Sodium Hydroxide Market by Grade (Solid, 50% Aqueous Solution), Production Process, Application (Biodiesel, Alumina, Inorganic Chemicals, Organic Chemicals, Food, Pulp & Paper, Soap & Detergent, Textiles, Water Treatment), Region - Global Forecast to 2029

Updated on : January 27, 2025

Sodium Hydroxide Market

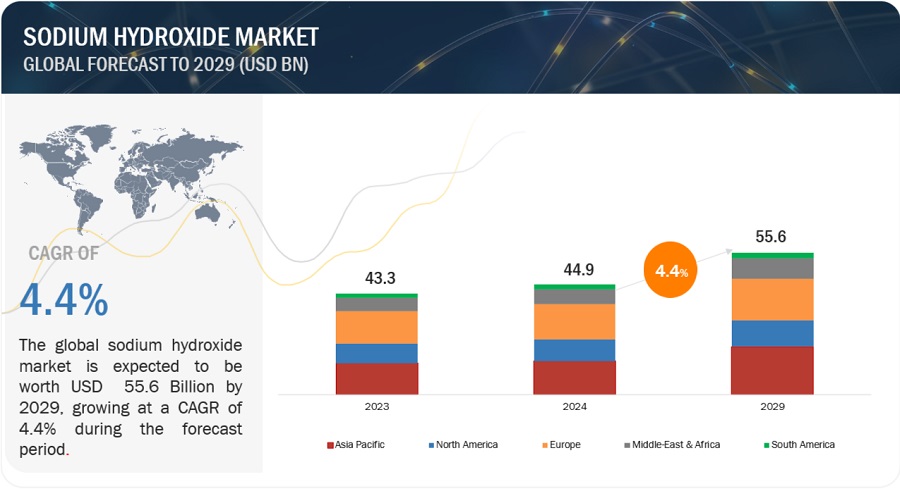

Sodium Hydroxide Market Size was valued at USD 44.9 billion in 2024 and is projected to reach USD 55.6 billion by 2029, growing at 4.4% cagr from 2024 to 2029. The global construction industry is experiencing significant growth, encompassing both residential and non-residential infrastructure. This surge in construction activities is one of the primary drivers of the increased demand for paints and coatings. Consequently, this rising demand for paints and coatings is propelling the titanium dioxide market forward, as titanium dioxide is a key ingredient used in these products. This, in turn, positively influences the sodium hydroxide market. Sodium hydroxide plays a crucial role in the production of titanium dioxide, thus the expansion in the paints and coatings sector, driven by the booming construction and automotive industries, indirectly fuels the demand for sodium hydroxide.

Attractive Opportunities in the Sodium Hydroxide Market

To know about the assumptions considered for the study, Request for Free Sample Report

Sodium Hydroxide Market Dynamics

Driver: Increasing demand for alumina in major end-use industries

The escalating demand for sodium hydroxide is increased by its pivotal role in refining raw bauxite into high-grade alumina, a crucial precursor in the production of aluminum. This process, essential for aluminum refinement, heavily relies on sodium hydroxide due to its widespread availability and cost efficiency. Notably, aluminum finds extensive application across various sectors, including transportation, containers & packaging, and building, & construction. Within the building and construction domain, aluminum serves diverse purposes such as staircases, heating systems, roofs, crafting door and window frames and furnishings. Furthermore, it contributes significantly to the construction of infrastructural elements like roads, bridges, and buildings. Thus, the burgeoning utilization of alumina in these end-use industries underscores the escalating demand for sodium hydroxide, given its indispensable role in the aluminum refining process.

Restraints: Environmental impact

Caustic soda, when exposed to the atmosphere, poses significant dangers due to its high reactivity with other chemicals and its susceptibility to wet deposition. It reacts with water vapor in the air, producing corrosive mist or aerosols. These concentrated aerosols, which can include harmful substances like silica and asbestos, can cause severe upper respiratory tract irritation and lead to diseases such as black lung and silicosis upon exposure.

As a very strong base, caustic soda is a contaminant if disposed of in water. Its primary effect is to raise the water's pH level. If the ocean becomes too basic, it will produce carbonic acid. These carbonic acid releases more hydrogen ions, ultimately making the ocean more acidic in nature. Increased in the ocean acidity adversely affects marine life; for instance, mussels and clams will produce weaker shells and may not survive. Coral reefs, whose skeletons are made of calcium carbonate, will also suffer. Since coral provides food and oxygen to many sea creatures, it is vital to our environment. The death of coral reefs would lead to a significant decline in fish populations, resulting in widespread ecological disruption.

