Mobile Phone & Smartphone Market Global Forecast (2010-2015)

Smartphones are fast becoming a viable alternative to PDAs and laptops, offering phone features such as voice and SMS coupled with mobile internet applications, multimedia functionality, high speed data processing capabilities, and inbuilt GPS capabilities.

The total global mobile phone and smartphone market is expected to be worth $341.4 billion by 2015 while smartphone revenue will account for 75.8% of the overall mobile handset revenue at $258.9 billion in the same year. Smartphones are currently witnessing high growth due to a host of factors, including lower product cost, improved handset design and functionalities, the expansion of global mobile email and browsing services, the emergence of 3G and 4G network technologies, the rising competition among mobile carriers, and the standardization and upgrades of operating systems.

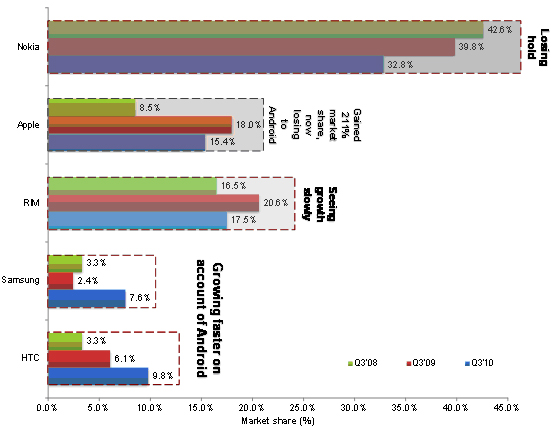

The competition in the smartphone market place is at the peak and vendors are finding it difficult to maintain their market shares. Market leader Nokia has lost considerable market share over the past two years; to a market share of 32.8% in Q3’10 from 42.6% in the same quarter two years ago. Apple, on the other hand, gained 211% market share in Q3’09 over Q3’08 and then lost approximately 15% market share in same quarter in 2010 under the growing popularity of Android operating system and more number of devices switching to it.

HTC and Samsung joined the Android popularity wave and are now the clear beneficiaries. Samsung gained 316% market share in Q3’10 over Q3’09 while HTC gained 160% market share during the same period.

The global market for smartphones operating systems (OS) is dominated by Europe with a 37% market share. Asia-Pacific follows with a share of 31%, accounted for mainly by Japan, Korea, China, and India. Symbian is the most popular mobile OS in Europe and Asia, while Blackberry OS dominates the North American OS market. IPhones mobile OS has shown a high growth rate in the North American market in last two years, and is expected to have a double-digit growth rate in next few years as well.

This report will identify the key players in each application market; focusing on their growth strategies and other developments such as geographic expansion and the development of patented technologies.

Scope of the report

This report analyzes the global mobile phones and Smartphone markets based on:

Mobile handsets vendor:

- Nokia, RIM, Apple, Samsung, Sony Ericsson, HTC, Fujitsu, LG, Sharp & Motorola

Smartphone vendors:

- Nokia, RIM, Apple, Samsung, Sony Ericsson, HTC, Fujitsu, LG, Sharp & Motorola

Smartphone operating system:

- Symbian, Blackberry, Windows, iPhone OS, Android, Linux, Web OS, Others

Smartphone devices type:

- Consumer phones (high-end, mid-range, and entry-level)

- Business phones (large enterprise and small and medium business)

Smartphone input method:

- Touch screen

- Keyboard

- Keypad

The report extensively analyzes each macro and micro smartphones market based on operating system; and offers market analyses of application segments such as consumer and business smartphones. In addition to market sizes and forecasts, the report also provides a detailed analysis of the market trends and factors influencing market growth, offering in-depth geographic analyses of the smartphones markets in the North America, Europe, Asia-Pacific, and Rest of the World (ROW). The report draws the competitive landscape of the global smartphones market, providing an in-depth comparative analysis of the technical and marketing strategies the key players are adopting in order to gain an edge over the their competitors.

Mobile Phone & Smartphone Market Global Forecast (2010-2015)

The total global mobile phone and smartphone market is expected to be worth $341.4 billion by 2015 while smartphone revenue will account for 75.8% of the overall mobile handset revenue at $258.9 billion in the same year.

