Temperature Monitoring Systems Market: Growth, Size, Share, and Trends

Temperature Monitoring Systems Market by Type (Wireless, Strip, Pyrometer, IR), Application (Patient Monitoring, Lab, Manufacturing, Cold Storage, Home Care, Server), End User (Healthcare, Food, Pharma, Energy, Semi-conductor) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The temperature monitoring systems market is projected to reach USD 5.65 billion by 2030 from USD 4.35 billion in 2025, at a CAGR of 5.3% from 2024 to 2030. The global temperature monitoring systems market is witnessing strong growth, driven by increasing demand for continuous, accurate, and remote monitoring of temperature-sensitive assets across healthcare, life sciences, food & beverage, and industrial sectors. These systems—comprising sensors, data loggers, smart thermometers, and connected monitoring platforms—play a vital role in maintaining product integrity during storage, manufacturing, and transport. Rising regulatory compliance for cold chain validation, especially in pharmaceuticals and vaccines, coupled with the growing integration of IoT and wireless connectivity, is expanding the market’s reach. Furthermore, advancements in cloud-based analytics and real-time alerting are transforming traditional monitoring into predictive temperature management solutions, creating significant opportunities for technology providers and integrators.

KEY TAKEAWAYS

-

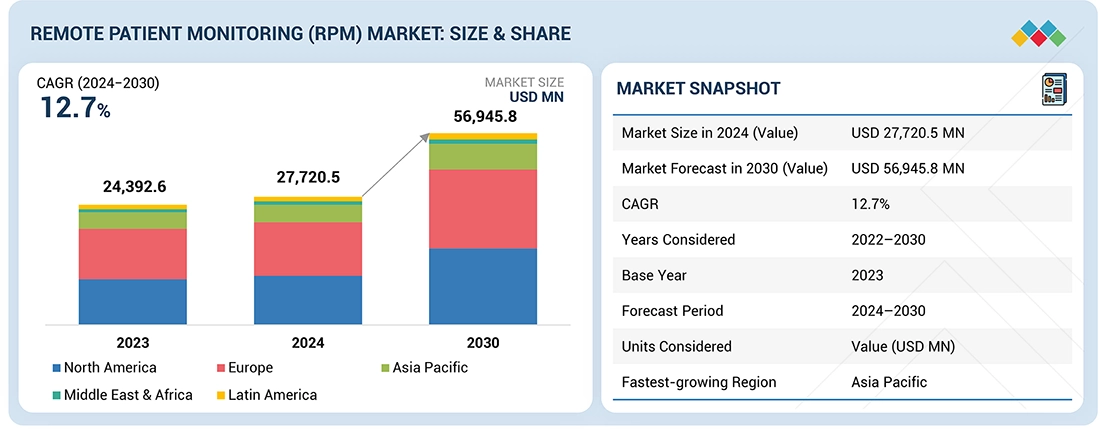

By RegionThe region segment which includes north america, europe, asia-pacific, latin amrica, middle east and africa. asia-pacific region is expected to witness the fastest growth in the Liquid handing system market. The north america region is experiencing strong growth due to the rising investments in healthcare infrastructure, food safety compliance, and cold-chain logistics coupled with increasing adoption of digital monitoring technologies are driving demand for temperature monitoring systems in the region. The North America Temperature monitoring systemsmarket dominated, with a share of 36.6% in 2024