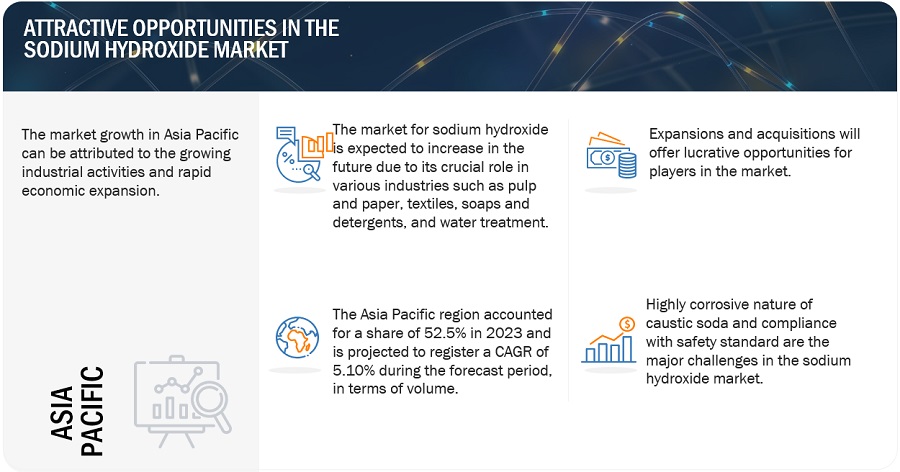

Opportunity: Industrialization in emerging economies

The increasing demand from the building & construction, packaging, consumer goods, and transportation industries in countries such as China, India, Thailand, Indonesia, South Korea, Taiwan, Brazil, Argentina and Mexico is boosting the need for plastics, aluminum, and other materials used across these sectors. The growth in industrialization in these emerging economies is expected to augment the demand for sodium hydroxide over the next five years. The global chemicals market has been experiencing strong growth and is expected to maintain a similar trend during the forecast period. As a company that manufactures and sells various chemicals to customers worldwide, favorable trends in the global chemicals market present lucarative opportunities for the sodium hydroxide market. The chemical industries in the US and Europe are saturated, with their growth majorly influenced by GDP fluctuations. Rapid industrialization, significant population bases, coupled with strong demand driven by improving living standards, and abundant workforces in the Asia Pacific, South America, and Middle East & Africa, has prompted companies to establish facilities in these regions to meet regional demand.

Challenges: Highly corrosive nature of caustic soda and compliance with safety standards

Solid caustic soda (pearls or flakes) also known for its highly corrosive nature, poses significant hazards upon contact with organic substances such as greases and fats. This interaction can lead to severe and often irreversible damage to any affected body parts, including the eyes and skin When dissolved in water, sodium hydroxide forms solutions whose corrosiveness, irritation potential vary depending on the concentration. These solutions exert immediate and localized effects upon contact with the body, necessitating caution. Additionally, sodium hydroxide's reactivity extends to its interaction with ambient moisture where exothermic reaction occurs, a process that can release substantial heat. This exothermic reaction carries the risk of igniting nearby flammable materials, further emphasizing the need for careful handling and storage of sodium hydroxide to prevent fire hazards.

Sodium Hydroxide Market ECOSYSTEM

The 50% w/w aqueous solution grade is projected to be the fastest growing segment in the Sodium Hydroxide market.

Sodium hydroxide 50% w/w aqueous solution is a crucial chemical compound used across various industries. Its primary application lies in its role as a neutralization agent or chemical reactant. This solution finds extensive use in industries such as soap & detergent, chemical, petrochemical, textile, pulp & paper, metal, and food industries, as well as in pharmaceutical manufacturing.

In the chemical industry, it serves as a fundamental ingredient in various chemical processes and chemical reactions. In pharmaceuticals, it is used for pH adjustment and in the synthesis of certain medications. In the textile industry, sodium hydroxide solution is used for the production of synthetic fabrics like rayon. Moreover, in the food industry, it is used for manufacture of food products and as a pH regulator. Additionally, caustic soda also plays a crucial role in bioethanol and biodiesel processing, where it is used for the formation of in situ sodium methylate, an essential step in these processes. Given its wide-ranging applications and importance in various industries, the 50% w/w aqueous solution of sodium hydroxide is estimated to be the largest and fastest-growing segment of sodium hydroxide during the forecast period.