Mobile phones with basic functionalities such as voice, SMS, camera, and video are often referred to as feature phones, whereas high-end mobile phones that offer more advanced computing ability, and provide one stop solution for information management, voice and video calls and web access are referred to as smartphones. In addition to being a communication device, modern mobile phones now have additional capabilities, such as SMS messages, internet access, gaming, Bluetooth, camera, MMS messaging, radio, and MP3 player, which helped in increasing the popularity and faster adoption of mobile handsets. The mobile handsets market has seen exponential growth since its first commercial launch in 1983. There were 12 million global mobile phone subscribers in 1990 and by the end of 2010; the number of mobile phone subscribers reached 5.2 billion. However, the growth has slowed a bit between 2006 and 2009 due to economic slowdown and lack of strong telecommunication infrastructure in emerging countries.

The global smartphones market registered growth at a brisk pace, accounting for 22% of the global mobile handset sales in 2010. This high growth has been backed by rapid technology developments such as high-speed internet browsing, sophisticated personal and professional data management, and the evolution of 3G and 4G network technologies. The usability and the device class has helped the market to avoid the repeated feat of Q1’09 when market tumbled by 4% over Q4’08.

TABLE OF CONTENTS

EXECUTIVE SUMMARY

MARKET OVERVIEW

SMARTPHONES DEVICE MARKET

SMARTPHONES MARKET BY OPERATING SYSTEM

GEOGRAPHIC ANALYSIS

COMPETITIVE LANDSCAPE

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

2 SUMMARY

3 MARKET OVERVIEW

3.1 OVERVIEW

3.2 DEFINING MOBILE PHONES & SMARTPHONES

3.2.1 KEY FEATURES OF SMARTPHONES

3.2.2 EVOLUTION OF MOBILE PHONES AND SMARTPHONES MARKET

3.3 SMARTPHONES MARKET COMPETITIVE SCENARIO

3.4 MOBILE OS MARKET

3.5 GLOBAL SMARTPHONES MARKET, BY INPUT TYPES

3.6 OPPORTUNITIES

3.7 FIVE FORCES OF COMPETITION

3.8 PATENT ANALYSIS OF SMARTPHONES MARKET

4 GLOBAL MOBILE HANDSET MARKET

4.1 OVERVIEW

4.1.1 GLOBAL MOBILE HANDSET MARKET SHARES ANALYSIS BY VENDORS

4.2 GLOBAL MOBILE HANDSET MARKET REVENUE GROWTH AND FORECAST

4.2.1 GLOBAL MOBILE HANDSET VENDOR MARKET SHARE ANALYSIS AND FORECAST BY REVENUE

4.2.2 GLOBAL MOBILE HANDSET MARKET SHARE ANALYSIS & FORECAST BY SHIPMENT

5 THE SMARTPHONES DEVICE MARKET

5.1 OVERVIEW

5.2 TYPES OF SMARTPHONES

5.2.1 ENTRY-LEVEL SMARTPHONES

5.2.2 PERFORMANCE SMARTPHONES

5.2.3 MEDIA-CENTRIC SMARTPHONES

5.2.3.1 Music smartphones

5.2.3.2 Navigation smartphones

5.2.3.3 Gaming smartphones

5.2.3.4 Camera smartphones

5.3 BUSINESS SMARTPHONES

5.3.1 LARGE ENTERPRISE

5.3.2 SMALL AND MEDIUM BUSINESS (SMB)

5.4 SMARTPHONES MARKET BY INPUT DEVICE

5.4.1 TOUCHSCREEN

5.4.2 KEYPAD

5.4.3 KEYBOARD

6 GLOBAL SMARTPHONES HANDSET MARKET

6.1 OVERVIEW

6.2 DRIVERS

