Serverless Architecture Market by Service Type (Automation and Integration, Monitoring, API Management, Security, Analytics, and Design and Consulting), Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2025

Serverless Architecture Market Analysis

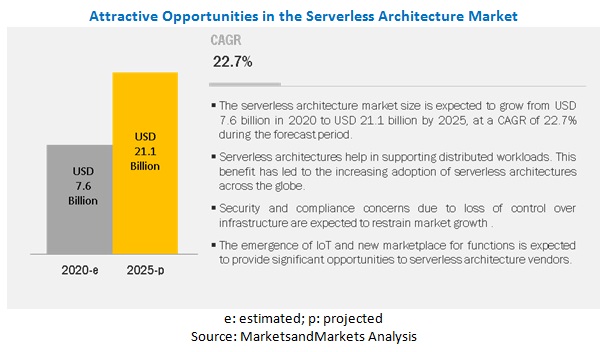

The global serverless architecture market size was crossed USD 7.6 billion in 2020 and is anticipated to exhibit a CAGR of 22.7% to reach USD 21.1 billion by the end of 2026. The major factors driving the growth of the serverless architecture market include the rising need of shifting from CAPEX to OPEX by removing the need to manage servers, thereby reducing the infrastructure cost.

Large enterprises segment to hold a larger market size during the forecast period

The adoption of serverless architecture service types among the large enterprises is high owing to the ever-increasing demand for cloud automation, and the trend is expected to continue during the forecast period. Large enterprises are heavily investing in advanced technology to increase the company’s overall productivity and efficiency. With the ever-increasing amount of data, large enterprises need to invest in IT infrastructure and technical expertise for automating various tasks regularly. To reduce CAPEX and OPEX of infrastructure, large enterprises are widely adopting serverless architecture service types. Large enterprises are expected to invest significantly to implement suitable serverless architecture service types which would enable enterprises to save on infrastructure costs, improve business functioning, and sustain in intense competition.

Monitoring services segment to record the highest growth rate during the forecast period

Monitoring is a crucial factor in maintaining stability and protection of operation. A successful tracking program alerts of failures until they impact clients, helping easily correct them and retain a high degree of service for the consumers of the application. In a serverless context, monitoring becomes significantly more challenging due to the disparate nature of a serverless application. Performance management services provide for quick troubleshoot and debugging and help in optimizing the performance of serverless functions. Serverless architecture assists in breaking down of the application into micro components to perform discrete functions. These functions therefore need to be effectively monitored and managed. Monitoring services give a complete picture of the health of the serverless infrastructure by providing visibility across various cloud deployments and provide key network metrics. These services further help reduce blind spots by detecting issues with containers, load balancers, disconnected hosts, and third-party providers.

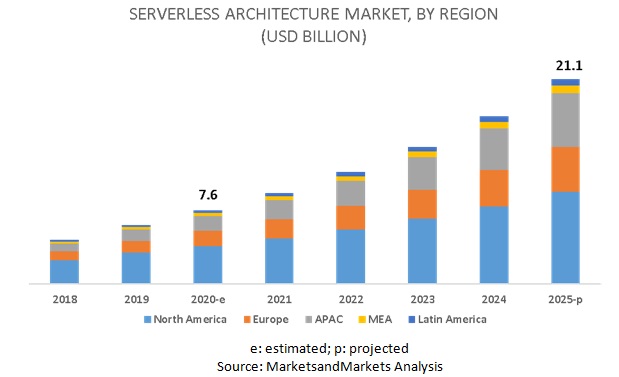

North America to account for the largest market size during the forecast period

The global serverless architecture market by region covers five major geographic regions: North America, Asia Pacific (APAC), Europe, MEA, and Latin America. North America is expected to account for the largest market size during the forecast period due to the presence of economically and technologically advanced countries such as the US and Canada, the adoption of Industry 4.0, and emerging technologies.