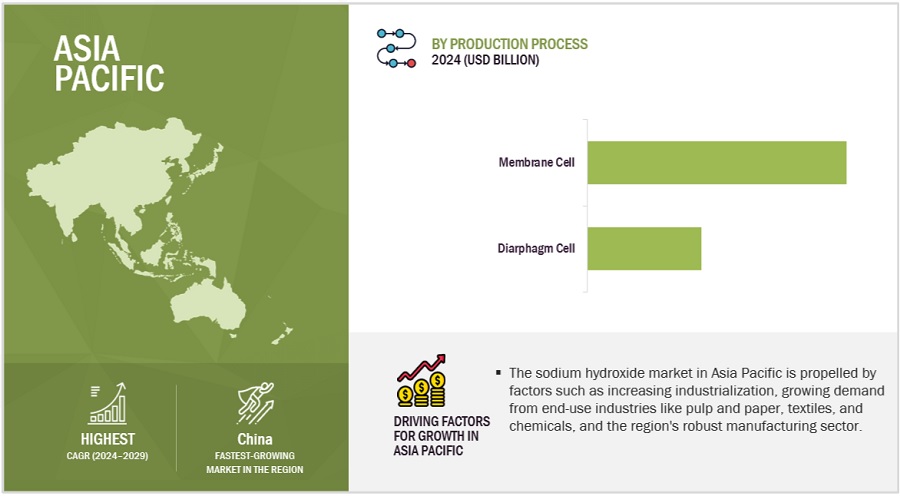

The membrane cell process is projected to be the fastest-growing segment in the Sodium Hydroxide market for the forecast period.

During the projected period, the membrane cell method is anticipated to dominate the Sodium Hydroxide market. Sodium hydroixde produced via membrane cell process is commonly referred to as membrane grade, with increasing recognition for its suitability in various applications beyond rayon fiber production. Notably, the membrane cell technique has comparatively reduced environmental footprint compared to diaphragm and mercury cell processes. This shift towards membrane cell technology is driven by factors such as, utilization of safer raw materials, lower electricity usage and the generation of superior-quality sodium hydroxide.

Asia Pacific is estimated to be the largest market for Sodium Hydroxide.

Asia Pacific is the largest and fastest growing market for Sodium Hydroxide, followed by Europe and North America. In Asia Pacific, China, India, and Indonesia are expected to witness high growth during the forecast period. The growth of the market in the region is led by rising demand from various applications, rapid industrialization, and increasing government spending. Different companies are focusing on these emerging markets and expanding their footprints by setting up manufacturing facilities, distribution centers, and research & development centers.

To know about the assumptions considered for the study, download the pdf brochure

Sodium Hydroxide Market Players

The leading players in the Sodium Hydroxide market are Tata Chemicals Ltd. (India), Olin Corporation (US), Westlake Corporation (US), Occidental Petroleum Corporation (US), Dow (US), Formosa Plastics Corporation (Taiwan), BASF SE (Germany), Xinjiang Zhongtai Chemical Co., Ltd (China), Nouryon (Netherlands), Grasim Industries Limited (India), and others are the top manufacturers covered in the sodium hydroxide market. Expansions, mergers & acquisitions, new product launches and deals were some of the major strategies adopted by these key players to enhance their positions in the sodium hydroxide market. A major focus was given to the expansions and deals.

Sodium Hydroxide Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2022–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Application, Grade, Production Process and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

Companies covered |

Tata Chemicals Ltd. (India), Olin Corporation (US), Westlake Corporation (US), Occidental Petroleum Corporation (US), Dow (US), Formosa Plastics Corporation (Taiwan), BASF SE (Germany), Xinjiang Zhongtai Chemical Co., Ltd (China), Nouryon (Netherlands), Grasim Industries Limited (India), and others are the top manufacturers covered in the sodium hydroxide market. |

This research report categorizes the sodium hydroxide market based on material type, end-use industry, application, and region.

Sodium Hydroxide Market by Grade

- Solid

- 50% Aqueous Solution

- Others

Sodium Hydroxide Market by Wear Parts

- Membrane Cell

- Diaphragm Cell

- Others

Sodium Hydroxide Market by Application

- Biodiesel

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food

- Pulp & Paper

- Soap & Detergent

- Textiles

- Water Treatment

- Others

Sodium Hydroxide Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In October 2023, Solvay is boosting the efficiency of its Soda Ash operations to better serve its global customers and strengthen its cost competitiveness. Starting January 2024, the production capacity od its Spain plant will be reduced to 600 kilotons from 900 kilotons of soda ash annually. The plant will prioritize meeting the requirement of regional soda ash and premium grade sodium bicarbonate customers who value its proximity and commitment to long-term sustainability.

- In December 2023, Dow launched two innovative caustic soda products, Caustic DEC and TRACELIGHT DEC, as part of its Decarbia portfolio. These products boast up to 90% lower carbon dioxide emissions due to an electrolysis production process powered by renewable energy.

- In February 2022, Westlake Chemical Corporation announced the completion of its acquisition of Hexion's global epoxy business for approximately USD 1.2 billion in an all-cash deal.

