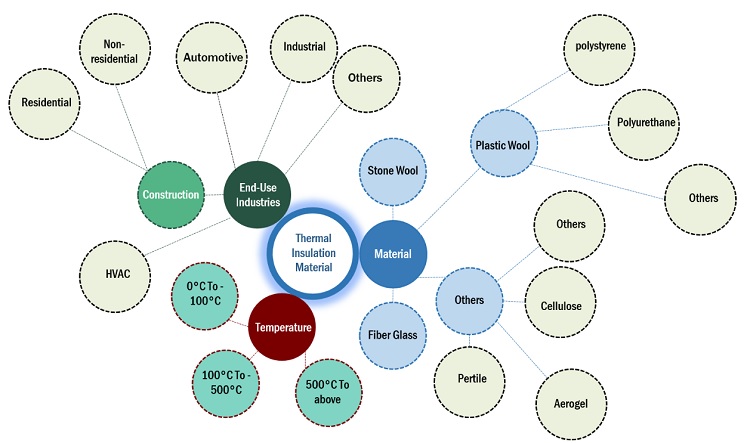

Thermal Insulation Material Market by Material Type (Fiberglass,Stone Wool,Foam,Wood Fiber), Temperature range (0-100 ℃, 100-500 ℃, 500 ℃ and above), End use industry (Construction,Automotive,HVAC,Industrial), and Region - Global Forecast to 2028

Thermal Insulation Material Market

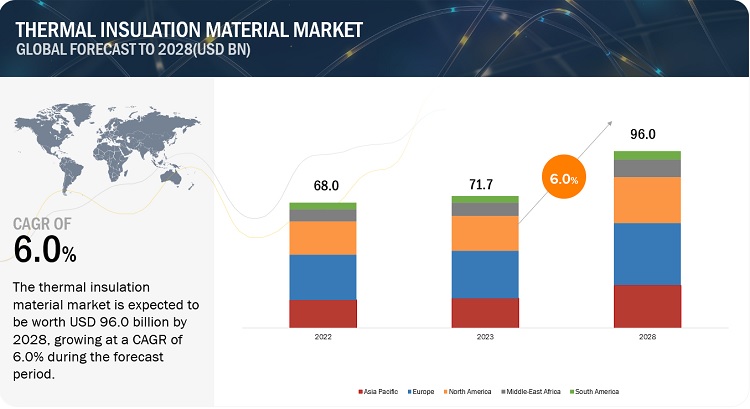

The global thermal insulation material market is valued at USD 71.7 billion in 2023 and is projected to reach USD 96.0 billion by 2028, growing at 6.0% cagr during forecast period. The market is mainly led by the significant usage of thermal insulation material in various end-use industries. The growing demand for noise reduction, indoor air quality and governmental initiatives and energy regulations are driving the market for thermal insulation material.

ATTRACTIVE OPPORTUNITIES IN THE THERMAL INSULATION MATERIAL MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

Thermal Insulation Material Market Dynamics

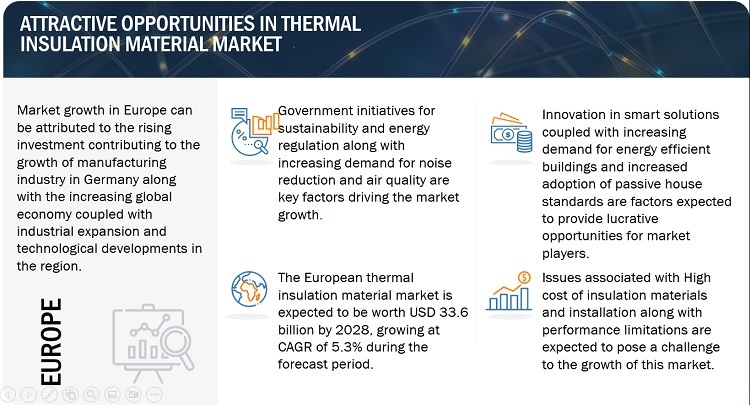

Driver: Government initiatives for sustainability and energy regulations along with the increasing demand for noise reduction and indoor air quality

Government initiatives to promote the construction of green buildings are rising globally due to the pressing need to reduce greenhouse gas emissions and conserve natural resources. Building construction and operation account for a considerable share of energy consumption and greenhouse gas emissions, making the promotion of green buildings critical for reaching sustainability goals. The increased demand for noise reduction is also propelling the thermal insulation material market forward. Thermal insulation materials reduce noise transmission through walls, floors, and ceilings, making them a vital component in soundproofing applicationsThere is an increased focus on indoor air quality which may further aid the expansion of the thermal insulation material industry. As individuals become increasingly concerned about indoor air quality, there may be a larger demand for thermal insulation materials that might aid in the creation of a healthier interior environment.Energy efficiency standards can assist property owners and occupants in lowering their energy bills. Buildings use less energy to heat and cool when energy consumption is reduced, resulting in cheaper energy bills. This can be especially advantageous for low-income homes and companies dealing with high energy expenditures.