-

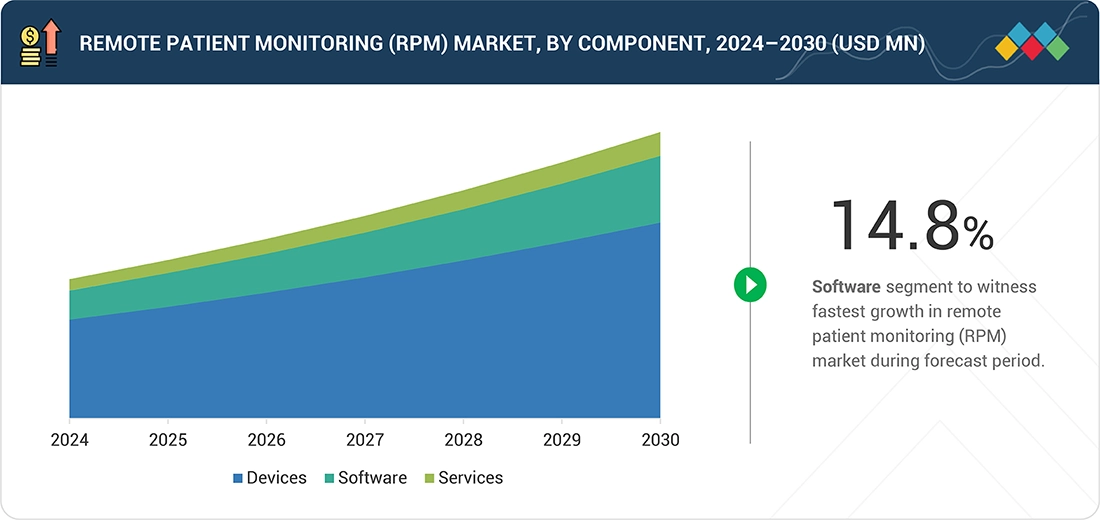

By ProductTemperature monitoring systems market is segmented into monitoring systems and software & service. The monitoring system segment is further divided into analog and digital systems. Whereas the software & service segment is segmented into data management and monitoring solutions, predictive analytics, maintenance & calibration services and other software & services. During the forecast period, monitoring systems is expected to dominate the temperature monitoring systems market

-

By TypeThe temperature monitoring systems market is segmented into contact-based and non-contact-based temperature monitoring systems. The contact-based temperature monitoring systems is further divided into conventional temperature monitoring systems, temperature measuring strips and labels, and wireless temperature monitoring systems. Meanwhile, the non-contact-based temperature monitoring systems is further divided into into pyrometers and infrared thermometers, thermal imagers, and fiber optic thermometers. Throughout the forecast period, the contact-based temperature monitoring systems segment is projected to claim the leading position in the market

-

By ApplicationThe temperature monitoring systems market is segmented into hospital room and patient monitoring, manufacturing area monitoring, cold storage monitoring, laboratory monitoring, server room monitoring, greenhouse monitoring and home care monitoring. During the forecast period, the cold storage monitoring sector is poised to command the most substantial market share in the temperature monitoring systems market. This dominance is fueled by the increasing adoption and the efficacy of temperature monitoring of cold storage for vaccine, drugs & food products storage and supply

