Rice Seeds Market by Type (Hybrid and Open-Pollinated Varieties), Grain Size (Long, Medium, and Short), Hybridization Technique (Two-Line and Three-Line), Treatment (Treated and Untreated Seeds), and Region - Global Forecast To 2023

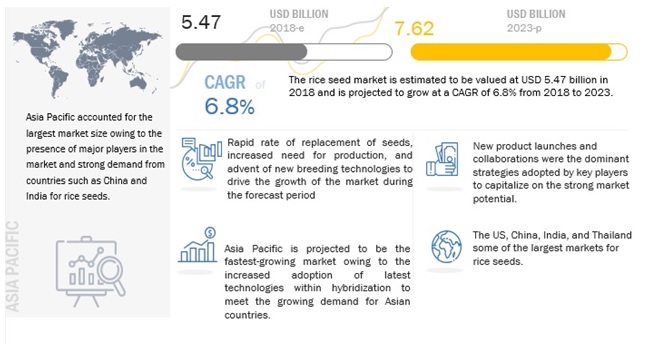

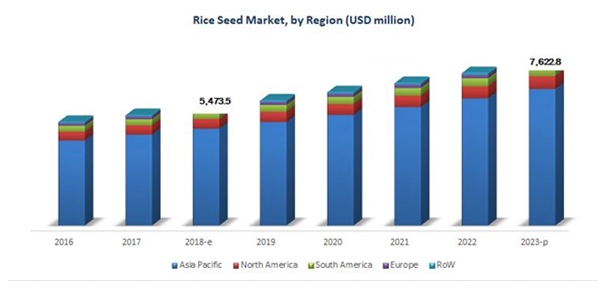

[179 Pages Report] The rice seeds market is projected to reach USD 7.62 billion by 2023, from USD 5.47 billion in 2018, at a CAGR of 6.8% during the forecast period. The market for rice seeds is driven by factors such as the increasing technological advances in rice breeding, declining prices of hybrid rice seeds, growing adoption of hybrid rice seeds in the developed and developing countries, and rising seed replacement rate for paddy across Asian countries.

To know about the assumptions considered for the study, Request for Free Sample Report

By seed size, long grain rice seeds are estimated to be most widely used in 2018. This is owing to the high rate of cultivation across various countries in North America and Asia. The limited application of short grain rice in the food industry is also aiding in driving the growth of these types of seeds. For instance, in Asian countries, Basmati and jasmine are some of the long-grain rice varieties that are exported from Asia in large quantities and have industrial importance from the perspective of rice millers in terms of price value. The major players in the market, such as Bayer and DowDuPont, focus on long rice grains, followed by medium-sized rice and short rice.

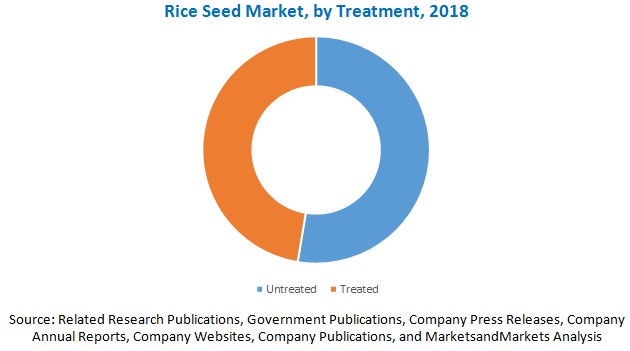

By treatment, untreated rice seeds account for a larger market size; however, treatment of seeds and their adoption has been gaining importance for field crops, such as corn, wheat, and soybean, to reduce crop loss from early pest attacks. However, the adoption of this technology for rice is still gradual across countries. Rice is mainly cultivated in Asian countries. However, farmers are reluctant to invest capital in crop inputs and prefer adopting the traditional techniques of crop protection. Due to the rising need for sustainable agriculture and integrated pest management guidelines laid by governments in Asian countries has encouraged farmers to adopt seed coating technologies. On account of these factors, this segment is projected to grow at the highest rate during the forecast period.

