Softgel Capsules Market by Material, Source (Porcine, Bovine), Application (Pharmaceuticals, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care), Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2028

Market Growth Outlook Summary

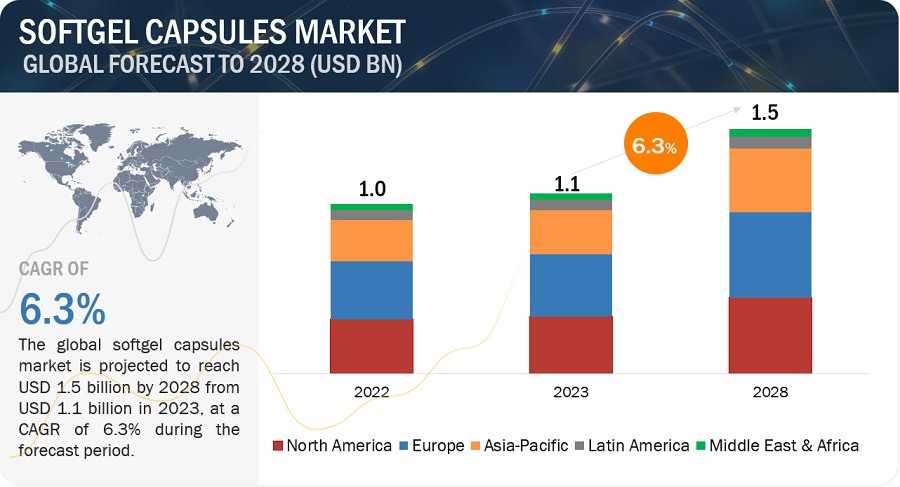

The global softgel capsules market, valued at US$1.0 billion in 2022, stood at US$1.1 billion in 2023 and is projected to advance at a resilient CAGR of 6.3% from 2023 to 2028, culminating in a forecasted valuation of US$1.5 billion by the end of the period. The growth of this market is majorly driven by the benefits of softgel capsules, increasing demand for dietary supplements and nutraceuticals, and rising demand for naturally sourced ingredients. On the other hand, limited acceptance due to cultural restrictions is expected to hinder the growth of this market.

Attractive Opportunities in the Softgel Capsules Market

To know about the assumptions considered for the study, Request for Free Sample Report

Softgel Capsules Market Dynamics

DRIVER: Benefits of Softgel Capsules

Softgel capsules provide a convenient and efficient way to deliver both liquid and solid ingredients. This versatility allows for the encapsulation of various compounds, from vitamins and minerals to oils and pharmaceutical drugs. Moreover, softgel capsules are known for their superior bioavailability, ensuring that the active ingredients are absorbed more effectively by the body compared to traditional tablet forms. The airtight seal of softgel capsules helps protect sensitive compounds from moisture and oxygen, increasing their shelf life and preserving their potency. Furthermore, these capsules have a smooth, easy-to-swallow exterior, enhancing patient compliance and overall user experience. These benefits have increased the demand for softgel capsules among the patient population.

DRIVER: Rising demand for naturally sourced ingredients

An increase in health concerns among consumers has driven the demand for natural ingredients. Consumers perceive that natural ingredients positively impact health; this perception has increased the demand for naturally sourced ingredients in products. Ingredient labeling has resulted in manufacturers becoming increasingly cautious about the ingredients used in their products. Frequent consumption of artificial ingredients is linked to health problems such as cancer, allergic reactions among sensitive individuals, and foodborne illnesses. Hence, the demand for natural ingredients is on the rise.

The increased focus on health and nutrition, especially the need to control the spread of diabetes and obesity, is increasing the demand for fat replacers. The demand for a low-calorie diet has also been driving the use of gelatin as a sugar replacer. Gelatin is useful as a functional ingredient; it is a natural source of protein and is considered a healthy ingredient. For instance, according to a survey by the Natural Products Association, 70% of consumers are looking for natural ingredients in their dietary supplements. Factors responsible for increasing the demand for naturally sourced ingredients include the rising popularity of vegan and vegetarian diets, the growing demand for personalized dietary supplements, and the development of new technologies for making softgel capsules. The increasing awareness among the patient population and consumers about vegan softgel capsules is further likely to fuel the market growth.

RESTRAINT: Negative environmental impact

The production of softgel capsules can have a negative environmental impact, which is a growing concern for consumers and regulators. The production of gelatin can generate waste products, and the use of solvents and other chemicals can pollute the environment. Conventional gelatin production based on liming is time-consuming and leads to significant land pollution and wastewater. The worldwide production of gelatin is about 330,000 tons per year. During the production of gelatin, 10% of waste is released, which is not hydrolyzed at a production temperature of 600C. The negative environmental impact on waste disposable is likely to hamper the market growth in the coming years. However, research scientists are focusing on reducing waste from gelatin production, which may help the market gain momentum in the next 5-7 years.

