Software Defined Radar Market by Subsystem (Antennas, Converters, Conditioners, Data Processors), Application (Target Detection & Recognition, Surveillance, Meteorology, Air-Traffic Control), End User (Commercial, Government & Military) and Region - Global Forecast to 2025

Exhaustive secondary research was undertaken to obtain information on the Software Defined Radar market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing by industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and radar component research papers.

Primary Research

The Software Defined Radar market comprises several stakeholders, such as component provider technology provider, processors, infrastructure provider, network service provider end-product manufacturers, and department of defense, regulatory organizations in the supply chain.

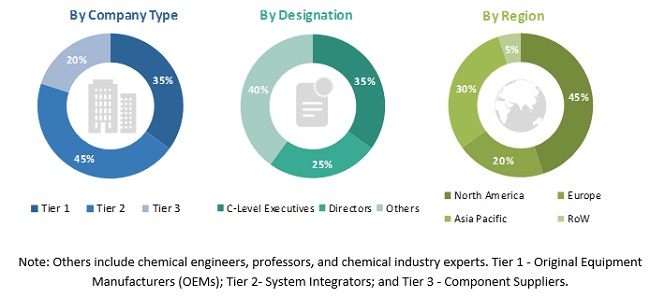

The demand-side of this market is characterized by various end users, such as commercial operators, government & military operators and OEMs. The supply-side is characterized by technology advancements in satellite components and the development in communication infrastructure, software upgrades, higher frequency ranges among others. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the Software Defined Radar market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides of the aircraft component manufacturing industry.

Report Objectives

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Software Defined Radar market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for 5 regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, acquisitions, and new product developments

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Subsystem, Application, End User and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East and RoW |

|

Companies covered |

Ancortek (US), Ultra Electronics (US), TERMA (Denmark), RADA Electronic Industries Ltd (Israel), Raytheon (US) , among others |

This research report categorizes the Software Defined Radar market based on Subsystem, Application, End User and Region.

On the basis of Subsystem, the Software Defined Radar market has been segmented as follows:

- Antennas

- Converters

- Conditioners

- Data Processors

- Signal conditioning modules

- Local Oscillators

On the basis of Application, the Software Defined Radar market has been segmented as follows:

- Target Detection & Recognition

- Surveillance

- Meteorology

- Air-Traffic Control

- Healthcare monitoring

- Industrial automation

On the basis of End User, the Software Defined Radar market has been segmented as follows:

- Commercial

- Government & Military

On the basis of region, the Software Defined Radar market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Focus on enhancing homeland security and border surveillance capabilities- Need for advanced weather monitoring radars in aviation industry- Advancements in radar technologies- Emergence of modern warfare- Increasing preference for phased array solid-state radarsRESTRAINTS- Need for substantial R&D fundingOPPORTUNITIES- Increasing hardware and software integration in radar technologies- Rising use of compact radars for anti-drone applications- Development of low-cost and miniaturized radarsCHALLENGES- Extreme weather conditions- Vulnerability of radars to new jamming techniques

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.7 OPERATIONAL DATA

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGY- Gallium Nitride Semiconductors- Active Electronically Scanned ArraysCOMPLEMENTARY TECHNOLOGY- Quantum ComputingADJACENT TECHNOLOGY- Sensor Fusion- Photonics and Optical Technologies

- 5.9 TRADE ANALYSIS

-

5.10 USE CASE ANALYSISNORTHROP GRUMMAN’S AESA FIRE CONTROL RADARLEONARDO’S TACTICAL MULTI-MISSION RADARLOCKHEED MARTIN’S TRACERSEA-BASED X-BAND RADAR

- 5.11 KEY CONFERENCES AND EVENTS, 2025–2026

- 5.12 REGULATORY LANDSCAPE

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 TECHNOLOGY ROADMAP

- 5.15 TOTAL COST OF OWNERSHIP

- 5.16 BILL OF MATERIALS

- 5.17 BUSINESS MODELS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

-

6.3 IMPACT OF MEGATRENDSADVENT OF INTERNET OF THINGSSHIFT IN GLOBAL ECONOMIC POWERDEVELOPMENT OF ANTENNAS IN RADAR SYSTEMS

-

6.4 IMPACT OF GENERATIVE AI ON SOFTWARE DEFINED RADAR MARKETINTRODUCTIONADOPTION OF GENERATIVE AI IN MILITARY BY TOP COUNTRIESIMPACT OF GENERATIVE AI ON MILITARY USE CASESIMPACT OF GENERATIVE AI ON SOFTWARE DEFINED RADAR MARKET

