Sorbitol Market by Product Type (Liquid/Syrup Sorbitol, and Crystal/Powder Sorbitol), Application (Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, Chemicals), and Region - Global Forecast to 2021

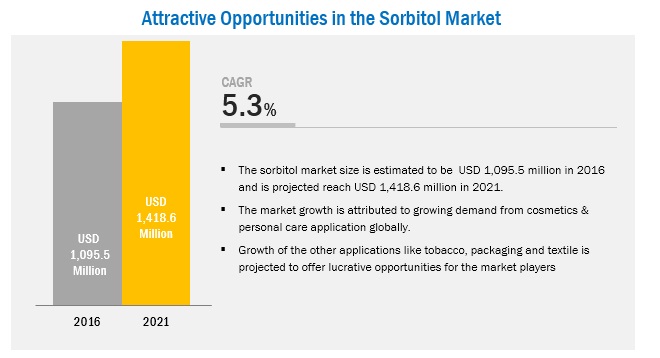

The sorbitol market is projected to reach USD 1,418.6 million by 2021, at a CAGR of 5.3%. The base year considered for the study is 2015 while the forecast period is from 2016 to 2021. Sorbitol is mainly derived from corn, seaweed, fruits, and berries. It is manufactured by the catalytic hydrogenation of sucrose. Sorbitol is primarily used as a sweetener, humectant, flavoring agent, and diuretic dehydrating agent for various applications such as food & beverage, pharmaceuticals, and cosmetics & personal care. Sorbitol is a sugar substitute with low-calorie, which is used in many products such as candy, gum, ice cream, baked goods, cosmetics, toothpaste, personal care, and pharmaceuticals.

Sorbitol Market Dynamics

Drivers

- Rising consumer preference for low-calorie food

- Increasing health problems due to consumption of sugar-based products

- Growing organic personal care market is expected to fuel the demand of sorbitol in cosmetics & personal care products

Restraints

- Adherence to international quality standards and regulations

Opportunities

- Growing demand from food & beverage industry in emerging markets

- Fluctuations in price and supply of sugar is creating opportunities for sorbitol

Challenges

- Ambiguity related to the side effects of sorbitol

Rising consumer preference for low-calorie food

Consumers in developed countries are habituated to sedentary lifestyles and are aware of the problems associated with it. Hence, in the recent past, the demand for low-caloric food and sweeteners has been on the rise. As people need to reduce their calorie intake, they prefer low-calorie foods, which play a major role in helping them maintain a healthy diet that supports their lifestyles. Most health-conscious consumers prefer sorbitol as a sugar substitute because it contains fewer calories than regular sugar. Consumption of sorbitol is an easy way to reduce the calorie intake and stay healthy; fueling the demand for sorbitol in various applications, globally.

Objectives of the Sorbitol Market Study:

- To define, describe, and forecast the sorbitol market on the basis of function, product type, application and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the membrane separation technology market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

The top-down and bottom-up both approaches have been used to estimate and validate the size of the global membrane separation technology market and to estimate the size of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the membrane separation technology market.

To know about the assumptions considered for the study, download the pdf brochure

The sorbitol value chain majorly includes raw material suppliers such as farmers, and harvesters who grow corn, wheat, and cassava. Sorbitol manufacturers such Roquette Freres (France), Cargill Inc. (U.S.), Tereos Starch & Sweeteners (France), Archer Daniel Midland (U.S.), and Ingredion Inc. (U.S.), and sorbitol based applications, namely, food & beverages, pharmaceuticals, cosmetics & personal care, chemical and bio fuel among others.

Major Sorbitol Market Developments

- In December 2016, Archer Daniels Midland (US) announced its capacity expansion of starches and sweeteners at its corn mill facilities in Razgrad (Bulgaria) and Adana (Turkey). This expansion is in response to seeking an opportunity in the Middle East and European markets by expanding the range of products to meet increasing demand.