-

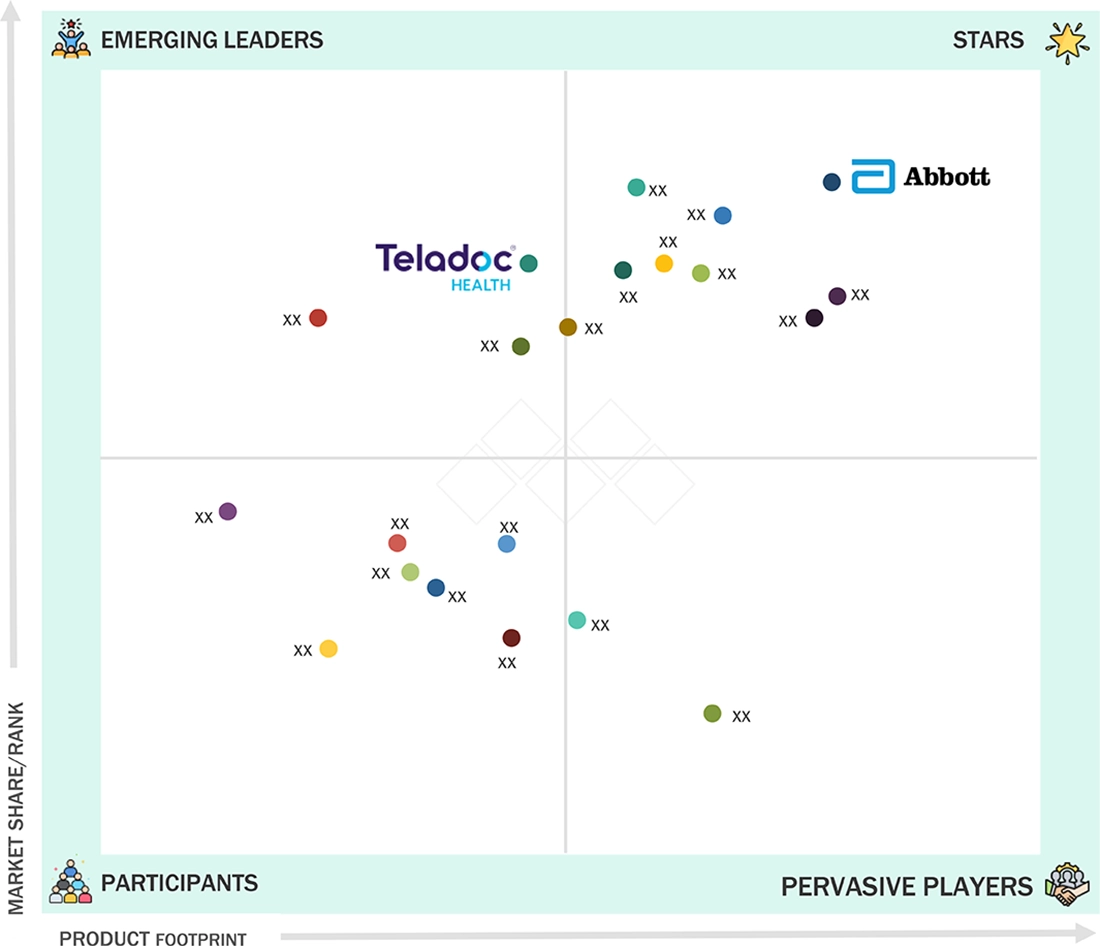

COMPETITIVE LANDSCAPEBaxter, Vaisala, and Fortive, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The market is rapidly evolving toward automation, digitization, and predictive monitoring. IoT-enabled temperature monitoring devices with Bluetooth and Wi-Fi connectivity are becoming the norm across biopharma manufacturing, diagnostic laboratories, and clinical trial logistics. Wireless sensors capable of real-time alerts and compliance logging are replacing conventional manual checks. Additionally, the integration of temperature data with quality management and LIMS systems is enhancing traceability and audit readiness. The increasing adoption of AI and data analytics for anomaly detection and predictive maintenance is another transformative trend reshaping customer expectations.