Restraint: Availability of green insulating materials and building codes and regulations coupled with the health concerns for adopting the thermal insulating materials.

The availability of green insulation materials can be a restraining factor for the thermal insulation material market since it can shift consumer demand away from traditional insulation materials. As more customers become aware of the environmental impact of construction and the benefits of sustainable building solutions, demand for green insulation materials may increase, while demand for standard insulating materials may decline.The market for thermal insulation materials may be constrained by building rules and regulations. This is due to the fact that building standards and regulations frequently stipulate particular amounts of thermal insulation in new construction or restoration projects, which might restrict the kinds of insulation materials that can be utilized.

In addition to that certain thermal insulation materials include hazardous substances or fibers that could be hazardous to the health of building inhabitants and employees

Opportunity: Innovation in smart solutions coupled with increasing demand for energy efficient buildings and increased adoption of passive house standards.

The market for thermal insulation materials has a sizable opportunity due to innovations in smart insulation. Smart insulation materials are well-positioned to fill this need and gain market share as the need for energy-efficient and sustainable building practices keeps rising.

The market for thermal insulation materials has a substantial opportunity as passive home standards are increasingly adopted. A building's energy consumption can be decreased by minimizing heat loss and optimizing heat intake by passive methods, such as solar radiation and internal heat sources, according to a set of energy efficiency guidelines called "passive house standards."This provides a big opportunity for the thermal insulation material industry to gain market share while developing new and innovative insulation materials that meet the specific requirements of passive house design.

The increasing adoption of energy-efficient buildings represents a huge opportunity for the thermal insulation material industry, both in new construction and retrofitting of existing structures, and throughout the residential, commercial, and industrial sectors

Challenge: High cost of insulation materials and installation along with performance limitations.

High insulation material and installation costs might provide a substantial barrier to the thermal insulation material market. High-quality thermal insulation materials can be costly to manufacture, increasing the cost to customers. Furthermore, the installation of insulation necessitates professional workers, which might raise the cost. The expense of insulating materials and installation might be especially difficult for large buildings or retrofitting older structures.

Performance limitations are an important element that can limit the growth of the thermal insulation material industry. Thermal insulation materials are generally used in buildings to reduce heat transfer and boost energy efficiency. Yet, some materials may have performance constraints that limit their usefulness and limit their market acceptance. The temperature range of some thermal insulation materials is one of their key restrictions.

Thermal Insulation Material Market Ecosystem

A market ecosystem refers to the interconnected network of individuals, businesses, and other organizations participating in a particular market. It includes various stakeholders such as producers, distributors, retailers, customers, and regulatory bodies that interact with each other to exchange goods, services, and information. Prominent companies in the market are the ones who are well-established and financially stable and have state-of-the-art technologies and a strong global marketing network and sales record. Some of the key players in this market are Saint Gobain SA(France),Kingspan Group(Ireland),Rockwool International A/S (Denmark),Owens Corning(US),Knauf Insulation(US), BASF SE(Germany), Asahi Kasei Corporation(Japan), Recticel(Belgium), GAF Material Corporation(US),Evonik(Germany),

"Fiberglass is the largest material type for thermal insulation material in 2022, in terms of value"

Fiberglass is a versatile and popular material that has numerous benefits in various applications. It is also highly resistant to corrosion and extreme weather conditions, making it a good choice for use in harsh environments. Other benefits of fiberglass include its insulation properties, fire resistance, and low maintenance requirements. Because of these benefits, fiberglass is widely used in industries such as construction, automotive, aerospace, marine, and more.

"Construction was the largest end-use industry for thermal insulation material market in 2022, in terms of value"

The largest end-use market for thermal insulation materials, representing a sizeable portion of the market, is the construction industry. The introduction of thermal insulation materials in the construction sector has been prompted by the growing demand for energy-efficient buildings and the need to lower carbon emissions. These materials offer an affordable way to lower heat loss, maintain cosy inside temperatures, and improve building toughness. Stringent building codes and regulations across the globe have mandated the use of thermal insulation materials in new constructions and building renovations, further fueling market growth. Moreover, the availability of a wide range of insulation materials suitable for different applications, such as walls, roofs, and floors, has also boosted the adoption of thermal insulation materials in the construction sector.