- In December 2016, Cargill Inc. (US) expanded its presence in Shanghai (China) by introducing an innovation center in China named Cargill ONE for the production of animal protein, sweeteners, cocoa, edible oils, and starches. This expansion is focused on offering new flavors and innovative food products in China.

- In November 2016, Ingredion Incorporated (US) acquired Shandong Huanong Specialty Corn Development Co., Ltd. (China). This acquisition aims at increasing production of specialty ingredients that includes starch and sweeteners products. This acquisition adds to the company’s second manufacturing facility operations in China.

- In June 2016, Archer Daniels Midland (US) acquired Casablanca (Morocco), a corn wet mill that produces native starch and glucose for applications in various industries. This acquisition aims at strengthening the company’s global position in the starch and sweetener market and meeting the global sorbitol demand in the near future.

Key Target Audience in Sorbitol Market

- Sorbitol manufacturers

- Sorbitol traders, distributors, and suppliers

- Raw material suppliers

- Government and research organizations

- FDA and other regulatory bodies

- Industry associations

- Applications

“This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments”.

Sorbitol Market Report Scope

This research report categorizes the global market of sorbitol on the basis of product type, application, and region. It provides a forecast of the market size, in terms of value and volume, and an analysis of trends in each of the submarkets.

Based on product type:

- Liquid/Syrup Sorbitol

- Crystal/Powder Sorbitol

Based on application:

-

Cosmetics & Personal Care

- Oral Care

- Skin Care

- Hair Care

- Cosmetics

- Shaving Cream

- Soaps & Detergent

- Food & Beverage

-

Food

- Confectionery Products

- Bakery products

- Frozen deserts

- Diabetic & Dietetic food

-

Beverages

- Diet Soda

- Fruit juices and Syrups

-

Pharmaceuticals

- Counter Medicine

- Syrups

- Tablets

- Creams and emulsions

- Medicated confectionery

-

Chemical

- Sorbitian Ester

- Ascorbic Acid

- Polyether

-

Other Industries

- Tobacco

- Paper Production

- Bio Fuel

- Surimi and Fish Products

- Plastic

- Packaging

- Dairy products

Based on region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Critical questions which the report answers

- What are the upcoming trends for membrane separation technologies in developing nations?

- Which are the key players in the market and how intense is the competition?

Sorbitol Market Report Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Sorbitol Market Company information

- Detailed analysis and profiles of additional market players.

Sorbitol Market Regional information

- Market analysis for additional countries.

The global sorbitol market is estimated to reach USD 1,418.6 million by 2021 at a CAGR of 5.3% from 2016 to 2021. The sorbitol market has witnessed significant growth in the recent years. Sorbitol, due to their functionalities, functionalities such as sweetening agent, non-cariogenic, cooling effect, free flowing powder, good blend homogeneity, coating agent, sugar free, low-calorie, filler/diluent, good compressibility, and granulating agent are used in a wide range of applications, including as cosmetic & personal care, pharmaceuticals, and others.

The main types of sorbitol are liquid/syrup sorbitol and crystal/powder sorbitol. Liquid/syrup sorbitol type is estimated to lead the sorbitol market in 2016, due to the suitability of liquid/syrup in several applications. Not only highest, but also it is estimated to witness the fastest growth during the forecast period, due to its increasing adoption in various day-to-day consumer applications as a low calorie sugar substitute. The demand for liquid sorbitol is very high in all regions due to its ease of use and low manufacturing cost. On the other hand, powder sorbitol has limited applications in the food and pharmaceuticals industries. However, factors such as adherence to international quality standards and regulations may hinder the growth of the market.

Sorbitol is used in applications, including cosmetics & personal care, food & beverage, pharmaceuticals, chemicals, and others. These are the main applications considered in the report. t. The cosmetics & personal care segment led the global sorbitol market, accounting for a share of 39.5%, in terms of volume, in 2015. This dominance is owing to the increasing demand for sorbitol in oral care products such as toothpaste, mouthwash, mouth freshener, and chewing gum.