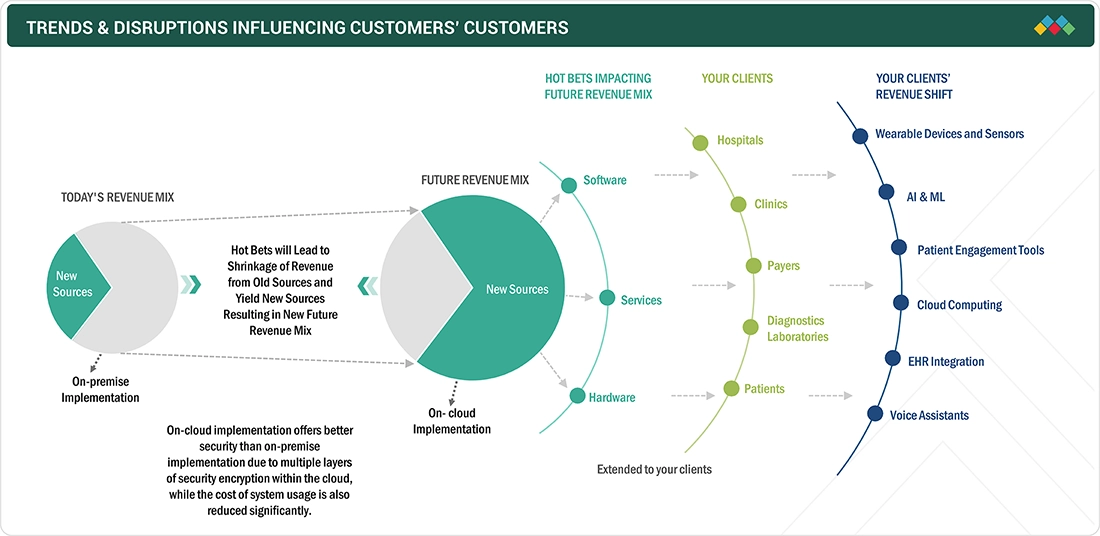

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

End users are facing a shift from reactive to proactive compliance management. Disruptions such as the rise of connected cold-chain ecosystems, blockchain-enabled traceability, and digital twins for environmental control are redefining the temperature monitoring paradigm. Pharmaceutical and biotech manufacturers are adopting smart monitoring solutions that ensure GxP compliance and data integrity under FDA 21 CFR Part 11 and EU Annex 11 regulations. Meanwhile, the logistics sector is embracing real-time tracking to minimize spoilage and wastage, especially for biologics, vaccines, and precision medicine shipments. These disruptions are compelling customers to re-evaluate legacy systems and prioritize digital continuity and remote oversight.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of secondary manufacturing sector

-

Rising safety standards for temperature-sensitive industries

Level

-

High prices of advanced products and installation costs in emerging economies

Level

-

Increasing adoption of IoT and AI technologies

-

High focus on medical tourism in emerging economies

Level

-

Technical Limitations in infrared and mercury thermometers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising safety standards for temperature-sensitive industries

The food & beverage and pharmaceutical sectors are among the most strictly regulated manufacturing industries due to their direct impact on public health and safety. In these temperature-sensitive markets, the adoption of passive temperature-controlled packaging has surged to meet stringent quality and safety requirements, driven by increasing demand for temperature-regulated transportation in biotechnology, pharmaceuticals, chemicals, and food applications. Regulatory authorities such as the US FDA, WHO, MHRA, and other regional agencies enforce rigorous standards to ensure pharmaceutical products retain their identity, strength, quality, purity, and potency throughout production and distribution. Food safety regulations likewise place strong emphasis on maintaining appropriate temperatures to prevent contamination and spoilage. Key regulatory frameworks include: US FDA CFR 21: Requires pharmaceutical manufacturing, storage, processing, and packaging facilities to maintain adequate temperature control. WHO guidelines: Recommend storing medicines in dry, ventilated areas at 15–25°C, or up to 30°C depending on local climate. MHRA (UK): Mandates that pharmaceutical storage facilities meet defined temperature-control standards to ensure product quality.

Restraint: High prices of advanced products and installation costs in emerging economies

Advanced temperature monitoring devices equipped with high-performance features can cost up to USD 1,000 or more, making them challenging to adopt for small and medium-sized manufacturers in both developed and emerging markets. Due to limited budgets, these users often opt for basic, lower-cost systems, which restrains the uptake of sophisticated monitoring technologies. Budget limitations are also common in hospitals and healthcare facilities, where the adoption of continuous and automated temperature monitoring systems is hindered by high purchasing, maintenance, and training expenses—posing significant barriers for smaller healthcare units. In addition, industries like pharmaceuticals, food processing, and chemicals require precise temperature control to meet quality and regulatory standards, but the high installation and infrastructure costs for wired and advanced non-contact systems continue to impede broader deployment. For example, thermal imaging systems used for infrared temperature measurement can be particularly expensive, with high-performance lenses alone costing up to USD 50,000 in long-range surveillance applications

Opportunity: Increasing adoption of IoT and AI technologies .

The adoption of IoT-enabled temperature monitoring solutions has revolutionized the cold-chain logistics landscape by enabling continuous, real-time visibility, automated alerts, and advanced data analytics, significantly boosting system uptake across industries. Artificial intelligence (AI) and machine learning (ML) further accelerate this shift by enabling predictive insights, automated decision-making, and rapid response to temperature excursions—for instance, by adjusting cooling systems, triggering automated alerts, and rerouting shipments when needed. As of 2024, nearly half of healthcare leaders report using AI for in-hospital monitoring, with the vast majority planning to expand investment, reflecting strong confidence in the technology's value. In pharmaceutical supply chains, AI-powered solutions enhance cold-chain resilience by predicting risk events, optimizing delivery routes, reducing spoilage, and ensuring regulatory compliance for high-value vaccines, biologics, and cell- and gene-therapy products. Additionally, integration with blockchain for secure data traceability, 5G networks for faster connectivity, and edge computing for immediate on-site processing is further elevating accuracy and reliability, strengthening the role of intelligent temperature monitoring in global safety-critical logistics