Key Market Players

The major players in the serverless architecture market are Amazon (US), Google (US), Microsoft (US), IBM (US), Oracle (US), Alibaba (China), Cloudflare (US), NTT DATA (Japan), Rackspace (US), TIBCO Software (US), Stackpath (US), Auth0 (US), EnterpriseWeb (US), Kong (US), Serverless (US), Snyk (UK), OpenLegacy (US), Innominds (US), Stackery (US), and Twistlock (US).

Please visit 360Quadrants to see the vendor listing of Best Architecture Software Quadrant

The study includes an in-depth competitive analysis of these key players in the serverless architecture market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Service type, Deployment model, Organization size, Vertical, And Region |

|

Geographies covered |

North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America |

|

Companies covered |

Amazon (US), Google (US), Microsoft (US), IBM (US), Oracle (US), Alibaba (China), Cloudflare (US). NTT DATA (Japan), Rackspace (US), TIBCO Software (US), Stackpath (US), Auth0 (US), EnterpriseWeb (US), Kong (US), Serverless (US), Snyk (UK), OpenLegacy (US), Innominds (US), Stackery (US), and Twistlock (US) |

This research report categorizes the serverless architecture market based on service type, deployment model, organization size, verticals, and region.

Based on component:

- Service types

- Automatation and Integration

- Monitoring

- API management

- Security

- Analytics

- Design and consulting

- Others (training and support, metering and billing, storage)

Based on deployment model:

- Public cloud

- Private cloud

Based on organization size:

- Large Enterprises

- SMEs

Based on verticals:

- BFSI

- Telecommunications and IT

- Retail and eCommerce

- Healthcare and Life Sciences

- Government and Public sector

- Manufacturing

- Media and Enetertainment

- Others (transportation and logistics, energy and utilities, travel and hospitality, and education)

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- ANZ

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- Qatar

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Serverless Architecture Market

- In April 2020, Amazon Web Services has launched Fargate 1.4. It is an update to its serverless container platform that adds support for shared Elastic File System storage and removes use of Docker Engine. This update makes it easy to run stateful workloads in container applications.

- In November 2019, Google releases Cloud Run serverless containers. Cloud Run service lets developers run containers on Kubernetes (K8s) using a serverless model.

- In May 2019, Microsoft updates its Event Grid platform, which will allow users to build a far broader and higher powered, range of event-driven and serverless applications. Event Grid is an event routing service that allows the application to publish an event, which is picked up by Event Grid, and then routed to an appropriate application or service such as an Azure function.

- In February 2019, IBM announced managed Knative on IBM Cloud Kubernetes service. Knative is Kubernetes-based platform to deploy and manage modern serverless workloads. Thus, a managed Knative on IBM cloud will help users to take advantage of serverless containers.

Key questions addressed by the report

- What are the opportunities in the serverless architecture market?

- What is the competitive landscape in the market?

- What are the data regulations that will impact the market?

- What are the primary growth factors for the serverless architecture market in North America?

- What are the dynamics of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

1.3 COVID-19 ECONOMIC ASSESSMENT

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 REGIONS COVERED

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 SERVERLESS ARCHITECTURE MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 COMPETITIVE LEADERSHIP MAPPING RESEARCH METHODOLOGY

2.5.1 VENDOR INCLUSION CRITERIA

2.6 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE SERVERLESS ARCHITECTURE MARKET

4.2 NORTH AMERICA SERVERLESS ARCHITECTURE MARKET, BY DEPLOYMENT MODEL AND COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Digital-centric business model