OPPORTUNITY: Personalization and Customization

Softgel capsules allow for easy customization of formulations, enabling precise dosing and targeted drug delivery. Consumers are increasingly looking for products that are tailored to their individual needs and preferences. Softgel capsules can be personalized and customized in several ways, which can make them more attractive to consumers. By personalizing and customizing softgel capsules, manufacturers can create products that are more likely to meet the needs and preferences of consumers. This can lead to increased sales and brand loyalty. With an increase in the demand for personalized healthcare products, the demand for raw materials for customized softgel formulations is also expected to increase.

CHALLENGE: Rising prices of raw materials

Due to its applications across various industries, including pharmaceutical, nutraceutical, dietary supplement, cosmetic, and personal care products, the demand for gelatin has witnessed significant growth. The use of gelatin in food preparations has increased six-fold in the last decade. Similar trends have been observed in the nutraceutical and cosmetic industries, where gelatin is used to produce dietary supplement capsules, lotions, shampoos, hair sprays, and creams.

The leather, tanning, and paper production industries also use large amounts of pigskin and bovine skin to produce various commercial goods. The increasing demand for these raw materials from different industries has boosted the prices of these ingredients. In the last five years, the gelatin manufacturing industry has faced challenges due to the lower availability of raw materials—bovine hide and bones and pigskin. For instance, Rousselot, one of the major suppliers of gelatin for the pharmaceutical, nutraceutical, and food & beverage industries, increased the prices of pigskin gelatin products by ~7% due to the decreased availability of pig gelatin; bovine gelatin by 10%; and bovine hide gelatin by 3–5%. The company’s updated reports suggested a mandatory price increase to compensate for the ongoing upward trend in raw material availability and cost in the coming years. The declining availability of raw materials is, therefore, intensifying the demand for gelatin across various industries, thus creating a supply-demand imbalance. Therefore, raw material supply must be considered carefully to meet the demand for raw materials and gelatin across all industries.

On the basis of materials type, the global softgel capsules market is segmented into gelatin and other materials, such as plantderived cellulose, HPMC (hydroxypropyl methylcellulose), pullulan, starch-glycerin, and carrageenan. In 2022, gelatin segment accounted for the largest share of softgel capsuels industry.

On the basis of material type, the global softgel capsules market is segmented into gelatin and other materials, such as carrageenan, plant-derived cellulose, hydroxypropyl methylcellulose (HPMC), pullulan, and starch-glycerin. In 2022, the gelatin segment accounted for the largest market share of the softgel capsules industry. The rising demand for health supplements and the benefits of soft gelatin capsules, such as easy to swallow, no taste, unit dose delivery, tamper-proof, and availability in a wide range of colors, shapes, and sizes. The gelatin material is a key component that gives softgels their soft, flexible, and easy-to-swallow nature. Thus supporting the growth of this market. In extension supporting the growth of raw materials used for softgel capsules.

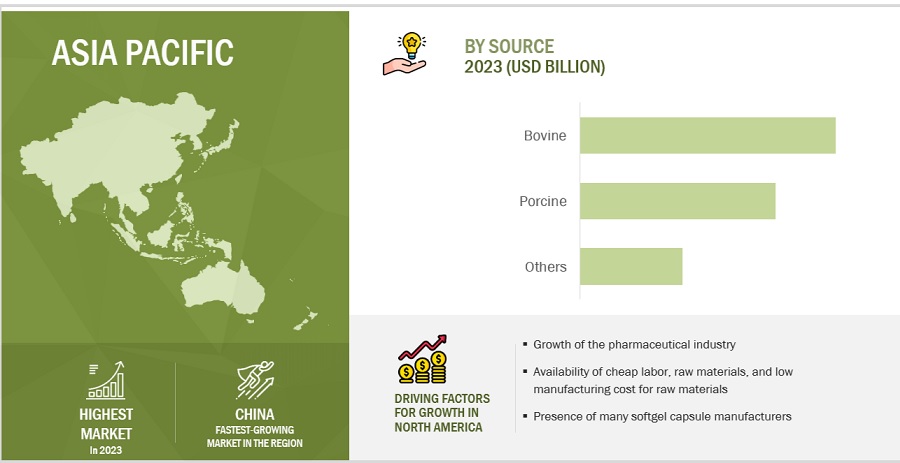

On the basis of source, the global softgel capsules market has been segmented into porcine, bovine, and other sources (including poultry, marine, and plant sources). In 2022, the bovine segment accounted for the largest share of the softgel capsules industry. Strong emphasis on the launch of new products in the market specifically for softgels and the abundance and easy availability of bovine is further likely to have a positive impact on the market growth. However, the prices of bovine gelatin is expected to increase in the coming years which can hinder the growth of this market segment.