- 6.5 SUPPLY CHAIN ANALYSIS

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 ANTENNASEVOLVING MODERN WARFARE REQUIREMENTS TO DRIVE MARKETPARABOLIC REFLECTOR ANTENNASSLOTTED WAVEGUIDE ANTENNASPHASED ARRAY ANTENNASMULTIPLE INPUT-MULTIPLE OUTPUT ANTENNASACTIVE SCANNED ARRAY ANTENNASPASSIVE SCANNED ARRAY ANTENNAS

-

7.3 TRANSMITTERSIMPROVING DEFENSE CAPABILITIES TO ADDRESS EMERGING THREATS TO DRIVE MARKETMICROWAVE TUBE-BASED TRANSMITTERSSOLID-STATE ELECTRONIC TRANSMITTERS

-

7.4 RECEIVERSGROWING PREVALENCE OF DIGITAL RECEIVERS TO DRIVE MARKETANALOG RECEIVERSDIGITAL RECEIVERS

-

7.5 POWER AMPLIFIERSENHANCED OPERATIONAL CAPABILITIES THROUGH DEFENSE UPGRADES TO DRIVE MARKETTRAVELING WAVE TUBE AMPLIFIERSSOLID-STATE POWER AMPLIFIERS- Gallium Arsenide- Gallium Nitride- Silicon CarbideGALLIUM NITRIDE POWER AMPLIFIERS

-

7.6 DUPLEXERSEXCELLENT RADAR RELIABILITY AND FUNCTIONALITY TO DRIVE MARKETBRANCH-TYPE DUPLEXERSBALANCED-TYPE DUPLEXERSCIRCULATOR DUPLEXERS

-

7.7 DIGITAL SIGNAL PROCESSORSADVANCEMENTS IN COMMUNICATIONS TECHNOLOGIES TO DRIVE MARKET

-

7.8 GRAPHICAL USER INTERFACESMULTIFUNCTION CAPABILITIES TO DRIVE MARKETCONTROL PANELSGRAPHIC PANELSDISPLAYS

-

7.9 STABILIZATION SYSTEMSOVERALL COMBAT EFFECTIVENESS TO DRIVE MARKET

- 7.10 OTHER COMPONENTS

- 8.1 INTRODUCTION

-

8.2 LANDNEED FOR BORDER SURVEILLANCE AND DRONE DETECTION TO DRIVE MARKETFIXED RADARSVEHICLE-BASED RADARSMAN-PORTABLE RADARS

-

8.3 NAVALSURGE OF ILLEGAL MARITIME ACTIVITIES TO DRIVE MARKETVESSEL-BASED RADARSCOASTAL RADARSUSV-MOUNTED RADARS

-

8.4 AIRBORNEMODERNIZATION OF AIR FORCES TO DRIVE MARKETMANNED AIRCRAFT RADARSUAV-MOUNTED RADARSAEROSTATS-BASED RADAR

-

8.5 SPACECONTRACTS SUPPORTING UPGRADES OF SPACE INFRASTRUCTURE TO DRIVE MARKETSATELLITESSPACECRAFT

- 9.1 INTRODUCTION

-

9.2 NAVYINCREASING PROCUREMENT OF ADVANCED NAVAL VESSELS TO DRIVE MARKETAIRBORNE RADARSCOASTAL SECURITY RADARSVESSEL-BASED RADARS

-

9.3 ARMYEMPHASIS ON BORDER SECURITY AND MISSILE DEFENSE TO DRIVE MARKETAIRBORNE RADARSLAND RADARSOVER-THE-HORIZON RADARSMISSILE & GUNFIRE CONTROL RADARSPERIMETER SURVEILLANCE RADARSLONG-RANGE SURVEILLANCE RADARS

-

9.4 AIR FORCERISING AIRBORNE THREATS TO DRIVE MARKETAIRBORNE RADARSLAND RADARSPRECISION APPROACH RADARSSURFACE MOVEMENT RADARSWEATHER NAVIGATION RADARS

