Specialty Advanced Ceramics Market by Type(Composite Structure Ceramics, Electrical & Electronic Functional Ceramics), Application (Defence & Security, Electronics & Semiconductor, Optics & Industrial Manufacturing), & Region - Global Forecast 2028

Specialty Advanced Ceramics Market

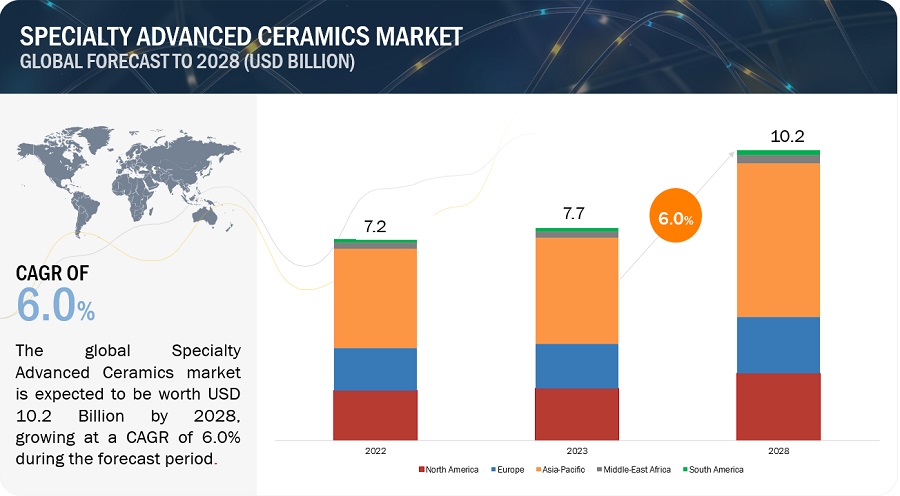

The global specialty advanced ceramics market is valued at USD 7.7 billion in 2023 and is projected to reach USD 10.2 billion by 2028, growing at 6.0% cagr during the forecast period. The specialty advanced ceramics market experiences robust growth driven by a multitude of influential factors. These advanced ceramics, engineered materials with exceptional properties, find applications across a diverse range of high-tech industries.

Attractive Opportunities in the Specialty Advanced Ceramics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Specialty Advanced Ceramics Market Dynamics

Driver: Growing use of advanced ceramics in energy applications

The market for advanced specialty ceramics has grown due to the increasing use of advanced ceramics in energy applications like solar cells, fuel cells, and batteries. Modern ceramics provide great temperature resistance, corrosion resistance, electrical insulation, and high mechanical strengthThe growing use of advanced ceramics in energy applications is poised to be a significant driving factor for the specialty advanced ceramics market. Advanced ceramics are increasingly being employed in energy-related sectors such as renewable energy, nuclear power, and energy storage due to their exceptional thermal, electrical, and corrosion-resistant properties. In renewable energy, ceramics play a crucial role in components like turbine blades and fuel cells, enhancing energy efficiency and sustainability. Moreover, as the world transitions towards cleaner and more efficient energy sources, the demand for advanced ceramics in these applications is expected to surge, underpinning market growth.

Restraint: Complex and fragmented IP landscape

The complex and fragmented intellectual property (IP) landscape presents a significant restraining factor for the specialty advanced ceramics market. Advanced ceramics often involve intricate formulations, unique processes, and innovative applications, leading to a multitude of patents and intellectual property rights. This complexity can result in barriers to entry for new market players, as they may encounter challenges navigating the web of existing patents, leading to potential legal disputes and increased development costs. Furthermore, a fragmented IP landscape can hinder collaborative efforts and knowledge-sharing within the industry, slowing down the pace of innovation and the adoption of advanced ceramics in various applications. This intricate IP environment may limit market growth and innovation potential as companies grapple with the complexities and uncertainties associated with intellectual property rights.

Opportunities: Development of ceramic composites for radar-absorbing materials

The development of ceramic composites for radar-absorbing materials presents significant opportunities for the specialty advanced ceramics market. These innovative composites combine the inherent properties of ceramics, such as high-temperature stability and durability, with radar-absorbing materials, enabling them to absorb and dissipate electromagnetic waves effectively. As the demand for stealth technology and electronic warfare systems grows in defense and aerospace applications, these ceramic composites offer a unique solution to enhance radar-evading capabilities. This niche market segment opens doors for specialty advanced ceramics manufacturers to diversify their product offerings, cater to specific defense needs, and establish themselves as key suppliers in the defense and aerospace industries, driving growth and profitability.