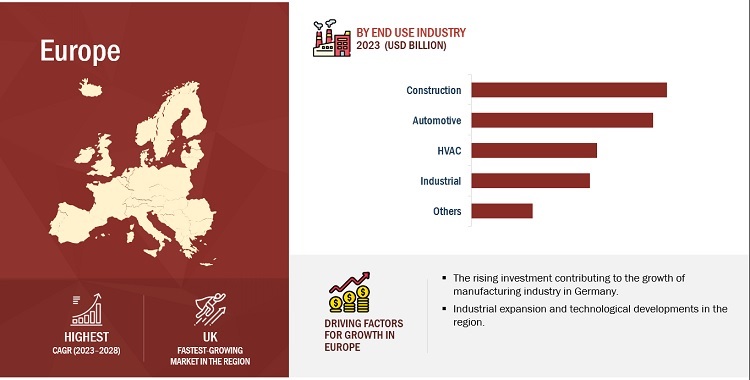

"Europe was the largest market for thermal insulation material in 2022, in terms of value."

Europe was the largest market for the global thermal insulation material market, in terms of value, in 2022. UK is the largest market in Europe. It is projected to witness the highest growth during the forecast period considering UK has a strong industry for thermal insulated products, such as insulation for buildings and refrigeration units. This sector is particularly important in reducing the country's carbon footprint and achieving its climate change goals. Companies operating in the thermal insulation sector include Kingspan, Armacell, and Recticel. These companies provide a range of insulation products for buildings, refrigeration units, and other applications, which can help reduce energy consumption and carbon emissions.

To know about the assumptions considered for the study, download the pdf brochure

Thermal Insulation Material Market Players

The key players in this market Saint Gobain SA (France), Kingspan Group (Ireland), Rockwool International A/S (Denmark), Owens Corning (US), Knauf Insulation (US), BASF SE (Germany), Asahi Kasei Corporation (Japan), Recticel (Belgium), GAF Material Corporation (US), Evonik (Germany). Continuous developments in the market —including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of thermal insulation materials have opted for new product launches to sustain their market position.

Thermal Insulation Material Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 71.7 billion |

|

Revenue Forecast in 2028 |

USD 96.0 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

Material, Temperature, End-use industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Saint Gobain SA(France),Kingspan Group(Ireland),Rockwool International A/S (Denmark),Owens Corning(US),Knauf Insulation(US), BASF SE(Germany), Asahi Kasei Corporation(Japan), Recticel(Belgium), GAF Material Corporation(US),Evonik(Germany), |

This report categorizes the global thermal insulation material market based on material type, temperature range,end use industry and region.

On the basis of material type, the thermal insulation material market has been segmented as follows:

- Fiberglass.

- Stone Wool

- Foam.

- Wood Fiber.

- Others.

On the basis of temperature range, the thermal insulation material market industry has been segmented as follows:

- 0-100 °C.

- 100-500°C.

- 500°C and above.

On the basis of end use industry, the thermal insulation material market has been segmented as follows:

- Construction.

- Automotive.

- HVAC.

- Industrial.

- Others.

On the basis of region, the thermal insulation material market industry has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2023 Saint-Gobain and Dalsan have obtained the necessary approval from competition authorities to merge their plaster and plasterboard activities in Turkey.

- In February 2023 Saint-Gobain has entered into a definitive agreement to acquire U.P. Twiga Fiberglass Ltd. (UP Twiga), the leader on the glass wool insulation market in India.

- In February2022, Kingspan Group completed its acquisition of THU PERFIL SL, the Valencian firm specializing in metal ceiling profiles. THU has decades of experience in ceilings, roofing, drywall, and partition profile manufacturing.

- In March 2022 Knauf insulation officially opened a new Glass Mineral Wool thermal insulation recycling facility with an investment of USD 12.5 million in Vise, Belgium, paving the way for an exciting new recycling service for the construction and deconstruction industry.

- In July 2021, Asahi Kasei announced that it had completed the acquisition of Sage Automotive Interiors, a leading provider of automotive interior materials. The acquisition is expected to strengthen Asahi Kasei's position in the global automotive market.

