Spray Polyurethane Foam Market by Type (Open-cell, and closed-cell), Product, Application (Insulation, Waterproofing, Roofing, Asbestos Encapsulation, Sealant, and Others), and Region - Global Forecast to 2030

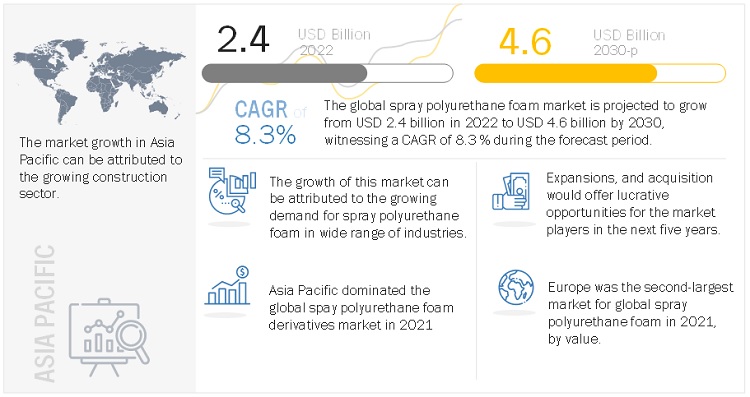

The global spray polyurethane foam market is projected to grow from USD 2.4 billion in 2022 to USD 4.6 billion by 2030, at a CAGR of 8.3% during the forecast period. Increased usage of spray polyurethane foam in the construction sector is expected to drive the market during the forecast period.

Global Spray Polyurethane Foam Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Spray Polyurethane Foam Market Dynamics

Driver: Growth in construction sector

Growth in construction sector is the major factor propelling market growth for spray polyurethane foam. The product can be applied to fill gaps, cracks, voids & crevices of buildings. It adheres to irregular surfaces to form an air sealing insulation owing to its ability to expand at the time of the application process. Also, spray polyurethane foams are used to protect the buildings from adverse weather conditions, and corrosions. Thus, majority of the overall spray polyurethane foam production is utilized in various construction activities including walls, roofs, and the interior & exterior of buildings.

Restraints: High maintenance and overspray potential

Rising concerns regarding the high maintenance and overspray potential of spray polyurethane foam in roofing systems is likely to hamper the growth of the market. Even though there is no established damage, spray polyurethane foam in roofing systems should be tested twice a year. Also, specifically after potentially damaging weather events such as hailstorms, tornadoes, and hurricanes, where there are high chances of damage caused to the spray polyurethane foam roofing systems. Furthermore, as the spray polyurethane foam is applied by spray, there is a possibility of overspray being carried by the wind onto nearby cars and other surfaces. Although this is not a health hazard, it is a risk for the property in the area. As a result, the high maintenance and overspray potential is considered as a restraint hindering the growth of the spray polyurethane foam market.

Opportunity: Stringent regulations of the government regarding energy efficiency

The U.S. Environment Protection Agency (EPA) recommends that insulated and ventilated buildings can conserve about one-fifth of the cost of heating & cooling. Also, it is estimated that more efficient walls & roofs will allow heating & cooling systems to be reduced by about 35%. Thus, growing understanding and need for energy efficiency solutions is further expected to give substantial prospects towards the growth of the spray polyurethane foams market.

Challenge: Fluctuation in raw material prices

Spray polyurethane foam is mainly obtained from the petroleum-based feedstock such as Toluene diisocyanate (TDI) and Methylene diphenyl diisocyanate (MDI). These chemicals are derived from benzene, which comes from crude oil. The prices of spray polyurethane foam fluctuate with changes in the price of crude oil. Factors such as the Middle Eastern upheaval and Iran's prohibition have led to disruptions in the supply of crude oil, which have hampered fuel prices. Consequently, changes in commodity prices have emerged as a significant barrier to the expansion of the spray polyurethane foam market.

