Solid-State Car Battery Market by Vehicle (Passenger Car and Commercial Vehicle), Battery Energy Density (>450 Wh/kg, >450 Wh/kg), Propulsion (BEV, PHEV), Component(Cathode, Anode, and Electrolyte), and Region - Global Forecast to 2030

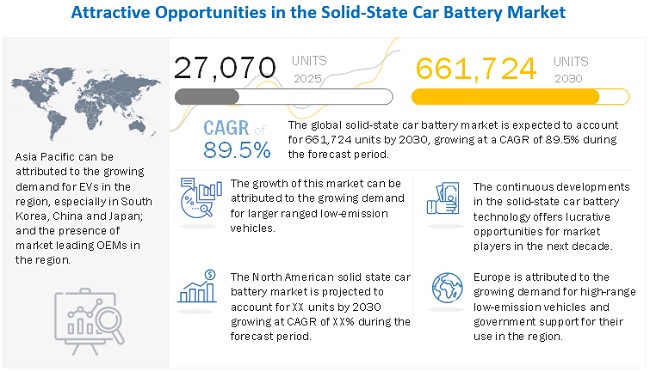

[161 Pages Report] The global solid-state car battery market size is projected to grow from 27,070 units in 2025 to 661,724 units by 2030, at a CAGR of 89.5%. The demand for solid-state car batteries will grow with the demand for EV’s. Electric vehicles have been growing in demand for the last few years. The increasing emission levels and stringent government regulations have compelled automakers to develop cost-efficient and environment-friendly modes of transport. The rising volume of toxic gases emitted by vehicles has created an alarming situation and made it imperative for various governments to take preventive steps to reduce pollution. Hence, governments of different countries have taken stringent measures to increase the adoption of electric vehicles. Electric vehicles produce zero or very low emissions of local air pollutants. In addition, BEV’s produce lower noise due to the absence of IC engines.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on solid-state car battery market

As this is a future market, Covid-19 had a minimal impact on this market. The impact was mostly due to a small delay in R&D time during the initial pandemic phase when the world went into lockdown. Meanwhile, due to countries showing a higher demand for EV’s during the pandemic, it is expected that overall the market wouldn’t be largely affected. The global market is expected to be launched well after the pandemic, due to which, there warent any material or financial losses in the market.

Market Dynamics

Driver: Higher capacity in solid-state batteries resulting in increased EV range leading to higher demand

A major concern for EV users is the lower range of vehicle on a single charge. This issue has been a major factor reducing the growth of the EV market. Compared to EVs using conventional lithium ion batteries, those installed with solid-state batteries are expected to have a significantly higher range due to the high battery density. Solid-state batteries can theoretically store twice as much energy as that in lithium ion batteries. Thus, various top EV manufacturers are investing in this technology. An EV installed with a solid-state battery according to various industry experts can have an approximately 600+ mile electric range.

Toyota plans to introduce its EV using SSB with a range of over 320 miles to the market by end 2021. Companies such as Solid Power and QuantumScape plan to develop higher power SSBs in the coming 2-3 years. QuantumScape has announced that its SSB is expected to have an 80% higher range compared to the presently available lithium ion batteries. Thus, this technology is expected to be a major game changer for EV manufacturers. This is expected to significantly improve the performance of EVs compared to ICE vehicles. Battery size is also expected to be another factor in increasing the range of EVs using SSBs. This is due to the fact that more cells can be attached in the same size SSB as that of the current lithium ion battery. Samsung has developed a prototype SSB with a vehicle range of over 500 miles, the battery size being half that of currently available lithium ion batteries.

Restraint: Higher cost compared to conventional EV batteries

Prices of lithium ion batteries have fallen by 89% during the past 12 years. In 2010, the price of lithium ion batteries was approximately USD 1,100 /kWh while in 2020, it reached approximately USD 137 /kWh. Lithium ion battery prices are expected to reach approximately USD 60 /kWh by 2030 according to many industry experts. In 2021, Tesla announced plans to reduce the prices of lithium ion EV batteries significantly during the next 2-3 years. Solid-state batteries are expected to cost approximately USD 80-90/ kWh by the same time according to various publications. Therefore, by the time solid-state car batteries are mass produced, most higher end EVs are expected to use solid-state batteries while lower end EV producers are expected to prefer using lithium ion batteries. When the prices of solid-state car batteries fall to the same levels to those of lithium ion batteries, higher demand is expected for solid-state batteries, leading to the rapid growth of the market.