Challenge: Technical Limitations in infrared and mercury thermometers

This lack of accuracy is a major concern associated with using infrared (IR) thermometers, as they only measure the surface temperature and not the internal temperature and readings can vary based on emissivity. By sensing the energy in the ear, infrared thermometers can produce readings of the corresponding body temperature. However, infrared thermometers can temporarily be affected by moisture, dust, frost, fog, smoke, or other particles in the air. Further, it could be temporarily affected by proximity to a radio frequency with an electromagnetic field strength of three volts per meter or greater, being not an ideal choice for the semiconductor & electronics industry. Readings may be affected due to the near ambient temperatures and temperature interference of the person holding the thermometer. Such low readings from the device could mislead authorized persons to take further actions during different processes. Similarly, mercury thermometers used for patient monitoring are encased in glass to measure the patient’s body temperature. Mercury thermometers are unable to perform in low temperatures. Further, due to a high freezing point, i.e., -40 degrees, mercury is poisonous; this could be hazardous if the bulb breaks and mercury leaks out. Mercury is a neurotoxic metal that can adversely affect the human body. Environmental concerns regarding the use of mercury; slow response time; a lack of automation; the capability of recording only intermittent readings; the fragile, toxic, and rigid nature of thermometers; and the risk of injuries and cross-infections are some major issues associated with the use of mercury thermometers. These issues have reduced the demand for mercury thermometers over the last few years. Additionally, the high maintenance requirements for these easily breakable thermometers, coupled with the low freezing point of mercury as compared to alcohol thermometers, limit the demand for mercury thermometers, particularly in colder regions

Temperature Monitoring Systems Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Post-operative: Monitor patients in recovery for temperature fluctuations and ensure normothermia | Continuous and accurate: Provides real-time temperature readings with minimal bias (less than ~0.23 °C compared to pulmonary artery catheter) |

|

Continuous monitoring of refrigerated pharmaceuticals during transport or storage | Reduces product spoilage and waste by providing early warnings when temperature drifts outside safe range |

|

Remote monitoring of medical device storage environments with alarms when conditions drift | Helps ensure regulatory compliance (e.g., for vaccines, pharmaceuticals) with minimal manual intervention |

|

Monitoring refrigerator/freezer temperatures in a laboratory environment to ensure biological samples stay within safe limits | Provides accurate, NIST-traceable readings with programmable alarms so temperature excursions are detected promptly |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