By hybridization technique, the three-line system has a higher market share and is adopted more often by major players for hybrid seed production in Asian countries. Very few companies such as LongPing Hi-Tech and RiceTec Inc. have been relying on the two-line system for product development. The dearth of skilled labor and requirement of a controlled environment and huge land area for system set-up are the major factors restraining the growth of the two-line system in Asian countries. The US and China are the major countries that are staying ahead of the curve and adopting the two-line system owing to the benefits associated with it.

By region, the Asia Pacific accounted for the largest share. The region is a major consumer and producer of rice across the globe, and inadequate arable land in this region has encouraged farmers for better yield from their cultivation. Adoption of advanced technologies such as hybrid and certified seeds is also increasing in this region. Since rice cultivation in other regions of the world is comparatively low, the growth of the Asia Pacific market is projected to remain steady during the forecast period and is projected to be the fastest-growing region during the forecast period.

The market for the competitive landscape rice seeds is highly fragmented, with many players who have a global presence and strong R&D and technological capacities to meet the growing demand across the globe. New product launches and collaborations are some of the strategies which are being adopted by players in the rice seed market to penetrate new markets.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018 – 2023 |

|

Forecast units |

Value (USD Million), Volume (KT) |

|

Segments covered |

By Type, Hybridization Technique, Treatment, Grain Size, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Bayer (Germany), DowDuPont (US), Syngenta (Switzerland), Advanta Seeds (UPL) (India), and Nuziveedu Seeds (India), Mahyco (India), BASF (Germany), Kaveri Seeds (India), SL Agritech (Philippines), Rasi seeds (India), Rallis (India), JK Seeds (India), Hefei Fengle (China), LongPing (China), Guard Agri (Pakistan), and National Seeds Corporation (India). |

This research report categorizes the rice seeds market based on type, hybridization technique, treatment, grain size, and region. It provides information on the market size for the various segments and sub-segments within the rice seed market between 2018 and 2023.

Type

- Open-pollinated varieties

- Commercial hybrids

Hybridization technique

- Two-line system

- Three-line system

Treatment

- Treated

- Untreated

Grain size

- Long grains

- Medium-sized grains

- Short grains

Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Italy

- Spain

- Russia

- Greece

- Rest of Europe (Portugal, France, Ukraine, Bulgaria, and Romania)

-

Asia Pacific

- China

- India

- Thailand

- Vietnam

- Rest of Asia Pacific (Bangladesh, Japan, Myanmar, the Philippines, and Indonesia

-

South America

- Brazil

- Peru

- Argentina

- Rest of South America (Colombia, Ecuador, Uruguay, Paraguay, and Venezuela)

-

RoW

- Nigeria

- Egypt

- Others in RoW (Madagascar, South Africa, and Kenya)

Frequently Asked Questions (FAQ):

What is the leading treatment in the rice seeds market?

The untreated segment was the highest revenue contributor to the market, with USD 2,723.1 million in 2017, and is estimated to reach USD 3,899.9 million by 2023, with a CAGR of 6.2%.

What is the estimated industry size of rice seeds?

The global rice seeds market was valued at USD 5,147.2 million in 2017, and is projected to reach USD 7,622.8 million by 2023, registering a CAGR of 6.9% from 2018 to 2023.

What is the leading type of rice seeds market?

The open-pollinated varieties segment was the highest revenue contributor to the market, with USD 2,855.2 million in 2017, and is estimated to reach USD 4,056.5 million by 2023, with a CAGR of 6.1%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Opportunities in this Market

4.2 Rice Seeds Market, By Type

4.3 Asia Pacific: Rice Seeds Market, By Grain Size & Country

4.4 Rice Seeds Market, By Treatment & Region

4.5 Market Share, By Key Country

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 Growing Necessity for Increase in Food Production

