Temperature Management Systems Market Size by Product (Warming Systems (Surface, Intravascular), Cooling Systems, Application (Perioperative, Acute, Newborn Care), Medical Speciality (Cardiology, Neurology, Pediatrics, Orthopedics) & Size - Global Forecast to 2028

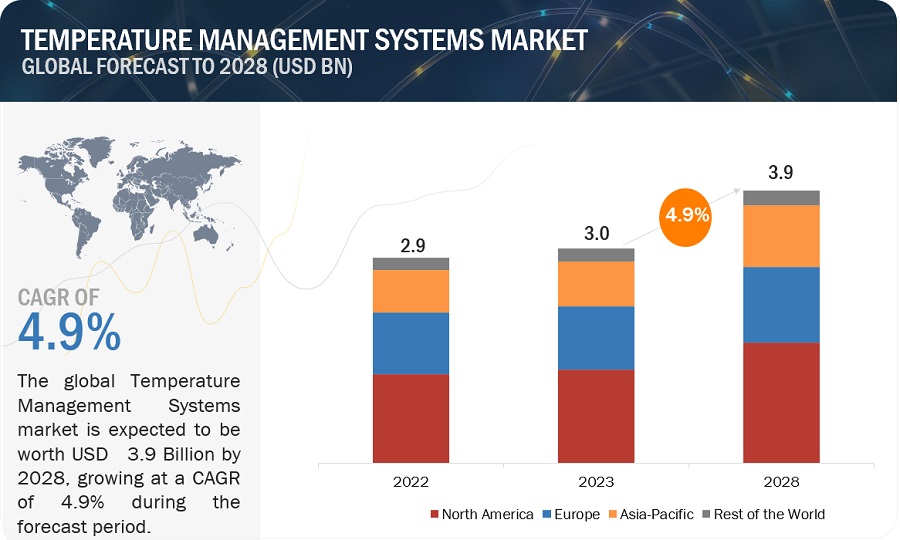

The size of global temperature management systems market in terms of revenue was estimated to be worth $3.0 billion in 2023 and is poised to reach $3.9 billion by 2028, growing at a CAGR of 4.9% from 2023 to 2028. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Increasing prevalence of chronic and infectious diseases, rising number of surgical procedures, increasing number of hypothermia cases, increasing growth opportunities in emerging markets, growing number of product launches, contracts and agreements between market players and developing healthcare infrastructure.

Attractive Opportunities in the Temperature Management Systems Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global temperature management systems dynamics

DRIVER: Increasing number of hypothermia cases

Hypothermia is caused due to environmental exposure, drug intoxication, or metabolic or nervous system dysfunction. Hypothermia occurs when the body’s temperature falls below 35°C. Annually, thousands die of primary hypothermia, and an unknown number die of secondary hypothermia worldwide. Hypothermia can be expected in emergency patients in the prehospital phase. Injured and intoxicated patients cool quickly, even in subtropical regions. Therefore, preventive measures are important to avoid hypothermia or cooling in ill or injured patients.

Hypothermia is associated with marked depression of cerebral blood flow and oxygen requirement, reduced cardiac output, and decreased arterial pressure. Victims can appear to be clinically dead because of marked depression of brain and cardiovascular function; however, full resuscitation with intact neurological recovery is possible. Alcohol or drug intoxication is the dominant precipitating factor. Around 20,000 hypothermia-related deaths occur every year in Britain. In the US and Canada, the number of hypothermia-related deaths is estimated at 25,000 and 8,000, respectively. Preventing inadvertent perioperative hypothermia helps to reduce surgical-site infections, the length of hospital stays, and the cost per patient. The need to reduce the occurrence of hypothermia will drive the demand for temperature management systems.

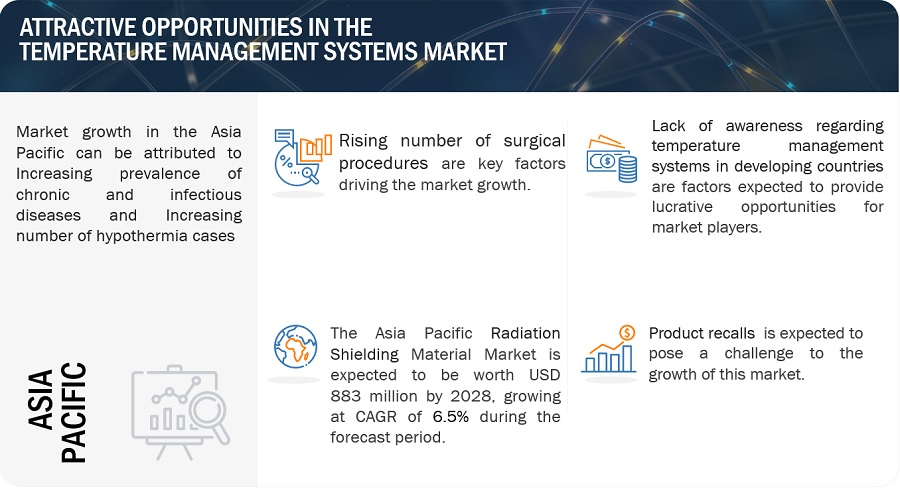

RESTRAINT: Lack of awareness regarding temperature management systems in developing countries