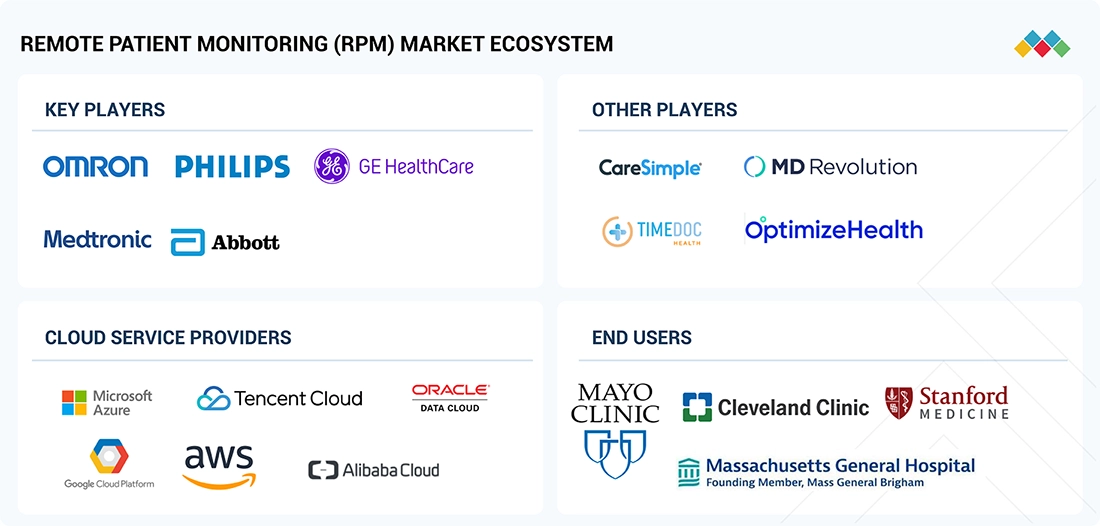

MARKET ECOSYSTEM

The temperature monitoring systems ecosystem includes hardware providers (sensors, data loggers, transmitters), software and analytics vendors (cloud dashboards, IoT platforms), service providers (installation, calibration, validation), and regulatory and logistics partners. Key players collaborate with pharma cold chain operators, healthcare facilities, and industrial distributors to offer integrated temperature assurance solutions. The ecosystem is increasingly shifting toward partnerships between device OEMs and software companies to deliver end-to-end visibility and compliance automation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Temperature Monitoring Systems Market, By Product

Among product types, wired and wireless sensors account for the largest market share due to their extensive use in laboratories, hospitals, and manufacturing environments for continuous monitoring. Wireless sensors dominate the growth segment, driven by ease of deployment, scalability, and compatibility with cloud-based dashboards. Data loggers and smart thermometers are gaining traction for in-transit monitoring and point-level temperature validation.

Temperature Monitoring Systems Market, By Type

By type, contact-based monitoring systems currently lead the market, offering high precision and established regulatory acceptance in pharma and biotech industries. However, non-contact infrared and thermal imaging systems are witnessing rapid adoption in industrial process monitoring and warehouse automation due to their ability to detect temperature variations across large surfaces without direct contact.

Temperature Monitoring Systems Market, By Application

Temperature monitoring systems market is segmented into hospital room and patient monitoring, manufacturing area monitoring, cold storage monitoring, laboratory monitoring, server room monitoring, greenhouse monitoring and home care monitoring. During the forecast period, the cold storage monitoring sector is poised to command the most substantial market share in the temperature monitoring systems market. This dominance is fueled by the increasing adoption and the efficacy of temperature monitoring of cold storage for vaccine, drugs & food products storage and supply.

REGION

North America to be fastest-growing region in global aerospace materials market during forecast period

North America is the largest regional market, driven by strong regulatory frameworks (FDA, CDC, USP), early adoption of digital cold chain monitoring, and the dominance of major pharma manufacturers. Asia Pacific (APAC) is the fastest-growing region, propelled by expanding vaccine manufacturing in India and China, the rise of pharmaceutical exports, and government-backed cold chain infrastructure investments. Increasing adoption of cloud-based monitoring platforms by regional healthcare providers and logistics players further accelerates growth in APAC.

Temperature Monitoring Systems Market: COMPANY EVALUATION MATRIX

The competitive landscape is moderately consolidated, with leading players such as Thermo Fisher Scientific, Sensitech (Carrier), DeltaTrak, Testo, Emerson Electric, Siemens, Vaisala, ELPRO, and Tek Troniks focusing on product innovation, wireless integration, and data-driven service models. Emerging players are differentiating through AI-based analytics, blockchain traceability, and subscription-based monitoring solutions. The evaluation matrix highlights a clear shift toward software-centric and predictive monitoring capabilities, where players offering seamless integration with enterprise systems are gaining competitive advantage.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.15 Billion |

| Market Forecast in 2030 (Value) | USD 5.65 Billion |

| Growth Rate | CAGR of 5.3% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