Opportunity: Rising demand for EVs expected to drive demand for solid-state batteries

Leading markets for electric vehicles such as China, US, and Germany are investing significantly in electric vehicles and EV charging infrastructure along with research & development for faster and efficient charging methods, longer range EVs, and lower cost batteries. They have also been investing in the development of the solid-state battery technology. Significant investments by automakers are expected to cater to the rising demand for EVs. Countries across North America and Europe along with various Asian countries have adopted measures to reduce emissions during the coming decades and replace their vehicle fleets for lower emission vehicles by 2050. This is expected to lead to significantly high demand for electric vehicles and related industries.

OEMs offer a wide range of vehicles, from small hatchbacks such as Leaf to high-end sedans such as Tesla model 3. The wide range of product offerings has attracted a high number of consumers, resulting in an increased market for electric vehicles. For instance, in January 2018, Ford announced plans to increase planned investments to USD 11 billion by 2022 for the development of EVs. The company plans to introduce 40 EVs by 2022, of which 16 are expected to be fully electric and 24 are expected to be plug-in hybrid vehicles. The investment is higher than a previously announced USD 4.5 billion.

Challenge: Technological barriers in the development of solid-state batteries

Currently, there are various technological barriers for development of solid-state batteries for use in EVs. These challenges include interfacial issues between the electrolyte and electrodes, poor solid-solid contact, and lithium dendrites during the charging and discharging processes. Various OEMs and battery manufacturers have been undertaking efforts to overcome these technological challenges and developing solid-state batteries. There are various other material gaps, processing demands, and design gaps. Some critical gaps in the realization of solid-state batteries have been given below.

A few other problems due to the use of solid-state batteries in EVs include bulk resistance of the solid electrolyte, cyclic stability of the battery, and the electrochemical stability of the system. Once these technical challenges are overcome, solid-state batteries are expected to be ready for use. Various sources estimate the challenges to be overcome by approximately 2025 and begin mass production of solid-state car batteries during the following years.

Adoption of electric vehicles worldwide will boost the market share of Passenger Cars segment during the forecast period

Asia Pacific is expected to be the market for passenger cars, followed by Europe and North America. This is due to the strong government support for the adoption of electric passenger vehicles in the region. North America to be the fastest-growing region with a fast-growing demand for premium electric vehicles which will use solid-state car batteries in the coming years. The market in Europe is expected to grow in the coming years. This is due to strong emission regulations and a variety of subsidies, grants, and incentives for adopting EVs in countries such as Germany, France, Netherlands, Norway, Sweden, and the UK. The demand for solid-state batteries in electric vehicles will be growing with the increased demand for EVs and the mass production of solid-state car batteries.

BEV’s are projected to achieve significant growth in market size globally

The demand for solid-state batteries in BEV is expected to be higher in the coming years compared to PHEVs. This will be mostly due to its high demand for premium BEVs with superior features such as larger battery capacity, faster charging, and better safety features. The prices of these batteries will reduce once their mass production starts on a larger scale and other lower-end BEVs also start using these batteries. The market for solid-state batteries in BEVs in North America is expected to grow at the highest rate due to the presence of top OEMs in the region, along with companies like QuantumScape and Solid Power working on the development of solid-state battery technology.

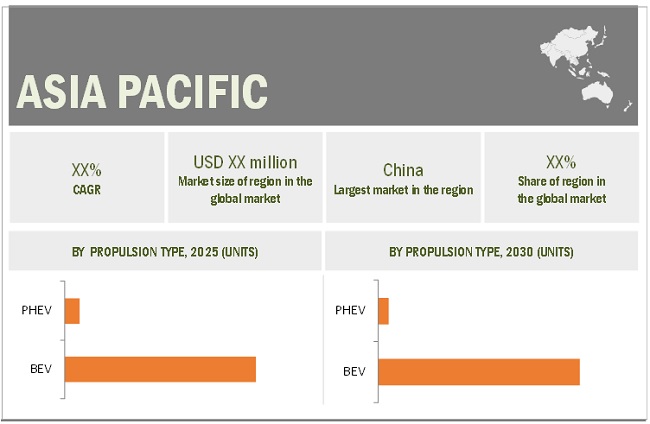

“Asia Pacific is expected to witness significant growth during the forecast period.”