5.2.1.1 Growth in Global Population Levels

5.2.1.2 Decline in Arable Land

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Seed Replacement Rate

5.3.1.2 Improved Varieties of Hybrid Seeds for Rice

5.3.2 Restraints

5.3.2.1 Low Margin for Industrial Crops

5.3.2.2 Government Regulations on Genetic Modifications

5.3.3 Opportunities

5.3.3.1 Advent of New Technologies

5.3.3.1.1 Hybrid Technology

5.3.3.1.2 Molecular Breeding

5.3.3.2 Increase in Export Varieties

5.3.3.3 Price Drop in Rice Hybrids

5.3.4 Challenges:

5.3.4.1 Commercialization of Fake Hybrid Rice Seeds and Counterfeit of Products

5.4 Regulatory Framework

5.4.1 North America

5.4.1.1 US

5.4.1.2 Canada

5.4.2 European Union

5.4.3 Asia Pacific

5.4.3.1 India

5.4.3.2 China

5.4.3.3 Bangladesh:

5.4.4 Brazil

5.4.5 South Africa

5.5 Supply Chain Analysis

5.6 Patent Analysis

6 Rice Seeds Market, By Type (Page No. - 61)

6.1 Introduction

6.2 Open-Pollinated Varieties (OPV)

6.3 Hybrids

7 Rice Seeds Market, By Hybridization Technique (Page No. - 67)

7.1 Introduction

7.2 Two-Line System

7.3 Three-Line System

8 Rice Seeds Market, By Treatment (Page No. - 72)

8.1 Introduction

8.2 Treated

8.3 Untreated

9 Rice Seeds Market, By Grain Size (Page No. - 77)

9.1 Introduction

9.2 Long Grains

9.3 Medium-Sized Grains

9.4 Short Grains

10 Rice Seeds Market, By Region (Page No. - 82)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Italy

10.3.2 Spain

10.3.3 Russia

10.3.4 Greece

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Thailand

10.4.4 Vietnam

10.4.5 Rest of Asia Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Peru

10.5.3 Argentina

10.5.4 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Nigeria

10.6.2 Egypt

10.6.3 Others in RoW

11 Competitive Landscape (Page No. - 125)

11.1 Overview

11.2 Company Share Analysis and Rankings

11.3 Competitive Scenario

11.3.1 Mergers & Acquisitions

11.3.2 New Product Launches

11.3.3 Agreements, Partnerships, and Joint Ventures

12 Company Profiles (Page No. - 131)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Bayer

12.2 Dowdupont

12.3 Syngenta

12.4 UPL Advanta

12.5 Nuziveedu Seeds

12.6 Kaveri Seeds

12.7 Rallis India Limited

12.8 Mahyco

12.9 SL Agritech

12.10 Rasi Seeds

12.11 Guard Agri

12.12 JK Seeds

12.13 Hefei Fengle Seeds

12.14 Krishidhan Seeds

12.15 National Seed Corporation

12.16 BASF

12.17 Long Ping Hi-Tech Seeds

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 172)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (100 Tables)

Table 1 USD Exchange Rates, 2014–2017

Table 2 Cost Comparison Between Hybrid Rice and Conventional Rice

Table 3 Revenue Comparison Between Hybrid Rice and Conventional Rice

Table 4 List of Important Patents for Rice Seeds, 2013–2018

Table 5 Rice Seeds Market Size, By Type, 2016–2023 (USD Million)

Table 6 Market Size, By Type, 2016–2023 (KT)

Table 7 Open-Pollinated Varieties: Rice Seed Market Size, By Region, 2016–2023 (USD Million)

Table 8 Open-Pollinated Varieties: Market Size, By Region, 2016–2023 (KT)

Table 9 Hybrids: Rice Seeds Market Size, By Region, 2016–2023 (USD Million)

Table 10 Hybrids: Market Size, By Region, 2016–2023 (KT)

Table 11 Hybrid Rice Seed Market, By Hybridization Technique, 2016–2023 (USD Million)

Table 12 Two-Line Hybrid Rice Seed Market Size, By Region, 2016–2023 (USD Million)

Table 13 Three-Line Hybrid Rice Seed Market Size, By Region, 2016–2023 (USD Million)

Table 14 Rice Seeds Market, By Treatment, 2016–2023 (USD Million)

Table 15 Treated Rice Seeds Market Size, By Region, 2016–2023 (USD Million)

Table 16 Untreated Rice Seed Market Size, By Region, 2016–2023 (USD Million)

Table 17 Rice Seeds Market Size, By Grain Size, 2016–2023 (USD Million

Table 18 Long Grains: Rice Seed Market Size, By Region, 2016–2023 (USD Million)

Table 19 Medium-Sized Grains: Rice Seeds Market Size, By Region, 2016–2023 (USD Million)