Challenges: Faults due to thermal expansion

Faults arising from thermal expansion pose a challenging factor for the specialty advanced ceramics market. Advanced ceramics are known for their excellent thermal stability, but they can still be susceptible to thermal stresses and fractures when exposed to rapid temperature changes. The coefficient of thermal expansion (CTE) mismatch between ceramics and other materials, such as metals, can lead to cracking and delamination in composite structures. Overcoming these challenges requires precise engineering, sophisticated design, and often the development of specialized coatings or joining techniques to mitigate the impact of thermal expansion mismatches. These complexities can increase production costs and limit the application of advanced ceramics in environments with extreme temperature variations, presenting a significant hurdle for their widespread adoption and market growth.

Speciality Advanced Ceramics Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of wet room waterproofing solutions. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Materion Corporation (US), Morgan Advanced Materials (UK), Kyocera Corporation (Japan), Ceramtec GMBH (Germany), Coorstek INC (US).

Based on material, titanate ceramics is projected to account for the second largest share of the Speciality advanced ceramics market

Titanate ceramics represent a distinctive category within the specialty advanced ceramics market due to their remarkable properties and specialized applications. Composed primarily of titanium and oxygen, these ceramics possess exceptional piezoelectric properties, making them invaluable in specific industries and applications. Titanate ceramics excel at converting mechanical stress into electrical voltage and vice versa, a feature that finds extensive use in the production of piezoelectric transducers.

Based on type, electric and electronic functional ceramics is projected to account for the second largest share of the Speciality advanced ceramics market

The electronics and electrical functional ceramics market occupies a critical position within the realm of advanced ceramics, focusing on ceramics engineered for their specialized electrical and electronic properties. This market is propelled by several key driving factors, chief among them being the relentless trend toward miniaturization and integration in electronic devices. With consumer and industrial electronics continually shrinking in size, there is a growing demand for ceramics possessing exceptional electrical characteristics like high dielectric constants and piezoelectricity.

Based on application, aerospace and defence security is projected to account for the second largest share of the Speciality advanced ceramics market

Specialty advanced ceramics are indispensable in the aerospace and defense security sector, driven by their exceptional properties and capacity to meet rigorous demands. These ceramics, notably silicon carbide (SiC) and alumina (Al2O3), offer high strength and durability, making them pivotal in protective gear like armor and vehicle plating. Additionally, their lightweight nature, coupled with resistance to extreme temperatures, makes them ideal for applications ranging from aircraft engine components to missile systems.

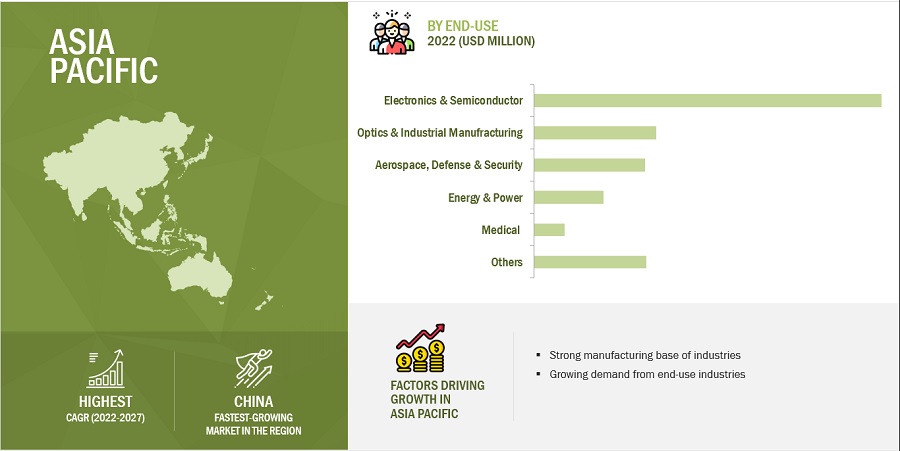

Asia Pacific is expected to be the fastest growing market during the forecast period.

The Asia-Pacific region, encompassing countries such as China, India, South Korea, and Japan, has become the fastest-growing market for specialty advanced ceramics due to several interrelated factors. The Asia-Pacific region is expected to be the fastest-growing region in the specialty advanced ceramics market due to several key factors. First, the region's rapid industrialization and urbanization have led to increased demand for advanced ceramics in various applications, including electronics, automotive, aerospace, and healthcare. Second, the presence of a burgeoning middle-class population has boosted consumer electronics and automotive sales, driving the need for advanced ceramics in these sectors. Additionally, government initiatives to promote clean energy and environmental sustainability have stimulated the demand for advanced ceramics in sectors like renewable energy and pollution control. Furthermore, the region benefits from a robust manufacturing ecosystem and cost-effective labor, making it an attractive destination for production and export of advanced ceramics, further fueling its growth in the market. These factors collectively contribute to the Asia-Pacific region's projected dominance in the specialty advanced ceramics market.