5.2.1.2 Powerful advantage to streamline operations

5.2.1.3 Future of microservices lies in serverless and function-as-a-service

5.2.1.4 Increasing number of verticals utilizing distributed workloads

5.2.2 RESTRAINTS

5.2.2.1 Compliance concerns

5.2.2.2 Loss of control over the infrastructure

5.2.3 OPPORTUNITIES

5.2.3.1 New marketplaces for functions

5.2.3.2 Emergence of IoT applications

5.2.3.3 Usage of edge computing with serverless

5.2.4 CHALLENGES

5.2.4.1 Cost-efficiency for long-running computation

5.2.4.2 Vendor lock-in

5.3 USE CASES

5.3.1 USE CASE 1: BANKING, FINANCIAL SERVICES AND INSURANCE

5.3.2 USE CASE 2: RETAIL AND CONSUMER GOODS

5.3.3 USE CASE 3: INFORMATION TECHNOLOGY

5.3.4 USE CASE 4: MANUFACTURING

5.3.5 USE CASE 5: MEDIA AND ENTERTAINMENT

6 SERVERLESS ARCHITECTURE MARKET, BY SERVICE TYPE (Page No. - 51)

6.1 INTRODUCTION

6.2 AUTOMATION AND INTEGRATION

6.2.1 AUTOMATION AND INTEGRATION: SERVERLESS ARCHITECTURE MARKET DRIVERS

6.3 MONITORING

6.3.1 MONITORING:MARKET DRIVERS

6.4 API MANAGEMENT

6.4.1 API MANAGEMENT: MARKET DRIVERS

6.5 SECURITY

6.5.1 SECURITY: MARKET DRIVERS

6.6 ANALYTICS

6.6.1 ANALYTICS: MARKET DRIVERS

6.7 DESIGN AND CONSULTING

6.7.1 DESIGN AND CONSULTING: SERVERLESS ARCHITECTURE MARKET DRIVERS

6.8 OTHERS

7 SERVERLESS ARCHITECTURE MARKET, BY DEPLOYMENT MODEL (Page No. - 60)

7.1 INTRODUCTION

7.2 PUBLIC CLOUD

7.2.1 PUBLIC CLOUD: MARKET DRIVERS

7.3 PRIVATE CLOUD

7.3.1 PRIVATE CLOUD: MARKET DRIVERS

8 SERVERLESS ARCHITECTURE MARKET, BY ORGANIZATION SIZE (Page No. - 64)

8.1 INTRODUCTION

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

9 SERVERLESS ARCHITECTURE MARKET, BY VERTICAL (Page No. - 68)

9.1 INTRODUCTION

9.2 BANKING, FINANCIAL SERVICES AND INSURANCE

9.2.1 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

9.2.2 IMPACT OF COVID-19 ON BANKING, FINANCIAL SERVICES AND INSURANCE

9.3 TELECOMMUNICATIONS AND IT

9.3.1 TELECOMMUNICATIONS AND IT: MARKET DRIVERS

9.3.2 IMPACT OF COVID-19 ON TELECOMMUNICATIONS AND IT

9.4 RETAIL AND ECOMMERCE

9.4.1 RETAIL AND ECOMMERCE: MARKET DRIVERS

9.4.2 IMPACT OF COVID-19 ON RETAIL AND ECOMMERCE

9.5 HEALTHCARE AND LIFESCIENCES

9.5.1 HEALTHCARE AND LIFE SCIENCES: MARKET DRIVERS

9.5.2 IMPACT OF COVID-19 ON HEALTHCARE AND LIFE SCIENCES

9.6 GOVERNMENT AND PUBLIC SECTOR

9.6.1 GOVERNMENT AND PUBLIC SECTOR: SERVERLESS ARCHITECTURE MARKET DRIVERS

9.6.2 IMPACT OF COVID-19 ON GOVERNMENT AND PUBLIC SECTOR

9.7 MANUFACTURING

9.7.1 MANUFACTURING: MARKET DRIVERS

9.7.2 IMPACT OF COVID-19 ON MANUFACTURING

9.8 MEDIA AND ENTERTAINMENT

9.8.1 MEDIA AND ENTERTAINMENT: MARKET DRIVERS

9.8.2 IMPACT OF COVID-19 ON MEDIA AND ENTERTAINMENT

9.9 OTHERS

9.9.1 IMPACT OF COVID-19 ON OTHERS

10 SERVERLESS ARCHITECTURE MARKET, BY REGION (Page No. - 80)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: IMPACT OF COVID-19