6.2.1 INCREASING USE OF MOBILE INTERNET

6.2.2 ICONIC DESIGN & APPLICATIONS

6.2.3 DECREASING COST OF DEVICES & SERVICES

6.2.4 COMPETITION AMONG MOBILE CARRIERS

6.2.5 EMERGENCE OF FASTER NETWORK TECHNOLOGIES

6.3 RESTRAINTS

6.3.1 SLOWER UPTAKE IN DEVELOPING COUNTRIES

6.3.2 DATA & IDENTITY THEFT ISSUES

6.4 SMARTPHONES VENDORS ANALYSIS

6.5 SHIPMENT, REVENUE & ASP ANALYSIS

6.5.1 MARKET SHARES OF VENDORS

6.5.2 MARKET GROWTH & FORECAST

6.5.3 MARKET SHARE FORECAST

7 SMARTPHONES MARKET BY OPERATING SYSTEMS

7.1 SYMBIAN SMARTPHONES MARKET

7.2 WINDOWS SMARTPHONES MARKET

7.3 BLACKBERRY SMARTPHONES MARKET

7.4 IPHONE OS

7.5 PALM WEBOS MARKET

7.6 LINUX OS

7.7 ANDROID OS BASED SMARTPHONES MARKET

7.8 OTHERS OS

8 GEOGRAPHIC ANALYSIS

8.1 NORTH AMERICA: SMARTPHONES MARKET

8.1.1 TRENDS: SMARTPHONES TO REPLACE FEATURE PHONES BY 2015

8.1.2 UNIT SHIPMENTS ANALYSIS

8.2 EUROPE: SMARTPHONES MARKET

8.2.1 UNIT SHIPMENTS & ASP ANALYSIS

8.3 ASIA-PACIFIC: SMARTPHONES MARKET

8.3.1 UNIT SHIPMENTS & ASP ANALYSIS

8.4 ROW: SMARTPHONES MARKET

9 COMPETITIVE LANDSCAPE

9.1 MARKET SHARE ANALYSIS

9.1.1 OVERALL MOBILE DEVICES MARKET SHARE ANALYSIS

9.1.2 SMARTPHONES MARKET SHARE ANALYSIS

9.2 GROWTH STRATEGY

9.3 MARKET STRATEGY ANALYSIS

10 COMPANY PROFILES

10.1 ACER INC

10.1.1 OVERVIEW

10.1.2 STRATEGY

10.1.3 DEVELOPMENTS

10.2 APPLE INC

10.2.1 OVERVIEW

10.2.2 FINANCIALS

10.2.3 STRATEGY

10.2.4 DEVELOPMENTS

10.3 ASUSTEK COMPUTER INC.

10.3.1 OVERVIEW

10.3.2 FINANCIALS

10.3.3 STRATEGY

10.3.4 DEVELOPMENT

10.4 BENQ CORPORATION

10.4.1 OVERVIEW

10.4.2 STRATEGY

10.4.3 DEVELOPMENTS

10.5 GOOGLE INC

10.5.1 OVERVIEW

10.5.2 FINANCIALS

10.5.3 STRATEGY

10.5.4 DEVELOPMENTS

10.6 HEWLETT-PACKARD COMPANY

10.6.1 OVERVIEW

10.6.2 FINANCIALS

10.6.3 STRATEGY

10.6.4 DEVELOPMENTS

10.7 HTC CORP

10.7.1 OVERVIEW

10.7.2 FINANCIALS

10.7.3 STRATEGY

10.7.4 DEVELOPMENTS

10.8 HUAWEI TECHNOLOGIES

10.8.1 OVERVIEW

10.8.2 FINANCIALS

10.8.3 STRATEGY

10.8.4 DEVELOPMENTS

10.9 LG ELECTRONICS

10.9.1 OVERVIEW

10.9.2 FINANCIALS

10.9.3 STRATEGY

10.9.4 DEVELOPMENTS

10.1 MITAC TECHNOLOGY CORP

10.10.1 OVERVIEW

10.10.2 STRATEGY

10.10.3 DEVELOPMENTS

10.11 MOTOROLA INC

10.11.1 OVERVIEW

10.11.2 FINANCIALS

10.11.3 STRATEGY

10.11.4 DEVELOPMENTS

10.12 NOKIA CORP.

10.12.1 OVERVIEW

10.12.2 FINANCIALS

10.12.3 STRATEGY

10.12.4 DEVELOPMENTS

10.13 PANASONIC CORPORATION

10.13.1 OVERVIEW

10.13.2 FINANCIALS

10.13.3 STRATEGY

10.14 RESEARCH IN MOTION LTD

10.14.1 OVERVIEW

10.14.2 FINANCIALS

10.14.3 STRATEGY

10.14.4 DEVELOPMENTS

10.15 SAGEM WIRELESS

10.15.1 OVERVIEW

10.15.2 STRATEGY

10.15.3 DEVELOPMENTS

10.16 SAMSUNG ELECTRONICS CO., LTD

10.16.1 OVERVIEW

10.16.2 FINANCIALS

10.16.3 STRATEGY

10.16.4 DEVELOPMENTS

10.17 SONY ERICSSON

10.17.1 OVERVIEW

10.17.2 FINANCIALS

10.17.3 STRATEGY

10.17.4 DEVELOPMENTS

10.18 SPICE MOBILITY LIMITED

10.18.1 OVERVIEW

10.18.2 STRATEGY

10.18.3 DEVELOPMENTS

APPENDIX

U.S. PATENTS

EUROPE PATENTS