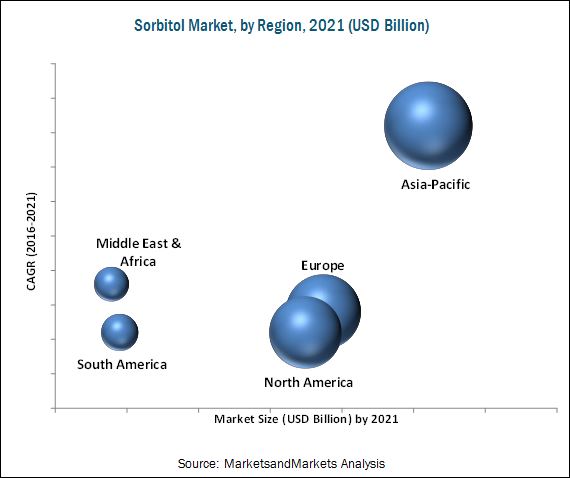

North America, Europe, Asia-Pacific, Middle East & Africa, and South America are considered the key market for sorbitol in the report. Asia-Pacific is estimated to dominate the sorbitol market, owing to the rising demand for sorbitol, driven by its increased use in the cosmetic & personal care and food & beverages industries. Europe is the second-largest consumer of sorbitol, globally. Also, the increase in purchasing power parity of consumers also propels the demand for sorbitol-based products, such as confections, bakery, dairy, and other food products such as cereals and desserts

Sorbitol is suitable for use in various applications such as cosmetics & personal care, food & beverage, pharmaceuticals, and chemical industries.

Cosmetics & Personal care

In cosmetics, sorbitol is used as skin conditioning agent and humectant in mild soaps, aftershave lotions, and baby shampoos. In personal care products, it is widely used as a sweetening agent and provides cooling effect in toothpaste, chewing gums, and mouth fresheners.

Food & Beverage

Sorbitol is an essential ingredient in the food & beverage industry. It is used as a humectant and sweetener in the food & beverage industry to increase sweetness, shelf life, and freshness of food and beverage products. Sorbitol contains 2.6 calories per gram, due to which it is used as a low-calorie sweetener. It is consumed majorly in diabetic food. Also, owing to sorbitol’s moisture-stabilizing property, it preserves commercial food products from getting hardened or dry and sustains their freshness throughout storage. Its dosage in food & beverage applications is controlled as per the FDA and other regulatory bodies.

Pharmaceutical

Sorbitol is used as a key bodying agent in many pharmaceuticals applications such as syrups, tablets, and elixirs. It is used in syrups for reducing bottle caps stickiness to bottle due to the presence of sugar. It acts as good plasticizer and humectant which makes it applicable in non-fat soluble ointments, emulsion ointments, and gelatin capsules. The excellent spreading capacity makes it applicable in creams, ointments, and pastes.

Critical questions the Sorbitol Market Report Answers:

- What are the upcoming hot bets for membrane separation technology market?

- How market dynamics is changing for different types of technology in different applications?

Key Sorbitol Market Industry Players

Roquette Frères (France), Cargill Inc. (US), Ingredion Incorporated (US), Tereos Starch & Sweeteners (France), and Archer Daniels Midland (US) are the key companies operational in the sorbitol market. Entering into related industries and targeting new markets will enable the sorbitol manufacturers to overcome the effects of volatile economy, leading to diversified business portfolio and increase in revenue. Other major manufacturers of sorbitol are SPI Pharma Inc. (US), Ecogreen Oleochemicals Pte. Ltd. (Singapore), Merck Group. (Germany), Sukhjit Starch & Chemicals Ltd. (India), and Gulshan Polyols Ltd. (India).

Frequently Asked Questions (FAQ):

What is the Sorbitol Market growth?

Growth of Sorbitol Market - At a CAGR of 5.3% from 2016 to 2021.

Who leading market players in Sorbitol industry?