Based on application, the global softgel capsules market is segmented into pharmaceutical, nutraceutical and dietary supplement, and cosmetics & personal care industries. In 2022, the nutraceutical and dietary supplement industry segment accounted for the largest market share of the softgel capsules industry. Factors such as the growing trend of adopting healthy lifestyles, growing demand for health supplements is a major driver for the nutraceutical and dietary supplement industry segment.

The Asia Pacific is the fastest-growing region

The softgel capsules market is broadly divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. During the forecast period, Asia Pacific is expected to grow the highest.

The Asia Pacific is the fastest-growing and most dynamic market in the world and is estimated to be the most attractive regional market for softgel capsule manufacturers. Countries such as China, India, and Japan are expected to witness high growth in the market for softgel capsule raw materials because of the large population in these countries. Also, due to rising health concerns, higher incomes, and better government initiatives, the pharmaceutical market in this region is projected to grow. Together, these factors fuel the growth of the market in the Asia Pacific region. The growing Asian scientific base and capability, growth in the Asian pharmaceutical market and pharmaceutical manufacturing capabilities, and the large patient pool in several Asia Pacific countries are driving the growth of this regional market. With its huge potential for growth and the low cost of manufacturing, several global pharmaceutical manufacturers are establishing manufacturing facilities or enhancing their existing facilities in the Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the softgel capsules market are Gelita AG (Germany), PB Leiner (part of Tessenderlo Group) (Belgium), Nitta Gelatin, Inc. (Japan), Sterling Gelatin and Croda Colloids (India), Narmada Gelatines Limited (India), Italgel S.r.l. (Italy), Darling Ingredients Inc. (US), Lapi Gelatine S.p.a. (Italy), Trobas Gelatine B.V. (Netherlands), Weishardt (France), India Gelatine & Chemicals Ltd. (India), Xiamen Gelken Gelatin Co., Ltd. (China), Gelco International (Brazil), Boom Gelatin (China), Geliko LLC (US), Kenney & Ross Limited Marine Gelatin (Canada), Baotou Dongbao Bio-Tech Co., Ltd. (China), Jellice Gelatin & Collagen (Netherlands), Athos Collagen Pvt. Ltd. (India), Kubon Biotechnology Co., Ltd. (Cambodia), C.J. Gelatine Products Limited (India), American Gelatin (US), and Geltech (South Korea).

Scope of the Softgel Capsules Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.1 billion |

|

Estimated Value by 2028 |

$1.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.3% |

|

Market Driver |

Benefits of Softgel Capsules, Rising demand for naturally sourced ingredients |

|

Market Opportunity |

Personalization and Customization |

This report categorizes the softgel capsules market to forecast revenue and analyze trends in each of the following submarkets:

By Material Type

- Gelatin

- Other Materials

By Source

- Porcine

- Bovine

- Others

By Application

- Pharmaceuticals

- Nutraceutical and Dietary Supplements

- Cosmetics & Personal Care

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Recent Developments of Softgel Capsules Industry

- In March 2023, Darlings Ingredients Inc. acquired Gelnex, which is a global producer of gelatin and collagen products. This acquisition would give the company the capacity to serve the growing needs of its collagen customers while continuing to serve the growing gelatin market.Thermo fisher launched Tumoroid Culture Medium to accelerate development of novel cancer therapies.

- In November 2022, PB Leiner established a joint venture with D&D Participações Societárias. Under the terms of this joint venture, D&D Participações Societárias will acquire a minority stake in the shares of the Brazilian plant of PB Leiner (PB Brasil Industria e Comercio de Gelatinas Ltda). The combined strength of the two companies will enable a long-term sustainable offering of a premium product range of beef hide gelatin based on PB Leiner’s technology.

- In October 2022, PB Leiner extended the gelwoRx Dsolve pharmaceutical portfolio with the launch of three new products—Dsolve B, Dsolve P, and Dsolve xTRA. Dsolve P (pig skin) and Dsolve B (beef hide) are specially developed to reduce cross-linking and fast dissolution of soft capsules. Dsolve xTRA (bovine bone) promises to perform better than Dsolve, Dsolve P, and Dsolve B.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global softgel capsules market between 2023 and 2028?

The global softgel capsules market is expected to grow from USD 1.1 billion in 2023 to USD 1.5 billion by 2028, at a CAGR of 6.3%, driven by increasing demand for dietary supplements and naturally sourced ingredients.

What factors are driving the growth of the softgel capsules market?

Key drivers of the softgel capsules market include the benefits of softgel formulations, rising consumer demand for dietary supplements, the trend towards naturally sourced ingredients, and increased patient compliance due to their easy-to-swallow nature.

What challenges are hindering the softgel capsules market?