The Asia Pacific region will the largest solid-state car battery market during the forecast period. The Asia Pacific market will be led by countries such as China, Japan, and South Korea. The governments of these countries have supported the growth of EV demand through subsidies, favorable policies for EVs and discouraging the use of petrol. This will lead to a fast-growing demand for solid-state car batteries in the region once they come into the market. Premium EVs using solid-state batteries will be launched in China and Japan, followed by South Korea and India. Growth will be slower in the initial years but will speed up after 2026. India will be the fastest-growing market in the region due to current and upcoming EV policies. Japan will also be one of the fastest-growing markets in the region due to top OEMs such as Toyota, Nissan, and Mitsubishi and battery manufacturers working to develop solid-state batteries.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global solid-state car battery market is dominated by global players such as Toyota Motor Corporation (Japan), Solid Power (US), QuantumScape (US), Samsung SDI (South Korea), and LG Chem (South Korea). These companies have been developing new products, adopted expansion strategies, and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2030 |

|

Base year considered |

2020 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Volume (Units) |

|

Segments covered |

Vehicle Type, Propulsion, Component, Battery Energy Density, and Region. |

|

Geographies covered |

North America, Asia Pacific, Europe, and Middle East & Africa. |

|

Companies Covered |

Toyota Motor Corporation (Japan), Solid Power (US), QuantumScape (US), Samsung SDI (South Korea) and LG Chem (South Korea). |

This research report categorizes the solid-state car battery market based on Vehicle, Propulsion, Component, Battery Energy Density, and Region.

Based on Vehicle Type:

- Passenger Car

- Commercial vehicle

Based on Propulsion:

- BEV

- PHEV

Based on Battery Energy Density:

- <450 Wh/kg

- >450 Wh/kg

Based on Component:

- Cathode

- Anode

- Electrolyte

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

-

Europe

- France

- Germany

- Norway

- Spain

- UK

- The Netherlands

-

Middle East & Africa

- UAE

- South Africa

- Egypt

Recent Developments

- In May 2021, BMW and Ford expanded their existing joint development agreement with Solid Power for the development of solid-state batteries and secure them for their future EVs. Together with Volta Energy Technologies, they funded Solid Power USD 130 million for the development of the same.

- In March 2021, Toyota announced its rechargeable solid-state car battery development and its prototype car, which will be launched in 2021. The company announced that the EV using the solid-state car battery will ensure a range greater than 500 miles on a single charge and charge the EV battery fully in 10 minutes.

- In February 2021, Hyundai and CATL partnered to provide EV batteries to Hyundai after 2023 for all its electric cars. They will also jointly speed up the development of new battery technology.

- In December 2020, QuantumScape released its performance data for its solid-state car battery technology based on a prototype developed. It takes 15 minutes for 80% charge of the battery and has a longer range than conventional lithium-ion batteries. It can operate at a wider temperature scope.

- In April 2020, Ilika and Comau, part of the Fiat Group, initiated a collaboration to develop the Goliath range of solid-state batteries for use in EVs. They will work together to deliver Ilika’s batteries to the market more cost-effectively and at a faster time by expanding the production capacity once the batteries are ready for sale.

- In February 2020, Panasonic and Toyota partnered for the development of EV battery technology. The partnership will focus on solid-state batteries in the coming years.

Frequently Asked Questions (FAQ):

What is the current size of the global solid-state car battery market?

The global solid-state car battery market size is projected to grow from 27,070 units in 2025 to 661,724 units by 2030, at a CAGR of 89.5%.

Who are the winners in the global solid-state car battery market?

The global solid-state car battery market is dominated by global players such as Toyota Motor Corporation (Japan), Solid Power (US), QuantumScape (US), Samsung SDI (South Korea), and LG Chem (South Korea). These companies have been developing new products, adopted expansion strategies, and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth solid-state car battery market.

What is the Covid-19 impact on future solid-state battery manufacturers?

Most top OEM’s and other battery manufacturers suffered in the initial months of Covid-19 due to lockdown. Although being a future technology, this market wasn’t directly affected by the pandemic, it may still be delayed by a few months due to the cascading impact of the pandemic. However, during the pandemic, with increasing demand for EV’s, the importance given to this technology has also increased, which will have a positive impact on the market on a long run.

Which region will have the biggest market for solid-state car Batteries?

The Asia Pacific region will the largest market for solid-state batteries due to the huge volume of demand for EV’s in the region while North America will be the fastest-growing market with a fast-growing demand for premium EV’s in US. Europe will also have a high demand for EV’s using this battery mainly led by countries like Germany, UK and France. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN THE SOLID-STATE CAR BATTERY MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 GLOBAL MARKET SIZE: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 SOLID-STATE CAR BATTERY MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 8 RESEARCH APPROACH: MARKET

FIGURE 9 MARKET: RESEARCH DESIGN & METHODOLOGY – DEMAND SIDE

2.3.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.4 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 11 SOLID-STATE CAR BATTERY MARKET OVERVIEW

FIGURE 12 MARKET, BY REGION, 2025–2030 (UNITS)

FIGURE 13 SOLID-STATE BATTERY TRENDS WOULD CREATE A SHIFT IN REVENUE MIX IN THE COMING YEARS

FIGURE 14 THE BATTERY ELECTRIC VEHICLES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD (2025–2030)

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SOLID-STATE CAR BATTERY MARKET