JAPAN PATENTS

LIST OF TABLES

1 GLOBAL MOBILE HANDSET MARKET, BY TYPES, 2008 – 2015 ($MILLION)

2 GLOBAL MOBILE HANDSET SHIPMENTS, BY TYPES, 2008 – 2015 (MILLION UNITS)

3 GLOBAL MOBILE HANDSET WHOLESALE ASP, BY TYPES, 2008 – 2015 ($/UNIT)

4 TOP-SELLING APPLE SMARTPHONES

5 TOP-SELLING RIM SMARTPHONES

6 TOP-SELLING NOKIA SMARTPHONES

7 TOP-SELLING HTC SMARTPHONES

8 TOP-SELLING SAMSUNG SMARTPHONES

9 TOP-SELLING MOTOROLA SMARTPHONES

10 TOP-SELLING PALM SMARTPHONES

11 OTHER TOP-SELLING SMARTPHONES

12 MOBILE OS MARKET SHIPMENTS SHARE, BY GEOGRAPHY, 2010

13 QUARTERLY GLOBAL MOBILE HANDSET MARKET REVENUE, BY VENDORS, 2008 ($MILLION)

14 QUARTERLY GLOBAL MOBILE HANDSET MARKET SHIPMENT, BY VENDORS, 2008 (MILLION UNITS)

15 QUARTERLY GLOBAL MOBILE HANDSET WHOLESALE ASP, BY VENDORS, 2008 ($/UNIT)

16 QUARTERLY GLOBAL MOBILE HANDSET REVENUE, BY VENDORS, 2009 ($MILLION)

17 QUARTERLY GLOBAL MOBILE HANDSET SHIPMENTS, BY VENDORS, 2009 (MILLION UNITS)

18 QUARTERLY GLOBAL MOBILE HANDSET WHOLESALE ASP, BY VENDORS, 2009 ($/UNIT)

19 QUARTERLY GLOBAL MOBILE HANDSET REVENUE, BY VENDORS, 2010 ($MILLIONS)

20 QUARTERLY GLOBAL MOBILE HANDSET SHIPMENTS, BY VENDORS, 2010 (MILLION UNITS)

21 QUARTERLY GLOBAL MOBILE HANDSET WHOLESALE ASP, BY VENDORS, 2010 ($/UNIT)

22 QUARTERLY GLOBAL MOBILE HANDSET REVENUE SHARE, BY VENDORS 2009 (%)

23 QUARTERLY GLOBAL MOBILE HANDSET SHIPMENT SHARE, BY VENDORS 2008 (%)

24 QUARTERLY GLOBAL MOBILE HANDSET REVENUE SHARE, BY VENDORS 2009 (%)

25 QUARTERLY GLOBAL MOBILE HANDSET SHIPMENT SHARE, BY VENDORS 2009 (%)

26 QUARTERLY GLOBAL MOBILE HANDSET REVENUE SHARE, BY VENDORS 2010 (%)

27 QUARTERLY GLOBAL MOBILE HANDSET SHIPMENT SHARE, BY VENDORS 2010 (%)

28 GLOBAL MOBILE HANDSET MARKET REVENUE FORECAST, BY VENDORS 2008 – 2015 ($MILLION)

29 GLOBAL MOBILE HANDSET MARKET SHIPMENT FORECAST, BY VENDORS, 2008 – 2015 (MILLION UNITS)

30 GLOBAL MOBILE HANDSET MARKET ASP FORECAST, BY VENDORS, 2008 – 2015 ($/UNIT)

31 GLOBAL MOBILE HANDSET VENDORS REVENUE SHARE & FORECAST, 2008 – 2015 (%)

32 GLOBAL MOBILE HANDSET VENDORS SHIPMENT SHARE AND FORECAST, 2008 – 2015 (%)

33 GLOBAL SMARTPHONES DEVICES MARKET, BY SEGMENTS, 2008 – 2015 ($MILLION)

34 GLOBAL CONSUMER SMARTPHONES DEVICES MARKET, BY SEGMENTS, 2008 – 2015 ($MILLION)

35 CONSUMER SMARTPHONES MARKET SEGMENTATION MEDIA-CENTRIC VS PERFORMANCE SMARTPHONES

36 COMPARISON OF TOP CAMERA SMARTPHONES

37 GLOBAL BUSINESS SMARTPHONES DEVICES MARKET, BY SEGMENTS, 2008 – 2015 ($MILLION)

38 GLOBAL SMARTPHONES DEVICES SHIPMENTS, BY INPUT TYPE, 2008 – 2015 (MILLION UNITS)

39 QUARTERLY GLOBAL SMARTPHONES REVENUE, BY VENDORS, 2008 ($MILLION)

40 QUARTERLY GLOBAL SMARTPHONES SHIPMENT, BY VENDORS, 2008 (MILLION)

41 QUARTERLY GLOBAL SMARTPHONES WHOLESALE ASP, BY VENDORS, 2008 ($/UNIT)

42 QUARTERLY GLOBAL SMARTPHONES REVENUE, BY VENDORS, 2009 ($MILLION)

43 QUARTERLY GLOBAL SMARTPHONES SHIPMENT, BY VENDORS, 2009 ($MILLION)