The proper use of warming and cooling systems to manage the core temperature of patients requires professionals with relevant experience and knowledge of the methodology. The launch of new and technologically advanced monitoring devices by market players has further created a need for proper training for their effective usage. Such advancements help in providing results of near-core and core temperature ranges to avoid additional risks of high fever and hypothermia in pre-and post-operative setups. However, the lack of awareness among doctors and healthcare practitioners about advancements that are incorporated by manufacturers, coupled with a dearth of skilled personnel who can effectively operate and process these devices, are the major factors limiting their adoption.

Despite advances in scientific research, several international surveys show low compliance in temperature management, with implementation rates between 13% and 34%. Therefore, barriers to implementation were identified as a lack of legislation, information, funding, equipment, and competence. These barriers may be more pronounced in low-resource settings and developing countries, which is restricting the growth of the temperature management systems market.

OPPORTUNITY: Growing number of contracts and agreements between market players

Over the years, the number of companies offering temperature management systems has increased globally. Major market players are focusing on strengthening their product offerings, distribution networks, and geographic presence by entering into contracts and agreements with other established and emerging players in the market. This provides growth opportunities for emerging companies in the market. For instance,

- In July 2023, ZOLL Medical Corporation (US) (a subsidiary of Asahi Kasei) entered into an agreement with BrainCool, a medical device company specializing in temperature management solutions. This agreement was aimed at the exclusive distribution of the BrainCool System/IQool System and the IQool System Pads in the US and key markets in Europe. The companies are working toward expanding distribution to select markets in Asia.

- In July 2022, Gentherm acquired Jiangmen Dacheng Medical Equipment Co., Ltd, a manufacturer of medical materials and medical equipment, including patient temperature management solutions.

- In May 2022, the Surgical Company Group (TSC Group) announced the completion of the acquisition by Duomed Group of the distribution activities of TSC Group in France and the Benelux, notably the Adhesia, Sebac, and Hospithera brands.

- In January 2022, ICU Medical announced that it had completed its acquisition of Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products. When combined with ICU Medical’s existing businesses, the combined companies create a leading infusion therapy company with estimated pro forma combined revenues of approximately USD 2.5 billion.

- In June 2021, ZOLL Medical Corporation (US) (a subsidiary of Asahi Kasei) and Wallaby Medical Technologies signed a distribution agreement whereby Wallaby will manage the sales and distribution of ZOLL’s temperature management products in China.

- In June 2021, ZOLL Medical Corporation (US) (a subsidiary of Asahi Kasei) and Global Healthcare SG signed an exclusive agreement to distribute portable targeted temperature management systems in the Asia Pacific.

- In March 2021, The Surgical Company (Netherlands) announced an agreement with Next Level Development TSC-PTM to develop, produce, and globally distribute specialist medical equipment to prevent hypothermia and for the warming of patients undergoing surgery.

Such strategies help companies expand their customer base and extend their presence in untapped, emerging markets.

CHALLENGE: Product recalls

Product recalls are often associated with quality failures and may negatively affect customer satisfaction and firm performance. A product recall occurs when safety issues or defects in a product are found that might endanger consumers or put the producer or seller at risk of legal action.

Mentioned below are some key examples in this regard:

- Smiths Medical recalled NORMOFLO Irrigation Fluid Warmers and Warming Sets due to the possibility of harmful levels of aluminum leaching into the fluid path of the warmers. When the fluid circulates through the patient’s body, the patient can be exposed to high levels of aluminum. Exposure to toxic levels of aluminum may not be easily recognized, and exposure effects may cause serious adverse events, including death.

- 3M Company recalled more than 165,000 Bair Hugger surgical warming blankets due to a design problem that could allow patients in surgery to experience dangerous body temperature changes. The US Food and Drug Administration received at least one report of a patient going into hypothermia during surgery involving the blankets. Air forced through the inflatable blankets helps maintain normal body temperature. An FDA alert said a design change in certain Bair Hugger blankets made airflow blockage more likely. This could prevent the blankets from fully inflating.

- Vyaire Medical announced an immediate global recall of the enFlow disposable cartridges used with the enFlow fluid warming system (part numbers 980200EU and 980202EU). Vyaire is directing customers to suspend the use of the enFlow system and follow instructions provided by the company in its recall notice with regard to the affected cartridges.