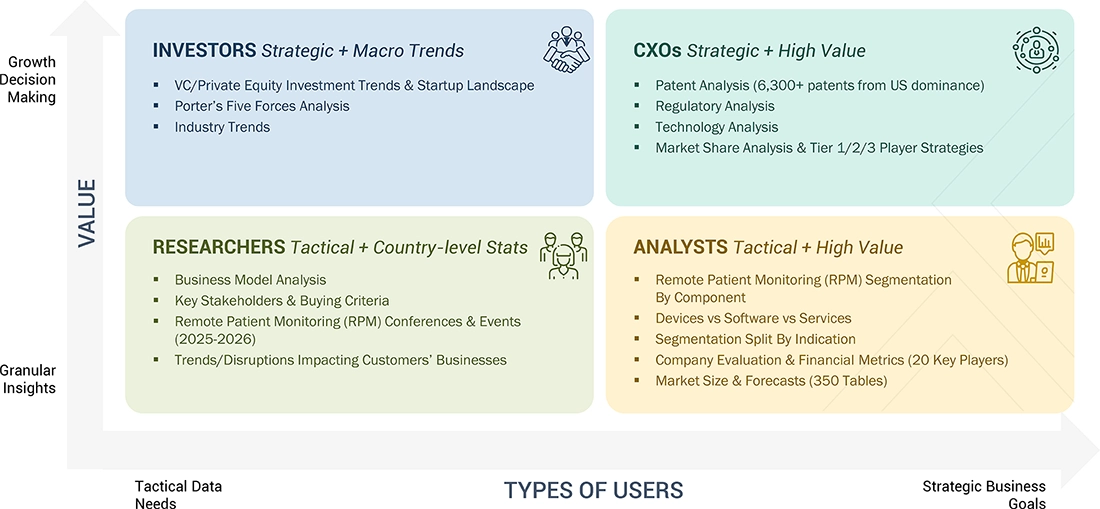

WHAT IS IN IT FOR YOU: Temperature Monitoring Systems Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Industry-specific temperature monitoring insights, technology benchmarking, and regulatory guidance | Tailored market models, segmentation refinements, and regional compliance analysi | Data-driven investment decisions, optimized product strategy, and accelerated market entry with regulatory confidence |

| Competitive landscape assessment, end-user demand trends, and pricing intelligence for temperature monitoring solutions | Customized competitor matrices, targeted end-user surveys, and price-sensitivity analysis | Enhanced go-to-market strategy, differentiated product positioning, and improved revenue forecasting |

RECENT DEVELOPMENTS

- August 2024 : ABB launched an enhanced version of its NINVA TSP341-N non-invasive temperature sensor.

- May 2024 : 3M expanded its facility in Valley, Nebraska, increasing the plant's manufacturing capacity

- May 2024 : ABB established a new USD 20.8 Mn (20 million Euro) energy-efficient factory in Belgium.

- October 2023 : Emerson Electric acquired NI, a leading provider of software-connected automated test and measurement systems

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

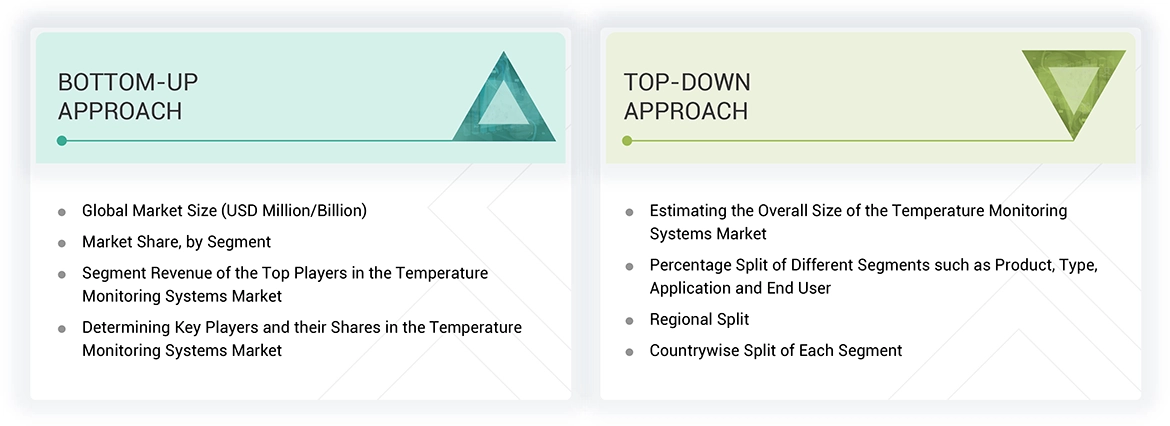

This study involved the extensive use of both primary and secondary sources. Exhaustive secondary research was done to collect information on the temperature monitoring systems industry. The next step was to validate these findings, assumptions and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up where employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the temperature monitoring systems market. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the temperature monitoring systems market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

The market for the companies offering temperature monitoring systems is arrived at by secondary data available through paid and unpaid sources analysing the product portfolios of the major companies in the ecosystem and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study full. The secondary research was used to obtain critical information on the industries value chain, the total pool of key players, market classification and segmentation from the market and technology oriented perspectives.