44 QUARTERLY GLOBAL SMARTPHONES WHOLESALE ASP, BY VENDORS, 2009 ($/UNIT)

45 QUARTERLY GLOBAL SMARTPHONES SHIPMENT, BY VENDORS, 2010 ($MILLION)

46 QUARTERLY GLOBAL SMARTPHONES SHIPMENT, BY VENDORS, 2010 ($MILLION)

47 QUARTERLY GLOBAL SMARTPHONES WHOLESALE ASP, BY VENDORS, 2010 ($/UNIT)

48 QUARTERLY GLOBAL SMARTPHONES REVENUE SHARE, BY VENDORS, 2008 (%)

49 QUARTERLY GLOBAL SMARTPHONES SHIPMENT SHARE, BY VENDORS, 2008 (%)

50 QUARTERLY GLOBAL SMARTPHONES REVENUE SHARE, BY VENDORS, 2009 (%)

51 QUARTERLY GLOBAL SMARTPHONES SHIPMENT SHARE, BY VENDORS, 2009 (%)

52 QUARTERLY GLOBAL SMARTPHONES REVENUE SHARE, BY VENDORS, 2010 (%)

53 QUARTERLY GLOBAL SMARTPHONES SHIPMENT SHARE, BY VENDORS, 2010 (%)

54 GLOBAL SMARTPHONES REVENUE & FORECAST, BY VENDORS, 2008 – 2015 ($MILLION)

55 GLOBAL SMARTPHONES SHIPMENTS & FORECAST, BY VENDORS, 2008 – 2015 (MILLION UNITS)

56 GLOBAL SMARTPHONES WHOLESALE ASP, BY VENDORS, 2008 – 2015 ($/UNIT)

57 GLOBAL SMARTPHONES MARKET REVENUE SHARE & FORECAST, BY VENDORS, 2008 – 2015 (%)

58 GLOBAL SMARTPHONES MARKET SHIPMENT SHARE & FORECAST, BY VENDORS, 2008 – 2015 (%)

59 QUARTERLY SMARTPHONES SHIPMENT, BY OPERATING SYSTEM, 2009 (UNIT/MILLION)

60 QUARTERLY SMARTPHONE SHIPMENTS, BY OPERATING SYSTEM, 2010 (UNIT/MILLION)

61 MARKET SHARE OF SMARTPHONES OPERATING SYSTEM, BY QUARTER 2009 (%)

62 MARKET SHARE OF SMARTPHONES OPERATING SYSTEM, BY QUARTER, 2010 (%)

63 GLOBAL SMARTPHONES MARKET REVENUE, BY PLATFORMS, 2008 – 2015 ($MILLION)

64 GLOBAL SMARTPHONES SHIPMENT, BY PLATFORMS, 2008 – 2015 (MILLION UNITS)

65 GLOBAL SMARTPHONES WHOLESALE ASP, BY PLATFORMS, 2008 – 2015 ($/UNIT)

66 SYMBIAN OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

67 SHIPMENTS & FORECASTS FOR SYMBIAN SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

68 SYMBIAN OS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

69 WINDOWS OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

70 SHIPMENTS & FORECASTS FOR WINDOWS SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

71 WINDOWS OS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

72 BLACKBERRY OS SMARTPHONES MARKET,BY GEOGRAPHY, 2008 – 2014 ($MILLION)

73 SHIPMENTS & FORECAST FOR BLACKBERRY SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

74 BLACKBERRY OS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

75 IPHONE OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2014 ($MILLION)

76 SHIPMENTS & FORECAST FOR IPHONE SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

77 IPHONE OS SMARTPHONES WHOLESALE ASP,BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

78 PALM WEB OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

79 SHIPMENTS & FORECAST FOR WEBOS SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

80 WEBOS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

81 LINUX OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

82 SHIPMENTS & FORECAST FOR LINUX OS SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