- In June 2021, Rockwool International A/S expanded its business by building a new production facility in Soissons, France. The new facility created 130 jobs and uses low-carbon electric melting technology to produce stone wool insulation for the French market.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the Thermal insulation material market?

This study's forecast period for the thermal insulation material market is 2023-2028. The market is expected to grow at a CAGR of 6.0%, in terms of value, during the forecast period.

Who are the major key players in the thermal insulation material market?

The key players in this market Saint Gobain SA(France),Kingspan Group(Ireland),Rockwool International A/S (Denmark),Owens Corning(US),Knauf Insulation(US), BASF SE(Germany), Asahi Kasei Corporation(Japan), Recticel(Belgium), GAF Material Corporation(US), Evonik(Germany).

What are the major regulations of the thermal insulation material market in various countries?

Environmental protection agencies of different countries have laid down certain energy regulations and initiatives for sustainable development

What are the drivers and opportunities for the thermal insulation material market?

Government initiatives for sustainability and energy regulations along with the increasing demand for noise reduction and indoor air quality and the oppertunities being innovation in smart solutions coupled with increasing demand for energy efficient buildings and increased adoption of passive house standards

Which are the key technology trends prevailing in the thermal insulation material market?

The one of the key technology trends is the XPS (extruded polystyrene foam technology) which is a thermal insulation board made of extruded polystyrene that has a smooth surface to prevent thermal bridges from forming. It is frequently used in construction, automotive, HVAC, and industrial applications due to its strong thermal resistance.

Another one is ECOSE technology , which is a ground-breaking, brand-new formaldehyde-free binder technology that relies on quickly renewable resources rather than chemicals derived from petroleum. It produces improved environmental sustainability while reducing embodied energy. ECOSE Technology was created for rock mineral wool and glass. This is currently being successfully implemented throughout Europe and North America, giving improved product performance along with a significant improvement in sustainability.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Government initiatives for green building projects- Increased use of green and sustainable materials for noise control in buildings- Strong focus on maintaining good indoor air quality- Stringent energy efficiency policiesRESTRAINTS- Easy availability of substitute green insulating materials- Building codes and regulations pertaining to specifications of insulation materials- Health concerns related to some thermal insulation materialsOPPORTUNITIES- Innovations in insulation materials and techniques- Adoption of passive house standards- Focus on constructing energy-efficient buildingsCHALLENGES- High material and installation costs- Performance limitation issues associated with certain insulation materials

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREATS OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 COVID-19 IMPACT

- 6.2 PRICING ANALYSIS

-

6.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS/CONSUMERS

-

6.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.5 THERMAL INSULATION MATERIAL MARKET REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.6 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN THERMAL INSULATION MATERIAL MARKET

-

6.8 ECOSYSTEM/MARKET MAP

-

6.9 TECHNOLOGY ANALYSISXPS FOAM TECHNOLOGYECOS TECHNOLOGY

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.11 PATENT ANALYSISINTRODUCTIONAPPROACHDOCUMENT TYPE- Patent statusLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS OF PATENTSTOP 10 PATENT OWNERS (US) IN LAST FIVE YEARS

- 6.12 KEY CONFERENCES AND EVENTS, 2023–2024

- 7.1 INTRODUCTION

-

7.2 STONE WOOLBOOMING CONSTRUCTION AND ARCHITECTURAL FIELDS TO DRIVE DEMAND FOR STONE WOOL

-

7.3 FIBERGLASSRISING USE OF FIBERGLASS IN INDUSTRIAL APPLICATIONS REQUIRING HIGH STRENGTH TO PROPEL MARKET

-

7.4 PLASTIC FOAMLONG-DISTANCE TRANSPORT OF FRAGILE GOODS TO INCREASE DEMAND FOR PLASTIC FOAM IN PACKAGING INDUSTRYPOLYSTYRENE FOAM- Extruded polystyrene foam (XPS)- Expanded polystyrene foam (EPS)POLYURETHANE (PUR) AND POLYISOCYANURATE (PIR) FOAMOTHER PLASTIC FOAM MATERIALS

-

7.5 WOOD FIBERINCREASING USE OF BIO-BASED MATERIALS IN INDUSTRIAL APPLICATIONS TO DRIVE REQUIREMENT FOR WOOD FIBER

-

7.6 OTHER MATERIALSPERLITEAEROSOLCELLULOSECERAMIC

- 8.1 INTRODUCTION

-

8.2 CONSTRUCTIONURGENT NEED TO REDUCE CARBON EMISSIONS AND OPTIMIZE BUILDING ENERGY TO DRIVE MARKETRESIDENTIAL- Wall insulation- Floor insulation- Roof insulationNON-RESIDENTIAL- Wall insulation- Floor insulation- Wall insulation