10.2.3 UNITED STATES

10.2.4 CANADA

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: IMPACT OF COVID-19

10.3.3 UNITED KINGDOM

10.3.4 GERMANY

10.3.5 FRANCE

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: SERVERLESS ARCHITECTURE MARKET DRIVERS

10.4.2 ASIA PACIFIC: IMPACT OF COVID-19

10.4.3 AUSTRALIA AND NEW ZEALAND

10.4.4 CHINA

10.4.5 JAPAN

10.4.6 INDIA

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: IMPACT OF COVID-19

10.5.3 KINGDOM OF SAUDI ARABIA

10.5.4 QATAR

10.5.5 UNITED ARAB EMIRATES

10.5.6 SOUTH AFRICA

10.5.7 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: IMPACT OF COVID-19

10.6.3 BRAZIL

10.6.4 MEXICO

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 131)

11.1 COMPETITIVE LEADER MAPPING

11.1.1 VISIONARY LEADERS

11.1.2 INNOVATORS

11.1.3 DYNAMIC DIFFERENTIATORS

11.1.4 EMERGING COMPANIES

12 COMPANY PROFILES (Page No. - 133)

12.1 INTRODUCTION

(Business Overview, Products and Solutions Offered, SWOT Analysis, and Recent Developments)*

12.2 AMAZON

12.3 GOOGLE

12.4 MICROSOFT

12.5 IBM

12.6 ORACLE

12.7 ALIBABA

12.8 CLOUDFLARE

12.9 NTT DATA

12.10 RACKSPACE

12.11 TIBCO SOFTWARE

* Business Overview, Products and Solutions Offered, SWOT Analysis, and Recent Developments might not be captured in case of unlisted companies.

12.12 STACKPATH

12.13 AUTH0

12.14 ENTERPRISEWEB

12.15 KONG

12.16 SERVERLESS

12.17 SNYK

12.18 OPENLEGACY

12.19 INNOMINDS

12.20 STACKERY

12.21 TWISTLOCK

12.22 RIGHT-TO-WIN

13 APPENDIX (Page No. - 165)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (109 Tables)

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2016–2019

TABLE 2 FACTOR ANALYSIS

TABLE 3 EVALUATION CRITERIA

TABLE 4 SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 5 AUTOMATION AND INTEGRATION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 MONITORING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 API MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 SECURITY: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 ANALYTICS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 DESIGN AND CONSULTING: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 11 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 SERVERLESS ARCHITECTURE MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 13 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 16 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 19 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 TELECOMMUNICATIONS AND IT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 HEALTHCARE AND LIFESCIENCES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 MANUFACTURING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 UNITED STATES: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 34 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 35 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 36 CANADA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 37 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 38 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 41 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 42 EUROPE: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 UNITED KINGDOM: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 45 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 46 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 47 GERMANY: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 48 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 49 GERMANY: SERVERLESS ARCHITECTURE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 50 FRANCE: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 51 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 52 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 53 REST OF EUROPE: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 54 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 55 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 62 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 63 AUSTRALIA AND NEW ZEALAND: SERVERLESS ARCHITECTURE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 64 CHINA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 65 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 66 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 67 JAPAN: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 68 JAPAN: SERVERLESS ARCHITECTURE MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 69 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 70 INDIA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 71 INDIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 72 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 73 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 74 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 75 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 82 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 83 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 84 QATAR: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 85 QATAR: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 86 QATAR: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 87 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 88 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 89 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 90 SOUTH AFRICA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 91 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 92 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 93 REST OF MIDDLE EAST AND AFRICA: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 94 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 95 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 100 LATIN AMERICA: SERVERLESS ARCHITECTURE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 BRAZIL: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 102 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 103 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 104 MEXICO: MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 105 MEXICO: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 106 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 107 REST OF LATIN AMERICA: SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD THOUSANDS)