83 LINUX OS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

84 ANDROID OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

85 SHIPMENTS & FORECAST FOR ANDROID OS SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

86 ANDROID OS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

87 OTHERS OS SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

88 SHIPMENTS & FORECAST FOR OTHER OS SMARTPHONES, BY GEOGRAPHY, 2009 – 2015 (MILLION UNITS)

89 OTHER OS SMARTPHONES WHOLESALE ASP, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

90 SMARTPHONES MARKET, BY GEOGRAPHY, 2008 – 2015 ($MILLION)

91 SMARTPHONES SHIPMENTS, BY GEOGRAPHY, 2008 – 2015 (MILLION UNITS)

92 SMARTPHONES AVERAGE SELLING PRICE, BY GEOGRAPHY, 2008 – 2015 ($/UNIT)

93 NORTH AMERICA: SMARTPHONES MARKET, BY OS TYPE, 2008 – 2015 ($MILLION)

94 NORTH AMERICA: SMARTPHONES SHIPMENT & FORECASTS, 2008 – 2015 (MILLION UNITS)

95 NORTH AMERICA: SMARTPHONES WHOLESALE ASP, BY PLATFORM, 2008 - 2015 (MILLION UNITS)

96 EUROPE: SMARTPHONES MARKET, BY PLATFORMS, 2008 – 2015 ($MILLION)

97 EUROPE: SMARTPHONES SHIPMENTS, BY PLATFORMS, 2008 – 2015 (MILLION UNITS)

98 EUROPE: SMARTPHONES WHOLESALE ASP, BY PLATFORMS, 2008 - 2015 (MILLION UNITS)

99 ASIA-PACIFIC SMARTPHONES MARKET REVENUE, BY PLATFORMS, 2008 – 2015 ($MILLION)

100 ASIA-PACIFIC SMARTPHONES SHIPMENTS, BY PLATFORMS, 2008 – 2015 (MILLION UNITS)

101 ASIA – PACIFIC SMARTPHONES WHOLESALE ASP, BY PLATFORMS, 2008 - 2015 (MILLION UNITS)

102 ROW SMARTPHONES MARKET REVENUE, PLATFORMS, 2008 – 2015 ($MILLION)

103 ROW SMARTPHONES SHIPMENTS, BY PLATFORMS, 2008 – 2014 (MILLION UNITS)

104 ROW SMARTPHONES WHOLESALE ASP, BY PLATFORMS, 2008 - 2015 (MILLION UNITS)

105 NEW PRODUCT LAUNCHES

106 AGREEMENTS & COLLABORATIONS

107 DEVELOPMENT OF NEW TECHNOLOGIES & APPLICATIONS

108 MERGERS & ACQUISITIONS

LIST OF FIGURES

1 EVOLUTION OF MOBILE PHONES & SMARTPHONES

2 SMARTPHONES VENDOR LANDSCAPE IS DYNAMIC

3 PRODUCT PRICES VS PRODUCT OFFERINGS (2009)

4 OS SHIPMENT SHARE ANALYSIS

5 GLOBAL SMARTPHONES MARKET BY INPUT TYPES (2009)

6 SMARTPHONES INDUSTRY FORCES OF COMPETITION

7 SMARTPHONES PATENTS GROWING OVER THE YEAR

8 YEAR-WISE COMPARISON OF SMARTPHONES PATENTS

9 NUMBER OF MOBILE INTERNET USERS 2008 – 2010

10 SMARTPHONES SUBSCRIBERS, BY REGION, 2008 – 2010

11 3G & 4G PENETRATION, BY REGION, 2008 – 2015 (AS % OF MOBILE PHONES)

12 COMPETITIVE ANALYSIS OF LEADING OS PLATFORMS

13 WINDOWS MOBILE OS SHARE IN ENTERPRISE SEGMENT (2009)

14 NORTH AMERICA: SMARTPHONES MARKET PENETRATION, 2008 – 2018

15 MOBILE DEVICE VENDORS MARKET SHARE, BY VOLUME (2010 & 2015)

16 SMARTPHONES DEVICE VENDORS MARKET SHARE, BY VOLUME, (2010 & 2015)

17 INDUSTRY GROWTH STRATEGIES (2008 – APRIL 2010)

Growth opportunities and latent adjacency in Mobile Phone & Smartphone Market

Interested in understanding market share of various Android device vendors and mobile platforms for each geography.

Looking for market outlook for smartphone in Saudi Arabia