The market faces challenges such as limited acceptance in certain regions due to cultural restrictions, rising raw material prices, and environmental concerns associated with gelatin production.

Which region is expected to witness the highest growth in the softgel capsules market?

The Asia Pacific region is projected to experience the fastest growth in the softgel capsules market due to rising healthcare concerns, increasing incomes, and growing pharmaceutical manufacturing capabilities in countries like China, India, and Japan.

What role do naturally sourced ingredients play in the softgel capsules market?

Naturally sourced ingredients are increasingly in demand due to consumer concerns over health risks associated with artificial ingredients. This shift is driving the market growth as manufacturers respond with natural and vegan softgel formulations.

How does customization influence the softgel capsules market?

Customization of softgel capsules, such as personalized formulations for targeted drug delivery and precise dosing, is driving market growth by catering to the specific needs of consumers and the growing demand for personalized healthcare solutions.

What environmental concerns are associated with softgel capsule production?

Softgel capsule production, especially gelatin-based capsules, generates waste and pollution, leading to environmental concerns. These issues are pushing the industry to seek more sustainable production methods and alternative raw materials.

What raw materials are used in the production of softgel capsules?

Softgel capsules are typically made from gelatin or plant-based alternatives such as hydroxypropyl methylcellulose (HPMC), carrageenan, and starch-glycerin. The gelatin segment currently holds the largest market share.

How are rising raw material prices impacting the softgel capsules market?

Increasing demand for raw materials like bovine and pigskin gelatin across multiple industries has driven up prices, creating supply-demand imbalances. This price surge is challenging manufacturers in maintaining cost efficiency.

What are the major applications of softgel capsules?

Softgel capsules are widely used in the pharmaceutical, nutraceutical, dietary supplement, and cosmetics industries. Nutraceuticals and dietary supplements are the largest segment, driven by growing consumer interest in health and wellness products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Benefits of softgel capsules- Increasing demand for dietary supplements and nutraceuticals- Rising demand for naturally sourced ingredientsRESTRAINTS- Negative environmental impact- Limited acceptance due to cultural restrictionsOPPORTUNITIES- Personalization and customizationCHALLENGES- Rising prices of raw materials- Insufficient technologies to extract and process gelatin

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

5.4 PATENT ANALYSIS

-

5.5 VALUE CHAIN ANALYSISSOURCING OF RAW MATERIALSCOLLECTION AND TRANSPORT OF RAW MATERIALSRAW MATERIAL PREPARATION AND PROCESSINGSOFTGEL PRODUCTION

- 5.6 SUPPLY CHAIN ANALYSIS

-

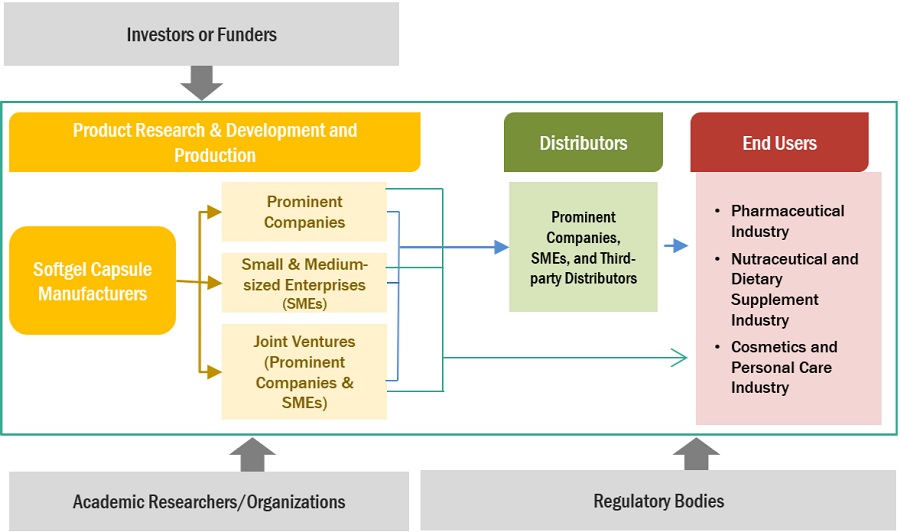

5.7 SOFTGEL CAPSULES MARKET: ECOSYSTEM ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE, BY SOURCE & REGION, 2022–2023 (USD/KT)

- 5.10 TRADE ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR SOFTGEL CAPSULES