-

9.5 SPACE3D IMAGING AND HIGH-RESOLUTION DIGITAL MAPPING CAPABILITIES TO DRIVE MARKETSEARCH & DETECTION RADARS

- 10.1 INTRODUCTION

-

10.2 FREQUENCY-MODULATED CONTINUOUS WAVERAPID ADOPTION DUE TO VERSATILITY TO DRIVE MARKET

-

10.3 DOPPLERPREDOMINANCE IN METEOROLOGICAL APPLICATIONS TO DRIVE MARKETCONVENTIONAL DOPPLERPULSE-DOPPLER

- 11.1 INTRODUCTION

-

11.2 HF/UHF/VHF-BANDLIMITED APPLICATIONS IN DEFENSE INDUSTRY TO IMPEDE MARKET

-

11.3 L-BANDEARLY AIR AND SURFACE TARGET IDENTIFICATION AND TRACKING CAPABILITIES TO DRIVE MARKET

-

11.4 S-BANDVERSATILITY AND EFFECTIVENESS IN DIVERSE APPLICATIONS TO DRIVE MARKET

-

11.5 C-BANDPRECISION IN LONG-RANGE MILITARY BATTLEFIELD SURVEILLANCE TO DRIVE MARKET

-

11.6 X-BANDENHANCED SIGNAL QUALITY TO DRIVE MARKET

-

11.7 KU-BANDWIDE BEAM COVERAGE AND HIGH THROUGHPUT TO DRIVE MARKET

-

11.8 KA-BANDHIGH DATA TRANSMISSION RATES TO DRIVE MARKET

-

11.9 MULTI-BANDDEVELOPMENTS IN PHOTONIC TECHNOLOGIES TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 SURVEILLANCE & AIRBORNE EARLY WARNING RADARSRISING INVESTMENTS IN PASSIVE RADAR SYSTEMS TO DRIVE MARKETAIRBORNE SURVEILLANCE RADARSLAND SURVEILLANCE RADARSNAVAL SURVEILLANCE RADARSSPACE SURVEILLANCE RADARS

-

12.3 TRACKING & FIRE CONTROL RADARSAUTOMATION OF DEFENSE AND SURVEILLANCE RADAR SYSTEMS TO DRIVE MARKETAIRBORNE TRACKING & FIRE CONTROL RADARSLAND TRACKING & FIRE CONTROL RADARSNAVAL TRACKING & FIRE CONTROL RADARSSPACE TRACKING & FIRE CONTROL RADARS

-

12.4 MULTIFUNCTION RADARSINNOVATIONS IN RADAR TECHNOLOGY FOR INTEGRATED CAPABILITIES TO DRIVE MARKETLAND MULTIFUNCTION RADARSNAVAL MULTIFUNCTION RADARS

-

12.5 WEAPON LOCATING & C-RAM RADARSINCREASING DEMAND FOR EFFECTIVE COUNTERMEASURES TO DRIVE MARKET

-

12.6 GROUND PENETRATING RADARSENHANCED SURVEILLANCE AND RECONNAISSANCE CAPABILITIES TO DRIVE MARKET

-

12.7 WEATHER RADARSNEED FOR PRECISE WEATHER FORECASTING IN MILITARY APPLICATIONS TO DRIVE MARKETAIRBORNE WEATHER RADARSLAND WEATHER RADARS