Table 20 Short Grains: Rice Seed Market Size, By Region, 2016–2023 (USD Million)

Table 21 Market Size, By Region, 2016–2023 (USD Million)

Table 22 Market Size, By Region, 2016–2023 (KT)

Table 23 North America: Rice Seeds Market Size, By Country, 2016–2023 (USD Million)

Table 24 North America: Market Size, By Country, 2016–2023 (KT)

Table 25 North America: Market Size, By Type, 2016–2023 (USD Million)

Table 26 North America: Market Size, By Type, 2016–2023 (KT)

Table 27 North America: Hybrid Rice Seed Market Size, By Hybridization Technique, 2016–2023 (USD Million)

Table 28 North America: Market Size, By Treatment, 2016–2023 (USD Million)

Table 29 North America: Market Size, By Grain Size, 2016–2023 (USD Million)

Table 30 US: Market Size, By Type, 2016–2023 (USD Million)

Table 31 US: Market Size, By Type, 2016–2023 (KT)

Table 32 Canada: Market Size, By Type, 2016–2023 (USD Million)

Table 33 Canada: Market Size, By Type, 2016–2023 (KT)

Table 34 Mexico: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 35 Mexico: Market Size, By Type, 2016–2023 (KT)

Table 36 Europe: Rice Seeds Market Size, By Country, 2016–2023 (USD Million)

Table 37 Europe: Market Size, By Country, 2016–2023 (KT)

Table 38 Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 39 Europe: Market Size, By Type, 2016–2023 (KT)

Table 40 Europe: Hybrid Rice Seed Market Size, By Hybridization Technique, 2016–2023 (USD Million)

Table 41 Europe: Market Size, By Treatment, 2016–2023 (USD Million)

Table 42 Europe: Market Size, By Grain Size, 2016–2023 (USD Million)

Table 43 Italy: Rice Seeds Market Size, By Type, 2016–2023 (USD Million)

Table 44 Italy: Market Size, By Type, 2016–2023 (KT)

Table 45 Spain: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 46 Spain: Market Size, By Type, 2016–2023 (KT)

Table 47 Russia: Market Size, By Type, 2016–2023 (USD Million)

Table 48 Russia: Market Size, By Type, 2016–2023 (KT)

Table 49 Greece: Rice Seed Market Size, By Type, 2016–2023 (USD Million)

Table 50 Greece: Market Size, By Type, 2016–2023 (KT)

Table 51 Rest of Europe: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 52 Rest of Europe: Market Size, By Type, 2016–2023 (KT)

Table 53 Asia Pacific: Rice Seeds Market Size, By Country, 2016–2023 (USD Million)

Table 54 Asia Pacific: Market Size, By Country, 2016–2023 (KT)

Table 55 Asia Pacific: Market Size, By Type, 2016–2023 (USD Million)

Table 56 Asia Pacific: Market Size, By Type, 2016–2023 (KT)

Table 57 Asia Pacific: Hybrid Rice Seeds: Market Size, By Hybridization Technique, 2016–2023 (USD Million)

Table 58 Asia Pacific: Market Size, By Treatment, 2016–2023 (USD Million)

Table 59 Asia Pacific: Market Size, By Grain Size, 2016–2023 (USD Million)

Table 60 China: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 61 China: Market Size, By Type, 2016–2023 (KT)

Table 62 India: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 63 India: Market Size, By Type, 2016–2023 (KT)

Table 64 Thailand: Rice Seed Market Size, By Type, 2016–2023 (USD Million)

Table 65 Thailand: Market Size, By Type, 2016–2023 (KT)

Table 66 Vietnam: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 67 Vietnam: Market Size, By Type, 2016–2023 (KT)

Table 68 Rest of Asia Pacific: Market Size, By Type, 2016–2023 (USD Million)

Table 69 Rest of Asia Pacific: Market Size, By Type, 2016–2023 (KT)

Table 70 South America: Rice Seeds Market Size, By Country, 2016–2023 (USD Million)

Table 71 South America: Market Size, By Country, 2016–2023 (KT)

Table 72 South America: Market Size, By Type, 2016–2023 (USD Million)