To know about the assumptions considered for the study, download the pdf brochure

Specialty Advanced Ceramics Market Players

The Speciality advanced ceramics market is dominated by a few major players that have a wide regional presence. The key players in the Speciality advanced ceramics market are Materion Corporation (US), Morgan Advanced Materials (UK), Kyocera Corporation (Japan), Ceramtec GMBH (Germany), Coorstek INC (US) (United States) Kyocera corporation (Japan), Saint – Gobian (France), NGK INSULATORS, LTD (Japan), Ferrotec (USA) Corporation (US), Materion Corporation (US), EBARA CORPORATION (Japan). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the Speciality advanced ceramics market.

Specialty Advanced Ceramics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 7.7 billion |

|

Revenue Forecast in 2028 |

USD 10.2 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2021-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Material, Type, end-use, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Materion Corporation (US), Morgan Advanced Materials (UK), Kyocera Corporation (Japan), Ceramtec GMBH (Germany), Coorstek INC (US) (United States) Kyocera corporation (Japan), Saint – Gobian (France), NGK INSULATORS, LTD (Japan), Ferrotec (USA) Corporation (US), Materion Corporation (US), EBARA CORPORATION (Japan). |

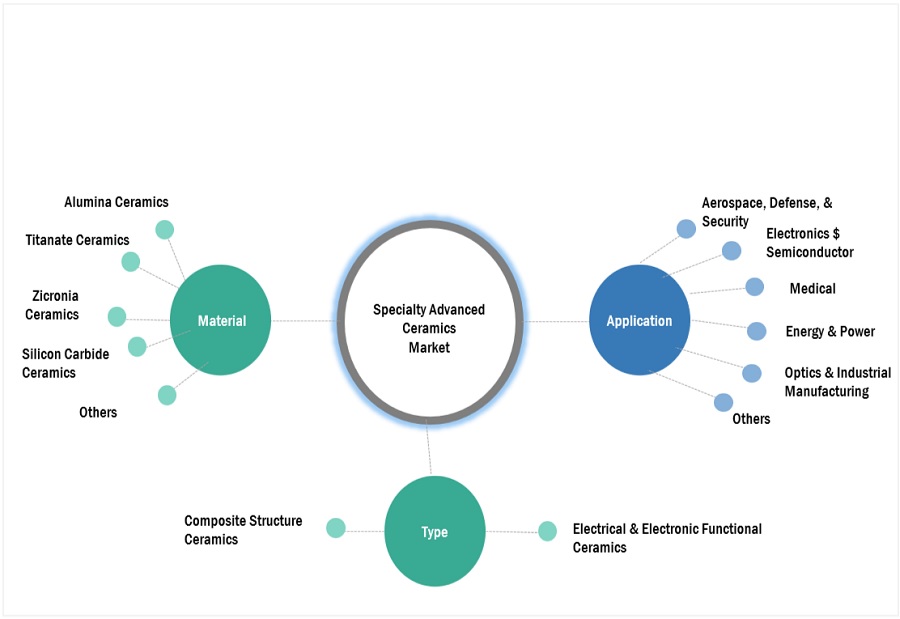

This report categorizes the global speciality advanced ceramics market based on raw material, Type, uses, application, and region.

On the basis of material, the speciality advanced ceramics market has been segmented as follows:

- Alumina Ceramics

- Titanate Ceramics

- Zirconia Ceramics

- Silicon Carbide

- Others

On the basis of type, the speciality advanced ceramics market has been segmented as follows

- Composite Structure Ceramics

- Electrical and Electronic Functional Ceramics

On the basis of uses, the speciality advanced ceramics market has been segmented as follows:

-

Medical

- Medical Prosthetics

- Dental Implants

- Others

-

Aerospace, Defence, And Security

- Missile Radomes

- Military Aircraft Lenses

- Spacecraft Heat Shields

- Jet Turbine Blades

- High-Performance Engines Pistons

- High-Power Laser Windows

- Others

-

Electronics & Semiconductor

- Semiconductor Lithography Masks

- Ion Implantation Components

- CMP (Chemical Mechanical Planarization) Components

- High-Frequency Insulators

- Others

-

Energy & Power

- Nuclear Reactors Fuel Pellets and Cladding

- Thermoelectric Modules

- Others

-

Optics & Industrial Manufacturing

- Air bearing Components

- Precision Ball Bearings

- Electron Microscopy Components

- Others

- Others

On the basis of region, the speciality advanced ceramics market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2020, Morgan advanced materials acquired carbo san luis, a leading manufacturer of specialty advanced ceramics. The acquisition cemented morgan advanced materials’ continuing investment in south america and supports future growth within the network.