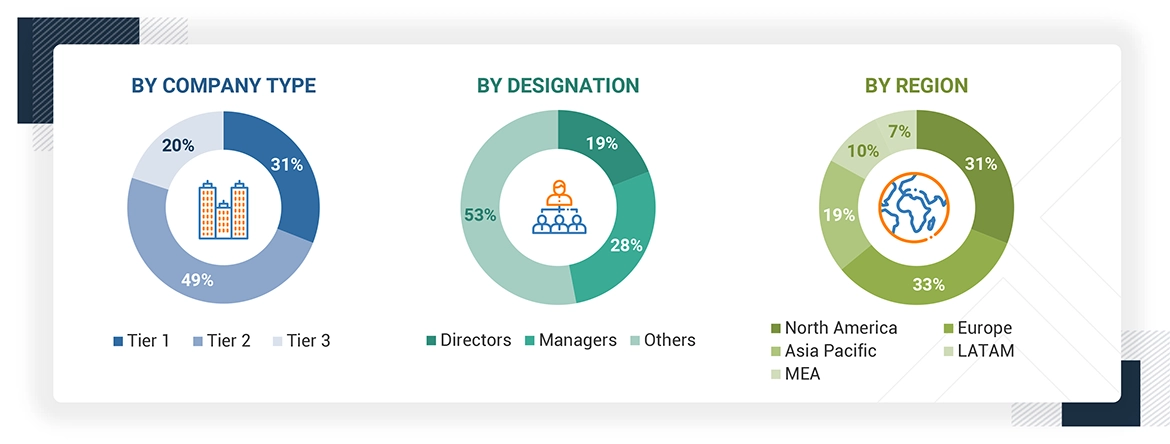

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the temperature monitoring systems market. The primary sources from the demand side include OEMs, private and contract testing organizations and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

After the complete market engineering (calculations for market statistics, market breakdown, market estimation, market forecasting and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at fill primary research was also conducted to identify the segmentation types industry trends competitive landscape of temperature monitoring systems offered by various market players and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends and key players strategies.

In the complete market engineering process, the top down and bottom up approaches were extensively used along with several data regulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/ insights through the report.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the lab consumable market. These methods were also used extensively to estimate the size of various segments in the market.

To determine the size of the global temperature monitoring systems market, revenue share analysis was employed in relation to the leading players. In this case, key players in the market have been identified, with their temperature monitoring systems, business revenues determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of top market players' annual and financial reports. On the other hand, primary research incorporated in-depth interviews with key opinion leaders, in particular, chief executive officers, directors, and key marketing executives.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global temperature monitoring systems market was split into segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the temperature monitoring systems market was validated using both top-down and bottom-up approaches.

Market Definition

Temperature monitoring systems are instruments or devices used to measure and monitor temperature during various processes such as product manufacturing, storage, and transportation across various industries. The scope of the report also covers products that are used to monitor patient temperatures in healthcare settings.

Stakeholders

- Temperature monitoring system manufacturing companies

- Product distributors, suppliers, and channel partners

- Medical device manufacturing companies

- Pharmaceutical and biotechnology companies

- Chemical and petrochemical manufacturers

- Energy and power generation companies

- Food and beverage product manufacturers

- Healthcare service providers

- Blood banks, tissue banks, diagnostic labs, and IVF clinics

- National and international regulatory authorities

- Public/private organizations and industry associations

- Research laboratories and academic institutes

Report Objectives

- To define, describe, and forecast the temperature monitoring systems market on the basis of on product, type, application, end user and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global temperature monitoring systems market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global temperature monitoring systems market.

- To analyze key growth opportunities in the global temperature monitoring systems market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, Nordic Region and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East and Africa (GCC Countries and Rest of MEA).

- To profile the key players in the global temperature monitoring systems market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global temperature monitoring systems market, such as agreements, expansions, and product launches.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Temperature Monitoring Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Temperature Monitoring Systems Market