The major players operating in the sorbitol market are Roquette Frères Corporation (France), Cargill Inc. (U.S.), Ingredion Incorporated (U.S.), Tereos Starch & Sweeteners (France), Archer Daniels Midland (U.S.), SPI Pharma Inc. (U.S.), Ecogreen Oleochemicals Pte. Ltd. (Singapore), Merck Millipore Corp. (U.S.), Sukhjit Starch & Chemicals Ltd. (India), and Gulshan Polyols Ltd. (India).

How big is the Sorbitol Market?

The sorbitol market is projected to reach USD 1.42 Billion by 2021.

Which segments are covered in Sorbitol Market report?

By Product Type (Liquid/Syrup Sorbitol, Crystal/Powder Sorbitol) & Application (Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, Chemicals).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

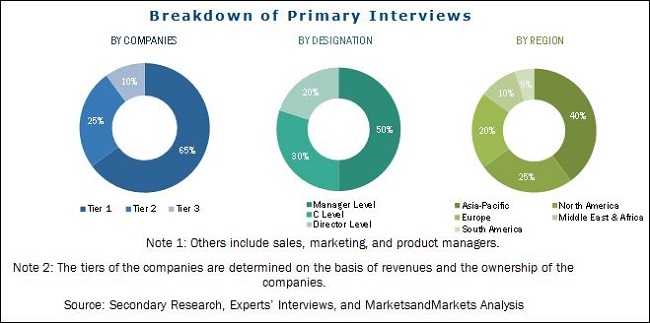

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Sorbitol Market

4.2 Market Growth, By Application

4.3 Sorbitol Market, By Product Type

4.4 Market, By Region

4.5 Sorbitol Market in Asia-Pacific, By Country and Application

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Function

5.2.2 By Product Type

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Consumer Preference for Low-Calorie Food

5.3.1.2 Increasing Health Problems Due to Consumption of Sugar-Based Products

5.3.1.3 Growing Organic Personal Care Market is Expected to Fuel the Demand of Sorbitol in Cosmetics & Personal Care Products