Based on type, open-cell segment is the largest market during the forecast period

Open-cell spray polyurethane foam accounted for the largest market segment based on type. Open-cell spray polyurethane foam is extensively used in building interiors as it is cost-effective, flexible, and offers higher moisture resistance over the closed-cell spray polyurethane foam. Open-cell spray polyurethane foam is made of millions of microscopic cells that insulate air-seal. They make residential and commercial structures more energy-efficient, comfortable, quieter, and less dusty as compared to that offered by closed-cell spray polyurethane foam. Because of this, it is perfect for usage in residential and commercial interior applications, which will directly fuel market expansion by 2030.

Based on product, two-component high-pressure segment is expected to account for the largest market share during the forecast period

Spray polyurethane foam market is classified based on product into two-component high-pressure spray foam, two-component low-pressure spray foam, and one-component foam. Among these, two-component high-pressure spray foam holds a dominating market share for the spray polyurethane foam market. The product's chemical cure makes it perfect for cavity filling, mold filling and other insulating applications. High-pressure two-component systems are more often utilized to insulate larger areas on new construction or major renovations on walls and roofs. This surging usage is expected to propel the expansion of two-component high-pressure segment of the spray polyurethane foam market.

Based on application, insulation segment is expected to account for the largest market share during the forecast period

Based on application, the spray polyurethane foam market is categorized into insulation, waterproofing, roofing, asbestos encapsulation, sealant, and others. Insulation accounted for the largest share in the spray polyurethane foam market in 2021. Spray polyurethane foam systems are ideal to achieve stringent insulation requirements as they aid in limiting excessive air leakage in addition to preventing condensation. As the foam fills in all gaps and molds to all contours, the insulation performance is among the highest accessible. Furthermore, spray polyurethane foam has its widespread use for insulation in building envelope assemblies, such as walls, ceilings, floors, attics, crawl spaces, and roofing. This is directly linked to code-mandated energy efficiency improvements, especially requirements for reducing building air leakage. Therefore, with improving demand for insulation applications, spray polyurethane foam market is expected to grow during the forecast period.

Asia Pacific is the largest and fastest growing segment of the spray polyurethane foam market during the forecast period

By region, Asia-Pacific is the largest and fastest growing market for spray polyurethane foam in the forecast period. The increasing demand for residences and commercial establishments is expected to accelerate Asia Pacific's spray polyurethane foam market growth over the forecast period. The major economies of the Asia Pacific region contributing significantly to the growth of the spray polyurethane foam market are China, Japan, India, and South Korea. High growth in the construction sector of China is more likely to create immense opportunities for spray polyurethane foam to expand in the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major companies in the spray polyurethane foam market include BASF SE (Germany), Saint-Gobain (France), Johns Manville (US), Honeywell International Inc. (US), and Covestro AG (Germany), among others. A total of 16 major players have been covered. These players have adopted joint ventures, new product launches and new product developments as the major strategies to consolidate their position in the market.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2030 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2030 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (Kiloton) |

|

Segments Covered |

Type, Product, Application, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

|

Companies Covered |

The major market players include BASF SE (Germany), Saint-Gobain (France), Johns Manville (US), Honeywell International Inc. (US), and Covestro AG (Germany), among others. |

This research report categorizes the Spray Polyurethane Foam market based on Type, Product, Application, and Region.

Based on type, the spray polyurethane foam market has been segmented as follows:

- Open-cell

- Closed-cell

Based on product, the spray polyurethane foam market has been segmented as follows:

- Two-component high-pressure spray foam

- Two-component low-pressure spray foam

- One-component foam

Based on application, the spray polyurethane foam market has been segmented as follows:

- Insulation

- Waterproofing

- Roofing

- Asbestos Encapsulation

- Sealant

- Others

Based on Region, the spray polyurethane foam market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2021, TECHNONICOL announced the launch of polyurethane foams by TECHNONICOL, a new product category to complement its existing range of construction materials in India. It includes professional sealing, fire-resistant, and gluing foams, as well as high-performance spray foam insulation, to address the builder requirements.