-

12.8 COUNTER-DRONE RADARSGROWING DEMAND FOR ADVANCED SITUATIONAL AWARENESS FROM WARFIGHTERS TO DRIVE MARKET

-

12.9 AIRCRAFT BIRD STRIKE AVOIDANCE RADARSREGULATORY REQUIREMENTS FOR WILDLIFE HAZARD MANAGEMENT TO DRIVE MARKET

- 12.10 OTHER PRODUCTS

- 13.1 INTRODUCTION

-

13.2 2DWIDE ACCEPTANCE IN TERRESTRIAL, NAVAL, AND AIRBORNE SURVEILLANCE TO DRIVE MARKET

-

13.3 3DADVANCEMENTS IN RADAR TECHNOLOGY TO DRIVE MARKET

-

13.4 4DPREVALENCE IN AUTONOMOUS TACTICAL SURVEILLANCE TO DRIVE MARKET

- 14.1 INTRODUCTION

-

14.2 NEW INSTALLATIONSEAMLESS INTEGRATION OF RADAR SYSTEMS TO DRIVE MARKET

-

14.3 SUPPORT & MAINTENANCENEED FOR REGULAR MAINTENANCE AND SERVICING TO DRIVE MARKET

-

14.4 TRAINING & CONSULTINGFOCUS ON OPTIMIZING RADAR UTILIZATION TO DRIVE MARKET

- 15.1 INTRODUCTION

- 15.2 VERY LONG RANGE

- 15.3 LONG RANGE

- 15.4 MEDIUM RANGE

- 15.5 SHORT RANGE

- 15.6 VERY SHORT RANGE

- 16.1 INTRODUCTION

- 16.2 AIRSPACE MONITORING & TRAFFIC MANAGEMENT

- 16.3 AIR & MISSILE DEFENSE

- 16.4 WEAPON GUIDANCE

- 16.5 GROUND SURVEILLANCE & INTRUDER DETECTION

- 16.6 VESSEL TRAFFIC SECURITY & SURVEILLANCE

- 16.7 AIRBORNE MAPPING

- 16.8 NAVIGATION

- 16.9 MINE DETECTION & UNDERGROUND MAPPING

-

16.10 GROUND FORCE PROTECTION & COUNTER-MAPPINGWEATHER MONITORINGGROUND PENETRATIONMARITIME PATROLLING, SEARCH, & RESCUEBORDER SECURITYSPACE SITUATIONAL AWARENESSOTHER APPLICATIONS

- 17.1 INTRODUCTION

- 17.2 REGIONAL RECESSION IMPACT ANALYSIS

-

17.3 NORTH AMERICAPESTLE ANALYSISRECESSION IMPACT ANALYSISUS- Strategic investments in advanced defense technologies to drive marketCANADA- Focus on improving surveillance radar technology to drive market

-

17.4 EUROPEPESTLE ANALYSISRECESSION IMPACT ANALYSISUK- Substantial military expenditure and special surveillance & missile defense programs to drive marketGERMANY- Development of advanced radar systems to enhance national security to drive marketFRANCE- Strategic defense initiatives to drive marketITALY- Significant presence of radar manufacturing companies to drive marketREST OF EUROPE

-

17.5 ASIA PACIFICPESTLE ANALYSISRECESSION IMPACT ANALYSISINDIA- Rising procurement of defense systems to drive marketJAPAN- Strategic pivot toward open defense exports to drive marketSOUTH KOREA- Focus on enhancing radar capabilities to drive marketAUSTRALIA- Emphasis on upgrading 737-based E-7 radar jets to drive marketREST OF ASIA PACIFIC

-

17.6 MIDDLE EASTPESTLE ANALYSISRECESSION IMPACT ANALYSISGCC- Saudi Arabia- UAEREST OF MIDDLE EAST

-

17.7 REST OF THE WORLDPESTLE ANALYSISRECESSION IMPACT ANALYSISLATIN AMERICA- Rigorous efforts to strengthen defense forces to drive marketAFRICA- Focus on small CubeSats for space-based surveillance to drive market

- 18.1 INTRODUCTION

- 18.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

- 18.3 REVENUE ANALYSIS, 2021–2024

- 18.4 MARKET SHARE ANALYSIS, 2024

-

18.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

18.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 18.7 COMPANY VALUATION AND FINANCIAL METRICS

- 18.8 BRAND/PRODUCT COMPARISON

-

18.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

19.1 KEY PLAYERSRTX- Business overview- Products offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products offered- Recent developments- MnM viewNORTHROP GRUMMAN- Business overview- Products offered- Recent development- MnM viewTHALES- Business overview- Products offered- Recent developments- MnM viewISRAEL AEROSPACE INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewLEONARDO S.P.A.- Business overview- Products offered- Recent developmentsBAE SYSTEMS- Business overview- Products offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsELBIT SYSTEMS LTD.- Business overview- Products offered- Recent developments- BHARAT ELECTRONICS LIMITED- INDRA SISTEMAS, S.A.- ASELSAN A.S.- SAAB AB- TELEDYNE FLIR LLC- TELEPHONICS CORPORATION

-

19.2 OTHER PLAYERSBLIGHTER SURVEILLANCE SYSTEMS LIMITEDDETECT, INC.TERMAACCIPITER RADARPIERSIGHTREUTECH RADAR SYSTEMSSRC INC.EASAT RADAR SYSTEMS LTD.METASENSING- AINSTEIN AI INC.

- 20.1 DISCUSSION GUIDE

- 20.2 ANNEXURE A: DEFENSE PROGRAM MAPPING

- 20.3 ANNEXURE B: OTHER MAPPED COMPANIES

- 20.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 20.5 CUSTOMIZATION OPTIONS

- 20.6 AUTHOR DETAILS

Growth opportunities and latent adjacency in Software Defined Radar Market