In such a case, the product is taken off the market, resulting in financial loss for the producing company and potential damage to the company’s reputation. It clashes sales, testing customer relationships, and disrupting supply chains.

Temperature Management Systems Ecosystem

Prominent companies in this market include well-established manufacturers of temperature management systems Market and offer a wide range of products. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include 3M Company (US), GE Healthcare (US), Dragerwerk AG & Co. KGAA (Germany), Asahi-kasei Corporation (Japan) and Becton, Dickinson and Company (US).

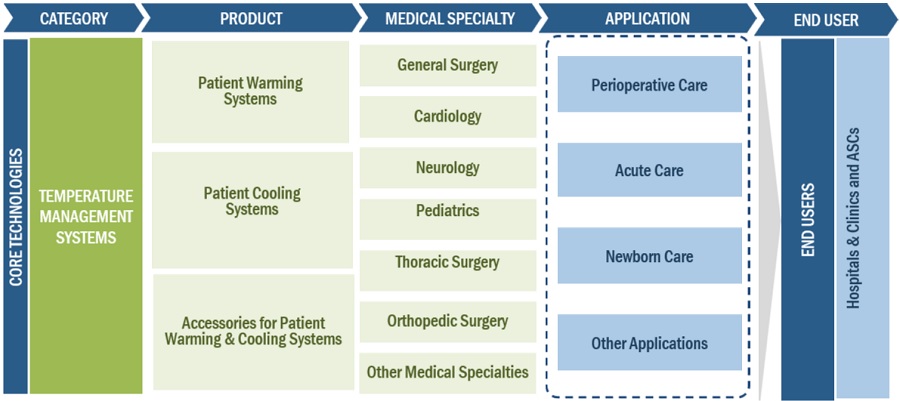

In 2022, Patient Warming Systems segment to observe highest growth rate of the temperature management systems industry, by product.

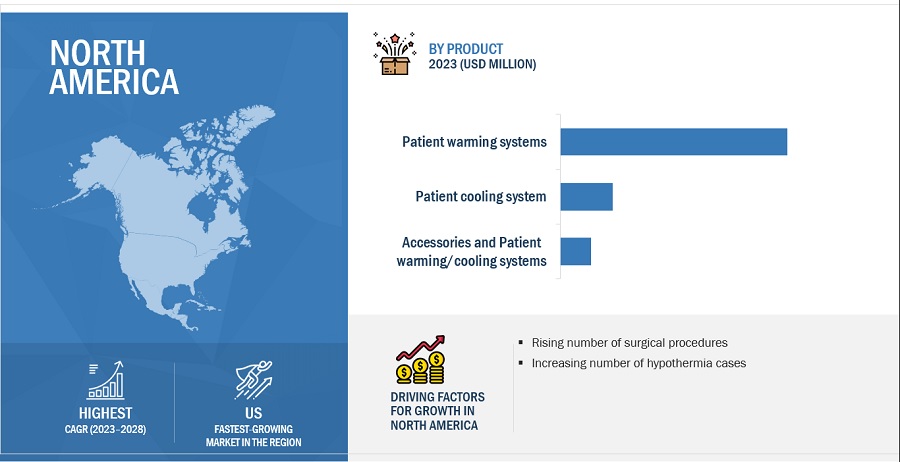

Based on the Product, The Temperature Management Systems market, by product, has been segmented into patient warming systems, patient cooling systems, and accessories for patient warming/cooling systems. Patient warming systems will drive the growth of the market due to growing number of product launches contracts and agreements between market players. For Instance In June 2023, Dragerwerk AG & Co. KGAA has launched the new patient warming systems Babyroo TN300 that offers supportive lung protection and temperature stability to a newborn. Also, In July 2023, Asahi-kasei Corporation signed an agreement with BrainCool for the exclusive distribution of the BrainCool System/IQool System and the IQool System Pads in the US and Europe market.

In 2022, Perioperative care segment to dominate the temperature management systems industry, by the application.

Based on application, the the temperature management systems market is segmented Perioperative care, acute care, newborn care, and other applications. Perioperative care is expected to grow highest due to the increasing number of hypothermia cases. In an operating room, managing intraoperative hypothermia is very important for eliminating surgical bleeding, surgical-site infections, and wound infections, all of which can ultimately lead to a higher mortality rate.

To know about the assumptions considered for the study, download the pdf brochure

The global temperature management systems market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America market is expected to rise due to increasing geriatric population and the rising incidence of chronic diseases, alongside an increasing number of surgical procedures and surgical centers, are supporting the growth of the market.