- In December 2020, Materion acquired h.c. Starck ceramics, a leading manufacturer of advanced ceramic powders and components. This acquisition expanded materion's advanced ceramics product portfolio and gave it to new markets.

- In April 2021, Materion partnered with Kyocera Corporation, a leading global manufacturer of advanced ceramics, to develop and commercialize new advanced ceramic materials and products. This partnership gives Materion access to Kyocera's expertise and technology in the advanced ceramics market.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Speciality advanced ceramics market?

The growth of this market can be attributed to the Increasing demand from emerging industries, Growing awareness of the benefits of specialty advanced ceramics.

Which are the key applications driving the Speciality advanced ceramics market?

The sectors driving the demand for Speciality advanced ceramics are medical, electronic & semiconductor, Aerospace, defence & security, energy & power, optics & Industrial manufacturing others.

Who are the major manufacturers?

Major manufacturers include Materion Corporation (US), Morgan Advanced Materials (UK), Kyocera Corporation (Japan), Ceramtec GMBH (Germany), Coorstek INC (US) (United States)) among others.

What will be the growth prospects of the Speciality advanced ceramics market?

Rising demand from the aerospace and defense industry, Growing demand from the automotive industry, are some of the driving factors.

Which end-use segment having the largest market share in the spcaiality advanced ceramics market ?

Electronics & Semicondutor, end-use segment covers the largest market share in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing use of advanced ceramics in energy applications- Development of advanced ceramics with unique properties- Increasing demand for lightweight materials across industriesRESTRAINTS- High cost of specialty ceramics- Complex and fragmented IP landscape- Availability of substitutesOPPORTUNITIES- Growth of 3D printing industry- Development of ceramic composites for radar-absorbing materials- Rising demand for sustainable nuclear powerCHALLENGES- Difficulty in controlling dimensional tolerances during processing- Faults due to thermal expansion

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSCONSUMERS

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 PATENT ANALYSISMETHODOLOGYPATENTS GRANTED WORLDWIDE, 2012–2022PATENT PUBLICATION TRENDSINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION-WISE PATENT ANALYSISTOP COMPANIES/APPLICANTSTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

-

6.5 MACROECONOMIC FACTORSGLOBAL GDP TRENDS

-

6.6 REGULATIONS IN SPECIALTY ADVANCED CERAMICS MARKETNORTH AMERICAEUROPEASIA PACIFIC

- 6.7 AVERAGE PRICING ANALYSIS

-

6.8 ECOSYSTEM MAPPING

- 6.9 TECHNOLOGY ANALYSIS

- 6.10 IMPACT OF RECESSION ON SPECIALTY ADVANCED CERAMICS MARKET

-

6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.12 KEY CONFERENCES & EVENTS, 2023–2024

- 6.13 KEY FACTORS AFFECTING BUYING DECISION

-

6.14 TRADE ANALYSISIMPORT-EXPORT SCENARIO IN SPECIALTY ADVANCED CERAMICS MARKET

-

6.15 CASE STUDY ANALYSISMORGAN ADVANCED MATERIALS ENSURES DURABILITY OF ROLLERS IN GRIPPLE PLUS WIRE JOINERS AND TENSIONERSKYOCERA CORPORATION’S FINE CERAMIC TECHNOLOGY SOLUTION CONTRIBUTES TO ELECTRONIC DEVICE MINIATURIZATION

- 7.1 INTRODUCTION

-

7.2 ALUMINA CERAMICSRISING ADOPTION ACROSS APPLICATIONS TO DRIVE MARKET

-

7.3 TITANATE CERAMICSGROWING USE IN HIGH-WEAR APPLICATIONS TO DRIVE DEMAND

-

7.4 ZIRCONIA CERAMICSHIGH RESILIENCE AND DURABILITY TO PROPEL DEMAND

-

7.5 SILICON CARBIDE CERAMICSINCREASING USE ACROSS INDUSTRIES TO BOOST MARKET

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 COMPOSITE STRUCTURE CERAMICSRISING DEMAND FROM AEROSPACE INDUSTRY TO BOOST MARKET