TABLE 108 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 109 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

LIST OF FIGURES (42 Figures)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 6 GLOBAL SERVERLESS ARCHITECTURE MARKET: MARKET SEGMENTATION

FIGURE 7 GLOBAL SERVERLESS ARCHITECTURE MARKET: RESEARCH DESIGN

FIGURE 8 METHOD 1: BASED ON COMPANIES’ REVENUE FROM SERVERLESS ARCHITECTURE SOFTWARE AND SERVICES (TOP-DOWN)

FIGURE 9 METHOD 2: BOTTOM-UP APPROACH

FIGURE 10 TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE 11 ILLUSTRATIVE EXAMPLE OF REVENUE ESTIMATION

FIGURE 12 SERVERLESS ARCHITECTURE MARKET OVERVIEW

FIGURE 13 HIGHEST-GROWING SEGMENTS OF THE SERVERLESS ARCHITECTURE MARKET

FIGURE 14 AUTOMATION AND INTEGRATION SEGMENT TO ACCOUNT FOR A LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 15 PUBLIC CLOUD SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 16 LARGE ENTERPRISES SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 17 BANKING, FINANCIAL SERVICES AND INSURANCE VERTICAL TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 18 SERVERLESS ARCHITECTURE MARKET: REGIONAL SNAPSHOT

FIGURE 19 GROWING NUMBER OF ORGANIZATIONS UTILIZING DISTRIBUTED WORKLOADS TO DRIVE THE MARKET

FIGURE 20 PUBLIC CLOUD SEGMENT AND THE UNITED STATES TO DOMINATE THE NORTH AMERICAN MARKET IN 2020

FIGURE 21 SERVERLESS ARCHITECTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 22 AUTOMATION AND INTEGRATION SEGMENT TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 23 PUBLIC CLOUD SEGMENT TO HAVE A LARGER MARKET SIZE IN 2020

FIGURE 24 LARGE ENTERPRISES SEGMENT TO HAVE A LARGER MARKET SIZE IN 2020

FIGURE 25 BANKING, FINANCIAL SERVICES AND INSURANCE VERTICAL TO HAVE THE LARGEST MARKET SIZE IN 2020

FIGURE 26 NORTH AMERICA TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 29 GLOBAL SERVERLESS ARCHITECTURE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 30 AMAZON: COMPANY SNAPSHOT

FIGURE 31 AMAZON: SWOT ANALYSIS

FIGURE 32 GOOGLE: COMPANY SNAPSHOT

FIGURE 33 GOOGLE: SWOT ANALYSIS

FIGURE 34 MICROSOFT: COMPANY SNAPSHOT

FIGURE 35 MICROSOFT: SWOT ANALYSIS

FIGURE 36 IBM: COMPANY SNAPSHOT

FIGURE 37 IBM: SWOT ANALYSIS

FIGURE 38 ORACLE: COMPANY SNAPSHOT

FIGURE 39 ORACLE: SWOT ANALYSIS

FIGURE 40 ALIBABA: COMPANY SNAPSHOT

FIGURE 41 CLOUDFLARE: COMPANY SNAPSHOT

FIGURE 42 NTT DATA: COMPANY SNAPSHOT

The study involved five major activities in estimating the current size of the serverless architecture market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred for, to identify and collect information for this study. The secondary sources included annual reports; press releases; and investor presentations of companies, white papers, and journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the data center rack server market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the serverless architecture market, and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global serverless architecture market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall serverless architecture market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the serverless architecture market by service type, deployment model, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the serverless architecture market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA) and Latin America.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the serverless architecture market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Serverless Architecture Market

What is the total market size and Vertical outlook of Serverless Architecture?