- 6.1 INTRODUCTION

-

6.2 GELATINHEALTH BENEFITS OF GELATIN TO DRIVE MARKET

- 6.3 OTHER MATERIALS

- 7.1 INTRODUCTION

-

7.2 BOVINEABUNDANCE AND EASY AVAILABILITY TO SUPPORT MARKET GROWTH

-

7.3 PORCINEINCREASING PORK PRODUCTION TO DRIVE GELATIN MANUFACTURING INDUSTRY

- 7.4 OTHER SOURCES

- 8.1 INTRODUCTION

-

8.2 NUTRACEUTICAL AND DIETARY SUPPLEMENT INDUSTRYGROWING CONSUMER PREFERENCE FOR CAPSULE-BASED NUTRACEUTICAL FORMULATIONS TO DRIVE MARKET

-

8.3 PHARMACEUTICAL INDUSTRYINCREASING BENEFITS OF SOFTGEL CAPSULES TO DRIVE MARKET

-

8.4 COSMETICS AND PERSONAL CARE INDUSTRYINCREASING DEMAND FOR GELATIN IN COSMETIC PRODUCTS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 EUROPEGERMANY- Greater demand for capsule-based pharmaceutical and nutraceutical formulations to drive marketFRANCE- Large demand for pharmaceutical products to support market growthUK- Increasing intake of nutraceuticals and other health supplements to favor market growthITALY- Growing pharmaceutical industry to drive marketSPAIN- Abundant raw materials for gelatin production to support market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

9.3 NORTH AMERICAUS- High demand for capsule-based pharmaceutical and nutraceutical products to drive marketCANADA- Rising government focus on healthcare expenditure to favor market growthNORTH AMERICA: RECESSION IMPACT

-

9.4 ASIA PACIFICCHINA- Availability of low-cost raw materials and workforce to drive marketINDIA- Increasing number of FDA-approved pharmaceutical manufacturing units to support market growthJAPAN- High levels of affordability to favor market growthREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

9.5 LATIN AMERICAAVAILABILITY OF RAW MATERIALS FOR BEEF PRODUCTS TO DRIVE BOVINE GELATIN MARKETLATIN AMERICA: RECESSION IMPACT

-

9.6 MIDDLE EAST & AFRICAGROWING PHARMACEUTICAL INDUSTRY TO DRIVE MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 INTRODUCTION

- 10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING OF PLAYERS- Company Footprint- Product footprint of companies- Regional Footprint of companies

-

10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.7 COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS

-

10.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSGELITA AG- Business overview- Products offered- Recent developments- MnM viewDARLING INGREDIENTS INC.- Business overview- Products offered- Recent developments- MnM viewPB LEINER (PART OF TESSENDERLO GROUP)- Business overview- Products offered- Recent developments- MnM viewNITTA GELATIN, INC.- Business overview- Products offeredNARMADA GELATINES LIMITED- Business overview- Products offeredC.J. GELATINE PRODUCTS LIMITED- Business overview- Products offeredWEISHARDT- Business overview- Products offeredTROBAS GELATINE B.V.- Business overview- Products offeredLAPI GELATINE S.P.A.- Business overview- Products offered- Recent developmentsINDIA GELATINE & CHEMICALS LTD.- Business overview- Products offeredITALGEL S.P.A.- Business overview- Products offeredSTERLING GELATIN AND CRODA COLLOIDS- Business overview- Products offered

-

11.2 OTHER PLAYERSXIAMEN GELKEN GELATIN CO., LTD.GELCO INTERNATIONALBOOM GELATINGELIKO LLCKENNEY & ROSS LIMITED MARINE GELATINBAOTOU DONGBAO BIO-TECH CO., LTD.JELLICE GELATIN & COLLAGENATHOS COLLAGEN PVT. LTD.KUBON BIOTECHNOLOGY CO., LTD.AMERICAN GELATINGELTECH CO., LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2024–2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2030 (USD MILLION)

- TABLE 4 SOFTGEL CAPSULES MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 5 SOFTGEL CAPSULES MARKET: INDICATIVE LIST OF PATENTS

- TABLE 6 SOFTGEL CAPSULES MARKET: ROLE IN ECOSYSTEM

- TABLE 7 SOFTGEL CAPSULES MARKET: CONFERENCES AND EVENTS, 2023–2024

- TABLE 8 AVERAGE SELLING PRICE, BY SOURCE & REGION (2022–2023)