-

8.3 AUTOMOTIVEGROWTH IN EV PRODUCTION TO BOOST DEMAND FOR THERMAL INSULATION MATERIALS

-

8.4 HVACMIDDLE EAST & AFRICA TO CONTRIBUTE MOST TO THERMAL INSULATION MATERIAL MARKET GROWTH IN HVAC SEGMENT

-

8.5 INDUSTRIALINCREASING NEED TO SAVE ENERGY AND REDUCE CARBON EMISSIONS TO STIMULATE GROWTH

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 0 TO 100°CUSE OF 0 TO 100°C THERMAL INSULATION MATERIALS TO IMPROVE ENERGY EFFICIENCY AND SAFETY IN INDUSTRIAL SETUP TO PROPEL MARKET

-

9.3 101 TO 500°CINDUSTRIALIZATION TRENDS IN DEVELOPING COUNTRIES TO BOOST DEMAND FOR THERMAL INSULATION MATERIALS ABLE TO WITHSTAND 101 TO 500°C

-

9.4 >500°CGROWTH OF LARGE-SCALE INDUSTRIES TO DRIVE SEGMENTAL GROWTH

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Rapid adoption of energy-efficient systems to boost demand for thermal insulation materialsJAPAN- Government investments in carbon emission reduction projects to boost requirement for thermal insulation materialsINDIA- Development of green buildings to accelerate market growthSOUTH KOREA- Government initiatives to promote use of energy-efficient products to fuel marketREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Hike in private construction sites to stimulate marketCANADA- Sustainable developments in commercial and residential construction sector to drive marketMEXICO- Investments by pharma players to develop innovative medical equipment to boost demand for thermal insulation materials

-

10.4 MIDDLE EAST & AFRICARECESSION IMPACT ON MARKET IN MEASAUDI ARABIA- Government initiatives to promote green building practices to boost demand for thermal insulation materialsSOUTH AFRICA- Growing adoption of energy-efficient systems in construction industry to boost demand for thermal insulation materialsREST OF MIDDLE EAST & AFRICA

-

10.5 EUROPERECESSION IMPACT ON MARKET IN EUROPEGERMANY- Adoption of green building labeling systems to foster marketFRANCE- Growing residential projects to increase requirement for thermal insulation materialsSPAIN- Rising demand for thermal insulation materials from automotive industry to drive marketITALY- Government focus on upgrading guidelines for energy certification of buildings to create opportunities for playersUK- Prominent presence of Kingspan, Armacell, and Recticel companies to support market growthREST OF EUROPE

-

10.6 SOUTH AMERICARECESSION IMPACT ON MARKET IN SOUTH AMERICABRAZIL- Brazil to hold largest share of South American market throughout forecast periodARGENTINA- Development of new standards for building envelope design to promote use of thermal insulation materialsPERU- Government initiatives for green buildings to stimulate market growthREST OF SOUTH AMERICA

- 11.1 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2022

- 11.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

11.4 COMPETITIVE EVALUATION MATRIX/QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.5 STARTUPS/SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.6 COMPETITIVE BENCHMARKING

- 11.7 THERMAL INSULATION MATERIAL MARKET: COMPANY FOOTPRINT

- 11.8 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSSAINT-GOBAIN SA- Business overview- Products/Services/Solutions offered- MnM viewKINGSPAN GROUP- Business overview- Products/Services/Solutions offered- MnM viewROCKWOOL INTERNATIONAL A/S- Business overview- Products/Services/Solutions offered- MnM viewOWENS CORNING- Business overview- Products/Services/Solutions offered- MnM viewKNAUF INSULATION- Business overview- Products/Services/Solutions offered- MnM viewBASF SE- Business overview- Products/Services/Solutions offered- MnM viewASAHI KASEI CORPORATION- Business overview- Products/Services/Solutions offeredRECTICEL- Business overview- Products/Services/Solutions offeredGAF- Business overview- Products/Services/Solutions offeredEVONIK INDUSTRIES AG- Business overview- Products/Services/Solutions offered- Recent developments