- In February 2020, Huntsman Corporation completed the acquisition of Icynene-Lapolla as to expand its downstream polyurethane business.

- In September 2019, Demilec, Inc., a Huntsman Corporation subsidiary, and a key manufacturer of open-cell and closed-cell spray polyurethane foam in North America, announced the launch of several spray foam insulation products for the Middle East market, as well as the inaugural of its Spray Foam Technical Application and Training Center in Dubai.

Frequently Asked Questions (FAQ):

What is the current size of the global spray polyurethane foam market?

The global spray polyurethane foam market is projected to grow from USD 2.4 billion in 2022 to USD 4.6 billion by 2030, at a CAGR of 8.3% during the forecast period.

Who are the leading players in the global spray polyurethane foam market?

Some of the key players operating in the spray polyurethane foam market are BASF SE (Germany), Saint-Gobain (France), Johns Manville (US), Honeywell International Inc. (US), and Covestro AG (Germany), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED IN THE REPORT

1.3.2 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZING AND FORECASTING

2.2.1 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.2.3 MARKET CRACKDOWN AND DATA TRIANGULATION

2.3 MARKET SHARE ESTIMATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.1.1 MARKET DYNAMICS

5.1.2 DRIVERS

5.1.3 RESTRAINTS

5.1.4 OPPORTUNITIES

5.1.5 CHALLENGES

6 INDUSTRY TRENDS

6.1 VALUE CHAIN ANALYSIS

6.2 ECOSYSTEM

6.3 PORTER’S FIVE FORCES MODEL

6.4 PRICING ANALYSIS

6.5 TARIFF AND REGULATORY LANDSCAPE

6.6 PATENT ANALYSIS

6.7 TRADE DATA STATISTICS

6.8 CASE STUDY ANALYSIS

6.9 TECHNOLOGY ANALYSIS

7 SPRAY POLYURETHANE FOAM MARKET, BY TYPE

7.1 INTRODUCTION

7.2 OPEN-CELL

7.3 CLOSED-CELL

8 SPRAY POLYURETHANE FOAM MARKET, BY PRODUCT

8.1 INTRODUCTION

8.2 TWO-COMPONENT HIGH-PRESSURE SPRAY FOAM

8.3 TWO-COMPONENT LOW-PRESSURE SPRAY FOAM

8.4 ONE-COMPONENT FOAM

9 SPRAY POLYURETHANE FOAM MARKET, BY APPLICATION

9.1 INTRODUCTION

9.2 INSULATION

9.3 WATERPROOFING

9.4 ROOFING

9.5 ASBESTOS ENCAPSULATION

9.6 SEALANT

9.7 OTHERS

10 SPRAY POLYURETHANE FOAM MARKET, BY REGION

10.1 INTRODUCTION

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 JAPAN

10.2.3 INDIA

10.2.4 REST OF ASIA SPECIFIC

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 REST OF EUROPE

10.4 NORTH AMERICA

10.4.1 US

10.4.2 CANADA

10.4.3 MEXICO

10.5 REST OF WORLD

10.5.1 MIDDLE EAST AND AFRICA

10.5.2 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

11.1 INTRODUCTION

11.2 KEY PLAYERS STRATEGIES

11.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT, 2021

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.6 STARTUP/SME EVALUATION QUADRANT, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 DYNAMIC COMPANIES