- TABLE 9 IMPORT DATA FOR GELATIN, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR GELATIN, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 11 SOFTGEL CAPSULES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 13 SOFT GELATIN CAPSULES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: SOFT GELATIN CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 EUROPE: SOFT GELATIN CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: SOFT GELATIN CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 SOFTGEL CAPSULES MARKET FOR OTHER MATERIALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: SOFTGEL CAPSULES MARKET FOR OTHER MATERIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 EUROPE: SOFTGEL CAPSULES MARKET FOR OTHER MATERIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: SOFTGEL CAPSULES MARKET FOR OTHER MATERIALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 22 BOVINE SOFTGEL CAPSULES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: BOVINE SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: BOVINE SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: BOVINE SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 PORCINE SOFTGEL CAPSULES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: PORCINE SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: PORCINE SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PORCINE SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 OTHER SOFTGEL CAPSULES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: OTHER SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: OTHER SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: OTHER SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 SOFTGEL CAPSULES MARKET FOR NUTRACEUTICAL AND DIETARY SUPPLEMENT INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: SOFTGEL CAPSULES MARKET FOR NUTRACEUTICAL AND DIETARY SUPPLEMENT INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EUROPE: SOFTGEL CAPSULES MARKET FOR NUTRACEUTICAL AND DIETARY SUPPLEMENT INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: SOFTGEL CAPSULES MARKET FOR NUTRACEUTICAL AND DIETARY SUPPLEMENT INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 SOFTGEL CAPSULES MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: SOFTGEL CAPSULES MARKET FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: SOFTGEL CAPSULES MARKET FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: SOFTGEL CAPSULES MARKET FOR PHARMACEUTICAL INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 SOFTGEL CAPSULES MARKET FOR COSMETICS AND PERSONAL CARE INDUSTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: SOFTGEL CAPSULES MARKET FOR COSMETICS AND PERSONAL CARE INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: SOFTGEL CAPSULES MARKET FOR COSMETICS AND PERSONAL CARE INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: SOFTGEL CAPSULES MARKET FOR COSMETICS AND PERSONAL CARE INDUSTRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 SOFTGEL CAPSULES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: EXPORT AND IMPORT DATA FOR GELATIN, BY COUNTRY, 2022 (TONS)

- TABLE 49 EUROPE: SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 51 EUROPE: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 GERMANY: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 54 GERMANY: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 55 GERMANY: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 FRANCE: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 57 FRANCE: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 58 FRANCE: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 59 UK: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 60 UK: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 61 UK: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 ITALY: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 64 ITALY: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 SPAIN: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: EXPORT AND IMPORT DATA FOR GELATIN, BY COUNTRY, 2022 (TONS)

- TABLE 72 NORTH AMERICA: SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 76 US: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 77 US: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 78 US: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 79 CANADA: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 80 CANADA: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 81 CANADA: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: EXPORT AND IMPORT DATA FOR GELATIN, BY COUNTRY, 2022 (TONS)

- TABLE 83 ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 CHINA: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 88 CHINA: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 89 CHINA: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 INDIA: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 91 INDIA: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 92 INDIA: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 JAPAN: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 94 JAPAN: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 95 JAPAN: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 LATIN AMERICA: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 100 LATIN AMERICA: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 101 LATIN AMERICA: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: SOFTGEL CAPSULES MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: SOFTGEL CAPSULES MARKET, BY SOURCE, 2021–2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: SOFTGEL CAPSULES MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 SOFTGEL CAPSULES MARKET: DEGREE OF COMPETITION

- TABLE 106 COMPANY FOOTPRINT ANALYSIS: KEY PLAYERS

- TABLE 107 SOFTGEL CAPSULES MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 108 SOFTGEL CAPSULES MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 109 SOFTGEL CAPSULES MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 110 SOFTGEL CAPSULES MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS

- TABLE 111 SOFTGEL CAPSULES MARKET: PRODUCT LAUNCHES, JANUARY 2020–AUGUST 2023

- TABLE 112 SOFTGEL CAPSULES MARKET: DEALS, JANUARY 2020–AUGUST 2023

- TABLE 113 SOFTGEL CAPSULES MARKET: OTHER DEVELOPMENTS, JANUARY 2020–AUGUST 2023

- TABLE 114 GELITA AG: COMPANY OVERVIEW

- TABLE 115 GELITA AG: PRODUCT PORTFOLIO

- TABLE 116 GELITA AG: DEALS

- TABLE 117 GELITA AG: OTHER DEVELOPMENTS

- TABLE 118 DARLING INGREDIENTS INC.: COMPANY OVERVIEW

- TABLE 119 DARLING INGREDIENTS INC.: PRODUCT PORTFOLIO

- TABLE 120 DARLING INGREDIENTS INC.: DEALS

- TABLE 121 DARLING INGREDIENTS INC.: OTHER DEVELOPMENTS

- TABLE 122 PB LEINER (PART OF TESSENDERLO GROUP): COMPANY OVERVIEW

- TABLE 123 PB LEINER (PART OF TESSENDERLO GROUP): PRODUCT PORTFOLIO

- TABLE 124 PB LEINER: PRODUCT LAUNCHES

- TABLE 125 PB LEINER: DEALS

- TABLE 126 NITTA GELATIN, INC.: COMPANY OVERVIEW

- TABLE 127 NITTA GELATIN, INC.: PRODUCT PORTFOLIO

- TABLE 128 NARMADA GELATINES LIMITED: COMPANY OVERVIEW

- TABLE 129 NARMADA GELATINES LIMITED: PRODUCT PORTFOLIO

- TABLE 130 C.J. GELATINE PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 131 C.J. GELATINE PRODUCTS LIMITED: PRODUCT PORTFOLIO