-

12.2 OTHER KEY PLAYERSCOVESTRO AGHUNTSMAN INTERNATIONAL LLCJOHNS MANVILLEDOW CHEMICAL COMPANYBAYER AGE. I. DUPONT DE NEMOURS AND COMPANYASPEN AEROGELS, INC.CNBM GROUP CO. LTD.HOLCIM LTD.KCC CORPORATIONURSA INSULATIONSIKA GROUPCELLOFOAM NORTH AMERICA LIMITEDODE INSULATIONLLOYD INSULATIONS LIMITED

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 LIFESPAN OF INSULATION MATERIALS

- TABLE 2 THERMAL INSULATION MATERIAL MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 THERMAL INSULATION MATERIAL: AVERAGE SELLING PRICE TRENDS ANALYSIS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 GDP TRENDS AND FORECASTS FOR KEY COUNTRIES, 2019–2027

- TABLE 8 ADVANTAGES OF XPS FOAM TECHNOLOGY

- TABLE 9 ADVANTAGES OF ECOS TECHNOLOGY

- TABLE 10 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP 4 END-USE INDUSTRIES

- TABLE 11 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- TABLE 12 GRANTED PATENTS WERE 2% OF TOTAL COUNT IN LAST FIVE YEARS

- TABLE 13 PATENTS BY BASF SE

- TABLE 14 PATENTS BY AEROSPACE RESEARCH INSTITUTE OF MATERIALS & PROCESSING

- TABLE 15 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 16 THERMAL INSULATION MATERIAL MARKET SIZE, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 17 THERMAL INSULATION MATERIAL MARKET SIZE, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 18 THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 19 THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 20 THERMAL INSULATION MATERIAL MARKET SIZE, BY TEMPERATURE RANGE, 2019–2022 (USD MILLION)

- TABLE 21 THERMAL INSULATION MATERIAL MARKET SIZE, BY TEMPERATURE RANGE, 2023–2028 (USD MILLION)

- TABLE 22 THERMAL INSULATION MATERIAL MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 THERMAL INSULATION MATERIAL MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 25 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 27 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 28 CHINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 29 CHINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 30 JAPAN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 31 JAPAN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 INDIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 33 INDIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 34 SOUTH KOREA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 35 SOUTH KOREA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 36 REST OF ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 37 REST OF ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 US: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 43 US: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 44 CANADA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 45 CANADA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 MEXICO: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 47 MEXICO: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 48 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 51 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 52 SAUDI ARABIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 53 SAUDI ARABIA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 54 SOUTH AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 55 SOUTH AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 REST OF MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 57 REST OF MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 61 EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 GERMANY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 63 GERMANY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 64 FRANCE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 65 FRANCE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 66 SPAIN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 67 SPAIN: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 ITALY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 69 ITALY: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 70 UK: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 71 UK: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 73 REST OF EUROPE: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 74 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 77 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 78 BRAZIL: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 79 BRAZIL: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 ARGENTINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 81 ARGENTINA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 82 PERU: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 83 PERU: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 84 REST OF SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 85 REST OF SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 REVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THERMAL INSULATION MATERIAL MARKET

- TABLE 87 THERMAL INSULATION MATERIAL MARKET: DEGREE OF COMPETITION

- TABLE 88 THERMAL INSULATION MATERIAL MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 89 THERMAL INSULATION MATERIAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES FOR END-USE INDUSTRY

- TABLE 90 END-USE INDUSTRY: COMPANY FOOTPRINT

- TABLE 91 TYPE: COMPANY FOOTPRINT

- TABLE 92 TEMPERATURE RANGE: COMPANY FOOTPRINT

- TABLE 93 REGION: COMPANY FOOTPRINT

- TABLE 94 COMPANY FOOTPRINT

- TABLE 95 THERMAL INSULATION MATERIAL MARKET: PRODUCT LAUNCHES, JUNE 2019–APRIL 2022

- TABLE 96 THERMAL INSULATION MATERIAL MARKET: DEALS, APRIL 2019–JUNE 2022

- TABLE 97 SAINT-GOBAIN SA: BUSINESS OVERVIEW

- TABLE 98 SAINT-GOBAIN SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 99 SAINT-GOBAIN SA: DEALS

- TABLE 100 KINGSPAN GROUP: BUSINESS OVERVIEW

- TABLE 101 KINGSPAN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 102 KINGSPAN GROUP: DEALS

- TABLE 103 KINGSPAN GROUP: OTHERS

- TABLE 104 ROCKWOOL INTERNATIONAL A/S: BUSINESS OVERVIEW

- TABLE 105 ROCKWOOL INTERNATIONAL A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 106 ROCKWOOL INTERNATIONAL A/S: DEALS