The temperature management systems is dominated by players such 3M Company (US), GE Healthcare (US), Dragerwerk AG & Co. KGAA (Germany), Asahi-kasei Corporation (Japan), Becton, Dickinson and Company (US).

Scope of the Temperature Management Systems Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$3.0 billion |

|

Projected Revenue Size by 2028 |

$3.9 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 4.9% |

|

Market Driver |

Increasing number of hypothermia cases |

|

Market Opportunity |

Growing number of contracts and agreements between market players |

This research report categorizes the temperature management systems market to forecast revenue and analyze trends in each of the following submarkets:

|

TYPE |

PARAMETER |

|

By Region |

|

|

By Product |

|

|

By Application |

|

|

By Medical Specialty |

|

Recent Developments of Temperature Management Systems Industry

- In June 2023, Dragerwerk AG & Co. KGAA has launched the FDA-cleared Babyroo TN300, a new open warmer that offers supportive lung protection and temperature stability from the moment of birth through discharge.

- In July 2023, Asahi-kasei Corporation (Japan) signed an agreement with BrainCool, a medical device company specializing in temperature management solutions, for the exclusive distribution of the BrainCool System/IQool System and the IQool System Pads in the US and key markets in Europe. The companies are working toward expanding distribution to select markets in Asia.

- In January 2022, ICU Medical completed the acquisition of Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products. When combined with ICU Medical’s existing businesses, the combined companies create a leading infusion therapy company with estimated pro forma combined revenues of approximately USD 2.5 billion.

- In July 2022, Gentherm acquired Jiangmen Dacheng Medical Equipment Co., Ltd., a manufacturer of medical materials and medical equipment, including patient temperature management solutions.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global temperature management systems market?

The global temperature management systems market boasts a total revenue value of $3.9 billion by 2028.

What is the estimated growth rate (CAGR) of the global temperature management systems market?

The global temperature management systems market has an estimated compound annual growth rate (CAGR) of 4.9% and a revenue size in the region of $3.0 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the temperature management systems market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are:

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the temperature management systems market. A database of the key industry leaders was also prepared using secondary research.

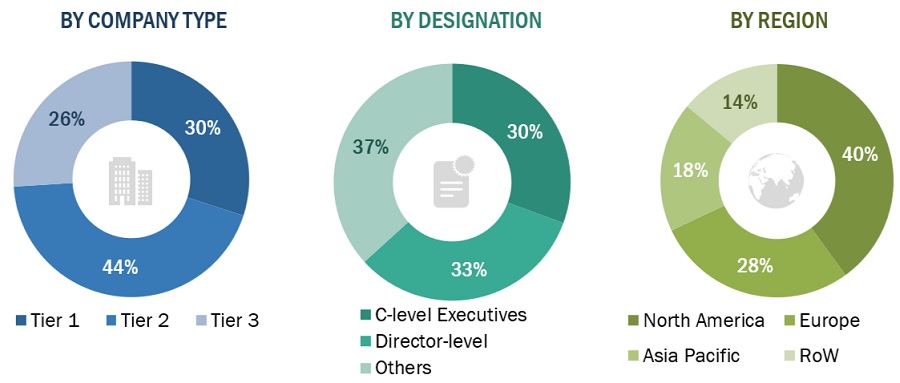

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about temperature management systems market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as Hospitals) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific and Rest of the world. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

GE Healthcare (US) |

Product Manager |

|

Becton, Dickinson and Company (US) |

Regional Manager |

|

3M Company (US) |

Regional Business Head |

Market Size Estimation

All major product manufacturers offering various temperature management systems markets were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value temperature management systems market was also split into various segments and subsegments at the regional and country levels based on the following:

- Product mapping of various manufacturers for each solution of temperature management systems market at the regional and country-level

- Relative adoption pattern of each temperature management systems market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

To know about the assumptions considered for the study, Request for Free Sample Report

Global Temperature Management Systems Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the temperature management systems industry.

Market Definition

Patient temperature management systems are medical devices and techniques used to regulate a patient’s body temperature during surgical procedures, post-surgery recovery, or in critical care settings. Maintaining a patient’s temperature within a specific range is essential for various medical reasons, including preventing hypothermia (low body temperature) and managing fever. These systems are designed to help achieve and maintain the desired temperature, which can vary depending on the patient’s condition and the medical procedure performed. There are two main types of temperature management systems—warming and cooling systems—used to maintain and regulate a patient’s normal body temperature.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the temperature management systems market by Product, Application, Medical specialty and Region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall temperature management systems market

- To forecast the size of the temperature management systems market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, and Rest of the world

- To profile key players in the temperature management systems market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the temperature management systems market.

- To benchmark players within the temperature management systems market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the temperature management systems market

- Profiling of additional market players (up to 5) Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the temperature management systems market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Temperature Management Systems Market