- TABLE 132 WEISHARDT: COMPANY OVERVIEW

- TABLE 133 WEISHARDT: PRODUCT PORTFOLIO

- TABLE 134 TROBAS GELATINE B.V.: COMPANY OVERVIEW

- TABLE 135 TROBAS GELATINE B.V.: PRODUCT PORTFOLIO

- TABLE 136 LAPI GELATINE S.P.A.: COMPANY OVERVIEW

- TABLE 137 LAPI GELATINE S.P.A.: PRODUCT PORTFOLIO

- TABLE 138 LAPI GELATINE S.P.A.: DEALS

- TABLE 139 INDIA GELATINE & CHEMICALS LTD.: COMPANY OVERVIEW

- TABLE 140 INDIA GELATINE & CHEMICALS LTD.: PRODUCT PORTFOLIO

- TABLE 141 ITALGEL S.P.A.: COMPANY OVERVIEW

- TABLE 142 ITALGEL: PRODUCT PORTFOLIO

- TABLE 143 STERLING GELATIN AND CRODA COLLOIDS: COMPANY OVERVIEW

- TABLE 144 STERLING GELATIN AND CRODA COLLOIDS: PRODUCT PORTFOLIO

- TABLE 145 XIAMEN GELKEN GELATIN CO., LTD.: COMPANY OVERVIEW

- TABLE 146 GELCO INTERNATIONAL: COMPANY OVERVIEW

- TABLE 147 BOOM GELATIN: COMPANY OVERVIEW

- TABLE 148 GELIKO LLC: COMPANY OVERVIEW

- TABLE 149 KENNEY & ROSS LIMITED MARINE GELATIN: COMPANY OVERVIEW

- TABLE 150 BAOTOU DONGBAO BIO-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 151 JELLICE GELATIN & COLLAGEN: COMPANY OVERVIEW

- TABLE 152 ATHOS COLLAGEN PVT. LTD.: COMPANY OVERVIEW

- TABLE 153 KUBON BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 154 AMERICAN GELATIN: COMPANY OVERVIEW

- TABLE 155 GELTECH CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 SOFTGEL CAPSULES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 SOFTGEL CAPSULES MARKET: MARKET SIZE ESTIMATION FOR SUPPLY-SIDE ANALYSIS (2022)

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS) FOR 2022

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF DARLING INGREDIENTS INC.: REVENUE SHARE ANALYSIS FOR 2022

- FIGURE 6 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 7 SOFTGEL CAPSULES MARKET: CAGR PROJECTIONS FOR FORECAST PERIOD

- FIGURE 8 SOFTGEL CAPSULES MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 SOFTGEL CAPSULES MARKET, BY MATERIAL, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 SOFTGEL CAPSULES MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 SOFTGEL CAPSULES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF SOFTGEL CAPSULES MARKET

- FIGURE 14 INCREASING DEMAND FOR DIETARY SUPPLEMENTS AND NUTRACEUTICALS TO DRIVE MARKET

- FIGURE 15 BOVINE SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- FIGURE 16 NUTRACEUTICAL AND DIETARY SUPPLEMENT INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 17 BOVINE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 18 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 SOFTGEL CAPSULES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 REVENUE SHIFT & NEW REVENUE POCKETS FOR SOFTGEL CAPSULE PROVIDERS

- FIGURE 21 SOFTGEL CAPSULES MARKET: PATENT APPLICATIONS, JANUARY 2012–JULY 2023

- FIGURE 22 VALUE CHAIN ANALYSIS OF SOFTGEL CAPSULES MARKET: RAW MATERIAL AND MANUFACTURING PHASE CONTRIBUTE MAXIMUM VALUE

- FIGURE 23 SOFTGEL CAPSULES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SOFTGEL CAPSULES

- FIGURE 25 KEY BUYING CRITERIA FOR END USERS

- FIGURE 26 EUROPE: SOFTGEL CAPSULES MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: SOFTGEL CAPSULES MARKET SNAPSHOT

- FIGURE 28 SOFTGEL CAPSULES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 31 SOFTGEL CAPSULES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 32 SOFTGEL CAPSULES MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 33 DARLING INGREDIENTS INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 PB LEINER (PART OF TESSENDERLO GROUP): COMPANY SNAPSHOT (2022)

- FIGURE 35 NITTA GELATIN: COMPANY SNAPSHOT (2022)

- FIGURE 36 NARMADA GELATINES LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 37 C.J. GELATINE PRODUCTS LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 38 INDIA GELATINE & CHEMICALS LTD.: COMPANY SNAPSHOT (2021)

