at the overall market size from the estimation process explained above. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The Remote work security market size has been validated using top-down and bottom-up approaches.

Market Definition

Remote work security involves safeguarding access to various applications, including those managed by the corporation, personal, recreational, and web-based applications. As businesses increasingly embrace hybrid and remote work models, ensuring the security of these critical applications, regardless of the device being used, has become a paramount concern. Organizations must carefully assess the necessary infrastructure to maintain application performance and security standards to meet the IT requirements associated with hybrid work effectively.

Stakeholders

- Remote Work Security vendors

- Project Managers

- System Integrators (SIs)

- Developers

- Business Analysts

- Cybersecurity Specialists

- Third-party vendors

- Technology Providers

- Consulting Firms

- Quality Assurance (QA)/ test engineers

Report Objectives

- To determine and forecast the global Remote work security market by offering (solution and service), security type, remote work model, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments concerning five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Remote work security market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the MEA market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Remote Work Security Market