Table 73 South America: Market Size, By Type, 2016–2023 (KT)

Table 74 South America: Hybrid Rice Seed Market Size, By Hybridization Technique, 2016–2023 (USD Million)

Table 75 South America: Market Size, By Treatment, 2016–2023 (USD Million)

Table 76 South America: Market Size, By Grain Size, 2016–2023 (USD Million)

Table 77 Brazil: Market Size, By Type, 2016–2023 (USD Million)

Table 78 Brazil: Market Size, By Type, 2016–2023 (KT)

Table 79 Peru: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 80 Peru: Market Size, By Type, 2016–2023 (KT)

Table 81 Argentina: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 82 Argentina: Market Size, By Type, 2016–2023 (KT)

Table 83 Rest of South America: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 84 Rest of South America: Market Size, By Type, 2016–2023 (KT)

Table 85 RoW: Rice Seeds Market Size, By Country, 2016–2023 (USD Million)

Table 86 RoW: Market Size, By Country, 2016–2023 (KT)

Table 87 RoW: Market Size, By Type, 2016–2023 (USD Million)

Table 88 RoW: Market Size, By Type, 2016–2023 (KT)

Table 89 RoW: Hybrid Rice Seeds: Market Size, By Hybridization Technique, 2016–2023 (USD Million)

Table 90 RoW: Market Size, By Treatment, 2016–2023 (USD Million)

Table 91 RoW: Market Size, By Grain Size, 2016–2023 (USD Million)

Table 92 Nigeria: Market Size, By Type, 2016–2023 (USD Million)

Table 93 Nigeria: Market Size, By Type, 2016–2023 (KT)

Table 94 Egypt: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 95 Egypt: Market Size, By Type, 2016–2023 (KT)

Table 96 Others in RoW: Market Size for Rice Seeds, By Type, 2016–2023 (USD Million)

Table 97 Others in RoW: Market Size, By Type, 2016–2023 (KT)

Table 98 Mergers & Acquisitions, 2016–2018

Table 99 New Product Launches, 2013–2018

Table 100 Agreements, Partnerships, and Joint Ventures, 2015–2018

List of Figures (51 Figures)

Figure 1 Market Segmentation

Figure 2 Rice Seed Market, By Region

Figure 3 Rice Seeds: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Rice Seeds Market Size, By Type, 2018 vs 2023 (KT)

Figure 9 Rice Seed Market Share (Value), By Treatment, 2018

Figure 10 Rice Seed Market Size, By Hybridization Technique, 2018 vs 2023 (USD Million)

Figure 11 Rice Seed Market: Regional Snapshot

Figure 12 Strong Annual Growth of Seed Replacement Rate for Paddy to Drive the Market

Figure 13 Open-Pollinated Varieties Were More Highly Adopted Rice Seeds Among Crop Growers in 2017

Figure 14 Asia Pacific: Strong Demand for Long Grain Seeds From End-User Farmers in 2017

Figure 15 Treated Seeds Dominated the Market Across the Americas in 2017

Figure 16 China: Important Market for Rice Seeds, 2017

Figure 17 World Population, 1980–2050 (Billion Heads)

Figure 18 Asian Rice Consumption and Arable Land, 1961–2013

Figure 19 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Rice Seed Replacement Rate Trends in India, 2004–2017

Figure 21 Percentage of Producers in the Us, By Seed Variety, 2006 vs 2013

Figure 22 Global Rice Price Trends, 2011–2017 (USD/Kg)

Figure 23 Rice Export Trends, 2014–2017 (USD Million)

Figure 24 Rice Price in China, 2012–2017 (USD/Kg)

Figure 25 Supply Chain Analysis: Rice Seeds Market

Figure 26 Number of Patents Approved for the Rice Seed Market, By Key Company, 2013–2018

Figure 27 Geographical Analysis: Patent Approval for the Rice Seeds Market, 2013–2018

Figure 28 Rice Seed Market Size, By Type, 2018 vs 2023 (USD Million)

Figure 29 Hybrid Rice Seeds Market, By Hybridization Technique, 2018 vs 2023 (USD Million)

Figure 30 Rice Seed Market Size, By Treatment, 2018 vs 2023 (USD Million)