-

8.3 ELECTRICAL AND ELECTRONIC FUNCTIONAL CERAMICSWIDESPREAD USE IN TELECOMMUNICATIONS INDUSTRY TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 MEDICALBIOCOMPATIBILITY AND NON-TOXICITY OF ADVANCED CERAMICS TO DRIVE DEMANDMEDICAL PROSTHETICSDENTAL IMPLANTSOTHERS

-

9.3 AEROSPACE, DEFENSE & SECURITYINCREASING USE OF ADVANCED CERAMICS WITH UNIQUE MATERIAL PROPERTIES TO PROPEL DEMANDMISSILE RADOMESMILITARY AIRCRAFT LENSESSPACECRAFT HEAT SHIELDSJET TURBINE BLADESHIGH-PERFORMANCE ENGINE PISTONSHIGH-POWER LASER WINDOWSOTHERS

-

9.4 ELECTRONICS & SEMICONDUCTOREMERGING TRENDS SUCH AS 5G TECHNOLOGY TO DRIVE DEMANDSEMICONDUCTOR LITHOGRAPHY MASKSION IMPLANTATION COMPONENTSCMP (CHEMICAL, MECHANICAL, PLANARIZATION) COMPONENTSHIGH-FREQUENCY INSULATORSOTHERS

-

9.5 ENERGY & POWERRISING USE OF ADVANCED CERAMICS IN POWER PRODUCTION & TRANSMISSION TO DRIVE MARKETNUCLEAR REACTOR FUEL PELLETS AND CLADDINGTHERMOELECTRIC MODULESOTHERS

-

9.6 OPTICS & INDUSTRIAL MANUFACTURINGGROWING USE OF ADVANCED CERAMICS IN OPTICAL COMPONENTS TO FUEL DEMANDAIR BEARING COMPONENTSPRECISION BALL BEARINGSELECTRON MICROSCOPY COMPONENTSMICRO-OPTIC AND NANO-OPTIC COMPONENTSOTHERS

- 9.7 OTHERS (AUTOMOTIVE, CHEMICALS, AND MINING)

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT- China- Japan- India- South Korea- Australia- Rest of Asia Pacific

-

10.3 NORTH AMERICARECESSION IMPACT- US- Canada- Mexico

-

10.4 EUROPERECESSION IMPACT- Germany- France- UK- Italy- Spain- Russia- Rest of Europe

-

10.5 SOUTH AMERICARECESSION IMPACT- Brazil- Argentina- Rest of South America

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACT- Saudi Arabia- South Africa- Rest of Middle East & Africa

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

- 11.7 SPECIALTY ADVANCED CERAMICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.8 STARTUPS/SMES EVALUATION QUADRANTRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

-

11.9 COMPETITIVE SCENARIO AND TRENDSDEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSMORGAN ADVANCED MATERIALS- Business overview- Products/Services/Solutions offered- Recent developments- MnM view3M COMPANY- Business overview- Products/Services/Solutions offered- MnM viewKYOCERA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCERAMTEC GMBH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOORSTEK, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMATERION CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFERROTEC (USA) CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNGK INSULATORS, LTD.- Business overview- Products/Services/Solutions offeredEBARA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsSAINT-GOBAIN- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSNISHIMURA ADVANCED CERAMICS CO., LTDBLASCH PRECISION CERAMICSELAN TECHNOLOGYHITACHI POWER SOLUTIONS CO., LTD.TECHNO CERA INDUSTRIESCOI CERAMICS, INC.BCE SPECIAL CERAMICS GMBHAGC CERAMICS CO., LTD.MCDANEL ADVANCED CERAMIC TECHNOLOGIESPRECISION CERAMICS UK LIMITEDSMITH+NEPHEWORTECH ADVANCED CERAMICSPREMATECH ADVANCED CERAMICSPAUL RAUSCHERT GMBH & CO. KGIBIDEN

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 SPECIALTY ADVANCED CERAMICS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 SPECIALTY ADVANCED CERAMICS MARKET SNAPSHOT

- TABLE 3 SPECIALTY ADVANCED CERAMICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 TOTAL NUMBER OF PATENTS

- TABLE 5 TOP TEN PATENT OWNERS

- TABLE 6 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 7 SPECIALTY ADVANCED CERAMICS MARKET: ECOSYSTEM

- TABLE 8 SPECIALTY ADVANCED CERAMICS MARKET: CONFERENCES & EVENTS

- TABLE 9 IMPORT TRADE DATA FOR CERAMIC PRODUCTS

- TABLE 10 EXPORT TRADE DATA FOR CERAMIC PRODUCTS

- TABLE 11 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 12 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 13 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019-2022 (KILOTONS)