- Also in February 2022, Occidental Petroleum's chemical division is considering a significant upgrade for certain chlor-alkali plants. This upgrade aims to increase production capacity, particularly for producing higher-value sodium hydroxide. This presents an lucrative opportunity for the company to significantly expand its current production capacity to meet the rising demand for its main products.

Frequently Asked Questions (FAQ):

What primary factor is propelling the growth of the Sodium Hydroxide market?

The Sodium Hydroxide market is witnessing increased demand driven by sectors such as chemicals, water treatment, food, biodiesel, and soap & detergents.

How is the Sodium Hydroxide market segmented in terms of applications?

The applications of Sodium Hydroxide span across biodiesel, alumina, inorganic chemicals, organic chemicals, food, pulp & paper, soap & detergent, textiles, water treatment, and other sectors.

What are the major challenges in Sodium Hydroxide market?

The challenges predominantly revolve around the highly corrosive nature of caustic soda and ensuring compliance with safety standards.

What are the major opportunities in Sodium Hydroxide market?

Emerging economies offer substantial opportunities for growth, driven by industrialization trends and increased demand for Sodium Hydroxide.

Which region has the largest demand?

The Asia Pacific (APAC) region stands out with the highest demand for Sodium Hydroxide. Various companies are strategically targeting these emerging markets, expanding their presence through the establishment of manufacturing facilities, distribution centers, and research & development hubs.

Who are the major manufacturers of Sodium Hydroxide?

Major players in the Sodium Hydroxide market Tata Chemicals Ltd. (India), Olin Corporation (US), Westlake Corporation (US), Occidental Petroleum Corporation (US), Dow (US), Formosa Plastics Corporation (Taiwan), BASF SE (Germany), Xinjiang Zhongtai Chemical Co., Ltd (China), Nouryon (Netherlands), Grasim Industries Limited (India), among others .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

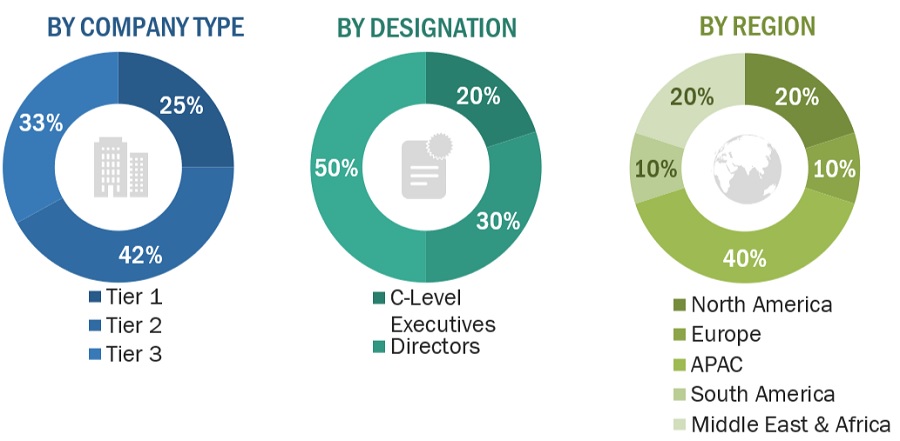

The study involved four major activities for estimating the current size of the global sodium hydroxide market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of sodium hydroxide through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the sodium hydroxide market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the sodium hydroxide market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The sodium hydroxide market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the sodium hydroxide market. Primary sources from the supply side include associations and institutions involved in the sodium hydroxide industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global sodium hydroxide market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the sodium hydroxide market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Sodium hydroxide, commonly referred to as caustic soda, is a white, crystalline inorganic substance known for its strongly hygroscopic nature. When sodium hydroxide is exposed to carbon dioxide in the air, it reacts with air and readily forms sodium carbonate. To prevent moisture absorption, sodium hydroxide must be stored in tightly sealed containers or special bags. It dissolves extremely well in water, generating significant heat and forming highly caustic soda lye. Sodium hydroxide is highly corrosive in nature and is typically used either in solid form or as a 50% w/w aqueous solution.

This powerful base is widely utilized in the manufacturing industry. Key applications include its use in the alumina, pulp and paper, soaps and detergents, inorganic chemicals, organic chemicals, and textiles industries. Sodium hydroxide serves as a neutralizing agent, pH controller, dehydrochlorinating agent, absorbent in off-gas scrubbing, catalyst, and sodium source.

Key Stakeholders

- Sodium hydroxide manufacturers

- Sodium hydroxide traders, distributors, and suppliers

- End-use industry participants of different segments

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Objectives

- To define, analyze, and project the size of the sodium hydroxide market in terms of value based on application, grade, production process and region.

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the sodium hydroxide market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of Asia Pacific market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sodium Hydroxide Market