Figure 31 Market Size, By Grain Size, 2018 vs 2023 (USD Million)

Figure 32 Mexico and Egypt are Projected to Witness the Highest Growth in the Coming Years

Figure 33 North America: Region Snapshot

Figure 34 Asia Pacific: Regional Snapshot

Figure 35 Key Developments By Leading Players in the Rice Seed Market, 2013–2018

Figure 36 Company Share Analysis: Rice Seed Market, 2017

Figure 37 Bayer: Company Snapshot

Figure 38 Bayer: SWOT Analysis

Figure 39 Dowdupont: Company Snapshot

Figure 40 Dowdupont: SWOT Analysis

Figure 41 Syngenta: Company Snapshot

Figure 42 Syngenta: SWOT Analysis

Figure 43 UPL Advanta: Company Snapshot

Figure 44 UPL Advanta: SWOT Analysis

Figure 45 Nuziveedu Seeds: Company Snapshot

Figure 46 Nuziveedu Seeds: SWOT Analysis

Figure 47 Kaveri Seeds: Company Snapshot

Figure 48 Rallis India Limited: Company Snapshot

Figure 49 JK Seeds: Company Snapshot

Figure 50 National Seed Corporation: Company Snapshot

Figure 51 BASF: Company Snapshot

The benefits associated with the adoption of commercial rice seeds are a major factor contributing to the growth of this market globally. The economic growth in developing countries and the increased R&D expenses in the agriculture industry drive the growth of the rice seeds market.

To know about the assumptions considered for the study, download the pdf brochure

According to the International Seed Federation (ISF), rice accounted for nearly 5% of the global commercial seeds market in 2014. The major seed manufacturing companies have been expanding their product portfolio in Asian countries. Strong support from the government in terms of subsidies for hybrid seeds has encouraged farmers to adopt this technology in developing countries as well. The decline in prices of hybrid seeds, to bridge the difference between hybrids and OPV seeds, has also encouraged key players to invest in the market.

Open-pollinated varieties were estimated to dominate the rice seeds market in 2018. Increasing adoption of hybrid seeds and increasing seed replacement rate across the countries of Asia Pacific, particularly in India, Thailand, China, and Vietnam is projected to impact the market growth; however, due to the high prices of hybrid seeds, its adoption has been limited to these developing countries. According to industry experts, even though the consumption of hybrid seeds has been exponentially increasing, particularly in China and India, and hybrid seeds have been increasingly preferred by farmers, the market is dominated by open-pollinated varieties owing to the high price of the hybrids.

The advent of genetically modified rice seeds was projected to boost the rice seed market, after the success of Bt cotton. Most of the key players have also invested in the development and support of GM rice projects. The Golden Rice Project supported by Syngenta and the development of GM rice seeds by Mahyco was scheduled to be commercialized in the past few years. However, the stringent regulations against GM technology for edible crops have hindered the commercialization of this technology, and multiple projects got shelved due to the regulatory policies.

Asia Pacific accounted for the largest share in the rice seeds market in 2017, followed by North America due to the high adoption of commercial open-pollinated varieties and hybrid rice seeds over farm-saved seeds to increase rice yield in countries such as China, India, Thailand, and the US. Development of improved hybrid seeds and the subsidy benefits provided by the government to encourage the adoption of hybrid seeds over farm-saved or OPV seeds have contributed to the growth of this market. The major factors restraining the adoption of hybrid seeds are their high cost as compared to OPV seeds and the lack of awareness about the advantages of hybrids on crop yield and profit margins. Also, the lack of skilled professionals and infrastructural facilities in the developing countries for hybridization techniques is projected to hinder the growth potential of this market.

The global market for rice seeds is dominated by key players such as Bayer (Germany), DowDuPont (US), Syngenta (Switzerland), Advanta Seeds (UPL) (India), and Nuziveedu Seeds (India). Some of the emerging players in the rice seed market include Mahyco (India), BASF (Germany), Kaveri Seeds (India), SL Agritech (Philippines), Rasi seeds (India), Rallis (India), JK Seeds (India), Hefei Fengle (China), LongPing (China), Guard Agri (Pakistan), and National Seeds Corporation (India).

Growth opportunities and latent adjacency in Rice Seeds Market