11.6.3 RESPONSIVE COMPANIES

11.6.4 STARTING BLOCKS

11.7 COMPETITIVE SCENARIO

12 COMPANY PROFILES

(Business Overview, Products Portfolio, Recent Developments, MnM View)*

12.1 BASF SE

12.1.1 Business Overview

12.1.2 Products & Services

12.1.3 Recent Developments

12.1.4 MnM View

12.2 SAINT-GOBAIN

12.3 HUNTSMAN INTERNATIONAL LLC

12.4 JOHNS MANVILLE

12.5 DOW

12.6 HONEYWELL INTERNATIONAL INC.

12.7 TECNOPOL

12.8 NCFI POLYURETHANES

12.9 SOPREMA

12.10 SPECIALTY PRODUCTS INC.

12.11 COVESTRO AG

12.12 RHINO LININGS CORPORATION

12.13 ISOTHANE LTD

12.14 CARLISLE SPRAY FOAM INSULATION

12.15 TECHNONICOL

12.16 KODIAK INDUSTRIES

12.17 OTHERS

13 APPENDIX

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 RELEATED REPORT

13.4 AUTHOR DETAILS

Note: e-Estimated, f-Forecasted

*Details on Business Overview, Product Offerings, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies

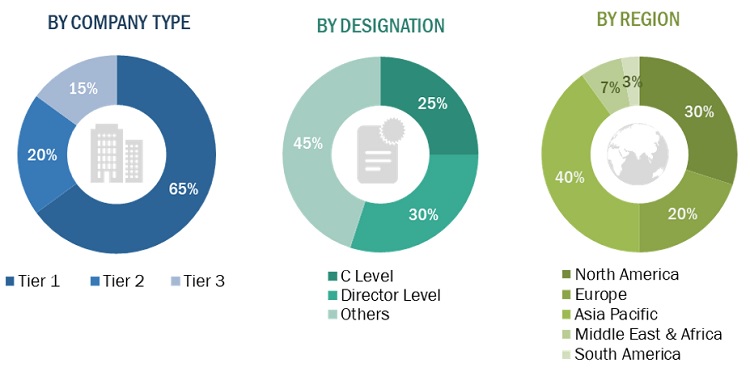

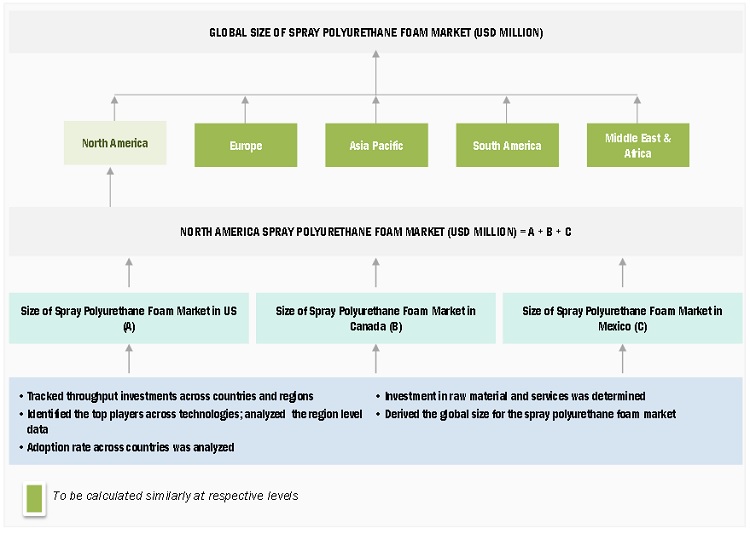

The study involved four major activities in estimating the current size of the spray polyurethane foam market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the spray polyurethane foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, spray polyurethane foam manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The spray polyurethane foam market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of spray polyurethane foam manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for spray polyurethane foam, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and spray polyurethane foam manufacturing companies.

Breakdown of the Primary Interviews

Notes: Other designations include sales managers, engineers, and regional managers.

Tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 billion and USD 5 billion, and tier 3 company—revenue To know about the assumptions considered for the study, download the pdf brochure Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the spray polyurethane foam market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following: The following segments provide details about the overall market size estimation process employed in this study To know about the assumptions considered for the study, Request for Free Sample Report After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches. MarketsandMarkets offers the following customizations for this market report: Market Size Estimation

Global Spray Polyurethane Foam Market Size: Bottom-Up Approach

Data Triangulation

Report Objectives

Market Intelligence

Competitive Intelligence

Available Customizations

Growth opportunities and latent adjacency in Spray Polyurethane Foam Market