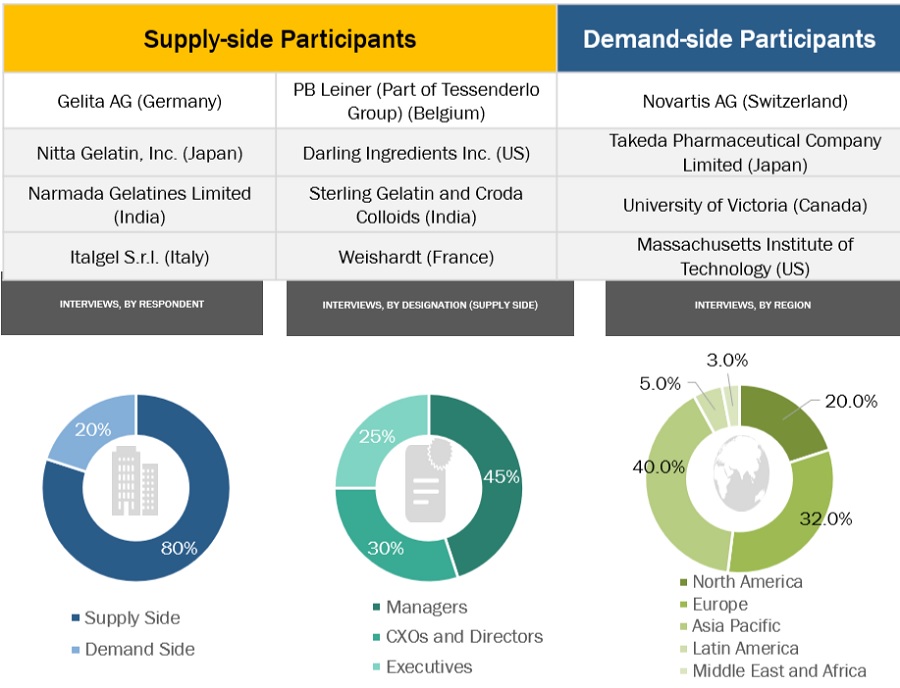

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global softgel capsules market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources such as the World Health Organization (WHO), Gelatin Manufacturer’s Institute of America (GMIA), Gelatin Manufacturers Association of Asia Pacific (GMAP), Gelatin Manufacturers Association of Europe (GME), European Federation of Pharmaceutical Industries and Associations (EFPIA), Pharmaceutical Research and Manufacturers of America (PhRMA), US Food and Drug Administration (USFDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), Organisation for Economic Co-operation and Development (OECD), Indian Pharmaceutical Association (IPA), Indian Drug Manufacturers’ Association (IDMA), Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentations, Journals, Expert Interviews, and MarketsandMarkets Analysis. Secondary data was collected and analyzed to arrive at the overall size of the global softgel capsules market, which was then validated by primary research.

Primary Research

Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side (pharmaceutical, nutraceutical, dietary supplement, cosmetics, and personal care industries) and supply side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, from Tier 1 and Tier 2 companies engaged in offering products) across five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 80% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining share. The primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report presents a detailed assessment of the softgel capsules market and qualitative inputs and insights from MarketsandMarkets. The total market size was determined after data triangulation from three different approaches. After completing each approach, the weighted average of the four approaches was taken based on each approach’s level of assumptions. A detailed market estimation approach was followed to estimate and validate the value of the softgel capsules market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- From the list of manufacturers of softgel capsules, companies were identified and finalized from secondary research.

- The revenues generated from the softgel capsules business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Approach: MnM Repository Analysis

For the estimation of the softgel capsules market, related market reports in the MnM Repository, including the gelatin market, pharmaceutical gelatin market, and empty capsules market were considered. The global and regional market values of softgel capsules and dependent submarkets were extracted from the MnM repository and validated through secondary and primary research. The final global market size was triangulated through the average of all approaches and validated through primary interviews with industry experts.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition:

Softgel Capsules Market covers the market size for raw materials such as gelatin and other plant-based materials used for manufacturing of soft gel capsules used in various industrial applications such as pharmaceutical, nutraceutical and dietary supplement, and cosmetics & personal care industries.

Key Stakeholders

- Softgel Capsule Manufacturers, Vendors, and Distributors

- Pharmaceutical Companies

- Nutraceutical and Dietary Supplement Companies

- Cosmeceutical Companies

Report Objectives

- To define, describe, and forecast the global softgel capsules market based on material, source, application, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the global softgel capsules market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the RoE softgel capsules market, by country

- Further breakdown of the RoAPAC softgel capsules market, by country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Segment Analysis

- Further breakdown of the therapeutic area segment as per the product portfolio of prominent players operating in the market.

Growth opportunities and latent adjacency in Softgel Capsules Market