5.3.2 Restraints

5.3.2.1 Adherence to International Quality Standards and Regulations

5.3.3 Opportunities

5.3.3.1 Growing Demand From Food & Beverage Industry in Emerging Markets

5.3.3.2 Fluctuations in Price and Supply of Sugar is Creating Opportunities for Sorbitol

5.3.4 Challenges

5.3.4.1 Ambiguity Related to the Side Effects of Sorbitol

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Material Suppliers

6.2.2 Manufacturers

6.2.3 Quality & Safety Controllers

6.2.4 Packaging

6.2.5 End-Use Industry

6.3 Industry Insights

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of Substitutes

6.4.4 Threat of New Entrants

6.4.5 Intensity of Competitive Rivalry

7 Sorbitol Market, By Function (Page No. - 53)

7.1 Introduction

7.2 Sweetener

7.3 Bulking Agent

7.4 Flavoring Agent

7.5 Humectant

7.6 Others

8 Sorbitol Market, By Product Type (Page No. - 55)

8.1 Introduction

8.2 Liquid/Syrup Sorbitol

8.3 Powder/Crystal Sorbitol

9 Sorbitol Market, By Application (Page No. - 58)

9.1 Introduction

9.2 Direct Application

9.2.1 Cosmetics & Personal Care

9.2.1.1 Oral Care

9.2.1.1.1 Toothpastes

9.2.1.1.2 Chewing Gums

9.2.1.1.3 Mouth Fresheners

9.2.1.2 Skin Care

9.2.1.3 Hair Care

9.2.1.4 Cosmetics

9.2.1.5 Shaving Creams

9.2.1.6 Soaps & Detergents

9.2.2 Food & Beverage

9.2.2.1 Food

9.2.2.1.1 Confectionery Products

9.2.2.1.1.1 Jams & Preserves

9.2.2.1.1.2 Chocolates

9.2.2.1.1.3 Processed Food

9.2.2.1.2 Bakery Products

9.2.2.1.2.1 Breads

9.2.2.1.2.2 Cakes

9.2.2.1.2.3 Biscuits & Cookies

9.2.2.1.3 Frozen Desserts

9.2.2.1.4 Diabetic & Dietetic Food

9.2.2.2 Beverages

9.2.2.2.1 Diet Soda

9.2.2.2.2 Fruit Juices & Syrups

9.2.3 Pharmaceuticals

9.2.3.1 Counter Medicine

9.2.3.1.1 Syrups

9.2.3.1.2 Tablets

9.2.3.1.2.1 Direct Compression

9.2.3.1.2.2 Wet and Dry Granulation

9.2.3.1.2.3 Capsules and Sachets

9.2.3.2 Creams and Emulsions

9.2.3.2.1 Transdermal & Topical Gels

9.2.3.3 Medicated Confectionery

9.2.3.3.1 Hard Boiled Candies/Lozenges

9.2.3.3.2 Medicated Chewing Gums

9.2.4 Others

9.2.4.1 Tobacco

9.2.4.2 Paper Production

9.2.4.3 Biofuel

9.2.4.4 Surimi and Fish Products

9.2.4.5 Dairy Products

9.2.4.6 Shredded Coconut

9.2.4.7 Plastic

9.2.4.8 Packaging

9.3 Indirect Application

9.3.1 Chemicals

9.3.1.1 Surfactants

9.3.1.2 Ascorbic Acid (Vitamin C)

9.3.1.3 Polyether

10 Sorbitol Market, By Region (Page No. - 67)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 South Korea

10.2.4 Japan

10.2.5 Rest of Asia-Pacific

10.3 North America

10.3.1 U.S.

10.3.2 Canada

10.3.3 Mexico

10.4 Europe

10.4.1 Germany

10.4.2 France

10.4.3 U.K.

10.4.4 Italy

10.4.5 Russia

10.4.6 Rest of Europe

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 Iran

10.5.3 Nigeria

10.5.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 Market Ranking Analysis

11.2.1 Roquette Freres

11.2.2 Cargill Incorporated

11.2.3 Archer Daniels Midland

11.2.4 Ingredion Incorporated

11.2.5 Tereos Starch & Sweeteners

11.3 Competitive Situation and Trends

11.3.1 Expansion

11.3.2 Merger & Acquisition

11.3.3 Partnership & Joint Venture

11.3.4 New Product Launch

12 Company Profiles (Page No. - 114)

12.1 Roquette Frères

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Cargill Incorporation

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Archer Daniels Midland (ADM)

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Ingredion Incorporated

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 Tereos Starch & Sweeteners

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Ecogreen Oleochemicals Pte. Ltd.

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.7 Gulshan Polyols Ltd.

12.7.1 Business Overview

12.7.2 Products Offered

12.8 Merck Group

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.8.4 MnM View

12.9 SPI Pharma, Inc.

12.9.1 Business Overview

12.9.2 Products Offered

12.10 Sukhjit Starch & Chemicals Ltd.

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Recent Developments

12.11 Other Market Players

12.11.1 Danisco A/S

12.11.2 Gujarat Ambuja Exports Ltd.

12.11.3 Qinhuangdao Lihua Starch Co. Ltd.

12.11.4 Kasyap Sweetners Ltd.

12.11.5 Jeecon Foods Pvt. Ltd.

13 Appendix (Page No. - 134)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (92 Tables)

Table 1 Sorbitol Market, By Function

Table 2 Market, By Product Type

Table 3 Sorbitol Market, By Application

Table 4 Market Size, By Product Type, 2014–2021 (Kiloton)

Table 5 Sorbitol Market Size, By Product Type, 2014–2021 (USD Million)

Table 6 Market Size, By Application, 2014–2021 (Kiloton)

Table 7 Sorbitol Market Size, By Application, 2014–2021 (USD Million)

Table 8 Market Size, By Region, 2014–2021 (Kiloton)