FIGURE 15 INCREASING DEMAND FOR LONG-RANGE ZERO-EMISSION COMMUTING TO DRIVE THE MARKET

4.2 MARKET GROWTH RATE, BY REGION

FIGURE 16 ASIA PACIFIC PROJECTED TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

4.3 AUTOMOTIVE SOLID-STATE BATTERY MARKET, BY VEHICLE TYPE

FIGURE 17 THE PASSENGER CAR SEGMENT TO BE A LARGER SEGMENT DURING THE FORECAST PERIOD (2025–2030)

4.4 MARKET, BY PROPULSION

FIGURE 18 THE BATTERY ELECTRIC VEHICLE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD (2025–2030)

4.5 MARKET, BY BATTERY ENERGY DENSITY

FIGURE 19 THE <450 WH/KG SEGMENT TO BE A LARGER SEGMENT DURING THE FORECAST PERIOD (2025–2030)

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 SOLID-STATE CAR BATTERY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Faster charging compared to lithium-ion batteries while using the same EV charging mode is expected to increase the demand for solid-state car batteries

FIGURE 21 EV CHARGING TIME OF LITHIUM-ION BATTERIES

5.2.1.2 Higher capacity in solid-state batteries resulting in increased EV range leading to higher demand

TABLE 2 COMPARISON BETWEEN LITHIUM ION AND SOLID-STATE BATTERIES

5.2.1.3 Lower chance of overheating as compared to lithium-ion batteries makes solid-state batteries safer

TABLE 3 ADVANTAGES OFFERED BY SOLID-STATE BATTERIES OVER LITHIUM-ION BATTERIES IN EVS

5.2.2 RESTRAINTS

5.2.2.1 Higher cost compared to conventional EV batteries

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for EVs expected to drive the demand for solid-state batteries

FIGURE 22 GLOBAL SALES OF BATTERY ELECTRIC VEHICLES, 2017-2020 (THOUSAND UNITS)

5.2.3.2 Government initiatives pertaining to EVs expected to increase the demand for solid-state batteries

FIGURE 23 EUROPEAN GOVERNMENT SUBSIDY SCHEMES FOR EVS

5.2.3.3 Increase in R&D investments expected to lead to an increase in demand for solid-state batteries

5.2.4 CHALLENGES

5.2.4.1 Technological barriers in the development of solid-state batteries

TABLE 4 CRITICAL GAPS IN THE DEVELOPMENT OF SOLID-STATE BATTERIES FOR USE IN AUTOMOTIVE

5.2.4.2 Hard ceramics used for the development of solid-state batteries are brittle and have problems with mechanical stress

TABLE 5 MARKET: IMPACT OF MARKET DYNAMICS

5.3 PORTER’S FIVE FORCES

FIGURE 24 PORTER’S FIVE FORCES: MARKET

TABLE 6 GLOBAL MARKET: IMPACT OF PORTER’S 5 FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 RIVALRY AMONG EXISTING COMPETITORS

5.4 SOLID-STATE CAR BATTERY MARKET ECOSYSTEM

FIGURE 25 GLOBAL MARKET: ECOSYSTEM ANALYSIS

5.4.1 EV CHARGING PROVIDERS

5.4.2 TIER 1 SUPPLIERS (EV BATTERY SUPPLIERS)

5.4.3 OEMS

5.4.4 END USERS

TABLE 7 MARKET: ROLE OF COMPANIES IN THE ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS OF GLOBAL MARKET

5.6 PATENT ANALYSIS

TABLE 8 IMPORTANT PATENT REGISTRATIONS RELATED TO THE GLOBAL MARKET

5.7 CASE STUDY

5.7.1 A PERFORMANCE AND COST OVERVIEW OF SELECTED SOLID-STATE ELECTROLYTES: RACE BETWEEN POLYMER ELECTROLYTES AND INORGANIC SULFIDE ELECTROLYTES

5.8 REGULATORY OVERVIEW

5.8.1 NETHERLANDS

TABLE 9 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

TABLE 10 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.8.2 GERMANY

TABLE 11 GERMANY: ELECTRIC VEHICLE INCENTIVES

TABLE 12 GERMANY: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.8.3 FRANCE

TABLE 13 FRANCE: ELECTRIC VEHICLE INCENTIVES

TABLE 14 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.8.4 UK

TABLE 15 UK: ELECTRIC VEHICLE INCENTIVES

TABLE 16 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.8.5 CHINA

TABLE 17 CHINA: ELECTRIC VEHICLE INCENTIVES

TABLE 18 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.8.6 US

TABLE 19 US: ELECTRIC VEHICLE INCENTIVES

TABLE 20 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

5.9 MARKET, SCENARIOS (2025–2030)

5.9.1 GLOBAL MARKET, MOST LIKELY SCENARIO

FIGURE 27 GLOBAL MARKET – FUTURE TRENDS & SCENARIO, 2025–2030 (THOUSAND UNITS)