- TABLE 107 ROCKWOOL INTERNATIONAL A/S: OTHERS

- TABLE 108 OWENS CORNING: BUSINESS OVERVIEW

- TABLE 109 OWENS CORNING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 KNAUF INSULATION: BUSINESS OVERVIEW

- TABLE 111 KNAUF INSULATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 112 KNAUF INSULATION: OTHERS

- TABLE 113 BASF SE: BUSINESS OVERVIEW

- TABLE 114 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 115 BASF SE: PRODUCT LAUNCHES

- TABLE 116 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- TABLE 117 ASAHI KASEI CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 118 ASAHI KASEI CORPORATION: DEALS

- TABLE 119 RECTICEL: BUSINESS OVERVIEW

- TABLE 120 RECTICEL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 RECTICEL: DEALS

- TABLE 122 RECTICEL: OTHERS

- TABLE 123 RECTICEL: PRODUCT LAUNCHES

- TABLE 124 GAF: BUSINESS OVERVIEW

- TABLE 125 GAF: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 126 GAF: PRODUCT LAUNCHES

- TABLE 127 EVONIK: BUSINESS OVERVIEW

- TABLE 128 EVONIK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 THERMAL INSULATION MATERIAL MARKET SEGMENTATION

- FIGURE 2 THERMAL INSULATION MATERIAL MARKET: RESEARCH DESIGN

- FIGURE 3 THERMAL INSULATION MATERIAL MARKET: DATA TRIANGULATION

- FIGURE 4 CONSTRUCTION INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE, IN TERMS OF VALUE, IN 2022

- FIGURE 5 0 TO 100°C SEGMENT ACCOUNTED FOR MAJOR SHARE OF THERMAL INSULATION MARKET, BY TEMPERATURE RANGE, IN TERMS OF VALUE, IN 2022

- FIGURE 6 FIBERGLASS SEGMENT ACCOUNTED FOR MAJORITY OF MARKET SHARE, BY MATERIAL TYPE, IN TERMS OF VALUE, IN 2022

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN THERMAL INSULATION MATERIAL MARKET DURING FORECAST PERIOD

- FIGURE 8 BOOMING CONSTRUCTION INDUSTRY TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 0 TO 100°C SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 CONSTRUCTION INDUSTRY ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 12 FIBERGLASS CAPTURED LARGEST MARKET SHARE IN 2022

- FIGURE 13 CONSTRUCTION AND CHINA ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN ASIA PACIFIC IN 2022

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: THERMAL INSULATION MATERIAL MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: THERMAL INSULATION MATERIAL MARKET

- FIGURE 16 VALUE CHAIN FOR THERMAL INSULATION MATERIALS

- FIGURE 17 EXPORT SCENARIO FOR HS CODE 680610 FOR KEY COUNTRIES, 2019–2022

- FIGURE 18 EXPORT SCENARIO FOR HS CODE 680690 FOR KEY COUNTRIES, 2019–2022

- FIGURE 19 IMPORT SCENARIO FOR HS CODE 680690 FOR KEY COUNTRIES, 2019–2022

- FIGURE 20 IMPORT SCENARIO FOR HS CODE 680610 FOR KEY COUNTRIES, 2019–2022

- FIGURE 21 REVENUE SHIFT OF THERMAL INSULATION MATERIAL PROVIDERS

- FIGURE 22 THERMAL INSULATION MATERIAL MARKET: ECOSYSTEM

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 4 END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- FIGURE 25 PATENTS REGISTERED FOR THERMAL INSULATION MATERIALS, 2017–2022

- FIGURE 26 PATENT PUBLICATION TRENDS FOR THERMAL INSULATION MATERIALS, 2017–2022

- FIGURE 27 LEGAL STATUS OF PATENTS FILED FOR THERMAL INSULATION MATERIALS

- FIGURE 28 HIGHEST NUMBER OF PATENTS FILED IN CHINA

- FIGURE 29 BASF REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2017 AND 2022

- FIGURE 30 THERMAL INSULATION MATERIAL MARKET, BY MATERIAL TYPE, 2022

- FIGURE 31 THERMAL INSULATION MATERIAL MARKET, BY END-USE INDUSTRY, 2022

- FIGURE 32 THERMAL INSULATION MATERIAL MARKET, BY TEMPERATURE RANGE, 2022

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR THERMAL INSULATION MATERIALS DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- FIGURE 36 MIDDLE EAST & AFRICA: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- FIGURE 37 EUROPE: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- FIGURE 38 SOUTH AMERICA: THERMAL INSULATION MATERIAL MARKET SNAPSHOT