- TABLE 14 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 15 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 16 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 17 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 18 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 19 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 20 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 21 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 22 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 23 SPECIALTY ADVANCED CERAMICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 SPECIALTY ADVANCED CERAMICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 SPECIALTY ADVANCED CERAMICS MARKET, BY REGION, 2019–2022 (KILOTONS)

- TABLE 26 SPECIALTY ADVANCED CERAMICS MARKET, BY REGION, 2023–2028 (KILOTONS)

- TABLE 27 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 28 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 29 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (KILOTONS)

- TABLE 30 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 31 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 32 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 34 SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 35 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 36 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 37 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 38 SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 39 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 40 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 42 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 43 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (KILOTONS)

- TABLE 46 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 47 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 48 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 50 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 51 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 52 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 54 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 55 CHINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 56 CHINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 57 CHINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 58 CHINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 59 JAPAN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 60 JAPAN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 61 JAPAN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 62 JAPAN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 63 INDIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 64 INDIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 65 INDIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 66 INDIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 67 SOUTH KOREA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 68 SOUTH KOREA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 69 SOUTH KOREA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 70 SOUTH KOREA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 71 AUSTRALIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 72 AUSTRALIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 73 AUSTRALIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 74 AUSTRALIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 75 REST OF ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 78 REST OF ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 79 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 82 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 83 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (KILOTONS)

- TABLE 86 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 87 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 90 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 91 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 94 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 95 US: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 96 US: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 97 US: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 98 US: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 99 CANADA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 100 CANADA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 102 CANADA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 103 MEXICO: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 104 MEXICO: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 105 MEXICO: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 106 MEXICO: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 107 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 110 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 111 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (KILOTONS)

- TABLE 114 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 115 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 116 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 118 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 119 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 120 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 122 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 123 GERMANY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 124 GERMANY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 125 GERMANY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 126 GERMANY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 127 FRANCE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 128 FRANCE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 129 FRANCE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 130 FRANCE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 131 UK: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 132 UK: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 133 UK: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 134 UK: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 135 ITALY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 136 ITALY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 137 ITALY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 138 ITALY: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 139 SPAIN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 140 SPAIN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 141 SPAIN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 142 SPAIN: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 143 RUSSIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 144 RUSSIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 145 RUSSIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 146 RUSSIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 147 REST OF EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 148 REST OF EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 150 REST OF EUROPE: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 151 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 152 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 153 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 154 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 155 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 156 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 158 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 159 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (KILOTONS)

- TABLE 162 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 163 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 164 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 165 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 166 SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 167 BRAZIL: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 168 BRAZIL: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 169 BRAZIL: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 170 BRAZIL: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 171 ARGENTINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 172 ARGENTINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 173 ARGENTINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 174 ARGENTINA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 175 REST OF SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 177 REST OF SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 178 REST OF SOUTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 179 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 182 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 183 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 186 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 187 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2019–2022 (KILOTONS)

- TABLE 190 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023–2028 (KILOTONS)

- TABLE 191 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 194 MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 195 SAUDI ARABIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 196 SAUDI ARABIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 197 SAUDI ARABIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 198 SAUDI ARABIA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 199 SOUTH AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 200 SOUTH AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 201 SOUTH AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 202 SOUTH AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: SPECIALTY ADVANCED CERAMICS MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 207 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 208 SPECIALTY ADVANCED CERAMICS MARKET: DEGREE OF COMPETITION

- TABLE 209 SPECIALTY ADVANCED CERAMICS MARKET: KEY COMPANY TYPE FOOTPRINT

- TABLE 210 SPECIALTY ADVANCED CERAMICS MARKET: KEY COMPANY END USE FOOTPRINT

- TABLE 211 SPECIALTY ADVANCED CERAMICS MARKET: KEY COMPANY MATERIAL FOOTPRINT

- TABLE 212 SPECIALTY ADVANCED CERAMICS MARKET: KEY COMPANY REGION FOOTPRINT

- TABLE 213 SPECIALTY ADVANCED CERAMICS MARKET: KEY STARTUPS/SMES

- TABLE 214 SPECIALTY ADVANCED CERAMICS MARKET: SME PLAYERS TYPE FOOTPRINT

- TABLE 215 SPECIALTY ADVANCED CERAMICS MARKET: SME PLAYERS END USE FOOTPRINT

- TABLE 216 SPECIALTY ADVANCED CERAMICS MARKET: SME PLAYERS MATERIAL FOOTPRINT

- TABLE 217 SPECIALTY ADVANCED CERAMICS MARKET: SME PLAYERS REGION FOOTPRINT

- TABLE 218 SPECIALTY ADVANCED CERAMICS MARKET: DEALS (2020–2023)