5.9.2 GLOBAL MARKET, OPTIMISTIC SCENARIO

TABLE 21 GLOBAL MARKET (OPTIMISTIC), BY REGION, 2025–2030 (THOUSAND UNITS)

5.9.3 GLOBAL MARKET, PESSIMISTIC SCENARIO

TABLE 22 GLOBAL MARKET (PESSIMISTIC), BY REGION, 2025–2030 (THOUSAND UNITS)

6 SOLID-STATE CAR BATTERY MARKET, BY COMPONENT (Page No. - 67)

6.1 INTRODUCTION

TABLE 23 MARKET: CURRENT DEVELOPMENT SCENARIO

6.2 CATHODE

6.2.1 OXIDE CATHODE

6.2.2 PHOSPHATE CATHODE

6.3 ELECTROLYTE

6.3.1 POLYMER ELECTROLYTE

6.3.2 CERAMIC ELECTROLYTE

FIGURE 28 COMPARISON OF ELECTROLYTES FOR SSBS

6.4 ANODE

6.4.1 CARBON-BASED ANODE

6.4.2 LITHIUM METAL-BASED ANODE

6.5 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE SOLID-STATE BATTERY MARKET, BY VEHICLE TYPE (Page No. - 71)

7.1 INTRODUCTION

TABLE 24 AUTOMOTIVE SOLID-STATE BATTERY MARKET, BY VEHICLE TYPE, 2023–2030 (UNITS)

FIGURE 29 THE PASSENGER CARS SEGMENT IS EXPECTED TO LEAD THE MARKET FROM 2025–2030

7.2 OPERATIONAL DATA

7.2.1 ASSUMPTIONS

TABLE 25 ASSUMPTIONS: BY VEHICLE TYPE

7.3 RESEARCH METHODOLOGY

7.4 PASSENGER CARS

7.4.1 GROWING EMISSION NORMS WILL BOOST THE DEMAND FOR PASSENGER CARS

TABLE 26 AUTOMOTIVE SOLID-STATE BATTERY MARKET IN PASSENGER CARS, BY REGION, 2023–2030 (UNITS)

7.5 COMMERCIAL VEHICLES

7.5.1 GROWTH OF E-COMMERCE AND LOGISTICS WILL BOOST THIS SEGMENT

TABLE 27 MARKET FOR AUTOMOTIVE SOLID-STATE CAR BATTERY IN COMMERCIAL VEHICLES, BY REGION, 2023–2030 (UNITS)

7.6 KEY PRIMARY INSIGHTS

8 SOLID-STATE CAR BATTERY MARKET, BY PROPULSION (Page No. - 76)

8.1 INTRODUCTION

TABLE 28 MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

FIGURE 30 BEV SEGMENT IS EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD (2025-2030)

8.2 OPERATIONAL DATA

8.2.1 ASSUMPTIONS

TABLE 29 ASSUMPTIONS: BY PROPULSION TYPE

8.3 RESEARCH METHODOLOGY

8.4 BATTERY ELECTRIC VEHICLE (BEV)

8.4.1 INCREASE IN VEHICLE RANGE PER CHARGE WILL INCREASE THE DEMAND FOR SOLID-STATE CAR BATTERIES IN ELECTRIC VEHICLES

TABLE 30 BEV: GLOBAL MARKET, BY REGION, 2023–2030 (UNITS)

8.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

8.5.1 GOVERNMENTS PROVIDING TAX BENEFITS AND INCENTIVES WILL BOOST THIS SEGMENT

TABLE 31 PHEV: GLOBAL MARKET, BY REGION, 2023–2030 (UNITS)

8.6 KEY PRIMARY INSIGHTS

9 SOLID-STATE CAR BATTERY MARKET, BY BATTERY ENERGY DENSITY (Page No. - 81)

9.1 INTRODUCTION

TABLE 32 MARKET, BY BATTERY DENSITY, 2023–2030 (UNITS)

FIGURE 31 <450 WH/KG SEGMENT IS EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD (2025-2030)

9.2 OPERATIONAL DATA

9.2.1 ASSUMPTIONS

TABLE 33 ASSUMPTIONS: BY ENERGY DENSITY

9.3 RESEARCH METHODOLOGY

9.4 <450 WH/KG

9.4.1 USE OF SOLID-STATE BATTERIES WITH ENERGY DENSITY <450 WH/KG IN LOWER-END ELECTRIC VEHICLES WILL BOOST THIS SEGMENT

TABLE 34 <450 WH/KG: GLOBAL MARKET, BY REGION, 2023–2030 (UNITS)