- FIGURE 39 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN THERMAL INSULATION MATERIAL MARKET, 2022

- FIGURE 40 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- FIGURE 41 THERMAL INSULATION MATERIAL MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2022

- FIGURE 42 THERMAL INSULATION MATERIAL MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 43 SAINT-GOBAIN SA: COMPANY SNAPSHOT

- FIGURE 44 KINGSPAN GROUP: COMPANY SNAPSHOT

- FIGURE 45 ROCKWOOL INTERNATIONAL A/S: COMPANY SNAPSHOT

- FIGURE 46 OWENS CORNING: COMPANY SNAPSHOT

- FIGURE 47 BASF SE: FINANCIAL SNAPSHOT

The study involved four major activities in estimating the market size of the thermal insulation material market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The thermal insulation material market comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the thermal insulation material industry have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the thermal insulation material industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of thermal insulation material and the future outlook of their business, which will affect the overall market.

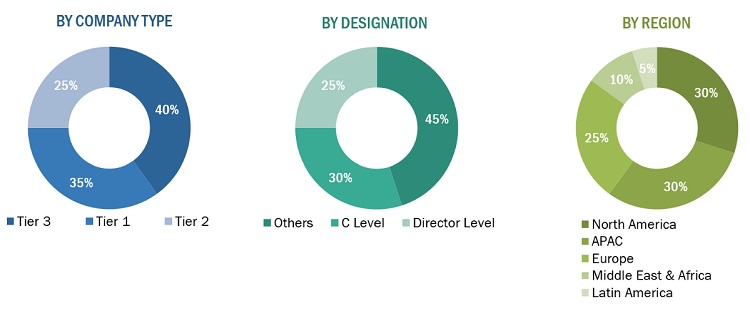

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Saint Gobain SA |

Individual Industry Expert |

|

Kingspan Group |

Sales Manager |

|

Rockwool Internatiional A/S |

Director |

|

Owens Corning |

Marketing Manager |

|

Knauf Insulation |

R&D Manager |

|

|

|

Market Size Estimation

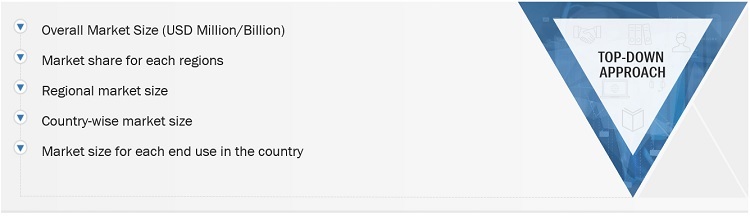

The top-down and bottom-up approaches have been used to estimate and validate the size of the thermal insulation material market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

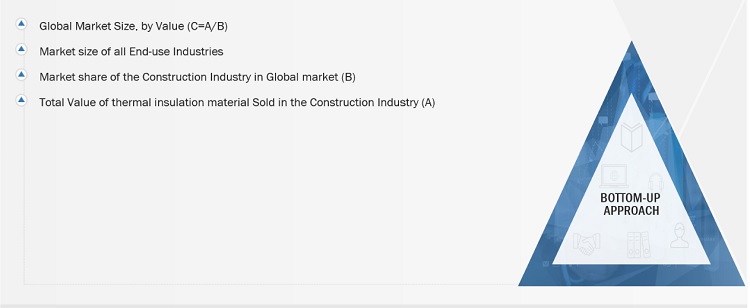

Thermal Insulation Material Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Thermal Insulation Material Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Thermal insulation materials serve the purpose of reducing the flow of heat energy between surfaces by acting as a barrier. These materials are widely used in various industries, buildings, HVAC, and transportation vehicles to improve energy efficiency and reduce heating and cooling costs. The insulation material products are made from natural substances such as fiberglass and cellulose, synthetic or mineral materials such as foam glass and mineral wool etc. The thermal conductivity of insulation materials measures their effectiveness in preventing heat transfer. Materials with low thermal conductivity values are considered better insulators. In addition, the density, thickness, and moisture resistance of thermal insulation materials can also impact their performance

Key Stakeholders

- Thermal Insulation Material manufacturers

- Raw material suppliers

- Distributors and suppliers

- End-use industries

- Industry associations

- R&D institutions

Report Objectives

- To define, describe, and forecast the size of the thermal insulation material market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on end use industry,material type, temperature range and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermal Insulation Material Market