- TABLE 219 SPECIALTY ADVANCED CERAMICS MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 220 SPECIALTY ADVANCED CERAMICS MARKET: OTHER DEVELOPMENTS (2021–2023)

- TABLE 221 MORGAN ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 222 MORGAN ADVANCED MATERIALS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 MORGAN ADVANCED MATERIALS: DEALS

- TABLE 224 MORGAN ADVANCED MATERIALS: OTHERS

- TABLE 225 3M COMPANY: COMPANY OVERVIEW

- TABLE 226 3M COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 228 KYOCERA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 229 KYOCERA CORPORATION: PRODUCT LAUNCHES

- TABLE 230 KYOCERA CORPORATION: OTHERS

- TABLE 231 CERAMTEC GMBH: COMPANY OVERVIEW

- TABLE 232 CERAMTEC GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 CERAMTEC GMBH: PRODUCT LAUNCHES

- TABLE 234 CERAMTEC GMBH: DEALS

- TABLE 235 COORSTEK, INC.: COMPANY OVERVIEW

- TABLE 236 COORSTEK, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 COORSTEK, INC.: DEALS

- TABLE 238 COORSTEK, INC.: OTHERS

- TABLE 239 MATERION CORPORATION: COMPANY OVERVIEW

- TABLE 240 MATERION CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 241 MATERION CORPORATION: DEALS

- TABLE 242 MATERION CORPORATION: OTHERS

- TABLE 243 FERROTEC (USA) CORPORATION: COMPANY OVERVIEW

- TABLE 244 FERROTEC (USA) CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 FERROTEC (USA) CORPORATION: PRODUCT LAUNCHES

- TABLE 246 FERROTEC (USA) CORPORATION: DEALS

- TABLE 247 FERROTEC (USA) CORPORATION: OTHERS

- TABLE 248 NGK INSULATORS, LTD.: COMPANY OVERVIEW

- TABLE 249 NGK INSULATORS, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 250 EBARA CORPORATION: COMPANY OVERVIEW

- TABLE 251 EBARA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 252 EBARA CORPORATION: DEALS

- TABLE 253 EBARA CORPORATION: OTHERS

- TABLE 254 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 255 SAINT-GOBAIN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 256 NISHIMURA ADVANCED CERAMICS CO., LTD: COMPANY OVERVIEW

- TABLE 257 BLASCH PRECISION CERAMICS: COMPANY OVERVIEW

- TABLE 258 ELAN TECHNOLOGY: COMPANY OVERVIEW

- TABLE 259 HITACHI POWER SOLUTIONS CO., LTD.: COMPANY OVERVIEW

- TABLE 260 TECHNO CERA INDUSTRIES: COMPANY OVERVIEW

- TABLE 261 COI CERAMICS, INC.: COMPANY OVERVIEW

- TABLE 262 BCE SPECIAL CERAMICS GMBH: COMPANY OVERVIEW

- TABLE 263 AGC CERAMICS CO., LTD.: COMPANY OVERVIEW

- TABLE 264 MCDANEL ADVANCED CERAMIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 265 PRECISION CERAMICS UK LIMITED: COMPANY OVERVIEW

- TABLE 266 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 267 ORTECH ADVANCED CERAMICS: COMPANY OVERVIEW

- TABLE 268 PREMATECH ADVANCED CERAMICS: COMPANY OVERVIEW

- TABLE 269 PAUL RAUSCHERT GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 270 IBIDEN: COMPANY OVERVIEW

- FIGURE 1 SPECIALTY ADVANCED CERAMICS MARKET SEGMENTATION

- FIGURE 2 SPECIALTY ADVANCED CERAMICS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 SPECIALTY ADVANCED CERAMICS MARKET: DATA TRIANGULATION

- FIGURE 8 ASIA PACIFIC TO LEAD SPECIALTY ADVANCED CERAMICS MARKET IN 2023

- FIGURE 9 ELECTRONICS & SEMICONDUCTOR SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 10 ALUMINA CERAMICS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 COMPOSITE STRUCTURE CERAMICS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 INCREASING AWARENESS OF BENEFITS OF ADVANCED CERAMICS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 14 INDIAN MARKET TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 COMPOSITE STRUCTURE CERAMICS SEGMENT TO LEAD MARKET IN 2028

- FIGURE 16 ALUMINA CERAMICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 17 ELECTRONICS & SEMICONDUCTOR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 18 ELECTRONICS & SEMICONDUCTOR SEGMENT AND CHINA LED MARKET IN 2022