9.5 >450 WH/KG

9.5.1 DEMAND FOR HIGH-END VEHICLES WILL BOOST THIS SEGMENT

TABLE 35 >450 WH/KG: SOLID-STATE BATTERY MARKET, BY REGION, 2023–2030 (UNITS)

9.6 KEY PRIMARY INSIGHTS

10 SOLID-STATE CAR BATTERY MARKET, BY REGION (Page No. - 86)

10.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC IS ESTIMATED TO BE THE LARGEST MARKET FOR SOLID-STATE CAR BATTERIES DURING THE FORECAST PERIOD (2025–2030)

TABLE 36 MARKET, BY REGION, 2023–2030 (UNITS)

10.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT, 2025-2030

TABLE 37 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (UNITS)

10.2.1 CHINA

10.2.1.1 Increased investment in charging infrastructure will uplift the market

TABLE 38 CHINA: CURRENT AND UPCOMING PROJECTS FOR SOLID-STATE BATTERIES

TABLE 39 CHINA: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.2.2 INDIA

10.2.2.1 Government initiatives to boost the demand

TABLE 40 INDIA: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.2.3 JAPAN

10.2.3.1 Advancement in battery technology will boost the demand

FIGURE 34 JAPAN: PATENT APPLICATIONS FOR SSB BY TOYOTA AND OTHER KEY PLAYERS, 2014–2019

TABLE 41 JAPAN: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.2.4 SOUTH KOREA

10.2.4.1 Increased investment in electric vehicles will boost the demand

TABLE 42 SOUTH KOREA: TOP BATTERY SUPPLIERS AND CONSUMER OEMS

TABLE 43 SOUTH KOREA: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.3 EUROPE

FIGURE 35 EUROPE: GERMANY TO BE THE LEADING SOLID-STATE CAR BATTERY MARKET

TABLE 44 EUROPE: MARKET, BY COUNTRY, 2023–2030 (UNITS)

10.3.1 FRANCE

10.3.1.1 Government offering purchase grants will boost the demand

TABLE 45 FRANCE: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.3.2 GERMANY

10.3.2.1 Rise in sales of hybrid vehicles by domestic players will boost the demand

TABLE 46 GERMANY: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.3.3 NETHERLANDS

10.3.3.1 Government focus on greener vehicles will boost the demand

TABLE 47 NETHERLANDS: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.3.4 NORWAY

10.3.4.1 Emergence of e-mobility will boost the demand

TABLE 48 NORWAY: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.3.5 UK

10.3.5.1 Country’s investment toward ultra-low emission vehicles will boost the demand

TABLE 49 UK: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.3.6 SPAIN

10.3.6.1 Increasing investments in EVs will uplift the market

TABLE 50 SPAIN: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.4 NORTH AMERICA

FIGURE 36 NORTH AMERICA: SOLID-STATE CAR BATTERY MARKET SNAPSHOT (2025-2030)

TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

10.4.1 CANADA

10.4.1.1 Development in electric vehicles infrastructure boosting the demand

TABLE 52 CANADA: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.4.2 US

10.4.2.1 Increasing production capacity of electric vehicles will uplift the market

TABLE 53 US: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.5 MIDDLE EAST & AFRICA

FIGURE 37 THE UAE TO BE THE LARGEST MARKET IN THE MEA REGION

TABLE 54 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

10.5.1 UAE

10.5.1.1 Government support will increase the demand for EVs in the market

TABLE 55 UAE: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.5.2 EGYPT

10.5.2.1 Increase in development in electric vehicles’ infrastructure boosting the demand

TABLE 56 EGYPT: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

10.5.3 SOUTH AFRICA

10.5.3.1 Increasing EV imports and popularization of EV charging stations to fuel the EV market growth

TABLE 57 SOUTH AFRICA: MARKET, BY PROPULSION TYPE, 2023–2030 (UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 109)

11.1 OVERVIEW

11.2 MARKET RANKING ANALYSIS FOR SOLID-STATE CAR BATTERIES

FIGURE 38 SOLID-STATE CAR BATTERY MARKET RANKING ANALYSIS, 2021

11.3 COMPETITIVE SCENARIO

11.3.1 DEALS

TABLE 58 DEALS, 2018–2021

11.3.2 NEW PRODUCT DEVELOPMENTS

TABLE 59 NEW PRODUCT DEVELOPMENTS, 2018–2021

11.4 COMPETITIVE LEADERSHIP MAPPING FOR THE SOLID-STATE CAR BATTERY MARKET

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 EMERGING COMPANIES

FIGURE 39 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR TOP MARKET MANUFACTURERS, 2021