Table 9 Sorbitol Market Size, By Region, 2014–2021 (USD Million)

Table 10 Asia-Pacific: Sorbitol Market Size, By Country, 2014–2021 (Kiloton)

Table 11 Asia-Pacific: Market Size, By Country, 2014–2021 (USD Million)

Table 12 Asia-Pacific: Market Size, By Application, 2014–2021 (Kiloton)

Table 13 Asia-Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 14 China: Economic Outlook, 2015

Table 15 China: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 16 China: Market Size, By Application, 2014–2021 (USD Million)

Table 17 India: Economic Outlook, 2015

Table 18 India: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 19 India: Market Size, By Application, 2014–2021 (USD Million)

Table 20 South Korea: Economic Outlook, 2015

Table 21 South Korea: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 22 South Korea: Market Size, By Application, 2014–2021 (USD Million)

Table 23 Japan: Economic Outlook, 2015

Table 24 Japan: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 25 Japan: Market Size, By Application, 2014–2021 (USD Million)

Table 26 Rest of Asia-Pacific: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 27 Rest of Asia-Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 28 North America: Sorbitol Market Size, By Country, 2014–2021 (Kiloton)

Table 29 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 30 North America: Market Size, By Application, 2014–2021 (Kiloton)

Table 31 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 32 U.S.: Economic Outlook, 2015

Table 33 U.S.: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 34 U.S.: Market Size, By Application, 2014–2021 (USD Million)

Table 35 Canada: Economic Outlook, 2015

Table 36 Canada: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 37 Canada: Market Size, By Application, 2014–2021 (USD Million)

Table 38 Mexico: Economic Outlook, 2015

Table 39 Mexico: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 40 Mexico: Market Size, By Application, 2014–2021 (USD Million)

Table 41 Europe: Sorbitol Market Size, By Country, 2014–2021 (Kiloton)

Table 42 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 43 Europe: Market Size, By Application, 2014–2021 (Kiloton)

Table 44 Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 45 Germany: Economic Outlook, 2015

Table 46 Germany: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 47 Germany: Market Size, By Application, 2014–2021 (USD Million)

Table 48 France: Economic Outlook, 2015

Table 49 France: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 50 France: Market Size, By Application, 2014–2021 (USD Million)

Table 51 U.K.: Economic Outlook, 2015

Table 52 U.K.: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 53 U.K.: Market Size, By Application, 2014–2021 (USD Million)

Table 54 Italy: Economic Outlook, 2015

Table 55 Italy: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 56 Italy: Market Size, By Application, 2014–2021 (USD Million)

Table 57 Russia: Economic Outlook, 2015

Table 58 Russia: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 59 Russia: Market Size, By Application, 2014–2021 (USD Million)

Table 60 Rest of Europe: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 61 Rest of Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 62 Middle East & Africa: Sorbitol Market Size, By Country, 2014–2021 (Kiloton)

Table 63 Middle East & Africa: Market Size, By Country, 2014–2021 (USD Million)

Table 64 Middle East & Africa: Market Size, By Application, 2014–2021 (Kiloton)

Table 65 Middle East & Africa: Market Size, By Application, 2014–2021 (USD Million)

Table 66 Saudi Arabia: Economic Outlook, 2015

Table 67 Saudi Arabia: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 68 Saudi Arabia: Market Size, By Application, 2014–2021 (USD Million)

Table 69 Iran: Economic Outlook, 2015

Table 70 Iran: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 71 Iran: Market Size, By Application, 2014–2021 (USD Million)

Table 72 Nigeria: Economic Outlook, 2015

Table 73 Nigeria: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 74 Nigeria: Market Size, By Application, 2014–2021 (USD Million)

Table 75 Rest of Middle East & Africa: Sorbitol Market Size, By Application 2014–2021 (Kiloton)

Table 76 Rest of Middle East & Africa: Market Size, By Application, 2014–2021 (USD Million)

Table 77 South America: Sorbitol Market Size, By Country, 2014–2021 (Kiloton)