- FIGURE 19 SPECIALTY ADVANCED CERAMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 SPECIALTY ADVANCED CERAMICS MARKET: VALUE CHAIN

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: SPECIALTY ADVANCED CERAMICS MARKET

- FIGURE 22 TOTAL NUMBER OF PATENTS IN LAST TEN YEARS

- FIGURE 23 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 24 TOP JURISDICTIONS FOR SPECIALTY ADVANCED CERAMICS PATENTS

- FIGURE 25 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 26 AVERAGE SELLING PRICE BY REGION

- FIGURE 27 SPECIALTY ADVANCED CERAMICS MARKET: ECOSYSTEM MAPPING

- FIGURE 28 TRENDS IN SPECIALTY ADVANCED CERAMICS MARKET

- FIGURE 29 SPECIALTY ADVANCED CERAMICS MARKET, BY MATERIAL, 2023

- FIGURE 30 COMPOSITE STRUCTURE CERAMICS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 ELECTRONICS & SEMICONDUCTOR SEGMENT TO LEAD MARKET

- FIGURE 32 ASIA PACIFIC: SPECIALTY ADVANCED CERAMICS MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: SPECIALTY ADVANCED CERAMICS MARKET SNAPSHOT

- FIGURE 34 EUROPE: SPECIALTY ADVANCED CERAMICS MARKET SNAPSHOT

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN SPECIALTY ADVANCED CERAMICS MARKET, 2022

- FIGURE 36 SPECIALTY ADVANCED CERAMICS MARKET, 2022

- FIGURE 37 SPECIALTY ADVANCED CERAMICS MARKET COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- FIGURE 38 SPECIALTY ADVANCED CERAMICS MARKET: STARTUPS/SMES COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

- FIGURE 40 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 41 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 CERAMTEC GMBH: COMPANY SNAPSHOT

- FIGURE 43 MATERION CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 NGK INSULATORS, LTD.: COMPANY SNAPSHOT

- FIGURE 45 EBARA CORPORATION: COMPANY SNAPSHOT

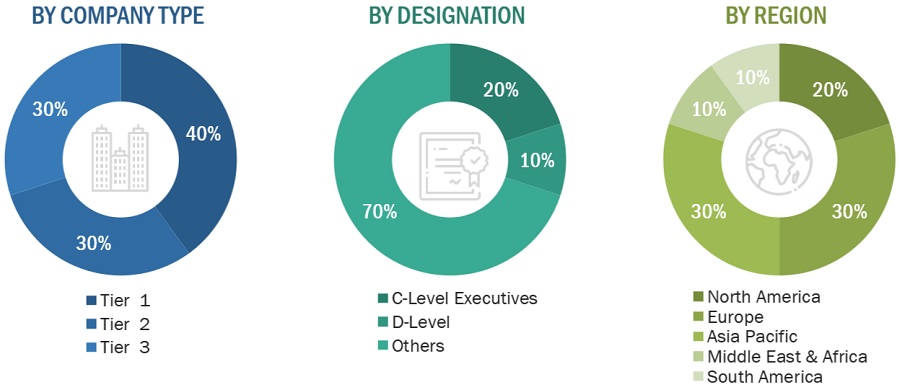

The study involved four major activities in estimating the market size of the speciality advanced ceramics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key speciality advanced ceramics, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The speciality advanced ceramics market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the speciality advanced ceramics market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the speciality advanced ceramics industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of speciality advanced ceramics and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for speciality advanced ceramics for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on material, type, end-use, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Speciality Advanced Ceramics Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Speciality Advanced Ceramics Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process speciality advanced ceramics above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The specialty advanced ceramics market refers to a specific segment of the ceramics industry focused on the production and sale of advanced ceramic materials engineered to possess exceptional properties and performance characteristics. These ceramics are tailored for specialized applications across various industries, such as electronics, aerospace, automotive, healthcare, and energy. Specialty advanced ceramics are known for their high-temperature resistance, superior mechanical strength, electrical insulation, thermal conductivity, and resistance to corrosion, making them essential materials in the manufacturing of cutting-edge technologies and components. This market encompasses a wide range of ceramic compositions and products designed to meet stringent requirements in demanding and high-tech applications, driving innovation and growth in this sector.

Key Stakeholders

- speciality advanced ceramics Manufacturers

- speciality advanced ceramics Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the speciality advanced ceramics market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on material, type, end-use, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on speciality advanced ceramics market

By Form Analysis

- Market size for speciality advanced ceramics in terms of value and volume

Growth opportunities and latent adjacency in Specialty Advanced Ceramics Market