TABLE 60 GLOBAL SOLID-STATE CAR BATTERY MARKET: COMPANY FOOTPRINT FOR TOP SOLID-STATE CAR BATTERY COMPANIES, 2021

TABLE 61 GLOBAL MARKET: COMPANY APPLICATION FOOTPRINT FOR TOP SOLID-STATE CAR BATTERY COMPANIES, 2021

TABLE 62 GLOBAL MARKET: REGIONAL FOOTPRINT FOR TOP SOLID-STATE CAR BATTERY COMPANIES, 2021

FIGURE 40 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR NEW PLAYERS, 2021

11.5 RIGHT TO WIN, 2018-2021

TABLE 63 RIGHT TO WIN, 2018-2021

12 COMPANY PROFILES (Page No. - 121)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 KEY PLAYERS

12.1.1 TOYOTA MOTOR CORPORATION

TABLE 64 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

FIGURE 41 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 42 TOYOTA MOTOR CORPORATION: SOLID-STATE CAR BATTERY PATENT COUNT

TABLE 65 TOYOTA MOTOR CORPORATION: PRODUCTS OFFERED

TABLE 66 TOYOTA MOTOR COMPANY: NEW PRODUCT DEVELOPMENTS

TABLE 67 TOYOTA MOTOR CORPORATION: DEALS

12.1.2 SOLID POWER

TABLE 68 SOLID POWER: BUSINESS OVERVIEW

TABLE 69 SOLID POWER: PRODUCTS OFFERED

TABLE 70 SOLID POWER: NEW PRODUCT DEVELOPMENTS

TABLE 71 SOLID POWER: DEALS

12.1.3 QUANTUMSCAPE

TABLE 72 QUANTUMSCAPE: BUSINESS OVERVIEW

TABLE 73 QUANTUMSCAPE: PRODUCTS OFFERED

TABLE 74 QUANTUMSCAPE: NEW PRODUCT DEVELOPMENTS

TABLE 75 QUANTUMSCAPE: DEALS

12.1.4 SAMSUNG SDI

TABLE 76 SAMSUNG SDI: BUSINESS OVERVIEW

FIGURE 43 SAMSUNG SDI: COMPANY SNAPSHOT

FIGURE 44 SAMSUNG SDI: SOLID-STATE CAR BATTERY PATENT COUNT

TABLE 77 SAMSUNG SDI: PRODUCTS OFFERED

TABLE 78 SAMSUNG SDI: NEW PRODUCT DEVELOPMENTS

TABLE 79 SAMSUNG SDI: DEALS

12.1.5 LG CHEM

TABLE 80 LG CHEM: BUSINESS OVERVIEW

FIGURE 45 LG CHEM: COMPANY SNAPSHOT

FIGURE 46 LG CHEM: SOLID-STATE CAR BATTERY PATENT COUNT

TABLE 81 LG CHEM: PRODUCTS OFFERED

TABLE 82 LG CHEM: NEW PRODUCT DEVELOPMENTS

12.1.6 ILIKA

TABLE 83 ILIKA: BUSINESS OVERVIEW

FIGURE 47 ILIKA: COMPANY SNAPSHOT

FIGURE 48 ILIKA: SOLID-STATE CAR BATTERY PATENT COUNT

TABLE 84 ILIKA: PRODUCTS OFFERED

TABLE 85 ILIKA: NEW PRODUCT DEVELOPMENTS

TABLE 86 ILIKA: DEALS

12.1.7 BRIGHTVOLT

TABLE 87 BRIGHTVOLT: BUSINESS OVERVIEW

TABLE 88 BRIGHTVOLT: PRODUCTS OFFERED

12.1.8 PANASONIC

TABLE 89 PANASONIC: BUSINESS OVERVIEW

FIGURE 49 PANASONIC: COMPANY SNAPSHOT

FIGURE 50 PANASONIC: SOLID-STATE CAR BATTERY PATENT COUNT

TABLE 90 PANASONIC: PRODUCTS OFFERED

TABLE 91 PANASONIC: NEW PRODUCT DEVELOPMENTS

TABLE 92 PANASONIC: DEALS

12.1.9 CATL

TABLE 93 CATL: BUSINESS OVERVIEW

FIGURE 51 CATL: COMPANY SNAPSHOT

TABLE 94 CATL: PRODUCTS OFFERED

TABLE 95 CATL: NEW PRODUCT DEVELOPMENTS

TABLE 96 CATL: DEALS

12.1.10 IONIQ MATERIALS

TABLE 97 IONIQ MATERIALS: BUSINESS OVERVIEW

TABLE 98 IONIQ MATERIALS: PRODUCTS OFFERED

TABLE 99 IONIQ MATERIALS: DEALS

12.1.11 NORTHVOLT

TABLE 100 NORTHVOLT: BUSINESS OVERVIEW

TABLE 101 NORTHVOLT: PRODUCTS OFFERED

TABLE 102 NORTHVOLT: NEW PRODUCT DEVELOPMENTS

TABLE 103 NORTHVOLT: DEALS

12.1.12 CYMBET

TABLE 104 CYMBET: BUSINESS OVERVIEW

TABLE 105 CYMBET: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 GENERAL MOTORS