Table 78 South America: Market Size, By Country, 2014–2021 (USD Million)

Table 79 South America: Market Size, By Application, 2014–2021 (Kiloton)

Table 80 South America: Market Size, By Application, 2014–2021 (USD Million)

Table 81 Brazil: Economic Outlook, 2015

Table 82 Brazil: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 83 Brazil: Market Size, By Application, 2014–2021 (USD Million)

Table 84 Argentina: Economic Outlook, 2015

Table 85 Argentina: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 86 Argentina: Market Size, By Application, 2014–2021 (USD Million)

Table 87 Rest of South America: Sorbitol Market Size, By Application, 2014–2021 (Kiloton)

Table 88 Rest of South America: Market Size, By Application, 2014–2021 (USD Million)

Table 89 Expansion, 2012–2016

Table 90 Merger & Acquisition, 2012–2016

Table 91 Partnership & Joint Venture, 2012–2016

Table 92 New Product Launch, 2012–2016

List of Figures (41 Figures)

Figure 1 Sorbitol Market: Segmentation

Figure 2 Sorbitol Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Sorbitol Market: Data Triangulation

Figure 6 Assumptions

Figure 7 Cosmetics & Personal Care Segment to Register the Highest CAGR During the Forecast Period

Figure 8 Liquid/Syrup Sorbitol Accounted for the Highest Market Share in 2015

Figure 9 Asia-Pacific Was the Fastest-Growing Sorbitol Market in 2015

Figure 10 Emerging Economies Offer Attractive Opportunities in the Sorbitol Market

Figure 11 Cosmetics & Personal Care to Be the Major Application of Sorbitol

Figure 12 Liquid/Syrup Sorbitol to Be the Fastest-Growing Product Type

Figure 13 Asia-Pacific to Be the Fastest-Growing Market

Figure 14 Asia-Pacific Accounted for the Largest Market Share in 2015

Figure 15 Sorbitol Market, By Region

Figure 16 Impact Analysis of Short-, Medium-, and Long-Term Drivers and Restraints

Figure 17 Rising Consumer Awareness About Low-Calorie and Healthy Food to Drive the Market

Figure 18 Global Diabetes Prevalence in 2015 and 2040

Figure 19 Manufacturers are the Most Important Entity in the Value Chain

Figure 20 Leading Trends Among the Key Players

Figure 21 Porter’s Five Forces Analysis

Figure 22 Liquid/Syrup Sorbitol to Dominate the Market Between 2016 and 2021

Figure 23 Cosmetics & Personal Care Application to Lead the Sorbitol Market

Figure 24 Regional Snapshot: India and China are Emerging as Strategic Destinations

Figure 25 Asia-Pacific Market Snapshot: China to Be the Largest Sorbitol Market

Figure 26 China Leads the Sorbitol Market in Asia-Pacific

Figure 27 North America Market Snapshot: U.S. Accounted for the Largest Market Share

Figure 28 Companies Adopted Expansion and Merger & Acquisition as the Key Growth Strategy Between 2012 and 2016

Figure 29 Roquette Freres Was the Leading Market Player in 2015

Figure 30 Battle for the Market Share: Expansion and Merger & Acquisition Were the Key Strategies

Figure 31 Roquette Frères: SWOT Analysis

Figure 32 Cargill Incorporation: Company Snapshot

Figure 33 Cargill Incorporation: SWOT Analysis

Figure 34 Archer Daniels Midland: Company Snapshot

Figure 35 Archer Daniels Midland: SWOT Analysis

Figure 36 Ingredion Incorporated: Company Snapshot

Figure 37 Ingredion Incorporated: SWOT Analysis

Figure 38 Tereos Starch & Sweeteners: SWOT Analysis

Figure 39 Gulshan Polyols Ltd.: Company Snapshot

Figure 40 Merck Group: Company Snapshot

Figure 41 Sukhjit Starch & Chemicals Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Sorbitol Market

Interested in details of sorbitol powder manufacturers.