TABLE 106 GENERAL MOTORS: BUSINESS OVERVIEW

12.2.2 RENAULT GROUP

TABLE 107 RENAULT GROUP: BUSINESS OVERVIEW

12.2.3 STELLANTIS N.V.

TABLE 108 STELLANTIS N.V.: BUSINESS OVERVIEW

12.2.4 KIA MOTORS

TABLE 109 KIA MOTORS: BUSINESS OVERVIEW

12.2.5 MITSUBISHI MOTORS

TABLE 110 MITSUBISHI MOTORS: BUSINESS OVERVIEW

12.2.6 VOLKSWAGEN AG

TABLE 111 VOLKSWAGEN AG: BUSINESS OVERVIEW

12.2.7 FORD MOTOR COMPANY

TABLE 112 FORD MOTOR COMPANY: BUSINESS OVERVIEW

12.2.8 BYD

TABLE 113 BYD: BUSINESS OVERVIEW

12.2.9 HYUNDAI GROUP

TABLE 114 HYUNDAI GROUP: BUSINESS OVERVIEW

12.2.10 SK INNOVATION

TABLE 115 SK INNOVATION: BUSINESS OVERVIEW

12.2.11 DYSON

TABLE 116 DYSON: BUSINESS OVERVIEW

12.2.12 PRIETO BATTERY

TABLE 117 PRIETO BATTERY: BUSINESS OVERVIEW

12.2.13 STOREDOT

TABLE 118 STOREDOT: BUSINESS OVERVIEW

13 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 154)

13.1 CHINA, JAPAN, SOUTH KOREA, GERMANY, FRANCE, THE UK, AND THE US ARE KEY FOCUS AREAS FOR THE SOLID-STATE CAR BATTERY MARKET

13.2 TECHNOLOGICAL ADVANCEMENTS TO HELP DEVELOP A MARKET FOR THE PASSENGER CAR SEGMENT

13.3 CONCLUSION

14 APPENDIX (Page No. - 155)

14.1 KEY INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

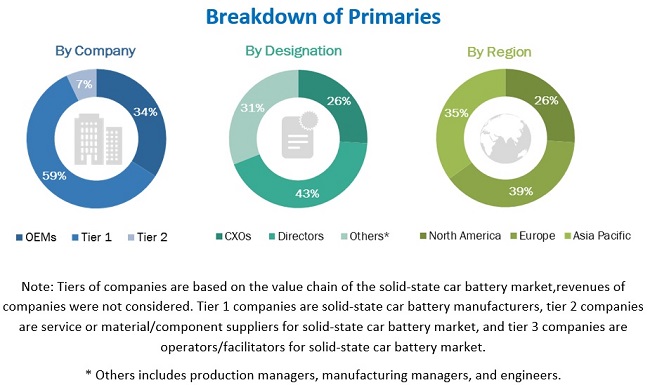

The study involved 4 major activities in estimating the current size of the solid-state car battery market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automobile OEMs, Publications of EV batteries, Solid-state battery associations, American Automobile Association (AAA), country-level automotive associations and European Alternative Fuels Observatory (EAFO)], automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global solid-state car battery market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, and trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (battery manufacturers, and raw material suppliers) side across four major regions, namely, North America, Europe, Asia Pacific, and the Middle East & Africa. 21% of the experts involved in primary interviews were from the demand side, and 79% were from the supply side of the industry. Primary data was collected through questionnaires, emails, and telephonic interviews. Several primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the solid-state car battery market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global market, in terms of volume (units)

- To define, describe, and forecast the market based on vehicle type, propulsion, Components, Battery Energy Density, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the global market, by vehicle type (passenger cars and commercial vehicles)

- To segment and forecast the market, by propulsion (BEV, PHEV)

- To segment the global market providing qualitative data on the basis of component (Cathode, Anode, Electrolyte)

- To segment and forecast the market, by Battery energy density (<450 Wh/kg, >450 Wh/kg)

- To forecast the global market with respect to the key regions, namely, North America, Europe, Asia Pacific, and Middle East & Africa.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Solid-state Car Battery Market, By Battery Density Type At Country Level

- Solid-state Car Battery Market, By Vehicle Type At Country Level

- Company Information

- Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solid-State Car Battery Market